Reports

Reports

The market for collagen peptides and gelatin has witnessed an astounding growth in the past two years, with an increasing consumer knowledge of the health and well-being associated with the product. Collagen peptides, derived from animal connective tissue, are increasingly gaining favor because individuals are seeking their skin elasticity, joint flexibility, and overall wellness. The factor of age and increased sensitivity towards preventive health are two of the key drivers to the market.

Additionally, the food and beverage industry is also utilizing collagen peptides and gelatin as a food ingredient to a great extent in products such as food supplements, snacks, and beverages. They are eliciting more their market potential. The products' versatility enables the companies to maintain pace with a wide scope of consumer demands, including those who require plant-based alternatives. With the market also on the move, advancements in the formulation and extraction process are enhancing the effectiveness and bioavailability of collagen-based products.

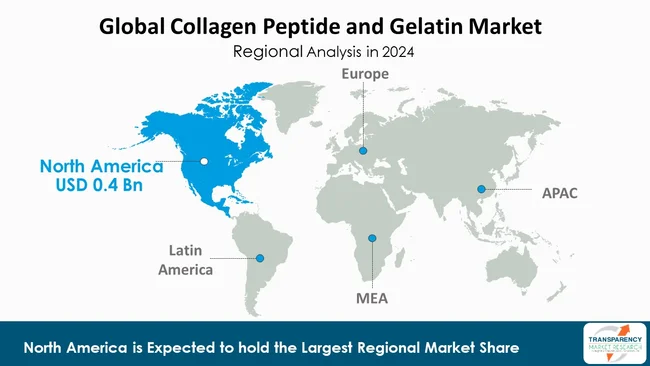

ON a geographical note, the market is dominated by North America and Europe due to higher disposable incomes and better health awareness. Asia-Pacific, though, will be the growth driver with emulation of Western diets and rise in urbanization.

Peptides and gelatin are proteins primarily derived from collagen, which is present in connective tissue, skin, and bones. Collagen peptides mean hydrolyzed collagen that is easily absorbed by the body. Gelatin is a gelling agent derived from collagen and used extensively in food, nutritional supplements, and cosmetics.

Greater understanding of the role these proteins play in health and well-being is driving expansion of the market. As consumers increasingly expect more from functional and natural ingredients, gelatin and peptides are being adopted with growing interest into dietary supplements, functional foods, and cosmetic applications. This fits into a larger trend toward preventive medicine, where nutrition is being viewed increasingly as a key to longer life and quality of life. Therefore, the market for collagen peptide and gelatin is on the cusp of expanding exponentially.

| Attribute | Detail |

|---|---|

| Collagen Peptide and Gelatin Market Drivers |

|

The broad market demand for functional foods and nutritional foods is the strongest driving force for collagen peptide and gelatin business. With increasing health awareness among consumers, more number of consumers are asking for additional health benefit instead of just nutrition from the food.

Collagen peptides, with their promise to strengthen skin, joint flexibility, and healing muscles, are establishing their place in everything, right from drinks and protein bars to fortified foods.

Furthermore, rising demand for clean label foods-food manufactured with open, natural ingredients-has generated additional demand for collagen-enriched foods as well. Firms are responding to this with new product development to cater to such tastes, usually related to the source of collagen, sustainability, and bioavailability.

Geographically, the market is strong in North America and Europe, which have established health trends. However, markets such as Asia-Pacific are also emerging as new growth drivers with urbanization and rising disposable incomes, thereby creating more interest in dietary supplements. Overall, interest in functional foods should take the collagen peptide and gelatin market to new heights as consumers continue to choose diet-related wellness.

The increasing pharmaceutical and nutraceutical uses of gelatin and collagen peptides are the primary growth drivers to the gelatin and collagen peptide market. With the healthcare industry increasingly aware of the potential therapeutic benefits of these proteins, the usage in a number of formulations for medical and nutritional applications is increasing.

Collagen peptides are being used in formulations to enhance the health of joints, elasticity of the skin, and healing of wounds and therefore play important roles in prevention and therapeutic care. Their bioactivity makes them attractive to drug companies to produce enhanced efficacy in health supplements and drugs.

Collagen is becoming increasingly popular in the nutraceutical industry as one of the flagship bioactive ingredients in nutritional supplements emphasizing specific health issues, including aging and sport performance.

North America and Europe are currently leading the market with highly developed health systems and sound consumer consciousness. However, their counterparts in emerging Asia-Pacific nations are also showing rapid growth with growing disposable income and consumer health sensitivity. Overall, increased application in pharmaceuticals and nutraceuticals makes the collagen peptide and gelatin market well-positioned for expansion in the future.

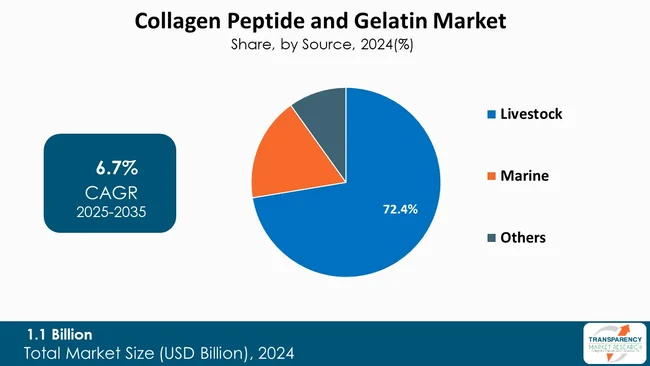

Livestock sources, especially swine and bovine, are dominating the collagen peptide and gelatin industry due to with the fact that, livestock sources offer high-protein-content collagen with rich Type I and Type III collagen that promotes healthy skin, joints, and connective tissues. The vast quantity of collagen derived from livestock is affordable, viable, and an attractive source for manufacturers with an uninterrupted supply chain to address increasing consumer demand.

Additionally, the use of livestock collagen is associated with proven extraction and processing technology for economy and efficiency. The cost-effectiveness is achieved in terms of cost-friendly final product prices, rendering affordable collagen food and supplements.

With consumers increasingly calling for natural and functional ingredients to support beauty and health, livestock collagen is still the market leader. This triumphant blend of product quality, supply, and regulatory backing places livestock in pole position again in the collagen peptide and gelatin industry.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America currently leads the market for collagen peptide and gelatin due to numerous driving forces. North America experiences high consumer healthiness combined with health consciousness driving functional food as well as dietary supplement with collagen sales. This is followed by mass promotion and education by the firms.

Apart from this, availability of such significant health-focused consumer groups such as sportspeople and old-age people has led to prolonged application of collagen supplements in terms of enhancement of mobility of the joints and flexibility of the skin. The region is also blessed with augmented research and development facilities that enable manufacturing of sophisticated collagen products for meeting different requirements of the consumers.

Secondly, stringent regulatory norms enhance product quality and safety and thus foster consumer trust in collagen products. Collectively, these regulations create a robust marketplace that renders North America the most powerful in the market for collagen peptide and gelatin.

Key players in the global collagen peptide and gelatin market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Amicogen, BioCell Technology LLC, Lonza Group Ltd, Nitta Gelatin, Inc., GELITA AG, Norland Products Inc., Gelnex, Ewald-Gelatine GmbH, Tessenderlo Group NV, Athos Collagen Pvt. Ltd., PB Leiner, Funingpu, Geltech are some of the leading players.

Each of these players has been profiled in the collagen peptide and gelatin market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

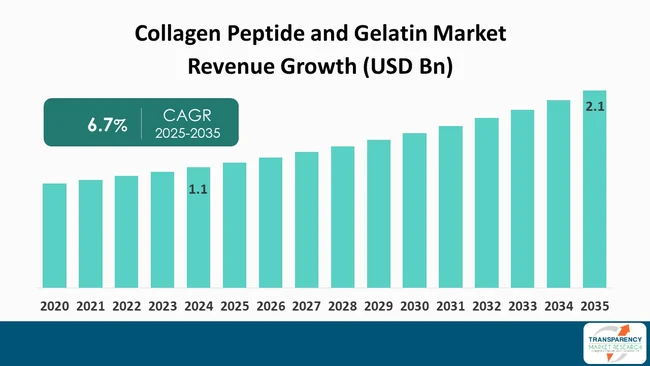

| Size in 2024 | US$ 1.1 Bn |

| Forecast Value in 2035 | US$ 2.1 Bn |

| CAGR | 6.7% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020–2023 |

| Quantitative Units | US$ Bn |

| Collagen Peptide and Gelatin Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Source

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.1 Bn in 2024

It is projected to cross US$ 2.1 Bn by the end of 2035

Growing demand for functional & nutritional foods and rising pharmaceutical & nutraceutical applications.

It is anticipated to grow at a CAGR of 6.7% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035

Amicogen, BioCell Technology LLC, Lonza Group Ltd, Nitta Gelatin, Inc., GELITA AG, Norland Products Inc., Gelnex, Ewald-Gelatine GmbH, Tessenderlo Group NV, Athos Collagen Pvt. Ltd., PB Leiner, Funingpu, Geltech, and Others.

Table 01: Global Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 02: Global Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Livestock, 2020 to 2035

Table 03: Global Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Marine, 2020 to 2035

Table 04: Global Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Form, 2020 to 2035

Table 05: Global Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 06: Global Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Cosmetic, 2020 to 2035

Table 07: Global Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Pharmaceutical, 2020 to 2035

Table 08: Global Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 09: North America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 10: North America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 11: North America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Livestock, 2020 to 2035

Table 12: North America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Marine, 2020 to 2035

Table 13: North America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Form, 2020 to 2035

Table 14: North America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: North America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Cosmetic, 2020 to 2035

Table 16: North America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Pharmaceutical, 2020 to 2035

Table 17: Europe Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 18: Europe Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 19: Europe Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Livestock, 2020 to 2035

Table 20: Europe Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Marine, 2020 to 2035

Table 21: Europe Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Form, 2020 to 2035

Table 22: Europe Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 23: Europe Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Cosmetic, 2020 to 2035

Table 24: Europe Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Pharmaceutical, 2020 to 2035

Table 25: Asia Pacific Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 26: Asia Pacific Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 27: Asia Pacific Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Livestock, 2020 to 2035

Table 28: Asia Pacific Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Marine, 2020 to 2035

Table 29: Asia Pacific Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Form, 2020 to 2035

Table 30: Asia Pacific Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 31: Asia Pacific Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Cosmetic, 2020 to 2035

Table 32: Asia Pacific Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Pharmaceutical, 2020 to 2035

Table 33: Latin America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 34: Latin America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 35: Latin America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Livestock, 2020 to 2035

Table 36: Latin America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Marine, 2020 to 2035

Table 37: Latin America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Form, 2020 to 2035

Table 38: Latin America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 39: Latin America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Cosmetic, 2020 to 2035

Table 40: Latin America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Pharmaceutical, 2020 to 2035

Table 41: Middle East & Africa Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 42: Middle East & Africa Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Source, 2020 to 2035

Table 43: Middle East & Africa Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Livestock, 2020 to 2035

Table 44: Middle East & Africa Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Marine, 2020 to 2035

Table 45: Middle East & Africa Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Form, 2020 to 2035

Table 46: Middle East & Africa Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 47: Middle East & Africa Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Cosmetic, 2020 to 2035

Table 48: Middle East & Africa Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, By Pharmaceutical, 2020 to 2035

Figure 01: Global Collagen Peptide and Gelatin Market Value Share Analysis, By Source, 2024 and 2035

Figure 02: Global Collagen Peptide and Gelatin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 03: Global Collagen Peptide and Gelatin Market Revenue (US$ Bn), by Livestock, 2020 to 2035

Figure 04: Global Collagen Peptide and Gelatin Market Revenue (US$ Bn), by Marine, 2020 to 2035

Figure 05: Global Collagen Peptide and Gelatin Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 06: Global Collagen Peptide and Gelatin Market Value Share Analysis, By Form, 2024 and 2035

Figure 07: Global Collagen Peptide and Gelatin Market Attractiveness Analysis, By Form, 2025 to 2035

Figure 08: Global Collagen Peptide and Gelatin Market Revenue (US$ Bn), by Powders, 2020 to 2035

Figure 09: Global Collagen Peptide and Gelatin Market Revenue (US$ Bn), by Granules, 2020 to 2035

Figure 10: Global Collagen Peptide and Gelatin Market Revenue (US$ Bn), by Liquid, 2020 to 2035

Figure 11: Global Collagen Peptide and Gelatin Market Value Share Analysis, By Application, 2024 and 2035

Figure 12: Global Collagen Peptide and Gelatin Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 13: Global Collagen Peptide and Gelatin Market Revenue (US$ Bn), by Cosmetic, 2020 to 2035

Figure 14: Global Collagen Peptide and Gelatin Market Revenue (US$ Bn), by Pharmaceutical, 2020 to 2035

Figure 15: Global Collagen Peptide and Gelatin Market Revenue (US$ Bn), by Food and Beverage, 2020 to 2035

Figure 16: Global Collagen Peptide and Gelatin Market Revenue (US$ Bn), by Nutraceutical, 2020 to 2035

Figure 17: Global Collagen Peptide and Gelatin Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global Collagen Peptide and Gelatin Market Value Share Analysis, By Region, 2024 and 2035

Figure 19: Global Collagen Peptide and Gelatin Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 20: North America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 21: North America Collagen Peptide and Gelatin Market Value Share Analysis, by Country, 2024 and 2035

Figure 22: North America Collagen Peptide and Gelatin Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 23: North America Collagen Peptide and Gelatin Market Value Share Analysis, By Source, 2024 and 2035

Figure 24: North America Collagen Peptide and Gelatin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 25: North America Collagen Peptide and Gelatin Market Value Share Analysis, By Form, 2024 and 2035

Figure 26: North America Collagen Peptide and Gelatin Market Attractiveness Analysis, By Form, 2025 to 2035

Figure 27: North America Collagen Peptide and Gelatin Market Value Share Analysis, By Application, 2024 and 2035

Figure 28: North America Collagen Peptide and Gelatin Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 29: Europe Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: Europe Collagen Peptide and Gelatin Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 31: Europe Collagen Peptide and Gelatin Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 32: Europe Collagen Peptide and Gelatin Market Value Share Analysis, By Source, 2024 and 2035

Figure 33: Europe Collagen Peptide and Gelatin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 34: Europe Collagen Peptide and Gelatin Market Value Share Analysis, By Form, 2024 and 2035

Figure 35: Europe Collagen Peptide and Gelatin Market Attractiveness Analysis, By Form, 2025 to 2035

Figure 36: Europe Collagen Peptide and Gelatin Market Value Share Analysis, By Application, 2024 and 2035

Figure 37: Europe Collagen Peptide and Gelatin Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 38: Asia Pacific Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: Asia Pacific Collagen Peptide and Gelatin Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 40: Asia Pacific Collagen Peptide and Gelatin Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 41: Asia Pacific Collagen Peptide and Gelatin Market Value Share Analysis, By Source, 2024 and 2035

Figure 42: Asia Pacific Collagen Peptide and Gelatin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 43: Asia Pacific Collagen Peptide and Gelatin Market Value Share Analysis, By Form, 2024 and 2035

Figure 44: Asia Pacific Collagen Peptide and Gelatin Market Attractiveness Analysis, By Form, 2025 to 2035

Figure 45: Asia Pacific Collagen Peptide and Gelatin Market Value Share Analysis, By Application, 2024 and 2035

Figure 46: Asia Pacific Collagen Peptide and Gelatin Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 47: Latin America Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Latin America Collagen Peptide and Gelatin Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 49: Latin America Collagen Peptide and Gelatin Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 50: Latin America Collagen Peptide and Gelatin Market Value Share Analysis, By Source, 2024 and 2035

Figure 51: Latin America Collagen Peptide and Gelatin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 52: Latin America Collagen Peptide and Gelatin Market Value Share Analysis, By Form, 2024 and 2035

Figure 53: Latin America Collagen Peptide and Gelatin Market Attractiveness Analysis, By Form, 2025 to 2035

Figure 54: Latin America Collagen Peptide and Gelatin Market Value Share Analysis, By Application, 2024 and 2035

Figure 55: Latin America Collagen Peptide and Gelatin Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 56: Middle East & Africa Collagen Peptide and Gelatin Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Middle East & Africa Collagen Peptide and Gelatin Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 58: Middle East & Africa Collagen Peptide and Gelatin Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 59: Middle East & Africa Collagen Peptide and Gelatin Market Value Share Analysis, By Source, 2024 and 2035

Figure 60: Middle East & Africa Collagen Peptide and Gelatin Market Attractiveness Analysis, By Source, 2025 to 2035

Figure 61: Middle East & Africa Collagen Peptide and Gelatin Market Value Share Analysis, By Form, 2024 and 2035

Figure 62: Middle East & Africa Collagen Peptide and Gelatin Market Attractiveness Analysis, By Form, 2025 to 2035

Figure 63: Middle East & Africa Collagen Peptide and Gelatin Market Value Share Analysis, By Application, 2024 and 2035

Figure 64: Middle East & Africa Collagen Peptide and Gelatin Market Attractiveness Analysis, By Application, 2025 to 2035