Reports

Reports

The coding & marking systems market has been severely affected during the pandemic, due to halted businesses, forced lockdown, and disruption in all the supply chain manufacturing activities across the globe. This threatening pandemic has weakened all manufacturing operations in the coding & marking systems market. With the rapid increase in vaccination drives, manufacturers are recovering from the losses by adopting new trends and technologies in the coding & marking systems market. Stakeholders in the coding & marking systems market are focusing on providing environment-friendly solutions to fulfill the rising demand from various end-use industries such as food and packaging. Manufacturers are taking efforts to recover from losses due to COVID-19 outbreak and exploring different opportunities to overcome challenges in the coding & marking systems market.

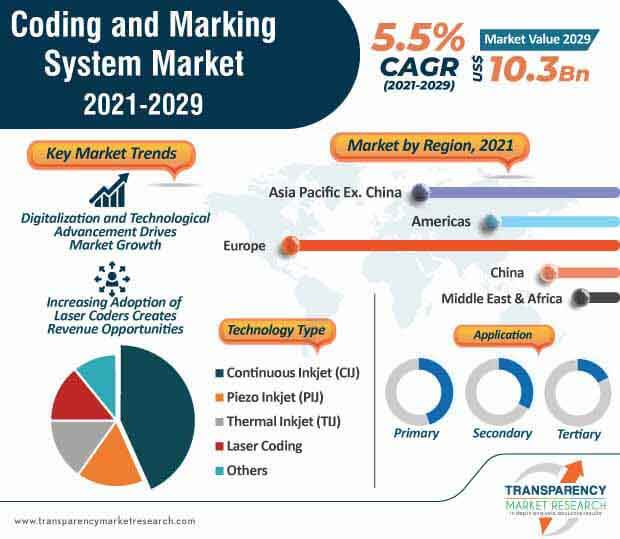

The laser technology has created incremental growth opportunities for the manufacturers operating in the coding & marking systems market. Digitalization and advancements in technologies are responsible for the popularity of laser coders across the globe. Being lucratively used in medicine and pharmaceutical industries, laser coders also proved to be beneficial for the production of vaccines. Manufacturers from coding and marking systems have upgraded their coding technology to meet the rising demand from various manufacturing industries. Laser marking systems are being widely used to print codes on metal products due to its high-speed and sharp marking features. The increasing demand for laser coders drives the global market during the forecast period.

Growing applications of coding and marking systems in product identification and traceability in different industries creates value-grab opportunities for market players. Growth and development of pharmaceuticals, food & beverages, construction, automotive, chemical & fertilizers, and electronics industries demand for printing codes on different products and surfaces and this factor is anticipated to boost the coding & marking systems market at the global level. The increasing popularity of coding and marking is due to their high-resolution images, high speed, and clear & precise printing. Many business leaders are adopting such systems to protect their brand identity. For product sustainability, market contributors are using environment-friendly solutions to use in industrial applications.

The automobile industry is gaining momentum after the threatening coronavirus pandemic. The increase in sales of vehicles across the globe has led to rise in production and manufacturing of automotive parts. In addition, the adoption of electric vehicles also fuels the demand for coding and marking systems to avoid the risk of counterfeiting of vehicle parts. The demand for automotive parts for clear marking and coding for the traceability. Automobile manufacturers are focusing on using high-quality marking systems to protect their brand from any fake activities. This factor boosts the demand for high-resolution, permanent coding on automotive parts. Due to increasing applications in the automobile industry, manufacturers in the coding & marking systems market are paving their ways to make use of technology to fulfill the rising demand.

Coding and marking systems can be increasingly used in food packaging to label the food products. With the increasing need of food quality and safety from all over the world, food manufacturers are using high-resolution coding and marking for labeling the necessary information on the packaged food products. Regulatory guidelines for the food & beverage industry regarding the display and labelling of information create a profitable opportunity for the manufacturers working in the coding & marking systems market. Awareness and adoption of such high-quality codes and marks to print information on food products with high speed and efficiency boost the market growth.

Analysts’ Viewpoint

Laser coders and inkjet printers are anticipated to create revenue opportunities for manufacturers in the coding & marking systems market. The rise in the number of fraudulent activities to suppress the brand value and identity in various industries across the globe is likely to augment the coding & marking systems market in the upcoming years. Technological advancements, along with increasing applications in a variety of industries, is also projected to drive the coding & marking systems market over the next few years. However, market stakeholder should focus on providing cost-effective solutions to fulfill the rising demand from industries.

|

Attribute |

Detail |

|

Market Size Value in 2020 (Base Year) |

US$ 6.3 Bn |

|

Market Forecast Value in 2029 |

US$ 10.3 Bn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2021-2029 |

|

Quantitative Units |

US$ Mn for Value & (000’ Units) for Volume |

|

Market Analysis |

This report represents market dynamics of coding & marking systems and lucrative hotspots of the market. |

|

Competition Landscape |

Competition analysis section in the report represents 5 years performance of the key players and strategies implement by them, along with market share of respective companies in the global market. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The Coding and Marking System Market is studied from 2021 - 2029.

Coding & Marking Systems Market To Reach Valuation Of US$ 10.3 Bn By 2029.

The coding & marking systems market is anticipated to register growth at 5.5% CAGR during the forecast period.

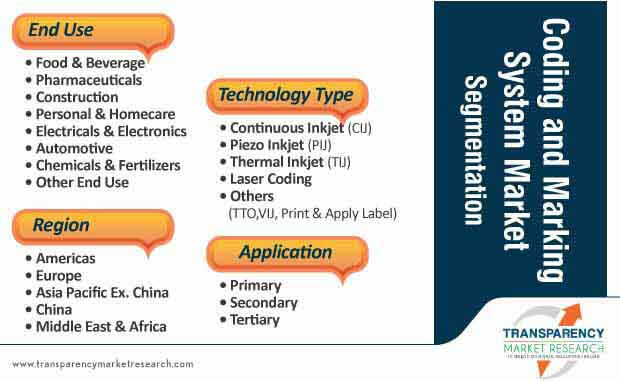

The global Coding and Marking System Market is segmented on basis of application, imaging modality and key regions.

Videojet Technologies, Inc., Hitachi America, Ltd., Markem-Image Corporation, Domino Printing Sciences plc, Squid Ink Manufacturing Inc., ATD Ltd, TYKMA Electrox, Inc, MACSA ID, S.A, REA Elektronik GmbH, Linx Printing Technologies Ltd, RN Mark Inc, Control Print Ltd., etc.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Market Background

3.1. Global Packaging Market Overview

3.2. Global Food & Beverage Market Overview

3.3. Global Pharmaceutical Industry Overview

3.4. Macro-Economic Factors

3.5. Forecast Factors – Relevance & Impact

3.6. Impact of COVID-19 on Coding and Marking System Market

3.7. Value Chain Analysis

3.7.1. Key Participants

3.7.1.1. Component Suppliers

3.7.1.2. Coding and Marking System Manufacturers

3.7.1.3. Distributors

3.7.1.4. End-users

3.7.2. Profitability Margins

4. Coding and Marking System Market Dynamics

4.1. Drivers

4.2. Restraints

4.3. Key Market Regulations/Advisories

4.4. Opportunity Analysis

4.5. Trends

4.6. Application specific Growth Drivers

5. Market Forecast

5.1. Market Volume Projections

5.2. Pricing Analysis

5.3. Market Size Projections

5.3.1. Y-o-Y Projections

5.3.2. Absolute $ Opportunity Analysis

6. Global Coding and Marking System Market Analysis by Technology Type

6.1. Introduction

6.1.1. Market share Analysis by Technology Type

6.1.2. Y-o-Y Growth Analysis by Technology Type

6.2. Market Value (US$ Mn) and Volume (‘000 Units) Historical 2015-2020 and Forecast 2021-2029, by Technology Type

6.2.1. Continuous Inkjet (CIJ)

6.2.2. Piezo Inkjet (PIJ)

6.2.3. Thermal Inkjet (TIJ)

6.2.4. Laser Coding

6.2.5. Others (TTO, VIJ, Print & Apply Label)

6.3. Market Attractiveness Analysis by Technology Type

7. Global Coding and Marking System Market Analysis by Application

7.1. Introduction

7.1.1. Market share Analysis by Application

7.1.2. Y-o-Y Growth Analysis by Application

7.2. Market Value (US$ Mn) and Volume (‘000 Units) Historical 2015-2020 and Forecast 2021-2029, by Application

7.2.1. Primary

7.2.2. Secondary

7.2.3. Tertiary

7.3. Dominant technology within each Market Application

7.4. Market Attractiveness Analysis by Application

8. Global Coding and Marking System Market Analysis by End Use

8.1. Introduction

8.1.1. Market share Analysis by End Use

8.1.2. Y-o-Y Growth Analysis by End Use

8.2. Market Value (US$ Mn) and Volume (‘000 Units) Historical 2015-2020 and Forecast 2021-2029, by End Use

8.2.1. Food & Beverages

8.2.2. Pharmaceuticals

8.2.3. Construction

8.2.4. Personal & Homecare

8.2.5. Electricals & Electronics

8.2.6. Automotive

8.2.7. Chemical & Fertilizers

8.2.8. Other End Use

8.3. Market Attractiveness Analysis by End Use

9. Global Coding and Marking System Market Analysis by Region

9.1. Introduction

9.1.1. Market share Analysis by Region

9.1.2. Y-o-Y Growth Analysis by Region

9.2. Market Value (US$ Mn) and Volume (‘000 Units) Historical 2015-2020 and Forecast 2021-2029, by Region

9.2.1. Americas

9.2.2. China

9.2.3. Europe

9.2.4. Asia Pacific Ex. China

9.3. Market Attractiveness Analysis by Region

10. America Coding and Marking System Market Analysis

10.1. Introduction

10.2. Market Value (US$ Mn) and Volume (‘000 Units) Historical 2015-2020 and Forecast 2021-2029

10.2.1. By Country

10.2.1.1. U.S.

10.2.1.2. Canada

10.2.1.3. Brazil

10.2.1.4. Mexico

10.2.1.5. Rest of Americas

10.2.2. By Technology Type

10.2.2.1. Continuous Inkjet (CIJ)

10.2.2.2. Piezo Inkjet (PIJ)

10.2.2.3. Thermal Inkjet (TIJ)

10.2.2.4. Laser Coding

10.2.2.5. Others (TTO, VIJ, Print & Apply Label)

10.2.3. By Application

10.2.3.1. Primary

10.2.3.2. Secondary

10.2.3.3. Tertiary

10.2.4. By End Use

10.2.4.1. Food & Beverages

10.2.4.2. Pharmaceuticals

10.2.4.3. Construction

10.2.4.4. Personal & Homecare

10.2.4.5. Electricals & Electronics

10.2.4.6. Automotive

10.2.4.7. Chemical & Fertilizers

10.2.4.8. Other End Use

10.3. Market Attractiveness Analysis

10.3.1. By Country

10.3.2. By Technology Type

10.3.3. Application

10.3.4. End Use

10.4. Market Trends

11. Europe Coding and Marking System Market Analysis

11.1. Introduction

11.2. Market Value (US$ Mn) and Volume (‘000 Units) Historical 2015-2020 and Forecast 2021-2029

11.2.1. By Country

11.2.1.1. Germany

11.2.1.2. Italy

11.2.1.3. France

11.2.1.4. U.K.

11.2.1.5. Spain

11.2.1.6. Benelux

11.2.1.7. Nordic

11.2.1.8. Russia

11.2.1.9. Poland

11.2.1.10. Rest of Europe

11.2.2. By Technology Type

11.2.2.1. Continuous Inkjet (CIJ)

11.2.2.2. Piezo Inkjet (PIJ)

11.2.2.3. Thermal Inkjet (TIJ)

11.2.2.4. Laser Coding

11.2.2.5. Others (TTO, VIJ, Print & Apply Label)

11.2.3. By Application

11.2.3.1. Primary

11.2.3.2. Secondary

11.2.3.3. Tertiary

11.2.4. By End Use

11.2.4.1. Food & Beverages

11.2.4.2. Pharmaceuticals

11.2.4.3. Construction

11.2.4.4. Personal & Homecare

11.2.4.5. Electricals & Electronics

11.2.4.6. Automotive

11.2.4.7. Chemical & Fertilizers

11.2.4.8. Other End Use

11.3. Market Attractiveness Analysis

11.3.1. By Country

11.3.2. By Technology Type

11.3.3. Application

11.3.4. End Use

11.4. Market Trends

12. Asia Pacific Ex. China Coding and Marking System Market Analysis

12.1. Introduction

12.2. Market Value (US$ Mn) and Volume (‘000 Units) Historical 2015-2020 and Forecast 2021-2029

12.2.1. By Country

12.2.1.1. India

12.2.1.2. Japan

12.2.1.3. ASEAN

12.2.1.4. South Korea

12.2.1.5. Australia & NZ

12.2.1.6. Rest of APexC

12.2.2. By Technology Type

12.2.2.1. Continuous Inkjet (CIJ)

12.2.2.2. Piezo Inkjet (PIJ)

12.2.2.3. Thermal Inkjet (TIJ)

12.2.2.4. Laser Coding

12.2.2.5. Others (TTO, VIJ, Print & Apply Label)

12.2.3. By Application

12.2.3.1. Primary

12.2.3.2. Secondary

12.2.3.3. Tertiary

12.2.4. By End Use

12.2.4.1. Food & Beverages

12.2.4.2. Pharmaceuticals

12.2.4.3. Construction

12.2.4.4. Personal & Homecare

12.2.4.5. Electricals & Electronics

12.2.4.6. Automotive

12.2.4.7. Chemical & Fertilizers

12.2.4.8. Other End Use

12.3. Market Attractiveness Analysis

12.3.1. By Country

12.3.2. By Technology Type

12.3.3. Application

12.3.4. End Use

12.4. Market Trends

13. China Coding and Marking System Market Analysis

13.1. Introduction

13.2. Market Value (US$ Mn) and Volume (‘000 Units) Historical 2015-2020 and Forecast 2021-2029

13.2.1. By Technology Type

13.2.1.1. Continuous Inkjet (CIJ)

13.2.1.2. Piezo Inkjet (PIJ)

13.2.1.3. Thermal Inkjet (TIJ)

13.2.1.4. Laser Coding

13.2.1.5. Others (TTO, VIJ, Print & Apply Label)

13.2.2. By Application

13.2.2.1. Primary

13.2.2.2. Secondary

13.2.2.3. Tertiary

13.2.3. By End Use

13.2.3.1. Food & Beverages

13.2.3.2. Pharmaceuticals

13.2.3.3. Construction

13.2.3.4. Personal & Homecare

13.2.3.5. Electricals & Electronics

13.2.3.6. Automotive

13.2.3.7. Chemical & Fertilizers

13.2.3.8. Other End Use

13.3. Market Attractiveness Analysis

13.3.1. By Technology Type

13.3.2. Application

13.3.3. End Use

13.4. Market Trends

14. Middle East and Africa Coding and Marking System Market Analysis

14.1. Introduction

14.2. Market Value (US$ Mn) and Volume (‘000 Units) Historical 2015-2020 and Forecast 2021-2029

14.2.1. By Country

14.2.1.1. GCC Countries

14.2.1.2. South Africa

14.2.1.3. Northern Africa

14.2.1.4. Turkey

14.2.1.5. Israel

14.2.1.6. Rest of MEA

14.2.2. By Technology Type

14.2.2.1. Continuous Inkjet (CIJ)

14.2.2.2. Piezo Inkjet (PIJ)

14.2.2.3. Thermal Inkjet (TIJ)

14.2.2.4. Laser Coding

14.2.2.5. Others (TTO, VIJ, Print & Apply Label)

14.2.3. By Application

14.2.3.1. Primary

14.2.3.2. Secondary

14.2.3.3. Tertiary

14.2.4. By End Use

14.2.4.1. Food & Beverages

14.2.4.2. Pharmaceuticals

14.2.4.3. Construction

14.2.4.4. Personal & Homecare

14.2.4.5. Electricals & Electronics

14.2.4.6. Automotive

14.2.4.7. Chemical & Fertilizers

14.2.4.8. Other End Use

14.3. Market Attractiveness Analysis

14.3.1. By Country

14.3.2. By Technology Type

14.3.3. Application

14.3.4. End Use

14.4. Market Trends

15. Market Structure Analysis

15.1. Market Analysis by Tier of Companies

15.1.1. By Large, Medium and Small

15.2. Market Concentration

15.2.1. By Top 5 and by Top 10

15.3. Production Capacity Share Analysis

15.3.1. By Large, Medium, and Small

15.3.2. By Top 5 and Top 10

15.4. Market Share Analysis by Top 10 Players

15.4.1. America Market Share Analysis by Top Players

15.4.2. Europe Market Share Analysis by Top Players

15.4.3. Asia Pacific Market Share Analysis by Top Players

15.5. Market Presence Analysis

15.5.1. By Regional footprint of Players

15.5.2. Product footprint by Players

15.5.3. Channel footprint by Players

16. Competitive Analysis

16.1. Competition Dashboard

16.2. Pricing Analysis by Competition

16.3. Competition Benchmarking

16.4. Thermal Inkjet vs. Piezo Technology: A Detailed Outlook

16.5. TIJ & PIJ Consumables Market Analysis

16.6. Competition Deep Dive

16.6.1. Videojet Technologies, Inc.

16.6.1.1. Overview

16.6.1.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.1.3. Profitability by Application/Technology

16.6.1.4. Sales Footprint

16.6.1.5. Channel Footprint

16.6.1.6. Competition Benchmarking

16.6.1.7. Strategy

16.6.2. Hitachi America, Ltd.

16.6.2.1. Overview

16.6.2.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.2.3. Profitability by Application/Technology

16.6.2.4. Sales Footprint

16.6.2.5. Channel Footprint

16.6.2.6. Competition Benchmarking

16.6.2.7. Strategy

16.6.3. Markem-Imaje Corporation.

16.6.3.1. Overview

16.6.3.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.3.3. Profitability by Application/Technology

16.6.3.4. Sales Footprint

16.6.3.5. Channel Footprint

16.6.3.6. Competition Benchmarking

16.6.3.7. Strategy

16.6.4. Domino Printing Sciences plc.

16.6.4.1. Overview

16.6.4.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.4.3. Profitability by Application/Technology

16.6.4.4. Sales Footprint

16.6.4.5. Channel Footprint

16.6.4.6. Competition Benchmarking

16.6.4.7. Strategy

16.6.5. Squid Ink Manufacturing Inc.

16.6.5.1. Overview

16.6.5.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.5.3. Profitability by Application/Technology

16.6.5.4. Sales Footprint

16.6.5.5. Channel Footprint

16.6.5.6. Competition Benchmarking

16.6.5.7. Strategy

16.6.6. ATD Ltd.

16.6.6.1. Overview

16.6.6.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.6.3. Profitability by Application/Technology

16.6.6.4. Sales Footprint

16.6.6.5. Channel Footprint

16.6.6.6. Competition Benchmarking

16.6.6.7. Strategy

16.6.7. TYKMA Electrox, Inc.

16.6.7.1. Overview

16.6.7.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.7.3. Profitability by Application/Technology

16.6.7.4. Sales Footprint

16.6.7.5. Channel Footprint

16.6.7.6. Competition Benchmarking

16.6.7.7. Strategy

16.6.8. MACSA ID, S.A

16.6.8.1. Overview

16.6.8.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.8.3. Profitability by Application/Technology

16.6.8.4. Sales Footprint

16.6.8.5. Channel Footprint

16.6.8.6. Competition Benchmarking

16.6.8.7. Strategy.

16.6.9. REA Elektronik GmbH

16.6.9.1. Overview

16.6.9.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.9.3. Profitability by Application/Technology

16.6.9.4. Sales Footprint

16.6.9.5. Channel Footprint

16.6.9.6. Competition Benchmarking

16.6.9.7. Strategy

16.6.10. Linx Printing Technologies Ltd.

16.6.10.1. Overview

16.6.10.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.10.3. Profitability by Application/Technology

16.6.10.4. Sales Footprint

16.6.10.5. Channel Footprint

16.6.10.6. Competition Benchmarking

16.6.10.7. Strategy

16.6.11. RN Mark Inc.

16.6.11.1. Overview

16.6.11.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.11.3. Profitability by Application/Technology

16.6.11.4. Sales Footprint

16.6.11.5. Channel Footprint

16.6.11.6. Competition Benchmarking

16.6.11.7. Strategy

16.6.12. Control Print Ltd.

16.6.12.1. Overview

16.6.12.2. Product Portfolio (CIJ, TIJ, Piezo, Laser)

16.6.12.3. Profitability by Application/Technology

16.6.12.4. Sales Footprint

16.6.12.5. Channel Footprint

16.6.12.6. Competition Benchmarking

16.6.12.7. Strategy

17. Assumptions and Acronyms Used

18. Research Methodology

List of Tables

Table 01: Global Coding and Marking System Market Value (US$ Mn) by Technology Type, 2015H-2029F

Table 02: Global Coding and Marking System Market Volume (‘000 Units) by Technology Type, 2015H-2029F

Table 03: Global Coding and Marking System Market Value (US$ Mn) by Application, 2015H-2029F

Table 04: Global Coding and Marking System Market Volume (‘000 Units) by Application, 2015H-2029F

Table 05: Global Coding and Marking System Market Value (US$ Mn) by End Use, 2015H-2029F

Table 06: Global Coding and Marking System Market Volume (‘000 Units) by End Use, 2015H-2029F

Table 07: Global Coding and Marking System Market Value (US$ Mn) by Region, 2015H-2029F

Table 08: Global Coding and Marking System Market Volume (‘000 Units) by Region, 2015H-2029F

Table 09: Americas Coding and Marking System Market Value (US$ Mn) by Technology Type, 2015H-2029F

Table 10: Americas Coding and Marking System Market Volume (‘000 Units) by Technology Type, 2015H-2029F

Table 11: Americas Coding and Marking System Market Value (US$ Mn) by Application, 2015H-2029F

Table 12: Americas Coding and Marking System Market Volume (‘000 Units) by Application, 2015H-2029F

Table 13: Americas Coding and Marking System Market Value (US$ Mn) by End Use, 2015H-2029F

Table 14: Americas Coding and Marking System Market Volume (‘000 Units) by End Use, 2015H-2029F

Table 15: Americas Coding and Marking System Market Value (US$ Mn) by Country, 2015H-2029F

Table 16: Americas Coding and Marking System Market Volume (‘000 Units) by Country, 2015H-2029F

Table 17: Europe Coding and Marking System Market Value (US$ Mn) by Technology Type, 2015H-2029F

Table 18: Europe Coding and Marking System Market Volume (‘000 Units) by Technology Type, 2015H-2029F

Table 19: Europe America Coding and Marking System Market Value (US$ Mn) by Application, 2015H-2029F

Table 20: Europe America Coding and Marking System Market Volume (‘000 Units) by Application, 2015H-2029F

Table 21: Europe America Coding and Marking System Market Value (US$ Mn) by End Use, 2015H-2029F

Table 22: Europe America Coding and Marking System Market Volume (‘000 Units) by End Use, 2015H-2029F

Table 23: Europe America Coding and Marking System Market Value (US$ Mn) by Country, 2015H-2029F

Table 24: Europe America Coding and Marking System Market Volume (‘000 Units) by Country, 2015H-2029F

Table 25: Asia Pacific Ex. China Coding and Marking System Market Value (US$ Mn) by Technology Type, 2015H-2029F

Table 26: Asia Pacific Ex. China Coding and Marking System Market Volume (‘000 Units) by Technology Type, 2015H-2029F

Table 27: Asia Pacific Ex. China Coding and Marking System Market Value (US$ Mn) by Application, 2015H-2029F

Table 28: Asia Pacific Ex. China Coding and Marking System Market Volume (‘000 Units) by Application, 2015H-2029F

Table 29: Asia Pacific Ex. China Coding and Marking System Market Value (US$ Mn) by End Use, 2015H-2029F

Table 30: Asia Pacific Ex. China Coding and Marking System Market Volume (‘000 Units) by End Use, 2015H-2029F

Table 31: Asia Pacific Ex. China Coding and Marking System Market Value (US$ Mn) by Country, 2015H-2029F

Table 32: Asia Pacific Ex. China Coding and Marking System Market Volume (‘000 Units) by Country, 2015H-2029F

Table 33: China Coding and Marking System Market Value (US$ Mn) by Technology Type, 2015H-2029F

Table 34: China Coding and Marking System Market Volume (‘000 Units) by Technology Type, 2015H-2029F

Table 35: China Coding and Marking System Market Value (US$ Mn) by Application, 2015H-2029F

Table 36: China Coding and Marking System Market Volume (‘000 Units) by Application, 2015H-2029F

Table 37: China Coding and Marking System Market Value (US$ Mn) by End Use, 2015H-2029F

Table 38: China Coding and Marking System Market Volume (‘000 Units) by End Use, 2015H-2029F

Table 39: MEA Coding and Marking System Market Value (US$ Mn) by Technology Type, 2015H-2029F

Table 40: MEA Coding and Marking System Market Volume (‘000 Units) by Technology Type, 2015H-2029F

Table 41: MEA Coding and Marking System Market Value (US$ Mn) by Application, 2015H-2029F

Table 42: MEA Coding and Marking System Market Volume (‘000 Units) by Application, 2015H-2029F

Table 43: MEA Coding and Marking System Market Value (US$ Mn) by End Use, 2015H-2029F

Table 44: MEA Coding and Marking System Market Volume (‘000 Units) by End Use, 2015H-2029F

Table 45: MEA Coding and Marking System Market Value (US$ Mn) by Country, 2015H-2029F

Table 46: MEA Coding and Marking System Market Volume (‘000 Units) by Country, 2015H-2029F

List of Figures

Figure 01: Global Coding and Marking System Market Share Analysis by Technology Type, 2021E & 2029F

Figure 02: Global Coding and Marking System Market Attractiveness Analysis by Technology Type , 2021E-2029F

Figure 03: Global Coding and Marking System Market Y-o-Y Analysis by Technology Type, 2019H-2029F

Figure 04: Global Coding and Marking System Market Share Analysis by Application, 2021E & 2029F

Figure 05: Global Coding and Marking System Market Attractiveness Analysis by Application , 2021E-2029F

Figure 06: Global Coding and Marking System Market Y-o-Y Analysis by Application, 2019H-2029F

Figure 07: Global Coding and Marking System Market Share Analysis by End Use, 2021E & 2029F

Figure 08: Global Coding and Marking System Market Attractiveness Analysis by End Use , 2021E-2029F

Figure 09: Global Coding and Marking System Market Y-o-Y Analysis by End Use, 2019H-2029F

Figure 10: Global Coding and Marking System Market Share Analysis by Region, 2021E & 2029F

Figure 11: Global Coding and Marking System Market Attractiveness Analysis by Region , 2021E-2029F

Figure 12: Global Coding and Marking System Market Y-o-Y Analysis by Region, 2019H-2029F

Figure 13: Americas Coding and Marking System Market Y-o-Y Analysis by Technology Type, 2019H-2029F

Figure 14: Americas Coding and Marking System Market Share Analysis by Application, 2021E & 2029F

Figure 15: Americas Coding and Marking System Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 16: Americas Coding and Marking System Market Value Share Analysis by Country, 2021(E)

Figure 17: Europe America Coding and Marking System Market Y-o-Y Analysis by Technology Type, 2019H-2029F

Figure 18: Europe America Coding and Marking System Market Share Analysis by Application, 2021E & 2029F

Figure 19: Europe America Coding and Marking System Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 20: Europe America Coding and Marking System Market Value Share Analysis by Country, 2021(E)

Figure 21: Asia Pacific Ex. China Coding and Marking System Market Y-o-Y Analysis by Technology Type, 2019H-2029F

Figure 22: Asia Pacific Ex. China Coding and Marking System Market Share Analysis by Application, 2021E & 2029F

Figure 23: Asia Pacific Ex. China Coding and Marking System Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 24: Asia Pacific Ex. China Coding and Marking System Market Value Share Analysis by Country, 2021(E)

Figure 25: China Coding and Marking System Market Y-o-Y Analysis by Technology Type, 2019H-2029F

Figure 26: China Coding and Marking System Market Share Analysis by Application, 2021E & 2029F

Figure 27: China Coding and Marking System Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 28: MEA Coding and Marking System Market Y-o-Y Analysis by Technology Type, 2019H-2029F

Figure 29: MEA Coding and Marking System Market Share Analysis by Application, 2021E & 2029F

Figure 30: MEA Coding and Marking System Market Attractiveness Analysis by End Use, 2021E-2029F

Figure 31: MEA Coding and Marking System Market Value Share Analysis by Country, 2021(E)