Reports

Reports

Analysts’ Viewpoint on Market Scenario

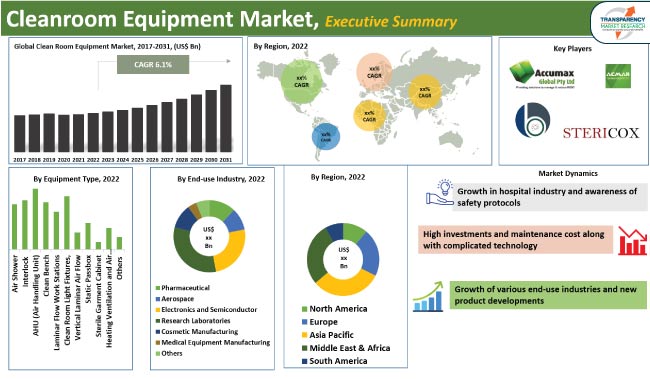

Demand for cleanroom equipment such as laminar flow work stations is increasing due to their application in laboratories involved in biological activities. The rise in number of microbiological tests due to the COVID-19 pandemic and the surge in co-morbidities due to the infection is expected to fuel the cleanroom equipment market size in the near future.

Recent advances in cleanroom design include computer-aided engineering for process location and mapping. This helps maximize device workflow and efficiency and extends device life. Additionally, the use of IoT-based HVAC systems have augmented the cleanroom equipment market demand. IoT offers remote monitoring solutions for HVAC cleanroom installations and maintenance. This, in turn, is likely to offer lucrative opportunities for market growth.

Cleanroom equipment is specifically designed and engineered to prevent contamination of highly sensitive cleanroom environments. Cleanrooms are classified primarily based on their size and the amount of allowable particles per volume of air.

Regulatory standards such as ISO, British Standard 5295, Federal Standard 209, and Pharmaceutical Cleanroom Classifications are used to classify different types of cleanrooms. Cleanroom equipment include cleanroom supplies, cleanroom vacuum cleaners, cleanroom vacuums, and cleanroom tools.

Modular cleanroom equipment are replacing conventional ones due to their versatility and flexibility. Modular cleanroom equipment can be assembled, disassembled, and relocated quickly and serves as an economic alternative for companies in their quest to adhere to cleanliness standards.

According to the cleanroom equipment market research, continuous advances in the field of medicine and drugs have opened up a number of possibilities to treat different health problems and helped in developing patient-centered healthcare models. An increase in drug approvals by regulatory bodies is expected to boost drug-manufacturing practices. Additionally, a large number of ongoing clinical trials have created numerous growth opportunities, which is expected to drive the demand for cleanroom equipment globally.

The incidence of healthcare-acquired infections (HAIs) has increased in recent years. The need to install cleanrooms in hospitals has increased significantly to overcome the increasing incidence of HAIs. Thus, rise in HAIs is propelling the cleanroom equipment market value.

Within hospitals, cleanrooms are integrated into burn units, surgical suits, isolation rooms, and in some cases corridors that are regularly exposed to bio-hazardous material. The COVID-19 pandemic fueled market development due to surge in demand for cleanroom technologies.

Technological advancements in cleanrooms are expected to boost the cleanroom equipment industry growth during the forecast period.

Surge in demand for cleanroom technology in manufacturing units across several industries is one of the key reasons expected to fuel industry growth during the forecast period. Various sources of contamination such as product flow, raw materials, machinery, and personnel are likely to contaminate the entire production cycle, which can lead to contamination of the final product.

Regional manufacturing regulations and guidelines require pharmaceutical and biotech manufacturers to conduct all aseptic manufacturing processes in a cleanroom environment, which has led to increased adoption of cleanrooms. This can reduce worker fatigue, minimize errors, and increase yield, leading to higher production.

As per the cleanroom equipment market forecast, North America accounted for largest share in the global landscape. State-of-the-art healthcare facilities, presence of a well-developed healthcare infrastructure, and increase in number of medical and surgical procedures is boosting market progress in the region.

The market in Asia Pacific is expected to witness the fastest growth rate during the forecast years. Expanding pharmaceutical, biotech, and medical industries; favorable healthcare guidelines; and rise in healthcare expenditure are the primary factors augmenting market statistics in Asia Pacific. Asia Pacific is also a strategic location for investment in hi-tech applications. In 2021, investments in hi-tech clean spaces were recorded uniformly in Taiwan, South Korea, Singapore, and Hong Kong.

The global cleanroom equipment market is considerably consolidated with the presence of both large-scale manufacturers as well as local players.

AccumaX India, ACMAS Technologies (P) Ltd, Aircare Projects Pvt. Ltd, Airomax Airborne LLP, Bionics Scientific Technologies (P) LTD., Brinda Pharma Technologies, K J Pharmatech, MRC Systems FZE, Pharma Air Modular Systems, and Stericox India Private Limited are the prominent cleanroom equipment manufacturers.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 4.6 Bn |

|

Market Forecast Value in 2031 |

US$ 7.8 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 4.6 Bn in 2022

The CAGR is anticipated to be 6.1% from 2023 to 2031

It is expected to reach US$ 7.6 Bn in 2031

Application in every laboratory involved in biological activities, and rise in microbiological tests

AccumaX India, ACMAS Technologies (P) Ltd, Aircare Projects Pvt. Ltd, Airomax Airborne LLP, Bionics Scientific Technologies (P) LTD., Brinda Pharma Technologies, K J Pharmatech, MRC Systems FZE, Pharma Air Modular Systems, and Stericox India Private Limited

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Industry SWOT Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Import/Export Analysis

5.9. Cleanroom Equipment Market Overview

5.10. Key Suppliers Analysis

5.11. Price Trend Analysis

5.11.1. Weighted Average Selling Price (US$)

6. Global Cleanroom Equipment Market Analysis and Forecast, By Equipment Type

6.1. Cleanroom Equipment Market Size (US$ Mn and Thousand Units), By Equipment Type, 2017 - 2031

6.1.1. Air Shower

6.1.2. Interlock

6.1.3. AHU (Air Handling Unit)

6.1.4. Clean Bench

6.1.5. Laminar Flow Work Stations

6.1.6. Cleanroom Light Fixtures

6.1.7. Vertical Laminar Air Flow

6.1.8. Static Passbox

6.1.9. Sterile Garment Cabinet

6.1.10. Heating Ventilation and Air Conditioning Equipment (HVAC)

6.1.11. Others

6.2. Incremental Opportunity, By Equipment Type

7. Global Cleanroom Equipment Market Analysis and Forecast, By End-use Industry

7.1. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By End-use Industry, 2017 - 2031

7.1.1. Pharmaceutical

7.1.2. Aerospace

7.1.3. Electronics and semiconductor

7.1.4. Research laboratories

7.1.5. Cosmetic manufacturing

7.1.6. Medical equipment manufacturing

7.1.7. Others

7.2. Incremental Opportunity, By End-use Industry

8. Global Cleanroom Equipment Market Analysis and Forecast, By Region

8.1. Cleanroom Equipment Market Size (US$ Mn and Thousand Units), By Region, 2017 - 2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Incremental Opportunity, By Region

9. North America Cleanroom Equipment Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Key Supplier Analysis

9.3. Key Trends Analysis

9.3.1. Supply side

9.3.2. Demand Side

9.4. Price Trend Analysis

9.4.1. Weighted Average Selling Price (US$)

9.5. Cleanroom Equipment Market Size (US$ Mn and Thousand Units), By Equipment Type, 2017 - 2031

9.5.1. Air Shower

9.5.2. Interlock

9.5.3. AHU (Air Handling Unit)

9.5.4. Clean Bench

9.5.5. Laminar Flow Work Stations

9.5.6. Cleanroom Light Fixtures

9.5.7. Vertical Laminar Air Flow

9.5.8. Static Passbox

9.5.9. Sterile Garment Cabinet

9.5.10. Heating Ventilation and Air Conditioning Equipment (HVAC)

9.5.11. Others

9.6. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By End-use Industry, 2017 - 2031

9.6.1. Pharmaceutical

9.6.2. Aerospace

9.6.3. Electronics and semiconductor

9.6.4. Research laboratories

9.6.5. Cosmetic manufacturing

9.6.6. Medical equipment manufacturing

9.6.7. Others

9.7. Cleanroom Equipment Market Size (US$ Mn, Thousand Units) , by Country/Sub-region, 2017- 2031

9.7.1. U.S.

9.7.2. Canada

9.7.3. Rest of North America

9.8. Incremental Opportunity Analysis

10. Europe Cleanroom Equipment Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Supplier Analysis

10.3. Key Trends Analysis

10.3.1. Supply side

10.3.2. Demand Side

10.4. Price Trend Analysis

10.4.1. Weighted Average Selling Price (US$)

10.5. Cleanroom Equipment Market Size (US$ Mn and Thousand Units), By Equipment Type, 2017 - 2031

10.5.1. Air Shower

10.5.2. Interlock

10.5.3. AHU (Air Handling Unit)

10.5.4. Clean Bench

10.5.5. Laminar Flow Work Stations

10.5.6. Cleanroom Light Fixtures

10.5.7. Vertical Laminar Air Flow

10.5.8. Static Passbox

10.5.9. Sterile Garment Cabinet

10.5.10. Heating Ventilation and Air Conditioning Equipment (HVAC)

10.5.11. Others

10.6. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By End-use Industry, 2017 - 2031

10.6.1. Pharmaceutical

10.6.2. Aerospace

10.6.3. Electronics and semiconductor

10.6.4. Research laboratories

10.6.5. Cosmetic manufacturing

10.6.6. Medical equipment manufacturing

10.6.7. Others

10.7. Cleanroom Equipment Market Size (US$ Mn, Thousand Units), by Country/Sub-region, 2017- 2031

10.7.1. U.K.

10.7.2. Germany

10.7.3. France

10.7.4. Rest of Europe

10.8. Incremental Opportunity Analysis

11. Asia Pacific Cleanroom Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trends Analysis

11.3.1. Supply side

11.3.2. Demand Side

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. Cleanroom Equipment Market Size (US$ Mn and Thousand Units), By Equipment Type, 2017 - 2031

11.5.1. Air Shower

11.5.2. Interlock

11.5.3. AHU (Air Handling Unit)

11.5.4. Clean Bench

11.5.5. Laminar Flow Work Stations

11.5.6. Cleanroom Light Fixtures

11.5.7. Vertical Laminar Air Flow

11.5.8. Static Passbox

11.5.9. Sterile Garment Cabinet

11.5.10. Heating Ventilation and Air Conditioning Equipment (HVAC)

11.5.11. Others

11.6. Cleanroom Equipment Market Size (US$ Mn and Thousand Units), By End-use Industry, 2017 - 2031

11.6.1. Pharmaceutical

11.6.2. Aerospace

11.6.3. Electronics and semiconductor

11.6.4. Research laboratories

11.6.5. Cosmetic manufacturing,

11.6.6. Medical equipment manufacturing

11.6.7. Others

11.7. Cleanroom Equipment Market Size (US$ Mn, Thousand Units), by Country/Sub-region, 2017- 2031

11.7.1. China

11.7.2. India

11.7.3. Japan

11.7.4. Rest of Asia Pacific

11.8. Incremental Opportunity Analysis

12. Middle East & Africa Cleanroom Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Cleanroom Equipment Market Size (US$ Mn and Thousand Units), By Equipment Type, 2017 - 2031

12.5.1. Air Shower

12.5.2. Interlock

12.5.3. AHU (Air Handling Unit)

12.5.4. Clean Bench

12.5.5. Laminar Flow Work Stations

12.5.6. Cleanroom Light Fixtures

12.5.7. Vertical Laminar Air Flow

12.5.8. Static Passbox

12.5.9. Sterile Garment Cabinet

12.5.10. Heating Ventilation and Air Conditioning Equipment (HVAC)

12.5.11. Others

12.6. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By End-use Industry, 2017 - 2031

12.6.1. Pharmaceutical

12.6.2. Aerospace

12.6.3. Electronics and semiconductor

12.6.4. Research laboratories

12.6.5. Cosmetic manufacturing,

12.6.6. Medical equipment manufacturing

12.6.7. Others

12.7. Cleanroom Equipment Market Size (US$ Mn, Thousand Units), by Country/Sub-region, 2017- 2031

12.7.1. GCC

12.7.2. South Africa

12.7.3. Egypt

12.7.4. Rest of Middle East & Africa

12.8. Incremental Opportunity Analysis

13. South America Cleanroom Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Cleanroom Equipment Market Size (US$ Mn and Thousand Units), By Equipment Type, 2017 - 2031

13.5.1. Air Shower

13.5.2. Interlock

13.5.3. AHU (Air Handling Unit)

13.5.4. Clean Bench

13.5.5. Laminar Flow Work Stations

13.5.6. Cleanroom Light Fixtures

13.5.7. Vertical Laminar Air Flow

13.5.8. Static Passbox

13.5.9. Sterile Garment Cabinet

13.5.10. Heating Ventilation and Air Conditioning Equipment (HVAC)

13.5.11. Others

13.6. Cleanroom Equipment Market Size (US$ Mn and Thousand Units ), By End-use Industry, 2017 - 2031

13.6.1.1. Pharmaceutical

13.6.1.2. Aerospace

13.6.1.3. Electronics and semiconductor

13.6.1.4. Research laboratories

13.6.1.5. Cosmetic manufacturing

13.6.1.6. Medical equipment manufacturing

13.6.1.7. Others

13.7. Cleanroom Equipment Market Size (US$ Mn, Thousand Units) , by Country/Sub-region, 2017- 2031

13.7.1. Brazil

13.7.2. Rest of South America

13.8. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player - Competition Dashboard

14.2. Market Share Analysis (%), 2022

14.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

14.3.1. AccumaX Global

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.1.5. Go-To-Market Strategy

14.3.2. ACMAS Technologies (P) Ltd

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.2.5. Go-To-Market Strategy

14.3.3. AIRCARE PROJECTS PVT. LTD

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.3.5. Go-To-Market Strategy

14.3.4. Airomax Airborne LLP

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.4.5. Go-To-Market Strategy

14.3.5. Bionics Scientific Technologies (P) Ltd.

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.5.5. Go-To-Market Strategy

14.3.6. Brinda Pharma Technologies

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.6.5. Go-To-Market Strategy

14.3.7. K J Pharmatech

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.7.5. Go-To-Market Strategy

14.3.8. MRC Systems FZE

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.8.5. Go-To-Market Strategy

14.3.9. Pharma Air Modular Systems

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.9.5. Go-To-Market Strategy

14.3.10. Stericox Global Private Limited

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

14.3.10.5. Go-To-Market Strategy

14.3.11. Other Key Players

14.3.11.1. Company Overview

14.3.11.2. Sales Area/Geographical Presence

14.3.11.3. Revenue

14.3.11.4. Strategy & Business Overview

14.3.11.5. Go-To-Market Strategy

15. Go To Market Strategy

15.1. Identification of Potential Market Spaces

15.2. Understanding the Buying Process of Customers

List of Tables

Table 1: Global Cleanroom Equipment Market Volume (Thousand Units) Share, By Equipment Type 2017-2031

Table 2: Global Cleanroom Equipment Market Value (US$ Mn) Share, By Equipment Type 2017-2031

Table 3: Global Cleanroom Equipment Market Volume (Thousand Units) Share, By End-use Industry 2017-2031

Table 4: Global Cleanroom Equipment Market Value (US$ Mn) Share, By End-use Industry 2017-2031

Table 5: Global Cleanroom Equipment Market Volume (Thousand Units) Share, By Region 2017-2031

Table 6: Global Cleanroom Equipment Market Value (US$ Mn) Share, By Region 2017-2031

Table 7: North America Cleanroom Equipment Market Volume (Thousand Units) Share, By Equipment Type 2017-2031

Table 8: North America Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Table 9: North America Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Table 10: North America Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Table 11: North America Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Table 12: North America Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Table 13: Europe Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Table 14: Europe Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Table 15: Europe Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Table 16: Europe Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Table 17: Europe Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Table 18: Europe Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Table 19: Asia Pacific Cleanroom Equipment Market Volume (Thousand Units) Share, By Equipment Type 2017-2031

Table 20: Asia Pacific Cleanroom Equipment Market Value (US$ Mn) Share, By Equipment Type 2017-2031

Table 21: Asia Pacific Cleanroom Equipment Market Volume (Thousand Units) Share, By End-use Industry 2017-2031

Table 22: Asia Pacific Cleanroom Equipment Market Value (US$ Mn) Share, By End-use Industry 2017-2031

Table 23: Asia Pacific Cleanroom Equipment Market Volume (Thousand Units) Share, By Country 2017-2031

Table 24: Asia Pacific Cleanroom Equipment Market Value (US$ Mn) Share, By Country 2017-2031

Table 25: Middle East & Africa Cleanroom Equipment Market Volume (Thousand Units) Share, By Equipment Type 2017-2031

Table 26: Middle East & Africa Cleanroom Equipment Market Value (US$ Mn) Share, By Equipment Type 2017-2031

Table 27: Middle East & Africa Cleanroom Equipment Market Volume (Thousand Units) Share, By End-use Industry 2017-2031

Table 28: Middle East & Africa Cleanroom Equipment Market Value (US$ Mn) Share, By End-use Industry 2017-2031

Table 29: Middle East & Africa Cleanroom Equipment Market Volume (Thousand Units) Share, By Country 2017-2031

Table 30: Middle East & Africa Cleanroom Equipment Market Value (US$ Mn) Share, By Country 2017-2031

Table 31: South America Cleanroom Equipment Market Volume (Thousand Units) Share, By Equipment Type 2017-2031

Table 32: South America Cleanroom Equipment Market Value (US$ Mn) Share, By Equipment Type 2017-2031

Table 33: South America Cleanroom Equipment Market Volume (Thousand Units) Share, By End-use Industry 2017-2031

Table 34: South America Cleanroom Equipment Market Value (US$ Mn) Share, By End-use Industry 2017-2031

Table 35: South America Cleanroom Equipment Market Volume (Thousand Units) Share, By Country 2017-2031

Table 36: South America Cleanroom Equipment Market Value (US$ Mn) Share, By Country 2017-2031

List of Figures

Figures 1: Global Cleanroom Equipment Market Volume (Thousand Units) Share, By Equipment Type 2017-2031

Figures 2: Global Cleanroom Equipment Market Value (US$ Mn) Share, By Equipment Type 2017-2031

Figures 3: Global Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By Equipment Type 2017-2031

Figures 4: Global Cleanroom Equipment Market Volume (Thousand Units) Share, By End-use Industry 2017-2031

Figures 5: Global Cleanroom Equipment Market Value (US$ Mn) Share, By End-use Industry 2017-2031

Figures 6: Global Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By End-use Industry 2017-2031

Figures 7: Global Cleanroom Equipment Market Volume (Thousand Units) Share, By Region 2017-2031

Figures 8: Global Cleanroom Equipment Market Value (US$ Mn) Share, By Region 2017-2031

Figures 9: Global Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By Region 2017-2031

Figures 10: North America Cleanroom Equipment Market Volume (Thousand Units) Share, By Equipment Type 2017-2031

Figures 11: North America Cleanroom Equipment Market Value (US$ Mn) Share, By Equipment Type 2017-2031

Figures 12: North America Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By Equipment Type 2017-2031

Figures 13: North America Cleanroom Equipment Market Volume (Thousand Units) Share, By End-use Industry 2017-2031

Figures 14: North America Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Figures 15: North America Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By End-use Industry 2017-2031

Figures 16: North America Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Figures 17: North America Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Figures 18: North America Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By Country 2017-2031

Figures 19: Europe Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Figures 20: Europe Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Figures 21: Europe Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By Equipment Type 2017-2031

Figures 22: Europe Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Figures 23: Europe Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Figures 24: Europe Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By End-use Industry 2017-2031

Figures 25: Europe Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Figures 26: Europe Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Figures 27: Europe Cleanroom Equipment Market Incremental Opportunity (US$ Mn),By Country 2017-2031

Figures 28: Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Figures 29: Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Figures 30: Asia Pacific Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By Equipment Type 2017-2031

Figures 31: Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Figures 32: Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Figures 33: Asia Pacific Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By End-use Industry 2017-2031

Figures 34: Asia Pacific Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Figures 35: Asia Pacific Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Figures 36: Asia Pacific Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By Country 2017-2031

Figures 37: Middle East & Africa Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Figures 38: Middle East & Africa Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Figures 39: Middle East & Africa Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By Equipment Type 2017-2031

Figures 40: Middle East & Africa Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Figures 41: Middle East & Africa Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Figures 42: Middle East & Africa Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By End-use Industry 2017-2031

Figures 43: Middle East & Africa Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Figures 44: Middle East & Africa Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Figures 45: Middle East & Africa Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By Country 2017-2031

Figures 46: South America Cleanroom Equipment Market Volume(Thousand Units) Share, By Equipment Type 2017-2031

Figures 47: South America Cleanroom Equipment Market Value(US$ Mn) Share, By Equipment Type 2017-2031

Figures 48: South America Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By Equipment Type 2017-2031

Figures 49: South America Cleanroom Equipment Market Volume(Thousand Units) Share, By End-use Industry 2017-2031

Figures 50: South America Cleanroom Equipment Market Value(US$ Mn) Share, By End-use Industry 2017-2031

Figures 51: South America Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By End-use Industry 2017-2031

Figures 52: South America Cleanroom Equipment Market Volume(Thousand Units) Share, By Country 2017-2031

Figures 53: South America Cleanroom Equipment Market Value(US$ Mn) Share, By Country 2017-2031

Figures 54: South America Cleanroom Equipment Market Incremental Opportunity (US$ Mn), By Country 2017-2031