Reports

Reports

Analysts’ Viewpoint

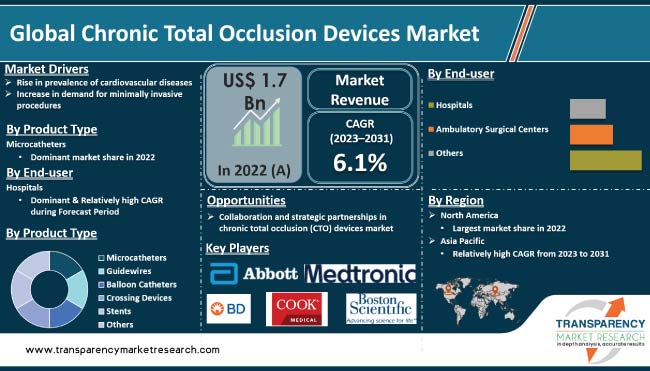

The global chronic total occlusion (CTO) devices market is expected to be driven by rise in prevalence of cardiovascular diseases. Demand for CTO devices is increasing due to the ability to diagnose and treat these complex conditions. Furthermore, surge in geriatric population and sedentary lifestyles of people are likely to propel the global chronic total occlusion devices market growth in the next few years.

Development of innovative products and services to diagnose and treat CTO is projected to offer lucrative opportunities to market players. Manufacturers are focusing on technological advancements in devices with improved success rates for treating chronic total occlusions. However, high cost of CTO devices and availability of alternative treatment options, such as bypass surgery and angioplasty, are likely to hamper market expansion.

Chronic total occlusion (CTO) refers to complete blockage of a coronary artery for an extended period, which could lead to severe chest pain, reduced heart function, and increased risk of heart attack. CTO is common in patients with advanced coronary artery disease, particularly those with a history of heart attack or coronary artery bypass surgery.

CTO devices are medical tools used during percutaneous coronary intervention (PCI) to treat complete blockages in coronary arteries that have been present for more than three months. CTO devices can help to improve outcomes for patients with complete blockages in coronary arteries, and could offer a minimally invasive alternative to bypass surgery.

Rise in prevalence of cardiovascular diseases (CVDs) is driving the global chronic total occlusion devices market demand. CVDs are the leading cause of death across the world, with an estimated 17.9 million deaths each year.

CTO is a severe form of coronary artery disease, in which a blood vessel is completely blocked for more than three months. It could lead to angina, heart attack, and heart failure. Prevalence of CTO is increasing globally, driven by aging population, lifestyle changes, and increase in rate of obesity and diabetes.

CTO devices, also know as chronic total occlusion intervention devices, are among the most promising treatment options for CTO. These devices are designed to navigate and cross the occluded arteries, enabling delivery of therapeutic agents, such as stents or balloons, to restore blood flow.

Surge in demand for CTO devices is ascribed to increase in number of patients suffering from CVDs and advancements in device technology.

Technological advancements are propelling global chronic total occlusion devices market size. These advancements have improved the accuracy and precision of CTO procedures, reduced the risk of complications, and led to the development of more specialized devices.

With ongoing research & development, the global chronic total occlusion devices industry is expected to continue to grow and innovate, thereby improving patient outcomes and reducing the burden of cardiovascular diseases.

CTO devices integrated with high-definition imaging technology provide more detailed images of arterial blockage. This technology enables physicians to view the blockage with greater accuracy, leading to better treatment decisions. It has also resulted in development of more specialized CTO devices that are tailored to different types of blockages.

Usage of specialized materials and coatings in CTO devices helps to reduce the risk of restenosis, the reoccurrence of arterial blockages after treatment. For instance, utilization of biodegradable polymers in drug-eluting stents has proven to be effective in reducing restenosis rates.

Integration of robotics and artificial intelligence (AI) is bolstering the global chronic total occlusion devices industry growth. Robotics and AI have been used to improve the precision and accuracy of CTO procedures. For instance, robotic-assisted catheterization allows for more precise control of the catheter, leading to better outcomes. AI algorithms could also be used to analyze patient data, helping physicians to make more informed treatment decisions.

Development of new CTO devices that are designed to be flexible and easy to maneuver and rise in prevalence of CTO across the world have led to surge in demand for CTO devices. Technological advancements in these devices are expected to propel demand for minimally invasive procedures.

The global chronic total occlusion devices market value has increased significantly in the past few years, primarily due to rise in demand for minimally invasive procedures. CTO is a condition, in which an artery is completely blocked, restricting blood flow to the heart. It could lead to serious health issues, including heart attack and stroke.

The traditional treatment for CTO has been open-heart surgery, which is invasive and could lead to complications. However, advent of minimally invasive procedures has made the treatment of CTO less invasive and more effective, leading to increase in demand for CTO devices.

Minimally invasive procedures involve the use of specialized tools and techniques to access and treat a blockage without the need for open-heart surgery. These procedures are less invasive, require less recovery time, and result in fewer complications than traditional open-heart surgery. Moreover, these offer a more cost-effective and efficient way to treat CTO.

Rise in demand for minimally invasive procedures has led to the development of new CTO devices, such as guidewires, microcatheters, and balloons, that can be used to treat CTO. These devices are designed to navigate through the blocked artery and deliver medication or remove the blockage. These are designed to be flexible and easy to maneuver, which makes them ideal for use in minimally invasive procedures.

In terms of product type, the microcatheters segment accounted for the largest global chronic total occlusion devices market share in 2022. Microcatheters are thin, flexible catheters that are used to navigate through small and tortuous vessels in order to reach and treat chronic total occlusions.

The segment's dominance is ascribed to rise in usage of microcatheters due to surge in adoption of minimally invasive procedures, which are less invasive than traditional surgeries and offer several advantages such as reduced hospital stays, faster recovery times, and lower costs.

Microcatheters can be used in combination with other devices, such as guidewires and balloons, to perform complex procedures such as angioplasty and stenting, which can help restore blood flow in the affected area. Surge in demand for cardiovascular interventions is expected to augment the microcatheters segment during the forecast period.

As per chronic total occlusion devices market trends, North America dominated the global industry in 2022. This is ascribed to increase in incidence of cardiovascular diseases, rise in demand for minimally invasive procedures, and large patient pool.

The region is a key market for CTO devices owing to well-established healthcare infrastructure, high awareness about CTO procedures, and favorable reimbursement policies. Prevalence of cardiovascular diseases in North America is high, which has resulted in increase in demand for CTO devices.

According to the American Heart Association, nearly 18.2 million adults in the U.S. suffer from coronary artery disease (CAD). The region's healthcare infrastructure provides access to the latest technologies and treatment methods.

Favorable reimbursement policies have facilitated the adoption of CTO devices in North America. Government-funded healthcare programs such as Medicare and Medicaid cover the cost of CTO procedures, making them accessible to a larger patient population.

The market in Asia Pacific has experienced significant growth in 2022. The market in the region is expected to grow at a rapid pace due to large patient pool, increase in demand for minimally invasive procedures, and technological advancements.

Rise in prevalence of cardiovascular diseases is likely to create lucrative chronic total occlusion devices market opportunities in Asia Pacific. Moreover, adoption of minimally invasive procedures is increasing in the region. Patients are opting for less invasive procedures to avoid the risks associated with open surgeries.

Technological advancements in CTO devices are also contributing to the growth of the market in Asia Pacific. Key market players are investing significantly in research & development to introduce innovative CTO devices that can provide better patient outcomes.

The chronic total occlusion devices industry research report provides profiles of leading players operating in the market. Medtronic, Boston Scientific Corporation, Abbott, Asahi Intecc Co., Ltd, Acrostak Int. Distr. Sàrl, Cook Medical, Koninklijke Philips N.V., Terumo Corporation, Teleflex Incorporated, Becton, Dickinson and Company, Reflow Medical, Inc., and Cordis are the prominent players in the market.

These players engage in merger & acquisition, strategic collaborations, and new product launches to expand presence and gain market share.

The chronic total occlusion devices market report profiles the top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 1.7 Bn |

|

Forecast (Value) in 2031 |

More than US$ 2.9 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 1.7 Bn in 2022

It is projected to reach more than US$ 2.9 Bn by 2031

It is anticipated to expand at a CAGR of 6.1% from 2023 to 2031

The microcatheters segment accounted for the largest share in 2022

North America is expected to account for significant share of global market during the forecast period.

Medtronic, Boston Scientific Corporation, Abbott, Asahi Intecc Co., Ltd, Acrostak Int. Distr. Sàrl, Cook Medical, Koninklijke Philips N.V., Terumo Corporation, Teleflex Incorporated, Becton, Dickinson and Company, Reflow Medical, Inc., and Cordis are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Chronic Total Occlusion Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution /Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Chronic Total Occlusion Devices Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Sales Analysis of Major Micro Catheter Brands, 2022

5.2. Sales Analysis of Major Guide Wires Brands, 2022

5.3. Sales Analysis of Major Crossing Device Brands, 2022

5.4. Technological Advancements

5.5. Disease Prevalence & Incidence Rate globally with key countries

5.6. Regulatory Scenario by Region/globally

5.7. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Chronic Total Occlusion Devices Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017-2031

6.3.1. Microcatheters

6.3.2. Guidewires

6.3.3. Balloon Catheters

6.3.4. Crossing Devices

6.3.5. Stents

6.3.6. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Chronic Total Occlusion Devices Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017-2031

7.3.1. Hospitals

7.3.2. Ambulatory Surgical Centers

7.3.3. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Chronic Total Occlusion Devices Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Chronic Total Occlusion Devices Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product Type, 2017-2031

9.2.1. Microcatheters

9.2.2. Guidewires

9.2.3. Balloon Catheters

9.2.4. Crossing Devices

9.2.5. Stents

9.2.6. Others

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017-2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By End-user

9.5.3. By Country

10. Europe Chronic Total Occlusion Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017-2031

10.2.1. Microcatheters

10.2.2. Guidewires

10.2.3. Balloon Catheters

10.2.4. Crossing Devices

10.2.5. Stents

10.2.6. Others

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Hospitals

10.3.2. Ambulatory Surgical Centers

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Chronic Total Occlusion Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017-2031

11.2.1. Microcatheters

11.2.2. Guidewires

11.2.3. Balloon Catheters

11.2.4. Crossing Devices

11.2.5. Stents

11.2.6. Others

11.3. Market Value Forecast, by End-user, 2017-2031

11.3.1. Hospitals

11.3.2. Ambulatory Surgical Centers

11.3.3. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Chronic Total Occlusion Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017-2031

12.2.1. Microcatheters

12.2.2. Guidewires

12.2.3. Balloon Catheters

12.2.4. Crossing Devices

12.2.5. Stents

12.2.6. Others

12.3. Market Value Forecast, by End-user, 2017-2031

12.3.1. Hospitals

12.3.2. Ambulatory Surgical Centers

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Chronic Total Occlusion Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017-2031

13.2.1. Microcatheters

13.2.2. Guidewires

13.2.3. Balloon Catheters

13.2.4. Crossing Devices

13.2.5. Stents

13.2.6. Others

13.3. Market Value Forecast, by End-user, 2017-2031

13.3.1. Hospitals

13.3.2. Ambulatory Surgical Centers

13.3.3. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2022

14.3. Company Profiles

14.3.1. Medtronic

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Type Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Boston Scientific Corporation

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Type Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Abbott

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Type Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Asahi Intecc Co., Ltd

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Type Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Acrostak Int. Distr. Sàrl

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Type Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Cook Medical

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Type Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Koninklijke Philips N.V

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Type Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Terumo Corporation

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Type Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Teleflex Incorporated

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Type Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Becton, Dickinson and Company

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Type Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Reflow Medical, Inc.

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Type Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Cordis

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Type Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

List of Tables

Table 01: Global Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 02: Global Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 03: Global Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 04: North America Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 05: North America Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 06: North America Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 07: Europe Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 08: Europe Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 09: Europe Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Asia Pacific Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 11: Asia Pacific Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 12: Asia Pacific Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 13: Latin America Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 14: Latin America Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 15: Latin America Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Middle East & Africa Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 17: Middle East & Africa Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 18: Middle East & Africa Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01: Global Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Chronic Total Occlusion Devices Market Value Share, by Product Type, 2022

Figure 03: Chronic Total Occlusion Devices Market Value Share, by End-user, 2022

Figure 04: Chronic Total Occlusion Devices Market Value Share, by Region, 2022

Figure 05: Global Chronic Total Occlusion Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 06: Global Chronic Total Occlusion Devices Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 07: Global Chronic Total Occlusion Devices Market Revenue (US$ Mn), by Micro Catheters, 2017-2031

Figure 08: Global Chronic Total Occlusion Devices Market Revenue (US$ Mn), by Guide Wires, 2017-2031

Figure 09: Global Chronic Total Occlusion Devices Market Revenue (US$ Mn), by Balloon Catheters, 2017-2031

Figure 10: Global Chronic Total Occlusion Devices Market Revenue (US$ Mn), by Crossing Devices, 2017-2031

Figure 11: Global Chronic Total Occlusion Devices Market Revenue (US$ Mn), by Stents, 2017-2031

Figure 12: Global Chronic Total Occlusion Devices Market Revenue (US$ Mn), by Others, 2017-2031

Figure 13: Global Chronic Total Occlusion Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 14: Global Chronic Total Occlusion Devices Market Attractiveness Analysis, End-user, 2023-2031

Figure 15: Global Chronic Total Occlusion Devices Market Revenue (US$ Mn), by Hospitals, 2017-2031

Figure 16: Global Chronic Total Occlusion Devices Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017-2031

Figure 17: Global Chronic Total Occlusion Devices Market Revenue (US$ Mn), by Others, 2017-2031

Figure 18: Global Chronic Total Occlusion Devices Market Value Share Analysis, by Region, 2022 and 2031

Figure 19: Global Chronic Total Occlusion Devices Market Attractiveness Analysis, by Region, 2023-2031

Figure 20: North America Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, 2017-2031

Figure 21: North America AI in Endoscopy Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 22: North America AI in Endoscopy Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 23: North America Chronic Total Occlusion Devices Market Value Share Analysis, by End--user, 2022 and 2031

Figure 24: North America Chronic Total Occlusion Devices Market Attractiveness Analysis, by End-user, 2023-2031

Figure 25: North America AI in Endoscopy Market Value Share Analysis, by Country, 2022 and 2031

Figure 26: North America AI in Endoscopy Market Attractiveness Analysis, by Country, 2023-2031

Figure 27: Europe Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, 2017-2031

Figure 28: Europe Chronic Total Occlusion Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 29: Europe Chronic Total Occlusion Devices Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 30: Europe Chronic Total Occlusion Devices Market Value Share Analysis, by End--user, 2022 and 2031

Figure 31: Europe Chronic Total Occlusion Devices Market Attractiveness Analysis, by End-user, 2023-2031

Figure 32: Europe Chronic Total Occlusion Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Europe Chronic Total Occlusion Devices Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 34: Asia Pacific Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, 2017-2031

Figure 35: Asia Pacific Chronic Total Occlusion Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 36: Asia Pacific Chronic Total Occlusion Devices Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 37: Asia Pacific Chronic Total Occlusion Devices Market Value Share Analysis, by End-user 2022 and 2031

Figure 38: Asia Pacific Chronic Total Occlusion Devices Market Attractiveness Analysis, End-user, 2023-2031

Figure 39: Asia Pacific Chronic Total Occlusion Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 40: Asia Pacific Chronic Total Occlusion Devices Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 41: Latin America Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, 2017-2031

Figure 42: Latin America Chronic Total Occlusion Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 43: Latin America Chronic Total Occlusion Devices Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 44: Latin America Chronic Total Occlusion Devices Market Value Share Analysis, by End-user 2022 and 2031

Figure 45: Latin America Chronic Total Occlusion Devices Market Attractiveness Analysis, End-user, 2023-2031

Figure 46: Latin America Chronic Total Occlusion Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 47: Latin America Chronic Total Occlusion Devices Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 48: Middle East & Africa Chronic Total Occlusion Devices Market Value (US$ Mn) Forecast, 2017-2031

Figure 49: Middle East & Africa Chronic Total Occlusion Devices Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 50: Middle East & Africa Chronic Total Occlusion Devices Market Attractiveness Analysis, by Product Type, 2023-2031

Figure 51: Middle East & Africa Chronic Total Occlusion Devices Market Value Share Analysis, by End-user 2022 and 2031

Figure 52: Middle East & Africa Chronic Total Occlusion Devices Market Attractiveness Analysis, End-user, 2023-2031

Figure 53: Middle East & Africa Chronic Total Occlusion Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 54: Middle East & Africa Chronic Total Occlusion Devices Market Attractiveness Analysis, by Country/Sub-region, 2023-2031