Reports

Reports

Analysts’ Viewpoint on Market Scenario

Chloromethane or is one of the primary haloalkanes that is extensively utilized as a solvent, chemical intermediate, and propellant in the chemical industry. The primary factors driving market expansion are rise in demand for silicone elastomers in industries such as construction, electronics, and automotive and increase in need for tire replacements from emerging economies. Rapid urbanization and increased usage of silicone in personal and medical applications are further aiding in market progression. In the construction industry, silicones are majorly utilized in coating and weatherproofing.

Chloromethane is widely used in the manufacture of several silicone products that are employed in the chemical industry. Chloromethane is also utilized in the synthesis of methylate silicone, dimethylchlorosilane, and related organosilicone compounds. It is extensively required in silicone fluids, silicone elastomers, adhesives, sealants, silicone resins, and other silicone products. Increase in demand for silicone in diverse applications is likely to boost the market for chloromethane during the forecast period.

Chloromethane is an organic flammable gas, which is toxic and colorless. Chloromethane, or CH3Cl, is produced by the reaction of methanol and chlorine under certain temperature and pressure. Methylene chloride, chloroform, and carbon tetra chloride are considered to be derivatives of chloromethane.

Chloromethane has numerous uses as a solvent, chemicals intermediate, and as a propellant. It is primarily utilized to manufacture silicones. Chloromethane is also used to make its precursor, which includes methylate silicon and dimethyldichlorosilane. Its chemical properties are beneficial in the production of various pharmaceutical medicines and chemicals. It is widely used to manufacture silicon fluids, silicone elastomers, and silicone resins. Methyl chloride is also employed in applications of methyl cellulose and hydroxypropyl. Chloromethane is also used as a raw material in agrochemicals specialty chemicals, water treatment, and other consumer products around the world.

Chloromethane is widely employed in the manufacture of several chemicals such as di chloro methane, tetra chloromethane, and bromo chloromethane. Multiple substitution in the methane and chlorine reaction may lead to formation of di chloro methane, tro chloro methane, and tetra chloromethane. The chloromethane structure has more reactivity towards chlorination or bromination, which leads to formation of various halokanes.

Chloromethane is extensively utilized in the synthesis of methylate silicone, dimethylchlorosilane and related organosilicone compounds. It is consumed in various applications such as silicone fluids, silicone elastomers, adhesives, sealants, silicone resins, and other silicone products.

Chloromethane is extensively employed as a key feedstock in the manufacture of silicone products such as silanes and siloxanes. These silicone materials are widely used in elastomers, sealants, and aerogels. Increase in demand for chloromethane in the manufacture of silicone is projected to boost the chloromethane market size during the forecast period.

Silicones are used in various applications, especially in the manufacture of silicone oil, silicone grease, silicone, rubber resins, and caulk. Increase in demand for sealants, adhesives, and lubricants is anticipated to augment the demand for chloromethane products during the forecast period. Silicone is employed in large number of end-use industries such a construction, automotive, coatings, aerospace, de-foaming, dry cleaning, medicine, health care, and electronics. The health care sector purchases a broad range of silicone products every year. This includes medical equipment, pharmaceutical products, and specialized medical devices.

Chloromethane is commonly used as a propellant or blowing agent in the manufacture of polystyrene foam in the polymer industry. Increase in consumer demand for chloromethane is positively impacting polymer end-use industries across the globe. The chloromethane market is expected to expand at a rapid pace during the forecast period due to the excellent chemical properties and less ozone layer depleting potential of chloromethane.

The Extruded Polystyrene Foam Association (XPFA), the Structural Insulated Panel Association (SIPA), and the European Extruded Polystyrene Insulation Board Association (EXIBA) are key associations in North America and Europe that strongly support the usage of polystyrene foams in the construction sector.

Extruded polystyrene foam offers excellent insulation properties that are useful in the construction industry. Polystyrene foam is employed widely in insulation products in the form of sheets, walls, and insulation panels in the construction industry in order to protect against external climatic conditions. Foam products are used extensively in flooring, roofs, facades, and ceilings. Rise in usage in insulation products and key applications of polystyrene foam in the building & construction sector is estimated to drive the demand for chloromethane and its derivatives during the forecast period.

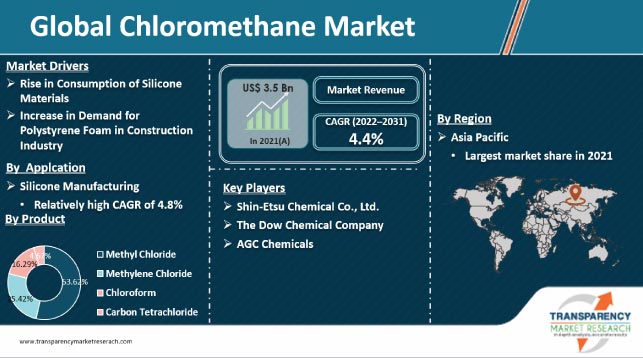

Most commonly used type of chloromethane is methyl chloride, which is primarily utilized for the production of silicone that is required as a chemical intermediate in the rubber and building & construction industries. In terms of market segmentation, the methyl chloride segment accounted for 53.6% of the global market share in 2021. The segment is estimated to grow at an above average CAGR of 4.5% during the forecast period.

Majority of methyl chloride produced is consumed as feedstock in the manufacture of the chemical intermediate, methyl chlorosilanes, which are used in the production of silicone fluids, elastomers, and resins.

The largest volume goes into silicone fluids, which are used in a wide range of products including processing aids such as antifoaming agents, release agents, and light-duty lubricants. It’s also used in specialty chemicals for consumer products such as cosmetics, auto polishes, furniture polishes, and paper coatings.

Silicone elastomers are used in the construction industry as sealants and adhesives and to a lesser degree, in automotive applications, wire and cable insulation, and medical and surgical applications. Silicone resins are utilized in coatings, water-repellent resins, molding resins, laminating resins, and electrical insulation. Silicon manufacturing accounted for 52.6% share of the total demand for chloromethane, globally, in 2021. It is estimated to grow at an above average CAGR of 4.8% during the forecast period.

Asia Pacific was a highly attractive market for chloromethane, which held around 58.5% of the global market share in 2021. It is expected to grow at an average CAGR of 4.7%, owing to the rapid industrialization in emerging countries such as China and India, which is estimated to propel the demand for chloromethane during the forecast period. Demand for chloromethane and its derivatives is anticipated to rise during the forecast period due to the extensive use of polystyrene foam in the building and construction industry.

Increase in disposable income of the middle class population in Asia Pacific is driving the construction sector in the region. Moreover, financial support in the form of subsidies and low interest rates for housing loans is also a key factor fueling the building and construction industry in the region, which in turn augments market growth.

The global chloromethane market was fragmented in 2021, with several manufacturers - AGC Chemicals, Gujarat Fluorochemicals Limited, Occidental Petroleum Corporation, Shin-Etsu Chemical Co., Ltd., Gujarat Alkalies and Chemical Limited, Tokuyama Corporation, KEM ONE - accounting for around 30% share.

Chloromethane manufacturers focus on establishing multiple production locations in multiple regions, capacity expansions, and growth of sales & distribution network in order to consolidate their position in the chloromethane business. Shin-Etsu Chemical Co., Ltd., The Dow Chemical Company, AGC Chemicals, Occidental Petroleum Corporation and Gujarat Fluorochemicals Limited are a few of the prominent market entities.

Key players have been profiled in the chloromethane market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 3.5 Bn |

|

Market Forecast Value in 2031 |

US$ 5.4 Bn |

|

Growth Rate (CAGR) |

4.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn For Value And Kilo Tons For Volume |

|

Market Analysis |

It includes cross segment analysis at Europe as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 3,538.3 Mn in 2021

The market is expected to grow at a CAGR of 4.4% from 2022 to 2031

Rise in consumption of silicone materials and increase in demand for polystyrene foam in construction industry

Methyl chloride held the largest product segment and held 53.6% share in 2021

Asia Pacific was the most lucrative region and held 58.5% share in 2021

Shin-Etsu Chemical Co., Ltd., The Dow Chemical Company, AGC Chemicals, Gujarat Alkalies, and Chemical Limited

1. Executive Summary

1.1. Chloromethane Market Snapshot

1.2. Key Market Trends

1.3. Current Market and Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Dynamics

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Opportunities

2.5. Porter’s Five Forces Analysis

2.6. Value Chain Analysis

2.6.1. List of Service Providers

2.6.2. List of Potential Customers

2.7. Production Analysis/Route of Synthesis

2.8. Product Specification Analysis

3. COVID-19 Impact Analysis

4. Global Chloromethane Market Analysis and Forecast, by Product, 2020–2031

4.1. Introduction and Definitions

4.2. Global Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

4.2.1.1. Methyl Chloride

4.2.1.2. Methylene Chloride

4.2.1.3. Chloroform

4.2.1.4. Carbon Tetrachloride

4.3. Global Chloromethane Market Attractiveness, by Product

5. Global Chloromethane Market Analysis and Forecast, by Application, 2020–2031

5.1. Introduction and Definitions

5.2. Global Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application,

5.2.1. Silicone Manufacturing

5.2.2. Medical & Pharmaceutical

5.2.3. Foam Blowing

5.2.4. Chemical Intermediaries & Catalyst

5.2.5. Agrochemicals

5.2.6. Others

5.3. Global Chloromethane Market Attractiveness, by Application

6. Global Chloromethane Market Analysis and Forecast, by Region, 2020–2031

6.1. Key Findings

6.2. Global Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Latin America

6.2.5. Middle East & Africa

6.3. Global Chloromethane Market Attractiveness, by Region

7. North America Chloromethane Market Analysis and Forecast, 2020–2031

7.1. Key Findings

7.2. North America Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

7.3. North America Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.4. North America Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

7.4.1. U.S. Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

7.4.2. U.S. Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.4.3. Canada Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

7.4.4. Canada Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.5. North America Chloromethane Market Attractiveness Analysis

8. Europe Chloromethane Market Analysis and Forecast, 2020–2031

8.1. Key Findings

8.2. Europe Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

8.3. Europe Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4. Europe Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

8.4.1. Germany Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

8.4.2. Germany Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4.3. France Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

8.4.4. France Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4.5. U.K. Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

8.4.6. U.K. Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4.7. Italy Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

8.4.8. Italy Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4.9. Spain Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

8.4.10. Spain Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4.11. Russia & CIS Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

8.4.12. Russia & CIS Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.4.13. Rest of Europe Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

8.4.14. Rest of Europe Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.5. Europe Chloromethane Market Attractiveness Analysis

9. Asia Pacific Chloromethane Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. Asia Pacific Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020-2031

9.3. Asia Pacific Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4. Asia Pacific Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

9.4.1. China Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

9.4.2. China Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.3. Japan Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

9.4.4. Japan Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.5. India Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

9.4.6. India Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.7. ASEAN Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

9.4.8. ASEAN Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4.9. Rest of Asia Pacific Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

9.4.10. Rest of Asia Pacific Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.5. Asia Pacific Chloromethane Market Attractiveness Analysis

10. Latin America Chloromethane Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Latin America Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.3. Latin America Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. Latin America Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

10.4.1. Brazil Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.4.2. Brazil Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.3. Mexico Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.4.4. Mexico Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4.5. Rest of Latin America Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.4.6. Rest of Latin America Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. Latin America Chloromethane Market Attractiveness Analysis

11. Middle East & Africa Chloromethane Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Middle East & Africa Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.3. Middle East & Africa Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4. Middle East & Africa Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

11.4.1. GCC Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.2. GCC Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.3. South Africa Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.4. South Africa Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4.5. Rest of Middle East & Africa Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.6. Rest of Middle East & Africa Chloromethane Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Middle East & Africa Chloromethane Market Attractiveness Analysis

12. Global Chloromethane Company Market Share Analysis, 2021

12.1. Competition Matrix

12.2. Market Footprint Analysis

12.2.1. By Product

12.2.2. By Application

12.3. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

12.3.1. The Dow Chemical Company

12.3.1.1. Company Description

12.3.1.2. Business Overview

12.3.1.3. Financial Details

12.3.1.4. Strategic Overview

12.3.2. AGC Chemicals

12.3.2.1. Company Description

12.3.2.2. Business Overview

12.3.2.3. Financial Details

12.3.2.4. Strategic Overview

12.3.3. Gujarat Fluorochemicals Limited

12.3.3.1. Company Description

12.3.3.2. Business Overview

12.3.3.3. Financial Details

12.3.3.4. Strategic Overview

12.3.4. The Sanmar Group

12.3.4.1. Company Description

12.3.4.2. Business Overview

12.3.4.3. Financial Details

12.3.4.4. Strategic Overview

12.3.5. Nouryon

12.3.5.1. Company Description

12.3.5.2. Business Overview

12.3.5.3. Financial Details

12.3.5.4. Strategic Overview

12.3.6. Occidental Petroleum Corporation

12.3.6.1. Company Description

12.3.6.2. Business Overview

12.3.6.3. Financial Details

12.3.6.4. Strategic Overview

12.3.7. KEM ONE

12.3.7.1. Company Description

12.3.7.2. Business Overview

12.3.7.3. Financial Details

12.3.7.4. Strategic Overview

12.3.8. Shin-Etsu Chemical Co., Ltd.

12.3.8.1. Company Description

12.3.8.2. Business Overview

12.3.8.3. Financial Details

12.3.8.4. Strategic Overview

12.3.9. Gujarat Alkalies and Chemical Limited

12.3.9.1. Company Description

12.3.9.2. Business Overview

12.3.9.3. Financial Details

12.3.9.4. Strategic Overview

12.3.10. Spectrum Chemical Manufacturing Corp.

12.3.10.1. Company Description

12.3.10.2. Business Overview

12.3.10.3. Financial Details

12.3.10.4. Strategic Overview

12.3.11. Krunal Acid Agency

12.3.11.1. Company Description

12.3.11.2. Business Overview

12.3.11.3. Financial Details

12.3.11.4. Strategic Overview

12.3.12. Mitsubishi Australia Ltd.

12.3.12.1. Company Description

12.3.12.2. Business Overview

12.3.12.3. Financial Details

12.3.12.4. Strategic Overview

12.3.13. Alfa Aesar

12.3.13.1. Company Description

12.3.13.2. Business Overview

12.3.13.3. Financial Details

12.3.13.4. Strategic Overview

12.3.14. Tokuyama Corporation

12.3.14.1. Company Description

12.3.14.2. Business Overview

12.3.14.3. Financial Details

12.3.14.4. Strategic Overview

12.3.15. SRF Limited

12.3.15.1. Company Description

12.3.15.2. Business Overview

12.3.15.3. Financial Details

12.3.15.4. Strategic Overview

12.3.16. Benzer Multi Tech India Private Limited

12.3.16.1. Company Description

12.3.16.2. Business Overview

12.3.16.3. Financial Details

12.3.16.4. Strategic Overview

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 01: Import Volume Statistics, by Region (Tons), 2019-2021

Table 02: Export Volume Statistics, by Region (Tons), 2019-2021

Table 03: Import Volume Statistics, by Region (Tons), 2019-2021

Table 04: Export Volume Statistics, by Region (Tons), 2019-2021

Table 05: Import Volume Statistics, by Region (Tons), 2019-2021

Table 06: Export Volume Statistics, by Region (Tons), 2019-2021

Table 07: Import Volume Statistics, by Country (Tons), 2019-2021

Table 08: Export Volume Statistics, by Country (Tons), 2019-2021

Table 09: Global Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 10: Global Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 11: Global Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2022–2031

Table 12: North America Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 13: North America Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 14: North America Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2022–2031

Table 15: U.S. Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 16: U.S. Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 17: Canada Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 18: Canada Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 19: Europe Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 20: Europe Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 21: Europe Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Country & Sub-region, 2022–2031

Table 22: Germany Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 23: Germany Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 24: U.K. Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 25: U.K. Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 26: France Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 27: France Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 28: Italy Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 29: Italy Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 30: Spain Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 31: Spain Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 32: Russia & CIS Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 33: Russia & CIS Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 34: Rest of Europe Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 35: Rest of Europe Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 36: Asia Pacific Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 37: Asia Pacific Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 39: China Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 40: China Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 41: Japan Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 42: Japan Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 43: India Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 44: India Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 45: ASEAN Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 46: ASEAN Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 47: Rest of Asia Pacific Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 48: Rest of Asia Pacific Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 49: Latin America Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 50: Latin America Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 51: Latin America Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Country & Sub-region, 2022–2031

Table 52: Brazil Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 53: Brazil Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 54: Mexico Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 55: Mexico Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 56: Rest of Latin America Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 57: Rest of Latin America Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 58: Middle East & Africa Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 59: Middle East & Africa Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 60: GCC Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 61: GCC Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 62: South Africa Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 63: South Africa Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 64: Rest of Middle East & Africa Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

Table 65: Rest of Middle East & Africa Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

Table 66: Rest of Middle East & Africa Chloromethane Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

List of Figures

Figure 01: Global Chloromethane Market Share Analysis, by Product, 2022–2031

Figure 02: Global Chloromethane Market Attractiveness Analysis, by Product, 2022–2031

Figure 03: Global Chloromethane Market Volume (Tons) and Value (US$ Mn), 2022–2031

Figure 04: Global Chloromethane Market Share Analysis, by Application, 2022–2031

Figure 05: Global Chloromethane Market Attractiveness Analysis, by Application, 2022–2031

Figure 06: Global Chloromethane Market Share Analysis, by Region, 2022–2031

Figure 07: Global Chloromethane Market Attractiveness Analysis, by Region, 2022–2031

Figure 08: North America Chloromethane Market Volume (Tons) and Value (US$ Mn), 2022–2031

Figure 09: North America Chloromethane Market Value Share Analysis, by Country, 2022–2031

Figure 10: North America Chloromethane Market Attractiveness Analysis, by Country, 2022–2031

Figure 11: North America Chloromethane Market Share Analysis, by Product, 2022–2031

Figure 12: North America Chloromethane Market Attractiveness Analysis, by Product, 2022–2031

Figure 13: North America Chloromethane Market Share Analysis, by Application, 2022–2031

Figure 14: North America Chloromethane Market Attractiveness Analysis, by Application, 2022–2031

Figure 15: Europe Chloromethane Market Volume (Tons) and Value (US$ Mn), 2022–2031

Figure 16: Europe Chloromethane Market Share Analysis, by Country, 2022–2031

Figure 17: Europe Chloromethane Market Attractiveness Analysis, by Country, 2022–2031

Figure 18: Europe Chloromethane Market Share Analysis, by Product, 2022–2031

Figure 19: Europe Chloromethane Market Attractiveness Analysis, by Product, 2022–2031

Figure 20: Europe Chloromethane Market Share Analysis, by Application, 2022–2031

Figure 21: Europe Chloromethane Market Attractiveness Analysis, by Application, 2022–2031

Figure 22: Asia Pacific Chloromethane Market Volume (Tons) and Value (US$ Mn), 2022–2031

Figure 23: Asia Pacific Chloromethane Market Value Share Analysis, by Country and Sub-region, 2022–2031

Figure 24: Asia Pacific Chloromethane Market Attractiveness Analysis, by Country and Sub-region, 2022–2031

Figure 25: Asia Pacific Chloromethane Market Share Analysis, by Product, 2022–2031

Figure 26: Asia Pacific Chloromethane Market Attractiveness Analysis, by Product, 2022–2031

Figure 27: Asia Pacific Chloromethane Market Share Analysis, by Application, 2022–2031

Figure 28: Asia Pacific Chloromethane Market Attractiveness Analysis, by Application, 2022–2031

Figure 29: Latin America Chloromethane Market Volume (Tons) and Value (US$ Mn), 2022–2031

Figure 30: Latin America Chloromethane Market Share Analysis, by Country and Sub-region, 2022–2031

Figure 31: Latin America Chloromethane Market Attractiveness Analysis, by Country and Sub-region, 2022–2031

Figure 32: Latin America Chloromethane Market Share Analysis, by Product, 2022–2031

Figure 33: Latin America Chloromethane Market Attractiveness Analysis, by Product, 2022–2031

Figure 34: Latin America Chloromethane Market Share Analysis, by Application, 2022–2031

Figure 35: Latin America Chloromethane Market Attractiveness Analysis, by Application, 2022–2031

Figure 36: Middle East & Africa Chloromethane Market Volume (Tons) and Value (US$ Mn), 2022–2031

Figure 37: Middle East & Africa Chloromethane Market Share Analysis, by Country and Sub-region, 2022–2031

Figure 38: Middle East & Africa Chloromethane Market Attractiveness Analysis, by Country and Sub-region, 2022–2031

Figure 39: Middle East & Africa Chloromethane Market Share Analysis, by Product, 2022–2031

Figure 40: Middle East & Africa Chloromethane Market Attractiveness Analysis, by Product, 2022–2031

Figure 41: Middle East & Africa Chloromethane Market Share Analysis, by Application, 2022–2031

Figure 42: Middle East & Africa Chloromethane Market Attractiveness Analysis, by Application, 2022–2031

Figure 43: Company Market Share Analysis, 2021