Reports

Reports

Analysts’ Viewpoint

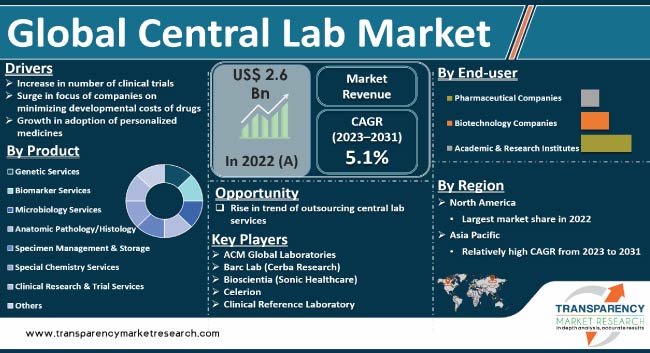

Increase in demand for personalized medicines and rise in number of clinical trials are the key factors boosting central lab market development. Surge in prevalence of chronic diseases such as diabetes and cancer and growth in need for accurate and reliable diagnostic services are also fueling central lab market dynamics.

Adoption of advanced technologies, such as automation and Artificial Intelligence, is expected to drive central lab industry growth in the next few years. However, high cost of central lab services and lack of skilled professionals are likely to restrain market growth to some extent. Key players operating in the global market are focusing on strategic collaborations and partnerships to enhance product offerings and expand their global footprint.

Central diagnostic laboratory is a vital component of the healthcare industry, as it provides essential services to pharmaceutical and biotech companies. Central labs are specialized facilities that offer a range of services, including clinical trial testing, biomarker analysis, and drug development support. These labs are equipped with advanced technologies and highly skilled professionals who work together to provide accurate and reliable results.

Central laboratory services include bioanalytical testing, clinical chemistry, hematology, microbiology, and molecular diagnostics. These services are essential for drug development and clinical trials, as they help identify potential safety issues and ensure the efficacy of new drugs.

Central labs offer a range of advantages, including standardized testing protocols, centralized data management, and faster turnaround times.

Clinical trials are an essential part of drug development. Central labs provide various services such as sample collection, testing, analysis, and reporting to support clinical trial activities.

The global central lab business is growing at a rapid pace due to the increase in prevalence of chronic diseases and rise in aging population. As a result, demand for new drugs that help treat these diseases effectively is rising significantly. This has led to an increase in number of clinical trials being conducted globally.

Regulatory organizations of different countries have made it mandatory for pharmaceutical companies to conduct extensive clinical trials before launching any new drug in the market. Such regulations ensure that drugs are safe and effective before they reach patients.

Central labs play a crucial role in supporting these clinical trials by providing accurate and reliable data on drug efficacy and safety. They help pharmaceutical companies meet regulatory requirements while ensuring patient safety.

Advancements in technologies, such as electronic data capture (EDC) systems and cloud-based platforms, have allowed central labs to offer more efficient services at lower costs than traditional methods. This has further increased their popularity among pharmaceutical companies conducting clinical trials.

Personalized medicine involves offering medical treatment based on a patient’s genetic information. Personalized medicine offers several benefits over traditional approaches such as improved treatment outcomes with fewer side effects, which lead to a better quality of life for patients suffering from chronic conditions.

Personalized medicine also reduces healthcare costs through targeted therapies, which help reduce unnecessary treatments or hospitalizations.

Central labs play a key role in supporting personalized medicines by providing accurate and reliable data on patient characteristics such as genetics, biomarkers, and other diagnostic tests. This information is used to develop targeted therapies that are more effective than traditional approaches.

Rise in prevalence of chronic diseases such as cancer and diabetes has boosted the demand for personalized medicines. According to the World Health Organization (WHO), cancer is one of the leading causes of death across the globe. Personalized medicines offer hope for better treatment outcomes for these patients.

The genetic services product segment accounted for significant market share in 2022. It is expected to dominate in the near future. Increase in demand for personalized medicines is one of the key factors driving the segment.

Advancements in technology have made genetic testing faster and more affordable. For instance, Illumina, Inc., a leading provider of DNA sequencing technology, announced the launch of its new NovaSeq 6000 Sequencing System in January 2017. The system can sequence up to 48 human genomes per run at a lower cost than previous systems.

Such technological advancements have enabled central labs to offer genetic testing services at competitive prices, thereby boosting central lab market growth.

The pharmaceutical companies end-user segment is estimated to account for major share of the global market in the near future. Pharmaceutical companies are taking efforts to reduce the cost of development and manufacture of drugs.

Central lab services can be outsourced by these companies. Central lab services provide advanced technologies and use innovative processes. This helps in the drug development process. Central labs also prove more efficient and cost-effective for large multinational pharmaceutical companies in lowering the development cost of new drugs.

North America is anticipated to dominate the global central lab market during the forecast period, owing to the presence of well-established pharmaceutical companies and high adoption rate of advanced technologies.

Presence of leading players such as Laboratory Corporation of America Holdings (Labcorp), Quest Diagnostics, and Charles River Laboratories International, Inc. is also fueling market statistics in North America. The central lab market size in the region is projected to increase steadily in the next few years, owing to the favorable government initiatives aimed at improving healthcare facilities.

As per the latest central lab market forecast, Asia Pacific is likely to be one of the fastest-growing regions during the forecast period. This growth can be ascribed to the increase in investment by key players in the healthcare sector and rise in demand for clinical trials in the region.

Increase in population and rise in prevalence of chronic diseases in countries such as China and India are projected to fuel central lab market demand in Asia Pacific. Furthermore, low labor costs make it easier for companies to set up operations in the region.

The global landscape is fragmented, with the presence of several prominent companies that control majority of the central lab market share.

As per the central lab market research analysis, companies are focusing on strategies such as launch of new products, mergers & acquisitions (M&A), and partnerships to strengthen their position in the industry.

ACM Global Laboratories, Bioscientia (Sonic Healthcare), CIRION BioPharma Research, Eurofins Central Laboratory, ICON Central Laboratories, InVitro International, INTERLAB Central Lab Services, Labcorp/Covance, Medpace, PPD, MLM Medical Labs GmbH, Frontage Laboratories, Inc., Barc Lab (Cerba Research), Q² Solutions, Celerion, Clinical Reference Laboratory, and LabConnect are the leading central lab companies operating in this market.

Each of these players has been profiled in the central lab market report based on parameters such as financial overview company overview, latest developments, business strategies, business segments, and product portfolio.

|

Attribute |

Detail |

|---|---|

|

Market Value in 2022 |

US$ 2.6 Bn |

|

Market Forecast Value in 2031 |

More than US$ 4.1 Bn |

|

Compound Annual Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 2.6 Bn in 2022

It is projected to reach more than US$ 4.1 Bn by 2031

It is anticipated to grow at a CAGR of 5.1% from 2023 to 2031

Increase in complexity and number of clinical trials and rise in focus of companies on minimizing developmental cost of drugs

The genetic services product segment accounted for major share in 2022

North America is the most lucrative region

ACM Global Laboratories, Barc Lab (Cerba Research), Bioscientia (Sonic Healthcare), Celerion, CIRION BioPharma Research, Clinical Reference Laboratory, Eurofins Central Laboratory, Frontage Laboratories, Inc., ICON Central Laboratories, INTERLAB Central Lab Services, InVitro International, Labcorp/Covance, LabConnect, Medpace, MLM Medical Labs GmbH., PPD, and Q² Solutions

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Central Lab Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Central Lab Market Analysis and Forecast, 2017 - 2031

5. Key Insights

5.1. Strategies Adopted by Top 3 Players

5.2. Impact of Cell and Gene Therapy on Central Lab Market

5.3. Impact of Clinical Trial on Central Lab Market

5.4. COVID-19 Impact Analysis

6. Global Central Lab Market Analysis and Forecast, By Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product, 2017 - 2031

6.3.1. Genetic Services

6.3.2. Biomarker Services

6.3.3. Microbiology Services

6.3.4. Anatomic Pathology/Histology

6.3.5. Specimen Management & Storage

6.3.6. Special Chemistry Services

6.3.7. Clinical Research & Trial Services

6.3.8. Others

6.4. Market Attractiveness By Product

7. Global Central Lab Market Analysis and Forecast, By End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By End-user, 2017 - 2031

7.3.1. Pharmaceutical Companies

7.3.2. Biotechnology Companies

7.3.3. Academic & Research Institutes

7.4. Market Attractiveness By End-user

8. Global Central Lab Market Analysis and Forecast, By Region

8.1. Key Findings

8.2. Market Value Forecast By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness By Country/Region

9. North America Central Lab Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast By Product, 2017 - 2031

9.2.1. Genetic Services

9.2.2. Biomarker Services

9.2.3. Microbiology Services

9.2.4. Anatomic Pathology/Histology

9.2.5. Specimen Management & Storage

9.2.6. Special Chemistry Services

9.2.7. Clinical Research & Trial Services

9.2.8. Others

9.3. Market Value Forecast By End-user, 2017 - 2031

9.3.1. Pharmaceutical Companies

9.3.2. Biotechnology Companies

9.3.3. Academic & Research Institutes

9.4. Market Value Forecast By Country, 2017 - 2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Central Lab Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Product, 2017 - 2031

10.2.1. Genetic Services

10.2.2. Biomarker Services

10.2.3. Microbiology Services

10.2.4. Anatomic Pathology/Histology

10.2.5. Specimen Management & Storage

10.2.6. Special Chemistry Services

10.2.7. Clinical Research & Trial Services

10.2.8. Others

10.3. Market Value Forecast By End-user, 2017 - 2031

10.3.1. Pharmaceutical Companies

10.3.2. Biotechnology Companies

10.3.3. Academic & Research Institutes

10.4. Market Value Forecast By Country, 2017 - 2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country

11. Asia Pacific Central Lab Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product, 2017 - 2031

11.2.1. Genetic Services

11.2.2. Biomarker Services

11.2.3. Microbiology Services

11.2.4. Anatomic Pathology/Histology

11.2.5. Specimen Management & Storage

11.2.6. Special Chemistry Services

11.2.7. Clinical Research & Trial Services

11.2.8. Others

11.3. Market Value Forecast By End-user, 2017 - 2031

11.3.1. Pharmaceutical Companies

11.3.2. Biotechnology Companies

11.3.3. Academic & Research Institutes

11.4. Market Value Forecast By Country, 2017 - 2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country

12. Latin America Central Lab Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product, 2017 - 2031

12.2.1. Genetic Services

12.2.2. Biomarker Services

12.2.3. Microbiology Services

12.2.4. Anatomic Pathology/Histology

12.2.5. Specimen Management & Storage

12.2.6. Special Chemistry Services

12.2.7. Clinical Research & Trial Services

12.2.8. Others

12.3. Market Value Forecast By End-user, 2017 - 2031

12.3.1. Pharmaceutical Companies

12.3.2. Biotechnology Companies

12.3.3. Academic & Research Institutes

12.4. Market Value Forecast By Country, 2017 - 2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country

13. Middle East & Africa Central Lab Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product, 2017 - 2031

13.2.1. Genetic Services

13.2.2. Biomarker Services

13.2.3. Microbiology Services

13.2.4. Anatomic Pathology/Histology

13.2.5. Specimen Management & Storage

13.2.6. Special Chemistry Services

13.2.7. Clinical Research & Trial Services

13.2.8. Others

13.3. Market Value Forecast By End-user, 2017 - 2031

13.3.1. Pharmaceutical Companies

13.3.2. Biotechnology Companies

13.3.3. Academic & Research Institutes

13.4. Market Value Forecast By Country, 2017 - 2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country

14. Competition Landscape

14.1. Market Player - Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2022)

14.3. Company Profiles

14.3.1. ACM Global Laboratories

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Test Type Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Barc Lab (Cerba Research)

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Test Type Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Bioscientia (Sonic Healthcare)

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Test Type Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Celerion

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Test Type Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. CIRION BioPharma Research

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Test Type Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Clinical Reference Laboratory

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Test Type Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Eurofins Central Laboratory

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Test Type Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Frontage Laboratories, Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Test Type Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. ICON Central Laboratories

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Test Type Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. INTERLAB Central Lab Services

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Test Type Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. InVitro International

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Test Type Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Labcorp/Covance

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Test Type Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

14.3.13. LabConnect

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Test Type Portfolio

14.3.13.3. Financial Overview

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

14.3.14. Medpace

14.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.14.2. Test Type Portfolio

14.3.14.3. Financial Overview

14.3.14.4. SWOT Analysis

14.3.14.5. Strategic Overview

14.3.15. MLM Medical Labs GmbH

14.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.15.2. Test Type Portfolio

14.3.15.3. Financial Overview

14.3.15.4. SWOT Analysis

14.3.15.5. Strategic Overview

14.3.16. PPD

14.3.16.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.16.2. Test Type Portfolio

14.3.16.3. Financial Overview

14.3.16.4. SWOT Analysis

14.3.16.5. Strategic Overview

14.3.17. Q² Solutions

14.3.17.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.17.2. Test Type Portfolio

14.3.17.3. Financial Overview

14.3.17.4. SWOT Analysis

14.3.17.5. Strategic Overview

List of Tables

Table 01: Global Central Lab Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 02: Global Central Lab Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 03: Global Central Lab Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 04: North America Central Lab Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 05: North America Central Lab Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 06: North America Central Lab Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 07: Europe Central Lab Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017-2031

Table 08: Europe Central Lab Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 09: Europe Central Lab Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 10: Asia Pacific Central Lab Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017-2031

Table 11: Asia Pacific Central Lab Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 12: Asia Pacific Central Lab Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 13: Latin America Central Lab Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017-2031

Table 14: Latin America Central Lab Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 15: Latin America Central Lab Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 16: Middle East & Africa Central Lab Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017-2031

Table 17: Middle East & Africa Central Lab Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 18: Middle East & Africa Central Lab Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

List of Figures

Figure 01: Global Central Lab market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Central Lab market Value Share, by Product, 2022

Figure 03: Global Central Lab market Value Share, by End-user, 2022

Figure 04: Global Central Lab market Value Share, by Region, 2022

Figure 05: Global Central Lab Market Value Share Analysis, by Product, 2022 and 2031

Figure 06: Global Central Lab Market Attractiveness Analysis, by Product, 2023-2031

Figure 07: Global Central Lab Market Revenue (US$ Mn), by Genetic Services, 2017-2031

Figure 08: Global Central Lab Market Revenue (US$ Mn), by Biomarker Services, 2017-2031

Figure 09: Global Central Lab Market Revenue (US$ Mn), by Microbiology Services, 2017-2031

Figure 10: Global Central Lab Market Revenue (US$ Mn), by Anatomic Pathology/Histology, 2017-2031

Figure 11: Global Central Lab Market Revenue (US$ Mn), by Specimen Management & Storage, 2017-2031

Figure 12: Global Central Lab Market Revenue (US$ Mn), by Special Chemistry Services, 2017-2031

Figure 13: Global Central Lab Market Revenue (US$ Mn), by Clinical Research & Trial Services, 2017-2031

Figure 14: Global Central Lab Market Revenue (US$ Mn), by Others, 2017-2031

Figure 15: Global Central Lab Market, by End-user, 2022 and 2031

Figure 16: Global Central Lab Market, by End-user, 2023-2031

Figure 17: Global Central Lab Market Revenue (US$ Mn), by Pharmaceutical Companies, 2017-2031

Figure 18: Global Central Lab Market Revenue (US$ Mn), by Biotechnology Companies, 2017-2031

Figure 19: Global Central Lab Market Revenue (US$ Mn), by Academic & Research Institutes, 2017-2031

Figure 20: Global Central Lab Market Value Share Analysis, by Region, 2022 and 2031

Figure 21: Global Central Lab Market Attractiveness Analysis, by Region, 2023-2031

Figure 22: North America Central Lab Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 23: North America Central Lab Market Value Share Analysis, by Country, 2022 and 2031

Figure 24: North America Central Lab Market Attractiveness Analysis, by Country, 2023-2031

Figure 25: North America Central Lab Market Value Share Analysis, by Product, 2022 and 2031

Figure 26: North America Central Lab Market Attractiveness Analysis, by Product, 2023-2031

Figure 27: North America Central Lab Market, by End-user, 2022 and 2031

Figure 28: North America Central Lab Market, by End-user, 2023-2031

Figure 29: Europe Central Lab Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 30: Europe Central Lab Market Value Share Analysis, by Country, 2022 and 2031

Figure 31: Europe Central Lab Market Attractiveness Analysis, by Country, 2023-2031

Figure 32: Europe Central Lab Market Value Share Analysis, by Product, 2022 and 2031

Figure 33: Europe Central Lab Market Attractiveness Analysis, by Product, 2023-2031

Figure 34: Europe Central Lab Market, by End-user, 2022 and 2031

Figure 35: Europe Central Lab Market, by End-user, 2023-2031

Figure 36: Asia Pacific Central Lab Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 37: Asia Pacific Central Lab Market Value Share Analysis, by Country, 2022 and 2031

Figure 38: Asia Pacific Central Lab Market Attractiveness Analysis, by Country,

Figure 39: Asia Pacific Central Lab Market Value Share Analysis, by Product, 2022 and 2031

Figure 40: Asia Pacific Central Lab Market Attractiveness Analysis, by Product, 2023-2031

Figure 41: Asia Pacific Central Lab Market, by End-user, 2022 and 2031

Figure 42: Asia Pacific Central Lab Market, by End-user, 2023-2031

Figure 43: Latin America Central Lab Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 44: Latin America Central Lab Market Value Share Analysis, by Country, 2022 and 2031

Figure 45: Latin America Central Lab Market Attractiveness Analysis, by Country, 2023-2031

Figure 46: Latin America Central Lab Market Value Share Analysis, by Product, 2022 and 2031

Figure 47: Latin America Central Lab Market Attractiveness Analysis, by Product, 2023-2031

Figure 48: Latin America Central Lab Market, by End-user, 2022 and 2031

Figure 49: Latin America Central Lab Market, by End-user, 2023-2031

Figure 50: Middle East & Africa Central Lab Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 51: Middle East & Africa Central Lab Market Value Share Analysis, by Country, 2022 and 2031

Figure 52: Middle East & Africa Central Lab Market Attractiveness Analysis, by Country, 2023-2031

Figure 53: Middle East & Africa Central Lab Market Value Share Analysis, by Product, 2022 and 2031

Figure 54: Middle East & Africa Central Lab Market Attractiveness Analysis, by Product, 2023-2031

Figure 55: Middle East & Africa Central Lab Market, by End-user, 2022 and 2031

Figure 56: Middle East & Africa Central Lab Market, by End-user, 2023-2031

Figure 57: Global Central Lab Market Share, by Company, 2022