Reports

Reports

Analysts’ Viewpoint

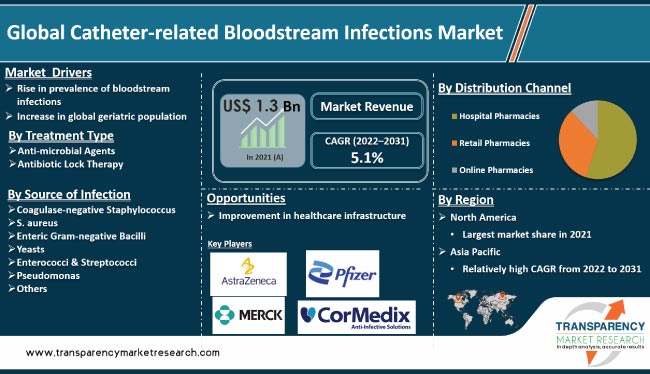

Growth in aging population, rise in prevalence of chronic diseases, and increase in number of invasive medical procedures are driving the global catheter-related bloodstream infections market. Surge in number of surgeries and increase in number of patients requiring catheterization are also expected to fuel market expansion.

Increase in adoption of advanced technologies & products for CRBSI infection prevention and treatment, such as antimicrobial-coated catheters and improved diagnostic methods, is presenting significant opportunities for market players.

Leading players are focusing on the development of advanced, safe, and cost-effective products. Government initiatives to promote patient safety and increase in awareness about CRBSIs among healthcare professionals and patients are likely to augment market progress.

Catheter-related bloodstream infection (CRBSI) can be defined as presence of bacteremia after the usage of intravenous catheter. It is a frequent and severe complication of central venous catheterization, and a common cause of nosocomial bacteremia.

Integral to modern practice, intravascular catheters are used for critically-ill patients for administration of fluids, blood products, medication, nutritional solutions, and for hemodynamic monitoring.

Central venous catheters (CVCs) present a significant risk of device-related infections than any other type of medical devices. CVCs are also major causes of morbidity and mortality. These are also the primary source of bacteremia and septicemia in hospitalized patients.

Rise in number of invasive medical procedures performed, such as surgeries and cancer treatments that require the use of catheters, increases the risk of infection. This results in higher demand for products and services related to prevention and treatment of these infections. Usage of catheter for a long duration increases the chances of infection. Thus, rise in number of invasive medical procedures is a key driver of the catheter-related bloodstream infection market.

Surge in prevalence of antibiotic-resistant bacteria is another prominent market catalyst. Rise in antibiotic-resistant infections is leading to an increase in demand for products and services that could help prevent and treat these infections.

Rise in prevalence of bloodstream infections, increase in awareness, surge in adoption of minimally invasive procedures, growth in prevalence of antibiotic-resistant bacteria, and higher demand for more effective and safer products are fueling the catheter-related bloodstream infections market.

Growth in aging population is one of the key drivers of the catheter associated bloodstream infections market. The global population over 60 years is expected to double from 11% to 22% between 2000 and 2050. The number of people aged 60 and above is anticipated to increase from 605 million to 2.1 billion during the period.

Incidence of chronic diseases such as diabetes and heart diseases rises with age. This, in turn, increases the risk of CRBSI infections, resulting in higher demand for products and services related to prevention and treatment of these infections.

Aging population is driving the global catheter-related bloodstream infections industry, as older individuals are more likely to require invasive medical procedures. Elderly people are more likely to develop chronic conditions, such as cancer, heart diseases, and diabetes, which require treatment. Several of these conditions require the use of catheters, which increases the risk of CRBSI infection. Hence, older individuals are more likely to develop CRBSI infection and require treatment. Thus, surge in geriatric population is expected to increase the catheter-related bloodstream infections market size.

In terms of treatment type, the anti-microbial agents segment accounted for the largest market share of more than 75% in 2021. This trend is expected to continue during the forecast period.

Anti-microbial agents, such as antibiotics, can help treat catheter-related bloodstream infections by killing or inhibiting the growth of bacteria that have colonized the catheter or have entered the bloodstream through the catheter. These agents can be administered orally, intravenously, or topically.

It is important to use the appropriate antibiotic based on the type of bacteria causing the infection. It is equally vital to continue treatment for the recommended duration to ensure the infection is fully cleared.

Based on distribution channel, the hospital pharmacies segment dominated the global catheter-related bloodstream infections market in 2021. Most patients prefer hospital pharmacies owing to the convenience of treatment and availability of medicines offered at hospitals. Furthermore, proper diagnosis and availability of multiple options for treating catheter-related bloodstream infections are leading to an increase in number of patient visits to hospital pharmacies. Thus, the hospital pharmacies segment held around 55.0% share of the global market in 2021.

According to catheter-related bloodstream infections industry analysis, North America held the largest share of the global market in 2021. This trend is expected to continue during the forecast period primarily due to the presence of well-established health care infrastructure and technological advancements in the healthcare sector to treat blood-related infections.

Increase in number of people suffering from catheter-related blood infections in the U.S. and Canada, especially the geriatric population, is driving the market in North America. Furthermore, availability of various treatments for catheter associated bloodstream infections is propelling the market in the region.

The market in Asia Pacific is projected to grow at a rapid pace during the forecast period owing to the rise in prevalence of hospital-acquired infections. According to the World Health Organization's Department of Communicable Disease, the risk of healthcare-associated infection is two to 20 times higher in developing countries than that in developed countries.

The global market is highly consolidated, with the presence of small number of key players. These players hold major share in their respective regions. Demand for catheter-related bloodstream infection products has increased in emerging as well as developed markets due to the rise in prevalence of blood stream infections. Growth strategies and focus on research & development by key players are the factors likely to drive the global market.

Leading companies in the global catheter-related bloodstream infections market are Xellia Pharmaceuticals Ltd., Pfizer, Glenmark Pharmaceuticals Ltd., Fresenius Medical Care, CorMedix, Inc., TauroPhar GmbH, Geistlich Pharma, Citus Pharmaceuticals, AstraZeneca, and Merck & Co., Inc.

Prominent players have been profiled in the global catheter-related bloodstream infections market report based on parameters such as product portfolio, recent developments, financial overview, company overview, strategies, and segments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 1.3 Bn |

|

Forecast (Value) in 2031 |

More than US$ 2.0 Bn |

|

Compound Annual Growth Rate (CAGR) |

5.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 1.3 Bn in 2021

It is projected to reach more than US$ 2.0 Bn by 2031

The CAGR is expected to be 5.1% from 2022 to 2031

Rise in prevalence of bloodstream infections and increase in global geriatric population

Xellia Pharmaceuticals Ltd., Pfizer, Glenmark Pharmaceuticals Ltd., Fresenius Medical Care, CorMedix Inc., TauroPhar GmbH, Geistlich Pharma, Citus Pharmaceuticals, AstraZeneca, and Merck & Co., Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Catheter-related Bloodstream Infections Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Catheter-related Bloodstream Infections Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Forces Analysis

5. Key Insights

5.1. Disease Prevalence & Incidence Rate Globally With Key Countries

5.2. Key Industry Events

5.3. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Catheter-related Bloodstream Infections Market Analysis and Forecast, by Treatment Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Treatment Type, 2017–2031

6.3.1. Anti-microbial Agents

6.3.2. Antibiotic Lock Therapy

6.4. Market Attractiveness Analysis, by Treatment Type

7. Global Catheter-related Bloodstream Infections Market Analysis and Forecast, by Source of Infection

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Source of Infection, 2017–2031

7.3.1. Coagulase-negative Staphylococcus

7.3.2. S. aureus

7.3.3. Enteric Gram-negative Bacilli

7.3.4. Yeasts

7.3.5. Enterococci & Streptococci

7.3.6. Pseudomonas

7.3.7. Others

7.4. Market Attractiveness Analysis, by Source of Infection

8. Global Catheter-related Bloodstream Infections Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Catheter-related Bloodstream Infections Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Catheter-related Bloodstream Infections Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Treatment Type, 2017–2031

10.2.1. Anti-microbial Agents

10.2.2. Antibiotic Lock Therapy

10.3. Market Value Forecast, by Source of Infection, 2017–2031

10.3.1. Coagulase-negative Staphylococcus

10.3.2. S. aureus

10.3.3. Enteric Gram-negative Bacilli

10.3.4. Yeasts

10.3.5. Enterococci & Streptococci

10.3.6. Pseudomonas

10.3.7. Others

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Treatment Type

10.6.2. By Source of Infection

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Catheter-related Bloodstream Infections Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Treatment Type, 2017–2031

11.2.1. Anti-microbial Agents

11.2.2. Antibiotic Lock Therapy

11.3. Market Value Forecast, by Source of Infection, 2017–2031

11.3.1. Coagulase-negative Staphylococcus

11.3.2. S. aureus

11.3.3. Enteric Gram-negative Bacilli

11.3.4. Yeasts

11.3.5. Enterococci & Streptococci

11.3.6. Pseudomonas

11.3.7. Others

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Treatment Type

11.6.2. By Source of Infection

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Catheter-related Bloodstream Infections Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Treatment Type, 2017–2031

12.2.1. Anti-microbial Agents

12.2.2. Antibiotic Lock Therapy

12.3. Market Value Forecast, by Source of Infection, 2017–2031

12.3.1. Coagulase-negative Staphylococcus

12.3.2. S. aureus

12.3.3. Enteric Gram-negative Bacilli

12.3.4. Yeasts

12.3.5. Enterococci & Streptococci

12.3.6. Pseudomonas

12.3.7. Others

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Treatment Type

12.6.2. By Source of Infection

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Catheter-related Bloodstream Infections Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Treatment Type, 2017–2031

13.2.1. Anti-microbial Agents

13.2.2. Antibiotic Lock Therapy

13.3. Market Value Forecast, by Source of Infection, 2017–2031

13.3.1. Coagulase-negative Staphylococcus

13.3.2. S. aureus

13.3.3. Enteric Gram-negative Bacilli

13.3.4. Yeasts

13.3.5. Enterococci & Streptococci

13.3.6. Pseudomonas

13.3.7. Others

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Treatment Type

13.6.2. By Source of Infection

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Catheter-related Bloodstream Infections Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Treatment Type, 2017–2031

14.2.1. Anti-microbial Agents

14.2.2. Antibiotic Lock Therapy

14.3. Market Value Forecast, by Source of Infection, 2017–2031

14.3.1. Coagulase-negative Staphylococcus

14.3.2. S. aureus

14.3.3. Enteric Gram-negative Bacilli

14.3.4. Yeasts

14.3.5. Enterococci & Streptococci

14.3.6. Pseudomonas

14.3.7. Others

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Treatment Type

14.6.2. By Source of Infection

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. AstraZeneca

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. CorMedix, Inc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Citus Pharmaceuticals

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Fresenius Medical Care

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Glenmark Pharmaceuticals Ltd.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Geistlich Pharma

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Merck & Co., Inc.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Pfizer

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. TauroPhar GmbH

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. Xellia Pharmaceuticals Ltd.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

List of Tables

Table 01: Global Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 02: Global Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Source of Infection, 2017–2031

Table 03: Global Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 06: North America Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Source of Infection, 2017–2031

Table 07: North America Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 08: North America Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 10: Europe Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Source of Infection, 2017–2031

Table 11: Europe Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 12: Europe Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 14: Asia Pacific Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Source of Infection, 2017–2031

Table 15: Asia Pacific Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 16: Asia Pacific Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 18: Latin America Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Source of Infection, 2017–2031

Table 19: Latin America Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 20: Latin America Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Treatment Type, 2017–2031

Table 22: Middle East & Africa Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Source of Infection, 2017–2031

Table 23: Middle East & Africa Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 24: Middle East & Africa Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Catheter-related Bloodstream Infections Market Analysis and Forecast, by Treatment Type, 2021 and 2031

Figure 03: Global Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 04: Global Catheter-related Bloodstream Infections Market Analysis and Forecast, by Source of Infection 2021 and 2031

Figure 05: Global Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Source of Infection, 2022–2031

Figure 06: Global Catheter-related Bloodstream Infections Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 07: Global Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 08: Global Catheter-related Bloodstream Infections Market Analysis and Forecast, by Region, 2021 and 2031

Figure 09: Global Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Region, 2022–2031

Figure 10: North America Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: North America Catheter-related Bloodstream Infections Market Analysis and Forecast, by Treatment Type, 2021 and 2031

Figure 12: North America Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 13: North America Catheter-related Bloodstream Infections Market Analysis and Forecast, by Source of Infection, 2021 and 2031

Figure 14: North America Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Source of Infection, 2022–2031

Figure 15: North America Catheter-related Bloodstream Infections Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 16: North America Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 17: North America Catheter-related Bloodstream Infections Market Analysis and Forecast, by Country, 2021 and 2031

Figure 18: North America Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Country, 2022–2031

Figure 19: Europe Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, 2017–2031

Figure 20: Europe Catheter-related Bloodstream Infections Market Analysis and Forecast, by Treatment Type, 2021 and 2031

Figure 21: Europe Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 22: Europe Catheter-related Bloodstream Infections Market Analysis and Forecast, by Source of Infection, 2021 and 2031

Figure 23: Europe Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Source of Infection, 2022–2031

Figure 24: Europe Catheter-related Bloodstream Infections Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 25: Europe Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 26: Europe Catheter-related Bloodstream Infections Market Analysis and Forecast, by Country/Sub-region, 2021 and 2031

Figure 27: Europe Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 28: Asia Pacific Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, 2017–2031

Figure 29: Asia Pacific Catheter-related Bloodstream Infections Market Analysis and Forecast, by Treatment Type, 2021 and 2031

Figure 30: Asia Pacific Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 31: Asia Pacific Catheter-related Bloodstream Infections Market Analysis and Forecast, by Source of Infection, 2021 and 2031

Figure 32: Asia Pacific Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Source of Infection, 2022–2031

Figure 33: Asia Pacific Catheter-related Bloodstream Infections Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 34: Asia Pacific Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 35: Asia Pacific Catheter-related Bloodstream Infections Market Analysis and Forecast, by Country/Sub-region, 2021 and 2031

Figure 36: Asia Pacific Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 37: Latin America Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, 2017–2031

Figure 38: Latin America Catheter-related Bloodstream Infections Market Analysis and Forecast, by Treatment Type, 2021 and 2031

Figure 39: Latin America Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 40: Latin America Catheter-related Bloodstream Infections Market Analysis and Forecast, by Source of Infection, 2021 and 2031

Figure 41: Latin America Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Source of Infection, 2022–2031

Figure 42: Latin America Catheter-related Bloodstream Infections Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 43: Latin America Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 44: Latin America Catheter-related Bloodstream Infections Market Analysis and Forecast, by Country/Sub-region, 2021 and 2031

Figure 45: Latin America Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 46: Middle East & Africa Catheter-related Bloodstream Infections Market Value (US$ Mn) Forecast, 2017–2031

Figure 47: Middle East & Africa Catheter-related Bloodstream Infections Market Analysis and Forecast, by Treatment Type, 2021 and 2031

Figure 48: Middle East & Africa Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Treatment Type, 2022–2031

Figure 49: Middle East & Africa Catheter-related Bloodstream Infections Market Analysis and Forecast, by Source of Infection, 2021 and 2031

Figure 50: Middle East & Africa Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Source of Infection, 2022–2031

Figure 51: Middle East & Africa Catheter-related Bloodstream Infections Market Analysis and Forecast, by Distribution Channel, 2021 and 2031

Figure 52: Middle East & Africa Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 53: Middle East & Africa Catheter-related Bloodstream Infections Market Analysis and Forecast, by Country/Sub-region, 2021 and 2031

Figure 54: Middle East & Africa Catheter-related Bloodstream Infections Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 55: Global Catheter-related Bloodstream Infections Market Share Analysis/Ranking, by Company, 2021