Reports

Reports

Analysts’ Viewpoint

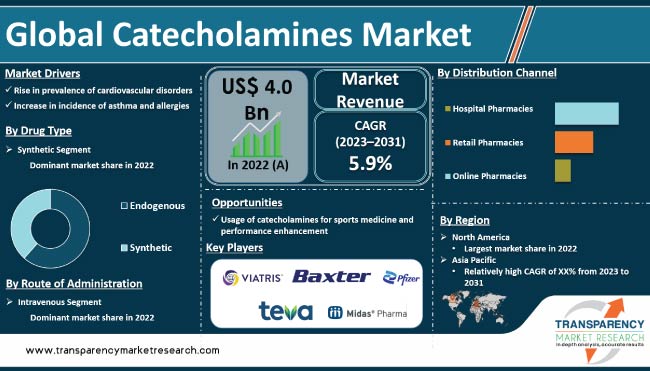

Increase in incidence of cardiovascular diseases, including heart failure, hypotension, and shock, is driving the global catecholamines market demand. Advancements in drug delivery systems, such as infusion pumps, needle-free devices, implantable systems, and nanotechnology-based delivery, are improving the administration and effectiveness of catecholamines, leading to enhanced patient outcomes. Furthermore, growing emphasis on personalized medicine, which entails tailoring treatments based on individual patient characteristics, is propelling market expansion.

Development of more efficacious and safe catecholamine medications offers lucrative opportunities to market players. Companies are focusing on development of advanced infusion pumps and devices for precise delivery of catecholamines.

However, competition from alternative treatments and lack of awareness & understanding among healthcare professionals and patients about appropriate use, dosing, and potential benefits & risks are likely to hamper the global catecholamines industry.

Catecholamines are a group of neurotransmitters and hormones that play essential roles in the human body. These are derived from the amino acid tyrosine and have a common chemical structure that includes a catechol ring and an amine group. The three primary catecholamines are dopamine, epinephrine (adrenaline), and norepinephrine (noradrenaline).

Catecholamines are involved in regulating various physiological processes, including the nervous system, cardiovascular system, and metabolic functions. These act as chemical messengers, transmitting signals between nerve cells and modulating the body's response to stress and emergencies. Catecholamines exert their effects by binding to specific receptors located on the surface of target cells.

Catecholamines, such as dopamine and norepinephrine, are used to treat cardiovascular disorders such as hypotension (low blood pressure), shock, and heart failure. These increase cardiac output, elevate blood pressure, and improve organ perfusion. Moreover, catecholamines, specifically dopamine, are involved in regulating the production and release of hormones in the body.

Rise in prevalence of cardiovascular diseases is a significant driver of the global catecholamines market. Catecholamines, such as dopamine, epinephrine (adrenaline), and norepinephrine (noradrenaline), are commonly used in the management of hypotension (low blood pressure) and shock.

These conditions can occur as a result of cardiovascular diseases, including heart failure, myocardial infarction, and septic shock. Rise in prevalence of cardiovascular conditions directly drives demand for catecholamines for treatment regimen.

According to the American Heart Association (AHA), in the U.S., cardiovascular diseases claim more lives than all forms of cancer combined, with approximately 1 in 3 deaths attributed to CVD. In Europe, cardiovascular diseases are responsible for more than 4 million deaths each year, according to the European Heart Network.

Catecholamines, especially epinephrine, play a crucial role in emergency cardiac care, such as cardiac arrest and resuscitation. Epinephrine is administered during CPR (cardiopulmonary resuscitation) to stimulate the heart, increase myocardial contractility, and restore blood flow.

Increase in incidence of cardiovascular emergencies and cardiac arrests propels demand for catecholamines in emergency medical settings.

Technological advancements in drug delivery systems are driving the global market. These advancements have the potential to improve the administration, efficacy, and safety of catecholamine medications.

Development of advanced infusion pumps and devices has revolutionized the delivery of catecholamines. These devices allow for precise control over infusion rates, enabling healthcare professionals to administer catecholamines in a controlled and consistent manner.

Advanced infusion pumps also offer features such as programmable dosing, multiple infusion modes, and integration with patient monitoring systems, enhancing the overall safety and efficiency of catecholamine therapy.

Needle-free delivery systems, such as jet injectors and needle-free injectors, are being explored as alternatives to traditional needle-based injections for catecholamine administration. These systems use pressure or gas to propel medications through the skin, eliminating the need for needles and reducing the associated pain and anxiety. Needle-free delivery systems offer the potential for improved patient comfort, convenience, and medication adherence.

Nanotechnology has opened up new possibilities in drug delivery, including the delivery of catecholamines. Nanoparticles and nanostructures can be designed to encapsulate catecholamines, protecting them from degradation and enhancing their stability and bioavailability. Nanotechnology-based delivery systems offer the potential for targeted and controlled release of catecholamines, minimizing off-target effects and improving therapeutic outcomes.

Technological advancements not only improve the administration of catecholamines, but also address challenges such as dose accuracy, patient compliance, and individualized therapy. These advancements contribute to the growth and expansion of the catecholamines market by enhancing the overall effectiveness and safety of catecholamine therapy, driving innovation and investment in this field.

In terms of drug type, the synthetic segment accounted for the largest global catecholamines market share in 2022. Catecholamines are naturally occurring substances in the body and not synthetic drugs. However, synthetic formulations of catecholamines are used in several medical applications.

Synthetic formulations of catecholamines offer greater stability and consistency in terms of potency and dosing compared to endogenous catecholamines. Synthetic catecholamines are produced under controlled laboratory conditions, ensuring standardized and reliable concentrations.

Synthetic catecholamine medications, such as dopamine, epinephrine (adrenaline), and norepinephrine (noradrenaline), are commercially available in various formulations and delivery methods. These synthetic drugs are produced by pharmaceutical companies and can be readily obtained by healthcare providers.

The physiological effects and functions of synthetic and endogenous catecholamines are similar, as they act on the same receptors in the body. The choice of synthetic formulations depends on factors such as medical indications, patient characteristics, and healthcare provider's judgment.

Based on route of administration, the intravenous (IV) segment dominated the global catecholamines market in 2022. The IV route allows for direct delivery of catecholamines into the bloodstream, resulting in a rapid onset of action. This is particularly important in emergency situations where immediate intervention is required, such as in cases of hypotension or shock.

By administering catecholamines intravenously, healthcare professionals can closely monitor and control the dosage, ensuring accurate and individualized therapy. This is essential as the dosage may need to be adjusted based on the patient's response and clinical condition.

The IV route enables continuous infusion of catecholamines, which is often necessary in critical care settings or when a sustained therapeutic effect is required. Continuous infusion allows for maintaining the desired blood pressure, cardiac output, or organ perfusion over an extended period.

With the IV route, catecholamine infusion rates can be easily adjusted, titrated, and fine-tuned to achieve the desired hemodynamic parameters. This flexibility allows healthcare professionals to customize therapy based on the patient's specific needs and response.

In terms of indication, the cardiac arrest segment held leading share of the global market in 2022. Catecholamines, such as dopamine, epinephrine (adrenaline), and norepinephrine (noradrenaline), are used in various medical conditions and indications.

Catecholamines are commonly used to treat hypotension (low blood pressure) and shock, including septic shock, cardiogenic shock, and hypovolemic shock. These help increase blood pressure and improve cardiac output.

Catecholamines, especially epinephrine, are utilized in cardiac arrest situations to restore cardiac rhythm and support cardiac function. These can be administered during resuscitation efforts to stimulate the heart.

Epinephrine is a primary treatment option for acute asthma attacks and severe allergic reactions (anaphylaxis). It helps relax the airway muscles, open up the airways, and constrict blood vessels.

Catecholamines, particularly epinephrine, can be used to relieve bronchospasm, which occurs in conditions such as asthma and chronic obstructive pulmonary disease (COPD). These help dilate the airways and improve breathing.

Epinephrine is the drug of choice for the emergency treatment of anaphylaxis and severe allergic reactions. It rapidly reverses the symptoms by counteracting the allergic response and preventing life-threatening complications.

Based on distribution channel, the hospital pharmacies segment dominated the global catecholamines market in 2022. Catecholamine medications, including dopamine, epinephrine (adrenaline), and norepinephrine (noradrenaline), are commonly used in hospital settings for the treatment of various medical conditions, such as cardiovascular disorders, shock, and respiratory emergencies.

Hospital pharmacies stock a range of medications, including critical care drugs such as catecholamines. These pharmacies are equipped to handle and dispense specialized medications required for emergency situations or inpatient treatments.

Hospital pharmacies are conveniently located within healthcare facilities, ensuring direct access to healthcare professionals, including physicians, nurses, and pharmacists. This facilitates prompt prescription verification, consultation, and monitoring of patients receiving catecholamine therapy.

As per catecholamines market trends, North America dominated the global market in 2022. The region has a well-established healthcare infrastructure, high prevalence of cardiovascular diseases, and strong focus on emergency medical services. These factors contribute to the demand for catecholamines in this region.

Europe is another major market for catecholamines. The region has high incidence of cardiovascular diseases and strong emphasis on healthcare. Demand for catecholamines is high in countries such as Germany, the U.K., France, and Italy.

The catecholamines market in Asia Pacific has experienced rapid growth in the past few years. Increase in healthcare spending, improving healthcare infrastructure, and surging population contribute to the expansion of the market in countries such as China, Japan, India, and South Korea. Additionally, rise in prevalence of chronic diseases and greater awareness about emergency medical services are fueling the demand for catecholamines in the region.

Product portfolio expansion and mergers & acquisitions are the key strategies adopted by major companies in the market. Pfizer, Inc., Baxter International, Novartis International AG (Sandoz), Breckenridge Pharmaceutical, Inc., Viatris, Inc. (Mylan N.V), Mallinckrodt Pharmaceuticals, Amneal Pharmaceuticals, Lexicare Pharma Pvt. Ltd., Midas Pharma GmbH, Armstrong Pharmaceuticals, Inc., Adamis Pharmaceuticals Corporation, and Teva Pharmaceutical Industries Ltd. are the prominent players in the global market.

The catecholamines market report profiles key players based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 4.0 Bn |

|

Forecast (Value) in 2031 |

US$ 6.7 Bn |

|

Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 4.0 Bn in 2022

It is projected to reach more than US$ 6.7 Bn by 2031

The business is anticipated to grow at a CAGR of 5.9% from 2023 to 2031

Rise in prevalence cardiovascular diseases and increase in incidence of asthma & allergic reactions are propelling the market.

North America is projected to account for major market share during the forecast period

Pfizer, Inc., Baxter International, Novartis International AG (Sandoz), Breckenridge Pharmaceutical, Inc., Viatris, Inc. (Mylan N.V), Mallinckrodt Pharmaceuticals, Amneal Pharmaceuticals, Lexicare Pharma Pvt. Ltd., Midas Pharma GmbH, Armstrong Pharmaceuticals, Inc., Adamis Pharmaceuticals Corporation, and Teva Pharmaceutical Industries Ltd. are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Catecholamines Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Catecholamines Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Overview of Catecholamines Market

5.2. Regulatory Scenario Globally/Region

5.3. Pipeline Analysis

5.4. COVID-19 Pandemic Impact on Industry

6. Global Catecholamines Market Analysis and Forecast, by Drug Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Drug Type, 2017-2031

6.3.1. Endogenous

6.3.2. Synthetic

6.4. Market Attractiveness Analysis, by Drug Type

7. Global Catecholamines Market Analysis and Forecast, by Route of Administration

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Route of Administration, 2017-2031

7.3.1. Intravenous

7.3.2. Inhalation

7.3.3. Transdermal

7.3.4. Others

7.4. Market Attractiveness Analysis, by Route of Administration

8. Global Catecholamines Market Analysis and Forecasts, by Indication

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Indication, 2017-2031

8.3.1. Anaphylaxis

8.3.2. Cardiac Arrest

8.3.3. Acute Asthma

8.3.4. Shock

8.3.5. Hypertension

8.3.6. Others

8.4. Market Attractiveness Analysis, by Indication

9. Global Catecholamines Market Analysis and Forecast, by Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Distribution Channel, 2017-2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Attractiveness Analysis, by Distribution Channel

10. Global Catecholamines Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2017-2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, By Region

11. North America Catecholamines Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Type, 2017-2031

11.2.1. Endogenous

11.2.2. Synthetic

11.3. Market Value Forecast, by Route of Administration, 2017-2031

11.3.1. Intravenous

11.3.2. Inhalation

11.3.3. Transdermal

11.3.4. Others

11.4. Market Value Forecast, by Indication, 2017-2031

11.4.1. Anaphylaxis

11.4.2. Cardiac Arrest

11.4.3. Acute Asthma

11.4.4. Shock

11.4.5. Hypertension

11.4.6. Others

11.5. Market Value Forecast, by Distribution Channel, 2017-2031

11.5.1. Hospital Pharmacies

11.5.2. Retail Pharmacies

11.5.3. Online Pharmacies

11.6. Market Value Forecast, by Country, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Drug Type

11.7.2. By Route of Administration

11.7.3. By Indication

11.7.4. By Distribution Channel

11.7.5. By Country

12. Europe Catecholamines Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Type, 2017-2031

12.2.1. Endogenous

12.2.2. Synthetic

12.3. Market Value Forecast, by Route of Administration, 2017-2031

12.3.1. Intravenous

12.3.2. Inhalation

12.3.3. Transdermal

12.3.4. Others

12.4. Market Value Forecast, by Indication, 2017-2031

12.4.1. Anaphylaxis

12.4.2. Cardiac Arrest

12.4.3. Acute Asthma

12.4.4. Shock

12.4.5. Hypertension

12.4.6. Others

12.5. Market Value Forecast, by Distribution Channel, 2017-2031

12.5.1. Hospital Pharmacies

12.5.2. Retail Pharmacies

12.5.3. Online Pharmacies

12.6. Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Drug Type

12.7.2. By Route of Administration

12.7.3. By Indication

12.7.4. By Distribution Channel

12.7.5. By Country/Sub-region

13. Asia Pacific Catecholamines Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Type, 2017-2031

13.2.1. Endogenous

13.2.2. Synthetic

13.3. Market Value Forecast, by Route of Administration, 2017-2031

13.3.1. Intravenous

13.3.2. Inhalation

13.3.3. Transdermal

13.3.4. Others

13.4. Market Value Forecast, by Indication, 2017-2031

13.4.1. Anaphylaxis

13.4.2. Cardiac Arrest

13.4.3. Acute Asthma

13.4.4. Shock

13.4.5. Hypertension

13.4.6. Others

13.5. Market Value Forecast, by Distribution Channel, 2017-2031

13.5.1. Hospital Pharmacies

13.5.2. Retail Pharmacies

13.5.3. Online Pharmacies

13.6. Market Value Forecast, by Country/Sub-region, 2017-2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Drug Type

13.7.2. By Route of Administration

13.7.3. By Indication

13.7.4. By Distribution Channel

13.7.5. By Country/Sub-region

14. Latin America Catecholamines Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Type, 2017-2031

14.2.1. Endogenous

14.2.2. Synthetic

14.3. Market Value Forecast, by Route of Administration, 2017-2031

14.3.1. Intravenous

14.3.2. Inhalation

14.3.3. Transdermal

14.3.4. Others

14.4. Market Value Forecast, by Indication, 2017-2031

14.4.1. Anaphylaxis

14.4.2. Cardiac Arrest

14.4.3. Acute Asthma

14.4.4. Shock

14.4.5. Hypertension

14.4.6. Others

14.5. Market Value Forecast, by Distribution Channel, 2017-2031

14.5.1. Hospital Pharmacies

14.5.2. Retail Pharmacies

14.5.3. Online Pharmacies

14.6. Market Value Forecast, by Country/Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Drug Type

14.7.2. By Route of Administration

14.7.3. By Indication

14.7.4. By Distribution Channel

14.7.5. By Country/Sub-region

15. Middle East & Africa Catecholamines Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Drug Type, 2017-2031

15.2.1. Endogenous

15.2.2. Synthetic

15.3. Market Value Forecast, by Route of Administration, 2017-2031

15.3.1. Intravenous

15.3.2. Inhalation

15.3.3. Transdermal

15.3.4. Others

15.4. Market Value Forecast, by Indication, 2017-2031

15.4.1. Anaphylaxis

15.4.2. Cardiac Arrest

15.4.3. Acute Asthma

15.4.4. Shock

15.4.5. Hypertension

15.4.6. Others

15.5. Market Value Forecast, by Distribution Channel, 2017-2031

15.5.1. Hospital Pharmacies

15.5.2. Retail Pharmacies

15.5.3. Online Pharmacies

15.6. Market Value Forecast, by Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Drug Type

15.7.2. By Route of Administration

15.7.3. By Indication

15.7.4. By Distribution Channel

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company (2022)

16.3. Company Profiles

16.3.1. Pfizer, Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Baxter International

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Novartis International AG (Sandoz)

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Breckenridge Pharmaceutical, Inc.

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Viatris, Inc. (Mylan N.V)

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Mallinckrodt Pharmaceuticals

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Amneal Pharmaceuticals.

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Lexicare Pharma Pvt. Ltd.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Midas Pharma GmbH

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Armstrong Pharmaceuticals, Inc.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. Adamis Pharmaceuticals Corporation

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

16.3.12. Teva Pharmaceutical Industries Ltd.

16.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.12.2. Product Portfolio

16.3.12.3. Financial Overview

16.3.12.4. SWOT Analysis

16.3.12.5. Strategic Overview

List of Tables

Table 01: Global Catecholamines Market Value (US$ Mn) Forecast, by Drug Type, 2017-2031

Table 02: Global Catecholamines Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 03: Global Catecholamines Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 04: Global Catecholamines Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 05: Global Catecholamines Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 06: North America Catecholamines Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 07: North America Catecholamines Market Value (US$ Mn) Forecast, by Drug Type, 2017-2031

Table 08: North America Catecholamines Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 09: North America Catecholamines Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 10: North America Catecholamines Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 11: Europe Catecholamines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 12: Europe Catecholamines Market Value (US$ Mn) Forecast, by Drug Type, 2017-2031

Table 13: Europe Catecholamines Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 14: Europe Catecholamines Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 15: Europe Catecholamines Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 16: Asia Pacific Catecholamines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Asia Pacific Catecholamines Market Value (US$ Mn) Forecast, by Drug Type, 2017-2031

Table 18: Asia Pacific Catecholamines Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 19: Asia Pacific Catecholamines Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 20: Asia Pacific Catecholamines Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 21: Latin America Catecholamines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Catecholamines Market Value (US$ Mn) Forecast, by Drug Type, 2017-2031

Table 23: Latin America Catecholamines Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 24: Latin America Catecholamines Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 25: Latin America Catecholamines Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 26: Middle East & Africa Catecholamines Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 27: Middle East & Africa Catecholamines Market Value (US$ Mn) Forecast, by Drug Type, 2017-2031

Table 28: Middle East & Africa Catecholamines Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 29: Middle East & Africa Catecholamines Market Value (US$ Mn) Forecast, by Indication, 2017-2031

Table 30: Middle East & Africa Catecholamines Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

List of Figures

Figure 01: Global Catecholamines Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Catecholamines Market Value Share, by Drug Type, 2022

Figure 03: Global Catecholamines Market Value Share, by Route of Administration, 2022

Figure 04: Global Catecholamines Market Value Share, by Indication, 2022

Figure 05: Global Catecholamines Market Value Share, by Distribution Channel, 2022

Figure 06: Global Catecholamines Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 07: Global Catecholamines Market Attractiveness Analysis, by Drug Type, 2023-2031

Figure 08: Global Catecholamines Market Revenue (US$ Mn), by Endogenous , 2017-2031

Figure 09: Global Catecholamines Market Revenue (US$ Mn), by Synthetic, 2017-2031

Figure 10: Global Catecholamines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 11: Global Catecholamines Market Attractiveness Analysis, by Route of Administration 2023-2031

Figure 12: Global Catecholamines Market Value (US$ Mn), by Intravenous, 2017‒2031

Figure 13: Global Catecholamines Market Value (US$ Mn), by Inhalation, 2017‒2031

Figure 14: Global Catecholamines Market Value (US$ Mn), by Transdermal, 2017‒2031

Figure 15: Global Catecholamines Market Value (US$ Mn), by Others, 2017‒2031

Figure 15: Global Catecholamines Market Value Share Analysis, by Indication, 2022 and 2031

Figure 16: Global Catecholamines Market Attractiveness Analysis, Indication, 2023-2031

Figure 17: Global Catecholamines Market Revenue (US$ Mn), by Anaphylaxis , 2017-2031

Figure 18: Global Catecholamines Market Revenue (US$ Mn), by Cardiac Arrest, 2017-2031

Figure 19: Global Catecholamines Market Revenue (US$ Mn), by Acute Asthma, 2017-2031

Figure 20: Global Catecholamines Market Revenue (US$ Mn), by Shock, 2017-2031

Figure 21: Global Catecholamines Market Revenue (US$ Mn), by Hypertension, 2017-2031

Figure 22: Global Catecholamines Market Revenue (US$ Mn), by Others, 2017-2031

Figure 23: Global Catecholamines Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 24: Global Catecholamines Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 25: Global Catecholamines Market Revenue (US$ Mn), by Hospital Pharmacies, 2017-2031

Figure 26: Global Catecholamines Market Revenue (US$ Mn), by Retail Pharmacies, 2017-2031

Figure 27: Global Catecholamines Market Revenue (US$ Mn), by Online Pharmacies, 2017-2031

Figure 28: Global Catecholamines Market Value Share Analysis, by Region, 2022 and 2031

Figure 29: Global Catecholamines Market Attractiveness Analysis, by Region, 2023-2031

Figure 30: North America Catecholamines Market Value (US$ Mn) Forecast, 2017-2031

Figure 31: North America Catecholamines Market Value Share Analysis, by Country, 2022 and 2031

Figure 32: North America Catecholamines Market Attractiveness Analysis, by Country, 2023-2031

Figure 33: North America Catecholamines Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 34: North America Catecholamines Market Attractiveness Analysis, by Drug Type, 2023-2031

Figure 35: North America Catecholamines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 36: North America Catecholamines Market Attractiveness Analysis, by Route of Administration 2023-2031

Figure 37: North America Catecholamines Market Value Share Analysis, by Indication, 2022 and 2031

Figure 38: North America Catecholamines Market Attractiveness Analysis, Indication, 2023-2031

Figure 39: North America Catecholamines Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 40: North America Catecholamines Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 41: Europe Catecholamines Market Value (US$ Mn) Forecast, 2017-2031

Figure 42: Europe Catecholamines Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 43: Europe Catecholamines Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 44: Europe Catecholamines Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 45: Europe Catecholamines Market Attractiveness Analysis, by Drug Type, 2023-2031

Figure 46: Europe Catecholamines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 47: Europe Catecholamines Market Attractiveness Analysis, by Route of Administration 2023-2031

Figure 48: Europe Catecholamines Market Value Share Analysis, by Indication, 2022 and 2031

Figure 49: Europe Catecholamines Market Attractiveness Analysis, Indication, 2023-2031

Figure 50: Europe Catecholamines Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 51: Europe Catecholamines Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 52: Asia Pacific Catecholamines Market Value (US$ Mn) Forecast, 2017-2031

Figure 53: Asia Pacific Catecholamines Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 54: Asia Pacific Catecholamines Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 55: Asia Pacific Catecholamines Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 56: Asia Pacific Catecholamines Market Attractiveness Analysis, by Drug Type, 2023-2031

Figure 57: Asia Pacific Catecholamines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 58: Asia Pacific Catecholamines Market Attractiveness Analysis, by Route of Administration 2023-2031

Figure 59: Asia Pacific Catecholamines Market Value Share Analysis, by Indication, 2022 and 2031

Figure 60: Asia Pacific Catecholamines Market Attractiveness Analysis, Indication, 2023-2031

Figure 61: Asia Pacific Catecholamines Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 62: Asia Pacific Catecholamines Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 63: Latin America Catecholamines Market Value (US$ Mn) Forecast, 2017-2031

Figure 64: Latin America Catecholamines Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 65: Latin America Catecholamines Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 66: Latin America Catecholamines Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 67: Latin America Catecholamines Market Attractiveness Analysis, by Drug Type, 2023-2031

Figure 68: Latin America Catecholamines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 69: Latin America Catecholamines Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 70: Latin America Catecholamines Market Value Share Analysis, by Indication, 2022 and 2031

Figure 71: Latin America Catecholamines Market Attractiveness Analysis, Indication, 2023-2031

Figure 72: Latin America Catecholamines Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 73: Latin America Catecholamines Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 74: Middle East & Africa Catecholamines Market Value (US$ Mn) Forecast, 2017-2031

Figure 75: Middle East & Africa Catecholamines Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 76: Middle East & Africa Catecholamines Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 77: Middle East & Africa Catecholamines Market Value Share Analysis, by Drug Type, 2022 and 2031

Figure 78: Middle East & Africa Catecholamines Market Attractiveness Analysis, by Drug Type, 2023-2031

Figure 79: Middle East & Africa Catecholamines Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 80: Middle East & Africa Catecholamines Market Attractiveness Analysis, by Route of Administration 2023-2031

Figure 81: Middle East & Africa Catecholamines Market Value Share Analysis, by Indication, 2022 and 2031

Figure 82: Middle East & Africa Catecholamines Market Attractiveness Analysis, by Indication, 2023-2031

Figure 83: Middle East & Africa Catecholamines Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 84: Middle East & Africa Catecholamines Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 85: Global Catecholamines Market Share Analysis By Company (2022)