Reports

Reports

Analysts’ Viewpoint

Growth in the e-commerce sector and rise in demand for last-mile delivery services are expected to fuel cargo bike market size in the near future. The ability to access narrow streets, bike lanes, and pedestrian zones makes cargo bikes an attractive choice for companies seeking efficient and reliable last-mile delivery solutions.

Rise in environmental awareness is leading to a surge in preference for emission-free electric vehicles. This is likely to offer lucrative opportunities to players in the global cargo bike industry. Vendors are focused on advancing battery technology and developing cutting-edge battery chemistries to extend the range of electric vehicles. They are also partnering with courier and parcel delivery service providers to expand customer base and increase their cargo bike market share.

Cargo bikes are specially designed bicycles that are built to carry heavy loads or transport goods and equipment. They are equipped with large, sturdy cargo compartments or platforms, allowing for efficient transportation of various items, from groceries and packages to tools and equipment.

In recent years, there has been a resurgence of interest in cargo bikes due to their numerous advantages. They offer a sustainable and eco-friendly alternative to traditional vehicles, thus helping reduce traffic congestion and air pollution in crowded urban environments.

Cargo bikes are also highly maneuverable, which allows riders to navigate through narrow streets, alleys, and bike lanes. Thus, they are particularly suitable for last-mile deliveries and accessing areas that are inaccessible to larger vehicles.

Rise in need for sustainable and efficient urban transport is expected to fuel the cargo bike business in the next few years. Cargo bikes have emerged as a promising alternative, as cities are grappling with traffic congestion, air pollution, and last-mile delivery challenges. These bicycles, equipped with spacious cargo compartments, offer a practical and eco-friendly mode of transportation for goods and services.

Cargo bikes are gaining popularity among businesses, delivery services, and environmentally conscious individuals seeking efficient urban mobility solutions due to their ability to navigate narrow streets, access restricted areas, and reduce carbon emissions.

Cargo bikes have traditionally been associated with delivery and transportation of goods. These bikes are increasingly being utilized as platforms for providing mobile services such as bike repair, mobile libraries, pet grooming, and even healthcare services.

These bike-based businesses offer convenience by bringing essential services directly to customers, particularly in areas where accessibility is a challenge or for those who prefer eco-friendly service options. This is likely to create significant cargo bike market growth opportunities during the forecast period.

Cargo bikes are also utilized as mobile pop-up shops and food trucks. Entrepreneurs are converting these bikes into mobile businesses, such as cafes, shops, or food trucks. These mobile ventures offer flexibility and the ability to cater to various events, markets, or neighborhoods, thus attracting customers with their unique and eco-friendly approach. Hence, increase in number of mobile pop-up shops and food trucks is boosting cargo bike market development.

Financial assistance provided by governments plays a crucial role in driving the cargo bike market value. Recognizing the need for sustainable transportation options, governments have implemented various measures to support the adoption of cargo bikes.

One effective strategy is the provision of subsidies and grants, which help reduce upfront costs associated with purchasing cargo bikes. By making these vehicles more affordable and accessible, governments are encouraging individuals, businesses, and organizations to consider cargo bikes as a viable alternative to traditional vehicles for urban logistics and transportation needs.

Governments are offering tax incentives, such as credits or exemptions, to further incentivize the usage of cargo bikes. These financial benefits significantly reduce the overall cost of ownership, thus making cargo bikes an attractive option for both individuals and businesses.

Governments are also allocating funds to improve cycling infrastructure, including the development of dedicated bike lanes, parking facilities, and safety measures. Such investments are driving cargo bike market progress.

Governments across the globe are also investing in awareness and education campaigns to promote the benefits of cargo bikes. They are informing the public about environmental advantages, cost savings, and health benefits of these bikes.

According to the latest cargo bike market trends, the electric propulsion segment is expected to dominate the industry during the forecast period. Growth in focus on reducing carbon emissions and improving urban mobility is boosting the demand for electric cargo bikes.

Governments and businesses worldwide are actively promoting the adoption of electric vehicles as part of their sustainable transportation strategies, thus further contributing to growth of the electric propulsion segment.

Electric cargo bikes offer the advantage of assisted pedaling or fully electric propulsion, making it easier for riders to navigate through crowded city streets and transport heavier loads. These bikes typically feature larger cargo capacities and robust frames to accommodate various types of goods.

According to the latest cargo bike market forecast, Asia Pacific is projected to hold the largest share from 2023 to 2031. Rapid urbanization, increase in government support, and expansion in the e-commerce sector are fueling market dynamics of the region.

Cargo bikes are becoming a popular solution for last-mile delivery in congested urban areas in Asia Pacific. Governments of various countries in the region are implementing policies and incentives to promote sustainable transportation, thus creating a favorable environment for cargo bike adoption.

Surge in awareness about environmental sustainability and rise in need for eco-friendly solutions are also augmenting market statistics in Asia Pacific. Innovation and technological advancements are driving the development of specialized cargo bike models, including electric options. However, limited cycling infrastructure and concerns regarding security and maintenance are some of the market challenges. Despite these challenges, the industry in Asia Pacific is projected to grow at a significant pace in the near future.

Governments of countries in Europe and North America are also initiating numerous projects, such as City Changer Cargo Bike, Transportrad Initiative of Sustainable Municipalities (TINK), and Commercial Cargo Bike Program, to encourage the adoption of cargo bikes. Financial assistance in the form of subsidies and grants, dedicated infrastructure, and well-established regulatory framework are propelling market progress in these regions.

Growth in awareness about vehicle emissions is boosting the adoption of environment-friendly cargo bikes. Cities such as Paris, New York, and London are partnering with courier and parcel delivery service providers, including DHL International GmbH and FedEx Corporation, to use cargo bikes for short-distance urban trips. This reduces the number of heavy vehicles on roads and decreases pollution levels in cities.

Significant presence of cargo manufacturers, such as Xtracycle Inc., Rad Power Bikes LLC, and Johammer E-Mobility GmbH, in Europe and North America is providing customers with a wide array of options.

The global landscape is highly competitive, with several key players operating in the market. Key players are adopting various strategies to gain competitive edge and capture a larger market share.

Babboe, Bakfiets.nl, BODO Vehicle Group Co., Ltd., Bullitt, Carqon, Christiania Bikes, Cycles Maximus, Douze Cycles, Gomier, Harry vs. Larry, Johnny Loco, Kona, Nihola, Pashley Cycles, Rad Power Bikes, Riese & Müller, Tern Bicycle, Triobike, Urban Arrow, Urban Tribe, XCYC, Xtracycle, and Yuba Bicycles are prominent entities operating in this sector.

Each of these players has been profiled in the cargo bike market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 2.9 Bn |

|

Market Forecast Value in 2031 |

US$ 4.6 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

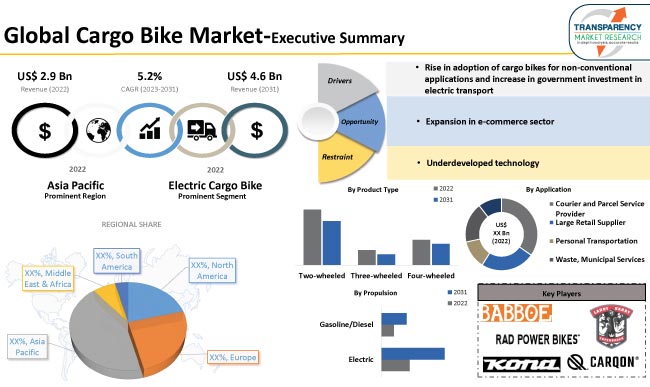

It was valued at US$ 2.9 Bn in 2022

It is projected to grow at a CAGR of 5.2% from 2023 to 2031

It is estimated to reach US$ 4.6 Bn by the end of 2031

Rise in adoption of cargo bikes for non-conventional applications and increase in government investment in electric transport

The electric propulsion segment is likely to account for the largest share during the forecast period

Asia Pacific is estimated to record the highest demand during the forecast period

Babboe, Bakfiets.nl, BODO Vehicle Group Co., Ltd., Bullitt, Carqon, Christiania Bikes, Cycles Maximus, Douze Cycles, Gomier, Harry vs. Larry, Johnny Loco, Kona, Nihola, Pashley Cycles, Rad Power Bikes, Riese & Müller, Tern Bicycle, Triobike, Urban Arrow, Urban Tribe, XCYC, Xtracycle, and Yuba Bicycles

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size in Units, Value US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Market Overview

2.1. Market Coverage/Taxonomy

2.2. Market Definition/Scope/Limitations

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Go to Market Strategy

2.8.1. Demand & Supply Side Trends

2.8.1.1. GAP Analysis

2.8.2. Identification of Potential Market Spaces

2.8.3. Understanding Buying Process of Customers

2.8.4. Preferred Sales & Marketing Strategy

3. Global Cargo Bike Market, By Product Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Cargo Bike Market Size & Forecast, 2017-2031, By Product Type

3.2.1. Two-wheeled

3.2.2. Three-wheeled

3.2.3. Four-wheeled

4. Global Cargo Bike Market, By Wheel Size

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Cargo Bike Market Size & Forecast, 2017-2031, By Wheel Size

4.2.1. Below 20"

4.2.2. 20" - 24"

4.2.3. 26"

4.2.4. 27.5"

4.2.5. Others

5. Global Cargo Bike Market, By Application

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Cargo Bike Market Size & Forecast, 2017-2031, By Application

5.2.1. Courier and Parcel Service Provider

5.2.2. Large Retail Supplier

5.2.3. Personal Transportation

5.2.4. Waste, Municipal Services

5.2.5. Others

6. Global Cargo Bike Market, By Ownership

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Cargo Bike Market Size & Forecast, 2017-2031, By Ownership

6.2.1. Personal Use

6.2.2. Commercial/Fleet Use

7. Global Cargo Bike Market, By Load Capacity

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Cargo Bike Market Size & Forecast, 2017-2031, By Load Capacity

7.2.1. Small Load Capacity (Less than 200 Pounds)

7.2.2. Medium Load Capacity (200 - 400 Pounds)

7.2.3. Large Load Capacity (More than 400 Pounds)

8. Global Cargo Bike Market, By Propulsion

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Cargo Bike Market Size & Forecast, 2017-2031, By Propulsion

8.2.1. Electric

8.2.1.1. Sealed Lead Acid

8.2.1.2. Lithium-ion

8.2.2. Gasoline/Diesel

9. Global Cargo Bike Market, by Region

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Cargo Bike Market Size & Forecast, 2017-2031, By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Cargo Bike Market

10.1. Market Snapshot

10.2. North America Cargo Bike Market Size & Forecast, 2017-2031, By Product Type

10.2.1. Two-wheeled

10.2.2. Three-wheeled

10.2.3. Four-wheeled

10.3. North America Cargo Bike Market Size & Forecast, 2017-2031, By Wheel Size

10.3.1. Below 20"

10.3.2. 20" - 24"

10.3.3. 26"

10.3.4. 27.5"

10.3.5. Others

10.4. North America Cargo Bike Market Size & Forecast, 2017-2031, By Application

10.4.1. Courier and Parcel Service Provider

10.4.2. Large Retail Supplier

10.4.3. Personal Transportation

10.4.4. Waste, Municipal Services

10.4.5. Others

10.5. North America Cargo Bike Market Size & Forecast, 2017-2031, By Ownership

10.5.1. Personal Use

10.5.2. Commercial/Fleet Use

10.6. North America Cargo Bike Market Size & Forecast, 2017-2031, By Load Capacity

10.6.1. Small Load Capacity (Less than 200 Pounds)

10.6.2. Medium Load Capacity (200 - 400 Pounds)

10.6.3. Large Load Capacity (More than 400 Pounds)

10.7. North America Cargo Bike Market Size & Forecast, 2017-2031, By Propulsion

10.7.1. Electric

10.7.1.1. Sealed Lead Acid

10.7.1.2. Lithium-ion

10.7.2. Gasoline/Diesel

10.8. North America Cargo Bike Market Size & Forecast, 2017-2031, By Country

10.8.1. U.S.

10.8.2. Canada

10.8.3. Mexico

11. Europe Cargo Bike Market

11.1. Market Snapshot

11.2. Europe Cargo Bike Market Size & Forecast, 2017-2031, By Product Type

11.2.1. Two-wheeled

11.2.2. Three-wheeled

11.2.3. Four-wheeled

11.3. Europe Cargo Bike Market Size & Forecast, 2017-2031, By Wheel Size

11.3.1. Below 20"

11.3.2. 20" - 24"

11.3.3. 26"

11.3.4. 27.5"

11.3.5. Others

11.4. Europe Cargo Bike Market Size & Forecast, 2017-2031, By Application

11.4.1. Courier and Parcel Service Provider

11.4.2. Large Retail Supplier

11.4.3. Personal Transportation

11.4.4. Waste, Municipal Services

11.4.5. Others

11.5. Europe Cargo Bike Market Size & Forecast, 2017-2031, By Ownership

11.5.1. Personal Use

11.5.2. Commercial/Fleet Use

11.6. Europe Cargo Bike Market Size & Forecast, 2017-2031, By Load Capacity

11.6.1. Small Load Capacity (Less than 200 Pounds)

11.6.2. Medium Load Capacity (200 - 400 Pounds)

11.6.3. Large Load Capacity (More than 400 Pounds)

11.7. Europe Cargo Bike Market Size & Forecast, 2017-2031, By Propulsion

11.7.1. Electric

11.7.1.1. Sealed Lead Acid

11.7.1.2. Lithium-ion

11.7.2. Gasoline/Diesel

11.8. Europe Cargo Bike Market Size & Forecast, 2017-2031, By Country

11.8.1. Germany

11.8.2. U.K.

11.8.3. France

11.8.4. Italy

11.8.5. Spain

11.8.6. Nordic Countries

11.8.7. Russia & CIS

11.8.8. Rest of Europe

12. Asia Pacific Cargo Bike Market

12.1. Market Snapshot

12.2. Asia Pacific Cargo Bike Market Size & Forecast, 2017-2031, By Product Type

12.2.1. Two-wheeled

12.2.2. Three-wheeled

12.2.3. Four-wheeled

12.3. Asia Pacific Cargo Bike Market Size & Forecast, 2017-2031, By Wheel Size

12.3.1. Below 20"

12.3.2. 20" - 24"

12.3.3. 26"

12.3.4. 27.5"

12.3.5. Others

12.4. Asia Pacific Cargo Bike Market Size & Forecast, 2017-2031, By Application

12.4.1. Courier and Parcel Service Provider

12.4.2. Large Retail Supplier

12.4.3. Personal Transportation

12.4.4. Waste, Municipal Services

12.4.5. Others

12.5. Asia Pacific Cargo Bike Market Size & Forecast, 2017-2031, By Ownership

12.5.1. Personal Use

12.5.2. Commercial/Fleet Use

12.6. Asia Pacific Cargo Bike Market Size & Forecast, 2017-2031, By Load Capacity

12.6.1. Small Load Capacity (Less than 200 Pounds)

12.6.2. Medium Load Capacity (200 - 400 Pounds)

12.6.3. Large Load Capacity (More than 400 Pounds)

12.7. Asia Pacific Cargo Bike Market Size & Forecast, 2017-2031, By Propulsion

12.7.1. Electric

12.7.1.1. Sealed Lead Acid

12.7.1.2. Lithium-ion

12.7.2. Gasoline/Diesel

12.8. Asia Pacific Cargo Bike Market Size & Forecast, 2017-2031, By Country

12.8.1. China

12.8.2. India

12.8.3. Japan

12.8.4. ASEAN Countries

12.8.5. South Korea

12.8.6. ANZ

12.8.7. Rest of Asia Pacific

13. Middle East & Africa Cargo Bike Market

13.1. Market Snapshot

13.2. Middle East & Africa Cargo Bike Market Size & Forecast, 2017-2031, By Product Type

13.2.1. Two-wheeled

13.2.2. Three-wheeled

13.2.3. Four-wheeled

13.3. Middle East & Africa Cargo Bike Market Size & Forecast, 2017-2031, By Wheel Size

13.3.1. Below 20"

13.3.2. 20" - 24"

13.3.3. 26"

13.3.4. 27.5"

13.3.5. Others

13.4. Middle East & Africa Cargo Bike Market Size & Forecast, 2017-2031, By Application

13.4.1. Courier and Parcel Service Provider

13.4.2. Large Retail Supplier

13.4.3. Personal Transportation

13.4.4. Waste, Municipal Services

13.4.5. Others

13.5. Middle East & Africa Cargo Bike Market Size & Forecast, 2017-2031, By Ownership

13.5.1. Personal Use

13.5.2. Commercial/Fleet Use

13.6. Middle East & Africa Cargo Bike Market Size & Forecast, 2017-2031, By Load Capacity

13.6.1. Small Load Capacity (Less than 200 Pounds)

13.6.2. Medium Load Capacity (200 - 400 Pounds)

13.6.3. Large Load Capacity (More than 400 Pounds)

13.7. Middle East & Africa Cargo Bike Market Size & Forecast, 2017-2031, By Propulsion

13.7.1. Electric

13.7.1.1. Sealed Lead Acid

13.7.1.2. Lithium-ion

13.7.2. Gasoline/Diesel

13.8. Middle East & Africa Cargo Bike Market Size & Forecast, 2017-2031, By Country

13.8.1. GCC

13.8.2. South Africa

13.8.3. Turkey

13.8.4. Rest of Middle East & Africa

14. South America Cargo Bike Market

14.1. Market Snapshot

14.2. South America Cargo Bike Market Size & Forecast, 2017-2031, By Product Type

14.2.1. Two-wheeled

14.2.2. Three-wheeled

14.2.3. Four-wheeled

14.3. South America Cargo Bike Market Size & Forecast, 2017-2031, By Wheel Size

14.3.1. Below 20"

14.3.2. 20" - 24"

14.3.3. 26"

14.3.4. 27.5"

14.3.5. Others

14.4. South America Cargo Bike Market Size & Forecast, 2017-2031, By Application

14.4.1. Courier and Parcel Service Provider

14.4.2. Large Retail Supplier

14.4.3. Personal Transportation

14.4.4. Waste, Municipal Services

14.4.5. Others

14.5. South America Cargo Bike Market Size & Forecast, 2017-2031, By Ownership

14.5.1. Personal Use

14.5.2. Commercial/Fleet Use

14.6. South America Cargo Bike Market Size & Forecast, 2017-2031, By Load Capacity

14.6.1. Small Load Capacity (Less than 200 Pounds)

14.6.2. Medium Load Capacity (200 - 400 Pounds)

14.6.3. Large Load Capacity (More than 400 Pounds)

14.7. South America Cargo Bike Market Size & Forecast, 2017-2031, By Propulsion

14.7.1. Electric

14.7.1.1. Sealed Lead Acid

14.7.1.2. Lithium-ion

14.7.2. Gasoline/Diesel

14.8. South America Cargo Bike Market Size & Forecast, 2017-2031, By Country

14.8.1. Brazil

14.8.2. Argentina

14.8.3. Rest of South America

15. Competitive Landscape

15.1. Company Share Analysis/Brand Share Analysis, 2022

15.2. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

16. Company Profile/ Key Players

16.1. Babboe

16.1.1. Company Overview

16.1.2. Company Footprints

16.1.3. Production Locations

16.1.4. Product Portfolio

16.1.5. Competitors & Customers

16.1.6. Subsidiaries & Parent Organization

16.1.7. Recent Developments

16.1.8. Financial Analysis

16.1.9. Profitability

16.1.10. Revenue Share

16.2. Bakfiets.nl

16.2.1. Company Overview

16.2.2. Company Footprints

16.2.3. Production Locations

16.2.4. Product Portfolio

16.2.5. Competitors & Customers

16.2.6. Subsidiaries & Parent Organization

16.2.7. Recent Developments

16.2.8. Financial Analysis

16.2.9. Profitability

16.2.10. Revenue Share

16.3. BODO Vehicle Group Co., Ltd.

16.3.1. Company Overview

16.3.2. Company Footprints

16.3.3. Production Locations

16.3.4. Product Portfolio

16.3.5. Competitors & Customers

16.3.6. Subsidiaries & Parent Organization

16.3.7. Recent Developments

16.3.8. Financial Analysis

16.3.9. Profitability

16.3.10. Revenue Share

16.4. Bullitt

16.4.1. Company Overview

16.4.2. Company Footprints

16.4.3. Production Locations

16.4.4. Product Portfolio

16.4.5. Competitors & Customers

16.4.6. Subsidiaries & Parent Organization

16.4.7. Recent Developments

16.4.8. Financial Analysis

16.4.9. Profitability

16.4.10. Revenue Share

16.5. Carqon

16.5.1. Company Overview

16.5.2. Company Footprints

16.5.3. Production Locations

16.5.4. Product Portfolio

16.5.5. Competitors & Customers

16.5.6. Subsidiaries & Parent Organization

16.5.7. Recent Developments

16.5.8. Financial Analysis

16.5.9. Profitability

16.5.10. Revenue Share

16.6. Christiania Bikes

16.6.1. Company Overview

16.6.2. Company Footprints

16.6.3. Production Locations

16.6.4. Product Portfolio

16.6.5. Competitors & Customers

16.6.6. Subsidiaries & Parent Organization

16.6.7. Recent Developments

16.6.8. Financial Analysis

16.6.9. Profitability

16.6.10. Revenue Share

16.7. Cycles Maximus

16.7.1. Company Overview

16.7.2. Company Footprints

16.7.3. Production Locations

16.7.4. Product Portfolio

16.7.5. Competitors & Customers

16.7.6. Subsidiaries & Parent Organization

16.7.7. Recent Developments

16.7.8. Financial Analysis

16.7.9. Profitability

16.7.10. Revenue Share

16.8. Douze Cycles

16.8.1. Company Overview

16.8.2. Company Footprints

16.8.3. Production Locations

16.8.4. Product Portfolio

16.8.5. Competitors & Customers

16.8.6. Subsidiaries & Parent Organization

16.8.7. Recent Developments

16.8.8. Financial Analysis

16.8.9. Profitability

16.8.10. Revenue Share

16.9. Gomier

16.9.1. Company Overview

16.9.2. Company Footprints

16.9.3. Production Locations

16.9.4. Product Portfolio

16.9.5. Competitors & Customers

16.9.6. Subsidiaries & Parent Organization

16.9.7. Recent Developments

16.9.8. Financial Analysis

16.9.9. Profitability

16.9.10. Revenue Share

16.10. Harry vs. Larry

16.10.1. Company Overview

16.10.2. Company Footprints

16.10.3. Production Locations

16.10.4. Product Portfolio

16.10.5. Competitors & Customers

16.10.6. Subsidiaries & Parent Organization

16.10.7. Recent Developments

16.10.8. Financial Analysis

16.10.9. Profitability

16.10.10. Revenue Share

16.11. Johnny Loco

16.11.1. Company Overview

16.11.2. Company Footprints

16.11.3. Production Locations

16.11.4. Product Portfolio

16.11.5. Competitors & Customers

16.11.6. Subsidiaries & Parent Organization

16.11.7. Recent Developments

16.11.8. Financial Analysis

16.11.9. Profitability

16.11.10. Revenue Share

16.12. Kona

16.12.1. Company Overview

16.12.2. Company Footprints

16.12.3. Production Locations

16.12.4. Product Portfolio

16.12.5. Competitors & Customers

16.12.6. Subsidiaries & Parent Organization

16.12.7. Recent Developments

16.12.8. Financial Analysis

16.12.9. Profitability

16.12.10. Revenue Share

16.13. Nihola

16.13.1. Company Overview

16.13.2. Company Footprints

16.13.3. Production Locations

16.13.4. Product Portfolio

16.13.5. Competitors & Customers

16.13.6. Subsidiaries & Parent Organization

16.13.7. Recent Developments

16.13.8. Financial Analysis

16.13.9. Profitability

16.13.10. Revenue Share

16.14. Pashley Cycles

16.14.1. Company Overview

16.14.2. Company Footprints

16.14.3. Production Locations

16.14.4. Product Portfolio

16.14.5. Competitors & Customers

16.14.6. Subsidiaries & Parent Organization

16.14.7. Recent Developments

16.14.8. Financial Analysis

16.14.9. Profitability

16.14.10. Revenue Share

16.15. Rad Power Bikes

16.15.1. Company Overview

16.15.2. Company Footprints

16.15.3. Production Locations

16.15.4. Product Portfolio

16.15.5. Competitors & Customers

16.15.6. Subsidiaries & Parent Organization

16.15.7. Recent Developments

16.15.8. Financial Analysis

16.15.9. Profitability

16.15.10. Revenue Share

16.16. Riese & Müller

16.16.1. Company Overview

16.16.2. Company Footprints

16.16.3. Production Locations

16.16.4. Product Portfolio

16.16.5. Competitors & Customers

16.16.6. Subsidiaries & Parent Organization

16.16.7. Recent Developments

16.16.8. Financial Analysis

16.16.9. Profitability

16.16.10. Revenue Share

16.17. Tern Bicycle

16.17.1. Company Overview

16.17.2. Company Footprints

16.17.3. Production Locations

16.17.4. Product Portfolio

16.17.5. Competitors & Customers

16.17.6. Subsidiaries & Parent Organization

16.17.7. Recent Developments

16.17.8. Financial Analysis

16.17.9. Profitability

16.17.10. Revenue Share

16.18. Triobike

16.18.1. Company Overview

16.18.2. Company Footprints

16.18.3. Production Locations

16.18.4. Product Portfolio

16.18.5. Competitors & Customers

16.18.6. Subsidiaries & Parent Organization

16.18.7. Recent Developments

16.18.8. Financial Analysis

16.18.9. Profitability

16.18.10. Revenue Share

16.19. Urban Arrow

16.19.1. Company Overview

16.19.2. Company Footprints

16.19.3. Production Locations

16.19.4. Product Portfolio

16.19.5. Competitors & Customers

16.19.6. Subsidiaries & Parent Organization

16.19.7. Recent Developments

16.19.8. Financial Analysis

16.19.9. Profitability

16.19.10. Revenue Share

16.20. Urban Tribe

16.20.1. Company Overview

16.20.2. Company Footprints

16.20.3. Production Locations

16.20.4. Product Portfolio

16.20.5. Competitors & Customers

16.20.6. Subsidiaries & Parent Organization

16.20.7. Recent Developments

16.20.8. Financial Analysis

16.20.9. Profitability

16.20.10. Revenue Share

16.21. XCYC

16.21.1. Company Overview

16.21.2. Company Footprints

16.21.3. Production Locations

16.21.4. Product Portfolio

16.21.5. Competitors & Customers

16.21.6. Subsidiaries & Parent Organization

16.21.7. Recent Developments

16.21.8. Financial Analysis

16.21.9. Profitability

16.21.10. Revenue Share

16.22. Xtracycle

16.22.1. Company Overview

16.22.2. Company Footprints

16.22.3. Production Locations

16.22.4. Product Portfolio

16.22.5. Competitors & Customers

16.22.6. Subsidiaries & Parent Organization

16.22.7. Recent Developments

16.22.8. Financial Analysis

16.22.9. Profitability

16.22.10. Revenue Share

16.23. Yuba Bicycles

16.23.1. Company Overview

16.23.2. Company Footprints

16.23.3. Production Locations

16.23.4. Product Portfolio

16.23.5. Competitors & Customers

16.23.6. Subsidiaries & Parent Organization

16.23.7. Recent Developments

16.23.8. Financial Analysis

16.23.9. Profitability

16.23.10. Revenue Share

16.24. Other Key Players

16.24.1. Company Overview

16.24.2. Company Footprints

16.24.3. Production Locations

16.24.4. Product Portfolio

16.24.5. Competitors & Customers

16.24.6. Subsidiaries & Parent Organization

16.24.7. Recent Developments

16.24.8. Financial Analysis

16.24.9. Profitability

16.24.10. Revenue Share

List of Tables

Table 1: Global Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Table 2: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Table 3: Global Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Table 4: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Table 5: Global Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Table 6: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 7: Global Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 8: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 9: Global Cargo Bike Market Volume (Units) Forecast, by Load Capacity, 2017-2031

Table 10: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Table 11: Global Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 12: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 13: Global Cargo Bike Market Volume (Units) Forecast, by Region, 2017-2031

Table 14: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Table 15: North America Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Table 16: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Table 17: North America Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Table 18: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Table 19: North America Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Table 20: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 21: North America Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 22: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 23: North America Cargo Bike Market Volume (Units) Forecast, by Load Capacity, 2017-2031

Table 24: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Table 25: North America Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 26: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 27: North America Cargo Bike Market Volume (Units) Forecast, by Country, 2017-2031

Table 28: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 29: Europe Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Table 30: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Table 31: Europe Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Table 32: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Table 33: Europe Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Table 34: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 35: Europe Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 36: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 37: Europe Cargo Bike Market Volume (Units) Forecast, by Load Capacity, 2017-2031

Table 38: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Table 39: Europe Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 40: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 41: Europe Cargo Bike Market Volume (Units) Forecast, by Country, 2017-2031

Table 42: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 43: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Table 44: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Table 45: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Table 46: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Table 47: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Table 48: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 49: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 50: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 51: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Load Capacity, 2017-2031

Table 52: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Table 53: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 54: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 55: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Country, 2017-2031

Table 56: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 57: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Table 58: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Table 59: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Table 60: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Table 61: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Table 62: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 63: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 64: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 65: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Load Capacity, 2017-2031

Table 66: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Table 67: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 68: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 69: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Country, 2017-2031

Table 70: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Table 71: South America Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Table 72: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Table 73: South America Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Table 74: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Table 75: South America Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Table 76: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Table 77: South America Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Table 78: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Table 79: South America Cargo Bike Market Volume (Units) Forecast, by Load Capacity, 2017-2031

Table 80: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Table 81: South America Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 82: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Table 83: South America Cargo Bike Market Volume (Units) Forecast, by Country, 2017-2031

Table 84: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 2: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 3: Global Cargo Bike Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 4: Global Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Figure 5: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Figure 6: Global Cargo Bike Market, Incremental Opportunity, by Wheel Size, Value (US$ Bn), 2023-2031

Figure 7: Global Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Figure 8: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 9: Global Cargo Bike Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 10: Global Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Figure 11: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 12: Global Cargo Bike Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 13: Global Cargo Bike Market Volume (Units) Forecast, by Load capacity, 2017-2031

Figure 14: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Figure 15: Global Cargo Bike Market, Incremental Opportunity, by Load Capacity, Value (US$ Bn), 2023-2031

Figure 16: Global Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 17: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 18: Global Cargo Bike Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 19: Global Cargo Bike Market Volume (Units) Forecast, by Region, 2017-2031

Figure 20: Global Cargo Bike Market Revenue (US$ Bn) Forecast, by Region, 2017-2031

Figure 21: Global Cargo Bike Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 22: North America Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 23: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 24: North America Cargo Bike Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 25: North America Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Figure 26: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Figure 27: North America Cargo Bike Market, Incremental Opportunity, by Wheel Size, Value (US$ Bn), 2023-2031

Figure 28: North America Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Figure 29: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 30: North America Cargo Bike Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 31: North America Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Figure 32: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 33: North America Cargo Bike Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 34: North America Cargo Bike Market Volume (Units) Forecast, by Load capacity, 2017-2031

Figure 35: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Figure 36: North America Cargo Bike Market, Incremental Opportunity, by Load Capacity, Value (US$ Bn), 2023-2031

Figure 37: North America Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 38: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 39: North America Cargo Bike Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 40: North America Cargo Bike Market Volume (Units) Forecast, by Country, 2017-2031

Figure 41: North America Cargo Bike Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 42: North America Cargo Bike Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 43: Europe Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 44: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 45: Europe Cargo Bike Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 46: Europe Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Figure 47: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Figure 48: Europe Cargo Bike Market, Incremental Opportunity, by Wheel Size, Value (US$ Bn), 2023-2031

Figure 49: Europe Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Figure 50: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 51: Europe Cargo Bike Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 52: Europe Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Figure 53: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 54: Europe Cargo Bike Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 55: Europe Cargo Bike Market Volume (Units) Forecast, by Load capacity, 2017-2031

Figure 56: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Figure 57: Europe Cargo Bike Market, Incremental Opportunity, by Load Capacity, Value (US$ Bn), 2023-2031

Figure 58: Europe Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 59: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 60: Europe Cargo Bike Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 61: Europe Cargo Bike Market Volume (Units) Forecast, by Country, 2017-2031

Figure 62: Europe Cargo Bike Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 63: Europe Cargo Bike Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 64: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 65: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 66: Asia Pacific Cargo Bike Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Figure 68: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Figure 69: Asia Pacific Cargo Bike Market, Incremental Opportunity, by Wheel Size, Value (US$ Bn), 2023-2031

Figure 70: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Figure 71: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 72: Asia Pacific Cargo Bike Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 73: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Figure 74: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 75: Asia Pacific Cargo Bike Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 76: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Load capacity, 2017-2031

Figure 77: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Figure 78: Asia Pacific Cargo Bike Market, Incremental Opportunity, by Load Capacity, Value (US$ Bn), 2023-2031

Figure 79: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 80: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 81: Asia Pacific Cargo Bike Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 82: Asia Pacific Cargo Bike Market Volume (Units) Forecast, by Country, 2017-2031

Figure 83: Asia Pacific Cargo Bike Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 84: Asia Pacific Cargo Bike Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 86: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 87: Middle East & Africa Cargo Bike Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 88: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Figure 89: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Figure 90: Middle East & Africa Cargo Bike Market, Incremental Opportunity, by Wheel Size, Value (US$ Bn), 2023-2031

Figure 91: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Figure 92: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 93: Middle East & Africa Cargo Bike Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 94: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Figure 95: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 96: Middle East & Africa Cargo Bike Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 97: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Load capacity, 2017-2031

Figure 98: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Figure 99: Middle East & Africa Cargo Bike Market, Incremental Opportunity, by Load Capacity, Value (US$ Bn), 2023-2031

Figure 100: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 101: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 102: Middle East & Africa Cargo Bike Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 103: Middle East & Africa Cargo Bike Market Volume (Units) Forecast, by Country, 2017-2031

Figure 104: Middle East & Africa Cargo Bike Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 105: Middle East & Africa Cargo Bike Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 106: South America Cargo Bike Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 107: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Product Type, 2017-2031

Figure 108: South America Cargo Bike Market, Incremental Opportunity, by Product Type, Value (US$ Bn), 2023-2031

Figure 109: South America Cargo Bike Market Volume (Units) Forecast, by Wheel Size, 2017-2031

Figure 110: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Wheel Size, 2017-2031

Figure 111: South America Cargo Bike Market, Incremental Opportunity, by Wheel Size, Value (US$ Bn), 2023-2031

Figure 112: South America Cargo Bike Market Volume (Units) Forecast, by Application, 2017-2031

Figure 113: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Application, 2017-2031

Figure 114: South America Cargo Bike Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 115: South America Cargo Bike Market Volume (Units) Forecast, by Ownership, 2017-2031

Figure 116: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Ownership, 2017-2031

Figure 117: South America Cargo Bike Market, Incremental Opportunity, by Ownership, Value (US$ Bn), 2023-2031

Figure 118: South America Cargo Bike Market Volume (Units) Forecast, by Load capacity, 2017-2031

Figure 119: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Load Capacity, 2017-2031

Figure 120: South America Cargo Bike Market, Incremental Opportunity, by Load Capacity, Value (US$ Bn), 2023-2031

Figure 121: South America Cargo Bike Market Volume (Units) Forecast, by Propulsion, 2017-2031

Figure 122: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 123: South America Cargo Bike Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 124: South America Cargo Bike Market Volume (Units) Forecast, by Country, 2017-2031

Figure 125: South America Cargo Bike Market Revenue (US$ Bn) Forecast, by Country, 2017-2031

Figure 126: South America Cargo Bike Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031