Reports

Reports

Analysts’ Viewpoint

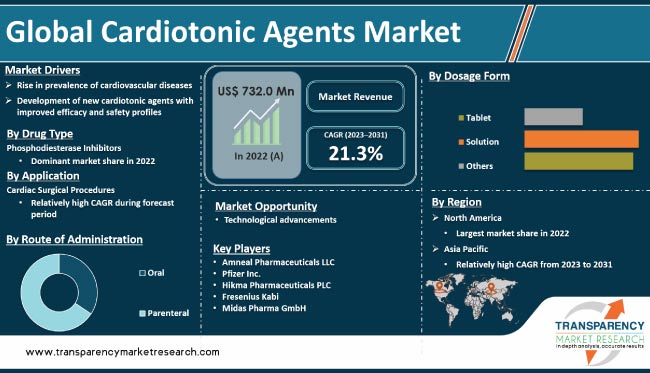

Rise in prevalence of cardiovascular diseases is significantly driving the cardiotonic agents industry growth. High incidence of heart diseases and the presence of well-established healthcare infrastructure across several countries are contributing to the cardiotonic agents market development. Rise in number of cardiac surgeries across the globe and development of new medications for emergency and critical care situations are augmenting market growth.

Advancements in drug development are creating lucrative cardiotonic agents market opportunities for market participants. Manufacturers in the market are engaged in R&D activities to explore new types of cardiotonic agents. Development of medications, such as sodium-glucose cotransporter 2 (SGLT2) inhibitors, which can improve heart function is fueling market statistics.

Cardiotonic agents, also known as inotropic agents, are medications that affect the heart's contractility and improve its function. These agents are commonly used in the treatment of heart failure, arrhythmias, and other cardiovascular conditions.

Digoxins are cardiotonic drugs that are used to increase the force of the heart's contractions and slow down the heart rate, thereby improving blood circulation. Digitalis glycosides have been used for decades and are still a common treatment option for heart failure, atrial fibrillation, and other cardiovascular conditions. However, their use has declined in the last few years due to the availability of newer medications with fewer side effects.

Another type of cardiotonic agent is beta-adrenergic agonists, such as dobutamine. These drugs stimulate the beta-receptors in the heart and increase the heart's contractility. Beta-adrenergic agonists are commonly utilized in the treatment of acute heart failure and shock, as they rapidly increase cardiac output and improve blood pressure. However, their use is limited due to their potential for adverse effects, such as tachycardia and arrhythmias.

Calcium sensitizers, such as levosimendan, are a newer class of cardiotonic agents that improve the heart's contractility by increasing its sensitivity to calcium. Calcium sensitizers are used in the treatment of heart failure and are particularly effective in patients with reduced ejection fraction.

Cardiovascular diseases (CVDs) are a major cause of morbidity and mortality worldwide, with heart failure being one of the most common cardiovascular conditions. The incidence of heart failure is expected to rise in the near future, owing to the rise in the geriatric population and the surge in the prevalence of obesity, diabetes, and high blood pressure. This has led to an increased demand for cardiotonic agents to manage the condition. Several new medications are being developed to reduce the risk of cardiovascular death.

According to a report by the American Heart Association, heart failure affects nearly 6.2 million adults in the U.S., and it is projected to increase by 46.0% by 2030. The rise in the prevalence of heart failure is driving the demand for cardiotonic agents such as digoxin and milrinone, which are commonly used to improve cardiac function in patients with heart failure.

Technological advancements in the development of cardiotonic agents are driving market progress. New drugs are being developed with improved efficacy and safety profiles. Novartis developed Entresto, a combination drug that has been shown to be effective in reducing cardiovascular death and hospitalization for heart failure.

In addition to the development of new drugs, companies are also investing in the development of advanced drug delivery systems and novel formulations. For instance, Milestone Pharmaceuticals has developed a novel drug delivery system for etripamil, a drug used to treat certain types of cardiac arrhythmias. The delivery system allows for rapid administration of etripamil and has been shown to be effective in treating patients with supraventricular tachycardia.

Other companies are exploring the use of nanotechnology in the development of novel formulations for cardiotonic agents. Nanotechnology involves the manipulation of particles on a nanoscale level and has the potential to improve the efficacy and safety of drugs.

The phosphodiesterase inhibitors drug type segment dominated the global industry in 2022. This segment is likely to maintain its dominance during the forecast period. Growth of the phosphodiesterase inhibitors drug type segment is attributable to the increase in the prevalence of heart failure and other cardiovascular diseases, as well as the rise in demand for effective and safe treatments.

Sildenafil is a phosphodiesterase inhibitor that was originally developed as a treatment for erectile dysfunction; however, later, it was found to be effective for cardiovascular diseases. Studies have shown that sildenafil can improve exercise capacity and quality of life in patients with heart failure.

The cardiac surgical procedures application segment accounted for the largest share of the global market in 2022. The increase in demand for cardiac surgeries, such as bypass surgeries, valve replacements, and heart transplants, as well as the rise in the need for medications to support and enhance the outcomes of these surgeries, are driving the segment.

Dopamine is often used during cardiac surgery to increase blood pressure and improve cardiac output. Other medications commonly used in cardiac surgical procedures include nitroglycerin, which can dilate blood vessels and improve blood flow, and heparin, which is used to prevent blood clots during surgery.

Several pharmaceutical companies have been investing in the development of new cardiotonic agents to improve the outcomes of cardiac surgical procedures.

In terms of the route of administration, the global market has been divided into oral and parenteral. As per the latest cardiotonic agents market trends, the parenteral route of administration segment dominated in 2022. It is anticipated to lead the global market in the next few years.

Parenteral administration refers to the delivery of medication through injection or infusion directly into the bloodstream, bypassing the gastrointestinal tract. This route of administration is often used for cardiotonic agents in emergency and critical care situations, where rapid onset and precise dosing are crucial.

Common examples of parenteral cardiotonic agents include dobutamine, which is used to improve heart function in cases of acute heart failure. Other medications administered parenterally include epinephrine, norepinephrine, and nitroglycerin.

Several pharmaceutical companies have started investing in the development of new parenteral cardiotonic agents, including Novartis and its medication LCZ696, which has shown promising results in the treatment of heart failure.

According to the latest cardiotonic agents market analysis, the solution dosage form segment accounted for major share of the global industry in 2022. The solution dosage form segment is projected to lead the global market in the near future.

Cardiotonic agents can be delivered effectively using oral solutions, intravenous solutions, and others. Digoxin is given in a solution form, which is commonly used in the treatment of heart failure and certain arrhythmias. It is available in both oral and intravenous solution forms.

Based on distribution channels, the global industry has been divided into hospital pharmacies retail pharmacies, and online pharmacies. According to the latest cardiotonic agents industry research report, the hospital pharmacies distribution channel segment is expected to account for major share during the forecast period.

Hospital pharmacies are an important distribution channel for cardiotonic agents, as these medications are often administered in a hospital or clinical setting, and require specialized expertise for proper storage, handling, and administration.

Retail pharmacies are often used for the distribution of oral cardiotonic agents for outpatient use, while online pharmacies are becoming increasingly popular for the purchase and delivery of these medications.

As per the latest cardiotonic agents market forecast, North America held major share of the global landscape in 2022. It is projected to maintain its dominance during the forecast period. This can be attributed to high prevalence of cardiovascular diseases in the region, advanced healthcare infrastructure, and increase in healthcare spending.

The U.S. is the largest market for cardiotonic agents in North America, with several major pharmaceutical companies operating in the region. These companies include Pfizer Inc, Novartis, and Amgen. These companies are actively engaged in the development and commercialization of cardiotonic agents.

The cardiotonic agents market size in Asia Pacific is anticipated to increase in the near future. Rise in incidence of cardiovascular diseases and increase in demand for effective treatments are significant factors fueling cardiotonic agents market growth in the region.

The cardiotonic agents market demand is rising in Asia Pacific due to the rise in geriatric population in the region. The presence of several major pharmaceutical companies in Asia Pacific countries, such as Japan, China, and India, is fueling market expansion in the region.

Amneal Pharmaceuticals LLC, Pfizer Inc., Hikma Pharmaceuticals PLC, Fresenius Kabi, Midas Pharma GmbH, Sanofi, Aurobindo Pharma Limited, and SimSon Pharma Limited are the major players operating in the global market. These players are engaged in mergers & acquisitions, strategic collaborations, and new product launches to strengthen their cardiotonic agents market share.

Key players have been profiled in the cardiotonic agents market report based on parameters such as business strategies, company overview, product portfolio, financial overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size in 2022 |

US$ 732.0 Mn |

|

Forecast (Value) in 2031 |

More than US$ 4.5 Bn |

|

Growth Rate (CAGR) |

21.3% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 732.0 Mn in 2022.

It is projected to reach more than US$ 4.5 Bn by 2031.

The CAGR is anticipated to be 21.3% from 2023 to 2031.

The cardiac surgical procedures application segment held major share in 2022.

North America is expected to account for major share during the forecast period.

Amneal Pharmaceuticals LLC, Pfizer Inc., Hikma Pharmaceuticals PLC, Fresenius Kabi, Midas Pharma GmbH, Sanofi, Aurobindo Pharma Limited, and SimSon Pharma Limited.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cardiotonic Agents Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cardiotonic Agents Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Key Industry Events

5.2. Technological Advancements

5.3. Value Chain Analysis

5.4. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Cardiotonic Agents Market Analysis and Forecast, by Drug Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Drug Type, 2017–2031

6.3.1. Digitalis Glycosides

6.3.2. Phosphodiesterase Inhibitors

6.3.3. Cardioprotectants

6.3.4. Sympathomimetic Agents

6.3.5. Others

6.4. Market Attractiveness Analysis, by Drug Type

7. Global Cardiotonic Agents Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Cardiac Surgical Procedures

7.3.2. Atrial Fibrillation

7.3.3. Heart Failure

7.3.4. Pulmonary Hypertension

7.3.5. Others (Atrial Flutter, Cardiogenic Shock, etc.)

7.4. Market Attractiveness Analysis, by Application

8. Global Cardiotonic Agents Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Route of Administration, 2017–2031

8.3.1. Oral

8.3.2. Parenteral

8.4. Market Attractiveness Analysis, by Route of Administration

9. Global Cardiotonic Agents Market Analysis and Forecast, by Dosage Form

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Dosage Form, 2017–2031

9.3.1. Tablet

9.3.2. Solution

9.3.3. Others

9.4. Market Attractiveness Analysis, by Dosage Form

10. Global Cardiotonic Agents Market Analysis and Forecast, by Distribution Channel

10.1. Introduction & Definition

10.2. Key Findings/Developments

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.4. Market Attractiveness Analysis, by Distribution Channel

11. Global Cardiotonic Agents Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region, 2017–2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness Analysis, by Region

12. North America Cardiotonic Agents Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Type, 2017–2031

12.2.1. Digitalis Glycosides

12.2.2. Phosphodiesterase Inhibitors

12.2.3. Cardioprotectants

12.2.4. Sympathomimetic Agents

12.2.5. Others

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Cardiac Surgical Procedures

12.3.2. Atrial Fibrillation

12.3.3. Heart Failure

12.3.4. Pulmonary Hypertension

12.3.5. Others (Atrial Flutter, Cardiogenic Shock, etc.)

12.4. Market Value Forecast, by Route of Administration, 2017–2031

12.4.1. Oral

12.4.2. Parenteral

12.5. Market Value Forecast, by Dosage Form, 2017–2031

12.5.1. Tablet

12.5.2. Solution

12.5.3. Others

12.6. Market Value Forecast, by Distribution Channel, 2017–2031

12.6.1. Hospital Pharmacies

12.6.2. Retail Pharmacies

12.6.3. Online Pharmacies

12.7. Market Value Forecast, by Country, 2017–2031

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Drug Type

12.8.2. By Application

12.8.3. By Route of Administration

12.8.4. By Dosage Form

12.8.5. By Distribution Channel

12.8.6. By Country

13. Europe Cardiotonic Agents Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Type, 2017–2031

13.2.1. Digitalis Glycosides

13.2.2. Phosphodiesterase Inhibitors

13.2.3. Cardioprotectants

13.2.4. Sympathomimetic Agents

13.2.5. Others

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Cardiac Surgical Procedures

13.3.2. Atrial Fibrillation

13.3.3. Heart Failure

13.3.4. Pulmonary Hypertension

13.3.5. Others (Atrial Flutter, Cardiogenic Shock, etc.)

13.4. Market Value Forecast, by Route of Administration, 2017–2031

13.4.1. Oral

13.4.2. Parenteral

13.5. Market Value Forecast, by Dosage Form, 2017–2031

13.5.1. Tablet

13.5.2. Solution

13.5.3. Others

13.6. Market Value Forecast, by Distribution Channel, 2017–2031

13.6.1. Hospital Pharmacies

13.6.2. Retail Pharmacies

13.6.3. Online Pharmacies

13.7. Market Value Forecast, by Country/Sub-region, 2017–2031

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Drug Type

13.8.2. By Application

13.8.3. By Route of Administration

13.8.4. By Dosage Form

13.8.5. By Distribution Channel

13.8.6. By Country/Sub-region

14. Asia Pacific Cardiotonic Agents Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Type, 2017–2031

14.2.1. Digitalis Glycosides

14.2.2. Phosphodiesterase Inhibitors

14.2.3. Cardioprotectants

14.2.4. Sympathomimetic Agents

14.2.5. Others

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Cardiac Surgical Procedures

14.3.2. Atrial Fibrillation

14.3.3. Heart Failure

14.3.4. Pulmonary Hypertension

14.3.5. Others (Atrial Flutter, Cardiogenic Shock, etc.)

14.4. Market Value Forecast, by Route of Administration, 2017–2031

14.4.1. Oral

14.4.2. Parenteral

14.5. Market Value Forecast, by Dosage Form, 2017–2031

14.5.1. Tablet

14.5.2. Solution

14.5.3. Others

14.6. Market Value Forecast, by Distribution Channel, 2017–2031

14.6.1. Hospital Pharmacies

14.6.2. Retail Pharmacies

14.6.3. Online Pharmacies

14.7. Market Value Forecast, by Country/Sub-region, 2017–2031

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Drug Type

14.8.2. By Application

14.8.3. By Route of Administration

14.8.4. By Dosage Form

14.8.5. By Distribution Channel

14.8.6. By Country/Sub-region

15. Latin America Cardiotonic Agents Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Drug Type, 2017–2031

15.2.1. Digitalis Glycosides

15.2.2. Phosphodiesterase Inhibitors

15.2.3. Cardioprotectants

15.2.4. Sympathomimetic Agents

15.2.5. Others

15.3. Market Value Forecast, by Application, 2017–2031

15.3.1. Cardiac Surgical Procedures

15.3.2. Atrial Fibrillation

15.3.3. Heart Failure

15.3.4. Pulmonary Hypertension

15.3.5. Others (Atrial Flutter, Cardiogenic Shock, etc.)

15.4. Market Value Forecast, by Route of Administration, 2017–2031

15.4.1. Oral

15.4.2. Parenteral

15.5. Market Value Forecast, by Dosage Form, 2017–2031

15.5.1. Tablet

15.5.2. Solution

15.5.3. Others

15.6. Market Value Forecast, by Distribution Channel, 2017–2031

15.6.1. Hospital Pharmacies

15.6.2. Retail Pharmacies

15.6.3. Online Pharmacies

15.7. Market Value Forecast, by Country/Sub-region, 2017–2031

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Drug Type

15.8.2. By Application

15.8.3. By Route of Administration

15.8.4. By Dosage Form

15.8.5. By Distribution Channel

15.8.6. By Country/Sub-region

16. Middle East & Africa Cardiotonic Agents Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Drug Type, 2017–2031

16.2.1. Digitalis Glycosides

16.2.2. Phosphodiesterase Inhibitors

16.2.3. Cardioprotectants

16.2.4. Sympathomimetic Agents

16.2.5. Others

16.3. Market Value Forecast, by Application, 2017–2031

16.3.1. Cardiac Surgical Procedures

16.3.2. Atrial Fibrillation

16.3.3. Heart Failure

16.3.4. Pulmonary Hypertension

16.3.5. Others (Atrial Flutter, Cardiogenic Shock, etc.)

16.4. Market Value Forecast, by Route of Administration, 2017–2031

16.4.1. Oral

16.4.2. Parenteral

16.5. Market Value Forecast, by Dosage Form, 2017–2031

16.5.1. Tablet

16.5.2. Solution

16.5.3. Others

16.6. Market Value Forecast, by Distribution Channel, 2017–2031

16.6.1. Hospital Pharmacies

16.6.2. Retail Pharmacies

16.6.3. Online Pharmacies

16.7. Market Value Forecast, by Country/Sub-region, 2017–2031

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Drug Type

16.8.2. By Application

16.8.3. By Route of Administration

16.8.4. By Dosage Form

16.8.5. By Distribution Channel

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player – Competition Matrix (By Tier and Size of Companies)

17.2. Market Share Analysis, by Company (2022)

17.3. Company Profiles

17.3.1. Amneal Pharmaceuticals LLC

17.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.1.2. Product Portfolio

17.3.1.3. Financial Overview

17.3.1.4. SWOT Analysis

17.3.1.5. Strategic Overview

17.3.2. Pfizer Inc.

17.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.2.2. Product Portfolio

17.3.2.3. Financial Overview

17.3.2.4. SWOT Analysis

17.3.2.5. Strategic Overview

17.3.3. Hikma Pharmaceuticals PLC

17.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.3.2. Product Portfolio

17.3.3.3. Financial Overview

17.3.3.4. SWOT Analysis

17.3.3.5. Strategic Overview

17.3.4. Fresenius Kabi

17.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.4.2. Product Portfolio

17.3.4.3. Financial Overview

17.3.4.4. SWOT Analysis

17.3.4.5. Strategic Overview

17.3.5. Midas Pharma GmbH

17.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.5.2. Product Portfolio

17.3.5.3. Financial Overview

17.3.5.4. SWOT Analysis

17.3.5.5. Strategic Overview

17.3.6. Sanofi

17.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.6.2. Product Portfolio

17.3.6.3. Financial Overview

17.3.6.4. SWOT Analysis

17.3.6.5. Strategic Overview

17.3.7. Aurobindo Pharma Limited

17.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.7.2. Product Portfolio

17.3.7.3. Financial Overview

17.3.7.4. SWOT Analysis

17.3.7.5. Strategic Overview

17.3.8. SimSon Pharma Limited

17.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.8.2. Product Portfolio

17.3.8.3. Financial Overview

17.3.8.4. SWOT Analysis

17.3.8.5. Strategic Overview

17.3.9. Other Players

17.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.9.2. Product Portfolio

17.3.9.3. Financial Overview

17.3.9.4. SWOT Analysis

17.3.9.5. Strategic Overview

List of Tables

Table 01: Global Cardiotonic Agents Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 02: Global Cardiotonic Agents Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Cardiotonic Agents Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 04: Global Cardiotonic Agents Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 05: Global Cardiotonic Agents Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 06: Global Cardiotonic Agents Market Value (US$ Mn) Forecast, by Country/Region, 2017–2031

Table 07: North America Cardiotonic Agents Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 08: North America Cardiotonic Agents Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 10: North America Cardiotonic Agents Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 11: North America Cardiotonic Agents Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 13: North America Cardiotonic Agents Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 14: Europe Cardiotonic Agents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 15: Europe Cardiotonic Agents Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 16: Europe Cardiotonic Agents Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 17: Europe Cardiotonic Agents Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 18: Europe Cardiotonic Agents Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 20: Europe Cardiotonic Agents Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Asia Pacific Cardiotonic Agents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Asia Pacific Cardiotonic Agents Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 23: Asia Pacific Cardiotonic Agents Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Asia Pacific Cardiotonic Agents Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 25: Asia Pacific Cardiotonic Agents Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 26: Latin America Cardiotonic Agents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 27: Latin America Cardiotonic Agents Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 28: Latin America Cardiotonic Agents Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 29: Latin America Cardiotonic Agents Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 30: Latin America Cardiotonic Agents Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 31: Middle East & Africa Cardiotonic Agents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Middle East & Africa Cardiotonic Agents Market Value (US$ Mn) Forecast, by Drug Type, 2017–2031

Table 33: Middle East & Africa Cardiotonic Agents Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 34: Middle East & Africa Cardiotonic Agents Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 35: Middle East & Africa Cardiotonic Agents Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

List of Figures

Figure 01: Global Cardiotonic Agents Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Cardiotonic Agents Market Value Share, by Drug Type, 2022

Figure 03: Cardiotonic Agents Market Value Share, by Application, 2022

Figure 04: Cardiotonic Agents Market Value Share, by Route of Administration, 2022

Figure 05: Cardiotonic Agents Market Value Share, by Dosage Form, 2022

Figure 06: Cardiotonic Agents Market Value Share, by Distribution Channel, 2022

Figure 07: Cardiotonic Agents Market Value Share, by Radiotracer Type, 2022

Figure 08: Global Cardiotonic Agents Market Value Share Analysis, by Drug Type 2022 and 2031

Figure 09: Global Cardiotonic Agents Market Attractiveness Analysis, Drug Type, 2023–2031

Figure 10: Global Cardiotonic Agents Market Revenue (US$ Mn), by Digitalis Glycosides, 2017–2031

Figure 11: Global Cardiotonic Agents Market Revenue (US$ Mn), by Phosphodiesterase Inhibitors, 2017–2031

Figure 12: Global Cardiotonic Agents Market Revenue (US$ Mn), by Cardioprotectants, 2017–2031

Figure 13: Global Cardiotonic Agents Market Revenue (US$ Mn), by Sympathomimetic Agents, 2017–2031

Figure 14: Global Cardiotonic Agents Market Revenue (US$ Mn), by Others, 2017–2031

Figure 15: Global Cardiotonic Agents Market Value Share Analysis, by Application 2022 and 2031

Figure 16: Global Cardiotonic Agents Market Attractiveness Analysis, Application, 2023–2031

Figure 17: Global Cardiotonic Agents Market Revenue (US$ Mn), by Cardiac Surgical Procedures, 2017–2031

Figure 18: Global Cardiotonic Agents Market Revenue (US$ Mn), by Atrial Fibrillation, 2017–2031

Figure 19: Global Cardiotonic Agents Market Revenue (US$ Mn), by Heart Failure, 2017–2031

Figure 20: Global Cardiotonic Agents Market Revenue (US$ Mn), by Pulmonary Hypertension, 2017–2031

Figure 21: Global Cardiotonic Agents Market Revenue (US$ Mn), by Others (Atrial Flutter, Cardiogenic Shock, etc.), 2017–2031

Figure 21: Global Cardiotonic Agents Market Value Share Analysis, by Route of Administration 2022 and 2031

Figure 23: Global Cardiotonic Agents Market Attractiveness Analysis, Route of Administration, 2023–2031

Figure 24: Global Cardiotonic Agents Market Revenue (US$ Mn), by Oral, 2017–2031

Figure 25: Global Cardiotonic Agents Market Revenue (US$ Mn), by Parenteral, 2017–2031

Figure 26: Global Cardiotonic Agents Market Value Share Analysis, by Dosage Form 2022 and 2031

Figure 27: Global Cardiotonic Agents Market Attractiveness Analysis, Dosage Form, 2023–2031

Figure 28: Global Cardiotonic Agents Market Revenue (US$ Mn), by Tablet, 2017–2031

Figure 29: Global Cardiotonic Agents Market Revenue (US$ Mn), by Solution, 2017–2031

Figure 30: Global Cardiotonic Agents Market Value Share Analysis, by Others 2022 and 2031

Figure 31: Global Cardiotonic Agents Market Value Share Analysis, by Distribution Channel 2022 and 2031

Figure 32: Global Cardiotonic Agents Market Attractiveness Analysis, Distribution Channel, 2023–2031

Figure 33: Global Cardiotonic Agents Market Revenue (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 34: Global Cardiotonic Agents Market Revenue (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 35: Global Cardiotonic Agents Market Revenue (US$ Mn), by Online Pharmacies, 2017–2031

Figure 36: Global Cardiotonic Agents Market Value Share Analysis, by Country, 2022 and 2031

Figure 37: Global Cardiotonic Agents Market Attractiveness Analysis, by Country, 2023–2031

Figure 38: North America Cardiotonic Agents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 39: North America Cardiotonic Agents Market Value Share Analysis, by Drug Type 2022 and 2031

Figure 40: North America Cardiotonic Agents Market Attractiveness Analysis, Drug Type, 2023–2031

Figure 41: North America Cardiotonic Agents Market Value Share Analysis, by Application 2022 and 2031

Figure 42: North America Cardiotonic Agents Market Attractiveness Analysis, Application, 2023–2031

Figure 43: North America Cardiotonic Agents Market Value Share Analysis, by Route of Administration 2022 and 2031

Figure 44: North America Cardiotonic Agents Market Attractiveness Analysis, Route of Administration, 2023–2031

Figure 45: North America Cardiotonic Agents Market Value Share Analysis, by Dosage Form 2022 and 2031

Figure 46: North America Cardiotonic Agents Market Attractiveness Analysis, Dosage Form, 2023–2031

Figure 47: North America Cardiotonic Agents Market Value Share Analysis, by Distribution Channel 2022 and 2031

Figure 48: North America Cardiotonic Agents Market Attractiveness Analysis, Distribution Channel, 2023–2031

Figure 49: Europe Cardiotonic Agents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 50: Europe Cardiotonic Agents Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 51: Europe Cardiotonic Agents Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 52: Europe Cardiotonic Agents Market Value Share Analysis, by Drug Type 2022 and 2031

Figure 53: Europe Cardiotonic Agents Market Attractiveness Analysis, Drug Type, 2023–2031

Figure 54: Europe Cardiotonic Agents Market Value Share Analysis, by Application, 2022 and 2031

Figure 55: Europe Cardiotonic Agents Market Attractiveness Analysis, Application, 2023–2031

Figure 56: Europe Cardiotonic Agents Market Value Share Analysis, by Route of Administration 2022 and 2031

Figure 57: Europe Cardiotonic Agents Market Attractiveness Analysis, Route of Administration, 2023–2031

Figure 58: Europe Cardiotonic Agents Market Value Share Analysis, by Dosage Form 2022 and 2031

Figure 59: Europe Cardiotonic Agents Market Attractiveness Analysis, Dosage Form, 2023–2031

Figure 60: Europe Cardiotonic Agents Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 61: Europe Cardiotonic Agents Market Attractiveness Analysis, Distribution Channel, 2023–2031

Figure 62: Asia Pacific Cardiotonic Agents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 63: Asia Pacific Cardiotonic Agents Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 64: Asia Pacific Cardiotonic Agents Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 65: Asia Pacific Cardiotonic Agents Market Value Share Analysis, by Drug Type 2022 and 2031

Figure 66: Asia Pacific Cardiotonic Agents Market Attractiveness Analysis, Drug Type, 2023–2031

Figure 67: Asia Pacific Cardiotonic Agents Market Value Share Analysis, by Application, 2022 and 2031

Figure 68: Asia Pacific Cardiotonic Agents Market Attractiveness Analysis, Application, 2023–2031

Figure 69: Asia Pacific Cardiotonic Agents Market Value Share Analysis, by Route of Administration 2022 and 2031

Figure 70: Asia Pacific Cardiotonic Agents Market Attractiveness Analysis, Route of Administration, 2023–2031

Figure 71: Asia Pacific Cardiotonic Agents Market Value Share Analysis, by Dosage Form 2022 and 2031

Figure 72: Asia Pacific Cardiotonic Agents Market Attractiveness Analysis, Dosage Form, 2023–2031

Figure 73: Asia Pacific Cardiotonic Agents Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 74: Asia Pacific Cardiotonic Agents Market Attractiveness Analysis, Distribution Channel, 2023–2031

Figure 75: Latin America Cardiotonic Agents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 76: Latin America Cardiotonic Agents Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 77: Latin America Cardiotonic Agents Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 78: Latin America Cardiotonic Agents Market Value Share Analysis, by Drug Type 2022 and 2031

Figure 79: Latin America Cardiotonic Agents Market Attractiveness Analysis, Drug Type, 2023–2031

Figure 80: Latin America Cardiotonic Agents Market Value Share Analysis, by Application, 2022 and 2031

Figure 81: Latin America Cardiotonic Agents Market Attractiveness Analysis, Application, 2023–2031

Figure 82: Latin America Cardiotonic Agents Market Value Share Analysis, by Route of Administration 2022 and 2031

Figure 83: Latin America Cardiotonic Agents Market Attractiveness Analysis, Route of Administration, 2023–2031

Figure 84: Latin America Cardiotonic Agents Market Value Share Analysis, by Dosage Form 2022 and 2031

Figure 85: Latin America Cardiotonic Agents Market Attractiveness Analysis, Dosage Form, 2023–2031

Figure 86: Latin America Cardiotonic Agents Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 87: Latin America Cardiotonic Agents Market Attractiveness Analysis, Distribution Channel, 2023–2031

Figure 88: Middle East & Africa Cardiotonic Agents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 89: Middle East & Africa Cardiotonic Agents Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 90: Middle East & Africa Cardiotonic Agents Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 91: Middle East & Africa Cardiotonic Agents Market Value Share Analysis, by Drug Type 2022 and 2031

Figure 92: Middle East & Africa Cardiotonic Agents Market Attractiveness Analysis, Drug Type, 2023–2031

Figure 93: Middle East & Africa Cardiotonic Agents Market Value Share Analysis, by Application, 2022 and 2031

Figure 94: Middle East & Africa Cardiotonic Agents Market Attractiveness Analysis, Application, 2023–2031

Figure 95: Middle East & Africa Cardiotonic Agents Market Value Share Analysis, by Route of Administration 2022 and 2031

Figure 96: Middle East & Africa Cardiotonic Agents Market Attractiveness Analysis, Route of Administration, 2023–2031

Figure 97: Middle East & Africa Cardiotonic Agents Market Value Share Analysis, by Dosage Form 2022 and 2031

Figure 98: Middle East & Africa Cardiotonic Agents Market Attractiveness Analysis, Dosage Form, 2023–2031

Figure 99: Middle East & Africa Cardiotonic Agents Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 100: Middle East & Africa Cardiotonic Agents Market Attractiveness Analysis, Distribution Channel, 2023–2031