Reports

Reports

Analysts’ Viewpoint

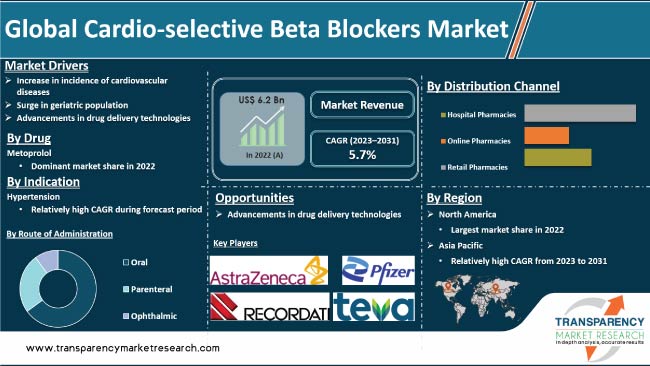

Increase in incidence of cardiovascular diseases and rise in demand for effective & safe drugs to manage them are driving the global cardio-selective beta blockers market. Surge in geriatric population is expected to fuel market expansion in the next few years.

Development of new formulations and drug delivery technologies is anticipated to offer lucrative opportunities to market players. Manufacturers are focusing on developing effective and safe drugs for the treatment of cardiovascular diseases. However, availability of alternative drugs and patent expiration of several blockbuster drugs are projected to restrain market development. Rise in demand for generic drugs and emergence of new drug classes, such as calcium channel blockers and ACE inhibitors, are also estimated to hamper the cardio-selective beta blockers industry growth during the forecast period.

Cardio-selective beta blockers, also known as beta-1 selective blockers, are a class of drugs that specifically target beta-1 receptors in the heart. These drugs are commonly used in the treatment of cardiovascular diseases such as hypertension, angina, and heart failure.

Beta blockers work by reducing the activity of the sympathetic nervous system, which is responsible for the "fight or flight" response. This, in turn, leads to reduction in heart rate, blood pressure, and myocardial oxygen demand. Cardio-selective beta blockers have a higher affinity for beta-1 receptors than beta-2 receptors, which are found in the lungs, skeletal muscle, and blood vessels. This makes them less likely to cause bronchoconstriction and peripheral vasoconstriction, which are potential side-effects of non-selective beta blockers.

High efficacy and safety profile of cardio-selective beta blockers have contributed to their widespread usage in the management of various cardiovascular conditions. The industry is highly competitive, with several established and emerging players competing for market share. Key players in the cardio-selective beta blockers market are investing significantly in research & development activities to develop new and improved formulations of cardio-selective beta blockers that offer better efficacy and safety profiles.

Cardiovascular diseases, including hypertension, heart failure, and arrhythmias, are leading causes of morbidity and mortality. According to the World Health Organization (WHO), cardiovascular diseases are responsible for an estimated 17.9 million deaths each year, which is almost a third of all global deaths.

Increase in incidence of these diseases has fueled the need for effective therapies to manage and prevent cardiovascular conditions. This has led to a surge in demand for cardio-selective beta-blockers, which are commonly used to manage these conditions.

Rise in incidence of cardiovascular diseases is a major driver of the cardio-selective beta blockers market. Growth in prevalence of hypertension, heart failure, and arrhythmias, and increase in geriatric population are expected to drive the demand for these drugs. Furthermore, surge in awareness about the benefits of beta-blockers in managing and preventing cardiovascular diseases is likely to boost the demand for these drugs.

According to a report by the American Heart Association, prevalence of cardiovascular diseases in the U.S. is projected to increase to 131.2 million by 2035, and the cost of medical care for these diseases is anticipated to reach US$ 1.1 Trn.

Cardio-selective beta-blockers have become a popular treatment option for patients with cardiovascular diseases. These are preferred over non-selective beta-blockers, as they have a more targeted effect on the heart, with fewer side-effects on other parts of the body.

Availability of generic versions of cardio-selective beta-blockers has also contributed to market growth. Lower cost of generic drugs has enabled patients to access these medications, thereby increasing the uptake of cardio-selective beta-blockers.

The geriatric population is increasing across the globe. This population is at a higher risk of developing cardiovascular diseases. Hence, demand for cardio-selective beta blockers is likely to increase in order to manage these conditions in older adults.

The global cardio-selective beta blockers market has witnessed significant growth in the past few years, driven by the increase in geriatric population. The global population is aging rapidly, and this demographic shift has significant implications on the healthcare system and the prevalence of chronic diseases such as cardiovascular diseases (CVDs). Older adults are at higher risk of developing CVDs due to age-related changes in the heart and blood vessels, making them a key demographic for cardiovascular treatments such as cardio-selective beta-blockers.

According to the United Nations (UN), the global population of people aged 60 years and older is increasing at an unprecedented rate. The UN's "World Population Ageing" report indicates that the number of people aged 60 years and above is projected to more than double by 2050 and more than triple by 2100. According to the Census Bureau, all baby boomers in the U.S. will be older than age 65 by 2030, and one in every five residents will be of retirement age.

Cardio-selective beta blockers are commonly prescribed for the treatment of hypertension, heart failure, angina, and arrhythmia, which are common cardiovascular diseases among the elderly population. This is expected to fuel the demand for cardio-selective beta blockers.

Advancements in drug delivery technologies have had a significant effect on the development of cardio-selective beta blockers, a class of drugs used to treat different cardiovascular conditions. Development of new drug delivery technologies has made it possible to create cardio selective beta blockers that can target the heart more specifically, while minimizing side-effects in other areas of the body.

Nanoparticle-based drug delivery is one of the most promising drug delivery technologies. It involves using tiny particles to encapsulate the drug, which can then be delivered directly to the target tissue. This approach has shown great promise in preclinical studies, and is being explored for usage in different cardiovascular conditions.

Advancements in drug delivery technologies are driving the demand for cardio-selective beta blockers, as these offer a more effective and targeted treatment option for patients. According to cardio-selective beta blockers market report, ongoing advancements in drug delivery technologies are anticipated to increase availability of innovative treatment options for patients with cardiovascular conditions in the next few years.

Based on drug, the metoprolol segment dominated the global cardio-selective beta blockers market in 2022. This can be ascribed to high efficacy, safety profile, and wide availability. Affordability and ease of administration also make it a preferred choice for patients and healthcare providers alike.

Demand for metoprolol has increased significantly in the past few years, driven by the rise in prevalence of cardiovascular diseases and hypertension. Its proven track record of effectiveness and safety, coupled with cost-effectiveness and ease of use, make it a reliable and popular choice for treating cardiovascular diseases.

North America dominated the global market in 2022. This can be ascribed to high prevalence of heart-related diseases in the region. According to the American Heart Association, cardiovascular diseases are the leading cause of death in the U.S., with around 655,000 deaths each year. Hence, demand for drugs that can effectively manage these conditions, such as cardio-selective beta blockers, has increased in the country.

North America's global dominance can also be ascribed to high prevalence of heart-related diseases, strong presence of key players, and advanced healthcare system. The market in the region is projected to witness robust growth in the next few years due to significant demand for effective treatments for heart-related conditions.

The global cardio-selective beta blockers market in Asia Pacific is expected to witness the fastest growth during the forecast period. This can be ascribed to rapidly aging population, increase in prevalence of cardiovascular diseases, rise in awareness about the benefits of beta blockers, and surge in demand for better healthcare infrastructure in the region.

Cardiovascular diseases are a major health concern in Asia Pacific. CVDs are the leading cause of death in several countries in the region. Therefore, there is a growing need for effective treatments that can help prevent and manage these diseases. Beta blockers have proven to be effective treatment option for several cardiovascular conditions, including hypertension and heart failure. Hence, these are becoming increasingly popular in the region.

The cardio-selective beta blockers market in Europe is driven by high prevalence of cardiovascular disease, presence of well-established pharmaceutical companies, and favorable regulatory environment. Therefore, most of the leading cardio-selective beta blocker drugs in the market are produced by European companies.

This report provides profiles of leading players operating in the global cardio-selective beta blocker market. These include AbbVie, Inc., AstraZeneca, Eagle Pharmaceuticals, WG Critical Care, Pfizer, Inc., Recordati S.p.A., Mitsubishi Tanabe Pharma Corporation, Sanofi, Novartis AG, Teva Pharmaceutical Industries Ltd., Viatris, Inc., Bayer AG, Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., and GSK plc. These players are engaging in mergers & acquisitions, collaborations, and new product launches to increase their cardio-selective beta blockers market share.

The cardio-selective beta blockers market report profiles the top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 6.2 Bn |

|

Forecast (Value) in 2031 |

More than US$ 10.1 Bn |

|

Growth Rate (CAGR) 2023-2031 |

5.7% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 6.2 Bn in 2022.

It is projected to reach more than US$ 10.1 Bn by 2031.

The CAGR is anticipated to be 5.7% from 2023 to 2031.

The metoprolol drug segment accounted for the largest share in 2022.

North America is expected to account for significant share during the forecast period.

AbbVie Inc., AstraZeneca, Pfizer, Inc., Recordati S.p.A., Mitsubishi Tanabe Pharma Corporation, Sanofi, Novartis AG, Teva Pharmaceutical Industries Ltd., Viatris, Inc., Bayer AG, Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., Eagle Pharmaceuticals, WG Critical Care, and GSK plc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cardio-selective Beta Blockers Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cardio-selective Beta Blockers Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate Globally with Key Countries

5.2. Pipeline Analysis

5.3. Key product/brand Analysis

5.4. COVID-19 Pandemic Impact on Industry

6. Global Cardio-selective Beta Blockers Market Analysis and Forecast, by Drug

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug, 2017–2031

6.3.1. Atenolol

6.3.2. Metoprolol

6.3.3. Bisoprolol

6.3.4. Nebivolol

6.3.5. Others

6.4. Market Attractiveness Analysis, by Drug

7. Global Cardio-selective Beta Blockers Market Analysis and Forecast, by Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Indication, 2017–2031

7.3.1. Angina

7.3.2. Hypertension

7.3.3. Heart Failure

7.3.4. Arrhythmias

7.3.5. Others

7.4. Market Attractiveness Analysis, by Indication

8. Global Cardio-selective Beta Blockers Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Route of Administration, 2017–2031

8.3.1. Oral

8.3.2. Parenteral

8.3.3. Ophthalmic

8.4. Market Attractiveness Analysis, by Route of Administration

9. Global Cardio-selective Beta Blockers Market Analysis and Forecast, by Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Attractiveness Analysis, by Distribution Channel

10. Global Cardio-selective Beta Blockers Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Cardio-selective Beta Blockers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug, 2017–2031

11.2.1. Atenolol

11.2.2. Metoprolol

11.2.3. Bisoprolol

11.2.4. Nebivolol

11.2.5. Others

11.3. Market Value Forecast, by Indication, 2017–2031

11.3.1. Angina

11.3.2. Hypertension

11.3.3. Heart Failure

11.3.4. Arrhythmias

11.3.5. Others

11.4. Market Value Forecast, by Route of Administration, 2017–2031

11.4.1. Oral

11.4.2. Parenteral

11.4.3. Ophthalmic

11.5. Market Value Forecast, by Distribution Channel, 2017–2031

11.5.1. Hospital Pharmacies

11.5.2. Retail Pharmacies

11.5.3. Online Pharmacies

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Drug

11.7.2. By Indication

11.7.3. By Route of Administration

11.7.4. By Distribution Channel

11.7.5. By Country

12. Europe Cardio-selective Beta Blockers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug, 2017–2031

12.2.1. Atenolol

12.2.2. Metoprolol

12.2.3. Bisoprolol

12.2.4. Nebivolol

12.2.5. Others

12.3. Market Value Forecast, by Indication, 2017–2031

12.3.1. Angina

12.3.2. Hypertension

12.3.3. Heart Failure

12.3.4. Arrhythmias

12.3.5. Others

12.4. Market Value Forecast, by Route of Administration, 2017–2031

12.4.1. Oral

12.4.2. Parenteral

12.4.3. Ophthalmic

12.5. Market Value Forecast, by Distribution Channel, 2017–2031

12.5.1. Hospital Pharmacies

12.5.2. Retail Pharmacies

12.5.3. Online Pharmacies

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Drug

12.7.2. By Indication

12.7.3. By Route of Administration

12.7.4. By Distribution Channel

12.7.5. By Country/Sub-region

13. Asia Pacific Cardio-selective Beta Blockers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug, 2017–2031

13.2.1. Atenolol

13.2.2. Metoprolol

13.2.3. Bisoprolol

13.2.4. Nebivolol

13.2.5. Others

13.3. Market Value Forecast, by Indication, 2017–2031

13.3.1. Angina

13.3.2. Hypertension

13.3.3. Heart Failure

13.3.4. Arrhythmias

13.3.5. Others

13.4. Market Value Forecast, by Route of Administration, 2017–2031

13.4.1. Oral

13.4.2. Parenteral

13.4.3. Ophthalmic

13.5. Market Value Forecast, by Distribution Channel, 2017–2031

13.5.1. Hospital Pharmacies

13.5.2. Retail Pharmacies

13.5.3. Online Pharmacies

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Drug

13.7.2. By Indication

13.7.3. By Route of Administration

13.7.4. By Distribution Channel

13.7.5. By Country/Sub-region

14. Latin America Cardio-selective Beta Blockers Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug, 2017–2031

14.2.1. Atenolol

14.2.2. Metoprolol

14.2.3. Bisoprolol

14.2.4. Nebivolol

14.2.5. Others

14.3. Market Value Forecast, by Indication, 2017–2031

14.3.1. Angina

14.3.2. Hypertension

14.3.3. Heart Failure

14.3.4. Arrhythmias

14.3.5. Others

14.4. Market Value Forecast, by Route of Administration, 2017–2031

14.4.1. Oral

14.4.2. Parenteral

14.4.3. Ophthalmic

14.5. Market Value Forecast, by Distribution Channel, 2017–2031

14.5.1. Hospital Pharmacies

14.5.2. Retail Pharmacies

14.5.3. Online Pharmacies

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Drug

14.7.2. By Indication

14.7.3. By Route of Administration

14.7.4. By Distribution Channel

14.7.5. By Country/Sub-region

15. Middle East & Africa Cardio-selective Beta Blockers Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Drug, 2017–2031

15.2.1. Atenolol

15.2.2. Metoprolol

15.2.3. Bisoprolol

15.2.4. Nebivolol

15.2.5. Others

15.3. Market Value Forecast, by Indication, 2017–2031

15.3.1. Angina

15.3.2. Hypertension

15.3.3. Heart Failure

15.3.4. Arrhythmias

15.3.5. Others

15.4. Market Value Forecast, by Route of Administration, 2017–2031

15.4.1. Oral

15.4.2. Parenteral

15.4.3. Ophthalmic

15.5. Market Value Forecast, by Distribution Channel, 2017–2031

15.5.1. Hospital Pharmacies

15.5.2. Retail Pharmacies

15.5.3. Online Pharmacies

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Drug

15.7.2. By Indication

15.7.3. By Route of Administration

15.7.4. By Distribution Channel

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company, 2022

16.3. Company Profiles

16.3.1. AbbVie, Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Type Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. AstraZeneca

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Type Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Pfizer, Inc.

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Type Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Recordati S.p.A.

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Type Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Mitsubishi Tanabe Pharma Corporation

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Type Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Sanofi

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Type Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Novartis AG

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Type Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Teva Pharmaceutical Industries Ltd.

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Type Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Viatris, Inc.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Type Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Bayer AG

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Type Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

16.3.11. Sun Pharmaceutical Industries Ltd.

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Product Type Portfolio

16.3.11.3. Financial Overview

16.3.11.4. SWOT Analysis

16.3.11.5. Strategic Overview

16.3.12. Merck & Co., Inc.

16.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.12.2. Product Type Portfolio

16.3.12.3. Financial Overview

16.3.12.4. SWOT Analysis

16.3.12.5. Strategic Overview

16.3.13. Eagle Pharmaceuticals

16.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.13.2. Product Type Portfolio

16.3.13.3. Financial Overview

16.3.13.4. SWOT Analysis

16.3.14. WG Critical Care

16.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.14.2. Product Type Portfolio

16.3.14.3. Financial Overview

16.3.14.4. SWOT Analysis

16.3.14.5. Strategic Overview

List of Tables

Table 01: Global Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 02: Global Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 03: Global Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 04: Global Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 05: Global Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 07: North America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 08: North America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 09: North America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 10: North America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 11: Europe Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 12: Europe Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 13: Europe Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 14: Europe Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 15: Europe Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Asia Pacific Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 17: Asia Pacific Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 18: Asia Pacific Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 19: Asia Pacific Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 20: Asia Pacific Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Latin America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 22: Latin America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 23: Latin America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 24: Latin America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 25: Latin America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Middle East & Africa Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Drug, 2017–2031

Table 27: Middle East & Africa Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 28: Middle East & Africa Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 29: Middle East & Africa Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 30: Middle East & Africa Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Cardio-selective Beta Blockers Market Value Share Analysis, by Drug, 2022 and 2031

Figure 03: Global Cardio-selective Beta Blockers Market Attractiveness Analysis, by Drug, 2023–2031

Figure 04: Global Cardio-selective Beta Blockers Market Value Share Analysis, by Indication, 2022 and 2031

Figure 05: Global Cardio-selective Beta Blockers Market Attractiveness Analysis, by Indication, 2023–2031

Figure 06: Global Cardio-selective Beta Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 07: Global Cardio-selective Beta Blockers Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 08: Global Cardio-selective Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 09: Global Cardio-selective Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 10: Global Cardio-selective Beta Blockers Market Value Share Analysis, by Region, 2022 and 2031

Figure 11: Global Cardio-selective Beta Blockers Market Attractiveness Analysis, by Region, 2023–2031

Figure 12: North America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 13: North America Cardio-selective Beta Blockers Market Value Share Analysis, by Drug, 2022 and 2031

Figure 14: North America Cardio-selective Beta Blockers Market Attractiveness Analysis, by Drug, 2023–2031

Figure 15: North America Cardio-selective Beta Blockers Market Value Share Analysis, by Indication, 2022 and 2031

Figure 16: North America Cardio-selective Beta Blockers Market Attractiveness Analysis, by Indication, 2023–2031

Figure 17: North America Cardio-selective Beta Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 18: North America Cardio-selective Beta Blockers Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 19: North America Cardio-selective Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 20: North America Cardio-selective Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 21: North America Cardio-selective Beta Blockers Market Value Share Analysis, by Country, 2022 and 2031

Figure 22: North America Cardio-selective Beta Blockers Market Attractiveness Analysis, by Country, 2023–2031

Figure 23: Europe Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 24: Europe Cardio-selective Beta Blockers Market Value Share Analysis, by Drug, 2022 and 2031

Figure 25: Europe Cardio-selective Beta Blockers Market Attractiveness Analysis, by Drug, 2023–2031

Figure 26: Europe Cardio-selective Beta Blockers Market Value Share Analysis, by Indication, 2022 and 2031

Figure 27: Europe Cardio-selective Beta Blockers Market Attractiveness Analysis, by Indication, 2023–2031

Figure 28: Europe Cardio-selective Beta Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 29: Europe Cardio-selective Beta Blockers Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 30: Europe Cardio-selective Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 31: Europe Cardio-selective Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 32: Europe Cardio-selective Beta Blockers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Europe Cardio-selective Beta Blockers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 34: Asia Pacific Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 35: Asia Pacific Cardio-selective Beta Blockers Market Value Share Analysis, by Drug, 2022 and 2031

Figure 36: Asia Pacific Cardio-selective Beta Blockers Market Attractiveness Analysis, by Drug, 2023–2031

Figure 37: Asia Pacific Cardio-selective Beta Blockers Market Value Share Analysis, by Indication, 2022 and 2031

Figure 38: Asia Pacific Cardio-selective Beta Blockers Market Attractiveness Analysis, by Indication, 2023–2031

Figure 39: Asia Pacific Cardio-selective Beta Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 40: Asia Pacific Cardio-selective Beta Blockers Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 41: Asia Pacific Cardio-selective Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 42: Asia Pacific Cardio-selective Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 43: Asia Pacific Cardio-selective Beta Blockers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 44: Asia Pacific Cardio-selective Beta Blockers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 45: Latin America Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Latin America Cardio-selective Beta Blockers Market Value Share Analysis, by Drug, 2022 and 2031

Figure 47: Latin America Cardio-selective Beta Blockers Market Attractiveness Analysis, by Drug, 2023–2031

Figure 48: Latin America Cardio-selective Beta Blockers Market Value Share Analysis, by Indication, 2022 and 2031

Figure 49: Latin America Cardio-selective Beta Blockers Market Attractiveness Analysis, by Indication, 2023–2031

Figure 50: Latin America Cardio-selective Beta Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 51: Latin America Cardio-selective Beta Blockers Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 52: Latin America Cardio-selective Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 53: Latin America Cardio-selective Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 54: Latin America Cardio-selective Beta Blockers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 55: Latin America Cardio-selective Beta Blockers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Middle East & Africa Cardio-selective Beta Blockers Market Value (US$ Mn) Forecast, 2017–2031

Figure 57: Middle East & Africa Cardio-selective Beta Blockers Market Value Share Analysis, by Drug, 2022 and 2031

Figure 58: Middle East & Africa Cardio-selective Beta Blockers Market Attractiveness Analysis, by Drug, 2023–2031

Figure 59: Middle East & Africa Cardio-selective Beta Blockers Market Value Share Analysis, by Indication, 2022 and 2031

Figure 60: Middle East & Africa Cardio-selective Beta Blockers Market Attractiveness Analysis, by Indication, 2023–2031

Figure 61: Middle East & Africa Cardio-selective Beta Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 62: Middle East & Africa Cardio-selective Beta Blockers Market Attractiveness Analysis, by Route of Administration, 2023–2031

Figure 63: Middle East & Africa Cardio-selective Beta Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 64: Middle East & Africa Cardio-selective Beta Blockers Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 65: Middle East & Africa Cardio-selective Beta Blockers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 66: Middle East & Africa Cardio-selective Beta Blockers Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 67: Global Cardio-selective Beta Blockers Market Share Analysis, by Company, 2022