Reports

Reports

The carbon concrete market is fueled mainly by the increased demand for eco-friendly, lighter, and durable construction materials. Carbon concrete is created when steel reinforcement gets replaced with carbon fiber. It has superior tensile strength, is resistant to corrosion, and has a greater lifespan; thereby making it ideal for construction in infrastructure, commercial, and residential projects.

When carbon concrete is created, it produces less CO₂ emissions and decreases the lifecycle costs of the material, thereby aligning with global sustainability measures and green building codes. In addition to rising demand driven by sustainability, growth in the carbon concrete sector is supported by speedy urbanization in developed markets, increased government spending on infrastructure projects, and continual investment in resilient construction materials.

Leading manufacturers are putting substantial funding into R&D efforts to improve the scalability and affordability of carbon concrete production while also partnering with construction companies to develop real-life implementations for carbon concrete structures including bridges, façades, and high-rise buildings. Additionally, pilot projects and government sponsored funding programs that prioritize promoting carbon concrete in Europe and Asia is accelerating adoption of carbon concrete and demonstrates a positive outlook towards growth for the carbon concrete market for the future.

The carbon concrete market is an industry that encompasses the development and use of carbon fiber-reinforced concrete as an advanced building material. Carbon concrete does offer the same advantages over conventional steel reinforced concrete in terms of strength, weight, and durability, but with significantly more corrosion resistance.

Carbon concrete is being used in a variety of projects across residential, civil, and commercial applications, especially for tunnels, bridges, façades, and high-rise buildings. It replaces steel reinforcement with carbon fibers or carbon mesh, providing better tensile strength and using less material and lowering maintenance costs. It has a longer lifespan and is compatible with green building certifications.

| Attribute | Detail |

|---|---|

| Carbon Concrete Market Drivers |

|

A growing global focus on sustainability and longevity in construction represents many significant drivers to the market for carbon concrete. With growing global concern over climate change, resource depletion, and environmental impacts of construction practices, industries are moving in a direction toward sustainable alternatives.

Carbon concrete directly addresses these concerns by replacing the conventional steel reinforcement within concrete with carbon fiber, which is lightweight, non-corrosive, and provides a drastically extended life span for a structure. Unlike steel reinforced concrete that breaks down over time due to corrosion.

Carbon concrete obtains structural integrity for decades, and in doing so, reduces repair and maintenance costs within that time frame. This offers not only a lower lifecycle cost for the project but also advances the development toward green infrastructure, as is being demanded by governments and organizations alike.

Carbon concrete has a dramatically lower carbon footprint than steel-reinforced concrete, given that it requires less raw material and permits lighter and thinner structures while still being very strong, thus contributing to reduction targets and providing documentation of energy efficiency and recoverability for St. John’s international green building rating systems LEED and BREEAM.

The international growth in carbon concrete market is primarily from the speed in infrastructure modernization and urban development action occurring globally as governments and private sectors move to upgrade to aging infrastructure, create sustainable transport networks, and foster the creation of smart cities. Steel reinforced concrete structures are regularly in a state of degradation due to corrosion, which may be costly and time-consuming to maintain and repair. Consequently, carbon concrete offers greater longevity of service life coupled with low maintenance and long-lasting durability -an ideal building material for modern infrastructure. Among the other benefits carbon concrete is lightweight but strong, which has benefits when constructing high-rises, bridges, and tunnels designed to carry significant loads, and operate under environmental duress and vibrations.

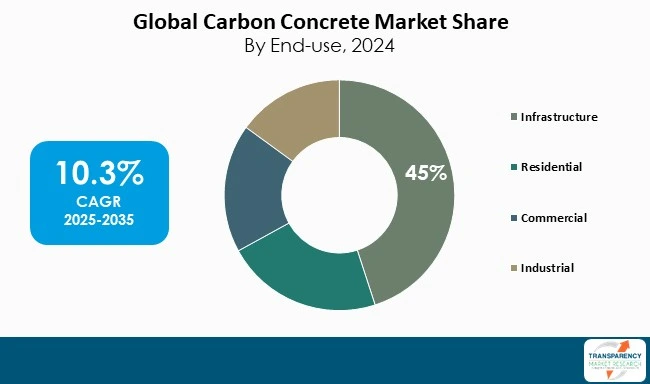

The infrastructure is the leading end-use segment of the carbon concrete market due to the worldwide demand for sustainable, long-lasting, and low-maintenance materials in their infrastructure (roads, bridges, and public buildings). Carbon concrete is lightweight and corrosion-resistant and is significantly stronger than traditional concrete, ultimately prolonging the infrastructure asset's lifespan and reducing lifecycle costs. Governmental support for green construction, in addition to urbanization and large scale smart city initiatives, results in a rapid transition towards carbon concrete use, making infrastructure, the quickest growing and largest segment of global carbon concrete use.

| Attribute | Detail |

|---|---|

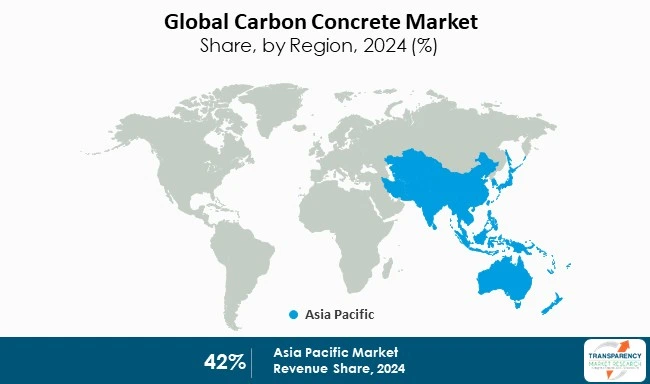

| Leading Region | Asia Pacific |

Asia Pacific is taking the lead due to rapid urbanization, infrastructure development, and government initiatives for sustainability in economies like China, India and Japan. The construction boom, along with environmental policies and investments in sustainable and low-carbon materials, are driving the demand for carbon concrete. Accelerating expansion is supported by developing partnerships with start-ups and universities for collaboration, and Asia Pacific is already taking the lead in innovation and commercialization as an ecosystem compared to other regions.

Holcim Group, Heidelberg Materials, and Cemex S.A.B. de C.V. are leading the charge for a carbon-concrete transition with innovative low-carbon products. Holcim’s ECOPact concrete and ECOPlanet cement utilize recycled aggregates and alternative binders to reduce emissions by 90%. Heidelberg Materials’ evoZero cement, with industrial-scale carbon capture, is establishing a standard for net-zero cement. Cemex’s Vertua line, including Vertua Ultra Zero, combines clinker optimization and alternative fuels with off-setting to also be carbon neutral. These companies are developing cement, concrete, and construction solutions for sustainable construction.

Additionally, CARBOCON GMBH, SGL Carbon, Carbonbuilt play a major role in the consolidated Carbon Concrete market, with a competitive landscape governed by innovation and productivity.

| Attribute | Detail |

|---|---|

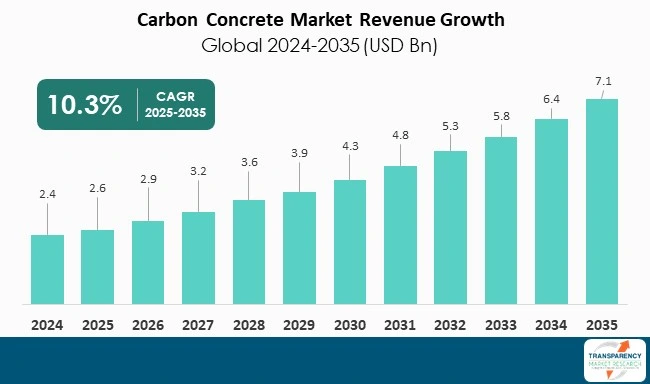

| Market Size Value in 2024 | US$ 2.4 Bn |

| Market Forecast Value in 2035 | US$ 7.1 Bn |

| Growth Rate (CAGR) | 10.3% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Tons For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Process

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The market stood at US$ 2.4 Bn in 2024

The market is expected to grow at a CAGR of 10.3% from 2025 to 2035

Rising demand for sustainable and durable construction materials and Increasing infrastructure modernization and urban development projects

Infrastructure held the largest share under end-use segment in 2024

Asia Pacific was the most lucrative region for the carbon concrete market in 2024

SGL Carbon, Mitsubishi Chemical Corporation (Blue Planet), Holcim Group, Heidelberg Materials, Cemex S.A.B. de C.V., Carbonbuilt, and CARBOCON GMBH

Table 1 Global Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 2 Global Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 3 Global Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 4 Global Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 5 Global Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 6 Global Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 7 Global Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 8 Global Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 9 North America Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 10 North America Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 11 North America Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 12 North America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 13 North America Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 14 North America Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 15 North America Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 16 North America Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 17 USA Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 18 USA Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 19 USA Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 20 USA Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 USA Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 22 USA Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 Canada Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 24 Canada Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 25 Canada Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 26 Canada Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27 Canada Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 Canada Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 29 Europe Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 30 Europe Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 31 Europe Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 32 Europe Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33 Europe Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 34 Europe Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Europe Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 36 Europe Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 37 Germany Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 38 Germany Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 39 Germany Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 40 Germany Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 41 Germany Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 42 Germany Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 43 France Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 44 France Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 45 France Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 46 France Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47 France Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 48 France Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 49 UK Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 50 UK Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 51 UK Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 UK Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 UK Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 UK Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 55 Italy Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 56 Italy Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 57 Italy Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 58 Italy Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 59 Italy Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 60 Italy Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 61 Spain Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 62 Spain Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 63 Spain Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 64 Spain Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65 Spain Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 66 Spain Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 67 Russia & CIS Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 68 Russia & CIS Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 69 Russia & CIS Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 70 Russia & CIS Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 71 Russia & CIS Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 72 Russia & CIS Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 73 Rest of Europe Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 74 Rest of Europe Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 75 Rest of Europe Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 76 Rest of Europe Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 77 Rest of Europe Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Rest of Europe Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 79 Asia Pacific Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 80 Asia Pacific Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 81 Asia Pacific Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 82 Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 83 Asia Pacific Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 84 Asia Pacific Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 85 Asia Pacific Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 86 Asia Pacific Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 87 China Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 88 China Market Value (US$ Bn) Forecast, by Process 2020 to 2035

Table 89 China Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 90 China Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 91 China Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 92 China Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 93 Japan Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 94 Japan Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 95 Japan Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 96 Japan Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 97 Japan Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 98 Japan Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 99 India Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 100 India Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 101 India Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 102 India Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 103 India Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 104 India Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 105 India Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 106 India Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 ASEAN Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 108 ASEAN Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 109 ASEAN Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 110 ASEAN Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 111 ASEAN Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 112 ASEAN Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 113 Rest of Asia Pacific Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 114 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 115 Rest of Asia Pacific Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 116 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 117 Rest of Asia Pacific Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 118 Rest of Asia Pacific Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 119 Latin America Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 120 Latin America Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 121 Latin America Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 122 Latin America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 123 Latin America Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 124 Latin America Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 125 Latin America Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 126 Latin America Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 127 Brazil Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 128 Brazil Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 129 Brazil Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 130 Brazil Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 131 Brazil Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 132 Brazil Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 133 Mexico Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 134 Mexico Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 135 Mexico Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 136 Mexico Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 137 Mexico Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 138 Mexico Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 139 Rest of Latin America Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 140 Rest of Latin America Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 141 Rest of Latin America Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 142 Rest of Latin America Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 143 Rest of Latin America Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 Rest of Latin America Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 145 Middle East & Africa Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 146 Middle East & Africa Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 147 Middle East & Africa Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 148 Middle East & Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 149 Middle East & Africa Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 150 Middle East & Africa Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 151 Middle East & Africa Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 152 Middle East & Africa Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 153 GCC Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 154 GCC Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 155 GCC Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 156 GCC Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 157 GCC Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 158 GCC Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 159 South Africa Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 160 South Africa Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 161 South Africa Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 162 South Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 163 South Africa Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 164 South Africa Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 165 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Process, 2020 to 2035

Table 166 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Process, 2020 to 2035

Table 167 Rest of Middle East & Africa Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 168 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 169 Rest of Middle East & Africa Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Rest of Middle East & Africa Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Figure 1 Global Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 2 Global Market Attractiveness, by Process

Figure 3 Global Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 4 Global Market Attractiveness, by Application

Figure 5 Global Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 6 Global Market Attractiveness, by End-use

Figure 7 Global Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 8 Global Market Attractiveness, by Region

Figure 9 North America Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 10 North America Market Attractiveness, by Process

Figure 11 North America Market Attractiveness, by Process

Figure 12 North America Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 13 North America Market Attractiveness, by Application

Figure 14 North America Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 15 North America Market Attractiveness, by End-use

Figure 16 North America Market Attractiveness, by Country and Sub-region

Figure 17 Europe Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 18 Europe Market Attractiveness, by Process

Figure 19 Europe Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 20 Europe Market Attractiveness, by Application

Figure 21 Europe Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 22 Europe Market Attractiveness, by End-use

Figure 23 Europe Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 24 Europe Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 26 Asia Pacific Market Attractiveness, by Process

Figure 27 Asia Pacific Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 28 Asia Pacific Market Attractiveness, by Application

Figure 29 Asia Pacific Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 30 Asia Pacific Market Attractiveness, by End-use

Figure 31 Asia Pacific Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 32 Asia Pacific Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 34 Latin America Market Attractiveness, by Process

Figure 35 Latin America Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 36 Latin America Market Attractiveness, by Application

Figure 37 Latin America Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 38 Latin America Market Attractiveness, by End-use

Figure 39 Latin America Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 40 Latin America Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Market Volume Share Analysis, by Process, 2024, 2027, and 2035

Figure 42 Middle East & Africa Market Attractiveness, by Process

Figure 43 Middle East & Africa Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 44 Middle East & Africa Market Attractiveness, by Application

Figure 45 Middle East & Africa Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 46 Middle East & Africa Market Attractiveness, by End-use

Figure 47 Middle East & Africa Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 48 Middle East & Africa Market Attractiveness, by Country and Sub-region