Reports

Reports

Analysts’ Viewpoint

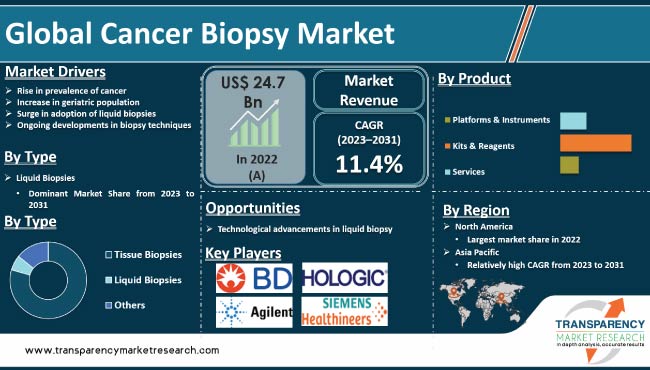

Rise in prevalence of cancer and increase in the geriatric population are driving the global cancer biopsy market. Surge in adoption of liquid biopsies and ongoing developments in biopsy techniques are expected to propel market expansion in the next few years. Furthermore, technological advancements in cancer biopsy are likely to bolster the global cancer biopsy industry during the forecast period.

Development of more accurate and effective biopsy procedures offers lucrative opportunities for market players. Leading companies operating in the market are focusing on strategic launches and collaborations to enhance product offerings and expand global footprint. Post the COVID-19 pandemic, cancer biopsy companies have adopted new technologies, such as liquid biopsies, to detect genetic alterations in cancer patients.

Cancer biopsy is a medical procedure, in which a small sample of tissue is taken from a suspicious or abnormal area in the body to be examined under a microscope. The purpose of a biopsy is to determine whether the tissue sample contains cancer cells and, if so, to identify the type of cancer present.

There are several different methods for performing a biopsy, depending on the type and location of the suspected cancer. The most common types of biopsies are needle biopsy, surgical biopsy, and endoscopic biopsy.

Rise in prevalence of cancer and increase in geriatric population are the major factors driving the global cancer biopsy market value. According to the National Cancer Institute (2020), 60% of cancer patients were 65 or older globally. Surge in adoption of liquid biopsies and ongoing developments in biopsy techniques are the other factors fueling the global market.

According to CanRehab-2022 estimates, 27.5 million new cancer cases would be recorded worldwide by 2040. Additionally, around 83,730 new bladder cancer cases were reported in the U.S. in 2021, along with 284,200 breast cancer cases and 149,500 colon and rectal cancer cases, according to the National Cancer Institute (NCI) 2022 update.

Technological advancements in cancer biopsy and key market players focusing on strategic launches and collaborations to enhance product offerings and expand global footprint are fueling the global cancer biopsy market development.

In 2022, BillionToOne, Inc. released Northstar Select and Northstar Response, its first oncology liquid biopsy products. Currently, a few academic cancer centers can use the items for research purposes.

Emergence of liquid biopsy for cancer diagnosis, screening, prognosis, and treatment monitoring has significantly enhanced the competition and capabilities in the market. This is anticipated to propel the market during the forecast period.

The COVID-19 pandemic has had a significant impact on the global market. Hospital visits were significantly reduced during the early stages due to social isolation policies, and only patients with emergencies were permitted. Thus, cancer biopsies declined in 2020, which hampered the market.

After the pandemic in mid-2020, however, technological advancements in cancer biopsies propelled the market. During the later stages of the pandemic, usage of liquid biopsies to identify genetic changes in cancer patients became more popular.

In terms of product, the kits & reagents segment accounted for largest global cancer biopsy market share in 2022. The trend is expected to continue during the forecast period. Rise in usage of kits & reagents due to surge in cancer patients is driving the segment. Furthermore, increase in availability of technologically advanced kits & reagents are propelling the segment.

Based on type, the liquid biopsy segment dominated the global market in 2022. This is ascribed to introduction of liquid biopsies that have drastically revolutionized the field of clinical oncology into an effective, minimally invasive tumor detection method used for tumor screening and early detection of recurrence, and devising personalized therapeutic regimens.

According to a study published in PMC Journal in September 2021, researchers suggested performing liquid biopsies as a valid and more expedient diagnostic method for treating lung cancer patients during the COVID-19 period.

In terms of application, the breast cancer segment accounted for larger share of the global cancer biopsy market in 2022. This is ascribed to increase in incidence of breast cancer across the globe. The 2022 update by Breastcancer.org indicated that an estimated 51,400 new cases of non-invasive (in situ) breast cancer and 287,850 cases of invasive breast cancer were reported among U.S. women in 2022.

Usage of biopsies for breast cancer screening is increasing, and core-needle biopsy is preferred over surgical biopsy, according to the American Cancer Society's (ACS) January 2022 update. Hence, rise in usage of cancer biopsies for breast cancer screening is driving the segment.

According to cancer biopsy market trends, North America accounted for significant share of the global market in 2022. This is ascribed to technological advancements, high burden of cancer prevalence, and increase in product approval and launches.

Rise in adoption of liquid biopsies across the U.S. is attributed to several strategies adopted by government authorities. For instance, at the American Society of Clinical Oncology (ASCO) 2022, liquid biopsy companies and top cancer researchers presented various liquid biopsy studies for different types of cancer.

The burden of cancer is increasing across countries in North America. As per data published by the National Center for Health Statistics, nearly 1,958,310 new cancer cases and 609,820 cancer deaths are projected to be recorded in the U.S. in 2023

As per the cancer biopsy market forecast, the industry in Asia Pacific is expected to witness robust growth during the forecast period. This is ascribed to high number of cancer patients, growing preference for non-invasive procedures among the population for early detection, adoption of advanced biopsy techniques, and research & collaborations for advanced cancer diagnosis.

The report concludes with the company profiles section that includes key information about the major players. Key players focus on strategies such as new product launches, mergers, and partnerships & collaborations to compete in the marketplace.

Leading companies operating in the market are Abbott Laboratories, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd., Hologic, Inc., Danaher Corporation, Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Illumina, Inc., Siemens Healthineers, GE Healthcare, Bio-Rad Laboratories, Inc., QIAGEN, and Olympus Corporation.

Prominent players have been profiled in the cancer biopsy market report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 24.7 Bn |

|

Forecast (Value) in 2031 |

More than US$ 62.0 Bn |

|

Growth Rate (CAGR) |

11.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 24.7 Bn in 2022.

It is projected to reach more than US$ 66.0 Bn by 2031.

It is anticipated to expand at a CAGR of 11.4% from 2023 to 2031.

Rise in prevalence of cancer, increase in geriatric population, surge in adoption of liquid biopsies, and ongoing developments in biopsy techniques are propelling the market.

The breast cancer segment accounted for more than 12.0% share in 2022.

North America is expected to account for the largest share of the market from 2023 to 2031.

Abbott Laboratories, Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd., Hologic, Inc., Danaher Corporation, Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Illumina, Inc., Siemens Healthineers, GE Healthcare, Bio-Rad Laboratories, Inc., QIAGEN, and Olympus Corporation are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cancer Biopsy Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cancer Biopsy Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Cancer Prevalence & Incidence, by Region

5.2. Technological Advancements

5.3. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

5.4. Reimbursement Scenario by Region/Globally

5.5. Value Chain Analysis

6. Global Cancer Biopsy Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017-2031

6.3.1. Platforms & Instruments

6.3.2. Kits & Reagents

6.3.3. Services

6.4. Market Attractiveness Analysis, by Product

7. Global Cancer Biopsy Market Analysis and Forecast, by Type

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Type, 2017-2031

7.3.1. Tissue Biopsies

7.3.1.1. Needle Biopsies

7.3.1.2. Surgical Biopsies

7.3.2. Liquid Biopsies

7.3.3. Others

7.4. Market Attractiveness Analysis, by Type

8. Global Cancer Biopsy Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2017-2031

8.3.1. Breast Cancer

8.3.2. Colorectal Cancer

8.3.3. Cervical Cancer

8.3.4. Lung Cancer

8.3.5. Prostate Cancer

8.3.6. Skin Cancer

8.3.7. Blood Cancer

8.3.8. Kidney Cancer

8.3.9. Liver Cancer

8.3.10. Pancreatic Cancer

8.3.11. Ovarian Cancer

8.3.12. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Cancer Biopsy Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Cancer Biopsy Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017-2031

10.2.1. Platforms & Instruments

10.2.2. Kits & Reagents

10.2.3. Services

10.3. Market Value Forecast, by Type, 2017-2031

10.3.1. Tissue Biopsies

10.3.1.1. Needle Biopsies

10.3.1.2. Surgical Biopsies

10.3.2. Liquid Biopsies

10.3.3. Others

10.4. Market Value Forecast, by Application, 2017-2031

10.4.1. Breast Cancer

10.4.2. Colorectal Cancer

10.4.3. Cervical Cancer

10.4.4. Lung Cancer

10.4.5. Prostate Cancer

10.4.6. Skin Cancer

10.4.7. Blood Cancer

10.4.8. Kidney Cancer

10.4.9. Liver Cancer

10.4.10. Pancreatic Cancer

10.4.11. Ovarian Cancer

10.4.12. Others

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Type

10.6.3. By Application

10.6.4. By Country

11. Europe Cancer Biopsy Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017-2031

11.2.1. Platforms & Instruments

11.2.2. Kits & Reagents

11.2.3. Services

11.3. Market Value Forecast, by Type, 2017-2031

11.3.1. Tissue Biopsies

11.3.1.1. Needle Biopsies

11.3.1.2. Surgical Biopsies

11.3.2. Liquid Biopsies

11.3.3. Others

11.4. Market Value Forecast, by Application, 2017-2031

11.4.1. Breast Cancer

11.4.2. Colorectal Cancer

11.4.3. Cervical Cancer

11.4.4. Lung Cancer

11.4.5. Prostate Cancer

11.4.6. Skin Cancer

11.4.7. Blood Cancer

11.4.8. Kidney Cancer

11.4.9. Liver Cancer

11.4.10. Pancreatic Cancer

11.4.11. Ovarian Cancer

11.4.12. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Type

11.6.3. By Application

11.6.4. By Country/Sub-region

12. Asia Pacific Cancer Biopsy Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017-2031

12.2.1. Instruments

12.2.2. Kits & Reagents

12.2.3. Services

12.3. Market Value Forecast, by Type, 2017-2031

12.3.1. Tissue Biopsies

12.3.1.1. Needle Biopsies

12.3.1.2. Surgical Biopsies

12.3.2. Liquid Biopsies

12.3.3. Others

12.4. Market Value Forecast, by Application, 2017-2031

12.4.1. Breast Cancer

12.4.2. Colorectal Cancer

12.4.3. Cervical Cancer

12.4.4. Lung Cancer

12.4.5. Prostate Cancer

12.4.6. Skin Cancer

12.4.7. Blood Cancer

12.4.8. Kidney Cancer

12.4.9. Liver Cancer

12.4.10. Pancreatic Cancer

12.4.11. Ovarian Cancer

12.4.12. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Type

12.6.3. By Application

12.6.4. By Country/Sub-region

13. Latin America Cancer Biopsy Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017-2031

13.2.1. Platforms & Platforms & Instruments

13.2.2. Kits & Reagents

13.2.3. Services

13.3. Market Value Forecast, by Type, 2017-2031

13.3.1. Tissue Biopsies

13.3.1.1. Needle Biopsies

13.3.1.2. Surgical Biopsies

13.3.2. Liquid Biopsies

13.3.3. Others

13.4. Market Value Forecast, by Application, 2017-2031

13.4.1. Breast Cancer

13.4.2. Colorectal Cancer

13.4.3. Cervical Cancer

13.4.4. Lung Cancer

13.4.5. Prostate Cancer

13.4.6. Skin Cancer

13.4.7. Blood Cancer

13.4.8. Kidney Cancer

13.4.9. Liver Cancer

13.4.10. Pancreatic Cancer

13.4.11. Ovarian Cancer

13.4.12. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Type

13.6.3. By Application

13.6.4. By Country/Sub-region

14. Middle East & Africa Cancer Biopsy Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017-2031

14.2.1. Platforms & Instruments

14.2.2. Kits & Reagents

14.2.3. Services

14.3. Market Value Forecast, by Type, 2017-2031

14.3.1. Tissue Biopsies

14.3.1.1. Needle Biopsies

14.3.1.2. Surgical Biopsies

14.3.2. Liquid Biopsies

14.3.3. Others

14.4. Market Value Forecast, by Application, 2017-2031

14.4.1. Breast Cancer

14.4.2. Colorectal Cancer

14.4.3. Cervical Cancer

14.4.4. Lung Cancer

14.4.5. Prostate Cancer

14.4.6. Skin Cancer

14.4.7. Blood Cancer

14.4.8. Kidney Cancer

14.4.9. Liver Cancer

14.4.10. Pancreatic Cancer

14.4.11. Ovarian Cancer

14.4.12. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Type

14.6.3. By Application

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. Abbott Laboratories

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Becton, Dickinson and Company

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. F. Hoffmann-La Roche Ltd.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Hologic, Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Danaher Corporation

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Thermo Fisher Scientific, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Agilent Technologies, Inc.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Illumina, Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Siemens Healthineers

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. GE Healthcare

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Bio-Rad Laboratories, Inc.

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. Olympus Corporation

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

15.3.13. QIAGEN

15.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.13.2. Product Portfolio

15.3.13.3. Financial Overview

15.3.13.4. SWOT Analysis

15.3.13.5. Strategic Overview

List of Tables

Table 01: Global Cancer Biopsy Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 02: Global Cancer Biopsy Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 03: Global Cancer Biopsy Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 04: Global Cancer Biopsy Market Value (US$ Mn) Forecast, by Tissue Biopsies, 2017-2031

Table 05: Global Cancer Biopsy Market Value (US$ Mn) Forecast, by Liquid Biopsies, 2017-2031

Table 06: Global Cancer Biopsy Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 07: North America Cancer Biopsy Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 08: North America Cancer Biopsy Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 09: North America Cancer Biopsy Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 10: North America Cancer Biopsy Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 11: North America Cancer Biopsy Market Value (US$ Mn) Forecast, by Tissue Biopsies, 2017-2031

Table 12: North America Cancer Biopsy Market Value (US$ Mn) Forecast, by Liquid Biopsies, 2017-2031

Table 13: Europe Cancer Biopsy Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Europe Cancer Biopsy Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 15: Europe Cancer Biopsy Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 16: Europe Cancer Biopsy Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 17: Europe Cancer Biopsy Market Value (US$ Mn) Forecast, by Tissue Biopsies, 2017-2031

Table 18: Europe Cancer Biopsy Market Value (US$ Mn) Forecast, by Liquid Biopsies, 2017-2031

Table 19: Asia Pacific Cancer Biopsy Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 20: Asia Pacific Cancer Biopsy Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 21: Asia Pacific Cancer Biopsy Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 22: Asia Pacific Cancer Biopsy Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 23: Asia Pacific Cancer Biopsy Market Value (US$ Mn) Forecast, by Tissue Biopsies, 2017-2031

Table 24: Asia Pacific Cancer Biopsy Market Value (US$ Mn) Forecast, by Liquid Biopsies, 2017-2031

Table 25: Latin America Cancer Biopsy Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 26: Latin America Cancer Biopsy Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 27: Latin America Cancer Biopsy Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 28: Latin America Cancer Biopsy Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 29: Latin America Cancer Biopsy Market Value (US$ Mn) Forecast, by Tissue Biopsies, 2017-2031

Table 30: Latin America Cancer Biopsy Market Value (US$ Mn) Forecast, by Liquid Biopsies, 2017-2031

Table 31: Middle East & Africa Cancer Biopsy Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 32: Middle East & Africa Cancer Biopsy Market Value (US$ Mn) Forecast, by Product, 2017-2031

Table 33: Middle East & Africa Cancer Biopsy Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 34: Middle East & Africa Cancer Biopsy Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 35: Middle East & Africa Cancer Biopsy Market Value (US$ Mn) Forecast, by Tissue Biopsies, 2017-2031

Table 36: Middle East & Africa Cancer Biopsy Market Value (US$ Mn) Forecast, by Liquid Biopsies, 2017-2031

List of Figures

Figure 01: Global Cancer Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 02: Global Cancer Biopsy Market Attractiveness Analysis, Product, 2023-2031

Figure 03: Global Cancer Biopsy Market Revenue (US$ Mn), by Platforms & Instruments, 2017-2031

Figure 04: Global Cancer Biopsy Market Revenue (US$ Mn), by Kits & Reagents, 2017-2031

Figure 04: Global Cancer Biopsy Market Revenue (US$ Mn), by Services, 2017-2031

Figure 05: Global Cancer Biopsy Market Value Share Analysis, by Type, 2022 and 2031

Figure 06: Global Cancer Biopsy Market Attractiveness Analysis, by Type, 2023-2031

Figure 07: Global Cancer Biopsy Market Revenue (US$ Mn), by Tissue Biopsies, 2017-2031

Figure 08: Global Cancer Biopsy Market Revenue (US$ Mn), by Liquid Biopsies, 2017-2031

Figure 09: Global Cancer Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 10: Global Cancer Biopsy Market Attractiveness Analysis, Application, 2023-2031

Figure 11: Global Cancer Biopsy Market Revenue (US$ Mn), by Breast Cancer, 2017-2031

Figure 12: Global Cancer Biopsy Market Revenue (US$ Mn), by Colorectal Cancer, 2017-2031

Figure 13: Global Cancer Biopsy Market Revenue (US$ Mn), by Cervical Cancer 2022 and 2031

Figure 14: Global Cancer Biopsy Market Revenue (US$ Mn), Lung Cancer, 2023-2031

Figure 15: Global Cancer Biopsy Market Revenue (US$ Mn), by Prostate Cancer, 2017-2031

Figure 16: Global Cancer Biopsy Market Revenue (US$ Mn), by Skin Cancer, 2017-2031

Figure 17: Global Cancer Biopsy Market Revenue (US$ Mn), by Blood Cancer, 2017-2031

Figure 18: Global Cancer Biopsy Market Revenue (US$ Mn), Kidney Cancer, 2023-2031

Figure 19: Global Cancer Biopsy Market Revenue (US$ Mn), by Liver Cancer, 2017-2031

Figure 20: Global Cancer Biopsy Market Revenue (US$ Mn), by Pancreatic Cancer, 2017-2031

Figure 21: Global Cancer Biopsy Market Revenue (US$ Mn), by Ovarian Cancer, 2017-2031

Figure 22: Global Cancer Biopsy Market Revenue (US$ Mn), by Others, 2017-2031

Figure 23: Global Cancer Biopsy Market Value Share Analysis, by Region, 2022 and 2031

Figure 24: Global Cancer Biopsy Market Attractiveness Analysis, by Region, 2023-2031

Figure 25: North America Cancer Biopsy Market Value (US$ Mn) Forecast, 2017-2031

Figure 26: North America Cancer Biopsy Market Value Share Analysis, by Country, 2022 and 2031

Figure 27: North America Cancer Biopsy Market Attractiveness Analysis, by Country, 2023-2031

Figure 28: North America Cancer Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 29: North America Cancer Biopsy Market Attractiveness Analysis, Product, 2023-2031

Figure 30: North America Cancer Biopsy Market Value Share Analysis, by Type, 2022 and 2031

Figure 31: North America Cancer Biopsy Market Attractiveness Analysis, Type, 2023-2031

Figure 32: North America Cancer Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 33: North America Cancer Biopsy Market Attractiveness Analysis, by Application, 2023-2031

Figure 34: Europe Cancer Biopsy Market Value (US$ Mn) Forecast, 2017-2031

Figure 35: Europe Cancer Biopsy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 36: Europe Cancer Biopsy Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 37: Europe Cancer Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 38: Europe Cancer Biopsy Market Attractiveness Analysis, Product, 2023-2031

Figure 39: Europe Cancer Biopsy Market Value Share Analysis, by Type, 2022 and 2031

Figure 40: Europe Cancer Biopsy Market Attractiveness Analysis, by Type, 2023-2031

Figure 41: Europe Cancer Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 42: Europe Cancer Biopsy Market Attractiveness Analysis, by Application, 2023-2031

Figure 43: Asia Pacific Cancer Biopsy Market Value (US$ Mn) Forecast, 2017-2031

Figure 44: Asia Pacific Cancer Biopsy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 45: Asia Pacific Cancer Biopsy Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 46: Asia Pacific Cancer Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 47: Asia Pacific Cancer Biopsy Market Attractiveness Analysis, Product, 2023-2031

Figure 48: Asia Pacific Cancer Biopsy Market Value Share Analysis, by Type, 2022 and 2031

Figure 49: Asia Pacific Cancer Biopsy Market Attractiveness Analysis, by Type, 2023-2031

Figure 50: Asia Pacific Cancer Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 51: Asia Pacific Cancer Biopsy Market Attractiveness Analysis, by Application, 2023-2031

Figure 52: Latin America Cancer Biopsy Market Value (US$ Mn) Forecast, 2017-2031

Figure 53: Latin America Cancer Biopsy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 54: Latin America Cancer Biopsy Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 55: Latin America Cancer Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 56: Latin America Cancer Biopsy Market Attractiveness Analysis, Product, 2023-2031

Figure 57: Latin America Cancer Biopsy Market Value Share Analysis, by Type, 2022 and 2031

Figure 58: Latin America Cancer Biopsy Market Attractiveness Analysis, Type, 2023-2031

Figure 59: Latin America Cancer Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 60: Latin America Cancer Biopsy Market Attractiveness Analysis, by Application, 2023-2031

Figure 61: Middle East & Africa Cancer Biopsy Market Value (US$ Mn) Forecast, 2017-2031

Figure 62: Middle East & Africa Cancer Biopsy Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 63: Middle East & Africa Cancer Biopsy Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 64: Middle East & Africa Cancer Biopsy Market Value Share Analysis, by Product, 2022 and 2031

Figure 65: Middle East & Africa Cancer Biopsy Market Attractiveness Analysis, Product, 2023-2031

Figure 66: Middle East & Africa Cancer Biopsy Market Value Share Analysis, by Type, 2022 and 2031

Figure 67: Middle East & Africa Cancer Biopsy Market Attractiveness Analysis, Type, 2023-2031

Figure 68: Middle East & Africa Cancer Biopsy Market Value Share Analysis, by Application, 2022 and 2031

Figure 69: Middle East & Africa Cancer Biopsy Market Attractiveness Analysis, by Application, 2023-2031

Figure 70: Global Cancer Biopsy Market Share Analysis, by Company 2022