Reports

Reports

Analysts’ Viewpoint

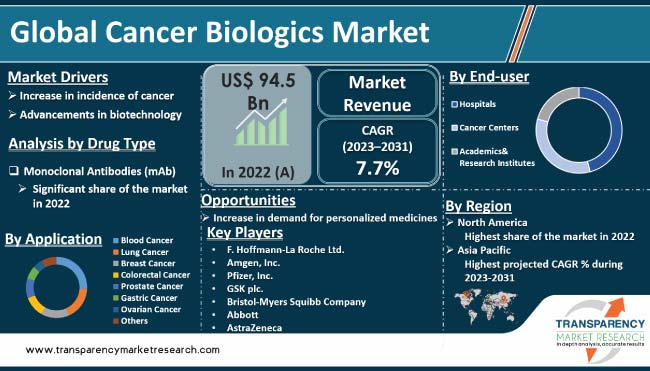

Rise in prevalence of cancer, advancements in cancer biotechnology, increase in demand for targeted therapies, and favorable reimbursement policies are the major factors driving the global cancer biologics market. Cancer continues to be a significant health challenge globally, with 10 million fatalities in 2020. Surge in need for effective and innovative treatments of cancer is propelling the cancer biologics market growth. Furthermore, advancements in understanding cancer biology, identifying specific molecular targets, and developing biologic drugs that can selectively target and inhibit cancer cells are expected to accelerate market expansion.

Rise in demand for targeted therapies, as these offer improved treatment outcomes and reduced side effects compared to traditional chemotherapy, offers lucrative opportunities to market players. Moreover, favorable reimbursement policies by governments and insurance providers have encouraged the adoption of cancer biologics, ensuring wider patient access to these advanced treatments.

The cancer biologics market encompasses a range of therapeutic products developed through biotechnology to treat various types of cancer. Biologic drugs are derived from living organisms, such as cells or proteins, and are designed to target specific cancer cells or pathways.

These drugs include monoclonal antibodies, vaccines, and cell-based therapies. These work by enhancing immune response, blocking tumor growth signals, or directly attacking cancer cells.

The market has witnessed significant developments in the past few years, including approval of novel biologic therapies, expansion of targeted therapies, and advancements in immunotherapies.

Targeted therapies, such as HER2-targeted antibodies for breast cancer or EGFR inhibitors for lung cancer, have shown improved treatment outcomes. Immunotherapies, such as immune checkpoint inhibitors and CAR-T cell therapies have demonstrated remarkable success in certain cancers.

The market continues to evolve with ongoing research and development efforts to discover new therapeutic targets and optimize treatment approaches, aiming to provide more effective and personalized options for cancer patients.

Rise in number of cancer cases across the globe has increased the need for effective and targeted therapies to combat this complex disease.

Surge in cancer incidence can be attributed to several factors. Population growth, aging population, and lifestyle changes have contributed to the increasing burden of cancer. Additionally, improved diagnostic techniques and increased awareness have led to better detection and reporting of cancer cases.

Rise in cancer cases has spurred significant advancements in the field of cancer treatment, with a particular focus on biologic drugs. Biologics, derived from living organisms or produced using biotechnology, offer unique advantages over traditional chemotherapy drugs.

Biologics can target specific molecules or pathways involved in cancer growth and progression, leading to more precise and personalized treatment approaches. Increase in cancer incidence has prompted greater research and development efforts in the field of oncology biologics.

Pharmaceutical companies, academic institutions, and research organizations are investing significantly in developing novel biologic drugs and conducting clinical trials to evaluate their safety and efficacy. The focus is not only on improving existing treatments, but also on discovering innovative approaches to combatting cancer.

Advancements in biotechnology are playing a crucial role in driving the global cancer biologics market demand. Biotechnology has revolutionized the field of cancer research and treatment by enabling the development of innovative biologic drugs with enhanced specificity, efficacy, and safety profiles.

One of the key advancements in biotechnology is the ability to produce monoclonal antibodies (mAbs). These biologic drugs are engineered to target specific molecules or proteins expressed on the surface of cancer cells.

By binding to these targets, mAbs can block signaling pathways, inhibit tumor growth, and stimulate immune responses against cancer cells. Development of techniques such as hybridoma technology and recombinant DNA technology has facilitated large-scale production of mAbs with high precision and consistency.

Advent of recombinant DNA technology and genetic engineering has enabled the creation of novel biologic drugs for cancer treatment. This technology enables the manipulation and modification of genes to produce therapeutic proteins with desired characteristics. For instance, the production of erythropoietin (EPO) using recombinant DNA technology has revolutionized the treatment of anemia associated with cancer and chemotherapy.

Development of targeted therapies is another breakthrough in biotechnology that is driving global cancer biologics market value. These therapies focus on specific molecular targets that play a critical role in cancer growth and progression. These are designed to inhibit the activity of these targets and disrupt the signaling pathways involved in tumor development.

Targeted therapies can be small molecules or biologic drugs, such as tyrosine kinase inhibitors or proteasome inhibitors, which selectively target cancer cells while sparing healthy cells.

Biotechnology has facilitated significant advancements in cancer immunotherapies. Immune checkpoint inhibitors, a form of immunotherapy, block inhibitory signals that cancer cells use to evade the immune system's attack.

This approach has shown remarkable success in treating various types of cancer, including melanoma, lung cancer, and bladder cancer. Biotechnology has enabled the production of these biologic drugs that can restore and enhance the body's immune response against cancer cells.

In terms of drug class, the monoclonal antibodies (mAbs) segment accounted for the largest global cancer biologics market share in 2022. This is ascribed to their unique properties and therapeutic potential.

One of the key reasons for their prominence is the ability to specifically target cancer cells or tumor-associated antigens, while sparing healthy cells. This targeted approach minimizes off-target effects and reduces the risk of systemic toxicity, making mAbs an attractive treatment option.

Monoclonal antibodies continue to be actively researched and developed for novel targets and therapeutic approaches. Emergence of bispecific antibodies, capable of simultaneously binding to two different targets, has gained attention in the past few years. These antibodies can be engineered to engage both cancer cells and immune cells, facilitating the destruction of cancer cells through immune-mediated mechanisms. Bispecific antibodies, such as blinatumomab (Blincyto) for acute lymphoblastic leukemia, represent a promising advancement in cancer treatment.

Advancements in antibody engineering and optimization techniques have enabled the development of next-generation monoclonal antibodies with improved efficacy and reduced immunogenicity. Antibodies with enhanced antibody-dependent cellular cytotoxicity (ADCC) or antibody-dependent cellular phagocytosis (ADCP) properties have shown increased tumor-killing capabilities.

Based on application, the blood cancer segment dominated the global cancer biologics industry in 2022. The segment includes leukemia, lymphoma, and multiple myeloma. Blood cancers are a diverse group of malignancies with distinct molecular and genetic characteristics, making them amenable to targeted therapies.

This has led to the development of numerous biologic drugs that specifically target the underlying mechanisms driving blood cancer growth and proliferation. Prevalence of blood cancer is high globally, and a wide range of biologics are available for treatment.

Ongoing research & development efforts in the field of blood cancer biologics continue to expand treatment options. Clinical trials are exploring novel monoclonal antibodies, antibody-drug conjugates, CAR-T cell therapies, and other biologic approaches to further enhance the effectiveness of treatment.

In terms of end-user, the hospitals segment accounted for the largest market share in 2022. Hospitals have a multidisciplinary approach to cancer care. These settings have a team of healthcare professionals, including medical oncologists, hematologists, radiation oncologists, and specialized nurses, who collaborate to develop comprehensive treatment plans for cancer patients.

This multidisciplinary approach facilitates the integration of cancer biologics into the overall treatment strategy, ensuring proper patient selection, monitoring, and management.

Hospitals often have established partnerships and collaborations with pharmaceutical companies and research institutions. These collaborations enable hospitals to participate in clinical trials and access the latest advancements in cancer biologics. Therefore, they have the advantage of early adoption and integration of new biologic therapies into their treatment protocols.

The ability to provide comprehensive care is another factor driving the hospitals segment. Cancer treatment often involves a combination of therapies, including surgery, radiation therapy, chemotherapy, and biologic therapies. Hospitals can offer all these treatment modalities under one roof, ensuring seamless coordination and continuity of care for patients.

As per cancer biologics market trends, North America emerged as a major market for cancer biologics in 2022. This is ascribed to advanced healthcare infrastructure, strong research & development capabilities, favorable regulatory environment, and high healthcare expenditure in the region.

North America is also home to prominent pharmaceutical companies and biotechnology firms that are at the forefront of cancer research and innovation. These companies have the expertise and resources to invest in the development of biologic drugs and conduct clinical trials to evaluate their safety and efficacy.

The region's strong research & development capabilities contribute to the continuous pipeline of new and improved cancer biologics.

Asia Pacific has witnessed steady rise in cancer cases, attributed to factors such as population growth, aging population, and lifestyle changes. This surge in cancer incidence has increased demand for effective cancer treatments, including biologic drugs.

Improving healthcare infrastructure is another crucial factor driving the cancer biologics market size in Asia Pacific. Countries in the region have been investing significantly in healthcare infrastructure, including the establishment of advanced hospitals, cancer centers, and research institutes. This improved infrastructure enables the development, production, and distribution of biologic drugs for cancer treatment, enhancing patient access to these therapies.

The global cancer biologics market is fragmented, with the presence of large number of players. Companies in the market have adopted strategies such as investment in R&D, product portfolio expansion, and merger & acquisition in order to increase market share and presence.

F. Hoffmann-La Roche Ltd., Amgen, Inc., Pfizer, Inc., GSK plc., Bristol-Myers Squibb Company, Abbott, AstraZeneca, Eli Lilly and Company, Gilead Sciences, Inc., and Johnson & Johnson Services, Inc.

The cancer biologics market report profiles top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 94.5 Bn |

|

Forecast Value in 2031 |

More than US$ 185.0 Bn |

|

CAGR - 2023-2031 |

7.7 % |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 94.5 Bn in 2022

It is projected to reach US$ 185.0 Bn by 2031

The industry is anticipated to expand at a 7.7% from 2023 to 2031

The monoclonal antibody (mAb) segment held the leading share in 2022

North America is expected to account for largest share from 2022 to 2031

F. Hoffmann-La Roche Ltd., Amgen, Inc., Pfizer, Inc., GSK plc, Bristol-Myers Squibb Company, Abbott, AstraZeneca, Eli Lilly and Company, Gilead Sciences, Inc., and Johnson & Johnson Services, Inc. are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cancer Biologics Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cancer Biologics Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Pipeline Analysis

5.2. Overview: Advances in Cancer Diagnostics & Therapeutics

5.3. Cancer Incidence & Prevalence Rate by Region/Key Countries

5.4. Key Product Brand Analysis

5.5. Covid-19 Impact Analysis

6. Global Cancer Biologics Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Class, 2017-2031

6.3.1. Monoclonal Antibodies (mAb)

6.3.1.1. Naked mAb

6.3.1.2. Conjugated mAb

6.3.1.3. Bispecific mAb

6.3.2. Recombinants Proteins

6.3.3. Cancer Growth Inhibitors

6.3.3.1. Tyrosine Kinase Inhibitors

6.3.3.2. mTOR Inhibitors

6.3.3.3. Others (Proteasome Inhibitors)

6.3.4. Vaccines

6.3.4.1. Preventive Vaccines

6.3.4.2. Therapeutic Vaccines

6.3.5. CAR-T Cells

6.3.6. Angiogenesis Inhibitors

6.3.7. Interleukins (IL)

6.3.8. Others (Interferons (IFN), Gene Therapy, etc.)

6.4. Market Attractiveness Analysis, by Drug Class

7. Global Cancer Biologics Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017-2031

7.3.1. Blood Cancer

7.3.2. Lung Cancer

7.3.3. Breast Cancer

7.3.4. Colorectal Cancer

7.3.5. Prostate Cancer

7.3.6. Gastric Cancer

7.3.7. Ovarian Cancer

7.3.8. Others (Skin, Liver cancer, etc.)

7.4. Market Attractiveness Analysis, by Application

8. Global Cancer Biologics Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.2. Cancer Centers

8.3.3. Academics & Research Institutes

8.4. Market Attractiveness Analysis, by End-user

9. Global Cancer Biologics Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Cancer Biologics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Class, 2017-2031

10.2.1. Monoclonal Antibodies (mAb)

10.2.1.1. Naked mAb

10.2.1.2. Conjugated mAb

10.2.1.3. Bispecific mAb

10.2.2. Recombinants Proteins

10.2.3. Cancer Growth Inhibitors

10.2.3.1. Tyrosine Kinase Inhibitors

10.2.3.2. mTOR Inhibitors

10.2.3.3. Others (Proteasome Inhibitors)

10.2.4. Vaccines

10.2.4.1. Preventive Vaccines

10.2.4.2. Therapeutic Vaccines

10.2.5. CAR-T Cells

10.2.6. Angiogenesis Inhibitors

10.2.7. Interleukins (IL)

10.2.8. Others (Interferons (IFN), Gene Therapy, etc.)

10.3. Market Value Forecast, by Application, 2017-2031

10.3.1. Blood Cancer

10.3.2. Lung Cancer

10.3.3. Breast Cancer

10.3.4. Colorectal Cancer

10.3.5. Prostate Cancer

10.3.6. Gastric Cancer

10.3.7. Ovarian Cancer

10.3.8. Others (Skin, Liver cancer, etc.)

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Hospitals

10.4.2. Cancer Centers

10.4.3. Academics& Research Institutes

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Drug Class

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Cancer Biologics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017-2031

11.2.1. Monoclonal Antibodies (mAb)

11.2.1.1. Naked mAb

11.2.1.2. Conjugated mAb

11.2.1.3. Bispecific mAb

11.2.2. Recombinants Proteins

11.2.3. Cancer Growth Inhibitors

11.2.3.1. Tyrosine Kinase Inhibitors

11.2.3.2. mTOR Inhibitors

11.2.3.3. Others (Proteasome Inhibitors)

11.2.4. Vaccines

11.2.4.1. Preventive Vaccines

11.2.4.2. Therapeutic Vaccines

11.2.5. CAR-T Cells

11.2.6. Angiogenesis Inhibitors

11.2.7. Interleukins (IL)

11.2.8. Others (Interferons (IFN), Gene Therapy, etc.)

11.3. Market Value Forecast, by Application, 2017-2031

11.3.1. Blood Cancer

11.3.2. Lung Cancer

11.3.3. Breast Cancer

11.3.4. Colorectal Cancer

11.3.5. Prostate Cancer

11.3.6. Gastric Cancer

11.3.7. Ovarian Cancer

11.3.8. Others (Skin, Liver cancer, etc.)

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Hospitals

11.4.2. Cancer Centers

11.4.3. Academics& Research Institutes

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Drug Class

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Cancer Biologics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017-2031

12.2.1. Monoclonal Antibodies (mAb)

12.2.1.1. Naked mAb

12.2.1.2. Conjugated mAb

12.2.1.3. Bispecific mAb

12.2.2. Recombinants Proteins

12.2.3. Cancer Growth Inhibitors

12.2.3.1. Tyrosine Kinase Inhibitors

12.2.3.2. mTOR Inhibitors

12.2.3.3. Others (Proteasome Inhibitors)

12.2.4. Vaccines

12.2.4.1. Preventive Vaccines

12.2.4.2. Therapeutic Vaccines

12.2.5. CAR-T Cells

12.2.6. Angiogenesis Inhibitors

12.2.7. Interleukins (IL)

12.2.8. Others (Interferons (IFN), Gene Therapy, etc.)

12.3. Market Value Forecast, by Application, 2017-2031

12.3.1. Blood Cancer

12.3.2. Lung Cancer

12.3.3. Breast Cancer

12.3.4. Colorectal Cancer

12.3.5. Prostate Cancer

12.3.6. Gastric Cancer

12.3.7. Ovarian Cancer

12.3.8. Others (Skin, Liver cancer, etc.)

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Hospitals

12.4.2. Cancer Centers

12.4.3. Academics& Research Institutes

12.5. Market Value Forecast, by Country, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Drug Class

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Cancer Biologics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017-2031

13.2.1. Monoclonal Antibodies (mAb)

13.2.1.1. Naked mAb

13.2.1.2. Conjugated mAb

13.2.1.3. Bispecific mAb

13.2.2. Recombinants Proteins

13.2.3. Cancer Growth Inhibitors

13.2.3.1. Tyrosine Kinase Inhibitors

13.2.3.2. mTOR Inhibitors

13.2.3.3. Others (Proteasome Inhibitors)

13.2.4. Vaccines

13.2.4.1. Preventive Vaccines

13.2.4.2. Therapeutic Vaccines

13.2.5. CAR-T Cells

13.2.6. Angiogenesis Inhibitors

13.2.7. Interleukins (IL)

13.2.8. Others (Interferons (IFN), Gene Therapy, etc.)

13.3. Market Value Forecast, by Application, 2017-2031

13.3.1. Blood Cancer

13.3.2. Lung Cancer

13.3.3. Breast Cancer

13.3.4. Colorectal Cancer

13.3.5. Prostate Cancer

13.3.6. Gastric Cancer

13.3.7. Ovarian Cancer

13.3.8. Others (Skin, Liver cancer, etc.)

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Hospitals

13.4.2. Cancer Centers

13.4.3. Academics& Research Institutes

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Drug Class

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Cancer Biologics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Class, 2017-2031

14.2.1. Monoclonal Antibodies (mAb)

14.2.1.1. Naked mAb

14.2.1.2. Conjugated mAb

14.2.1.3. Bispecific mAb

14.2.2. Recombinants Proteins

14.2.3. Cancer Growth Inhibitors

14.2.3.1. Tyrosine Kinase Inhibitors

14.2.3.2. mTOR Inhibitors

14.2.3.3. Others (Proteasome Inhibitors)

14.2.4. Vaccines

14.2.4.1. Preventive Vaccines

14.2.4.2. Therapeutic Vaccines

14.2.5. CAR-T Cells

14.2.6. Angiogenesis Inhibitors

14.2.7. Interleukins (IL)

14.2.8. Others (Interferons (IFN), Gene Therapy, etc.)

14.3. Market Value Forecast, by Application, 2017-2031

14.3.1. Blood Cancer

14.3.2. Lung Cancer

14.3.3. Breast Cancer

14.3.4. Colorectal Cancer

14.3.5. Prostate Cancer

14.3.6. Gastric Cancer

14.3.7. Ovarian Cancer

14.3.8. Others (Skin, Liver cancer, etc.)

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Hospitals

14.4.2. Cancer Centers

14.4.3. Academics& Research Institutes

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Drug Class

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. F. Hoffmann-La Roche Ltd.

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Amgen, Inc.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Pfizer, Inc.

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. GSK plc

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Bristol-Myers Squibb Company

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Abbott

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. AstraZeneca

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Eli Lilly and Company

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Gilead Sciences, Inc.

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Johnson & Johnson Services, Inc.

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

List of Tables

Table 01: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 02: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Monoclonal Antibodies (mAb), 2017-2031

Table 03: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Cancer Growth Inhibitors, 2017-2031

Table 04: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Vaccines, 2017-2031

Table 05: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 06: Global Cancer Biologics Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 07: Global Cancer Biologics Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 08: North America Cancer Biologics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 09: North America Cancer Biologics Market Size (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 10: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Monoclonal Antibodies (mAb), 2017-2031

Table 11: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Cancer Growth Inhibitors, 2017-2031

Table 12: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Vaccines, 2017-2031

Table 13: North America Cancer Biologics Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 14: North America Cancer Biologics Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 15: Europe Cancer Biologics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Europe Cancer Biologics Market Size (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 17: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Monoclonal Antibodies (mAb), 2017-2031

Table 18: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Cancer Growth Inhibitors, 2017-2031

Table 19: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Vaccines, 2017-2031

Table 20: Europe Cancer Biologics Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 21: Europe Cancer Biologics Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 22: Asia Pacific Cancer Biologics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 23: Asia Pacific Cancer Biologics Market Size (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 24: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Monoclonal Antibodies (mAb), 2017-2031

Table 25: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Cancer Growth Inhibitors, 2017-2031

Table 26: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Vaccines, 2017-2031

Table 27: Asia Pacific Cancer Biologics Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 28: Asia Pacific Cancer Biologics Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 29: Latin America Cancer Biologics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 30: Latin America Cancer Biologics Market Size (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 31: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Monoclonal Antibodies (mAb), 2017-2031

Table 32: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Cancer Growth Inhibitors, 2017-2031

Table 33: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Vaccines, 2017-2031

Table 34: Latin America Cancer Biologics Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 35: Latin America Cancer Biologics Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 36: Middle East and Africa Cancer Biologics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 37: Middle East and Africa Cancer Biologics Market Size (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 38: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Monoclonal Antibodies (mAb), 2017-2031

Table 39: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Cancer Growth Inhibitors, 2017-2031

Table 40: Global Cancer Biologics Market Size (US$ Mn) Forecast, by Vaccines, 2017-2031

Table 41: Middle East and Africa Cancer Biologics Market Size (US$ Mn) Forecast, by Application, 2017-2031

Table 42: Middle East and Africa Cancer Biologics Market Size (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Cancer Biologics Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Cancer Biologics Market Value Share, by Drug Class, 2022

Figure 03: Global Cancer Biologics Market Value Share, by Application, 2022

Figure 04: Global Cancer Biologics Market Value Share, by End-user, 2022

Figure 05: Global Cancer Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 06: Global Cancer Biologics Market Revenue (US$ Mn), by Monoclonal Antibodies (mAb), 2017-2031

Figure 07: Global Cancer Biologics Market Revenue (US$ Mn), by Recombinants Proteins, 2017-2031

Figure 08: Global Cancer Biologics Market Revenue (US$ Mn), by Cancer Growth Inhibitors, 2017-2031

Figure 09: Global Cancer Biologics Market Revenue (US$ Mn), by Vaccines, 2017-2031

Figure 10: Global Cancer Biologics Market Revenue (US$ Mn), by CAR-T Cells, 2017-2031

Figure 11: Global Cancer Biologics Market Revenue (US$ Mn), by Angiogenesis Inhibitors, 2017-2031

Figure 12: Global Cancer Biologics Market Revenue (US$ Mn), by Interleukins (IL), 2017-2031

Figure 13: Global Cancer Biologics Market Revenue (US$ Mn), by Others, 2017-2031

Figure 14: Global Cancer Biologics Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 15: Global Cancer Biologics Market Value Share Analysis, by Application, 2022 and 2031

Figure 16: Global Cancer Biologics Market Revenue (US$ Mn), by Blood Cancer, 2017-2031

Figure 17: Global Cancer Biologics Market Revenue (US$ Mn), by Lung Cancer, 2017-2031

Figure 18: Global Cancer Biologics Market Revenue (US$ Mn), by Breast Cancer, 2017-2031

Figure 19: Global Cancer Biologics Market Revenue (US$ Mn), by Colorectal Cancer, 2017-2031

Figure 20: Global Cancer Biologics Market Revenue (US$ Mn), by Prostate Cancer, 2017-2031

Figure 21: Global Cancer Biologics Market Revenue (US$ Mn), by Gastric Cancer, 2017-2031

Figure 22: Global Cancer Biologics Market Revenue (US$ Mn), by Ovarian Cancer, 2017-2031

Figure 23: Global Cancer Biologics Market Revenue (US$ Mn), by Other Cancer, 2017-2031

Figure 24: Global Cancer Biologics Market Attractiveness Analysis, by Application, 2023-2031

Figure 25: Global Cancer Biologics Market Value Share Analysis, by Region, 2022 and 2031

Figure 26: Global Cancer Biologics Market Attractiveness Analysis, by Region, 2023-2031

Figure 27: North America Cancer Biologics Market Value (US$ Mn) Forecast, 2017-2031

Figure 28: North America Cancer Biologics Market Value Share Analysis, by Country, 2022 and 2031

Figure 29: North America Cancer Biologics Market Attractiveness Analysis, by Country, 2023-2031

Figure 30: North America Cancer Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 31: North America Cancer Biologics Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 32: North America Cancer Biologics Market Value Share Analysis, by Application, 2022 and 2031

Figure 33: North America Cancer Biologics Market Attractiveness Analysis, by Application, 2023-2031

Figure 34: North America Cancer Biologics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 35: North America Cancer Biologics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 36: Europe Cancer Biologics Market Value (US$ Mn) Forecast, 2017-2031

Figure 37: Europe Cancer Biologics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 38: Europe Cancer Biologics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 39: Europe Cancer Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 40: Europe Cancer Biologics Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 41: Europe Cancer Biologics Market Value Share Analysis, by Application, 2022 and 2031

Figure 42: Europe Cancer Biologics Market Attractiveness Analysis, by Application, 2023-2031

Figure 43: Europe Cancer Biologics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 44: Europe Cancer Biologics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 45: Asia Pacific Cancer Biologics Market Value (US$ Mn) Forecast, 2017-2031

Figure 46: Asia Pacific Cancer Biologics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 47: Asia Pacific Cancer Biologics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 48: Asia Pacific Cancer Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 49: Asia Pacific Cancer Biologics Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 50: Asia Pacific Cancer Biologics Market Value Share Analysis, by Application, 2022 and 2031

Figure 51: Asia Pacific Cancer Biologics Market Attractiveness Analysis, by Application, 2023-2031

Figure 52: Asia Pacific Cancer Biologics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 53: Asia Pacific Cancer Biologics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 54: Latin America Cancer Biologics Market Value (US$ Mn) Forecast, 2017-2031

Figure 55: Latin America Cancer Biologics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 56: Latin America Cancer Biologics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 57: Latin America Cancer Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 58: Latin America Cancer Biologics Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 59: Latin America Cancer Biologics Market Value Share Analysis, by Application, 2022 and 2031

Figure 60: Latin America Cancer Biologics Market Attractiveness Analysis, by Application, 2023-2031

Figure 61: Latin America Cancer Biologics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 62: Latin America Cancer Biologics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 63: Middle East and Africa Cancer Biologics Market Value (US$ Mn) Forecast, 2017-2031

Figure 64: Middle East and Africa Cancer Biologics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 65: Middle East and Africa Cancer Biologics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 66: Middle East and Africa Cancer Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 67: Middle East and Africa Cancer Biologics Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 68: Middle East and Africa Cancer Biologics Market Value Share Analysis, by Application, 2022 and 2031

Figure 69: Middle East and Africa Cancer Biologics Market Attractiveness Analysis, by Application, 2023-2031

Figure 70: Middle East and Africa Cancer Biologics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 71: Middle East and Africa Cancer Biologics Market Attractiveness Analysis, by End-user, 2023-2031