Reports

Reports

The camel milk market is emerging as a fast-evolving part of global dairy and functional food systems. Growing demand for hypoallergenic and nutrient-rich dairy alternatives is drawing consumer interest, while policy attention highlighted by the UN/FAO’s International Year of Camelids enhances growth. At the same time, early industrialization of camel dairies is enabling safer, standardized production and opening export opportunities, thereby helping shift camel milk from a niche tradition to a formalized sector.

The dairy market is growing due to the integration of rural production into organized value chains incorporating collection centers, processing centers, and powdered milk lines, allowing for less perishable products for export markets. Improvements in processing with access to technology like spray-drying, aseptic packaging, and diversification into yogurt, infant formula base, and cosmetics have expanded consumer demand.

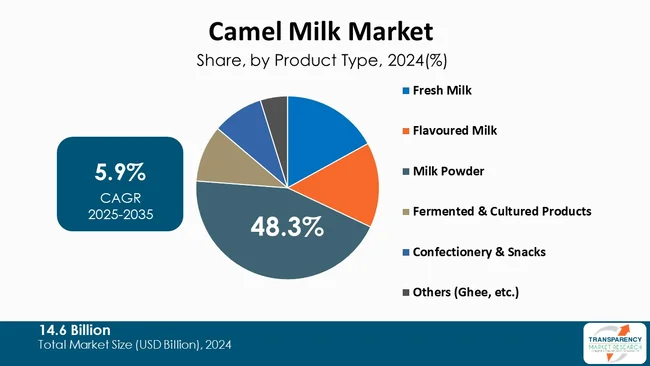

The camel milk market is shifting from niche to more structured growth, marked by premiumization as brands position it as a health-focused specialty product. Demand is evolving along two tracks such as fresh milk for local consumption in pastoral regions, and processed powder or ingredients for export into nutraceuticals and infant nutrition. Institutional procurement is gaining traction, especially in food security programs in arid zones. While climate variability, feed costs, and uneven regulations pose risks, the sector reflects gradual maturation with stronger policy support.

Camel milk, sourced from camels with one, two, or even three humps, is gaining recognition beyond its conventional role in pastoral diets of arid regions. Once valued mainly for cultural and subsistence purposes, it is now moving into commercial value chains where it is processed into fresh milk, powders, fermented beverages, and cosmetic ingredients. Recent initiatives such as the CAMILK 2024 seminar and related FAO programs highlight camel milk as more than just a food. It is instead being positioned as a strategic resource for dryland resilience, food security, and livelihood diversification.

What sets this market apart from conventional dairy is its focus on attributes rather than scale that includes camel milk’s nutritional profile, lower levels of allergens as compared to cow’s milk, and its suitability for production in water-scarce environments. However, commercialization is only at an early stage, and powders and functional products are leading the way as a solution to spoilage and transport issues.

Despite robust policy support and emerging and exciting private-sector innovation, persistent structural barriers remain from the supply side, including scattered supply from pastoral systems, insufficient industrial infrastructure, and incomplete scientific validation. This dual dynamic public support alongside entrepreneurial branding continues to form the path of the emerging camel milk industry.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Camel milk is increasingly being promoted in the nutrition and health area, mostly because it has a different nutritional and bioactive profile. For instance, camel milk is different from cow's milk as it contains less beta-lactoglobulin and a source of allergens for many consumers.

However, from a practical perspective, it has more vitamin C and bioactive peptides that researchers have hypothesized may grant some antibacterial, immunological, and cardio metabolic attributes.

Mainstream media is not only featured its various health benefits, such as hypoallergenic properties and immune-enhancing properties, but have also focused on the increasing amount of research and commercial interest projected and beyond. As reports add to camel milk's legitimacy and visibility, it also draws attention from consumers and institutional buyers.

At the same time, entrepreneurial activity is shaping the industry evolution. Start-ups and specialist dairies are actively investing in new formats such as fermented camel milk, infant formula blends, and immune-support supplements while strategically incorporating scientific claims into their branding.

Sustainable livestock systems that can survive climate fluctuation have commenced to incorporate camels as a sustainable domesticated species, particularly in regions that are regularly experiencing drought and increasing competition for water. Camels can maintain milk productivity under limited water and feed stress conditions, while the same cannot be assumed for the sudden declines in productivity with the same conditions in cattle.

The adaptability of camels is changing the introduction of camels from the traditional, rural, and travelling domesticated species into an economically feasible species that results in nutrient-rich food opportunities for families as well as for commercial development. With climate change leading the way for more frequent droughts in semi-arid areas, both - government and rural communities have begun shifting the scope of livestock policies to favor animal species with adaptation to environmental stresses.

State programs, donor initiatives, and private investors are channeling resources into distributing camels, thereby establishing milk collection hubs and developing processing infrastructure. In countries with severe cattle losses, camels have been stepping into the gap and filling it up, thereby allowing local milk markets to function, thereby increasing attractiveness for further investment in veterinary health, selection breeding, feed enhancement, and so on

For instance, in Kenya, the rural communities that lost cattle to drought swapped to camels with government-supported programs and urban, Nairobi-based demand. This transition demonstrates how climate stress can restructure livestock economies and create new opportunities fastened in the strength of camel milk production.

Milk powder dominates camel milk commercial segments as it resolves three of the market’s central limitations, including perishability, transportability, and scale of offtake. Recent camel milk products like dried camel milk powder need more commercial promotion for consumer use.

Powder offers the added advantage of shelf-stable status for ingredient use and food applications, such as industrial ingredient use or beverage formulations, ultimately increasing overall market demand beyond direct-to-consumer liquid sales. Processors can aggregate raw supply from many smallholders, standardize composition, and create consistent product specifications required by international buyers.

Governance and trade data indicate that powder has become the predominant traded form in several exporting countries, reflecting this operational logic, like powdered camel milk volumes and registered trade rose as processors have invested in drying and packaging plants to reach distant markets. Powder’s ability to be reconstituted, blended into formulations, and included in shelf-stable consumer goods makes it the preferred segment for scaling revenue and enabling cross-border commerce.

For instance, a Codex/FAO-referenced summary of 2024 trade and production reporting noted that camel milk powder was the most produced and internationally traded form, underscoring powder’s central role in directing dispersed rural output into tradable commodity flows.

| Attribute | Detail |

|---|---|

| Leading Region | Middle East & Africa |

Middle East & Africa (MEA) dominates the camel milk market as the region combines historical camel husbandry, large camel population, intense industrial investment, and policy attention. With history of camel pastoralism providing a wealth of animals and information locally, MEA is uniquely positioned regionally and globally.

Socially, MEA has more considerable investment and support for the commercial use of camels and camel products through government and private sector plotting with local culture to generate large dairy operations, collection infrastructure, and branded processors. Therefore, the MEA held the largest revenue share of the global camel-milk products market due to both - domestic consumption and developing export-oriented processing operations.

Policy and institutional drivers have also favored MEA leadership. Global and regional initiatives such as CAMILK activities supported by FAO and the IYCL 2024 have harnessed investment and technical cooperation at a national and regional level to improve hygiene, cold-chain, point-of-sale, and processing standards.

Commercial operators in the Gulf and East Africa have invested in herd development, mechanized milking, and packaging requirements for export markets, and produced higher-value products. Moreover, MEA’s urban demand for premium local brands, plus regional trade linkages, has created a robust growth in the internal market for both - fresh and processed camel products. This combination of biological endowments, policy focus, and private investment explains why MEA continues to lead the sector.

Gujarat Cooperative Milk Marketing Federation Limited (Amul), Camel Dairy Smits (Oasismilk), Camelicious, Camelot Camel Dairy, LLC, Desert Farms, Inc., Aadvik Foods & Products Pvt. Ltd, The Camel Milk Co. Australia Pty Ltd, Al Ain Farms, Tiviski Pvt Ltd., Camel Culture, QCamel, Juba farms, Camel Charisma Pvt. Ltd, Colorado Camel Milk, Sawani (NOUG) are some of the leading manufacturers operating in the global camel milk market.

Each of these companies has been profiled in the camel milk market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

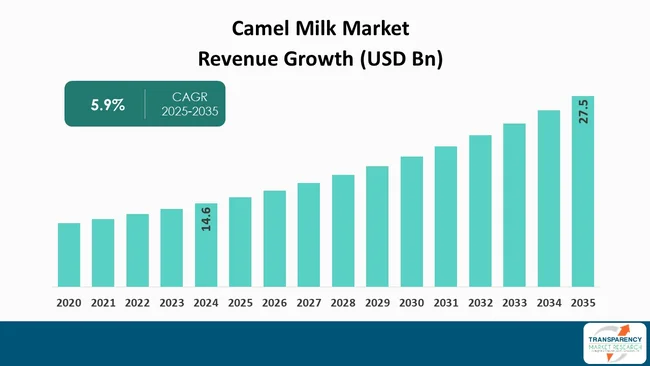

| Market Size Value in 2024 (Base Year) | US$ 14.6 Bn |

| Market Forecast Value in 2035 | US$ 27.5 Bn |

| Growth Rate (CAGR 2025 to 2035) | 5.9 % |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2024 |

| Quantitative Units | US$ Bn for Value and Thousand Tons for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player – Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global camel milk market was valued at US$ 14.6 Bn in 2024

The global camel milk industry is projected to reach at US$ 27.5 Bn by the end of 2035

Camel milk emerges as premium health food with functional attributes and rising preference for camel dairy in water-stressed regions, are some of the factors driving the expansion of camel milk market.

The CAGR is anticipated to be 5.9 % from 2025 to 2035

Gujarat Cooperative Milk Marketing Federation Limited (Amul), Camel Dairy Smits (Oasismilk), Camelicious, Camelot Camel Dairy, LLC, Desert Farms, Inc., Aadvik Foods & Products Pvt. Ltd, The Camel Milk Co. Australia Pty Ltd, Al Ain Farms, Tiviski Pvt Ltd., Camel Culture, QCamel, Juba farms, Camel Charisma Pvt. Ltd, Colorado Camel Milk, and Sawani (NOUG)

List of Tables

Table 1: Global Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 2: Global Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 3: Global Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 4: Global Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 5: Global Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Region

Table 6: Global Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Region

Table 7: North America Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 8: North America Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 9: North America Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 10: North America Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 11: North America Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 12: North America Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Country

Table 13: U.S. Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 14: U.S. Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 15: U.S. Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 16: U.S. Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 17: Canada Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 18: Canada Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 19: Canada Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 20: Canada Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 21: Europe Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 22: Europe Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 23: Europe Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 24: Europe Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 25: Europe Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 26: Europe Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Country

Table 27: U.K. Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 28: U.K. Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 29: U.K. Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 30: U.K. Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 31: Germany Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 32: Germany Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 33: Germany Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 34: Germany Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 35: France Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 36: France Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 37: France Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 38: France Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 39: Italy Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 40: Italy Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 41: Italy Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 42: Italy Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 43: Spain Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 44: Spain Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 45: Spain Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 46: Spain Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 47: The Netherlands Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 48: The Netherlands Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 49: The Netherlands Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 50: The Netherlands Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 51: Asia Pacific Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 52: Asia Pacific Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 53: Asia Pacific Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 54: Asia Pacific Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 55: Asia Pacific Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 56: Asia Pacific Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Country

Table 57: China Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 58: China Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 59: China Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 60: China Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 61: India Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 62: India Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 63: India Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 64: India Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 65: Japan Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 66: Japan Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 67: Japan Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 68: Japan Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 69: Australia Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 70: Australia Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 71: Australia Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 72: Australia Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 73: South Korea Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 74: South Korea Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 75: South Korea Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 76: South Korea Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 77: ASEAN Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 78: ASEAN Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 79: ASEAN Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 80: ASEAN Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 81: Middle East & Africa Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 82: Middle East & Africa Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 83: Middle East & Africa Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 84: Middle East & Africa Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 85: Middle East & Africa Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 86: Middle East & Africa Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Country

Table 87: GCC Countries Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 88: GCC Countries Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 89: GCC Countries Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 90: GCC Countries Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 91: South Africa Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 92: South Africa Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 93: South Africa Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 94: South Africa Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 95: Latin America Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 96: Latin America Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 97: Latin America Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 98: Latin America Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 99: Latin America Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 100: Latin America Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Country

Table 101: Brazil Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 102: Brazil Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 103: Brazil Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 104: Brazil Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 105: Argentina Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 106: Argentina Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 107: Argentina Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 108: Argentina Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Table 109: Mexico Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Product Type

Table 110: Mexico Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Product Type

Table 111: Mexico Camel Milk Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 112: Mexico Camel Milk Market Volume (Thousand Tons) Projection, 2020 to 2035 By Distribution Channel

Figure 1: Global Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 2: Global Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 3: Global Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 4: Global Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 5: Global Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 6: Global Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 7: Global Camel Milk Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 8: Global Camel Milk Market Volume (Thousand Tons) Projection, By Region 2020 to 2035

Figure 9: Global Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 10: North America Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 11: North America Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 12: North America Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 13: North America Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 14: North America Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 15: North America Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 16: North America Camel Milk Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 17: North America Camel Milk Market Volume (Thousand Tons) Projection, By Country 2020 to 2035

Figure 18: North America Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 19: U.S. Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 20: U.S. Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 21: U.S. Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 22: U.S. Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 23: U.S. Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 24: U.S. Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 25: Canada Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 26: Canada Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 27: Canada Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 28: Canada Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 29: Canada Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 30: Canada Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 31: Europe Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 32: Europe Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 33: Europe Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 34: Europe Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 35: Europe Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 36: Europe Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 37: Europe Camel Milk Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 38: Europe Camel Milk Market Volume (Thousand Tons) Projection, By Country 2020 to 2035

Figure 39: Europe Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 40: U.K. Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 41: U.K. Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 42: U.K. Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 43: U.K. Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 44: U.K. Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 45: U.K. Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 46: Germany Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 47: Germany Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 48: Germany Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 49: Germany Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 50: Germany Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 51: Germany Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 52: France Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 53: France Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 54: France Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 55: France Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 56: France Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 57: France Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 58: Italy Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 59: Italy Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 60: Italy Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 61: Italy Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 62: Italy Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 63: Italy Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 64: Spain Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 65: Spain Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 66: Spain Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 67: Spain Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 68: Spain Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 69: Spain Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 70: The Netherlands Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 71: The Netherlands Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 72: The Netherlands Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 73: The Netherlands Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 74: The Netherlands Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 75: The Netherlands Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 76: Asia Pacific Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 77: Asia Pacific Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 78: Asia Pacific Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 79: Asia Pacific Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 80: Asia Pacific Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 81: Asia Pacific Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Asia Pacific Camel Milk Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 83: Asia Pacific Camel Milk Market Volume (Thousand Tons) Projection, By Country 2020 to 2035

Figure 84: Asia Pacific Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 85: China Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 86: China Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 87: China Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 88: China Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 89: China Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 90: China Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 91: India Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 92: India Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 93: India Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 94: India Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 95: India Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 96: India Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 97: Japan Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 98: Japan Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 99: Japan Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 100: Japan Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 101: Japan Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 102: Japan Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 103: Australia Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 104: Australia Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 105: Australia Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 106: Australia Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 107: Australia Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 108: Australia Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 109: South Korea Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 110: South Korea Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 111: South Korea Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 112: South Korea Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 113: South Korea Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 114: South Korea Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 115: ASEAN Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 116: ASEAN Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 117: ASEAN Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 118: ASEAN Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 119: ASEAN Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 120: ASEAN Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 121: Middle East & Africa Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 122: Middle East & Africa Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 123: Middle East & Africa Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 124: Middle East & Africa Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 125: Middle East & Africa Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 126: Middle East & Africa Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 127: Middle East & Africa Camel Milk Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 128: Middle East & Africa Camel Milk Market Volume (Thousand Tons) Projection, By Country 2020 to 2035

Figure 129: Middle East & Africa Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 130: GCC Countries Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 131: GCC Countries Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 132: GCC Countries Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 133: GCC Countries Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 134: GCC Countries Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 135: GCC Countries Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 136: South Africa Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 137: South Africa Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 138: South Africa Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 139: South Africa Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 140: South Africa Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 141: South Africa Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 142: Latin America Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 143: Latin America Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 144: Latin America Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 145: Latin America Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 146: Latin America Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 147: Latin America Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 148: Latin America Camel Milk Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 149: Latin America Camel Milk Market Volume (Thousand Tons) Projection, By Country 2020 to 2035

Figure 150: Latin America Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 151: Brazil Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 152: Brazil Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 153: Brazil Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 154: Brazil Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 155: Brazil Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 156: Brazil Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 157: Argentina Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 158: Argentina Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 159: Argentina Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 160: Argentina Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 161: Argentina Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 162: Argentina Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 163: Mexico Camel Milk Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 164: Mexico Camel Milk Market Volume (Thousand Tons) Projection, By Product Type 2020 to 2035

Figure 165: Mexico Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 166: Mexico Camel Milk Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 167: Mexico Camel Milk Market Volume (Thousand Tons) Projection, By Distribution Channel 2020 to 2035

Figure 168: Mexico Camel Milk Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035