Reports

Reports

Analysts’ Viewpoint on Market Scenario

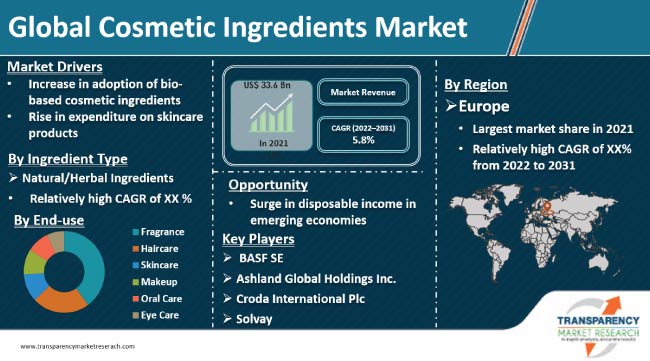

Demand for products containing natural ingredients is expected to augment the global cosmetic ingredients market development from 2022 to 2031. Cosmetics products are witnessing high demand due to the improvement in standard of living of the people and growth in expenditure on personal care products.

Females are the primary consumers of body care and makeup products. Chemical-free products are gaining traction among the populace, as these products are less likely to cause allergic reactions. Cosmetic ingredients manufacturers are adopting bio-based cosmetic ingredients to cater to the surge in demand for natural personal care products. They are also developing sustainable beauty care products to lower their carbon emissions.

Cosmetic ingredients are substances used in the manufacture of cosmetic products such as skincare, makeup, personal care, and fragrance products. Some of the common cosmetic ingredients are water, emulsifiers, preservatives, fragrances, colorants, surfactants, sunscreen agents, moisturizing agents, vitamins, antioxidants, and exfoliants.

Water is a key ingredient in many cosmetic products. It acts as a solvent to help dissolve other ingredients and keep products from drying out. Emulsifiers are oil and water-based ingredients that help in creating a smooth and stable formula. Preservatives are employed to prevent the growth of bacteria, mold, and yeast in cosmetic products. They help keep cosmetic products fresh and safe for usage.

Majority of conventional skincare cosmetic formulations used today contain harmful, non-biodegradable ingredients derived from petroleum or mineral oils. However, most of the cosmetic companies are switching their focus from petroleum-based ingredients to bio-based ingredients. This is enabling companies to achieve a circular economy, meet consumer demand for natural cosmetics, and address environmental concerns.

Surge in demand for sustainable, natural, and greener cosmetics is projected to spur cosmetic ingredients market growth in the near future. Biocosmetics are cosmetic products derived from 100% natural ingredients made from plant extracts, essential oils, and minerals.

Biocosmetics aim to create products that are safe, environmentally friendly, and effective. They often exclude harmful chemicals, such as parabens, sulfates, and synthetic fragrances, and are cruelty-free. Biocosmetics can range from skincare to makeup products and are marketed as healthier and more sustainable alternatives to traditional cosmetic products.

The shift toward exceptionally effective and sustainable cosmetics is driven by the increase in awareness about sustainability and the advantages of bio-based cosmetic ingredients among the people. This has prompted most companies in the industry to opt for environmentally-friendly manufacturing methods that cut down on waste and harmful emissions.

Several businesses are focusing on reducing their CO2 emissions with the utilization of sustainable materials in products and packaging. In 2022, BASF became the first chemical company to offer Rainforest Alliance-certified personal care ingredients. Such initiatives are likely to augment the cosmetic ingredients market size in the next few years.

Surge in disposable income and growth in focus on esthetic appeal have led to an increase in expenditure on personal care products. Functional cosmetic products are gaining traction among the populace due to the rise in geriatric population. Novel anti-aging products address skin-related issues such as wrinkles, dark spots, stress aging, loss of firmness, and redness of the skin.

Skincare specialists and health experts are increasingly recommending functional cosmetics. This has led to an increase in usage of functional cosmetics among various age groups such as 25-40 years and 40-50 years. These factors are estimated to augment market progress in the near future.

Europe accounted for prominent market share of 39.4% in 2021. The region is anticipated to dominate the industry during the forecast period. Surge in expenditure on personal care products and rise in geriatric population are likely to fuel market statistics in the region in the near future.

Asia Pacific held 26.0% share in 2021. Growth in awareness about cosmetic products and increase in focus on esthetic appeal are driving the cosmetic ingredients market revenue of the region. China and India are expected to be the fastest-growing markets in Asia Pacific during the forecast period.

North America is a key market for cosmetic ingredients. The region held 23.0% share in 2021. It is witnessing a paradigm shift toward bio-based ingredients. On the other hand, Middle East & Africa and Latin America are relatively minor markets for cosmetic ingredients.

The cosmetic ingredients market research report concludes with the company profiles section that includes key information such as company overview, financial overview, strategies, portfolio, segments, and recent developments. Ashland Global Holdings Inc., BASF SE, Berkshire Hathaway Inc., Clariant, Croda International Plc, Dow Inc., Evonik Industries, J.M. Huber Corporation, KCC Corporation, and Solvay are key players operating in the industry.

Most of the firms are focusing on adopting various organic and inorganic strategies to increase their cosmetic ingredients market share. For instance, Merck KGaA introduced two new cosmetic ingredients - Rona Care Baobab and Rona Care Hibiscus - in February 2022. These products are developed from nutrient-rich superfoods - the baobab fruit and the hibiscus flower.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 33.6 Bn |

|

Market Forecast Value in 2031 |

US$ 58.8 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value and Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, drivers, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 33.6 Bn in 2021.

It is anticipated to grow at a CAGR of 5.8% from 2022 to 2031.

Increase in adoption of bio-based cosmetic ingredients and rise in expenditure on skin care.

Based on ingredient type, natural/herbal ingredients was the largest segment in 2021.

Europe was the most lucrative region that held 39.4% share in 2021.

Ashland Global Holdings Inc., BASF SE, Berkshire Hathaway Inc., Clariant, Croda International Plc, Dow Inc., Evonik Industries, J.M. Huber Corporation, KCC Corporation, and Solvay.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Cosmetic Ingredients Market Analysis and Forecast, 2022-2031

2.6.1. Global Cosmetic Ingredients Market Revenue (Kilo Tons)

2.6.2. Global Cosmetic Ingredients Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Cosmetic Ingredients

3.2. Impact on Demand for Cosmetic Ingredients – Pre & Post Crisis

4. Production Output Analysis, 2021

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast, 2022-2031

6.1. Price Trend Analysis by Ingredient Type

6.2. Price Trend Analysis by Region

7. Cosmetic Ingredients Market Analysis and Forecast, by Ingredient Type, 2022–2031

7.1. Introduction and Definitions

7.2. Global Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

7.2.1. Synthetic Chemical Ingredients

7.2.2. Natural/Herbal Ingredients

7.2.3. Specialty Ingredients

7.2.4. Others

7.3. Global Cosmetic Ingredients Market Attractiveness, by Ingredient Type

8. Global Cosmetic Ingredients Market Analysis and Forecast, End-use, 2022–2031

8.1. Introduction and Definitions

8.2. Global Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

8.2.1. Fragrance

8.2.2. Haircare

8.2.3. Skincare

8.2.4. Makeup

8.2.5. Oral Care

8.2.6. Eye Care

8.3. Cosmetic Ingredients Market Attractiveness, by End-use

9. Global Cosmetic Ingredients Market Analysis and Forecast, by Region, 2022–2031

9.1. Key Findings

9.2. Global Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2022–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Cosmetic Ingredients Market Attractiveness, by Region

10. North America Cosmetic Ingredients Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. North America Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

10.3. North America Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

10.4. North America Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2022–2031

10.4.1. U.S. Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

10.4.2. U.S. Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

10.4.3. Canada Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

10.4.4. Canada Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

10.5. North America Cosmetic Ingredients Market Attractiveness Analysis

11. Europe Cosmetic Ingredients Market Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Europe Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

11.3. Europe Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

11.4. Europe Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

11.4.1. Germany Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

11.4.2. Germany Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.4.3. France Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

11.4.4. France Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.4.5. U.K. Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

11.4.6. U.K. Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.4.7. Italy Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

11.4.8. Italy Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.4.9. Russia & CIS Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

11.4.10. Russia & CIS Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.4.11. Rest of Europe Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

11.4.12. Rest of Europe Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

11.5. Europe Cosmetic Ingredients Market Attractiveness Analysis

12. Asia Pacific Cosmetic Ingredients Market Analysis and Forecast, 2022–2031

12.1. Key Findings

12.2. Asia Pacific Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type

12.3. Asia Pacific Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

12.4. Asia Pacific Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

12.4.1. China Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

12.4.2. China Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

12.4.3. Japan Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

12.4.4. Japan Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

12.4.5. India Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

12.4.6. India Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

12.4.7. ASEAN Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

12.4.8. ASEAN Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

12.4.9. Rest of Asia Pacific Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

12.4.10. Rest of Asia Pacific Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

12.5. Asia Pacific Cosmetic Ingredients Market Attractiveness Analysis

13. Latin America Cosmetic Ingredients Market Analysis and Forecast, 2022–2031

13.1. Key Findings

13.2. Latin America Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

13.3. Latin America Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

13.4. Latin America Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

13.4.1. Brazil Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

13.4.2. Brazil Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

13.4.3. Mexico Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

13.4.4. Mexico Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

13.4.5. Rest of Latin America Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

13.4.6. Rest of Latin America Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

13.5. Latin America Cosmetic Ingredients Market Attractiveness Analysis

14. Middle East & Africa Cosmetic Ingredients Market Analysis and Forecast, 2022–2031

14.1. Key Findings

14.2. Middle East & Africa Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

14.3. Middle East & Africa Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2022–2031

14.4. Middle East & Africa Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

14.4.1. GCC Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

14.4.2. GCC Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

14.4.3. South Africa Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

14.4.4. South Africa Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

14.4.5. Rest of Middle East & Africa Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

14.4.6. Rest of Middle East & Africa Cosmetic Ingredients Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, End-use, 2022–2031

14.5. Middle East & Africa Cosmetic Ingredients Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Cosmetic Ingredients Company Market Share Analysis, 2021

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Ashland Global Holdings Inc.

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.2. BASF SE

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.3. Berkshire Hathaway Inc.

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.4. Croda International Plc

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.5. Clariant

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.6. Dow Inc.

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.7. Evonik Industries

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.8. J.M. Huber Corporation

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.9. KCC Corporation

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.10. Solvay

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15.2.11. Others

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 2: Global Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 3: Global Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 4: Global Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 5: Global Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Region, 2022–2031

Table 6: Global Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 7: North America Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 8: North America Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 9: North America Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 10: North America Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 11: North America Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Country, 2022–2031

Table 12: North America Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 13: U.S. Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 14: U.S. Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 15: U.S. Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 16: U.S. Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use, 2022–2031

Table 17: Canada Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 18: Canada Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 19: Canada Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 20: Canada Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 21: Europe Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 22: Europe Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 23: Europe Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 24: Europe Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 25: Europe Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 26: Europe Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 27: Germany Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 28: Germany Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 29: Germany Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 30: Germany Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 31: France Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 32: France Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 33: France Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 34: France Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 35: U.K. Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 36: U.K. Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 37: U.K. Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 38: U.K. Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 39: Italy Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 40: Italy Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 41: Italy Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 42: Italy Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 43: Spain Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 44: Spain Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 45: Spain Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 46: Spain Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 47: Russia & CIS Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 48: Russia & CIS Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 49: Russia & CIS Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 50: Russia & CIS Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 51: Rest of Europe Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 52: Rest of Europe Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 53: Rest of Europe Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 54: Rest of Europe Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 55: Asia Pacific Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 56: Asia Pacific Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 57: Asia Pacific Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 58: Asia Pacific Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 59: Asia Pacific Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 60: Asia Pacific Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 61: China Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 62: China Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type 2022–2031

Table 63: China Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 64: China Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 65: Japan Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 66: Japan Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 67: Japan Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 68: Japan Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 69: India Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 70: India Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 71: India Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 72: India Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 73: ASEAN Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 74: ASEAN Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 75: ASEAN Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 76: ASEAN Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 77: Rest of Asia Pacific Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 78: Rest of Asia Pacific Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 79: Rest of Asia Pacific Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 80: Rest of Asia Pacific Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 81: Latin America Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 82: Latin America Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 83: Latin America Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 84: Latin America Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 85: Latin America Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 86: Latin America Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 87: Brazil Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 88: Brazil Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 89: Brazil Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 90: Brazil Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 91: Mexico Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 92: Mexico Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 93: Mexico Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 94: Mexico Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 95: Rest of Latin America Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 96: Rest of Latin America Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 97: Rest of Latin America Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 98: Rest of Latin America Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 99: Middle East & Africa Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 100: Middle East & Africa Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 101: Middle East & Africa Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 102: Middle East & Africa Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 103: Middle East & Africa Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022–2031

Table 104: Middle East & Africa Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 105: GCC Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 106: GCC Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 107: GCC Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 108: GCC Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 109: South Africa Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 110: South Africa Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 111: South Africa Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 112: South Africa Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

Table 113: Rest of Middle East & Africa Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by Ingredient Type, 2022–2031

Table 114: Rest of Middle East & Africa Cosmetic Ingredients Market Value (US$ Mn) Forecast, by Ingredient Type, 2022–2031

Table 115: Rest of Middle East & Africa Cosmetic Ingredients Market Volume (Kilo Tons) Forecast, by End-use, 2022–2031

Table 116: Rest of Middle East & Africa Cosmetic Ingredients Market Value (US$ Mn) Forecast, by End-use 2022–2031

List of Figures

Figure 1: Global Cosmetic Ingredients Market Volume Share Analysis, by Ingredient Type, 2021, 2027, and 2031

Figure 2: Global Cosmetic Ingredients Market Attractiveness, by Ingredient Type

Figure 3: Global Cosmetic Ingredients Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 4: Global Cosmetic Ingredients Market Attractiveness, by End-use

Figure 5: Global Cosmetic Ingredients Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 6: Global Cosmetic Ingredients Market Attractiveness, by Region

Figure 7: North America Cosmetic Ingredients Market Volume Share Analysis, by Ingredient Type, 2021, 2027, and 2031

Figure 8: North America Cosmetic Ingredients Market Attractiveness, by Ingredient Type

Figure 9: North America Cosmetic Ingredients Market Attractiveness, by Ingredient Type

Figure 10: North America Cosmetic Ingredients Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 11: North America Cosmetic Ingredients Market Attractiveness, by End-use

Figure 12: North America Cosmetic Ingredients Market Attractiveness, by Country and Sub-region

Figure 13: Europe Cosmetic Ingredients Market Volume Share Analysis, by Ingredient Type, 2021, 2027, and 2031

Figure 14: Europe Cosmetic Ingredients Market Attractiveness, by Ingredient Type

Figure 15: Europe Cosmetic Ingredients Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 16: Europe Cosmetic Ingredients Market Attractiveness, by End-use

Figure 17: Europe Cosmetic Ingredients Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 18: Europe Cosmetic Ingredients Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Cosmetic Ingredients Market Volume Share Analysis, by Ingredient Type, 2021, 2027, and 2031

Figure 20: Asia Pacific Cosmetic Ingredients Market Attractiveness, by Ingredient Type

Figure 21: Asia Pacific Cosmetic Ingredients Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 22: Asia Pacific Cosmetic Ingredients Market Attractiveness, by End-use

Figure 23: Asia Pacific Cosmetic Ingredients Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 24: Asia Pacific Cosmetic Ingredients Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Cosmetic Ingredients Market Volume Share Analysis, by Ingredient Type, 2021, 2027, and 2031

Figure 26: Latin America Cosmetic Ingredients Market Attractiveness, by Ingredient Type

Figure 27: Latin America Cosmetic Ingredients Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 28: Latin America Cosmetic Ingredients Market Attractiveness, by End-use

Figure 29: Latin America Cosmetic Ingredients Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 30: Latin America Cosmetic Ingredients Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Cosmetic Ingredients Market Volume Share Analysis, by Ingredient Type, 2021, 2027, and 2031

Figure 32: Middle East & Africa Cosmetic Ingredients Market Attractiveness, by Ingredient Type

Figure 33: Middle East & Africa Cosmetic Ingredients Market Volume Share Analysis, by End-use, 2021, 2027, and 2031

Figure 34: Middle East & Africa Cosmetic Ingredients Market Attractiveness, by End-use

Figure 35: Middle East & Africa Cosmetic Ingredients Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 36: Middle East & Africa Cosmetic Ingredients Market Attractiveness, by Country and Sub-region