Reports

Reports

Analysts’ Viewpoint

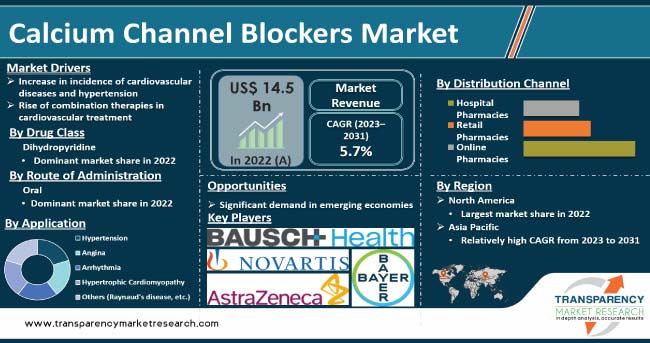

Increase in prevalence of cardiovascular diseases, surge in geriatric population, and rise in availability of combination therapies are driving the global calcium channel blockers market. Development of newer formulations and increase in healthcare expenditure are expected to bolster market growth. Furthermore, rise in awareness among healthcare professionals and patients about the benefits of calcium channel blockers (CCBs) are propelling global calcium channel blockers market size.

Increase in adoption of combination therapies and development of newer formulations of CCBs with improved pharmacokinetic properties and fewer side effects offer lucrative opportunities to market players. Companies are focusing on development of customized CCBs that can be tailored to individual patients' needs. Rise of telemedicine and remote patient monitoring is expected to increase access to CCBs and improve patient outcomes.

However, availability of alternative treatment options, such as ACE inhibitors and beta-blockers, is likely to hamper market growth in the next few years.

Calcium channel blockers (CCBs) are a class of drugs used to treat various medical conditions, particularly cardiovascular diseases such as hypertension (high blood pressure) and angina (chest pain). These drugs work by blocking the entry of calcium ions into the smooth muscle cells of blood vessels, which causes the vessels to relax and dilate. This reduces blood pressure and improves blood flow, which can help to prevent heart attacks, strokes, and other serious medical events.

Calcium channels are protein pores that allow the entry of calcium ions into cells. In the cardiovascular system, calcium channels are located in the smooth muscle cells that surround blood vessels and in the heart muscle cells. When calcium ions enter these cells, they trigger muscle contraction, which could lead to increased blood pressure and reduced blood flow.

CCBs work by selectively blocking the entry of calcium ions into the smooth muscle cells of blood vessels, which causes the vessels to relax and dilate. This reduces blood pressure and improves blood flow, which can help to prevent heart attack, stroke, and other serious medical events. CCBs also have other effects on the cardiovascular system, such as reducing heart rate and improving the oxygen supply to the heart.

Rise in prevalence of cardiovascular diseases and increase in demand for safe and effective treatment options are projected to bolster global calcium channel blockers market demand. However, emergence of alternative treatment options and increase in availability of generic drugs are likely to hamper market growth in the near future.

Cardiovascular diseases (CVDs) and hypertension are among the leading causes of mortality across the world, accounting for an estimated 17.9 million deaths per year, according to the World Health Organization.

Incidence of these diseases is expected to rise, as the global population ages and lifestyle factors such as poor diet, sedentary lifestyles, and stress increase. Surge in incidence of CVDs and hypertension is a major driver of the global calcium channel blockers market development.

According to the World Health Organization, hypertension affects about 1.13 billion people globally, and the number is expected to increase to 1.56 billion by 2025. Hypertension is a major risk factor for heart disease, stroke, and other complications, and calcium channel blockers drugs are among the most commonly prescribed medications for hypertension.

According to the American Heart Association, nearly 108 million adults in the U.S. have hypertension, which is approximately 45% of the population. Hypertension is also a leading cause of heart attacks, strokes, and heart failure. Similarly, the European Society of Cardiology estimates that CVDs account for 45% of all deaths in Europe, with hypertension being a major risk factor for CVDs.

The situation is similar in emerging economies such as India and China, where the incidence of hypertension and CVDs is rising rapidly. According to a report by the Indian Council of Medical Research, the prevalence of hypertension in India has increased from 20% in 2010 to 25% in 2020, affecting approximately 260 million people.

The Chinese Hypertension Control Alliance estimates that over 300 million people in China suffer from hypertension. Consequently, demand for CCB drugs is increasing in these countries, which is driving the calcium channel blockers industry in the country.

The shift toward combination therapies is one of the primary factors driving the global calcium channel blockers market value. Combination therapy involves the use of two or more drugs to treat a specific disease or condition.

Combination therapy is used in cardiovascular diseases to achieve better control of blood pressure, reduce the risk of adverse events, and improve patient outcomes. CCBs are often combined with other drugs, such as beta-blockers, diuretics, and ACE inhibitors, to treat various cardiovascular conditions, such as hypertension and angina.

Usage of combination therapies in cardiovascular diseases has been shown to be effective in several clinical trials. For example, the ACCOMPLISH trial found that a combination of the CCB amlodipine and the ACE inhibitor benazepril was more effective in reducing cardiovascular events than either drug alone.

The ALLHAT trial found that a combination of the CCB amlodipine and the ACE inhibitor lisinopril was more effective in reducing the risk of heart failure than the diuretic chlorthalidone.

Surge in usage of combination therapies is ascribed to the need to achieve better control of blood pressure, reduce the risk of adverse events, and improve patient outcomes. As more clinicians and patients become aware of the benefits of combination therapy, the demand for CCBs is expected to rise.

The calcium channel blockers market is expected to experience steady growth as more combination therapies are developed and used to treat cardiovascular diseases.

Adoption of generic drugs is a significant factor driving the calcium channel blockers industry growth. Generic drugs are cheaper alternatives to branded drugs and are bioequivalent to the original drug. The lower cost of generic drugs has made them more accessible to patients, leading to increased adoption. In the case of CCBs, generic drugs are available in various formulations, such as amlodipine, nifedipine, and diltiazem, among others.

Adoption of generic drugs has been driven by cost savings, increased accessibility, and government initiatives. Governments of several countries have implemented policies to promote the use of generic drugs, such as subsidies, pricing regulations, and incentives for physicians to prescribe generic drugs.

Adoption of generic drugs has also been driven by expiration of patents for branded drugs. When the patent for a branded drug expires, other manufacturers can produce generic versions of the drug, leading to increased competition and lower prices. In the case of CCBs, many of the patents for branded drugs have already expired or are set to expire soon, leading to increased availability of generic drugs.

Adoption of generic drugs is expected to drive the global market in the next few years. Increase in availability and adoption of generic CCBs would lead to increased market competition, lower prices, and increased access for patients. As more patients and healthcare providers switch to generic CCBs, demand for these drugs is expected to increase.

In terms of application, the hypertension segment accounted for the largest share of the global calcium channel blockers market in 2022. Hypertension, or high blood pressure, is a widespread medical condition affecting a significant portion of the global population.

According to the World Health Organization (WHO), hypertension is estimated to affect around 1.13 billion people globally. High prevalence of hypertension creates a large patient population in need of treatment, leading to a dominant market segment for calcium channel blockers.

Calcium channel blockers are often recommended as first-line treatment or as part of combination therapy for hypertension. Their efficacy in controlling blood pressure levels makes them a popular choice among healthcare professionals and patients.

Based on distribution channel, the online pharmacies segment dominated the global market in 2022. Convenience, accessibility, cost-effectiveness, regulatory advancements, and the impact of the COVID-19 pandemic collectively contribute to the growth of the segment.

Rise of e-commerce and digital platforms has enabled patients to conveniently order their prescribed medications from the comfort of their homes. The ease of browsing through medication options, comparing prices, and placing orders on online platforms enhances the appeal of purchasing calcium channel blockers online.

Cost is a critical factor in healthcare decisions. Attractive pricing strategy adopted by online pharmacies drives consumers toward purchasing calcium channel blockers online.

North America dominated the global market in 2022. This is ascribed to aging population, advanced healthcare systems, leading pharmaceutical companies, and favorable regulatory environment. These factors have resulted in a large and growing market for CCBs in the region.

North America has a large population of elderly people who are more prone to conditions such as hypertension and angina, which are treated using CCBs. Prevalence of hypertension in the region is expected to increase significantly in the next few years due to changing lifestyles and rise in obesity rates, which is likely to drive demand for these medications.

North America has a well-established healthcare system that is equipped with advanced medical technologies and treatment methods. This has allowed healthcare providers to diagnose and treat conditions more effectively, including prescribing CCBs where necessary.

Favorable regulatory environment in North America encourages innovation and ensures the safety and efficacy of medications. This has attracted pharmaceutical companies to invest in the region, leading to a range of CCB options for healthcare providers and patients.

The calcium channel blockers market in Asia Pacific is expected to grow at a faster pace in the next few years. Large population, increase in healthcare expenditure, rise in prevalence of hypertension, aging population, focus on chronic disease management, and technological advancements contribute to the region's rapid market growth.

This report provides profiles of leading players operating in the global calcium channel blockers market. These include Pfizer, Inc., Teva Pharmaceutical Industries Ltd., Bausch Health Company Inc., Novartis AG, AstraZeneca, Merck & Co. Inc., GSK plc, Bayer AG, Sun Pharmaceutical Industries Ltd., and Daiichi Sankyo Company, Limited.

These players engage in mergers & acquisitions, strategic collaborations, and new product launches to expand their presence and gain global calcium channel blockers market share.

The calcium channel blockers industry research report profiles the top players based on various factors including a company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 14.5 Bn |

|

Forecast (Value) in 2031 |

More than US$ 24.0 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 14.5 Bn in 2022

It is projected to reach more than US$ 24.0 Bn by 2031

The CAGR is anticipated to be 5.7% from 2023 to 2031

The dihydropyridine segment accounted for the largest share in 2022

North America is expected to account for leading share during the forecast period.

Pfizer, Inc., Teva Pharmaceutical Industries Ltd., Bausch Health Company, Inc., Novartis AG, AstraZeneca, Merck & Co. Inc., GSK plc, Bayer AG, Sun Pharmaceutical Industries Ltd., and Daiichi Sankyo Company, Limited. are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Calcium Channel Blockers Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Calcium Channel Blockers Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Disease Prevalence & Incidence Rate globally with key countries

5.2. Key product/brand Analysis

5.3. Pipeline Analysis

5.4. COVID-19 Pandemic Impact on Industry

6. Global Calcium Channel Blockers Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Class, 2017-2031

6.3.1. Phenylalkylamine

6.3.2. Benzothizepine

6.3.3. Dihydropyridine

6.3.3.1. 1st Generation

6.3.3.2. 2nd Generation

6.3.3.3. 3rd Generation

6.4. Market Attractiveness Analysis, by Drug Class

7. Global Calcium Channel Blockers Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017-2031

7.3.1. Hypertension

7.3.2. Angina

7.3.3. Arrhythmia

7.3.4. Hypertrophic Cardiomyopathy

7.3.5. Others (Raynaud's disease, etc.)

7.4. Market Attractiveness Analysis, by Application

8. Global Calcium Channel Blockers Market Analysis and Forecast, by Route of Administration

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Route of Administration, 2017-2031

8.3.1. Oral

8.3.2. Parenteral

8.4. Market Attractiveness Analysis, by Route of Administration

9. Global Calcium Channel Blockers Market Analysis and Forecast, by Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Distribution Channel, 2017-2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Attractiveness Analysis, by Distribution Channel

10. Global Calcium Channel Blockers Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Calcium Channel Blockers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017-2031

11.2.1. Phenylalkylamine

11.2.2. Benzothizepine

11.2.3. Dihydropyridine

11.2.3.1. 1st Generation

11.2.3.2. 2nd Generation

11.2.3.3. 3rd Generation

11.3. Market Value Forecast, by Application, 2017-2031

11.3.1. Hypertension

11.3.2. Angina

11.3.3. Arrhythmia

11.3.4. Hypertrophic Cardiomyopathy

11.3.5. Others (Raynaud's disease, etc.)

11.4. Market Value Forecast, by Route of Administration, 2017-2031

11.4.1. Oral

11.4.2. Parenteral

11.5. Market Value Forecast, by Distribution Channel, 2017-2031

11.5.1. Hospital Pharmacies

11.5.2. Retail Pharmacies

11.5.3. Online Pharmacies

11.6. Market Value Forecast, by Country, 2017-2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Drug Class

11.7.2. By Application

11.7.3. By Route of Administration

11.7.4. By Distribution Channel

11.7.5. By Country

12. Europe Calcium Channel Blockers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017-2031

12.2.1. Phenylalkylamine

12.2.2. Benzothizepine

12.2.3. Dihydropyridine

12.2.3.1. 1st Generation

12.2.3.2. 2nd Generation

12.2.3.3. 3rd Generation

12.3. Market Value Forecast, by Application, 2017-2031

12.3.1. Hypertension

12.3.2. Angina

12.3.3. Arrhythmia

12.3.4. Hypertrophic Cardiomyopathy

12.3.5. Others (Raynaud's disease, etc.)

12.4. Market Value Forecast, by Route of Administration, 2017-2031

12.4.1. Oral

12.4.2. Parenteral

12.5. Market Value Forecast, by Distribution Channel, 2017-2031

12.5.1. Hospital Pharmacies

12.5.2. Retail Pharmacies

12.5.3. Online Pharmacies

12.6. Market Value Forecast, by Country/Sub-region, 2017-2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Drug Class

12.7.2. By Application

12.7.3. By Route of Administration

12.7.4. By Distribution Channel

12.7.5. By Country/Sub-region

13. Asia Pacific Calcium Channel Blockers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017-2031

13.2.1. Phenylalkylamine

13.2.2. Benzothizepine

13.2.3. Dihydropyridine

13.2.3.1. 1st Generation

13.2.3.2. 2nd Generation

13.2.3.3. 3rd Generation

13.3. Market Value Forecast, by Application, 2017-2031

13.3.1. Hypertension

13.3.2. Angina

13.3.3. Arrhythmia

13.3.4. Hypertrophic Cardiomyopathy

13.3.5. Others (Raynaud's disease, etc.)

13.4. Market Value Forecast, by Route of Administration, 2017-2031

13.4.1. Oral

13.4.2. Parenteral

13.5. Market Value Forecast, by Distribution Channel, 2017-2031

13.5.1. Hospital Pharmacies

13.5.2. Retail Pharmacies

13.5.3. Online Pharmacies

13.6. Market Value Forecast, by Country/Sub-region, 2017-2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Drug Class

13.7.2. By Application

13.7.3. By Route of Administration

13.7.4. By Distribution Channel

13.7.5. By Country/Sub-region

14. Latin America Calcium Channel Blockers Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Class, 2017-2031

14.2.1. Phenylalkylamine

14.2.2. Benzothizepine

14.2.3. Dihydropyridine

14.2.3.1. 1st Generation

14.2.3.2. 2nd Generation

14.2.3.3. 3rd Generation

14.3. Market Value Forecast, by Application, 2017-2031

14.3.1. Hypertension

14.3.2. Angina

14.3.3. Arrhythmia

14.3.4. Hypertrophic Cardiomyopathy

14.3.5. Others (Raynaud's disease, etc.)

14.4. Market Value Forecast, by Route of Administration, 2017-2031

14.4.1. Oral

14.4.2. Parenteral

14.5. Market Value Forecast, by Distribution Channel, 2017-2031

14.5.1. Hospital Pharmacies

14.5.2. Retail Pharmacies

14.5.3. Online Pharmacies

14.6. Market Value Forecast, by Country/Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Drug Class

14.7.2. By Application

14.7.3. By Route of Administration

14.7.4. By Distribution Channel

14.7.5. By Country/Sub-region

15. Middle East & Africa Calcium Channel Blockers Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Drug Class, 2017-2031

15.2.1. Phenylalkylamine

15.2.2. Benzothizepine

15.2.3. Dihydropyridine

15.2.3.1. 1st Generation

15.2.3.2. 2nd Generation

15.2.3.3. 3rd Generation

15.3. Market Value Forecast, by Application, 2017-2031

15.3.1. Hypertension

15.3.2. Angina

15.3.3. Arrhythmia

15.3.4. Hypertrophic Cardiomyopathy

15.3.5. Others (Raynaud's disease, etc.)

15.4. Market Value Forecast, by Route of Administration, 2017-2031

15.4.1. Oral

15.4.2. Parenteral

15.5. Market Value Forecast, by Distribution Channel, 2017-2031

15.5.1. Hospital Pharmacies

15.5.2. Retail Pharmacies

15.5.3. Online Pharmacies

15.6. Market Value Forecast, by Country/Sub-region, 2017-2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Drug Class

15.7.2. By Application

15.7.3. By Route of Administration

15.7.4. By Distribution Channel

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company, 2022

16.3. Company Profiles

16.3.1. Pfizer, Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Teva Pharmaceutical Industries Ltd.

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Bausch Health Company, Inc.

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Novartis AG

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. AstraZeneca

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Merck & Co. Inc.

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. GSK plc

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Bayer AG

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Sun Pharmaceutical Industries Ltd.

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Daiichi Sankyo Company, Limited

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

List of Tables

Table 01. Global Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 02. Global Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 03. Global Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 04. Global Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 05. Global Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 06. North America Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 07. North America Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 08. North America Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 09. North America Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 10. North America Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 11. Europe Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 12. Europe Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 13. Europe Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 14. Europe Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 15. Europe Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 16. Asia Pacific Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 17. Asia Pacific Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 18. Asia Pacific Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 19. Asia Pacific Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 20. Asia Pacific Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 21. Latin America Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 22. Latin America Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 23. Latin America Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 24. Latin America Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 25. Latin America Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 26. Middle East & Africa Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Drug Class, 2017-2031

Table 27. Middle East & Africa Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 28. Middle East & Africa Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Route of Administration, 2017-2031

Table 29. Middle East & Africa Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Distribution Channel, 2017-2031

Table 30. Middle East & Africa Calcium Channel Blockers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

List of Figures

Figure 01. Global Calcium Channel Blockers Market Value (US$ Mn) Forecast, 2017-2031

Figure 02. Global Calcium Channel Blockers Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 03. Global Calcium Channel Blockers Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 04. Global Calcium Channel Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 05. Global Calcium Channel Blockers Market Attractiveness Analysis, by Application, 2023-2031

Figure 06. Global Calcium Channel Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 07. Global Calcium Channel Blockers Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 08. Global Calcium Channel Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 09. Global Calcium Channel Blockers Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 10. Global Calcium Channel Blockers Market Value Share Analysis, by Region, 2022 and 2031

Figure 11. Global Calcium Channel Blockers Market Attractiveness Analysis, by Region, 2023-2031

Figure 12. North America Calcium Channel Blockers Market Value (US$ Mn) Forecast, 2017-2031

Figure 13. North America Calcium Channel Blockers Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 14. North America Calcium Channel Blockers Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 15. North America Calcium Channel Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 16. North America Calcium Channel Blockers Market Attractiveness Analysis, by Application, 2023-2031

Figure 17. North America Calcium Channel Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 18. North America Calcium Channel Blockers Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 19. North America Calcium Channel Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 20. North America Calcium Channel Blockers Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 21. North America Calcium Channel Blockers Market Value Share Analysis, by Country, 2022 and 2031

Figure 22. North America Calcium Channel Blockers Market Attractiveness Analysis, by Country, 2023-2031

Figure 23. Europe Calcium Channel Blockers Market Value (US$ Mn) Forecast, 2017-2031

Figure 24. Europe Calcium Channel Blockers Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 25. Europe Calcium Channel Blockers Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 26. Europe Calcium Channel Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 27. Europe Calcium Channel Blockers Market Attractiveness Analysis, by Application, 2023-2031

Figure 28. Europe Calcium Channel Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 29. Europe Calcium Channel Blockers Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 30. Europe Calcium Channel Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 31. Europe Calcium Channel Blockers Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 32. Europe Calcium Channel Blockers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33. Europe Calcium Channel Blockers Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 34. Asia Pacific Calcium Channel Blockers Market Value (US$ Mn) Forecast, 2017-2031

Figure 35. Asia Pacific Calcium Channel Blockers Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 36. Asia Pacific Calcium Channel Blockers Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 37. Asia Pacific Calcium Channel Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 38. Asia Pacific Calcium Channel Blockers Market Attractiveness Analysis, by Application, 2023-2031

Figure 39. Asia Pacific Calcium Channel Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 40. Asia Pacific Calcium Channel Blockers Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 41. Asia Pacific Calcium Channel Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 42. Asia Pacific Calcium Channel Blockers Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 43. Asia Pacific Calcium Channel Blockers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 44. Asia Pacific Calcium Channel Blockers Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 45. Latin America Calcium Channel Blockers Market Value (US$ Mn) Forecast, 2017-2031

Figure 46. Latin America Calcium Channel Blockers Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 47. Latin America Calcium Channel Blockers Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 48. Latin America Calcium Channel Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 49. Latin America Calcium Channel Blockers Market Attractiveness Analysis, by Application, 2023-2031

Figure 50. Latin America Calcium Channel Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 51. Latin America Calcium Channel Blockers Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 52. Latin America Calcium Channel Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 53. Latin America Calcium Channel Blockers Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 54. Latin America Calcium Channel Blockers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 55. Latin America Calcium Channel Blockers Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 56. Middle East & Africa Calcium Channel Blockers Market Value (US$ Mn) Forecast, 2017-2031

Figure 57. Middle East & Africa Calcium Channel Blockers Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 58. Middle East & Africa Calcium Channel Blockers Market Attractiveness Analysis, by Drug Class, 2023-2031

Figure 59. Middle East & Africa Calcium Channel Blockers Market Value Share Analysis, by Application, 2022 and 2031

Figure 60. Middle East & Africa Calcium Channel Blockers Market Attractiveness Analysis, by Application, 2023-2031

Figure 61. Middle East & Africa Calcium Channel Blockers Market Value Share Analysis, by Route of Administration, 2022 and 2031

Figure 62. Middle East & Africa Calcium Channel Blockers Market Attractiveness Analysis, by Route of Administration, 2023-2031

Figure 63. Middle East & Africa Calcium Channel Blockers Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 64. Middle East & Africa Calcium Channel Blockers Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 65. Middle East & Africa Calcium Channel Blockers Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 66. Middle East & Africa Calcium Channel Blockers Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 67. Global Calcium Channel Blockers Market Share Analysis, by Company, 2022