Reports

Reports

Unlike typical solar, BIPV aspects are embedded into building envelopes, roofs, façades or windows utilizing two main parts of any building – generating power and architecture. Growth drivers consist of more stringent energy efficiency standards and codes, commitments to net-zero carbon emissions, and cities increasing investments in infrastructure.

In addition to potential aesthetic differentiation in premium real estate, BIPV will start helping in creating value via reducing energy costs. Key players are driving faster adoption by investing in applied research and development of lightweight, semi-transparent, and higher-power modules and creating partnerships with architects, general contractors and developers in the early phases of projects.

Cost structures are also likely to decrease with off-shoring options for producing modules beginning to be optimized with local firms and vertically integrated contracts.

Building-Integrated Photovoltaics (BIPV) refers to photovoltaic materials integrated into building envelope components (i.e., roofs, façades, skylights, windows), in which the materials are both - building elements and providers of renewable energy. As compared with traditional solar panelsthat are "on top" of the building, BIPV material can be built directly into architectural buildings, offering innovative aesthetic choices while providing energy to buildings and mitigating reliance on conventional electricity. BIPV also offers opportunities for buildings to become their own energy producers, meaning that they can lower operational costs as well as their carbon footprint.

| Attribute | Detail |

|---|---|

| Building-integrated Photovoltaics Drivers |

|

One of the strongest growth drivers to the BIPV market is the global movement toward sustainability and climate adaptation. Energy-efficient construction is a growing priority, including the construction of carbon-neutral buildings and net-zero targets, as governments, corporations, and urban planners reach their 2050 deadlines. Buildings consume almost 40% of global energy and emit approximately one-third of global greenhouse gas emissions. As a result, developing renewable energy generation capacity in buildings has become a strategic priority.

BIPV allows buildings to be producers of energy instead of energy consumers, which directly reduces both - grid dependency and operating expenses. BIPV is appealing to real estate developers and property owners, and the benefits are not only environmental but commercial as well. Green or energy-efficient buildings provide higher asset valuation, quicker leasing cycles, and increased interest from investors, particularly as allotment of capital consideration to ESG will increase in significance.

Energy cost awareness and sustainability consciousness will also enhance consumer market preference for self-reliant and sustainable housing, especially by urbanizing regions of the world, specifically Asia-Pacific and Europe where municipalities are imposing renewable energy requirements on new construction projects, creating even more growth opportunity. Leading BIPV players are aligning their business strategies to be in-step with the sustainability movement by partnering with construction companies, city planners, and policymakers.

Ongoing technological innovation is facilitating the evolution of BIPV with advancements in performance, aesthetics, and cost-driver capabilities to accelerate adoption of the product. The standard solar module has previously had barriers to adoption in urban contexts due to the bulk, limited applicability and design flexibility, and aesthetic appeal.

However, new thin-film solar cells, semi-transparent modules, and lightweight laminate are addressing these barriers to entry, enabling a more seamless integration directly into building façades, glass panels, and roofing materials while ensuring that the energy collection potential of the BIPV product doesn't outpace the architectural appeal of the building being constructed--particularly relevant in premium residential or commercial real estate projects. Efficiency change is also a factor here. New generation BIPV modules are achieving improved energy conversion rates, but with adaptability to various light conditions, which is critical in urban contexts where shading, limited rooftop space and lighting contribute to the necessities of ongoing adaptation.

New coatings for increased durability, combined with weather-resistance of BIPV materials, extends the product lifespan as a potential development investment. However, digital is adding a whole new value system with regards to the hardware systems. Smart energy management systems with integrated BIPV systems allow for real-time performance tracking, predictive maintenance, and optimized energy utilization. This type of approach to a building's energy collection and utilization is of great benefit to developers and building facility managers who are searching for efficiencies in operational costs or long-term savings relative to the project's vision and intended architectural impact.

.webp)

| Attribute | Detail |

|---|---|

| Leading Region |

|

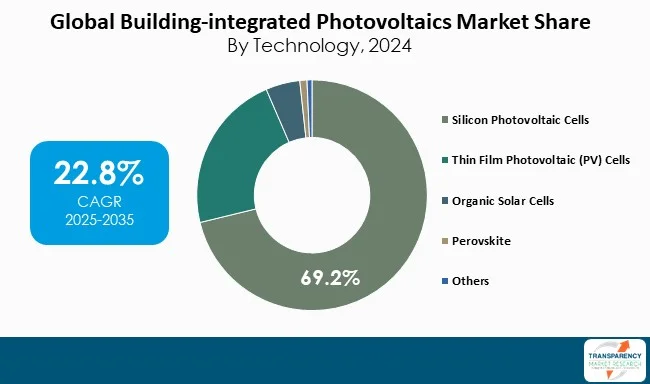

The main players in the building-integrated photovoltaics (BIPV) market include Onyx Solar, AGC Inc., Tesla, the Sharp Corporation, and First Solar, whose advancements and partnerships are pushing the market forward. They are working on silicon- and thin-film based BIPV modules, achieving different levels of design flexibility and efficiency.

They are also collaborating with construction firms to ensure that developers have the opportunity to incorporate BIPV products during the design process, in addition to producing other iterations of BIPV products, including semi-transparent glass and façade panels. The shift toward localization of production and all efforts relating to cost optimization further promote the viability of global adoption.

| Attribute | Detail |

|---|---|

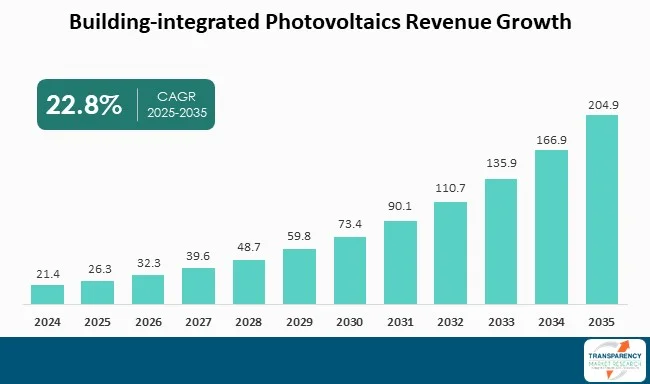

| Market Size Value in 2024 | US$ 21.4 Bn |

| Market Forecast Value in 2035 | US$ 204.6 Bn |

| Growth Rate (CAGR) | 22.8% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and MW for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Building-integrated Photovoltaics market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Technology

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The building-integrated photovoltaics market was valued at US$ 21.4 Bn in 2024

The building-integrated photovoltaics industry is expected to grow at a CAGR of 22.8% from 2025 to 2035

Global push toward sustainable construction and net-zero targets and technological advancements enhancing efficiency and architectural integration.

Silicon PV was the largest product type segment under which monocrystalline silicon module’s value was anticipated to grow at a CAGR of 16.5% during the forecast period

Europe was the most lucrative region in 2024

Kalyon PV, Sphelar Power Corporation, CW Energy, Polysolar Ltd, The Solaria Corporation, Greatcell and BELECTRIC are the major players in the building-integrated photovoltaics market

Table 1 Global Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 2 Global Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 3 Global Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 4 Global Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 5 Global Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 6 Global Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 7 Global Building-integrated Photovoltaics Market Volume (MW) Forecast, by Region, 2020 to 2035

Table 8 Global Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 9 North America Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 10 North America Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 11 North America Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 12 North America Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 13 North America Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 14 North America Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 15 North America Building-integrated Photovoltaics Market Volume (MW) Forecast, by Country, 2020 to 2035

Table 16 North America Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 17 U.S. Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 18 U.S. Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 19 U.S. Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 20 U.S. Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 U.S. Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 22 U.S. Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 Canada Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 24 Canada Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 25 Canada Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 26 Canada Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27 Canada Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 28 Canada Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 29 Europe Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 30 Europe Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 31 Europe Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 32 Europe Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33 Europe Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 34 Europe Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Europe Building-integrated Photovoltaics Market Volume (MW) Forecast, by Country and Sub-region, 2020 to 2035

Table 36 Europe Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 37 Germany Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 38 Germany Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 39 Germany Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 40 Germany Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 41 Germany Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 42 Germany Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 43 France Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 44 France Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 45 France Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 46 France Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47 France Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 48 France Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 49 U.K. Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 50 U.K. Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 51 U.K. Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 52 U.K. Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 U.K. Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 54 U.K. Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 55 Italy Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 56 Italy Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 57 Italy Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 58 Italy Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 59 Italy Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 60 Italy Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 61 Spain Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 62 Spain Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 63 Spain Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 64 Spain Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65 Spain Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 66 Spain Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 67 Russia & CIS Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 68 Russia & CIS Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 69 Russia & CIS Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 70 Russia & CIS Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 71 Russia & CIS Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 72 Russia & CIS Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 73 Rest of Europe Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 74 Rest of Europe Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 75 Rest of Europe Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 76 Rest of Europe Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 77 Rest of Europe Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 78 Rest of Europe Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 79 Asia Pacific Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 80 Asia Pacific Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 81 Asia Pacific Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 82 Asia Pacific Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 83 Asia Pacific Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 84 Asia Pacific Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 85 Asia Pacific Building-integrated Photovoltaics Market Volume (MW) Forecast, by Country and Sub-region, 2020 to 2035

Table 86 Asia Pacific Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 87 China Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 88 China Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology 2020 to 2035

Table 89 China Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 90 China Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 91 China Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 92 China Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 93 Japan Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 94 Japan Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 95 Japan Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 96 Japan Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 97 Japan Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 98 Japan Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 99 India Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 100 India Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 101 India Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 102 India Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 103 India Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 104 India Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 105 India Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 106 India Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 ASEAN Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 108 ASEAN Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 109 ASEAN Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 110 ASEAN Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 111 ASEAN Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 112 ASEAN Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 113 Rest of Asia Pacific Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 114 Rest of Asia Pacific Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 115 Rest of Asia Pacific Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 116 Rest of Asia Pacific Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 117 Rest of Asia Pacific Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 118 Rest of Asia Pacific Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 119 Latin America Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 120 Latin America Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 121 Latin America Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 122 Latin America Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 123 Latin America Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 124 Latin America Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 125 Latin America Building-integrated Photovoltaics Market Volume (MW) Forecast, by Country and Sub-region, 2020 to 2035

Table 126 Latin America Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 127 Brazil Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 128 Brazil Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 129 Brazil Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 130 Brazil Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 131 Brazil Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 132 Brazil Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 133 Mexico Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 134 Mexico Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 135 Mexico Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 136 Mexico Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 137 Mexico Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 138 Mexico Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 139 Rest of Latin America Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 140 Rest of Latin America Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 141 Rest of Latin America Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 142 Rest of Latin America Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 143 Rest of Latin America Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 144 Rest of Latin America Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 145 Middle East & Africa Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 146 Middle East & Africa Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 147 Middle East & Africa Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 148 Middle East & Africa Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 149 Middle East & Africa Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 150 Middle East & Africa Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 151 Middle East & Africa Building-integrated Photovoltaics Market Volume (MW) Forecast, by Country and Sub-region, 2020 to 2035

Table 152 Middle East & Africa Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 153 GCC Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 154 GCC Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 155 GCC Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 156 GCC Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 157 GCC Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 158 GCC Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 159 South Africa Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 160 South Africa Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 161 South Africa Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 162 South Africa Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 163 South Africa Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 164 South Africa Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 165 Rest of Middle East & Africa Building-integrated Photovoltaics Market Volume (MW) Forecast, by Technology, 2020 to 2035

Table 166 Rest of Middle East & Africa Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 167 Rest of Middle East & Africa Building-integrated Photovoltaics Market Volume (MW) Forecast, by Application, 2020 to 2035

Table 168 Rest of Middle East & Africa Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 169 Rest of Middle East & Africa Building-integrated Photovoltaics Market Volume (MW) Forecast, by End-use, 2020 to 2035

Table 170 Rest of Middle East & Africa Building-integrated Photovoltaics Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Figure 1 Global Building-integrated Photovoltaics Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 2 Global Building-integrated Photovoltaics Market Attractiveness, by Technology

Figure 3 Global Building-integrated Photovoltaics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 4 Global Building-integrated Photovoltaics Market Attractiveness, by Application

Figure 5 Global Building-integrated Photovoltaics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 6 Global Building-integrated Photovoltaics Market Attractiveness, by End-use

Figure 7 Global Building-integrated Photovoltaics Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 8 Global Building-integrated Photovoltaics Market Attractiveness, by Region

Figure 9 North America Building-integrated Photovoltaics Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 10 North America Building-integrated Photovoltaics Market Attractiveness, by Technology

Figure 11 North America Building-integrated Photovoltaics Market Attractiveness, by Technology

Figure 12 North America Building-integrated Photovoltaics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 13 North America Building-integrated Photovoltaics Market Attractiveness, by Application

Figure 14 North America Building-integrated Photovoltaics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 15 North America Building-integrated Photovoltaics Market Attractiveness, by End-use

Figure 16 North America Building-integrated Photovoltaics Market Attractiveness, by Country and Sub-region

Figure 17 Europe Building-integrated Photovoltaics Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 18 Europe Building-integrated Photovoltaics Market Attractiveness, by Technology

Figure 19 Europe Building-integrated Photovoltaics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 20 Europe Building-integrated Photovoltaics Market Attractiveness, by Application

Figure 21 Europe Building-integrated Photovoltaics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 22 Europe Building-integrated Photovoltaics Market Attractiveness, by End-use

Figure 23 Europe Building-integrated Photovoltaics Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 24 Europe Building-integrated Photovoltaics Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Building-integrated Photovoltaics Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 26 Asia Pacific Building-integrated Photovoltaics Market Attractiveness, by Technology

Figure 27 Asia Pacific Building-integrated Photovoltaics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 28 Asia Pacific Building-integrated Photovoltaics Market Attractiveness, by Application

Figure 29 Asia Pacific Building-integrated Photovoltaics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 30 Asia Pacific Building-integrated Photovoltaics Market Attractiveness, by End-use

Figure 31 Asia Pacific Building-integrated Photovoltaics Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 32 Asia Pacific Building-integrated Photovoltaics Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Building-integrated Photovoltaics Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 34 Latin America Building-integrated Photovoltaics Market Attractiveness, by Technology

Figure 35 Latin America Building-integrated Photovoltaics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 36 Latin America Building-integrated Photovoltaics Market Attractiveness, by Application

Figure 37 Latin America Building-integrated Photovoltaics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 38 Latin America Building-integrated Photovoltaics Market Attractiveness, by End-use

Figure 39 Latin America Building-integrated Photovoltaics Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 40 Latin America Building-integrated Photovoltaics Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Building-integrated Photovoltaics Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 42 Middle East & Africa Building-integrated Photovoltaics Market Attractiveness, by Technology

Figure 43 Middle East & Africa Building-integrated Photovoltaics Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 44 Middle East & Africa Building-integrated Photovoltaics Market Attractiveness, by Application

Figure 45 Middle East & Africa Building-integrated Photovoltaics Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 46 Middle East & Africa Building-integrated Photovoltaics Market Attractiveness, by End-use

Figure 47 Middle East & Africa Building-integrated Photovoltaics Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 48 Middle East & Africa Building-integrated Photovoltaics Market Attractiveness, by Country and Sub-region