Reports

Reports

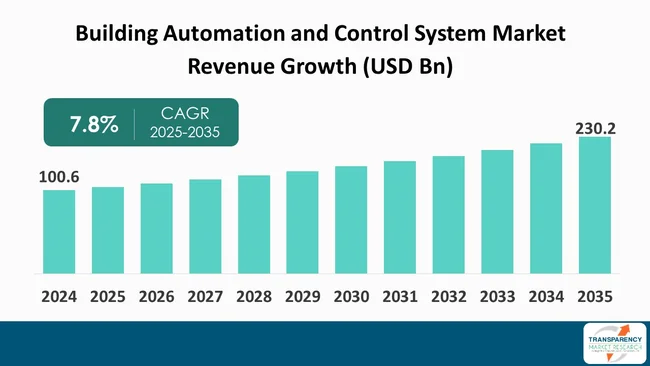

The global building automation and control system market size was valued at US$ 100.6 Bn in 2024 and is projected to reach US$ 230.2 Bn by 2035, expanding at a CAGR of 7.8% from 2025 to 2035. Increasing demand for energy efficiency and sustainability in commercial and residential buildings is driving adoption of automation systems that optimize HVAC, lighting, and energy use.

The building automation and control system (BACS) market is in a time of transformation with the status quo of energy efficiency, government regulations, and smarter, more sustainable infrastructure continuously in focus. Urbanization is growing and being mindful to its environmental effect, more and more buildings, regardless of age and type, are utilizing intelligent analogue controls for HVAC, lighting, life safety, security and energy management. Many of these new controllers are taking advantage of new technologies prior to the emergence of the Internet of Things (IoT), artificial intelligence (AI), and cloud computing, prior to intelligent turn using automated sector, resulting in traditional buildings transforming into smart ecosystems. The average net energy savings per installation are about 37% for space heating, water heating and cooling/ventilation, and 25% for lighting. Currently only about 25% of commercial buildings have properly installed BA.

The major players Honeywell, Siemens, Johnson Controls, Schneider Electric and ABB can only further develop the market with innovation, integrated solutions, and community partnerships. Their expansion to automation hardware and software with innovation, leveraging advances in performance improvement, reduced operation costs, and occupant comfort is ready for further adoption. Each of these companies fills the supply chain through research and development investments, increased product offerings, expanded global availability.

Competition in the domain of BACS market is primarily driven by innovation to leverage emerging features with open protocols, cybersecurity, and remote access, resulting in further visibility of product offerings and information in the developing markets. The active demand for improved energy efficiency projects is apparent, particularly in developing markets for new construction and retrofits for energy compliance.

The building automation and control system market is rapidly growing, largely due to the imperative of efficient energy consumption, reduced operating costs, and increases in occupant comfort. Building owners and facility managers are increasingly interested in systems capable of intelligently monitoring, managing, and optimizing building functions in real-time; the shift to the use of intelligent systems is supported by increasing digital transformation in the real-estate and infrastructure markets.

Urbanization, along with a global construction boom fueled primarily by the Asia-Pacific region, is creating a substantial demand for smart buildings. The interest in retrofitting existing buildings with green building compliance and sustainability standards is also increasing. Smart sensors, remote control capability, and integrated system platforms present improved capabilities for energy consumption, security, and overall enhanced control.

Modern occupants expect more responsive and automated environments, forcing property developers to invest in building technology and solutions. As a result, the Building Automation and Control System market continues to expand across commercial, industrial, and residential sectors with unique automation adaptations.

| Attribute | Detail |

|---|---|

| Building Automation and Control System Market Drivers |

|

Regulatory mandates and government incentives are key factors driving the adoption of building automation systems. As countries loosen energy codes and sustainability targets, governments are increasingly viewing automation systems as necessary infrastructure, or more explicitly, the energy code requires energy efficiency measures in commercial and industrial buildings, and automation is the s one acceptable way to comply.

For instance, code in the US like California's Title 24 now calls for integrated control systems for HVAC, lighting, and occupancy detection. And in Europe, the Energy Performance of Buildings Directive's policy encourages "smarter" buildings that significantly minimize wasted energy and improve occupant satisfaction, with automation systems as the solution for management of those systems.

As well, incentives such as tax credits, subsidies, and rebate programs ease the adoption curve. These financial incentive reduce the costs of installing automation systems, particularly for retrofit projects.

For example, Singapore's Green Building Master Plan now offers financial grants covering 50% of the cost of retrofitting smart building technologies. This has resulted in a critical mass of adoption with mid-sized commercial properties implementing smart building technologies and, in the process, significantly improving energy efficiency and building performance. With global governments wanting to decarbonize, they will continue to contribute governmental support and incentives for automation adoption.

The convergence of internet-of-things (IoT) technology, cloud computing, and artificial intelligence (AI) is transforming the Building Automation and Control System (BACs) market. IoT, cloud, and AI enable systems to be interconnected online, decision-making is automated,

and the multiple building systems-HVAC, lighting control, access control, and energy management-can work together as a cohesive unit in real-time.

IoT sensors can continuously acquire data from all aspects of a building, the data is put in the Cloud for processing, and AI algorithms assess the data to optimize the performance of the building, identify and analyze inefficient performance, and even predict when maintenance may be required. AI will improve decision making, decrease energy usage, and reduce operational costs, while simultaneously improving occupant comfort and safety.

For example, a smart office building utilizing AI software in an automation system could decrease HVAC energy use by forecasting and analyzing real time occupancy of the space. In one example, an office space reduced its energy usage by as much as 37% by integrating IoT sensors and AI analytics to increase automation of lighting and also the climate control system. Intelligent systems provide not only maximized automated efficiency but also real-time descriptive analytics and dashboards to support function and reduce operational issues.

As the need for smarter connected spaces continues to grow, the use and influence of these technologies will grow and change the manner in which buildings will be monitored, managed, and maintained.

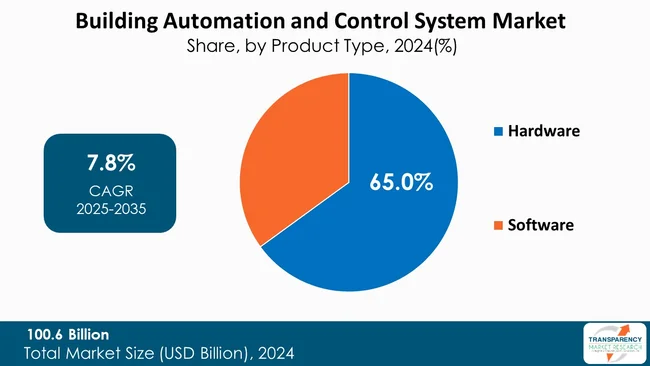

Hardware segment dominates the global market share with 65%. The building automation and control systems market identifies hardware as its leading segment. The monitoring of building environments has become more common because sensors, controllers, actuators, and other physical devices are widely used for this purpose.

Hardware components serve as the fundamental structure of automation systems because they provide immediate data collection capabilities, energy management functions, and software platform connectivity. These together maintain smart building operations across the globe.

The increasing need for energy-efficient smart buildings keeps hardware as the main solution because modern equipment needs to implement automated control systems. The worldwide adoption of IoT-enabled wireless hardware devices continues to grow because of ongoing technological advancements. These serve commercial and residential buildings, as well as industrial facilities.

| Attribute | Detail |

|---|---|

| Leading Region |

|

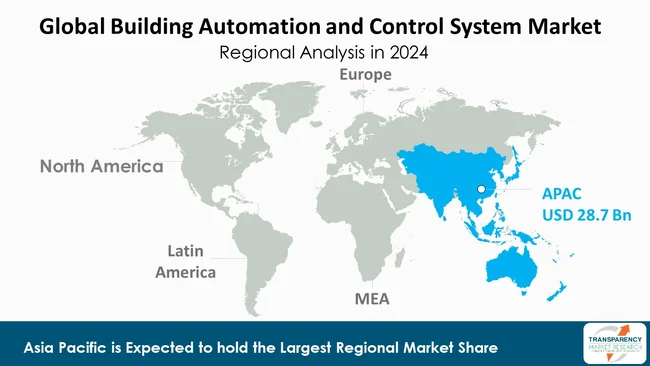

The Asia-Pacific region is presently the fastest expanding and most vibrant area in the building automation and control system market with 35.3% share. This is due to a number of factors including urbanization, high-rise commercial construction, government funded smart city projects, and growing awareness of the environment. Countries such as China, India, Japan and South Korea are investing heavily in digital infrastructure and sustainable building industry technologies.

Favorable government land use and funding policies are what has, and continues to, make Asia-Pacific an open land for building automation. With large scale infrastructure developments and a growing middle class, demand for smarter, energy efficient commercial and residential buildings are growing. Technological advancements and local makers building at lower prices are accelerating the use of automation systems.

On the other hand, the United States is, by and large, a mature market. Some demand is consistent due to energy regulations/codes, tax incentives and a growing focus on decarburization. Cities like New York and San Francisco are creating energy benchmarking and efficiency mandates in efforts to move construction to BACS whether in new or existing buildings.

Overall, Asia-Pacific will continue to dominate when taking into consideration broad scale, government involvement, and amount of construction. Global growth in terms of building automation adoption will equally develop in the region as investments in smart infrastructures increase amidst growing digital transformations and energy.

Key players operating in the building automation and control system industry are investing through innovation, strategic partnerships, and technological advancements. They emphasize on improving imaging clarity, and expanding product portfolios, ensuring sustained growth and leadership in the evolving semiconductor landscape.

Schneider Electric, Carrier, Johnson Controls, Siemens, Honeywell International Inc., Robert Bosch GmbH, Legrand, Hubbell, ABB, Trane, Lutron, Hitachi, Ltd., Lennox International Inc., Rockwell Automation, Emerson Electric Co. are the key players in building automation and control system market.

Each of these players has been profiled in the building automation and control system market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 100.6 Bn |

| Forecast Value in 2035 | US$ 230.2 Bn |

| CAGR | 7.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Building Automation and Control System Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global building automation and control system market was valued at US$ 100.6 Bn in 2024

The global building automation and control system industry is projected to reach more than US$ 230.2 Bn by the end of 2035

Regulatory and Incentive Pressure, Integration of IoT, Cloud, and AI are some of the factors driving the expansion of Building Automation and Control System market.

The CAGR is anticipated to be 7.8% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

Schneider Electric, Carrier, Johnson Controls, Siemens, Honeywell International Inc., Robert Bosch GmbH, Legrand, Hubbell, ABB, Trane, Lutron, Hitachi, Ltd., Lennox International Inc., Rockwell Automation, Emerson Electric Co

Table 01: Global Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 02: Global Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, By Offering, 2020 to 2035

Table 03: Global Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 04: Global Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Country, 2020-2035

Table 06: North America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 07: North America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 08: North America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 09: U.S. Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 10: U.S. Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 11: U.S. Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 12: Canada Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 13: Canada Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 14: Canada Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Europe Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 16: Europe Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 17: Europe Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 18: Europe Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 19: Germany Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 20: Germany Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 21: Germany Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 22: U.K. Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 23: U.K. Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 24: U.K. Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 25: France Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 26: France Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 27: France Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 28: Italy Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 29: Italy Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 30: Italy Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 31: Spain Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 32: Spain Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 33: Spain Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 34: Switzerland Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 35: Switzerland Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 36: Switzerland Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 37: The Netherlands Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 38: The Netherlands Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 39: The Netherlands Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 40: Rest of Europe Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 41: Rest of Europe Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 42: Rest of Europe Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 43: Asia Pacific Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 44: Asia Pacific Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 45: Asia Pacific Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 46: Asia Pacific Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 47: China Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 48: China Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 49: China Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 50: India Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 51: India Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 52: India Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 53: Japan Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 54: Japan Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 55: Japan Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 56: South Korea Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 57: South Korea Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 58: South Korea Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 59: Australia & New Zealand Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 60: Australia & New Zealand Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 61: Australia & New Zealand Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 62: ASEAN Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 63: ASEAN Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 64: ASEAN Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 65: Rest of Asia Pacific Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 66: Rest of Asia Pacific Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 67: Rest of Asia Pacific Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 68: Latin America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 69: Latin America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 70: Latin America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 71: Latin America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 72: Brazil Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 73: Brazil Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 74: Brazil Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 75: Mexico Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 76: Mexico Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 77: Mexico Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 78: Argentina Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 79: Argentina Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 80: Argentina Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 81: Rest of Latin America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 82: Rest of Latin America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 83: Rest of Latin America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 84: Middle East & Africa Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 85: Middle East & Africa Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 86: Middle East & Africa Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 87: Middle East & Africa Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 88: GCC Countries Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 89: GCC Countries Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 90: GCC Countries Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 91: South Africa Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 92: South Africa Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 93: South Africa Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 94: Rest of Middle East & Africa Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 95: Rest of Middle East & Africa Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 96: Rest of Middle East & Africa Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 02: Global Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 03: Global Building Automation and Control System Market Revenue (US$ Bn), by Hardware, 2020 to 2035

Figure 04: Global Building Automation and Control System Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 05: Global Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 06: Global Building Automation and Control System Market Attractiveness Analysis, by Offering, 2024 and 2035

Figure 07: Global Building Automation and Control System Market Revenue (US$ Bn), by Facility Management Systems, 2020 to 2035

Figure 08: Global Building Automation and Control System Market Revenue (US$ Bn), by Security & Access Control Systems, 2020 to 2035

Figure 09: Global Building Automation and Control System Market Revenue (US$ Bn), by Fire Protection Systems, 2020 to 2035

Figure 10: Global Building Automation and Control System Market Revenue (US$ Bn), by Building Energy Management Software, 2020 to 2035

Figure 11: Global Building Automation and Control System Market Revenue (US$ Bn), by BAS Services, 2020 to 2035

Figure 12: Global Building Automation and Control System Market Revenue (US$ Bn), by Other, 2020 to 2035

Figure 13: Global Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 14: Global Building Automation and Control System Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 15: Global Building Automation and Control System Market Revenue (US$ Bn), by Residential, 2025 to 2035

Figure 16: Global Building Automation and Control System Market Revenue (US$ Bn), by Commercial, 2020 to 2035

Figure 17: Global Building Automation and Control System Market Value & Volume Share Analysis, By Region, 2024 and 2035

Figure 18: Global Building Automation and Control System Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 19: North America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, 2020 to 2035

Figure 20: North America Building Automation and Control System Market Value & Volume Share Analysis, by Country, 2024 and 2035

Figure 21: North America Building Automation and Control System Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 22: North America Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 23: North America Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 24: North America Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 25: North America Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 26: North America Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 27: North America Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 28: U.S. Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 29: U.S. Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 30: U.S. Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 31: U.S. Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 32: U.S. Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 33: U.S. Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 34: Canada Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 35: Canada Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 36: Canada Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 37: Canada Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 38: Canada Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 39: Canada Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 40: Europe Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, 2020 to 2035

Figure 41: Europe Building Automation and Control System Market Value & Volume Share Analysis, by Country/Region, 2024 and 2035

Figure 42: Europe Building Automation and Control System Market Attractiveness Analysis, by Country/Region, 2025 to 2035

Figure 43: Europe Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 44: Europe Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 45: Europe Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 46: Europe Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 47: Europe Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 48: Europe Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 49: Germany Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 50: Germany Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 51: Germany Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 52: Germany Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 53: Germany Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 54: Germany Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 55: U.K. Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 56: U.K. Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 57: U.K. Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 58: U.K. Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 59: U.K. Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 60: U.K. Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 61: France Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 62: France Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 63: France Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 64: France Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 65: France Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 66: France Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 67: Italy Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 68: Italy Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 69: Italy Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 70: Italy Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 71: Italy Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 72: Italy Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 73: Spain Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 74: Spain Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 75: Spain Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 76: Spain Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 77: Spain Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 78: Spain Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 79: Switzerland Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 80: Switzerland Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 81: Switzerland Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 82: Switzerland Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 83: Switzerland Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 84: Switzerland Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 85: The Netherlands Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 86: The Netherlands Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 87: The Netherlands Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 88: The Netherlands Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 89: The Netherlands Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 90: The Netherlands Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 91: Rest of Europe Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 92: Rest of Europe Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 93: Rest of Europe Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 94: Rest of Europe Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 95: Rest of Europe Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 96: Rest of Europe Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 97: Asia Pacific Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, 2020 to 2035

Figure 98: Asia Pacific Building Automation and Control System Market Value & Volume Share Analysis, by Country/Region, 2024 and 2035

Figure 99: Asia Pacific Building Automation and Control System Market Attractiveness Analysis, by Country/Region, 2025 to 2035

Figure 100: Asia Pacific Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 101: Asia Pacific Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 102: Asia Pacific Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 103: Asia Pacific Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 104: Asia Pacific Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 105: Asia Pacific Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 106: China Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 107: China Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 108: China Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 109: China Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 110: China Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 111: China Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 112: India Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 113: India Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 114: India Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 115: India Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 116: India Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 117: India Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 118: Japan Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 119: Japan Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 120: Japan Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 121: Japan Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 122: Japan Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 123: Japan Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 124: South Korea Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 125: South Korea Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 126: South Korea Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 127: South Korea Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 128: South Korea Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 129: South Korea Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 130: Australia & New Zealand Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 131: Australia & New Zealand Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 132: Australia & New Zealand Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 133: Australia & New Zealand Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 134: Australia & New Zealand Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 135: Australia & New Zealand Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 136: ASEAN Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 137: ASEAN Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 138: ASEAN Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 139: ASEAN Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 140: ASEAN Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 141: ASEAN Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 142: Rest of Asia Pacific Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 143: Rest of Asia Pacific Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 144: Rest of Asia Pacific Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 145: Rest of Asia Pacific Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 146: Rest of Asia Pacific Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 147: Rest of Asia Pacific Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 148: Latin America Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, 2020 to 2035

Figure 149: Latin America Building Automation and Control System Market Value & Volume Share Analysis, by Country/Region, 2024 and 2035

Figure 150: Latin America Building Automation and Control System Market Attractiveness Analysis, by Country/Region, 2025 to 2035

Figure 151: Latin America Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 152: Latin America Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 153: Latin America Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 154: Latin America Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 155: Latin America Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 156: Latin America Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 157: Brazil Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 158: Brazil Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 159: Brazil Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 160: Brazil Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 161: Brazil Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 162: Brazil Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 163: Mexico Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 164: Mexico Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 165: Mexico Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 166: Mexico Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 167: Mexico Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 168: Mexico Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 169: Argentina Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 170: Argentina Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 171: Argentina Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 172: Argentina Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 173: Argentina Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 174: Argentina Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 175: Rest of Latin America Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 176: Rest of Latin America Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 177: Rest of Latin America Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 178: Rest of Latin America Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 179: Rest of Latin America Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 180: Rest of Latin America Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 181: Middle East & Africa Building Automation and Control System Market Value & Volume (US$ Bn) Forecast, 2020 to 2035

Figure 182: Middle East & Africa Building Automation and Control System Market Value & Volume Share Analysis, by Country/Region, 2024 and 2035

Figure 183: Middle East & Africa Building Automation and Control System Market Attractiveness Analysis, by Country/Region, 2025 to 2035

Figure 184: Middle East & Africa Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 185: Middle East & Africa Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 186: Middle East & Africa Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 187: Middle East & Africa Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 188: Middle East & Africa Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 189: Middle East & Africa Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 190: GCC Countries Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 191: GCC Countries Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 192: GCC Countries Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 193: GCC Countries Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 194: GCC Countries Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 195: GCC Countries Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 196: South Africa Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 197: South Africa Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 198: South Africa Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 199: South Africa Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 200: South Africa Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 201: South Africa Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 202: Rest of Middle East & Africa Building Automation and Control System Market Value & Volume Share Analysis, by Product Type, 2024 and 2035

Figure 203: Rest of Middle East & Africa Building Automation and Control System Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 204: Rest of Middle East & Africa Building Automation and Control System Market Value & Volume Share Analysis, by Offering, 2024 and 2035

Figure 205: Rest of Middle East & Africa Building Automation and Control System Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 206: Rest of Middle East & Africa Building Automation and Control System Market Value & Volume Share Analysis, by End-user, 2024 and 2035

Figure 207: Rest of Middle East & Africa Building Automation and Control System Market Attractiveness Analysis, by End-user, 2025 to 2035