Reports

Reports

The leading players in the HVAC equipment market are emphasizing technological advancements in HVAC systems for improving efficiency and cost-effectiveness. The HVAC industry’s dynamic nature can mainly be attributed to the factors such as unprecedented population growth, increasing urbanization, and frequently altering government regulations for making more energy-efficient HVAC products.

Key vendors in HVAC equipment market are anticipated to invest in R&D aiming at different air handling systems used for moving air between indoor and outdoor areas, along with heating and cooling both - residential and commercial buildings. Manufacturers are setting up new manufacturing plants for HVAC equipment to keep their businesses growing across regions.

The growing adoption of the Internet of Things (IoT), artificial intelligence (AI), and various other technological advancements such as sensors, predictive maintenance tools, smart thermostats, app-based control systems, etc. allow users to control, monitor, and interact with HVAC systems and appliances to become easy while operating.

Recent developments in the HVAC equipment by the major key players are leading to future business opportunities in the HVAC equipment industry. Asia Pacific is the most mature HVAC equipment market followed by North America and is expected to grow at the highest CAGR, due to the wide usage of heating, ventilation, and air conditioning devices in residential and commercial spheres.

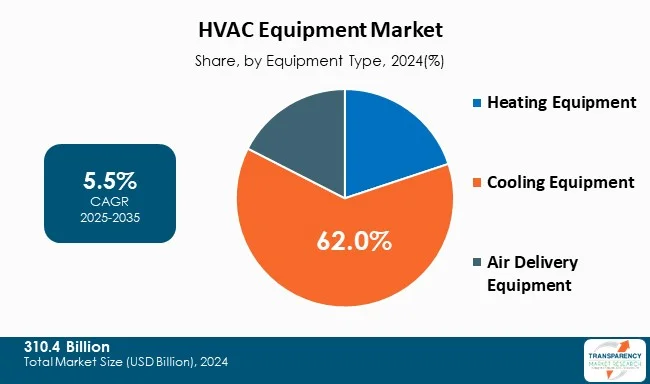

Heating, ventilation, and air-conditioning (HVAC) systems are designed to control moisture, temperature, or purity of air in an enclosed space. The HVAC equipment market is segmented by application, types of equipment, end-user, distribution channel, and geography. Heating equipment is segmented into heat pumps, furnaces, unitary pumps, and boilers. Cooling equipment for HVAC includes chillers, air conditioners, water cooling towers, etc., and air delivery equipment include fans, humidifiers, dehumidifiers, etc.

Different types of HVAC systems are provided for different types of buildings such as industrial, commercial, and residential-institutional. The working principle of HVAC systems is to safeguard thermal comfort for the users by either changing or adjusting the outdoor air conditions to the indoor condition of the building.

HVAC is important for the residential sector including apartments, single-family homes, and hotels. According to the U.S. Energy Information Administration, air conditioning consumes about 19% of the electricity in U.S. homes and 14% in commercial buildings, thereby inflicting a heavy toll on the energy sector.

The HVAC system is used in tall buildings, hospitals, departmental buildings, and vehicle environments like cars, trains, airplanes, ships, and submarines, marine environments where safe and healthy building conditions are maintained with respect to temperature and humidity by supplying fresh air from outdoors.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Urbanization and civil infrastructure development are rapidly restructuring HVAC market dynamics to create opportunities for unprecedented demand for intelligent climate control in densely populated urban environment. The UN projects that by 2050 about 68% of the world's population will reside in urban areas, signaling fast-paced urbanization wherein sophisticated HVAC installations will form an integral part of high-rise residential complexes, commercial towers, and mixed-use developments.

At a global scale, smart city initiatives are calling for integrated building management systems that optimize energy consumption within entire districts. The HVAC equipment must thus be able to interface with the other infrastructure systems through IoT connectivity, and real-time data analytics. As per the UN-Habitat World Cities Report 2024, buildings are significant emitters of greenhouse gases; hence, energy-efficient HVAC systems stand as the core toward climate adaptation in fast urbanizing areas.

With environmental regulations, operational cost considerations, and sustainability commitments in place, the demand for energy-efficient HVAC equipment has shaped the industry, setting a backdrop for advanced climate control technologies. Various building codes worldwide come with every nook and cranny enforcement arrangement wherein the building owners or developers have to meet the minimum energy performance standards for HVAC systems.

Simultaneously, utilities administer incentive programs to reward the installation of high-efficiency equipment that injures peak demand and loads on the grid. According to the International Energy Agency, another 30% of global final energy consumption is represented by building operations, while it is estimated that into 2035 residential air conditioning will be drawing in an additional 700 TWh of electricity, thus presenting strong grounds for putting energy-efficient HVAC technologies at the forefront of global energy planning.

In terms of equipment type, Cooling Equipment held the major share in the global HVAC equipment market. Air delivery equipment, as compared to heating equipment, are more convenient to use. The key growth driving factors of the cooling equipment market are rising urbanization andan increase in new households and average construction spending. The demand for cooling equipment is largely contributed by chillers and air conditioners, with water cooling towers taking a backstage and seeing a gradual drop in share due to huge pricing amounts. The air conditioning system market would be the fastest growing market for HVAC equipment in product type due to their high usage in residential as well as commercial buildings.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia-Pacific region is the leader in the global HVAC equipment market due to accelerated industrialization, massive urbanization projects, and governments’ support for infrastructural policy across major economies. With more construction work around China, India, Japan, and Southeast Asian countries, more is the demand for HVAC solutions since climatic extremes are observed almost throughout the year for both - heating and cooling.

With economic prosperity, rising middle class population, and increased residential air-conditioning application-manufacturing, commercial and infrastructure developments demand advanced HVAC installations with a certified capability to international efficiency standards.

India is urbanizing fast. For instance, over 600 million people will be living in towns and cities across India by 2036, which translates into 40% of the total population, up from 31% in 2011. This situation, together with ASEAN infrastructure investments, sets Asia-Pacific at the forefront in production-to-market capacity in HVAC equipment.

DAIKIN INDUSTRIES, Ltd, Midea, GREE ELECTRIC APPLIANCES, INC., Trane, Carrier, Mitsubishi Electric Corporation, Johnson Controls, Panasonic Holdings Corporation, LG Electronics, Lennox International Inc., Emerson Electric Co., Bosch Thermotechnik GmbH, Qingdao Hisense HVAC Equipment Co., Ltd., Danfoss A/S, Haier Inc. are some of the leading manufacturers operating in the global HVAC equipment market.

Each of these companies has been profiled in the HVAC equipment market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

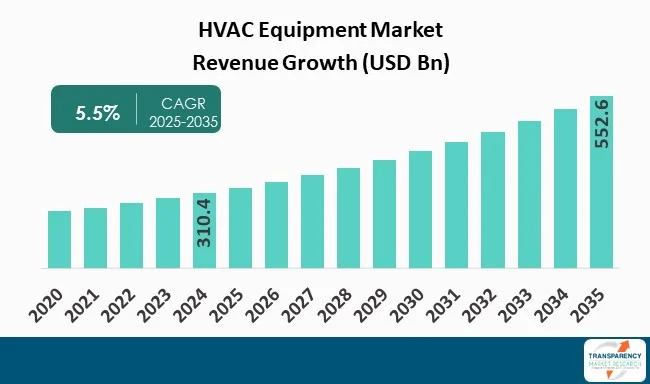

| Market Size Value in 2024 (Base Year) | US$ 310.4 Bn |

| Market Forecast Value in 2035 | US$ 552.6 Bn |

| Growth Rate (CAGR 2025 to 2035) | 5.5% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Equipment Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The HVAC equipment market stood at US$ 310.4 Bn in 2024.

The HVAC equipment industry is expected to reach at US$ 552.6 Bn by 2035.

Rising urbanization & smart infrastructure development, and growing demand for energy-efficient HVAC Equipment are some of the driving factors for the market

Cooling Equipment contributed to the highest share of the HVAC equipment market in 2024.

Asia Pacific contributed to about 45% in terms of share in 2024.

DAIKIN INDUSTRIES, Ltd, Midea, GREE ELECTRIC APPLIANCES, INC., Trane, Carrier, Mitsubishi Electric Corporation, Johnson Controls, Panasonic Holdings Corporation, LG Electronics, Lennox International Inc., Emerson Electric Co., Bosch Thermotechnik GmbH, Qingdao Hisense HVAC Equipment Co., Ltd., Danfoss A/S, Haier Inc., and others

Table 1: Global HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 2: Global HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 3: Global HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 4: Global HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 5: Global HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 6: Global HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 7: Global HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 8: Global HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 9: Global HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Region

Table 10: Global HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Region

Table 11: North America HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 12: North America HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 13: North America HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 14: North America HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 15: North America HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 16: North America HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 17: North America HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 18: North America HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 19: North America HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 20: North America HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 21: U.S. HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 22: U.S. HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 23: U.S. HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 24: U.S. HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 25: U.S. HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 26: U.S. HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 27: U.S. HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 28: U.S. HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 29: Canada HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 30: Canada HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 31: Canada HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 32: Canada HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 33: Canada HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 34: Canada HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 35: Canada HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 36: Canada HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 37: Europe HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 38: Europe HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 39: Europe HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 40: Europe HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 41: Europe HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 42: Europe HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 43: Europe HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 44: Europe HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 45: Europe HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 46: Europe HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 47: U.K. HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 48: U.K. HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 49: U.K. HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 50: U.K. HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 51: U.K. HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 52: U.K. HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 53: U.K. HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 54: U.K. HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 55: Germany HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 56: Germany HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 57: Germany HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 58: Germany HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 59: Germany HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 60: Germany HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 61: Germany HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 62: Germany HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 63: France HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 64: France HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 65: France HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 66: France HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 67: France HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 68: France HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 69: France HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 70: France HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 71: Italy HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 72: Italy HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 73: Italy HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 74: Italy HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 75: Italy HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 76: Italy HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 77: Italy HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 78: Italy HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 79: Spain HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 80: Spain HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 81: Spain HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 82: Spain HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 83: Spain HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 84: Spain HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 85: Spain HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 86: Spain HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 87: The Netherlands HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 88: The Netherlands HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 89: The Netherlands HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 90: The Netherlands HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 91: The Netherlands HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 92: The Netherlands HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 93: The Netherlands HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 94: The Netherlands HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 95: Asia Pacific HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 96: Asia Pacific HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 97: Asia Pacific HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 98: Asia Pacific HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 99: Asia Pacific HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 100: Asia Pacific HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 101: Asia Pacific HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 102: Asia Pacific HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 103: Asia Pacific HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 104: Asia Pacific HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 105: China HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 106: China HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 107: China HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 108: China HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 109: China HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 110: China HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 111: China HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 112: China HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 113: India HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 114: India HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 115: India HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 116: India HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 117: India HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 118: India HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 119: India HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 120: India HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 121: Japan HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 122: Japan HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 123: Japan HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 124: Japan HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 125: Japan HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 126: Japan HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 127: Japan HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 128: Japan HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 129: Australia HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 130: Australia HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 131: Australia HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 132: Australia HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 133: Australia HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 134: Australia HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 135: Australia HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 136: Australia HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 137: South Korea HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 138: South Korea HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 139: South Korea HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 140: South Korea HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 141: South Korea HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 142: South Korea HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 143: South Korea HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 144: South Korea HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 145: ASEAN HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 146: ASEAN HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 147: ASEAN HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 148: ASEAN HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 149: ASEAN HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 150: ASEAN HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 151: ASEAN HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 152: ASEAN HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 153: Middle East & Africa HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 154: Middle East & Africa HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 155: Middle East & Africa HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 156: Middle East & Africa HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 157: Middle East & Africa HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 158: Middle East & Africa HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 159: Middle East & Africa HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 160: Middle East & Africa HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 161: Middle East & Africa HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 162: Middle East & Africa HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 163: GCC Countries HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 164: GCC Countries HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 165: GCC Countries HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 166: GCC Countries HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 167: GCC Countries HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 168: GCC Countries HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 169: GCC Countries HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 170: GCC Countries HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 171: South Africa HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 172: South Africa HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 173: South Africa HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 174: South Africa HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 175: South Africa HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 176: South Africa HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 177: South Africa HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 178: South Africa HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 179: Latin America HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 180: Latin America HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 181: Latin America HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 182: Latin America HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 183: Latin America HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 184: Latin America HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 185: Latin America HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 186: Latin America HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 187: Latin America HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 188: Latin America HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 189: Brazil HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 190: Brazil HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 191: Brazil HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 192: Brazil HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 193: Brazil HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 194: Brazil HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 195: Brazil HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 196: Brazil HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 197: Argentina HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 198: Argentina HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 199: Argentina HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 200: Argentina HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 201: Argentina HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 202: Argentina HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 203: Argentina HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 204: Argentina HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Table 205: Mexico HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Equipment Type

Table 206: Mexico HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Equipment Type

Table 207: Mexico HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 208: Mexico HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 209: Mexico HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By End-use

Table 210: Mexico HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By End-use

Table 211: Mexico HVAC Equipment Market Value (US$ Bn) Projection, 2020 to 2035 By Distribution Channel

Table 212: Mexico HVAC Equipment Market Volume (Thousand Units) Projection, 2020 to 2035 By Distribution Channel

Figure 1: Global HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 2: Global HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 3: Global HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 4: Global HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 5: Global HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 6: Global HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 7: Global HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 8: Global HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 9: Global HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 10: Global HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 11: Global HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 12: Global HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 13: Global HVAC Equipment Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 14: Global HVAC Equipment Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 15: Global HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 16: North America HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 17: North America HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 18: North America HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 19: North America HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 20: North America HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 21: North America HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 22: North America HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 23: North America HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 24: North America HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 25: North America HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 26: North America HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 27: North America HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 28: North America HVAC Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 29: North America HVAC Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 30: North America HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 31: U.S. HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 32: U.S. HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 33: U.S. HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 34: U.S. HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 35: U.S. HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 36: U.S. HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 37: U.S. HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 38: U.S. HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 39: U.S. HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 40: U.S. HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 41: U.S. HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 42: U.S. HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 43: Canada HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 44: Canada HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 45: Canada HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 46: Canada HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 47: Canada HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 48: Canada HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 49: Canada HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 50: Canada HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 51: Canada HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 52: Canada HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 53: Canada HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 54: Canada HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 55: Europe HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 56: Europe HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 57: Europe HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 58: Europe HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 59: Europe HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 60: Europe HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 61: Europe HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 62: Europe HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 63: Europe HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 64: Europe HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Europe HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 66: Europe HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe HVAC Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 68: Europe HVAC Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 69: Europe HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 70: U.K. HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 71: U.K. HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 72: U.K. HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 73: U.K. HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 74: U.K. HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 75: U.K. HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 76: U.K. HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 77: U.K. HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 78: U.K. HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 79: U.K. HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 80: U.K. HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 81: U.K. HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Germany HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 83: Germany HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 84: Germany HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 85: Germany HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 86: Germany HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 87: Germany HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 88: Germany HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 89: Germany HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 90: Germany HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 91: Germany HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 92: Germany HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 93: Germany HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 94: France HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 95: France HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 96: France HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 97: France HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 98: France HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 99: France HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 100: France HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 101: France HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 102: France HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 103: France HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 104: France HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 105: France HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 106: Italy HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 107: Italy HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 108: Italy HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 109: Italy HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 110: Italy HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 111: Italy HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 112: Italy HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 113: Italy HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 114: Italy HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 115: Italy HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 116: Italy HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 117: Italy HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 118: Spain HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 119: Spain HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 120: Spain HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 121: Spain HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 122: Spain HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 123: Spain HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 124: Spain HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 125: Spain HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 126: Spain HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 127: Spain HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 128: Spain HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 129: Spain HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: The Netherlands HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 131: The Netherlands HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 132: The Netherlands HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 133: The Netherlands HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 134: The Netherlands HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 135: The Netherlands HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 136: The Netherlands HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 137: The Netherlands HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 138: The Netherlands HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 139: The Netherlands HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 140: The Netherlands HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 141: The Netherlands HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 142: Asia Pacific HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 143: Asia Pacific HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 144: Asia Pacific HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 145: Asia Pacific HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 146: Asia Pacific HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 147: Asia Pacific HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 148: Asia Pacific HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 149: Asia Pacific HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 150: Asia Pacific HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 151: Asia Pacific HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 152: Asia Pacific HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 153: Asia Pacific HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 154: Asia Pacific HVAC Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 155: Asia Pacific HVAC Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 156: Asia Pacific HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 157: China HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 158: China HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 159: China HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 160: China HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 161: China HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 162: China HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 163: China HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 164: China HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 165: China HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 166: China HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 167: China HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 168: China HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 169: India HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 170: India HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 171: India HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 172: India HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 173: India HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 174: India HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 175: India HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 176: India HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 177: India HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 178: India HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 179: India HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 180: India HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 181: Japan HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 182: Japan HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 183: Japan HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 184: Japan HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 185: Japan HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 186: Japan HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 187: Japan HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 188: Japan HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 189: Japan HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 190: Japan HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 191: Japan HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 192: Japan HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 193: Australia HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 194: Australia HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 195: Australia HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 196: Australia HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 197: Australia HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 198: Australia HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 199: Australia HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 200: Australia HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 201: Australia HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 202: Australia HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 203: Australia HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 204: Australia HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 205: South Korea HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 206: South Korea HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 207: South Korea HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 208: South Korea HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 209: South Korea HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 210: South Korea HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 211: South Korea HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 212: South Korea HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 213: South Korea HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 214: South Korea HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 215: South Korea HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 216: South Korea HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 217: ASEAN HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 218: ASEAN HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 219: ASEAN HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 220: ASEAN HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 221: ASEAN HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 222: ASEAN HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 223: ASEAN HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 224: ASEAN HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 225: ASEAN HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 226: ASEAN HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 227: ASEAN HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 228: ASEAN HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 229: Middle East & Africa HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 230: Middle East & Africa HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 231: Middle East & Africa HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 232: Middle East & Africa HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 233: Middle East & Africa HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 234: Middle East & Africa HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 235: Middle East & Africa HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 236: Middle East & Africa HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 237: Middle East & Africa HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 238: Middle East & Africa HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 239: Middle East & Africa HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 240: Middle East & Africa HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 241: Middle East & Africa HVAC Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 242: Middle East & Africa HVAC Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 243: Middle East & Africa HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 244: GCC Countries HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 245: GCC Countries HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 246: GCC Countries HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 247: GCC Countries HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 248: GCC Countries HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 249: GCC Countries HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 250: GCC Countries HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 251: GCC Countries HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 252: GCC Countries HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 253: GCC Countries HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 254: GCC Countries HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 255: GCC Countries HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 256: South Africa HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 257: South Africa HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 258: South Africa HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 259: South Africa HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 260: South Africa HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 261: South Africa HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 262: South Africa HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 263: South Africa HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 264: South Africa HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 265: South Africa HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Africa HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Africa HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 268: Latin America HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 269: Latin America HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 270: Latin America HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 271: Latin America HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 272: Latin America HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 273: Latin America HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 274: Latin America HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 275: Latin America HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 276: Latin America HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 277: Latin America HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 278: Latin America HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 279: Latin America HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 280: Latin America HVAC Equipment Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 281: Latin America HVAC Equipment Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 282: Latin America HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 283: Brazil HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 284: Brazil HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 285: Brazil HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 286: Brazil HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 287: Brazil HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 288: Brazil HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 289: Brazil HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 290: Brazil HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 291: Brazil HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 292: Brazil HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 293: Brazil HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 294: Brazil HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 295: Argentina HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 296: Argentina HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 297: Argentina HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 298: Argentina HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 299: Argentina HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 300: Argentina HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 301: Argentina HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 302: Argentina HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 303: Argentina HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 304: Argentina HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 305: Argentina HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 306: Argentina HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 307: Mexico HVAC Equipment Market Value (US$ Bn) Projection, By Equipment Type 2020 to 2035

Figure 308: Mexico HVAC Equipment Market Volume (Thousand Units) Projection, By Equipment Type 2020 to 2035

Figure 309: Mexico HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Equipment Type 2025 to 2035

Figure 310: Mexico HVAC Equipment Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 311: Mexico HVAC Equipment Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 312: Mexico HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 313: Mexico HVAC Equipment Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 314: Mexico HVAC Equipment Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 315: Mexico HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 316: Mexico HVAC Equipment Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 317: Mexico HVAC Equipment Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 318: Mexico HVAC Equipment Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035