Reports

Reports

Analysts’ Viewpoint on Brewery Equipment Market Scenario

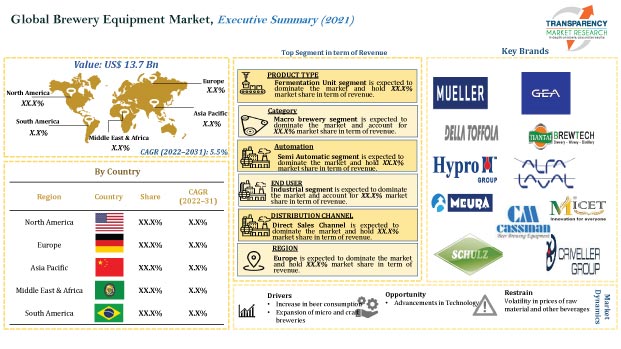

Rise in consumption of beer; increase in demand for brewing equipment from industrial breweries and small businesses; and growth of brewpubs and beer-producing companies are the major factors driving the global brewery equipment market. Companies operating in the brewery equipment market are focusing on customization, design, and automation. Manufacturers should tap into incremental opportunities by focusing on recent trends in the market in order to broaden their revenue streams. Volatility in prices of raw materials such as steel, copper, and aluminum have impacted the margins of manufacturers. Nevertheless, companies need to invest in technologies that can help make better and unique beer.

Brewery equipment refers to various units or equipment used in brewery processing or beer-making companies such as brewpubs and craft breweries. The term ‘brewery’ refers to the process or business of producing beer. Demand for different categories of customized and automated brewery equipment, including micro and macro/industrial breweries, is rising among end-users. Companies in the brewery equipment market are manufacturing equipment using technologies that can enhance efficiency and reduce energy consumption. Innovations in home beer brewing machines, microbrewery equipment, electric brewing systems, home beer brewing kits, and automated brewing systems are creating significant opportunities for market players.

The global brewery equipment market size is estimated to reach a value of US$ 23.3 Bn by the end of 2031, owing to the significant demand from commercial and industrial end-users. Rise in demand for different types of equipment owing to the increase in number of brewpubs and restaurants is also boosting the demand for home brewing equipment and commercial beer brewing equipment. Beer is one of the favorite and most consumed alcoholic beverages around the world. Rise in population in emerging countries and increase in consumption of beer among the millennials are augmenting the brewery industry. This, in turn, is estimated to propel the demand for brewery equipment during the forecast period.

Asia Pacific leads in terms of consumption of beer, while Europe follows the region. China consumes 21.5% of the total beer produced globally, while the U.S. consumes 12.8%. Consumption of beer in Germany Russia, Japan, and the U.K is also high. According to the Brewers Association, the overall U.S. beer volume sales increased by 1% in 2021. In the U.K., a 2.6% increase was witnessed; 2018 recorded the highest consumption in the U.K., in terms of volume, in the last 45 years. This is expected to propel the brewery equipment market during the forecast period.

Microbreweries and brewpubs strengthen the bond with consumers and enhance the loyalty factor by providing an open and friendly atmosphere. According to the Brewers Association, sales of craft beer in the U.S. increased by 8% in terms of volume in 2021, thereby boosting the share held by small and independent brewers in the U.S. beer market to 13.1%. The primary reason for the larger dollar sales increase was the shift back in beer volume from packaged sales to bars and restaurants. Asia Pacific, Europe, and North America are projected to be emerging markets for brewery equipment across the globe. This is anticipated to drive the demand for brewery equipment in these regions during the forecast period.

Out of 9,247 breweries in the U.S., microbreweries and brewpubs accounted for more than 56% share in 2021. Growth of microbreweries and brewpubs has also continued in countries across Europe, especially among smaller craft brewers who produce less than 30,000 barrels. Moreover, microbreweries account for nearly two-thirds of the craft category’s total growth, while sales at brewpubs are also rising. Thus, overall growth of the breweries market is expected to propel the brewery equipment market during the forecast period.

In terms of product type, the fermentation unit segment is estimated to hold major share of the brewery equipment market during the forecast period. The fermentation unit segment is likely to grow at a prominent CAGR owing to the rise in usage of fermentation tanks for a longer period during the brewing process. After the brewing and mashing process, the wort is kept in the fermentation tank for a long period for the fermentation process. The chances of tank deterioration increase due to the release of acid. This is projected to drive the need for fermenters and consequently boost the fermentation tank segment during the forecast period. Additionally, advancement of technology in equipment and customization of equipment are expected to fuel the fermentation unit segment during the forecast period.

In terms of end-use industry, the global brewery equipment market has been bifurcated into commercial and industrial. The commercial end-use industry segment includes pubs, bars, restaurants, and hotels. Demand for commercial brewing equipment is rising across the globe. The commercial segment is estimated to grow at a notable CAGR during the forecast period owing to the increase in population, standard of living, and the number of pubs, bars, etc. The industrial segment includes large manufacturers of beer. The industrial segment held major share of the brewery equipment market in 2021.

Europe is projected to hold major share of the global brewery equipment market during the forecast period. This can be ascribed to the rise in consumption and production of beer in Europe and growth of the beer industry in the region. Europe is home to around 10,000 breweries, and the region follows Asia Pacific in terms of consumption of beer. In terms of country, the U.S. is a major market for brewery equipment. The U.S. is home to around 9964 breweries. Additionally, after China, the U.S. is a major consumer and producer of beer.

The global brewery equipment market is fragmented, with the presence of numerous players. Competition is expected to intensify in the next few years due to the entry of several local players. Manufacturers in the brewery equipment market are also focusing on the advancement of technology and entering into partnerships with small businesses such as pubs, craft breweries, and industrial breweries (large beer manufacturers). Several brewery equipment suppliers are focusing on catering to the demands of customers according to the latest trends of customization in products. Key players operating in the global brewery equipment market include Alfa Laval, Brewtech, Tiantai, Criveller Group, Della Toffola, GEA Group, Hypro Group, Jinan Cassman Machinery Co., Ltd., Kaspar Schulz, Meura, Micet, and Paul Mueller.

Each of these players has been profiled in the brewery equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 13.7 Bn |

|

Market Forecast Value in 2031 |

US$ 23.3 Bn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Technology Overview, Standard and Regulations, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, Macro-Economic factors and key supplier analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The brewery equipment market stood at US$ 13.7 Bn in 2021

The brewery equipment market is expected to reach US$ 23.3 Bn by 2031

The brewery equipment market is estimated to grow at a CAGR of 5.5% by 2031

Rise in consumption of beer and growth of the brewery industry are key factors boosting the brewery equipment market

The fermentation unit segment accounted for 42.38% share of the brewery equipment market in 2021

Europe is a more attractive region for vendors in the brewery equipment market

Alfa Laval, Brewtech, Tiantai, Criveller Group, Della Toffola, GEA Group, Hypro Group, Jinan Cassman Machinery Co., Ltd., Kaspar Schulz, Meura, Micet, and Paul Mueller.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Brewery Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Technology Overview

5.9. Standard and Regulations

5.10. Covid-19 Impact Analysis

5.11. Global Brewery Equipment Market Analysis and Forecast, 2017‒2031

5.11.1. Market Value Projections (US$ Bn)

5.11.2. Market Volume Projections (Million Units)

6. Global Brewery Equipment Market Analysis and Forecast, by Product Type

6.1. Global Brewery Equipment Market Size (US$ Bn and Million Units), by Product Type, 2017‒2031

6.1.1. Fermentation Unit

6.1.2. BrewHouse Unit

6.1.3. Filtration System

6.1.4. Maturation Unit

6.1.5. Others

6.2. Incremental Opportunity, by Product Type

7. Global Brewery Equipment Market Analysis and Forecast, by Category

7.1. Global Brewery Equipment Market Size (US$ Bn and Million Units), by Category, 2017‒2031

7.1.1. Nano/Micro Brewery

7.1.2. Macro /Industrial Brewery

7.2. Incremental Opportunity, by Category

8. Global Brewery Equipment Market Analysis and Forecast, by Automation

8.1. Global Brewery Equipment Market Size (US$ Bn and Million Units), by Automation, 2017‒2031

8.1.1. Manual

8.1.2. Automatic

8.1.3. Semi-Automatic

8.2. Incremental Opportunity, by Automation

9. Global Brewery Equipment Market Analysis and Forecast, by Distribution Channel

9.1. Global Brewery Equipment Market Size (US$ Bn and Million Units), by Distribution Channel, 2017‒2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, by Distribution Channel

10. Global Brewery Equipment Market Analysis and Forecast, Region

10.1. Global Brewery Equipment Market Size (US$ Bn and Million Units), by Region, 2017‒2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Brewery Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trends Analysis

11.3. Macro-Economic Factors

11.4. Key Supplier Analysis

11.5. Price Trend Analysis

11.5.1. Weighted Average Selling Price (US$)

11.6. Brewery Equipment Market Size (US$ Bn and Million Units), by Product Type, 2017‒2031

11.6.1. Fermentation Unit

11.6.2. BrewHouse Unit

11.6.3. Filtration System

11.6.4. Maturation Unit

11.6.5. Others

11.7. Brewery Equipment Market Size (US$ Bn and Million Units), by Category, 2017‒2031

11.7.1. Nano/Micro Brewery

11.7.2. Macro /industrial Brewery

11.8. Brewery Equipment Market Size (US$ Bn and Million Units), by Automation, 2017‒2031

11.8.1. Manual

11.8.2. Automatic

11.8.3. Semi-Automatic

11.9. Brewery Equipment Market Size (US$ Bn and Million Units), by End-user, 2017‒2031

11.9.1. Commercial

11.9.2. Industrial

11.10. Brewery Equipment Market Size (US$ Bn and Million Units), by Distribution Channel, 2017‒2031

11.10.1. Direct Sales

11.10.2. Indirect Sales

11.11. Brewery Equipment Market Size (US$ Bn and Million Units), by Country & Sub-region, 2017‒2031

11.11.1. U.S.

11.11.2. Canada

11.11.3. Rest of North America

11.12. Incremental Opportunity Analysis

12. Europe Brewery Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trends Analysis

12.3. Macro-Economic Factors

12.4. Key Supplier Analysis

12.5. Price Trend Analysis

12.5.1. Weighted Average Selling Price (US$)

12.6. Brewery Equipment Market Size (US$ Bn and Million Units), by Product Type, 2017‒2031

12.6.1. Fermentation Unit

12.6.2. BrewHouse Unit

12.6.3. Filtration System

12.6.4. Maturation Unit

12.6.5. Others

12.7. Brewery Equipment Market Size (US$ Bn and Million Units), by Category, 2017‒2031

12.7.1. Nano/Micro Brewery

12.7.2. Macro /industrial Brewery

12.8. Brewery Equipment Market Size (US$ Bn and Million Units), by Automation, 2017‒2031

12.8.1. Manual

12.8.2. Automatic

12.8.3. Semi-Automatic

12.9. Brewery Equipment Market Size (US$ Bn and Million Units), by End-user, 2017‒2031

12.9.1. Commercial

12.9.2. Industrial

12.10. Brewery Equipment Market Size (US$ Bn and Million Units), by Distribution Channel, 2017‒2031

12.10.1. Direct Sales

12.10.2. Indirect Sales

12.11. Brewery Equipment Market Size (US$ Bn and Million Units), by Country & Sub-region, 2017‒2031

12.11.1. U.K.

12.11.2. Germany

12.11.3. France

12.11.4. Rest of Europe

12.12. Incremental Opportunity Analysis

13. Asia Pacific Brewery Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trends Analysis

13.3. Macro-Economic Factors

13.4. Key Supplier Analysis

13.5. Price Trend Analysis

13.5.1. Weighted Average Selling Price (US$)

13.6. Brewery Equipment Market Size (US$ Bn and Million Units), by Product Type, 2017‒2031

13.6.1. Fermentation Unit

13.6.2. BrewHouse Unit

13.6.3. Filtration System

13.6.4. Maturation Unit

13.6.5. Others

13.7. Brewery Equipment Market Size (US$ Bn and Million Units), by Category, 2017‒2031

13.7.1. Nano/Micro Brewery

13.7.2. Macro /industrial Brewery

13.8. Brewery Equipment Market Size (US$ Bn and Million Units), by Automation, 2017‒2031

13.8.1. Manual

13.8.2. Automatic

13.8.3. Semi-Automatic

13.9. Brewery Equipment Market Size (US$ Bn and Million Units), by End-user, 2017‒2031

13.9.1. Commercial

13.9.2. Industrial

13.10. Brewery Equipment Market Size (US$ Bn and Million Units), by Distribution Channel, 2017‒2031

13.10.1. Direct Sales

13.10.2. Indirect Sales

13.11. Brewery Equipment Market Size (US$ Bn and Million Units), by Country & Sub-region, 2017‒2031

13.11.1. China

13.11.2. India

13.11.3. Japan

13.11.4. Rest of Asia Pacific

13.12. Incremental Opportunity Analysis

14. Middle East & Africa Brewery Equipment Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trends Analysis

14.3. Macro-Economic Factors

14.4. Key Supplier Analysis

14.5. Price Trend Analysis

14.5.1. Weighted Average Selling Price (US$)

14.6. Brewery Equipment Market Size (US$ Bn and Million Units), by Product Type, 2017‒2031

14.6.1. Fermentation Unit

14.6.2. BrewHouse Unit

14.6.3. Filtration System

14.6.4. Maturation Unit

14.6.5. Others

14.7. Brewery Equipment Market Size (US$ Bn and Million Units), by Category, 2017‒2031

14.7.1. Nano/Micro Brewery

14.7.2. Macro /industrial Brewery

14.8. Brewery Equipment Market Size (US$ Bn and Million Units), by Automation, 2017‒2031

14.8.1. Manual

14.8.2. Automatic

14.8.3. Semi-Automatic

14.9. Brewery Equipment Market Size (US$ Bn and Million Units), by End-user, 2017‒2031

14.9.1. Commercial

14.9.2. Industrial

14.10. Brewery Equipment Market Size (US$ Bn and Million Units), by Distribution Channel, 2017‒2031

14.10.1. Direct Sales

14.10.2. Indirect Sales

14.11. Brewery Equipment Market Size (US$ Bn and Million Units), by Country & Sub-region, 2017‒2031

14.11.1. GCC

14.11.2. South Africa

14.11.3. Rest of Middle East & Africa

14.12. Incremental Opportunity Analysis

15. South America Brewery Equipment Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Trends Analysis

15.3. Macro-Economic Factors

15.4. Key Supplier Analysis

15.5. Price Trend Analysis

15.5.1. Weighted Average Selling Price (US$)

15.6. Brewery Equipment Market Size (US$ Bn and Million Units), by Product Type, 2017‒2031

15.6.1. Fermentation Unit

15.6.2. BrewHouse Unit

15.6.3. Filtration System

15.6.4. Maturation Unit

15.6.5. Others

15.7. Brewery Equipment Market Size (US$ Bn and Million Units), by Category, 2017‒2031

15.7.1. Nano/Micro Brewery

15.7.2. Macro /industrial Brewery

15.8. Brewery Equipment Market Size (US$ Bn and Million Units), by Automation, 2017‒2031

15.8.1. Manual

15.8.2. Automatic

15.8.3. Semi-Automatic

15.9. Brewery Equipment Market Size (US$ Bn and Million Units), by End-user, 2017‒2031

15.9.1. Commercial

15.9.2. Industrial

15.10. Brewery Equipment Market Size (US$ Bn and Million Units), by Distribution Channel, 2017‒2031

15.10.1. Direct Sales

15.10.2. Indirect Sales

15.11. Brewery Equipment Market Size (US$ Bn and Million Units), by Country & Sub-region, 2017‒2031

15.11.1. Brazil

15.11.2. Rest of South America

15.12. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), 2021

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

16.3.1. Alfa Laval

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Financial/Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Sales Channel Analysis

16.3.1.6. Size Portfolio

16.3.2. Brewtech, Tiantai

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Financial/Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Sales Channel Analysis

16.3.2.6. Size Portfolio

16.3.3. Criveller Group

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Financial/Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Sales Channel Analysis

16.3.3.6. Size Portfolio

16.3.4. Della Toffola

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Financial/Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Sales Channel Analysis

16.3.4.6. Size Portfolio

16.3.5. GEA Group

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Financial/Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Sales Channel Analysis

16.3.5.6. Size Portfolio

16.3.6. Hypro Group

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Financial/Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Sales Channel Analysis

16.3.6.6. Size Portfolio

16.3.7. Jinan Cassman Machinery Co., Ltd.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Financial/Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Sales Channel Analysis

16.3.7.6. Size Portfolio

16.3.8. Kaspar Schulz

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Financial/Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Sales Channel Analysis

16.3.8.6. Size Portfolio

16.3.9. Meura

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Financial/Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Sales Channel Analysis

16.3.9.6. Size Portfolio

16.3.10. Micet

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Financial/Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Sales Channel Analysis

16.3.10.6. Size Portfolio

16.3.11. Paul Mueller

16.3.11.1. Company Overview

16.3.11.2. Sales Area/Geographical Presence

16.3.11.3. Financial/Revenue

16.3.11.4. Strategy & Business Overview

16.3.11.5. Sales Channel Analysis

16.3.11.6. Size Portfolio

17. Key Takeaway

17.1. Identification of Potential Market Spaces

17.1.1. Product Type

17.1.2. Category

17.1.3. Automation

17.1.4. End-user

17.1.5. Distribution Channel

17.1.6. Region

17.2. Understanding the Buying Process of the Customers

17.3. Preferred Sales and Marketing Strategies

List of Tables

Table 1: Global Brewery Equipment Market by Product Type, Million Units 2017‒2031

Table 2: Global Brewery Equipment Market by Product Type, US$ Bn 2017‒2031

Table 3: Global Brewery Equipment Market by Category, Million Units 2017‒2031

Table 4: Global Brewery Equipment Market by Category, US$ Bn 2017‒2031

Table 5: Global Brewery Equipment Market by Automation, Million Units 2017‒2031

Table 6: Global Brewery Equipment Market by Automation, US$ Bn 2017‒2031

Table 7: Global Brewery Equipment Market by End-user, Million Units, 2017‒2031

Table 8: Global Brewery Equipment Market by End-user, US$ Bn 2017‒2031

Table 9: Global Brewery Equipment Market by Distribution Channel, Million Units, 2017‒2031

Table 10: Global Brewery Equipment Market by Distribution Channel, US$ Bn 2017‒2031

Table 11: Global Brewery Equipment Market by Region, Million Units, 2017‒2031

Table 12: Global Brewery Equipment Market by Region, US$ Bn 2017‒2031

Table 13: North America Brewery Equipment Market by Product Type, Million Units, 2017‒2031

Table 14: North America Brewery Equipment Market by Product Type, US$ Bn 2017‒2031

Table 15: North America Brewery Equipment Market by Category, Million Units 2017‒2031

Table 16: North America Brewery Equipment Market by Category, US$ Bn 2017‒2031

Table 17: North America Brewery Equipment Market by Automation, Million Units 2017‒2031

Table 18: North America Brewery Equipment Market by Automation, US$ Bn 2017‒2031

Table 19: North America Brewery Equipment Market by End-user, Million Units, 2017‒2031

Table 20: North America Brewery Equipment Market by End-user, Million Units, 2017‒2031

Table 21: North America Brewery Equipment Market by Distribution Channel, US$ Bn 2017‒2031

Table 22: North America Brewery Equipment Market by Distribution Channel, US$ Bn 2017‒2031

Table 23: North America Brewery Equipment Market by Country & Sub-region, US$ Bn 2017‒2031

Table 24: North America Brewery Equipment Market by Country & Sub-region, US$ Bn 2017‒2031

Table 25: Europe Brewery Equipment Market by Product Type, Million Units, 2017‒2031

Table 26: Europe Brewery Equipment Market by Product Type, US$ Bn 2017‒2031

Table 27: Europe Brewery Equipment Market by Category, Million Units 2017‒2031

Table 28: Europe Brewery Equipment Market by Category, US$ Bn 2017‒2031

Table 29: Europe Brewery Equipment Market by Automation, Million Units 2017‒2031

Table 30: Europe Brewery Equipment Market by Automation, US$ Bn 2017‒2031

Table 31: Europe Brewery Equipment Market by End-user, Million Units, 2017‒2031

Table 32: Europe Brewery Equipment Market by End-user, US$ Bn 2017‒2031

Table 33: Europe Brewery Equipment Market by Distribution Channel, Million Units, 2017‒2031

Table 34: Europe Brewery Equipment Market by Distribution Channel, US$ Bn 2017‒2031

Table 35: Europe Brewery Equipment Market by Country & Sub-region, Million Units, 2017‒2031

Table 36: Europe Brewery Equipment Market by Country & Sub-region, US$ Bn 2017‒2031

Table 37: Asia-Pacific Brewery Equipment Market by Product Type, Million Units, 2017‒2031

Table 38: Asia-Pacific Brewery Equipment Market by Product Type, US$ Bn 2017‒2031

Table 39: Asia-Pacific Brewery Equipment Market by Category, Million Units 2017‒2031

Table 40: Asia-Pacific Brewery Equipment Market by Category, US$ Bn 2017‒2031

Table 41: Asia-Pacific Brewery Equipment Market by Automation, Million Units 2017‒2031

Table 42: Asia-Pacific Brewery Equipment Market by Automation, US$ Bn 2017‒2031

Table 43: Asia-Pacific Brewery Equipment Market by End-user, Million Units, 2017‒2031

Table 44: Asia-Pacific Brewery Equipment Market by End-user, US$ Bn 2017‒2031

Table 45: Asia-Pacific Brewery Equipment Market by Distribution Channel, Million Units, 2017‒2031

Table 46: Asia-Pacific Brewery Equipment Market by Distribution Channel, US$ Bn 2017‒2031

Table 47: Asia-Pacific Brewery Equipment Market by Country & Sub-region, Million Units, 2017‒2031

Table 48: Asia-Pacific Brewery Equipment Market by Country & Sub-region, US$ Bn 2017‒2031

Table 49: Middle East & Africa Brewery Equipment Market by Product Type, Million Units, 2017‒2031

Table 50: Middle East & Africa Brewery Equipment Market by Product Type, US$ Bn 2017‒2031

Table 51: Middle East & Africa Brewery Equipment Market by Category, Million Units 2017‒2031

Table 52: Middle East & Africa Brewery Equipment Market by Category, US$ Bn 2017‒2031

Table 53: Middle East & Africa Brewery Equipment Market by Automation, Million Units 2017‒2031

Table 54: Middle East & Africa Brewery Equipment Market by Automation, US$ Bn 2017‒2031

Table 55: Middle East & Africa Brewery Equipment Market by End-user, Million Units, 2017‒2031

Table 56: Middle East & Africa Brewery Equipment Market by End-user, US$ Bn 2017‒2031

Table 57: Middle East & Africa Brewery Equipment Market by Distribution Channel, Million Units, 2017‒2031

Table 58: Middle East & Africa Brewery Equipment Market by Distribution Channel, US$ Bn 2017‒2031

Table 59: Middle East & Africa Brewery Equipment Market by Country, Million Units, 2017‒2031

Table 60: Middle East & Africa Brewery Equipment Market by Country, US$ Bn 2017‒2031

Table 61: South America Brewery Equipment Market by Product Type, Million Units, 2017‒2031

Table 62: South America Brewery Equipment Market by Product Type, US$ Bn 2017‒2031

Table 63: South America Brewery Equipment Market by Category, Million Units 2017‒2031

Table 64: South America Brewery Equipment Market by Category, US$ Bn 2017‒2031

Table 65: South America Brewery Equipment Market by Automation, Million Units 2017‒2031

Table 66: South America Brewery Equipment Market by Automation, US$ Bn 2017‒2031

Table 67: South America Brewery Equipment Market by End-user, Million Units, 2017‒2031

Table 68: South America Brewery Equipment Market by End-user, US$ Bn 2017‒2031

Table 69: South America Brewery Equipment Market by Distribution Channel, Million Units, 2017‒2031

Table 70: South America Brewery Equipment Market by Distribution Channel, US$ Bn 2017‒2031

Table 71: South America Brewery Equipment Market by Country & Sub-region, Million Units, 2017‒2031

Table 72: South America Brewery Equipment Market by Country, & Sub-region US$ Bn 2017‒2031

List of Figures

Figure 1: Global Brewery Equipment Market Projections, by Product Type, Million Units 2017‒2031

Figure 2: Global Brewery Equipment Market Projections, by Product Type, US$ Bn 2017‒2031

Figure 3: Global Brewery Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2021‒2031

Figure 4: Global Brewery Equipment Market Projections, by Category, Million Units 2017‒2031

Figure 5: Global Brewery Equipment Market Projections, by Category, US$ Bn 2017‒2031

Figure 6: Global Brewery Equipment Market, Incremental Opportunity, by Category, US$ Bn 2021‒2031

Figure 7: Global Brewery Equipment Market Projections, by Automation, Million Units 2017‒2031

Figure 8: Global Brewery Equipment Market Projections, by Automation, US$ Bn 2017‒2031

Figure 9: Global Brewery Equipment Market, Incremental Opportunity, by Automation, US$ Bn 2021‒2031

Figure 10: Global Brewery Equipment Market Projections, by End-user, Million Units, 2017‒2031

Figure 11: Global Brewery Equipment Market Projections, by End-user, US$ Bn 2017‒2031

Figure 12: Global Brewery Equipment Market, Incremental Opportunity, by End-user, US$ Bn 2021‒2031

Figure 13: Global Brewery Equipment Market Projections, by Distribution Channel, Million Units, 2017‒2031

Figure 14: Global Brewery Equipment Market Projections, by Distribution Channel, US$ Bn 2017‒2031

Figure 15: Global Brewery Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2021‒2031

Figure 16: Global Brewery Equipment Market Projections, by Region, Million Units, 2017‒2031

Figure 17: Global Brewery Equipment Market Projections, by Region, US$ Bn 2017‒2031

Figure 18: Global Brewery Equipment Market, Incremental Opportunity, by Region, US$ Bn 2021‒2031

Figure 19: North America Brewery Equipment Market Projections, by Product Type, Million Units, 2017‒2031

Figure 20: North America Brewery Equipment Market Projections, by Product Type, US$ Bn 2017‒2031

Figure 21: North America Brewery Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2021‒2031

Figure 22: North America Brewery Equipment Market Projections, by Category, Million Units 2017‒2031

Figure 23: North America Brewery Equipment Market Projections, by Category, US$ Bn 2017‒2031

Figure 24: North America Brewery Equipment Market, Incremental Opportunity, by Category, US$ Bn 2021‒2031

Figure 25: North America Brewery Equipment Market Projections, by Automation, Million Units 2017‒2031

Figure 26: North America Brewery Equipment Market Projections, by Automation, US$ Bn 2017‒2031

Figure 27: North America Brewery Equipment Market, Incremental Opportunity, by Automation, US$ Bn 2021‒2031

Figure 28: North America Brewery Equipment Market Projections, by End-user, Million Units, 2017‒2031

Figure 29: North America Brewery Equipment Market Projections, by End-user, US$ Bn 2017‒2031

Figure 30: North America Brewery Equipment Market, Incremental Opportunity, by End-user, US$ Bn 2021‒2031

Figure 31: North America Brewery Equipment Market Projections, by Distribution Channel, Million Units, 2017‒2031

Figure 32: North America Brewery Equipment Market Projections, by Distribution Channel, US$ Bn 2017‒2031

Figure 33: North America Brewery Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2021‒2031

Figure 34: North America Brewery Equipment Market Projections, by Country, Million Units, 2017‒2031

Figure 35: North America Brewery Equipment Market Projections, by Country, US$ Bn 2017‒2031

Figure 36: North America Brewery Equipment Market, Incremental Opportunity, by Country, US$ Bn 2021‒2031

Figure 37: Europe Brewery Equipment Market Projections, by Product Type, Million Units, 2017‒2031

Figure 38: Europe Brewery Equipment Market Projections, by Product Type, US$ Bn 2017‒2031

Figure 39: Europe Brewery Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2021‒2031

Figure 40: Europe Brewery Equipment Market Projections, by Category, Million Units 2017‒2031

Figure 41: Europe Brewery Equipment Market Projections, by Category, US$ Bn 2017‒2031

Figure 42: Europe Brewery Equipment Market, Incremental Opportunity, by Category, US$ Bn 2021‒2031

Figure 43: Europe Brewery Equipment Market Projections, by Automation, Million Units 2017‒2031

Figure 44: Europe Brewery Equipment Market Projections, by Automation, US$ Bn 2017‒2031

Figure 45: Europe Brewery Equipment Market, Incremental Opportunity, by Automation, US$ Bn 2021‒2031

Figure 46: Europe Brewery Equipment Market Projections, by End-user, Million Units, 2017‒2031

Figure 47: Europe Brewery Equipment Market Projections, by End-user, US$ Bn 2017‒2031

Figure 48: Europe Brewery Equipment Market, Incremental Opportunity, by End-user, US$ Bn 2021‒2031

Figure 49: Europe Brewery Equipment Market Projections, by Distribution Channel, Million Units, 2017‒2031

Figure 50: Europe Brewery Equipment Market Projections, by Distribution Channel, US$ Bn 2017‒2031

Figure 51: Europe Brewery Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2021‒2031

Figure 52: Europe Brewery Equipment Market Projections, by Country & Sub-region, Million Units, 2017‒2031

Figure 53: Europe Brewery Equipment Market Projections, by Country & Sub-region, US$ Bn 2017‒2031

Figure 54: Europe Brewery Equipment Market, Incremental Opportunity, by Country & Sub-region, US$ Bn 2021‒2031

Figure 55: Asia-Pacific Brewery Equipment Market Projections, by Product Type, Million Units, 2017‒2031

Figure 56: Asia-Pacific Brewery Equipment Market Projections, by Product Type, US$ Bn 2017‒2031

Figure 57: Asia-Pacific Brewery Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2021‒2031

Figure 58: Asia-Pacific Brewery Equipment Market Projections, by Category, Million Units 2017‒2031

Figure 59: Asia-Pacific Brewery Equipment Market Projections, by Category, US$ Bn 2017‒2031

Figure 60: Asia-Pacific Brewery Equipment Market, Incremental Opportunity, by Category, US$ Bn 2021‒2031

Figure 61: Asia-Pacific Brewery Equipment Market Projections, by Automation, Million Units 2017‒2031

Figure 62: Asia-Pacific Brewery Equipment Market Projections, by Automation, US$ Bn 2017‒2031

Figure 63: Asia-Pacific Brewery Equipment Market, Incremental Opportunity, by Automation, US$ Bn 2021‒2031

Figure 64: Asia-Pacific Brewery Equipment Market Projections, by End-user, Million Units, 2017‒2031

Figure 65: Asia-Pacific Brewery Equipment Market Projections, by End-user, US$ Bn 2017‒2031

Figure 66: Asia-Pacific Brewery Equipment Market, Incremental Opportunity, by End-user, US$ Bn 2021‒2031

Figure 67: Asia-Pacific Brewery Equipment Market Projections, by Distribution Channel, Million Units, 2017‒2031

Figure 68: Asia-Pacific Brewery Equipment Market Projections, by Distribution Channel, US$ Bn 2017‒2031

Figure 69: Asia-Pacific Brewery Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2021‒2031

Figure 70: Asia-Pacific Brewery Equipment Market Projections, by Country & Sub-region, Million Units, 2017‒2031

Figure 71: Asia-Pacific Brewery Equipment Market Projections, by Country & Sub-region, US$ Bn 2017‒2031

Figure 72: Asia-Pacific Brewery Equipment Market, Incremental Opportunity, by Country & Sub-region, US$ Bn 2021‒2031

Figure 73: Middle East & Africa Brewery Equipment Market Projections, by Product Type, Million Units, 2017‒2031

Figure 74: Middle East & Africa Brewery Equipment Market Projections, by Product Type, US$ Bn 2017‒2031

Figure 75: Middle East & Africa Brewery Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2021‒2031

Figure 76: Middle East & Africa Brewery Equipment Market Projections, by Category, Million Units 2017‒2031

Figure 77: Middle East & Africa Brewery Equipment Market Projections, by Category, US$ Bn 2017‒2031

Figure 78: Middle East & Africa Brewery Equipment Market, Incremental Opportunity, by Category, US$ Bn 2021‒2031

Figure 79: Middle East & Africa Brewery Equipment Market Projections, by Automation, Million Units 2017‒2031

Figure 80: Middle East & Africa Brewery Equipment Market Projections, by Automation, US$ Bn 2017‒2031

Figure 81: Middle East & Africa Brewery Equipment Market, Incremental Opportunity, by Automation, US$ Bn 2021‒2031

Figure 82: Middle East & Africa Brewery Equipment Market Projections, by End-user, Million Units, 2017‒2031

Figure 83: Middle East & Africa Brewery Equipment Market Projections, by End-user, US$ Bn 2017‒2031

Figure 84: Middle East & Africa Brewery Equipment Market, Incremental Opportunity, by End-user, US$ Bn 2021‒2031

Figure 85: Middle East & Africa Brewery Equipment Market Projections, by Distribution Channel, Million Units, 2017‒2031

Figure 86: Middle East & Africa Brewery Equipment Market Projections, by Distribution Channel, US$ Bn 2017‒2031

Figure 87: Middle East & Africa Brewery Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2021‒2031

Figure 88: Middle East & Africa Brewery Equipment Market Projections, by Country & Sub-region, Million Units, 2017‒2031

Figure 89: Middle East & Africa Brewery Equipment Market Projections, by Country & Sub-region, US$ Bn 2017‒2031

Figure 90: Middle East & Africa Brewery Equipment Market, Incremental Opportunity, by Country & Sub-region, US$ Bn 2021‒2031

Figure 91: South America Brewery Equipment Market Projections, by Product Type, Million Units, 2017‒2031

Figure 92: South America Brewery Equipment Market Projections, by Product Type, US$ Bn 2017‒2031

Figure 93: South America Brewery Equipment Market, Incremental Opportunity, by Product Type, US$ Bn 2021‒2031

Figure 94: South America Brewery Equipment Market Projections, by Category, Million Units 2017‒2031

Figure 95: South America Brewery Equipment Market Projections, by Category, US$ Bn 2017‒2031

Figure 96: South America Brewery Equipment Market, Incremental Opportunity, by Category, US$ Bn 2021‒2031

Figure 97: South America Brewery Equipment Market Projections, by Automation, Million Units 2017‒2031

Figure 98: South America Brewery Equipment Market Projections, by Automation, US$ Bn 2017‒2031

Figure 99: South America Brewery Equipment Market, Incremental Opportunity, by Automation, US$ Bn 2021‒2031

Figure 100: South America Brewery Equipment Market Projections, by End-user, Million Units, 2017‒2031

Figure 101: South America Brewery Equipment Market Projections, by End-user, US$ Bn 2017‒2031

Figure 102: South America Brewery Equipment Market, Incremental Opportunity, by End-user, US$ Bn 2021‒2031

Figure 103: South America Brewery Equipment Market Projections, by Distribution Channel, Million Units, 2017‒2031

Figure 104: South America Brewery Equipment Market Projections, by Distribution Channel, US$ Bn 2017‒2031

Figure 105: South America Brewery Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2021‒2031

Figure 106: South America Brewery Equipment Market Projections, by Country & Sub-region, Million Units, 2017‒2031

Figure 107: South America Brewery Equipment Market Projections, by Country & Sub-region, US$ Bn 2017‒2031

Figure 108: South America Brewery Equipment Market, Incremental Opportunity, by Country & Sub-region, US$ Bn 2021‒2031