Reports

Reports

Analysts’ Viewpoint on Breast Tissue Markers Market Scenario

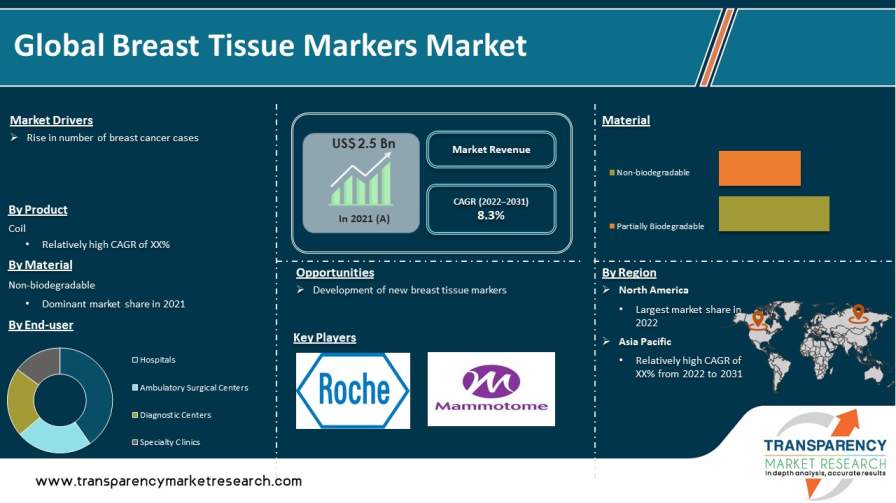

Rise in number of breast cancer cases has compelled governments across the world to spread awareness about the importance of early detection of breast cancer. This is expected to drive global breast tissue markers market size in the next few years. Breast tissue markers give the surgeon an advantage in identifying and marking the biopsy area with a physical tag, allowing him to diagnose and operate more effectively. A standard stainless steel marker is used in the traditional method. More advanced breast tissue markers, such as partially bio-absorbable and mineral-based markers, are used to ensure complete patient satisfaction. Key players in the market are launching new tissue marker breast biopsy products to enhance their market share. Increase in adoption of tissue markers is likely to augment the global breast tissue markers market growth in the near future.

Breast tissue markers are commonly used in mammography diagnostic imaging. Typically, these are implanted just after a percutaneous biopsy under ultrasonic or stereotactic guidelines. On follow-up imaging, these can be extremely helpful in identifying relatively harmless regions or shrinking/treated malignant lesions. Breast tissue markers are now available in various shapes, compositions, and partially bio-absorbable components. Ribbon, coil, and wing markers with easily distinguishable appearances on mammograms are among the makers currently in use. New ultrasound-detectable markers are also available in the market. Breast tissue markers can be used to guide subsequent radiotherapy treatments with clips inserted prior to surgery (localization wire targets).

In a biopsy procedure, a metal clip with a 3 mm diameter is commonly used as a radio marker so that the lesion can be clearly identified on subsequent imaging inspection. A metal clip marker remains in the breast indefinitely. This is a significant disadvantage. Therefore, most women refuse to have a biopsy. This is exacerbated when a patient has had numerous breast biopsies and much more than a metal clip marker is implanted to differentiate abnormal lesions on a mammography. Furthermore, metal clips migrate away from the biopsy insertion site after deployment. Another disadvantage of metal markers is that they cause issues during MRI because of changes in the local magnetic field caused by the implants' ferromagnetic, paramagnetic, and diamagnetic properties. This could reduce MRI's sensitivity for breast cancer detection and treatment monitoring. Therefore, biodegradable breast tissue markers are being developed as implants in the breast biopsy market. These biodegradable breast biopsy markers have the potential to serve as visual markers for breast tumor growth regions for the required follow-up period, such as six months, before being completely eliminated from the body.

Regional government authorities are launching breast cancer awareness and screening programs to reduce the mortality rates associated with breast cancer. Breast cancer therapeutics are becoming more effective in the treatment of the disease, with more than 90% survival probabilities, especially when the disease is detected early. According to the World Health Organization, around 2.3 million new cases of breast cancer and 685,000 deaths were recorded globally in 2020. Breast cancer has been diagnosed in 7.8 million women in the previous five years ending 2020, making it the world's most common cancer.

Initiation of breast cancer awareness campaigns by public organizations is expected to encourage breast cancer learning and breast cancer therapeutic applications. The National Breast Cancer Foundation launched ‘October as Breast Cancer Awareness Month,’ a campaign to increase awareness about the dangers of breast cancer. Such efforts are expected to encourage recently diagnosed breast cancer patients, thereby driving the global market.

Breast biopsies are typically used to diagnose breast cancer, but these can also be used to screen for other diseases discovered during a physical examination. Breast biopsies are commonly performed using fine needle aspiration biopsy, which is one of the least invasive procedures available. It also does not leave any scarring. A needle is inserted through the dermal tissue of the breast to remove tissue. Another technique, known as stereotactic needle biopsy in combination with a mammogram, guides this same biopsy with ultrasound radiation. The ultrasound tracker directs the needle to the chosen place in the breast during treatment. Stereotactic mammography is a method that employs images taken from different vantage points to identify the site of a malignant tumor in addition to the placement of the needle used to acquire a breast biopsy sample. Thus, breast marker is a small titanium or stainless steel marker the size of a sesame seed. Breast biopsy markers are used to pinpoint the location of the breast tissue removed during a biopsy procedure.

In terms of product, the global breast tissue markers market has been classified into coil, ribbon, bowtie, butterfly, bowtie, U shape, and others. Coil breast tissue markers are commonly used in partially biodegradable breast tissue markers. These breast tissue markers help a surgeon diagnose and operate more effectively by identifying and marking the biopsy area with a physical tag. Furthermore, mergers and acquisitions are projected to drive the coil segment in the near future. For instance, Mammotome announced the launch of a new product line of flexible HydroMARK Breast Biopsy Site Marker applicators designed to improve the clinician's user experience. The new applicator line expands compatibility with leading vacuum-assisted breast biopsy systems, bringing the HydroMARK markers to more customers in more clinical settings.

Based on material, the global breast tissue markers market has been bifurcated into partially biodegradable and non-biodegradable. Non-biodegradable clips are made up of titanium, with no absorbable PVA polymer pellet or other materials. Titanium is widely used in breast tissue markers. The breast tissue markers market is focusing on end-user education and training. Several companies operating in the global market are providing their products at reasonable prices.

In terms of end-user, the global breast tissue markers market has been divided into hospitals, ambulatory surgical centers, diagnostic centers, and specialty clinics. Increasing number of patients are seeking hospitals that provide patient-centered care. In other words, these hospitals establish a reputation of offering patients high-quality care, giving them a competitive edge over institutions that continue to rely on outdated practices. Overall decrease in hospital care expenses is also projected to drive the hospitals segment during the forecast period.

North America accounted for major share of around 40.0% of the global breast tissue markers market in 2021. According to the breast tissue markers market forecast, the region is anticipated to dominate the global breast tissue markers market in the next few years owing to the presence of major players, established diagnostic & screening infrastructure, technological advancements, high patient awareness, and favorable reimbursement policies. The prevalence of breast cancer is rising in North America. This has increased the usage of advanced diagnostic techniques in the region. The market in North America is expected to be driven by expanding healthcare infrastructure and favorable reimbursement policies in the region. Increase in disposable income, rapid urbanization, improved health care infrastructure, and distribution and partnership strategies adopted by key players are also propelling the market in the region.

The breast tissue markers market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to the surge in incidence of breast cancer and adoption of advanced diagnostic techniques in the region. Furthermore, rise in healthcare infrastructure and improving reimbursement guidelines are likely to augment the market in Asia Pacific.

The global breast tissue markers market is consolidated, with the presence of a small number of leading players. Most of the companies are investing significantly in R&D activities, primarily to introduce advanced breast tissue markers such as BioZorb tissue markers. Key players are engaging in strategic alliances to increase revenue and market share. Furthermore, diversification of product portfolios and mergers & acquisitions are the major strategies adopted by the players. Mammotome, BD, Hologic, Inc., Carbon Medical Technologies, Inc., Scion Medical Technologies, LLC, Mermaid Medical, and SOMATEX Medical Technologies GmbH are prominent players operating in the global breast tissue markers market.

Each of these players has been profiled in the breast tissue markers market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 2.5 Bn |

|

Market Forecast Value in 2031 |

More than US$ 5.8 Bn |

|

Growth Rate (CAGR) |

8.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global breast tissue markers market was valued at US$ 2.5 Bn in 2021

The global breast tissue markers market is projected to reach more than US$ 5.8 Bn by 2031

The global breast tissue markers market is anticipated to grow at a CAGR of 8.3% from 2022 to 2031

Rise in number of breast cancer cases is driving the global breast tissue markers market

The non-biodegradable segment held more than 57% share of the global breast tissue markers market in 2021

Mammotome, BD, Hologic, Inc., Carbon Medical Technologies, Inc., Scion Medical Technologies, LLC, Mermaid Medical, and SOMATEX Medical Technologies GmbH

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Breast Tissue Markers Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Breast Tissue Markers Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Key product/brand Analysis

5.2. Pipeline Analysis

5.3. Side Effects of Breast Tissue Markers

5.4. Patents

5.5. Key Mergers & Acquisitions

5.6. Pricing Analysis

5.7. Application of Clip Markers (outside mammography)

5.8. Breast Tissue Markers used per case

5.9. Disease Prevalence & Incidence Rate globally with key countries

5.10. COVID 19 Impact Analysis

6. Global Breast Tissue Markers Market Analysis and Forecast, By Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Coil

6.3.2. Ribbon

6.3.3. Bowtie

6.3.4. Butterfly

6.3.5. Wing

6.3.6. U Shape

6.3.7. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Breast Tissue Markers Market Analysis and Forecast, By Material

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market ValueForecast, by Material, 2017 - 2031

7.3.1. Non-biodegradable

7.3.2. Partially Biodegradable

7.4. Market Attractiveness Analysis, by Material

8. Global Breast Tissue Markers Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Ambulatory Surgical Centers

8.3.3. Diagnostic Centers

8.3.4. Specialty Clinics

8.4. Market Attractiveness Analysis, by End-user

9. Global Breast Tissue Markers Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

10. North America Breast Tissue Markers Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017 - 2031

10.2.1. Coil

10.2.2. Ribbon

10.2.3. Bowtie

10.2.4. Butterfly

10.2.5. Wing

10.2.6. U shape

10.2.7. Others

10.3. Market Value Forecast, by Material, 2017 - 2031

10.3.1. Non-biodegradable

10.3.2. Partially Biodegradable

10.4. Market Value Forecast, by End-user, 2017 - 2031

10.4.1. Hospitals

10.4.2. Ambulatory Surgical Centers

10.4.3. Diagnostic Centers

10.4.4. Specialty Clinics

10.5. Market Value Forecast, by Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Material

10.6.3. By End-user

10.6.4. By Country

11. Europe Breast Tissue Markers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017 - 2031

11.2.1. Coil

11.2.2. Ribbon

11.2.3. Bowtie

11.2.4. Butterfly

11.2.5. Wing

11.2.6. U shape

11.2.7. Others

11.3. Market Value Forecast, by Material, 2017 - 2031

11.3.1. Non-biodegradable

11.3.2. Partially Biodegradable

11.4. Market Value Forecast, by End-user, 2017 - 2031

11.4.1. Hospitals

11.4.2. Ambulatory Surgical Centers

11.4.3. Diagnostic Centers

11.4.4. Specialty Clinics

11.5. Market Value Forecast, by Country/Sub-region, 2017 - 2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Material

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Latin America Breast Tissue Markers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017 - 2031

12.2.1. Coil

12.2.2. Ribbon

12.2.3. Bowtie

12.2.4. Butterfly

12.2.5. Wing

12.2.6. U shape

12.2.7. Others

12.3. Market Value Forecast, by Material, 2017 - 2031

12.3.1. Non-biodegradable

12.3.2. Partially Biodegradable

12.4. Market Value Forecast, by End-user, 2017 - 2031

12.4.1. Hospitals

12.4.2. Ambulatory Surgical Centers

12.4.3. Diagnostic Centers

12.4.4. Specialty Clinics

12.5. Market Value Forecast, by Country/Sub-region, 2017 - 2031

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By Degree of Cooling

12.6.4. By Country/Sub-region

13. Middle East & Africa Breast Tissue Markers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017 - 2031

13.2.1. Coil

13.2.2. Ribbon

13.2.3. Bowtie

13.2.4. Butterfly

13.2.5. Wing

13.2.6. U shape

13.2.7. Others

13.3. Market Value Forecast, by Material, 2017 - 2031

13.3.1. Non-biodegradable

13.3.2. Partially Biodegradable

13.4. Market Value Forecast, by End-user, 2017 - 2031

13.4.1. Hospitals

13.4.2. Ambulatory Surgical Centers

13.4.3. Diagnostic Centers

13.4.4. Specialty Clinics

13.5. Market Value Forecast, by Country/Sub-region, 2017 - 2031

13.5.1. GCC Countries

13.5.2. South Africa

13.5.3. Rest of Middle East & Africa

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By Degree of Cooling

13.6.4. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2018

14.3. Company Profiles

14.3.1. Mammotome

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Company Financials

14.3.1.3. Growth Strategies

14.3.1.4. SWOT Analysis

14.3.2. BD

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Company Financials

14.3.2.3. Growth Strategies

14.3.2.4. SWOT Analysis

14.3.3. Hologic, Inc.

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Company Financials

14.3.3.3. Growth Strategies

14.3.3.4. SWOT Analysis

14.3.4. Carbon Medical Technologies, Inc.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Company Financials

14.3.4.3. Growth Strategies

14.3.4.4. SWOT Analysis

14.3.5. Scion Medical Technologies, LLC

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Company Financials

14.3.5.3. Growth Strategies

14.3.5.4. SWOT Analysis

14.3.6. Mermaid Medical

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Company Financials

14.3.6.3. Growth Strategies

14.3.6.4. SWOT Analysis

14.3.7. SOMATEX Medical Technologies GmbH

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Company Financials

14.3.7.3. Growth Strategies

14.3.7.4. SWOT Analysis

List of Tables

Table 01: Global Breast Tissue Markers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Breast Tissue Markers Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 03: Global Breast Tissue Markers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Breast Tissue Markers Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Breast Tissue Markers Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Breast Tissue Markers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 07: North America Breast Tissue Markers Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 08: North America Breast Tissue Markers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Breast Tissue Markers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Breast Tissue Markers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 11: Europe Breast Tissue Markers Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 12: Europe Breast Tissue Markers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Breast Tissue Markers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Breast Tissue Markers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Asia Pacific Breast Tissue Markers Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 16: Asia Pacific Breast Tissue Markers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Breast Tissue Markers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Breast Tissue Markers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Latin America Breast Tissue Markers Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 20: Latin America Breast Tissue Markers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Breast Tissue Markers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Breast Tissue Markers Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Middle East & Africa Breast Tissue Markers Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 24: Middle East & Africa Breast Tissue Markers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 1: Global Breast Tissue Markers Market, by Product, 2021 and 2031

Figure 2: Global Breast Tissue Markers Market Attractiveness Analysis, by Product, 2022–2031

Figure 3: Global Breast Tissue Markers Market (US$ Mn), by Coil, 2017–2031

Figure 4: Global Breast Tissue Markers Market (US$ Mn), by Ribbon, 2017–2031

Figure 5: Global Breast Tissue Markers Market (US$ Mn), by Bowtie, 2017–2031

Figure 6: Global Breast Tissue Markers Market (US$ Mn), by Butterfly, 2017–2031

Figure 7: Global Breast Tissue Markers Market (US$ Mn), by Wing, 2017–2031

Figure 8: Global Breast Tissue Markers Market (US$ Mn), by U shape, 2017–2031

Figure 9: Global Breast Tissue Markers Market (US$ Mn), by Others, 2017–2031

Figure 10: Global Breast Tissue Markers Market, by Material, 2021 and 2031

Figure 11: Global Breast Tissue Markers Market Attractiveness Analysis, by Product, 2022–2031

Figure 12: Global Breast Tissue Markers Market (US$ Mn), by Partially Biodegradable, 2017–2031

Figure 13: Global Breast Tissue Markers Market (US$ Mn), by Non-biodegradable, 2017–2031

Figure 14: Global Breast Tissue Markers Market, by End-user, 2021 and 2031

Figure 15: Global Breast Tissue Markers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 16: Global Breast Tissue Markers Market (US$ Mn), by Hospitals, 2017–2031

Figure 17: Global Breast Tissue Markers Market (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 18: Global Breast Tissue Markers Market (US$ Mn), by Diagnostic Centers, 2017–2031

Figure 19: Global Breast Tissue Markers Market (US$ Mn), by Specialty Clinics, 2017–2031

Figure 20: Global Breast Tissue Markers Market Value Share Analysis, by Region, 2021 and 2031

Figure 21: Global Breast Tissue Markers Market Attractiveness Analysis, by Region, 2022–2031

Figure 22: North America Breast Tissue Markers Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: North America Breast Tissue Markers Market Value Share Analysis, by Country, 2021 and 2031

Figure 24: North America Breast Tissue Markers Market Attractiveness Analysis, by Country, 2022–2031

Figure 25: North America Breast Tissue Markers Market, by Product, 2021 and 2031

Figure 26: North America Breast Tissue Markers Market Attractiveness Analysis, by Product, 2022–2031

Figure 27: North America Breast Tissue Markers Market, by Material, 2021 and 2031

Figure 28: North America Breast Tissue Markers Market Attractiveness Analysis, by Material, 2022–2031

Figure 29: North America Breast Tissue Markers Market, by End-user, 2021 and 2031

Figure 30: North America Breast Tissue Markers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 31: Europe Breast Tissue Markers Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: Europe Breast Tissue Markers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 33: Europe Breast Tissue Markers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 34: Europe Breast Tissue Markers Market, by Product, 2021 and 2031

Figure 35: Europe Breast Tissue Markers Market Attractiveness Analysis, by Product, 2022–2031

Figure 36: Europe Breast Tissue Markers Market, by Material, 2021 and 2031

Figure 37: Europe Breast Tissue Markers Market Attractiveness Analysis, by Material, 2022–2031

Figure 38: Europe Breast Tissue Markers Market, by End-user, 2021 and 2031

Figure 39: Europe Breast Tissue Markers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 40: Asia Pacific Breast Tissue Markers Market Value (US$ Mn) Forecast, 2017–2031

Figure 41: Asia Pacific Breast Tissue Markers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 42: Asia Pacific Breast Tissue Markers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Asia Pacific Breast Tissue Markers Market, by Product, 2021 and 2031

Figure 44: Asia Pacific Breast Tissue Markers Market Attractiveness Analysis, by Product, 2022–2031

Figure 45: Asia Pacific Breast Tissue Markers Market, by Material, 2021 and 2031

Figure 46: Asia Pacific Breast Tissue Markers Market Attractiveness Analysis, by Material, 2022–2031

Figure 47: Asia Pacific Breast Tissue Markers Market, by End-user, 2021 and 2031

Figure 48: Asia Pacific Breast Tissue Markers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 49: Latin America Breast Tissue Markers Market Value (US$ Mn) Forecast, 2017–2031

Figure 50: Latin America Breast Tissue Markers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 51: Latin America Breast Tissue Markers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 52: Latin America Breast Tissue Markers Market, by Product, 2021 and 2031

Figure 53: Latin America Breast Tissue Markers Market Attractiveness Analysis, by Product, 2022–2031

Figure 54: Latin America Breast Tissue Markers Market, by Material, 2021 and 2031

Figure 55: Latin America Breast Tissue Markers Market Attractiveness Analysis, by Material, 2022–2031

Figure 56: Latin America Breast Tissue Markers Market, by End-user, 2021 and 2031

Figure 57: Latin America Breast Tissue Markers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 58: Middle East & Africa Breast Tissue Markers Market Value (US$ Mn) Forecast, 2017–2031

Figure 59: Middle East & Africa Breast Tissue Markers Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 60: Middle East & Africa Breast Tissue Markers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 61: Middle East & Africa Breast Tissue Markers Market, by Product, 2021 and 2031

Figure 62: Middle East & Africa Breast Tissue Markers Market Attractiveness Analysis, by Product, 2022–2031

Figure 63: Middle East & Africa Breast Tissue Markers Market, by Material, 2021 and 2031

Figure 64: Middle East & Africa Breast Tissue Markers Market Attractiveness Analysis, by Material, 2022–2031

Figure 65: Middle East & Africa Breast Tissue Markers Market, by End-user, 2021 and 2031

Figure 66: Middle East & Africa Breast Tissue Markers Market Attractiveness Analysis, by End-user, 2022–2031