Reports

Reports

Analyst Viewpoint

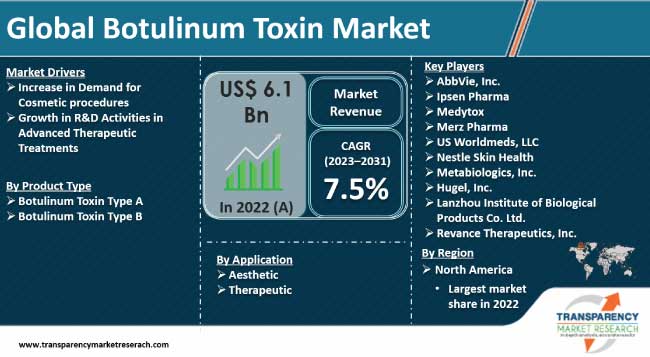

Increase in demand for cosmetic procedures and growth in R&D activities in advanced therapeutic treatments are propelling the botulinum toxin market size. Botulinum toxin is utilized in major cosmetic surgeries to reduce wrinkles and fine lines. Growth in popularity of non-invasive cosmetic surgeries among people is also fostering market progress. Technological advancements in the drug development industry enable manufacturers to revise their existing product range and enhance their product portfolio.

Leading players in the market are collaborating with healthcare organizations to increase awareness about their products and drive product sales. Moreover, stringent regulations are prompting manufacturers to focus on innovative drug development, which in turn is expected to positively influence the botulinum toxin market forecast in the next few years.

Botulinum toxin or botulinum neurotoxin, called botox, is a highly potent neurotoxic protein produced by the bacterium clostridium botulinum and related species. Botulinum toxin is a medication used to manage and treat therapeutic and cosmetic purposes. Medicinal uses include chronic migraine, spastic disorders, cervical dystonia, and detrusor hyperactivity. Botulinum toxin injections are shots that use a toxin to prevent a muscle from moving for a limited time. These shots are often employed to smooth wrinkles on the face, treat neck spasms, reduce sweating, treat an overactive bladder, lazy eye, and other conditions.

Innovations in botulinum toxin delivery systems are ensuring safety by using natural composition to seek approval from the U.S. Food and Drug Administration. The seven main types of botulinum toxin are named types A, B, C1, C2, D, E, F, and G. Botulinum toxin type A is purified and used to block acetylcholine release in the treatment of chronic sialorrhea, muscle spasticity, and dystonia, as well as in cosmetic applications.

Botulinum toxin products are considerably more expensive, as compared to other options available in the market. Furthermore, use of botulinum toxin can cause adverse reactions, such as swelling, headache, flu-like symptoms, in some individuals. These side-effects may hamper the quality of life of the patient. Moreover, botulinum toxin products are not covered by most insurance plans or government programs, which may limit the accessibility and affordability of these products for several patients. These factors are estimated to hamper the botulinum toxin market demand in the near future.

Botulinum toxin is majorly used to reduce wrinkles and fine lines, as it blocks certain nerve signals that contract muscles. Growing consciousness about appearance among consumers is driving the demand for non-surgical rejuvenation. Thus, rise in demand for cosmetic procedures is fostering the botulinum toxin market value. Growth in the popularity of Botox treatments among people in the entertainment sector is driving the demand for aesthetic cosmetic procedures. Moreover, easy availability of these treatments is propelling market statistics.

According to the data published by The Aesthetic Society, surgical procedures increased by 54% and non-surgical procedures were up 44%. Body procedures increased more than any other section (+63%), led by jumps in liposuction procedures (+66%) and abdominoplasties (+49%). The average plastic surgeon performed 320 surgical procedures in 2021, as compared to 220 in 2020.

Rise in the adoption of non-invasive procedures in the cosmetics sector is fueling the botulinum toxin market development. Non-invasive cosmetic surgeries have fewer incisions, minimal pain, rapid recovery, and natural-looking results. Moreover, rise in geriatric population is driving the demand for non-invasive procedures.

Skin peels, automated pen microneedling, mesotherapy, and dermaplaning are some of the advanced therapies adopted in cosmetology. Increase in investments in research and development activities to incorporate various botulinum toxin products, such as dysport, botox, and xeomin in cosmetic surgeries is fueling the botulinum toxin industry size. Moreover, growth in the adoption of advanced treatments for chemical browlift, glabellar lines, and forehead lines is driving the demand for botulinum toxin.

Rise in skin concerns, including early aging, skin peeling, acne, and dry skin due to pollution and changing dietary habits is propelling the botulinum toxin industry growth. Pollution and lack of nutritious diet can cause skin issues, leading to early signs of aging.

As per the latest botulinum toxin market insights, North America dominated the global market in 2022. Increase in awareness about non-surgical aesthetic and therapeutic procedures and easy availability of treatments is likely to propel the botulinum toxin industry share in the next few years. Rise in product launches by companies and growth in regulatory approvals for drugs are driving market expansion.

For instance, according to the International Society of Aesthetic Plastic Surgery, approximately 2,520,000 botulinum toxin procedures were performed in the U.S. in 2021. Increase in adoption of advanced therapies in cosmetology is driving the demand for botulinum toxin.

Leading companies in the botulinum toxin industry are launching new products with advanced technologies and seeking regulatory approvals to improve their product portfolio. They are investing in R&D to analyze current trends in the market in order to develop products accordingly. Manufacturers of botulinum toxin are entering into partnerships with healthcare organizations to promote their products and boost revenues.

Some of the leading companies in the industry are AbbVie, Inc., Ipsen Pharma, Medytox, Merz Pharma, US Worldmeds, LLC, Nestle Skin Health, Metabiologics, Inc., Hugel, Inc., Lanzhou Institute of Biological Products Co. Ltd., and Revance Therapeutics, Inc.

Key players in the botulinum toxin market report have been profiled based on various parameters such as company overview, financial overview, business segments, product portfolio, business strategies, and key developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 6.1 Bn |

| Market Forecast (Value) in 2031 | US$ 11.5 Bn |

| Growth Rate (CAGR) | 7.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global market was valued at US$ 6.1 Bn in 2022

It is projected to expand at a CAGR of 7.5% from 2023 to 2031

Increase in demand for cosmetic procedures and growth in R&D activities in advanced therapeutic treatments

North America was the most lucrative region in 2022

AbbVie, Inc., Ipsen Pharma, Medytox, Merz Pharma, US Worldmeds, LLC, Nestle Skin Health, Metabiologics, Inc., Hugel, Inc., Lanzhou Institute of Biological Products Co. Ltd., and Revance Therapeutics, Inc.

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Botulinum Toxin Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Botulinum Toxin Market Analysis and Forecasts, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. COVID-19 Pandemic Impact on Industry

6. Botulinum Toxin Market Analysis and Forecast, by Product Type

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Botulinum Toxin Type A

6.3.2. Botulinum Toxin Type B

6.4. Market Attractiveness, by Product Type

7. Global Botulinum Toxin Market Analysis and Forecast, by Application

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Aesthetic

7.3.2. Therapeutic

7.4. Market Attractiveness, by Application

8. Global Botulinum Toxin Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Botulinum Toxin Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product Type, 2017–2031

9.2.1. Botulinum Toxin Type A

9.2.2. Botulinum Toxin Type B

9.3. Market Value Forecast, by Application, 2017–2031

9.3.1. Aesthetic

9.3.2. Therapeutic

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product Type

9.5.2. By Application

9.5.3. By Country

10. Europe Botulinum Toxin Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Botulinum Toxin Type A

10.2.2. Botulinum Toxin Type B

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Aesthetic

10.3.2. Therapeutic

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product Type

10.5.2. By Application

10.5.3. By Country/Sub-region

11. Asia Pacific Botulinum Toxin Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Botulinum Toxin Type A

11.2.2. Botulinum Toxin Type B

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Aesthetic

11.3.2. Therapeutic

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product Type

11.5.2. By Application

11.5.3. By Country/Sub-region

12. Latin America Botulinum Toxin Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Botulinum Toxin Type A

12.2.2. Botulinum Toxin Type B

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Aesthetic

12.3.2. Therapeutic

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product Type

12.5.2. By Application

12.5.3. By Country/Sub-region

13. Middle East & Africa Botulinum Toxin Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Botulinum Toxin Type A

13.2.2. Botulinum Toxin Type B

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Aesthetic

13.3.2. Therapeutic

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product Type

13.5.2. By Application

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. AbbVie, Inc.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Ipsen Pharma

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Medytox

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Merz Pharma

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. US Worldmeds, LLC

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Nestle Skin Health

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Metabiologics, Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Hugel, Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Lanzhou Institute of Biological Products Co. Ltd.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Revance Therapeutic, Inc.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

List of Tables

Table 01: Global Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 02: Global Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Botulinum Toxin Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 05: North America Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 06: North America Botulinum Toxin Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 08: Europe Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 09: Europe Botulinum Toxin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Asia Pacific Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: Asia Pacific Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Asia Pacific Botulinum Toxin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Latin America Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 14: Latin America Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Latin America Botulinum Toxin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Middle East & Africa Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 17: Middle East & Africa Botulinum Toxin Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 18: Middle East & Africa Botulinum Toxin Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Botulinum Toxin Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Botulinum Toxin Market Value Share Analysis, by Application 2022 and 2031

Figure 03: Global Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 04: Global Botulinum Toxin Market Value Share Analysis, by Application, 2022 and 2031

Figure 05: Global Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 06: Global Botulinum Toxin Market Value Share Analysis, by Region, 2022 and 2031

Figure 07: Global Botulinum Toxin Market Attractiveness Analysis, by Region, 2023–2031

Figure 08: North America Botulinum Toxin Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: North America Botulinum Toxin Market Value Share Analysis, by Application, 2022 and 2031

Figure 10: North America Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 11: North America Botulinum Toxin Market Value Share Analysis, by Application, 2022 and 2031

Figure 12: North America Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 13: North America Botulinum Toxin Market Value Share Analysis, by Country, 2022 and 2031

Figure 14: North America Botulinum Toxin Market Attractiveness Analysis, by Country, 2023–2031

Figure 15: Europe Botulinum Toxin Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Europe Botulinum Toxin Market Value Share Analysis, by Application, 2022 and 2031

Figure 17: Europe Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 18: Europe Botulinum Toxin Market Value Share Analysis, by Application, 2022 and 2031

Figure 19: Europe Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 20: Europe Botulinum Toxin Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21: Europe Botulinum Toxin Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 22: Asia Pacific Botulinum Toxin Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Asia Pacific Botulinum Toxin Market Value Share Analysis, by Application 2022 and 2031

Figure 24: Asia Pacific Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 25: Asia Pacific Botulinum Toxin Market Value Share Analysis, by Application, 2022 and 2031

Figure 26: Asia Pacific Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 27: Asia Pacific Botulinum Toxin Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Asia Pacific Botulinum Toxin Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Latin America Botulinum Toxin Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Latin America Botulinum Toxin Market Value Share Analysis, by Application, 2022 and 2031

Figure 31: Latin America Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 32: Latin America Botulinum Toxin Market Value Share Analysis, by Application, 2022 and 2031

Figure 33: Latin America Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 34: Latin America Botulinum Toxin Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Latin America Botulinum Toxin Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Middle East & Africa Botulinum Toxin Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Middle East & Africa Botulinum Toxin Market Value Share Analysis, by Application, 2022 and 2031

Figure 38: Middle East & Africa Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 39: Middle East & Africa Botulinum Toxin Market Value Share Analysis, by Application, 2022 and 2031

Figure 40: Middle East & Africa Botulinum Toxin Market Attractiveness Analysis, by Application, 2023–2031

Figure 41: Middle East & Africa Botulinum Toxin Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Middle East & Africa Botulinum Toxin Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Global Botulinum Toxin Market Share Analysis, by Company, 2022