Reports

Reports

The global blood testing market is driven by several dynamics: the growing rates of chronic and infectious disease including diabetes, cardiovascular disease, and cancer, increase in aging population, and the rising interest in preventive and personalized medicine. At the same time, new technologies such as point‑of‑care (POC) devices, automated technologies, lab‑on‑a‑chip, and artificial intelligence (AI) are creating access to diagnostics on-demand, and revolutionizing the speed and accuracy with which testing can be performed.

Nevertheless, there are some key constraints to the blood testing market, including the high cost of advanced testing technologies, complicated, burdensome regulatory requirements and processes, limited access to operational testing in resource-poor developing countries, shortages of trained workforce, and issues with reliability of test results.

Despite the above-mentioned constraints, there are multiple market opportunities in the form of home testing, remote and telehealth, innovative markers and companion diagnostics, access to emerging markets, and increased collaboration amongst manufacturers and technology companies, health system providers, and research institutions to foster Future Innovation and scale

Blood testing is often used in healthcare where the blood is tested for a variety of purposes including being used to monitor one’s overall health and some health conditions, and also to monitor treatments that include blood tests. Blood tests are part of routine health screenings. They are used to check organ function and immune system activity, to diagnose chronic diseases like diabetes, and to help prevent complications from surgery. Needing a blood test doesn't necessarily mean that healthcare provider suspects something is wrong. In many cases, blood tests are used to confirm that person’s health is stable.

| Attribute | Detail |

|---|---|

|

Market Drivers |

|

The rising prevalence of chronic diseases is expected to boost the blood testing market during the forecast period due to higher demand for regular diagnostics, and monitoring and early detection through blood tests. Blood tests play a crucial role in identifying biomarkers, monitoring disease progression, and aiding treatment plans, and thus are regarded as essential tools to make the optimal diagnostic options available both in the hospital or outpatient settings. For instance, as per an article published by National Center for Biotechnology Information in January 2024, 2,001,140 new cancer cases and 611,720 cancer deaths were projected to occur in the U.S. in 2024 alone. Moreover, as per the data published by International Diabetes Federation in 2025, 589 million adults globally had diabetes, with a predicted global incidence of 11% of adults in 2024..= Furthermore, the escalating aging population globally, who are more vulnerable to chronic diseases, increases the need for routine blood testing. Due to this growing demand, healthcare and diagnostic providers are investing in innovative blood-testing options such as point-of-care testing and lab-based assays that process high volumes, advancing the expansion of the market

Rapid technological advancements are expected to boost the blood testing market by improving the speed, accuracy, availability, and breadth of diagnostics. Innovative advancements such as point-of-care (POC) testing devices, lab-on-a-chip technologies, automated analyzers, and AI-equipped platforms are making the industry's conventional blood testing much more patient-centric, and helping people in processing testing faster.

These technologies are transforming every aspect of blood testing and reducing turnaround from days to minutes, which greatly improves clinical outcomes by allowing for quicker clinical decisions. Liquid biopsies, molecular diagnostics, and next-generation sequencing (NGS) are ushering in a new era of early diagnosis of diseases such as cancers and genetic disorders through more non-invasive methods as well. The coupling of digital health and cloud computing solutions is enabling remote monitoring, real-time communication, and better engagement with patients.

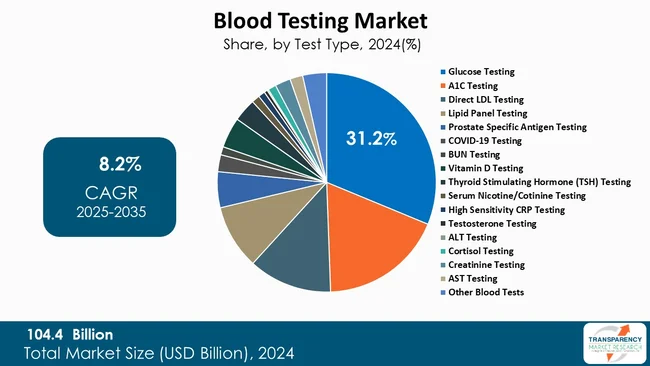

Glucose testing categorized by the variety of testing options (i.e. blood glucose test strips, glucose tolerance tests, etc.) is driving the blood testing market as it is crucial for the management of diabetes and the early detection of disease in both - clinical and self-monitoring scenarios.

Technologies demonstrating ease of use, such as needle-free devices and real time monitoring systems, are widely accepted by users as they align with patients' preferred approach - patient convenience and the ability to manage blood glucose levels without intervention. In addition, the digital health trends, regulatory landscape, and ongoing product development have supported clinical use, directly encouraging glucose testing to remain the leader of all the blood test types through continued use

| Attribute | Detail |

|---|---|

| Leading Region |

|

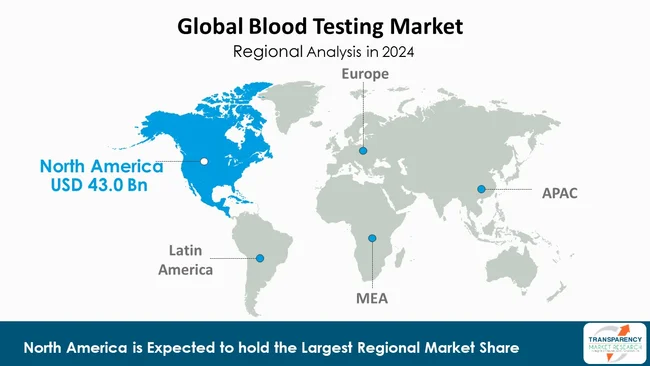

North America is dominating the blood testing market. This is due to multiple reasons; North America possesses a developed health system infrastructure, high public health awareness, high reimbursement policies that give patients more access to state-of-the-art diagnostic services. The presence of large market players and their respective reagent kits and lab significant ease availability to blood testing.

The increasing awareness of early disease detection and regular health screening will drive demand for blood tests in North America. Furthermore, the development in blood testing technology, and focus on management of chronic diseases encourages both - the demand for blood-testing as well as the blood-testing market's activity and an innovative environment

The high CAGR in the Asia-Pacific blood testing industry is mainly attributed to a combination of rising healthcare demands, technological advancements, and evolving public health initiatives. A significant rise in the incidences of chronic and infectious diseases such as diabetes, cardiovascular diseases, and cancer, and bloodstream infections has caused increased demand for early diagnosis and accurate diagnostics. Additionally, rapid urbanization and increasing access of healthcare many governments of countries in the Asia-Pacific region are investing in more prominent diagnostic infrastructure to support public health has created market opportunities

Abbott, F. Hoffmann-La Roche AG, Thermo Fisher Scientific Inc., Bio‑Rad Laboratories, BIOMÉRIEUX, Quest Diagnostics, Grifols, S.A, Sysmex Corporation, Guardant Health, GRAIL, Inc., Everlywell, Freenome Holdings, Inc., Hologic, Inc., Trinity Biotech are the key players governing the global blood testing market.

Each of these players has been profiled in the blood testing industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

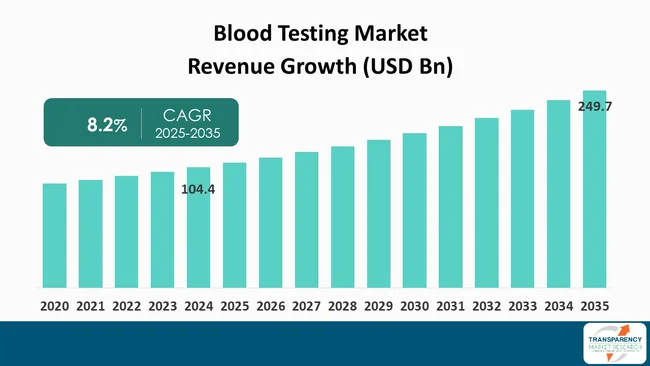

| Size in 2024 | US$ 104.4Bn |

| Forecast Value in 2035 | More than US$ 249.7 Bn |

| CAGR | 8.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Test Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 104.4 Bn in 2024

It is projected to cross US$ 249.7 Bn by the end of 2035

Rising prevalence of chronic diseases, rapid technological advancements, and expansion of home-based and remote testing platforms

It is anticipated to grow at a CAGR of 8.2% from 2025 to 2035

North America blood testing industry is expected to account for the largest share from 2025 to 2035

Abbott, F. Hoffmann-La Roche AG, Thermo Fisher Scientific Inc., Bio‑Rad Laboratories, BIOMÉRIEUX, Quest Diagnostics, Grifols, S.A, Sysmex Corporation, Guardant Health, GRAIL, Inc., Everlywell, Freenome Holdings, Inc., Hologic, Inc., Trinity Biotech, and others

Table 01: Global Blood Testing Market Value (US$ Bn) Forecast, By Test Type, 2020 to 2035

Table 02: Global Blood Testing Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 03: Global Blood Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 04: Global Blood Testing Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America Blood Testing Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 06: North America Blood Testing Market Value (US$ Bn) Forecast, By Test Type, 2020 to 2035

Table 07: North America Blood Testing Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 08: North America Blood Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 09: Europe Blood Testing Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 10: Europe Blood Testing Market Value (US$ Bn) Forecast, By Test Type, 2020 to 2035

Table 11: Europe Blood Testing Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 12: Europe Blood Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Asia Pacific Blood Testing Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 14: Asia Pacific Blood Testing Market Value (US$ Bn) Forecast, By Test Type, 2020 to 2035

Table 15: Asia Pacific Blood Testing Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 16: Asia Pacific Blood Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 17: Latin America Blood Testing Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 18: Latin America Blood Testing Market Value (US$ Bn) Forecast, By Test Type, 2020 to 2035

Table 19: Latin America Blood Testing Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 20: Latin America Blood Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Middle East & Africa Blood Testing Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Middle East & Africa Blood Testing Market Value (US$ Bn) Forecast, By Test Type, 2020 to 2035

Table 23: Middle East & Africa Blood Testing Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 24: Middle East & Africa Blood Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Blood Testing Market Value Share Analysis, By Test Type, 2024 and 2035

Figure 02: Global Blood Testing Market Attractiveness Analysis, By Test Type, 2025 to 2035

Figure 03: Global Blood Testing Market Revenue (US$ Bn), by Glucose Testing, 2020 to 2035

Figure 04: Global Blood Testing Market Revenue (US$ Bn), by A1C Testing, 2020 to 2035

Figure 05: Global Blood Testing Market Revenue (US$ Bn), by Direct LDL Testing, 2020 to 2035

Figure 06: Global Blood Testing Market Revenue (US$ Bn), by Lipid Panel Testing, 2020 to 2035

Figure 07: Global Blood Testing Market Revenue (US$ Bn), by Prostate Specific Antigen Testing, 2020 to 2035

Figure 08: Global Blood Testing Market Revenue (US$ Bn), by COVID-19 Testing, 2020 to 2035

Figure 09: Global Blood Testing Market Revenue (US$ Bn), by BUN Testing, 2020 to 2035

Figure 10: Global Blood Testing Market Revenue (US$ Bn), by Vitamin D Testing, 2020 to 2035

Figure 11: Global Blood Testing Market Revenue (US$ Bn), by Thyroid Stimulating Hormone (TSH) Testing, 2020 to 2035

Figure 12: Global Blood Testing Market Revenue (US$ Bn), by Serum Nicotine/Cotinine Testing, 2020 to 2035

Figure 13: Global Blood Testing Market Revenue (US$ Bn), by High Sensitivity CRP Testing, 2020 to 2035

Figure 14: Global Blood Testing Market Revenue (US$ Bn), by Testosterone Testing, 2020 to 2035

Figure 15: Global Blood Testing Market Revenue (US$ Bn), by ALT Testing, 2020 to 2035

Figure 16: Global Blood Testing Market Revenue (US$ Bn), by Cortisol Testing, 2020 to 2035

Figure 17: Global Blood Testing Market Revenue (US$ Bn), by Creatinine Testing, 2020 to 2035

Figure 18: Global Blood Testing Market Revenue (US$ Bn), by AST Testing, 2020 to 2035

Figure 19: Global Blood Testing Market Revenue (US$ Bn), by Other Blood Tests, 2020 to 2035

Figure 20: Global Blood Testing Market Value Share Analysis, by Method, 2024 and 2035

Figure 21: Global Blood Testing Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 22: Global Blood Testing Market Revenue (US$ Bn), by Manual Blood Testing, 2020 to 2035

Figure 23: Global Blood Testing Market Revenue (US$ Bn), by Automated Blood Testing, 2020 to 2035

Figure 24: Global Blood Testing Market Value Share Analysis, by End-user, 2024 and 2035

Figure 25: Global Blood Testing Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 26: Global Blood Testing Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 27: Global Blood Testing Market Revenue (US$ Bn), by Diagnostic Centers , 2020 to 2035

Figure 28: Global Blood Testing Market Revenue (US$ Bn), by Research Laboratories , 2020 to 2035

Figure 29: Global Blood Testing Market Revenue (US$ Bn), by Others , 2020 to 2035

Figure 30: Global Blood Testing Market Value Share Analysis, By Region, 2024 and 2035

Figure 31: Global Blood Testing Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 32: North America Blood Testing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 33: North America Blood Testing Market Value Share Analysis, by Country, 2024 and 2035

Figure 34: North America Blood Testing Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 35: North America Blood Testing Market Value Share Analysis, By Test Type, 2024 and 2035

Figure 36: North America Blood Testing Market Attractiveness Analysis, By Test Type, 2025 to 2035

Figure 37: North America Blood Testing Market Value Share Analysis, by Method, 2024 and 2035

Figure 38: North America Blood Testing Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 39: North America Blood Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 40: North America Blood Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 41: Europe Blood Testing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 42: Europe Blood Testing Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 43: Europe Blood Testing Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 44: Europe Blood Testing Market Value Share Analysis, By Test Type, 2024 and 2035

Figure 45: Europe Blood Testing Market Attractiveness Analysis, By Test Type, 2025 to 2035

Figure 46: Europe Blood Testing Market Value Share Analysis, by Method, 2024 and 2035

Figure 47: Europe Blood Testing Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 48: Europe Blood Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 49: Europe Blood Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 50: Asia Pacific Blood Testing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 51: Asia Pacific Blood Testing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 52: Asia Pacific Blood Testing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 53: Asia Pacific Blood Testing Market Value Share Analysis, By Test Type, 2024 and 2035

Figure 54: Asia Pacific Blood Testing Market Attractiveness Analysis, By Test Type, 2025 to 2035

Figure 55: Asia Pacific Blood Testing Market Value Share Analysis, by Method, 2024 and 2035

Figure 56: Asia Pacific Blood Testing Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 57: Asia Pacific Blood Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 58: Asia Pacific Blood Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 59: Latin America Blood Testing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 60: Latin America Blood Testing Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 61: Latin America Blood Testing Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 62: Latin America Blood Testing Market Value Share Analysis, By Test Type, 2024 and 2035

Figure 63: Latin America Blood Testing Market Attractiveness Analysis, By Test Type, 2025 to 2035

Figure 64: Latin America Blood Testing Market Value Share Analysis, by Method, 2024 and 2035

Figure 65: Latin America Blood Testing Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 66: Latin America Blood Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 67: Latin America Blood Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 68: Middle East & Africa Blood Testing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 69: Middle East & Africa Blood Testing Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 70: Middle East & Africa Blood Testing Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 71: Middle East & Africa Blood Testing Market Value Share Analysis, By Test Type, 2024 and 2035

Figure 72: Middle East & Africa Blood Testing Market Attractiveness Analysis, By Test Type, 2025 to 2035

Figure 73: Middle East & Africa Blood Testing Market Value Share Analysis, by Method, 2024 and 2035

Figure 74: Middle East & Africa Blood Testing Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 75: Middle East & Africa Blood Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 76: Middle East & Africa Blood Testing Market Attractiveness Analysis, By End-user, 2025 to 2035