Reports

Reports

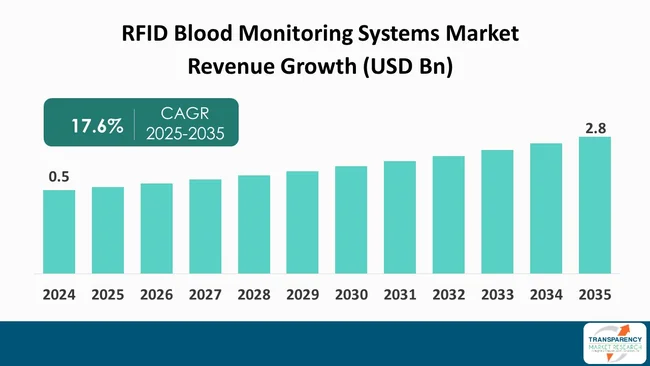

The global RFID blood monitoring systems market size was valued at US$ 0.5 billion in 2024 and is projected to reach US$ 2.8 Bn by 2035, expanding at a CAGR of 17.6% from 2025 to 2035. The market growth is driven by growing incidence of transfusion-related complications and rising demand for efficient blood management.

The RFID blood monitoring systems market is experiencing a major growth alongside the development of healthcare technology and the need for more effective blood management solutions. Radio frequency identification (RFID) technology makes it easier to track and manage blood products, which, in turn, leads to fewer errors and increased patient safety. With the objective of reducing wastage and enhancing patient outcomes, healthcare providers can find RFID technology as a viable tool to overcome such obstacles.

On the other side there are some barriers to this sector such as the high entering cost and the need of personnel training. Nevertheless, the general forecast is positive due to continuous updates of RFID technology and more healthcare IT investments. The RFID blood monitoring systems sector will experience a considerable expansion over the next few years as the necessity of safe and efficient blood management systems keeps on increasing.

RFID blood monitoring systems are a revolution in the medical world, which means a great change in how blood units are managed. By using radio frequency identification technology, they make it possible for anyone to see and check a blood bag at any time during the whole chain of its supply, which could be from donation to transfusion. The benefit of this technology to the accuracy of managing blood stock is very high, and all the risks that come with the errors of manual methods of tracking are removed. In case of blood typing or keeping track of expiration dates, these automation processes through RFID technology eliminate human errors. As such, no patient will be given unsterile blood products.

Moreover, RFID blood monitoring systems bring about a positive change in the performance of blood banks and hospitals through their increased working capacities. They optimize operations; reduce losses; and ensure strict adherence to standards that govern blood safety.

The use of RFID blood monitoring systems is being increasingly embraced by healthcare institutions as they see the benefit of these devices to patient safety and their operational efficiency. These devices are the ones to be blamed for various near-term setups like the high cost of putting the first installation in place and the need of training; however, their advantages made in the long run-safety enhancement, error reduction, and management facilitation-are the reasons for their existence in the healthcare sector. As time goes on, it is likely to hear about further innovations which will continue to bring them better capabilities.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

A significant factor that is propelling the RFID blood monitoring systems industry is the growing incidences of complications that are related to transfusions.

By exercising uninterrupted tracking and control of blood products, RFID technology overcomes these problems. In this way, each unit is the best match for the recipient and is still within its safety period. This technology limits mistakes made by people, which is the leading cause of transfusion-related complications. As hospitals and blood banks aim to lower the risks and raise patient safety, they are installing more RFID blood monitoring systems.

The demand for such devices is widening worldwide, mainly in North America and Europe, where strict rules and a particular focus on patient safety bring about changes. On the other hand, developing countries are also willing to accept the benefits of such innovations that result in a wider use of RFID systems in blood management. This is a sign of the trend to improve transfusion practices and overall healthcare quality.

The need for effective blood management is one of the significant factors that drive the RFID blood monitoring systems market. As healthcare systems globally work toward operational excellence, the need to optimize blood inventory, cut down on wastage, and ensure the timely availability of blood products have become the main issues. Besides, efficient blood management is essential to patient safety. Thus, it is a good way to maximize resource utilization, which is very important in a situation where healthcare costs are increasing.

RFID technology is the key solution to address these needs by providing the capability for real-time tracking and monitoring of blood products throughout their lifecycle.

The demand for RFID blood monitoring systems has been increasing in North America and Europe, where there is a strong focus on improving healthcare quality and safety standards. Besides, the emerging market is also recognizing that efficient blood management is very important to support their growing healthcare needs. Thus, as the demand for better blood management solutions keeps increasing, RFID technology will be at the forefront of the major changes in blood transfusion practices worldwide.

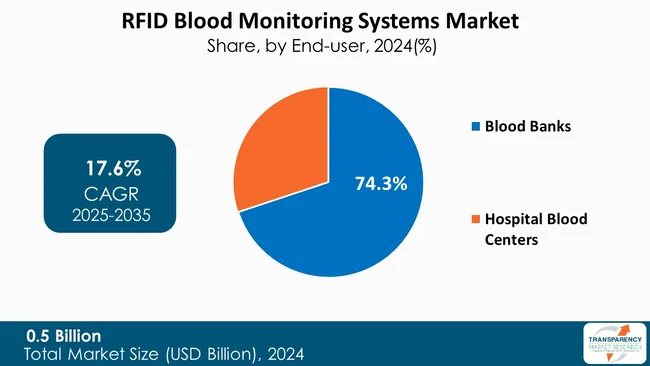

Blood banks as an end-user segment are amongst the significant growth factors of the RFID blood monitoring systems market. The reasons for such an impact are numerous. The first point is that blood banks are obliged to carry out the management of varied blood products such as whole blood, plasma, and platelets, which are not only different but also need to be stored and handled in a particular way.

With the help of the RFID system, they carry out their work more efficiently, as they get the live status of the products. This status allows the blood products to be properly matched with the recipients, and also they are used within the safe expiration dates. Therefore, the risk of errors is lowered, and patient safety is increased.

On top of that, blood banks have to reckon with the imperative to get the best out of their inventory management and cut down on waste, as their products are only good for a short time. The RFID system is there to make sure that the stock in blood banks is monitored at all times by easily keeping track of levels and dates of expiration, thus liberating the workforce of these tasks and reducing the risk of product contamination and wastage.

Besides, the growing importance of compliance with safety standards for blood is another reason for blood banks adopting the most advanced solution for tracking. In general, the deployment of RFID devices in blood banks not only opens up new horizons for their operational efficiency but also leads to improved patient safety, thus it has been a major factor behind the growth of the market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

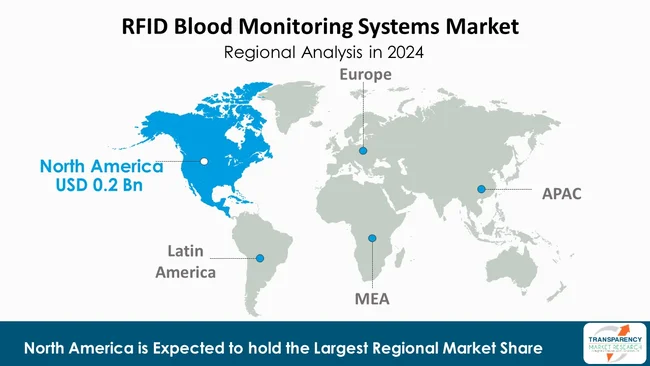

North America is the primary driver to the RFID blood monitoring systems market holding the largest revenue share of 41.2%, as a result of a mix of factors that are conducive to the adoption of advanced healthcare technologies. The patient safety and quality of care are the two major reasons for that.

As regulatory standards for blood safety become more stringent, healthcare providers in the region are turning to RFID technology as a means of going beyond the standard and therefore ensuring precision in the tracking and monitoring of blood products, which, in turn, leads to the least possible occurrence of transfusion errors and complications.

Moreover, the North American healthcare system can be described as an ideal environment that is highly supportive of technology, and thus characterized by a series of achievable goals, such as the bold investments in innovation and the substantial degree of tech usage. Thus, hospitals and blood banks in the area are more than willing to embrace the solutions that can lead to the quick and effective running of their operations and the smooth handling of the blood management system, which is the primary reason why RFID systems have become the most suitable choice. In addition, the market growth is further accelerated through the presence of local key industry players and ongoing research and development in this space.

Besides, the increased prevalence of chronic diseases that require frequent blood transfusions has led to a greater need for efficient blood management solutions. In any case, as medical professionals pledge to make the most of their resources and at the same time meet the need for prompt access to blood products, the use of RFID technology is inevitable. To sum up, North America, with its strong will to improve healthcare outcomes and its sound infrastructure, is a major player in the RFID blood monitoring systems market.

Shanghai Jiayulian Technology Co., Ltd., LogTag North America Inc., Mobile Aspects, Biolog-Id, Terso Solutions, Inc., InnerSpace, SATO Vicinity Pty. Ltd., GAO Group, Cardinal Health, Biolog-id, Mediware Information System, Honeywell, Nordic ID, TAGSY RFID, Zebra Technologies Wave Mark are the key players governing the global RFID Blood Monitoring Systems Market.

Each of these players has been profiled in the RFID blood monitoring systems market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 0.5 Bn |

| Forecast Value in 2035 | More than US$ 2.8 Bn |

| CAGR | 17.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 0.5 Bn in 2024

It is projected to cross US$ 2.8 Bn by the end of 2035

Growing incidence of transfusion-related complications and rising demand for efficient blood management

It is anticipated to grow at a CAGR of 17.6% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Shanghai Jiayulian Technology Co., Ltd., LogTag North America Inc., Mobile Aspects, Biolog-Id, Terso Solutions, Inc., InnerSpace, SATO Vicinity Pty. Ltd., GAO Group, Cardinal Health, Biolog-id, Mediware Information System, Honeywell, Nordic ID, TAGSY RFID, Zebra Technologies Wave Mark, and others

Table 01: Global RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 02: Global RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 03: Global RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 04: North America RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 05: North America RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 06: North America RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 07: Europe RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 08: Europe RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 09: Europe RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 10: Asia Pacific RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 11: Asia Pacific RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 12: Asia Pacific RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 13: Latin America RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 14: Latin America RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Latin America RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 16: Middle East and Africa RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 17: Middle East and Africa RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 18: Middle East and Africa RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Figure 01: Global RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global RFID Blood Monitoring Systems Market Value Share Analysis, by Product, 2024 and 2035

Figure 03: Global RFID Blood Monitoring Systems Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 04: Global RFID Blood Monitoring Systems Market Revenue (US$ Bn), by Systems, 2020 to 2035

Figure 05: Global RFID Blood Monitoring Systems Market Revenue (US$ Bn), by Tags, 2020 to 2035

Figure 06: Global RFID Blood Monitoring Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 07: Global RFID Blood Monitoring Systems Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 08: Global RFID Blood Monitoring Systems Market Revenue (US$ Bn), by Blood Banks, 2020 to 2035

Figure 09: Global RFID Blood Monitoring Systems Market Revenue (US$ Bn), by Hospital Blood Centers, 2020 to 2035

Figure 10: Global RFID Blood Monitoring Systems Market Value Share Analysis, by Region, 2024 and 2035

Figure 11: Global RFID Blood Monitoring Systems Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 12: North America RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 13: North America RFID Blood Monitoring Systems Market Value Share Analysis, by Product, 2024 and 2035

Figure 14: North America RFID Blood Monitoring Systems Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 15: North America RFID Blood Monitoring Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 16: North America RFID Blood Monitoring Systems Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 17: North America RFID Blood Monitoring Systems Market Value Share Analysis, by Region, 2024 and 2035

Figure 18: North America RFID Blood Monitoring Systems Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 19: Europe RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 20: Europe RFID Blood Monitoring Systems Market Value Share Analysis, by Product, 2024 and 2035

Figure 21: Europe RFID Blood Monitoring Systems Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 22: Europe RFID Blood Monitoring Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 23: Europe RFID Blood Monitoring Systems Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 24: Europe RFID Blood Monitoring Systems Market Value Share Analysis, by Region, 2024 and 2035

Figure 25: Europe RFID Blood Monitoring Systems Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 26: Asia Pacific RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: Asia Pacific RFID Blood Monitoring Systems Market Value Share Analysis, by Product, 2024 and 2035

Figure 28: Asia Pacific RFID Blood Monitoring Systems Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 29: Asia Pacific RFID Blood Monitoring Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 30: Asia Pacific RFID Blood Monitoring Systems Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 31: Asia Pacific RFID Blood Monitoring Systems Market Value Share Analysis, by Region, 2024 and 2035

Figure 32: Asia Pacific RFID Blood Monitoring Systems Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 33: Latin America RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Latin America RFID Blood Monitoring Systems Market Value Share Analysis, by Product, 2024 and 2035

Figure 35: Latin America RFID Blood Monitoring Systems Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 36: Latin America RFID Blood Monitoring Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 37: Latin America RFID Blood Monitoring Systems Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 38: Latin America RFID Blood Monitoring Systems Market Value Share Analysis, by Region, 2024 and 2035

Figure 39: Latin America RFID Blood Monitoring Systems Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 40: Middle East and Africa RFID Blood Monitoring Systems Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 41: Middle East and Africa RFID Blood Monitoring Systems Market Value Share Analysis, by Product, 2024 and 2035

Figure 42: Middle East and Africa RFID Blood Monitoring Systems Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 43: Middle East and Africa RFID Blood Monitoring Systems Market Value Share Analysis, by End-user, 2024 and 2035

Figure 44: Middle East and Africa RFID Blood Monitoring Systems Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 45: Middle East and Africa RFID Blood Monitoring Systems Market Value Share Analysis, by Region, 2024 and 2035

Figure 46: Middle East and Africa RFID Blood Monitoring Systems Market Attractiveness Analysis, by Region, 2025 to 2035