Reports

Reports

Within the blood glucose monitoring systems market, at present, companies are increasingly focusing on the development of advanced next-generation glucose monitoring systems to gain an edge in the current market landscape. Non-invasive glucose monitoring techniques have gained noteworthy popularity over the past couple of decades, and the trend is set to continue to gain momentum during the forecast period. Technological advancements continue to drive innovations in the blood glucose monitoring systems market and improve diagnostic techniques and equipment. Research and development activities continue to explore and discover new non-invasive glucose monitoring techniques.

Over the past few years, research and development activities have put forward infrared spectroscopy– a novel technology that is expected to offer tremendous scope in the blood glucose monitoring systems market. Rapid advancements in technology and improvement in the reliability and calibrating methods of non-invasive devices are some of the factors that are expected to augment the growth of the market for blood glucose monitoring systems in the coming years. The high prevalence of diabetes worldwide is one of the major causes of morbidity and mortality in most regions around the world. Surge in the aging population worldwide, unhealthy dietary patterns, an increase in the number of individuals leading a sedentary lifestyle and obesity are expected to increase the prevalence of diabetes mellitus in the coming years which in turn is expected to propel the demand for advanced blood glucose monitoring systems. At the back of these factors coupled with favorable government policies, the global blood glucose monitoring systems market is expected to reach ~US$ 25 Bn by the end of 2027.

Due to the growing prevalence of diabetes mellitus across the world, the pursuit of efficient blood glucose monitoring systems has gained considerable pace over the past few years– a trend that is likely to continue during the forecast period. Governments of both the developing as well as developed nations of the world are increasingly encouraging research and development activities that aim to minimize health complications caused by blood glucose levels. Non-invasive blood glucose monitoring systems have gained considerable traction in recent years of which, vibrational spectroscopy-based techniques of the skin have emerged as promising candidates.

At present, researchers are also increasingly investigating the potential benefits of deploying devices based on photoplethysmography, wherein wavelengths in near-infrared range are being considered for their exceptional capabilities of offering dependable blood glucose monitoring predictions. Optical glucose sensing is projected to remain one of the most critical types of treatment within the blood glucose monitoring systems market during the forecast period. Steady progress in biosensor technologies and growing emphasis on non-invasive blood glucose monitoring is expected to further accelerate the adoption of optical techniques in the blood glucose monitoring systems market. Advancements in technology have paved the way for a host of blood glucose monitoring systems and techniques, including Raman spectroscopy, fluorescence spectroscopy, absorption spectroscopy, photoacoustic spectroscopy, and ocular spectroscopy, among others.

The future of the blood glucose monitoring systems market is expected to hinge on the strides taken by nanotechnology and significant progress in biomaterials. Companies operating in the current market landscape are expected to develop glucose biosensors that are predominantly based on polymer nanocomposites, carbon nanotubes, and grapheme.

With technology progressing at a rapid pace, several companies are inclined toward the development of advanced blood glucose monitoring systems based on these technologies. Participants in the blood glucose monitoring systems market are expected to collaborate with pharmaceutical companies to launch reliable next-generation glucose monitoring systems. For instance, in January 2019, Eris Lifesciences and India Medtronic Pvt. Ltd announced that the two companies are collaborating to formulate efficient diabetes monitoring programs and initiatives in India. Both companies will leverage expertise from one another to develop advanced blood glucose monitoring systems. Both the companies announced the launch of the smart continuous blood glucose monitoring system, which can be connected with smartphones to gain real-time data, including glucose levels without excessive hardware requirements. Moreover, established brands are also launching new products and expanding their product range to improve their market share. For instance, in January 2018, Abbott announced the launch of the FreeSbtyle Libre System, an advanced continuous glucose monitoring system.

Analysts’ Viewpoint

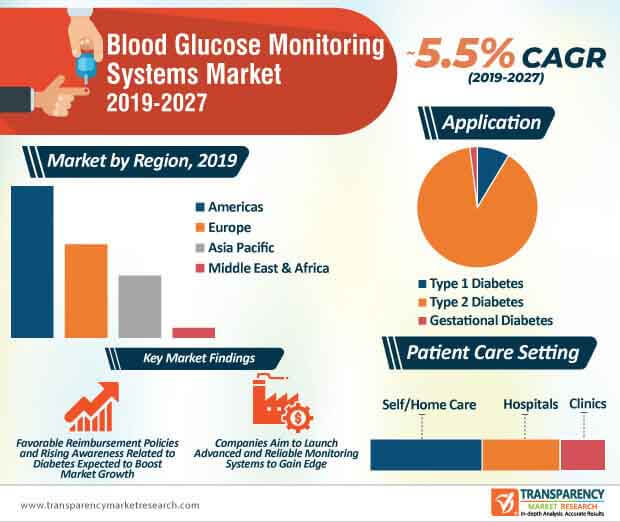

The global blood glucose monitoring systems market is expected to grow at a steady CAGR of ~5.5% during the forecast period. Some of the leading factors that will contribute to market growth include rapid developments in optical and non-invasive monitoring techniques, high prevalence of diabetes mellitus worldwide, rise in the geriatric population, and policies by government bodies worldwide that encourage the development of reliable, accurate, and efficient blood glucose monitoring systems. Companies should focus on expanding their product portfolio, improve the accuracy of their products, and continue to invest in new technologies to improve their market share in the current market landscape.

The global blood glucose monitoring systems market was worth US$ 15.4 Bn and is projected to reach a value of US$ 25 Bn by the end of 2027

Blood glucose monitoring systems market is anticipated to grow at a CAGR of 5.5% during the forecast period

Americas accounted for a major share of the global blood glucose monitoring systems market

Blood Glucose Monitoring Systems Market is driven by rise in prevalence of diabetes, rapid advancements in technology and improvement in the reliability and calibrating methods of non-invasive devices

Key players in the global blood glucose monitoring systems market include Abbott, Medtronic, Hoffmann-La Roche Ltd., B. Braun Melsungen AG, AgaMatrix, Sanofi, SD Biosensor, Inc., LifeScan, Ascensia Diabetes Care, Prodigy Diabetes Care, LLC, Nipro, Dexcom, Inc., Ypsomed AG, Senseonics, and ACON Laboratories, Inc.

1. Preface

1.1. Market Definition and Scope

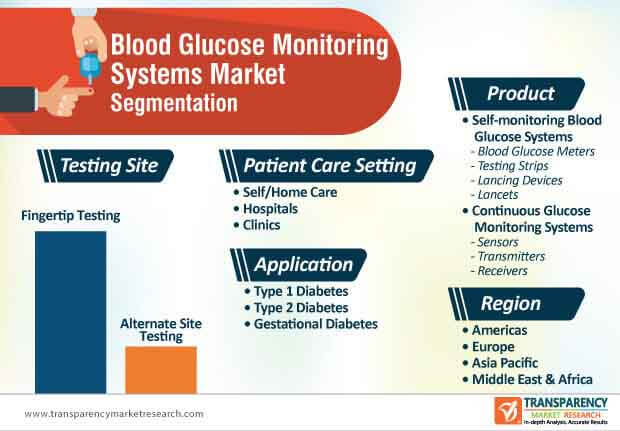

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Blood Glucose Monitoring Systems Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Blood Glucose Monitoring Systems Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Price Analysis

5.1.1. Average Price per Meter and Strip

5.1.2. Reimbursement Price by Region

5.2. Disease Prevalence & Incidence Rate Globally with Key Countries

5.3. Key Vendor and Distributor Analysis

5.4. Reimbursement Scenario by Region/Globally

5.5. Supply Chain Analysis, by Country (Market Structure)

5.6. Marketing Strategies and Promotional Activities

6. Global Blood Glucose Monitoring Systems Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2027

6.3.1. Self-monitoring Blood Glucose Systems

6.3.1.1. Blood Glucose Meters

6.3.1.2. Testing Strips

6.3.1.3. Lancing Devices

6.3.1.4. Lancets

6.3.2. Continuous Glucose Monitoring Systems

6.3.2.1. Sensors

6.3.2.2. Transmitters

6.3.2.3. Receivers

6.4. Market Attractiveness, by Product Type

7. Global Blood Glucose Monitoring Systems Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2027

7.3.1. Type 1 Diabetes

7.3.2. Type 2 Diabetes

7.3.3. Gestational Diabetes

7.4. Market Attractiveness, by Application

8. Global Blood Glucose Monitoring Systems Market Analysis and Forecast, by Testing Site

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Testing Site, 2017–2027

8.3.1. Fingertip Testing

8.3.2. Alternate Site Testing

8.4. Market Attractiveness, by Testing Site

9. Global Blood Glucose Monitoring Systems Market Analysis and Forecast, by Patient Care Settings

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Patient Care Settings, 2017–2027

9.3.1. Self/Home Care

9.3.2. Hospitals

9.3.3. Clinics

9.4. Market Attractiveness, by Patient Care Settings

10. Global Blood Glucose Monitoring System Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. Americas

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.3. Market Attractiveness, by Country/Region

11. Americas Blood Glucose Monitoring System Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2027

11.2.1. Self-monitoring Blood Glucose Systems

11.2.1.1. . Blood Glucose Meters

11.2.1.2. Testing Strips

11.2.1.3. Lancing Devices

11.2.1.4. Lancets

11.2.2. Continuous Glucose Monitoring Systems

11.2.2.1. Sensors

11.2.2.2. Transmitters

11.2.2.3. Receivers

11.3. Market Value Forecast, by Application, 2017–2027

11.3.1. Type 1 Diabetes

11.3.2. Type 2 Diabetes

11.3.3. Gestational Diabetes

11.4. Market Value Forecast, by Testing Site, 2017–2027

11.4.1. Fingertip Testing

11.4.2. Alternate Site Testing

11.5. Market Value Forecast, by Patient Care Settings, 2017–2027

11.5.1. Self/Home Care

11.5.2. Hospitals

11.5.3. Clinics

11.6. Market Value Forecast, by Country/Sub-region, 2017–2027

11.6.1. U.S.

11.6.2. Canada

11.6.3. Brazil

11.6.4. Mexico

11.6.5. Rest of Americas

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Application

11.7.3. By Testing Site

11.7.4. By Patient Care Settings

11.7.5. By Country/Sub-region

11.8. Market Share Analysis by Region for Big and Mid-sized Players

12. Europe Blood Glucose Monitoring System Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2027

12.2.1. Self-monitoring Blood Glucose Systems

12.2.1.1. Blood Glucose Meters

12.2.1.2. Testing Strips

12.2.1.3. Lancing Devices

12.2.1.4. Lancets

12.2.2. Continuous Glucose Monitoring Systems

12.2.2.1. Sensors

12.2.2.2. Transmitters

12.2.2.3. Receivers

12.3. Market Value Forecast, by Application, 2017–2027

12.3.1. Type 1 Diabetes

12.3.2. Type 2 Diabetes

12.3.3. Gestational Diabetes

12.4. Market Value Forecast, by Testing Site, 2017–2027

12.4.1. Fingertip Testing

12.4.2. Alternate Site Testing

12.5. Market Value Forecast, by Patient Care Settings, 2017–2027

12.5.1. Self/Home Care

12.5.2. Hospitals

12.5.3. Clinics

12.6. Market Value Forecast, by Country/Sub-region, 2017–2027

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Poland

12.6.7. Romania

12.6.8. Portugal

12.6.9. Netherlands

12.6.10. Czech

12.6.11. Israel

12.6.12. Austria

12.6.13. Sweden

12.6.14. Denmark

12.6.15. Switzerland

12.6.16. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Application

12.7.3. By Testing Site

12.7.4. By Patient Care Settings

12.7.5. By Country/Sub-region

12.8. Market Share Analysis by Region for Big and Mid-sized Players

13. Asia Pacific Blood Glucose Monitoring System Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2027

13.2.1. Self-monitoring Blood Glucose Systems

13.2.1.1. Blood Glucose Meters

13.2.1.2. Testing Strips

13.2.1.3. Lancing Devices

13.2.1.4. Lancets

13.2.2. Continuous Glucose Monitoring Systems

13.2.2.1. Sensors

13.2.2.2. Transmitters

13.2.2.3. Receivers

13.3. Market Value Forecast, by Application, 2017–2027

13.3.1. Type 1 Diabetes

13.3.2. Type 2 Diabetes

13.3.3. Gestational Diabetes

13.4. Market Value Forecast, by Testing Site, 2017–2027

13.4.1. Fingertip Testing

13.4.2. Alternate Site Testing

13.5. Market Value Forecast, by Patient Care Settings, 2017–2027

13.5.1. Self/Home Care

13.5.2. Hospitals

13.5.3. Clinics

13.6. Market Value Forecast, by Country/Sub-region, 2017–2027

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Indonesia

13.6.5. Philippines

13.6.6. Vietnam

13.6.7. Malaysia

13.6.8. Australia & New Zealand

13.6.9. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Application

13.7.3. By Testing Site

13.7.4. By Patient Care Settings

13.7.5. By Country/Sub-region

13.8. Market Share Analysis by Region for Big and Mid-sized Players

14. Middle East & Africa Blood Glucose Monitoring System Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2027

14.2.1. Self-monitoring Blood Glucose Systems

14.2.1.1. Blood Glucose Meters

14.2.1.2. Testing Strips

14.2.1.3. Lancing Devices

14.2.1.4. Lancets

14.2.2. Continuous Glucose Monitoring Systems

14.2.2.1. Sensors

14.2.2.2. Transmitters

14.2.2.3. Receivers

14.3. Market Value Forecast, by Application, 2017–2027

14.3.1. Type 1 Diabetes

14.3.2. Type 2 Diabetes

14.3.3. Gestational Diabetes

14.4. Market Value Forecast, by Testing Site, 2017–2027

14.4.1. Fingertip Testing

14.4.2. Alternate Site Testing

14.5. Market Value Forecast, by Patient Care Settings, 2017–2027

14.5.1. Self/Home Care

14.5.2. Hospitals

14.5.3. Clinics

14.6. Market Value Forecast, by Country/Sub-region, 2017–2027

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Application

14.7.3. By Testing Site

14.7.4. By Patient Care Settings

14.7.5. By Country/Sub-region

14.8. Market Share Analysis by Region for Big and Mid-sized Players

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis, by Company (2018)

15.3. Company Profiles

15.3.1. Abbott

15.3.1.1. Company Overview

15.3.1.2. Company Financials

15.3.1.3. Growth Strategies

15.3.1.4. SWOT Analysis

15.3.2. Medtronic

15.3.2.1. Company Overview

15.3.2.2. Company Financials

15.3.2.3. Growth Strategies

15.3.2.4. SWOT Analysis

15.3.3. F. Hoffmann-La Roche Ltd

15.3.3.1. Company Overview

15.3.3.2. Company Financials

15.3.3.3. Growth Strategies

15.3.3.4. SWOT Analysis

15.3.4. B.Braun Melsungen AG

15.3.4.1. Company Overview

15.3.4.2. Company Financials

15.3.4.3. Growth Strategies

15.3.4.4. SWOT Analysis

15.3.5. AgaMatrix

15.3.5.1. Company Overview

15.3.5.2. Company Financials

15.3.5.3. Growth Strategies

15.3.5.4. SWOT Analysis

15.3.6. Sanofi-aventis

15.3.6.1. Company Overview

15.3.6.2. Company Financials

15.3.6.3. Growth Strategies

15.3.6.4. SWOT Analysis

15.3.7. SD Biosensor, INC

15.3.7.1. Company Overview

15.3.7.2. Company Financials

15.3.7.3. Growth Strategies

15.3.7.4. SWOT Analysis

15.3.8. LifeScan

15.3.8.1. Company Overview

15.3.8.2. Company Financials

15.3.8.3. Growth Strategies

15.3.8.4. SWOT Analysis

15.3.9. Ascensia Diabetes Care

15.3.9.1. Company Overview

15.3.9.2. Company Financials

15.3.9.3. Growth Strategies

15.3.9.4. SWOT Analysis

15.3.10. Prodigy Diabetes Care, LLC

15.3.10.1. Company Overview

15.3.10.2. Company Financials

15.3.10.3. Growth Strategies

15.3.10.4. SWOT Analysis

15.3.11. Nipro

15.3.11.1. Company Overview

15.3.11.2. Company Financials

15.3.11.3. Growth Strategies

15.3.11.4. SWOT Analysis

15.3.12. Dexcom, Inc.

15.3.12.1. Company Overview

15.3.12.2. Company Financials

15.3.12.3. Growth Strategies

15.3.12.4. SWOT Analysis

15.3.13. Ypsomed AG

15.3.13.1. Company Overview

15.3.13.2. Company Financials

15.3.13.3. Growth Strategies

15.3.13.4. SWOT Analysis

15.3.14. ACON Laboratories, Inc

15.3.14.1. Company Overview

15.3.14.2. Company Financials

15.3.14.3. Growth Strategies

15.3.14.4. SWOT Analysis

15.3.15. Senseonics

15.3.15.1. Company Overview

15.3.15.2. Company Financials

15.3.15.3. Growth Strategies

15.3.15.4. SWOT Analysis

15.3.16. Other Prominent Players

List of Table

Table 01 Diabetes Prevalence in Key Countries

Table 02 Diabetes Prevalence in Key Countries

Table 03 Diabetes Prevalence in Key Countries

Table 04 Global Blood Glucose Monitoring Systems Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 05 Global Blood Glucose Monitoring Systems Market Value (US$ Mn) Forecast, by Self-monitoring Blood Glucose Systems, 2017–2027

Table 06 Global Blood Glucose Monitoring Systems Market Value (US$ Mn) Forecast, by Continuous Glucose Monitoring Systems, 2017–2027

Table 07 Global Blood Glucose Monitoring Systems Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 08 Global Blood Glucose Monitoring Systems Market Value (US$ Mn) Forecast, by Testing Site, 2017-2027

Table 09 Global Blood Glucose Monitoring Systems Market Value (US$ Mn) Forecast, by Patient Care Setting, 2017–2027

Table 10 Global Blood Glucose Monitoring Systems Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 11 Americas Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 12 Americas Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 13 Americas Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Self-monitoring Blood Glucose Systems, 2017–2027

Table 14 Americas Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Continuous Glucose Monitoring Systems, 2017–2027

Table 15 Americas Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 16 Americas Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Testing Site, 2017–2027

Table 17 Americas Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Patient Care Setting, 2017–2027

Table 18 Europe Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 19 Europe Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 20 Europe Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 21 Europe Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Self-monitoring Blood Glucose Systems, 2017–2027

Table 22 Europe Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Continuous Glucose Monitoring Systems, 2017–2027

Table 23 Europe Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 24 Europe Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Testing Site, 2017-2027

Table 25 Europe Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Patient Care Setting, 2017–2027

Table 26 Asia Pacific Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 27 Asia Pacific Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 28 Asia Pacific Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Self-monitoring Blood Glucose Systems, 2017–2027

Table 29 Asia Pacific Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, Continuous Glucose Monitoring Systems, 2017–2027

Table 30 Asia Pacific Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Application, 2017-2027

Table 31 Asia Pacific Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Testing Site, 2017-2027

Table 32 Asia Pacific Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Patient Care Setting, 2017–2027

Table 33 Middle East & Africa Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 34 Middle East & Africa Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Product Type, 2017–2027

Table 35 Middle East & Africa Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Product, Self-monitoring Blood Glucose Systems 2017–2027

Table 36 Middle East & Africa Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Product, Continuous Glucose Monitoring Systems 2017–2027

Table 37 Middle East & Africa Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Application, 2018-2028

Table 38 Middle East & Africa Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Testing Site, 2018-2028

Table 39 Middle East & Africa Blood Glucose Monitoring System Market Value (US$ Mn) Forecast, by Patient Care Setting, 2017–2027

List of Figures

Figure 01 Global Blood Glucose Monitoring Systems Market Value (US$ Mn) and Distribution (%), by Region, 2018 and 2027

Figure 02 Global Blood Glucose Monitoring Systems Market Value (US$ Mn) Forecast, 2017–2027

Figure 03 Global Blood Glucose Monitoring Systems Market Value Share Analysis, by Product Type, 2019 and 2027

Figure 04 Global Blood Glucose Monitoring Systems Market Attractiveness Analysis, by Product Type, 2018–2027

Figure 05 Global Blood Glucose Monitoring Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Self-monitoring Blood Glucose Systems, 2017–2027

Figure 06 Global Blood Glucose Monitoring Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Continuous Glucose Monitoring Systems, 2017–2027

Figure 07 Global Blood Glucose Monitoring Systems Market Value Share Analysis, by Application, 2019 and 2027

Figure 08 Global Blood Glucose Monitoring Systems Market Attractiveness Analysis, by Application, 2019–2027

Figure 09 Global Blood Glucose Monitoring Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), Type 1 Diabetes, 2017–2027

Figure 10 Global Blood Glucose Monitoring Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Type 2 Diabetes, 2017–2027

Figure 11 Global Blood Glucose Monitoring Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), Gestational Diabetes, 2017–2027

Figure 12 Global Blood Glucose Monitoring Systems Market Value Share Analysis, by Testing Site, 2019 and 2027

Figure 13 Global Blood Glucose Monitoring Systems Market Attractiveness Analysis, by Testing Site, 2019–2027

Figure 14 Global Blood Glucose Monitoring Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Fingertip Testing, 2017-2027

Figure 15 Global Blood Glucose Monitoring Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Alternate Site Testing, 2017-2027

Figure 16 Global Blood Glucose Monitoring Systems Market Value Share Analysis, by Patient Care Setting, 2019 and 2027

Figure 17 Global Blood Glucose Monitoring Systems Market Attractiveness Analysis, by Patient Care Setting, 2019–2027

Figure 18 Global Blood Glucose Monitoring Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by Self/Home Care, 2017–2027

Figure 19 Global Specialty Clinics Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by Hospitals, 2017–2027

Figure 20 Global Blood Glucose Monitoring Systems Market Revenue (US$ Mn) and Y-o-Y Growth (%) Forecast, by Clinics, 2017–2027

Figure 21 Global Blood Glucose Monitoring Systems Market Attractiveness, by Region, 2019–2027

Figure 22 Global Blood Glucose Monitoring Systems Market Value Share, by Region, 2019 and 2027

Figure 23 Americas Blood Glucose Monitoring System Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 24 Americas Blood Glucose Monitoring System Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 25 Americas Blood Glucose Monitoring System Market Value Share, by Country, 2018 and 2027

Figure 26 Americas Blood Glucose Monitoring System Market Value Share Analysis, by Product Type, 2018 and 2027

Figure 27 Blood Glucose Monitoring System Market Attractiveness Analysis, by Product Type, 2019–2027

Figure 28 Americas Blood Glucose Monitoring System Market Value Share Analysis, by Application, 2018 and 2027

Figure 29 Americas Blood Glucose Monitoring System Market Attractiveness Analysis, by Application, 2019–2027

Figure 30 Americas Blood Glucose Monitoring System Market Value Share Analysis, by Testing Site, 2018 and 2027

Figure 31 Americas Blood Glucose Monitoring System Market Attractiveness Analysis, by Testing Site, 2019–2027

Figure 32 Americas Blood Glucose Monitoring System Market Value Share Analysis, by Patient Care Setting, 2018 and 2027

Figure 33 Americas Blood Glucose Monitoring System Market Attractiveness Analysis, by Patient Care Setting, 2019–2027

Figure 34 Americas Self-monitoring Blood Glucose Systems Market Share, by Company, 2018

Figure 35 Americas Self-monitoring Blood Glucose Systems Market Share, by Mid-sized Company, 2018

Figure 36 Americas Continuous Glucose Monitoring Systems Market Share, by Company, 2018

Figure 37 Americas Continuous Glucose Monitoring Systems Market Share, by Mid-sized Company, 2018

Figure 38 Europe Blood Glucose Monitoring System Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 39 Europe Blood Glucose Monitoring System Market Attractiveness, by Country/Sub-Region, 2019–2027

Figure 40 Europe Blood Glucose Monitoring System Market Value Share, by Country/Sub-Region, 2018 and 2027

Figure 41 Europe Blood Glucose Monitoring System Market Value Share Analysis, by Product, 2018 and 2027

Figure 42 Europe Blood Glucose Monitoring System Market Attractiveness Analysis, by Product, 2019–2027

Figure 43 Europe Blood Glucose Monitoring System Market Value Share Analysis, by Application, 2018 and 2027

Figure 44 Europe Blood Glucose Monitoring System Market Attractiveness Analysis, by Application, 2019–2027

Figure 45 Europe Blood Glucose Monitoring System Market Value Share Analysis, by Testing Site, 2018 and 2027

Figure 46 Europe Blood Glucose Monitoring System Market Attractiveness Analysis, by Testing Site, 2019–2027

Figure 47 Europe Blood Glucose Monitoring System Market Value Share Analysis, by Patient Care Setting, 2018 and 2027

Figure 48 Europe Blood Glucose Monitoring System Market Attractiveness Analysis, by Patient Care Setting, 2019–2027

Figure 49 Europe & Middle East Africa Self-monitoring Blood Glucose Systems Market Share, by Company, 2018

Figure 50 Europe & Middle East Africa Self-monitoring Blood Glucose Systems Market Share, by Mid-sized Company, 2018

Figure 51 Europe & Middle East Africa Continuous Glucose Monitoring Systems Market Share, by Company, 2018

Figure 52 Europe & Middle East Africa Continuous Glucose Monitoring Systems Market Share, by Mid-sized Company, 2018

Figure 53 Asia Pacific Blood Glucose Monitoring System Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2017–2027

Figure 54 Asia Pacific Blood Glucose Monitoring System Market Attractiveness, by Country/Sub-Region, 2019–2027

Figure 55 Asia Pacific Blood Glucose Monitoring System Market Value Share, by Country/Sub-Region, 2019–2027

Figure 56 Asia Pacific Blood Glucose Monitoring System Market Value Share Analysis, by Product, 2018 and 2027

Figure 57 Asia Pacific Blood Glucose Monitoring System Market Attractiveness Analysis, by Product, 2019–2027

Figure 58 Asia Pacific Blood Glucose Monitoring System Market Value Share Analysis, by Application, 2018 and 2027

Figure 59 Asia Pacific Blood Glucose Monitoring System Market Attractiveness Analysis, by Application, 2019–2027

Figure 60 Asia Pacific Blood Glucose Monitoring System Market Value Share Analysis, by Testing Site, 2018 and 2027

Figure 61 Asia Pacific Blood Glucose Monitoring System Market Attractiveness Analysis, by Testing Site, 2019–2027

Figure 62 Asia Pacific Blood Glucose Monitoring System Market Value Share Analysis, by Patient Care Setting, 2018 and 2027

Figure 63 Asia Pacific Blood Glucose Monitoring System Market Attractiveness Analysis, by Patient Care Setting, 2019–2027

Figure 64 Asia Pacific Self-monitoring Blood Glucose Systems Market Share, by Company, 2018

Figure 65 Asia Pacific Self-monitoring Blood Glucose Systems Market Share, by Mid-sized Company, 2018

Figure 66 Asia Pacific Continuous Glucose Monitoring Systems Market Share, by Company, 2018

Figure 67 Asia Pacific Continuous Glucose Monitoring Systems Market Share, by Mid-sized Company, 2018

Figure 68 Middle East & Africa Blood Glucose Monitoring System Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%),

Figure 69 Middle East & Africa Blood Glucose Monitoring System Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 70 Middle East & Africa Blood Glucose Monitoring System Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 71 Middle East & Africa Blood Glucose Monitoring System Market Value Share Analysis, by Product, 2018 and 2027

Figure 72 Middle East & Africa Blood Glucose Monitoring System Market Attractiveness Analysis, by Product, 2019–2027

Figure 73 Middle East & Africa Blood Glucose Monitoring System Market Value Share Analysis, by Application, 2018 and 2027

Figure 74 Middle East & Africa Blood Glucose Monitoring System Market Attractiveness Analysis, by Application, 2019–2027

Figure 75 Middle East & Africa Blood Glucose Monitoring System Market Value Share Analysis, by Testing Site, 2018 and 2027

Figure 76 Middle East & Africa Blood Glucose Monitoring System Market Attractiveness Analysis, by Testing Site, 2019–2027

Figure 77 Middle East & Africa Blood Glucose Monitoring System Market Value Share Analysis, by Patient Care Setting, 2018 and 2027

Figure 78 Middle East & Africa Blood Glucose Monitoring System Market Attractiveness Analysis, by Patient Care Setting, 2019–2027

Figure 79 Global Self-monitoring Blood Glucose Systems Market Share, by Company, 2018

Figure 80 Global Continuous Glucose Monitoring Systems Market Share, by Company, 2018