Reports

Reports

In the current day and age, fast-paced urbanization, industrialization, and the flurry of new technologies have led to environmental issues, such as an imbalance in the ecological process of soil, global warming, undesired climate change, etc. The consistent deposition of xenobiotic recalcitrant compounds in the environment has had hazardous repercussions due to which, several disposing techniques and strategies have emerged in recent years. At present, one of the most popular disposing strategies that have gained considerable attention is bioremediation. At present, a broad spectrum of bioremediation technologies and services are increasingly being used in bio stimulation, bio augmentation, phytoremediation, fungal remediation, land-based remediation, and bioreactors.

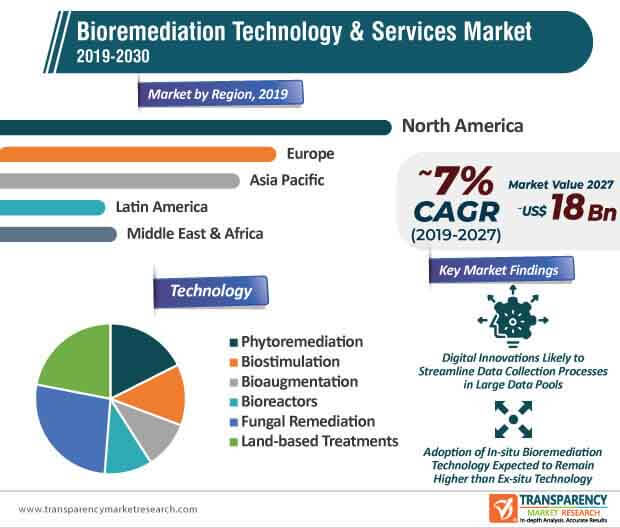

Research and development activities continue to investigate the benefits and drawbacks of each of these bioremediation technologies and services. At present, biological bioremediation technologies and services, including bio stimulation and bio augmentation are increasingly being used to the higher efficacy levels and superior eco-friendliness quotient in comparison with the other existing alternatives. As the government bodies across the world continue to focus on environment protection, the bioremediation technology & services market is expected to witness noteworthy growth during the forecast period. Due to these factors, along with consistent research and development, the global bioremediation technology & services market is expected to attain a market value of ~US$ 20 Bn by the end of 2030.

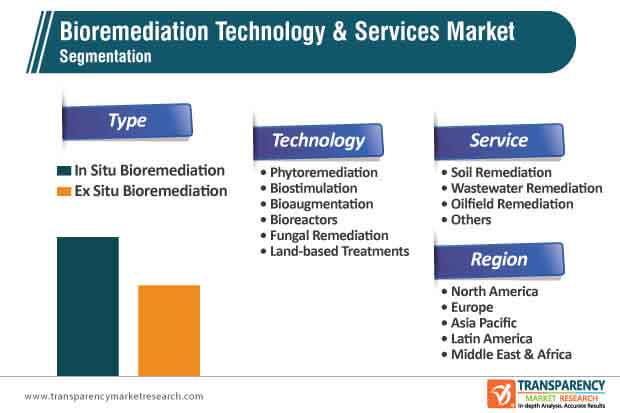

Over the past couple of decades, new techniques and concepts to treat contaminated soil have emerged. At present, the adoption of the in situ bioremediation technology & services is relatively higher than that of ex situ bioremediation technology & services due to economic benefits and the trend is likely to continue during the forecast period. Some of the most extensively deployed in situ bioremediation technologies & services include natural attenuation, bio slurping, composting, bio venting, and microbe-assisted phytoremediation.

The past couple of decades have witnessed consistent developments in the bioremediation techniques due to the mounting environmental concerns and emphasis on the development of a sustainable industrial and urban ecosystem. The adoption of biological remediation technologies & services is likely to be higher than that of the existing physical and chemical remediation techniques due to lower costs and environment-friendly features. Some of the most extensively deployed in situ bioremediation processes around the world include natural attenuation, bio augmentation, and bio stimulation. This is likely to drive the bioremediation technology & services market during the forecast period.

In the last decade, the bioremediation technology & services market has witnessed a considerable amount of activity as market participants continue to prioritize launching cutting-edge bioremediation solutions that primarily support stabilization, sequestration, recovery, and destruction of contaminants. Advancements in the global bioremediation technology & services market during the forecast period are likely to occur in two main areas, including innovations that aim to improve the resolution at which the overlay of contaminants and hydrogeology can be interpreted and digital innovations that are expected to streamline the data collection process across larger data pools.

Research and development activities, along with the growing number of government initiatives and investments to support these activities are expected to provide a considerable boost to the development of the global bioremediation technology & services market. For instance, the Environmental Biotechnology program, initiated by the Government of India largely focuses on assisting the research and development activities within the bioremediation sphere. While wastewater treatment and soil remediation are likely to remain the most prominent service types, the growing demand for degradation of dyes from the textile industrial affluent is expected to play a key role in accelerating the development of phytoremediation treatment processes.

As the COVID-19 infection spreads across the world, operations across an array of industrial sectors have been affected considerably. The COVID-19 pandemic is expected to have a short-term impact on the overall growth of the global bioremediation technology & services market. As governments across the world seek novel ways to contain the transmission of the COVID-19 virus, lockdowns, trade restrictions, and stringent transportation guidelines are expected to stall the development of new bioremediation technologies & services.

While the demand is likely to remain relatively low in 2020, the analysts at the Transparency Market Research predict that the adoption of bioremediation technology & services is projected to witness considerable growth in the upcoming months as operations across the value chain of the global bioremediation technology & services market resume gradually.

Analysts’ Viewpoint

The global bioremediation technology & services market is expected to grow at an impressive CAGR of ~7% during the forecast period. The mounting environmental concerns coupled with stringent environment protection guidelines, research and development, entry of innovative bioremediation technologies and services, and rise in the number of government initiatives and programs, which aim to support research and development in the current landscape will play an important role in boosting the overall growth of the bioremediation technology & services market during the assessment period.

Bioremediation technology & services market to reach valuation of ~US$ 20 Bn by 2030

Bioremediation technology & services market is expected to expand at a CAGR of ~7% during from 2020 to 2030

Bioremediation technology & services market is driven by rise in awareness about the scarcity of natural resources

North America accounted for a major share of the global bioremediation technology & services market

Key players in the global bioremediation technology & services market include REGENESIS, Xylem, Inc., Aquatech International LLC, Drylet LLC, Altogen Labs, InSitu Remediation Services Limited

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Bioremediation Technology & Services Market

4. Market Overview

4.1. Introduction

4.1.1. Technology & Services Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Bioremediation Technology & Services Market Analysis and Forecast, 2018–2030

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Bioremediation Service Offerings Comparative Assessment, by Company

5.2. Key Bioremediation Projects-Snapshot

5.3. Government Initiatives/Key Investments Assessment

6. Global Bioremediation Technology & Services Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2018–2030

6.3.1. In Situ Bioremediation

6.3.2. Ex Situ Bioremediation

6.4. Market Attractiveness, by Type

7. Global Bioremediation Technology & Services Market Analysis and Forecast, by Technology

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Technology, 2018–2030

7.3.1. Phytoremediation

7.3.2. Biostimulation

7.3.3. Bioaugmentation

7.3.4. Bioreactors

7.3.5. Fungal Remediation

7.3.6. Land-based Treatments

7.4. Market Attractiveness, by Technology

8. Global Bioremediation Technology & Services Market Analysis and Forecast, by Services

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Services, 2018–2030

8.3.1. Soil Remediation

8.3.2. Wastewater Remediation

8.3.3. Oilfield Remediation

8.3.4. Others

8.4. Market Attractiveness, by Services

9. Global Bioremediation Technology & Services Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Region

10. North America Bioremediation Technology & Services Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2018–2030

10.2.1. In Situ Bioremediation

10.2.2. Ex Situ Bioremediation

10.3. Market Value Forecast, by Technology, 2018–2030

10.3.1. Phytoremediation

10.3.2. Biostimulation

10.3.3. Bioaugmentation

10.3.4. Bioreactors

10.3.5. Fungal Remediation

10.3.6. Land-based Treatments

10.4. Market Value Forecast, by Services, 2018–2030

10.4.1. Soil Remediation

10.4.2. Wastewater Remediation

10.4.3. Oilfield Remediation

10.4.4. Others

10.5. Market Value Forecast, by Country, 2018–2030

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Technology

10.6.3. By Services

10.6.4. By Country

11. Europe Bioremediation Technology & Services Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2018–2030

11.2.1. In Situ Bioremediation

11.2.2. Ex Situ Bioremediation

11.3. Market Value Forecast, by Technology, 2018–2030

11.3.1. Phytoremediation

11.3.2. Biostimulation

11.3.3. Bioaugmentation

11.3.4. Bioreactors

11.3.5. Fungal Remediation

11.3.6. Land-based Treatments

11.4. Market Value Forecast, by Services, 2018–2030

11.4.1. Soil Remediation

11.4.2. Wastewater Remediation

11.4.3. Oilfield Remediation

11.4.4. Others

11.5. Market Value Forecast, by Country/Sub-region, 2018–2030

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Technology

11.6.3. By Services

11.6.4. By Country/Sub-region

12. Asia Pacific Bioremediation Technology & Services Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2018–2030

12.2.1. In Situ Bioremediation

12.2.2. Ex Situ Bioremediation

12.3. Market Value Forecast, by Technology, 2018–2030

12.3.1. Phytoremediation

12.3.2. Biostimulation

12.3.3. Bioaugmentation

12.3.4. Bioreactors

12.3.5. Fungal Remediation

12.3.6. Land-based Treatments

12.4. Market Value Forecast, by Services, 2018–2030

12.4.1. Soil Remediation

12.4.2. Wastewater Remediation

12.4.3. Oilfield Remediation

12.4.4. Others

12.5. Market Value Forecast, by Country/Sub-region, 2018–2030

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Technology

12.6.3. By Services

12.6.4. By Country/Sub-region

13. Latin America Bioremediation Technology & Services Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2018–2030

13.2.1. In Situ Bioremediation

13.2.2. Ex Situ Bioremediation

13.3. Market Value Forecast, by Technology, 2018–2030

13.3.1. Phytoremediation

13.3.2. Biostimulation

13.3.3. Bioaugmentation

13.3.4. Bioreactors

13.3.5. Fungal Remediation

13.3.6. Land-based Treatments

13.4. Market Value Forecast, by Services, 2018–2030

13.4.1. Soil Remediation

13.4.2. Wastewater Remediation

13.4.3. Oilfield Remediation

13.4.4. Others

13.5. Market Value Forecast, by Country/Sub-region, 2018–2030

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Technology

13.6.3. By Services

13.6.4. By Country/Sub-region

14. Middle East & Africa Bioremediation Technology & Services Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2018–2030

14.2.1. In Situ Bioremediation

14.2.2. Ex Situ Bioremediation

14.3. Market Value Forecast, by Technology, 2018–2030

14.3.1. Phytoremediation

14.3.2. Biostimulation

14.3.3. Bioaugmentation

14.3.4. Bioreactors

14.3.5. Fungal Remediation

14.3.6. Land-based Treatments

14.4. Market Value Forecast, by Services, 2018–2030

14.4.1. Soil Remediation

14.4.2. Wastewater Remediation

14.4.3. Oilfield Remediation

14.4.4. Others

14.5. Market Value Forecast, by Country/Sub-region, 2018–2030

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Technology

14.6.3. By Services

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Competitive Positioning

15.3. Competitive Business Strategies

15.4. Company Profiles

15.4.1. REGENESIS

15.4.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.1.2. Company Financials

15.4.1.3. Growth Strategies

15.4.1.4. SWOT Analysis

15.4.2. Aquatech International LLC

15.4.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.2.2. Company Financials

15.4.2.3. Growth Strategies

15.4.2.4. SWOT Analysis

15.4.3. Xylem Inc.

15.4.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.3.2. Company Financials

15.4.3.3. Growth Strategies

15.4.3.4. SWOT Analysis

15.4.4. Drylet LLC

15.4.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.4.2. Company Financials

15.4.4.3. Growth Strategies

15.4.4.4. SWOT Analysis

15.4.5. Altogen Labs

15.4.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.5.2. Company Financials

15.4.5.3. Growth Strategies

15.4.5.4. SWOT Analysis

15.4.6. InSitu Remediation Services Limited

15.4.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.6.2. Company Financials

15.4.6.3. Growth Strategies

15.4.6.4. SWOT Analysis

15.4.7. PROBIOSPHERE

15.4.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.7.2. Company Financials

15.4.7.3. Growth Strategies

15.4.7.4. SWOT Analysis

15.4.8. Ivey International, Inc.

15.4.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.8.2. Company Financials

15.4.8.3. Growth Strategies

15.4.8.4. SWOT Analysis

15.4.9. Sumas Remediation Services, Inc.

15.4.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.9.2. Company Financials

15.4.9.3. Growth Strategies

15.4.9.4. SWOT Analysis

15.4.10. Sarva Bio Remed, LLC

15.4.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.4.10.2. Company Financials

15.4.10.3. Growth Strategies

15.4.10.4. SWOT Analysis

List of Tables

Table 01: Bioremediation Technology & Services Market Offerings, by Company

Table 02: Global Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Type, 2018–2030

Table 03: Global Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 04: Global Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Services, 2018–2030

Table 05: Global Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Region, 2018–2030

Table 06: North America Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Country, 2018–2030

Table 07: North America Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Type, 2018–2030

Table 08: North America Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 09: North America Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Services, 2018–2030

Table 10: Europe Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 11: Europe Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Type, 2018–2030

Table 12: Europe Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 13: Europe Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Services, 2018–2030

Table 14: Asia Pacific Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 15: Asia Pacific Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Type, 2018–2030

Table 16: Asia Pacific Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 17: Asia Pacific Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Services, 2018–2030

Table 18: Latin America Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 19: Latin America Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Type, 2018–2030

Table 20: Latin America Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 21: Latin America Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Services, 2018–2030

Table 22: Middle East & Africa Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018–2030

Table 23: Middle East & Africa Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Type, 2018–2030

Table 24: Middle East & Africa Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Technology, 2018–2030

Table 25: Middle East & Africa Bioremediation Technology & Services Market Value (US$ Mn) Forecast, by Services, 2018–2030

List of Figures

Figure 01: Global Bioremediation Technology & Services Market Value (US$ Mn) and Distribution, by Region, 2019 and 2030

Figure 02: Global Bioremediation Technology & Services Market Value (US$ Mn) Forecast, 2018–2030

Figure 03: Global Bioremediation Technology & Services Market Value Share, by Type, 2019

Figure 04: Global Bioremediation Technology & Services Market Value Share, by Technology, 2019

Figure 05: Global Bioremediation Technology & Services Market Value Share, by Services, 2019

Figure 06: Global Bioremediation Technology & Services Market Value Share, by Region, 2019

Figure 07: Global Bioremediation Technology & Services Market Value Share Analysis, by Type, 2019 and 2030

Figure 08: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by In Situ Bioremediation, 2018-2030

Figure 09: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Ex Situ Bioremediation, 2018-2030

Figure 10: Global Bioremediation Technology & Services Market Attractiveness Analysis, by Type, 2020–2030

Figure 11: Global Bioremediation Technology & Services Market Value Share Analysis, by Technology, 2019 and 2030

Figure 12: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Phytoremediation, 2018-2030

Figure 13: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Biostimulation, 2018-2030

Figure 14: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Bioaugmentation, 2018-2030

Figure 15: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Bioreactors, 2018-2030

Figure 16: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Fungal Remediation, 2018-2030

Figure 17: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Land-based Treatments, 2018-2030

Figure 18: Global Bioremediation Technology & Services Market Attractiveness Analysis, by Technology 2020-2030

Figure 19: Global Bioremediation Technology & Services Market Value Share Analysis, by Services, 2019 and 2030

Figure 20: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Soil Remediation, 2018-2030

Figure 21: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Wastewater Remediation, 2018-2030

Figure 22: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Oilfield Remediation, 2018-2030

Figure 23: Global Bioremediation Technology & Services Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2018-2030

Figure 24: Global Bioremediation Technology & Services Market Attractiveness Analysis, by Services, 2020-2030

Figure 25: Global Bioremediation Technology & Services Market Value Share, by Region, 2019 and 2030

Figure 26: Global Bioremediation Technology & Services Market Attractiveness, by Region, 2019–2027

Figure 27: North America Bioremediation Technology & Services Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2018–2030

Figure 28: North America Bioremediation Technology & Services Market Value Share, by Country, 2019 and 2030

Figure 29: North America Bioremediation Technology & Services Market Attractiveness, by Country, 2020–2030

Figure 30: North America Bioremediation Technology & Services Market Value Share, by Type, 2019 and 2030

Figure 31: North America Bioremediation Technology & Services Market Attractiveness, by Type, 2020–2030

Figure 32: North America Bioremediation Technology & Services Market Value Share, by Technology, 2019 and 2030

Figure 33: North America Bioremediation Technology & Services Market Attractiveness, by Technology, 2020–2030

Figure 34: North America Bioremediation Technology & Services Market Value Share, by Services, 2019 and 2030

Figure 35: North America Bioremediation Technology & Services Market Attractiveness, by Services, 2020–2030

Figure 36: Europe Bioremediation Technology & Services Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2018–2030

Figure 37: Europe Bioremediation Technology & Services Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 38: Europe Bioremediation Technology & Services Market Attractiveness Analysis, by Country/Sub-region, 2020–2030

Figure 39: Europe Bioremediation Technology & Services Market Value Share Analysis, by Type, 2019 and 2030

Figure 40: Europe Bioremediation Technology & Services Market Attractiveness Analysis, by Type, 2020–2030

Figure 41: Europe Bioremediation Technology & Services Market Value Share, by Technology, 2019 and 2030

Figure 42: Europe Bioremediation Technology & Services Market Attractiveness, by Technology, 2020–2030

Figure 43: Europe Bioremediation Technology & Services Market Value Share Analysis, by Services, 2019 and 2030

Figure 44: Europe Bioremediation Technology & Services Market Attractiveness Analysis, by Services, 2020–2030

Figure 45: Asia Pacific Bioremediation Technology & Services Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2018–2030

Figure 46: Asia Pacific Bioremediation Technology & Services Market Value Share Analysis, by Country/Sub-region, 2019 and 2030

Figure 47: Asia Pacific Bioremediation Technology & Services Market Attractiveness Analysis, by Country/Sub-region

Figure 48: Asia Pacific Bioremediation Technology & Services Market Value Share Analysis, by Type, 2019 and 2030

Figure 49: Asia Pacific Bioremediation Technology & Services Market Attractiveness Analysis, by Type, 2020–2030

Figure 50: Asia Pacific Bioremediation Technology & Services Market Value Share Analysis, by Technology, 2019 and 2030

Figure 51: Asia Pacific Bioremediation Technology & Services Market Attractiveness Analysis, by Technology, 2020–2030

Figure 52: Asia Pacific Bioremediation Technology & Services Market Value Share Analysis, by Services, 2019 and 2030

Figure 53: Asia Pacific Bioremediation Technology & Services Market Attractiveness Analysis, by Services, 2020–2030

Figure 54: Latin America Bioremediation Technology & Services Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2018–2030

Figure 55: Latin America Bioremediation Technology & Services Market Value Share, by Country/Sub-region, 2019 and 2030

Figure 56: Latin America Bioremediation Technology & Services Market Attractiveness, by Country/sub-region, 2020–2030

Figure 57: Latin America Bioremediation Technology & Services Market Value Share, by Type, 2019 and 2030

Figure 58: Latin America Bioremediation Technology & Services Market Attractiveness, by Type, 2020–2030

Figure 59: Latin America Bioremediation Technology & Services Market Value Share, by Technology, 2019 and 2030

Figure 60: Latin America Bioremediation Technology & Services Market Attractiveness, by Technology, 2020–2030

Figure 61: Latin America Bioremediation Technology & Services Market Value Share, by Services, 2019 and 2030

Figure 62: Latin America Bioremediation Technology & Services Market Attractiveness, by Services, 2020–2030

Figure 63: Middle East & Africa Bioremediation Technology & Services Market Value (US$ Mn) Forecast and Y-o-Y Growth Projection (%), 2018–2030

Figure 64: Middle East & Africa Bioremediation Technology & Services Market Value Share, by Country/Sub-region, 2019 and 2030

Figure 65: Middle East & Africa Bioremediation Technology & Services Market Attractiveness, by Country/Sub-region, 2020–2030

Figure 66: Middle East & Africa Bioremediation Technology & Services Market Value Share, by Type, 2019 and 2030

Figure 67: Middle East & Africa Bioremediation Technology & Services Market Attractiveness, by Type, 2020–2030

Figure 68: Middle East & Africa Bioremediation Technology & Services Market Value Share, by Technology, 2019 and 2030

Figure 69: Middle East & Africa Bioremediation Technology & Services Market Attractiveness, by Technology, 2020–2030

Figure 70: Middle East & Africa Bioremediation Technology & Services Market Value Share, by Services, 2019 and 2030

Figure 71: Middle East & Africa Bioremediation Technology & Services Market Attractiveness, by Services, 2020–2030

Figure 72: Xylem Inc., Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2019

Figure 73: Xylem Inc., R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2019

Figure 74: Xylem Inc., Breakdown of Net Sales, by Region, 2019

Figure 75: Xylem Inc., Breakdown of Net Sales, by Business Segment, 2019