Reports

Reports

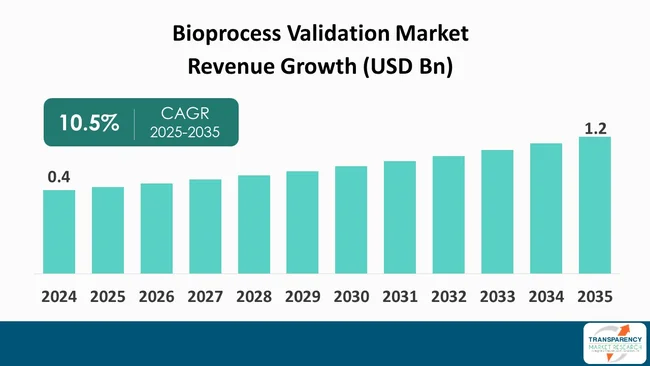

The global bioprocess validation market size was valued at US$ 0.4 billion in 2024 and is projected to reach US$ 1.2 billion by 2035, expanding at a CAGR of 10.5 % from 2025 to 2035. The global bioprocess validation industry is projected to expand at annual growth rate (CAGR of 10.5%) during the forecast period. The primary factors that are fueling this growth include the increasing acceptance of biopharmaceuticals, imposition of strict regulations to ensure safety and efficacy of products, and the technological innovations in the bioprocessing sector.

The international bioprocess validation market is poised to witness positive movement during the forecast period. One of the main factors to progress is the rising need for therapeutic proteins, vaccines, and biosimilars by the pharmaceuticals and biotechnology sectors. They indicate that one of the main drivers that gathers market adoption is the strong regulatory requirements and the demand for high-quality and consistent bioprocesses.

One of the main factors that lead to the expansion of the market is the increasing need to outsource the services of validating third-party organizations that are specialized in the field. Moreover, improvements in technology in areas such as automation, process analytics, and data management are also anticipated to increase productivity and lower expenses, thereby attracting more stakeholders to the market.

However, pharmaceutical companies working together with technology providers will boost the innovations in the validation processes. Additionally, a greater emphasis on personalized medicine will provide opportunities for niche validation solutions. Besides, it is anticipated that technological developments in areas such as automation, process analytics, and data management will improve productivity, lower expenditures, thereby increasing the attractiveness of the market for the stakeholders.

Bioprocess validation market encompasses the means, methods, and technology that ensure that the operations of biopharmaceutical manufacturing are consistent in producing products that comply with quality and regulatory standards that have been previously agreed upon.

The mentioned market has attracted substantial interest, which is largely due to the rising need for biologics, vaccines, and biosimilars, as well as the tough regulatory requirements for product safety and effectiveness. Validation of a bioprocess is the evaluation of the hardware, operations, and testing methods for certain uniformity, trustworthiness, and adherence to GMP.

The market is experiencing substantial expansion, which is largely attributed to the successful application of automation, process analytical technologies, and data management solutions. These technologies promote operational efficiency and lower the possibility of mistakes. In addition, the pattern of hiring third parties to perform validation services is accelerating the market spread in all countries globally.

For instance, WuXi Biologics received green signal from the European Medicines Agency (EMA) for the commercial production facility in Dundalk, Ireland. Biologics produced at this plant will be marketed globally, becoming a major milestone in the extension of production capacity for biopharmaceuticals in the EU.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The FDA has introduced preliminary recommendations to make it easier to create cellular and gene therapy products for small patient populations. The given details emphasize experimental designs that use new methods and endpoints in order to obtain a permit for the treatment of rare and severe diseases.

Consequently, a thorough bioprocess validation is essential these days, which allows the whole production pharmaceutical companies to comply with tight regulatory criteria and provide top-quality biopharmaceuticals to the market.

The increased demand for biopharmaceuticals has brought about these positive changes as well, such as investments in higher validation technologies, automation, and process analytical instruments for easy operations, and to make the risk potential throughout the production process lower.

For instance, one non-clinical and clinical guideline for investigational medicinal products for advanced therapies in clinical trials was indeed released by the EMA in April 2025. The core objective of this guidance document is to streamline the evaluation process of ATMPs including gene therapies to ensure they are safe and effective.

Growth of bioprocess validation market worldwide is largely driven by the need for biologics, biosimilars, and advanced therapies, which require substantial rise in the number of contract manufacturing organizations (CMOs) with increased business scope. According to the World Health Organization (WHO), the role of e-Commerce in the supply of medicines worldwide, especially in markets is considerable. The WHO acknowledges that following the growth in patients' preference for pharmaceutical services via the web, stringent cold chain criteria should be implemented. This is aimed at drug safety during cross-border transport in which their efficacy at low temperatures is required to be maintained.

Pharmaceutical and biotechnology companies have progressively been transferring their production and production validation to CMOs to achieve reduction in operational costs, to get their products on the market faster, and benefit from the utilization of specialized expertise. CMOs provide modern facilities, advanced technologies, and assistance with regulatory compliance that are all part of the package of services that make them a strategic partner in the complicated process of biopharmaceutical production.

The trend is notably visible in the areas that have strong bio manufacturing infrastructures. In such places, CMOs are making capital investments in capacity expansion, automation, and quality assurance systems so that they can cater to the increasing demands of their clients all globally. For instance, Biomedical Advanced Research and Development Authority (BARDA) in the U.S. has put in more than US$ 2 Bn in the increased domestic production of biopharmaceuticals for the rapid expansion of surge capacity.

Some of the key areas for this effort include the supply of materials, clean filling/ finishing, and the use of single-use technologies, with a goal to increase the readiness of the U.S. to any public health crises.

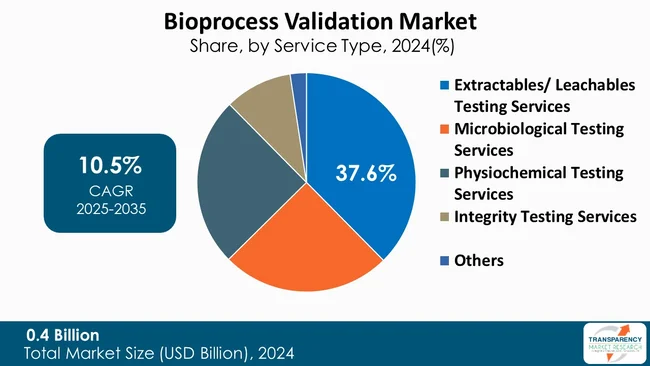

The segment of extractables and leachables (E&L) testing services maintains the leading position in the global bioprocess validation industry with 37.6% of market share, with the major factor consisting of the necessity of product safety assurance and meeting strict regulations. Such tests play a key role in detection of a wide range of chemical substances that can migrate from manufacturing components, packaging materials, or single-use systems, and end up in drug products.

The rising use of single-use bioprocessing equipment and the complex nature of biologic formulations are among the primary reasons for the higher demand for E&L testing that has spread globally across the biopharma industry. For instance, the Food and Drug Administration (FDA) and the European Medicines Agency (EMA), both - regulatory bodies, have set out rigorous rules that require exhaustive E&L investigations.

Consequently, manufacturers have to allocate funds to upgrade their analytical capabilities and also use the services of the testing laboratories that have the required expertise. Consequently, the segment is still undergoing substantial growth, which is sustained by increased biological manufacturing operations and greater attention to patient safety and product quality.

| Attribute | Detail |

|---|---|

| Leading Region |

|

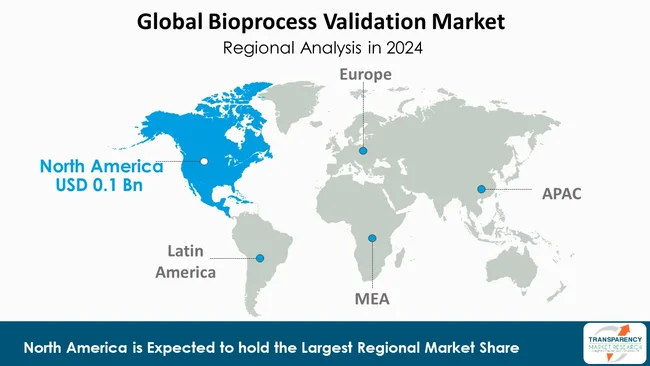

The global bioprocess validation market currently is led by North America with 40.6% market share, which is mainly attributable to the region having a well-developed biopharmaceutical industry, strict regulatory policies, and a high level of uptake of sophisticated technologies.

Presence of pharmaceutical and biotechnology companies, research institutions, and contract manufacturing organizations (CMOs) in the region that are the main reasons for the need for strong validation processes. North America's market leadership is also being upheld by established research and development activities, substantially supported by government initiatives that back bio manufacturing at home.

For instance, AstraZeneca began a US$ 4.5 Bn manufacturing expansion in Albemarle County, Virginia. This facility is linked to the company’s US$ 50 Bn investment plan to increase research and production in the U.S. by 2030, resulting in the creation of 600 high-skilled jobs and 3,000 more construction-related roles.

Eurofins Scientific, Sartorius AG, Merck KGaA, Thermo Fisher Scientific Inc., Lonza, Danaher Corporation, Charles River Laboratories, SGS Société Générale de Surveillance, LabCorp, Cobetter, Pall Corporation, Almac Group, METTLER TOLEDO, Cytiva, Bio-Rad Laboratories, Inc. and others are some of the leading manufacturers operating in the global bioprocess validation market.

Each of these companies has been profiled in the Bioprocess Validation market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 0.4 Bn |

| Forecast Value in 2035 | More than US$ 1.2 Bn |

| CAGR | 10.5 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Test Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global bioprocess validation market was valued at US$ 0.4 Bn in 2024

The global bioprocess validation industry is projected to reach more than US$ 1.2 Bn by the end of 2035

Increasing demand for biopharmaceuticals and expansion of contract manufacturing organizations (CMOs) are some of the factors driving the expansion of bioprocess validation market.

The CAGR is anticipated to be 10.5% from 2025 to 2035

Eurofins Scientific, Sartorius AG, Merck KGaA, Thermo Fisher Scientific Inc., Lonza, Danaher Corporation, Charles River Laboratories, SGS Société Générale de Surveillance, LabCorp, Cobetter, Pall Corporation, Almac Group, METTLER TOLEDO, Cytiva, Bio-Rad Laboratories, Inc. and other prominent players

Table 01: Global Bioprocess Validation Market Value (US$ Bn) Forecast, by Test Type, 2020 to 2035

Table 02: Global Bioprocess Validation Market Value (US$ Bn), By Microbiological Testing Services, 2020 to 2035

Table 03: Global Bioprocess Validation Market Value (US$ Bn) Forecast, By Process Component, 2020 to 2035

Table 04: Global Bioprocess Validation Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Bioprocess Validation Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Bioprocess Validation Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America Bioprocess Validation Market Value (US$ Bn) Forecast, by Test Type, 2020 to 2035

Table 08: North America Bioprocess Validation Market Value (US$ Bn), By Microbiological Testing Services, 2020 to 2035

Table 09: North America Bioprocess Validation Market Value (US$ Bn) Forecast, by Process Component, 2020 to 2035

Table 10: North America Bioprocess Validation Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 11: Europe Bioprocess Validation Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 12: Europe Bioprocess Validation Market Value (US$ Bn) Forecast, by Test Type, 2020 to 2035

Table 13: Europe Bioprocess Validation Market Value (US$ Bn), By Microbiological Testing Services, 2020 to 2035

Table 14: Europe Bioprocess Validation Market Value (US$ Bn) Forecast, by Process Component, 2020 to 2035

Table 15: Europe Bioprocess Validation Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 16: Asia Pacific Bioprocess Validation Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 17: Asia Pacific Bioprocess Validation Market Value (US$ Bn) Forecast, by Test Type, 2020 to 2035

Table 18: Asia Pacific Bioprocess Validation Market Value (US$ Bn), By Microbiological Testing Services, 2020 to 2035

Table 19: Asia Pacific Bioprocess Validation Market Value (US$ Bn) Forecast, by Process Component, 2020 to 2035

Table 20: Asia Pacific Bioprocess Validation Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 21: Latin America Bioprocess Validation Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Latin America Bioprocess Validation Market Value (US$ Bn) Forecast, by Test Type, 2020 to 2035

Table 23: Latin America Bioprocess Validation Market Value (US$ Bn), By Microbiological Testing Services, 2020 to 2035

Table 24: Latin America Bioprocess Validation Market Value (US$ Bn) Forecast, by Process Component, 2020 to 2035

Table 25: Latin America Bioprocess Validation Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 26: Middle East and Africa Bioprocess Validation Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 27: Middle East and Africa Bioprocess Validation Market Value (US$ Bn) Forecast, by Test Type, 2020 to 2035

Table 28: Middle East and Africa Bioprocess Validation Market Value (US$ Bn), By Microbiological Testing Services, 2020 to 2035

Table 29: Middle East and Africa Bioprocess Validation Market Value (US$ Bn) Forecast, by Process Component, 2020 to 2035

Table 30: Middle East and Africa Bioprocess Validation Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Bioprocess Validation Market Value Share Analysis, by Test Type, 2024 and 2035

Figure 02: Global Bioprocess Validation Market Attractiveness Analysis, by Test Type, 2025 to 2035

Figure 03: Global Bioprocess Validation Market Revenue (US$ Bn), by Extractables/ Leachables Testing Services, 2020 to 2035

Figure 04: Global Bioprocess Validation Market Revenue (US$ Bn), by Microbiological Testing Services, 2020 to 2035

Figure 05: Global Bioprocess Validation Market Revenue (US$ Bn), by Physiochemical Testing Services, 2020 to 2035

Figure 06: Global Bioprocess Validation Market Revenue (US$ Bn), by Integrity Testing Services, 2020 to 2035

Figure 07: Global Bioprocess Validation Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 08: Global Bioprocess Validation Market Value Share Analysis, by Process Component, 2024 and 2035

Figure 09: Global Bioprocess Validation Market Attractiveness Analysis, by Process Component, 2024 and 2035

Figure 10: Global Bioprocess Validation Market Revenue (US$ Bn), by Filter Elements, 2020 to 2035

Figure 11: Global Bioprocess Validation Market Revenue (US$ Bn), by Media Containers & Bags, 2020 to 2035

Figure 12: Global Bioprocess Validation Market Revenue (US$ Bn), by Freezing & Thawing Process Bag, 2020 to 2035

Figure 13: Global Bioprocess Validation Market Revenue (US$ Bn), by Mixing Systems, 2020 to 2035

Figure 14: Global Bioprocess Validation Market Revenue (US$ Bn), by Bioreactors, 2020 to 2035

Figure 15: Global Bioprocess Validation Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 16: Global Bioprocess Validation Market Value Share Analysis, by End-user, 2024 and 2035

Figure 17: Global Bioprocess Validation Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 18: Global Bioprocess Validation Market Revenue (US$ Bn), by Pharmaceutical Companies, 2025 to 2035

Figure 19: Global Bioprocess Validation Market Revenue (US$ Bn), by Contract Development & Manufacturing Organization, 2020 to 2035

Figure 20: Global Bioprocess Validation Market Revenue (US$ Bn), by Biotechnology Companies, 2020 to 2035

Figure 21: Global Bioprocess Validation Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 22: Global Bioprocess Validation Market Value Share Analysis, By Region, 2024 and 2035

Figure 23: Global Bioprocess Validation Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 24: North America Bioprocess Validation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 25: North America Bioprocess Validation Market Value Share Analysis, by Country, 2024 and 2035

Figure 26: North America Bioprocess Validation Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 27: North America Bioprocess Validation Market Value Share Analysis, by Test Type, 2024 and 2035

Figure 28: North America Bioprocess Validation Market Attractiveness Analysis, by Test Type, 2025 to 2035

Figure 29: North America Bioprocess Validation Market Value Share Analysis, by Process Component, 2024 and 2035

Figure 30: North America Bioprocess Validation Market Attractiveness Analysis, by Process Component, 2025 to 2035

Figure 31: North America Bioprocess Validation Market Value Share Analysis, by End-user, 2024 and 2035

Figure 32: North America Bioprocess Validation Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 33: Europe Bioprocess Validation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Europe Bioprocess Validation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 35: Europe Bioprocess Validation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 36: Europe Bioprocess Validation Market Value Share Analysis, by Test Type, 2024 and 2035

Figure 37: Europe Bioprocess Validation Market Attractiveness Analysis, by Test Type, 2025 to 2035

Figure 38: Europe Bioprocess Validation Market Value Share Analysis, By Process Component, 2024 and 2035

Figure 39: Europe Bioprocess Validation Market Attractiveness Analysis, By Process Component, 2025 to 2035

Figure 40: Europe Bioprocess Validation Market Value Share Analysis, by End-user, 2024 and 2035

Figure 41: Europe Bioprocess Validation Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 42: Asia Pacific Bioprocess Validation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 43: Asia Pacific Bioprocess Validation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 44: Asia Pacific Bioprocess Validation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 45: Asia Pacific Bioprocess Validation Market Value Share Analysis, by Test Type, 2024 and 2035

Figure 46: Asia Pacific Bioprocess Validation Market Attractiveness Analysis, by Test Type, 2025 to 2035

Figure 47: Asia Pacific Bioprocess Validation Market Value Share Analysis, By Process Component, 2024 and 2035

Figure 48: Asia Pacific Bioprocess Validation Market Attractiveness Analysis, By Process Component, 2025 to 2035

Figure 49: Asia Pacific Bioprocess Validation Market Value Share Analysis, by End-user, 2024 and 2035

Figure 50: Asia Pacific Bioprocess Validation Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 51: Latin America Bioprocess Validation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 52: Latin America Bioprocess Validation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 53: Latin America Bioprocess Validation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 54: Latin America Bioprocess Validation Market Value Share Analysis, by Test Type, 2024 and 2035

Figure 55: Latin America Bioprocess Validation Market Attractiveness Analysis, by Test Type, 2025 to 2035

Figure 56: Latin America Bioprocess Validation Market Value Share Analysis, By Process Component, 2024 and 2035

Figure 57: Latin America Bioprocess Validation Market Attractiveness Analysis, By Process Component, 2025 to 2035

Figure 58: Latin America Bioprocess Validation Market Value Share Analysis, by End-user, 2024 and 2035

Figure 59: Latin America Bioprocess Validation Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 60: Middle East & Africa Bioprocess Validation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 61: Middle East & Africa Bioprocess Validation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 62: Middle East & Africa Bioprocess Validation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 63: Middle East and Africa Bioprocess Validation Market Value Share Analysis, by Test Type, 2024 and 2035

Figure 64: Middle East and Africa Bioprocess Validation Market Attractiveness Analysis, by Test Type, 2025 to 2035

Figure 65: Middle East and Africa Bioprocess Validation Market Value Share Analysis, by Process Component, 2024 and 2035

Figure 66: Middle East and Africa Bioprocess Validation Market Attractiveness Analysis, By Process Component, 2025 to 2035

Figure 67: Middle East and Africa Bioprocess Validation Market Value Share Analysis, by End-user, 2024 and 2035

Figure 68: Middle East and Africa Bioprocess Validation Market Attractiveness Analysis, by End-user, 2025 to 2035