Reports

Reports

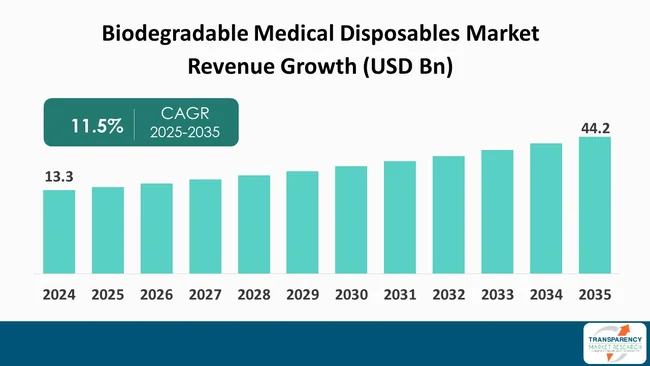

The global biodegradable medical disposables market size was valued at US $ 13.3 billion in 2024 and is projected to reach US $ 44.2 billion by 2035, expanding at a CAGR of 11.5% from 2025 to 2035. The market growth is driven by stringent environmental regulations and sustainability mandates, rising healthcare waste and infection control needs and consumer and institutional demand for green products.

The biodegradable medical disposables market is witnessing a significant growth, driven by increasing environmental concerns and regulatory pressures to reduce plastic waste. As hospitals and the other healthcare institutions become more emblazoned in attention to their own carbon footprint, they are calling for green products.

Biodegradables such as polylactic acid (PLA) and the other naturally derived materials from polymers are a perfect solution, breaking down naturally without sacrificing the needed sterility and usability of application within medicine.

Additionally, advancements in material technology are catching biodegradable disposables' performance characteristics up with their conventional counterparts. Governments and regulatory agencies in driving environmental sustainability are increasingly nudging practitioners toward biodegradability. There are, however, barriers, from higher production costs to limited availability of certain biodegradable products, capable of curdling adoption.

The market nevertheless has humongous potential for innovation and growth. Companies that have invested in research and development activities will gain from the growing need for environmentally-friendly medical products. As greater attention is put on the environment, the market for biodegradable medical disposables will grow, paving the way for green healthcare solutions of tomorrow.

Biodegradable medical disposables are a revolution in the healthcare sector toward meeting the pressing requirement for environmentally-friendly waste management items. Conventional medical disposables, used in the majority of cases, are petroleum-based plastics whose long time of decomposition is contributing to greater environmental contamination. Biodegradable medical disposables, are, on the contrary, formulated to decompose naturally, and they use materials like polylactic acid (PLA) and the other biopolymers that are renewable in nature.

These products are kept in a sterile state and retain the functional integrity for medical use. As such, they can be reused for applications like syringes, gloves, and surgical tools. Increased environmental awareness among patients and caregivers has fueled the need for these green alternatives. The government agencies are also promoting the use of biodegradable solutions actively to counter the problem of plastic waste in healthcare.

In spite of its shortcomings like increased cost of production and the requirement of adequate facilities for disposal, the market for biodegradable medical disposables is growing at an extremely rapid rate. Advancements in material science and technology are allowing the product to be more effective and cost-efficient. With healthcare facilities across the globe placing importance on sustainability, biodegradable medical disposables stand to take a huge opportunity to enable green practice with patient safety and quality of care assured.

| Attribute | Detail |

|---|---|

| Biodegradable Medical Disposables Market Drivers |

|

The increasing plastic waste management issues are amongst the major drivers for the biodegradable medical disposables market. While the global healthcare industry churns out enormous amounts of single-use plastic waste, the environmental hazards have become a key concern. Conventional medical disposables such as syringes, gloves, and packaging materials are part of the increasing plastic pollution concerns, which is causing severe threats to public health and the ecosystem.

Government agencies and governments from across the globe are responding to these challenges with stringent regulations lowering plastic consumption and encouraging the eco-friendly practices. This regulatory environment is asking medical professionals to find biodegradable alternatives that help in minimizing their carbon footprint. Biodegradable medical disposables produced using plastics such as polylactic acid (PLA) and the other biopolymers are an excellent alternative as they degrade naturally and therefore minimize landfill waste.

While spurred by waste management, health professionals are also urged by the need to improve their image and satisfy patient expectations of green practice. Increased consumers' awareness of environmental concerns also creates more demand for biodegradable products and sets up the market for biodegradable medical disposables for robust growth. By addressing the urgent demand for sustainable waste disposal solutions, this market will be a central force in remaking healthcare practices and defining a more sustainable future.

Technological advancements in biopolymer technology are amongst the most important growth drivers to the biodegradable medical disposables market. Since the healthcare industry is increasingly asking for environmentally-friendly medical disposables for replacing conventional plastics, material science-related innovations have paved the way to create high-performance biopolymers. These products, made out of renewable feedstock like starch, cellulose, and polylactic acid (PLA), possess the characteristics needed for application in medicine, i.e., sterility, strength, and flexibility.

Advancements in biopolymer production processes have improved the performance qualities of biodegradable disposables on a considerable note. With new formulations, one can now replicate the performance qualities of traditional plastics while providing the guarantee of lowering the environment's footprint. For instance, new blending technology and additives can improve the mechanical performance and thermal stability of biopolymers so that they are usable in medical products ranging between surgical instruments and packaging materials.

Besides, the use of biodegradable materials in medical devices does resonate with the growing regulatory impetus toward sustainable development. Companies are now better equipped for addressing compliance requirements as well as the rising consumer demand for sustainable products. This innovation through technology not only offsets past limitations on biodegradability but also encourages innovation within the industry, resulting in new and advanced medical disposables.

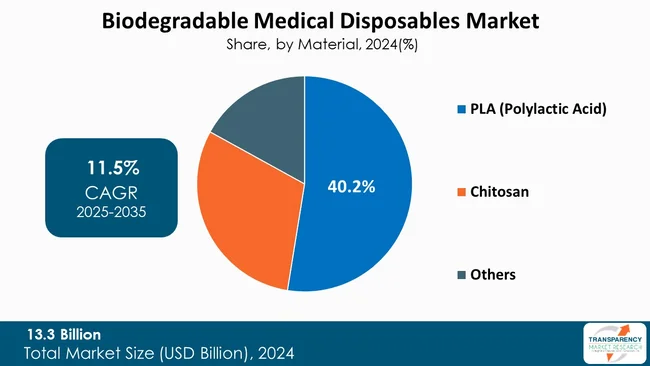

Polylactic acid or PLA is dominating the market for biodegradable medical disposables due to its eco-friendliness. Developed from renewable raw materials like corn starch or sugarcane, PLA is biodegradable as well as compostable, wherein it breaks down into natural products without leaving behind any toxic residue.

PLA has superior mechanical properties, including strength and flexibility, and thus can have applications in various medical applications, ranging from sutures, drug delivery systems, and surgery equipment to implant devices. Sterilization functionality is another significant advantage as medical disposables need to have high standards of sanitation.

The push toward environmentally-friendly compliant alternatives is also influencing PLA application. Governments as well as healthcare systems are increasingly encouraging healthcare organizations that utilize biodegradable products due to their ability to aid in environmental conservation.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America dominates the biodegradable medical disposables Industry, holding the largest revenue share of 37.5% due to governments’ support, increased environmental consciousness, and enormous investments in healthcare technology. Government agencies like the FDA are applying pressure on sustainable consumption and are promoting eco-friendly medical devices.

Secondly, heightened awareness of healthcare consumers does exist. Clinics and hospitals are now seeking to reduce their ecological impact, hence the shift toward biodegradable disposables. This is backed by campaigns for heightened awareness of the environmentally disastrous effects of single-use plastics.

Also, there are various research institutions and high-tech firms based in North America that lead the way in creating new biopolymer technologies like Polylactic Acid (PLA). The new technologies improve the performance and application of biodegradable materials in healthcare environments.

Key players in the global biodegradable medical disposables market are investing in innovation, technological advancements, and forming alliances. Their objective is for improving the accuracy of testing, diversifying their products, and gaining a stronger market presence in order to gain a competitive edge in the evolving healthcare market.

Bayer AG, BD, Smith & Nephew PLC, Cardinal Health, Medline Industries, Inc., 3M, MED-CON Inc., Medtronic, Boston Scientific, Becton, Dickinson and Company, Pfizer, Johnson and Johnson are some of the leading players.

Each of these players has been profiled in the biodegradable medical disposables market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 13.3 Bn |

| Forecast Value in 2035 | US$ 44.2 Bn |

| CAGR | 11.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Biodegradable Medical Disposables Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

Product

Material

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 13.3 Bn in 2024

It is projected to cross US$ 44.2 Bn by the end of 2035

Rising plastic waste management challenges and advancements in biopolymer technologies

It is anticipated to grow at a CAGR of 11.5% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Bayer AG, BD, Smith & Nephew PLC, Cardinal Health, Medline Industries, Inc., 3M, MED-CON Inc., Medtronic, Boston Scientific, Becton, Dickinson and Company, Pfizer, Johnson and Johnson, and others

Table 01: Global Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 02: Global Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 03: Global Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 04: Global Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 05: North America Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 06: North America Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 07: North America Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 08: North America Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 09: Europe Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 10: Europe Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 11: Europe Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 12: Europe Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Asia Pacific Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 14: Asia Pacific Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 15: Asia Pacific Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 16: Asia Pacific Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 17: Latin America Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 18: Latin America Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 19: Latin America Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 20: Latin America Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Middle East & Africa Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Middle East & Africa Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 23: Middle East & Africa Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 24: Middle East & Africa Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Biodegradable Medical Disposables Market Value Share Analysis, By Product, 2024 and 2035

Figure 02: Global Biodegradable Medical Disposables Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 03: Global Biodegradable Medical Disposables Market Revenue (US$ Bn), by Isolation Gowns, 2020 to 2035

Figure 04: Global Biodegradable Medical Disposables Market Revenue (US$ Bn), by Gloves and Wound Dressings, 2020 to 2035

Figure 05: Global Biodegradable Medical Disposables Market Revenue (US$ Bn), by Sutures and Bandages, 2020 to 2035

Figure 06: Global Biodegradable Medical Disposables Market Revenue (US$ Bn), by Drug Delivery Systems, 2020 to 2035

Figure 07: Global Biodegradable Medical Disposables Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 08: Global Biodegradable Medical Disposables Market Value Share Analysis, By Material, 2024 and 2035

Figure 09: Global Biodegradable Medical Disposables Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 10: Global Biodegradable Medical Disposables Market Revenue (US$ Bn), by PLA (Polylactic Acid), 2020 to 2035

Figure 11: Global Biodegradable Medical Disposables Market Revenue (US$ Bn), by Chitosan, 2020 to 2035

Figure 12: Global Biodegradable Medical Disposables Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 13: Global Biodegradable Medical Disposables Market Value Share Analysis, By End-user, 2024 and 2035

Figure 14: Global Biodegradable Medical Disposables Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 15: Global Biodegradable Medical Disposables Market Revenue (US$ Bn), by Hospitals & Clinics, 2020 to 2035

Figure 16: Global Biodegradable Medical Disposables Market Revenue (US$ Bn), by Ambulatory Surgical Centers, 2020 to 2035

Figure 17: Global Biodegradable Medical Disposables Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global Biodegradable Medical Disposables Market Value Share Analysis, By Region, 2024 and 2035

Figure 19: Global Biodegradable Medical Disposables Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 20: North America Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 21: North America Biodegradable Medical Disposables Market Value Share Analysis, by Country, 2024 and 2035

Figure 22: North America Biodegradable Medical Disposables Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 23: North America Biodegradable Medical Disposables Market Value Share Analysis, By Product, 2024 and 2035

Figure 24: North America Biodegradable Medical Disposables Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 25: North America Biodegradable Medical Disposables Market Value Share Analysis, By Material, 2024 and 2035

Figure 26: North America Biodegradable Medical Disposables Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 27: North America Biodegradable Medical Disposables Market Value Share Analysis, By End-user, 2024 and 2035

Figure 28: North America Biodegradable Medical Disposables Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 29: Europe Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 30: Europe Biodegradable Medical Disposables Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 31: Europe Biodegradable Medical Disposables Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 32: Europe Biodegradable Medical Disposables Market Value Share Analysis, By Product, 2024 and 2035

Figure 33: Europe Biodegradable Medical Disposables Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 34: Europe Biodegradable Medical Disposables Market Value Share Analysis, By Material, 2024 and 2035

Figure 35: Europe Biodegradable Medical Disposables Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 36: Europe Biodegradable Medical Disposables Market Value Share Analysis, By End-user, 2024 and 2035

Figure 37: Europe Biodegradable Medical Disposables Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 38: Asia Pacific Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: Asia Pacific Biodegradable Medical Disposables Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 40: Asia Pacific Biodegradable Medical Disposables Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 41: Asia Pacific Biodegradable Medical Disposables Market Value Share Analysis, By Product, 2024 and 2035

Figure 42: Asia Pacific Biodegradable Medical Disposables Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 43: Asia Pacific Biodegradable Medical Disposables Market Value Share Analysis, By Material, 2024 and 2035

Figure 44: Asia Pacific Biodegradable Medical Disposables Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 45: Asia Pacific Biodegradable Medical Disposables Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: Asia Pacific Biodegradable Medical Disposables Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 47: Latin America Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Latin America Biodegradable Medical Disposables Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 49: Latin America Biodegradable Medical Disposables Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 50: Latin America Biodegradable Medical Disposables Market Value Share Analysis, By Product, 2024 and 2035

Figure 51: Latin America Biodegradable Medical Disposables Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 52: Latin America Biodegradable Medical Disposables Market Value Share Analysis, By Material, 2024 and 2035

Figure 53: Latin America Biodegradable Medical Disposables Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 54: Latin America Biodegradable Medical Disposables Market Value Share Analysis, By End-user, 2024 and 2035

Figure 55: Latin America Biodegradable Medical Disposables Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 56: Middle East & Africa Biodegradable Medical Disposables Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Middle East & Africa Biodegradable Medical Disposables Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 58: Middle East & Africa Biodegradable Medical Disposables Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 59: Middle East & Africa Biodegradable Medical Disposables Market Value Share Analysis, By Product, 2024 and 2035

Figure 60: Middle East & Africa Biodegradable Medical Disposables Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 61: Middle East & Africa Biodegradable Medical Disposables Market Value Share Analysis, By Material, 2024 and 2035

Figure 62: Middle East & Africa Biodegradable Medical Disposables Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 63: Middle East & Africa Biodegradable Medical Disposables Market Value Share Analysis, By End-user, 2024 and 2035

Figure 64: Middle East & Africa Biodegradable Medical Disposables Market Attractiveness Analysis, By End-user, 2025 to 2035