Reports

Reports

Analyst Viewpoint

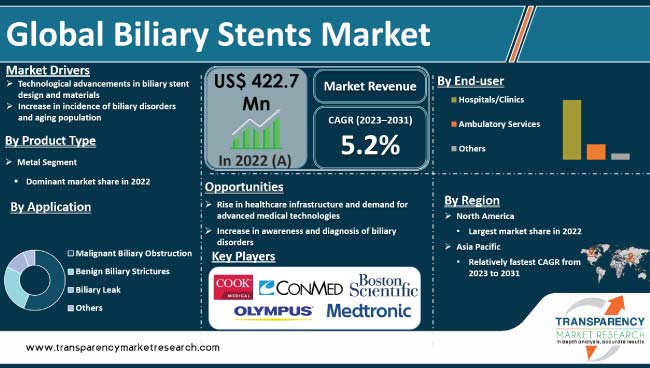

Technological advances in stent design and materials is driving the global biliary stents market. Ongoing advancement in biliary stent technology not only improves patient outcomes but also addresses the issues associated with stent-related complications. Increase in awareness and rise in diagnosis of biliary disorders are the other major factors propelling market expansion. Furthermore, surge in prevalence of biliary disorders in an aging global population is expected to bolster the global biliary stents industry size during the forecast period.

Expansion of healthcare infrastructure and increase in demand for advanced medical technologies offer lucrative opportunities to market players. Manufacturers are focusing on development of more effective and patient-friendly solutions in order to increase market share.

Biliary stents are medical devices used to treat obstructions in the bile duct, which carry bile from the liver to the small intestine. These stents are crucial in managing various conditions affecting the biliary system, including biliary strictures, gallstones, and tumors that could cause blockages. Biliary stent placement is often performed through minimally invasive procedures, providing relief and improving the flow of bile.

Biliary stenting is the insertion of stents, which are tubes made of plastic or metal, into the biliary tree to relieve obstruction or treat biliary leaks. It can be used to relieve obstruction in both benign and malignant biliary conditions, as well as for palliative treatment of advanced biliary malignancies.

Biliary stenting is a very effective treatment for biliary drainage. Biliary stents are most commonly used to treat obstructive jaundice caused by a benign or malignant cause. Gastroenterologists and interventional radiologists are typically the ones who place biliary stents.

Continuous evolution of technology in the design and materials used in these medical devices is one of the key drivers fueling the global biliary stents market growth. Recent innovations in stent design have focused on improving efficacy, durability, and patient comfort. Introduction of self-expanding metal stents (SEMS) and covered metal stents has significantly enhanced the performance of biliary stents.

Self-expanding metal stents are designed to expand upon deployment, ensuring optimal positioning within the bile ducts. This feature minimizes the risk of stent migration and enhances the overall effectiveness of the treatment.

Covered metal stents incorporate a protective layer, reducing the likelihood of tissue ingrowth and stent occlusion. These advancements contribute to prolonged stent patency and reduce the need for frequent interventions. Thus, technological advancements in biliary stents design and materials are likely to fuel the global biliary stents market during the forecast period.

In terms of product type, the metal segment accounted for the largest global biliary stents market share in 2022. This is ascribed to durability and resistance to deformation of metal stents, making them suitable for long-term placements. This durability allows them to withstand the dynamic environment of the bile ducts and maintain their structural integrity over an extended period.

Self-expanding metal stents (SEMS) have high radial force, enabling them to exert outward pressure against the walls of the bile ducts. This feature is crucial for keeping the stent in place and preventing migration. Additionally, the self-expanding nature of these stents facilitates optimal positioning during deployment.

Based on application, the malignant biliary obstruction segment dominated the global biliary stents market demand in 2022. Malignant biliary obstructions can severely impact a patient's quality of life.

Biliary stents, particularly self-expanding metal stents (SEMS), provide a minimally invasive solution to alleviate symptoms. Improved drainage achieved with stent placement contributes to better digestion, reduced jaundice, and enhanced overall comfort for patients facing advanced-stage cancers.

Malignant biliary obstructions could lead to complications such as cholangitis and liver failure. Biliary stents help prevent these complications by maintaining bile flow. By addressing these issues early on, patients are better positioned to undergo further treatment modalities, such as chemotherapy, with improved outcomes.

In terms of end-user, the hospitals/clinics segment accounted for significant share of the global biliary stents market in 2022. Hospitals and clinics cater to a large number of patients with diverse medical conditions, including those requiring surgical procedures.

Biliary stent placement is commonly performed through endoscopic procedures such as Endoscopic Retrograde Cholangiopancreatography (ERCP). Hospitals and clinics are well-equipped with endoscopy units and skilled medical personnel who specialize in interventional gastroenterology.

Hospitals often employ a multidisciplinary approach to patient care, involving gastroenterologists, interventional radiologists, and surgeons. This collaborative approach is essential for comprehensive management, including the evaluation of whether biliary stent placement is the most suitable intervention.

As per biliary stents market analysis, North America dominated the global industry in 2022. The U.S. and Canada boast of advanced healthcare infrastructure, with well-equipped hospitals and clinics. This facilitates the diagnosis and treatment of biliary disorders, contributing to the demand for biliary stents.

Major medical device companies, including those specializing in biliary stents, are headquartered or have a significant presence in North America. These companies often drive innovation and market growth.

According to biliary stents market research, Europe has an aging population, and age-related biliary disorders are prevalent. Demand for biliary stents is influenced by the need to manage conditions associated with aging.

The European regulatory landscape is conducive to medical device innovation. Companies often introduce their products to the European market, obtaining CE marks, before seeking approvals in other regions.

Leading market players are focusing on strategies such as new product launches, mergers, partnerships, and collaborations to strengthen their position. These companies are following the latest biliary stents market trends to avail lucrative revenue opportunities.

Boston Scientific Corporation, Cook Medical, Olympus Corporation, Medtronic, C. R. Bard (Becton, Dickinson & Company), CONMED Corporation, Merit Medical Systems, Inc. and Cordis Corporation (Cardinal Health) are the prominent players in the global market.

Prominent players have been profiled in the biliary stents market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and latest developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 422.7 Mn |

| Forecast (Value) in 2031 | More than US$ 666.5 Mn |

| Growth Rate (CAGR) | 5.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

| Competition Landscape | Company profiles section includes overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, and key financials |

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 422.7 Mn in 2022.

It is projected to reach more than US$ 666.5 Mn by 2031

The CAGR is anticipated to be 5.2% from 2023 to 2031

Technological advancements in biliary stent design & materials and increase in incidence of biliary disorders and aging population.

The malignant biliary obstruction application segment accounted for major share in 2022

North America is expected to account for major share during the forecast period

Boston Scientific Corporation, Cook Medical, Olympus Corporation, Medtronic, C.R. Bard (Becton, Dickinson & Company), CONMED Corporation, Merit Medical Systems, Inc. and Cordis Corporation (Cardinal Health)

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Biliary Stents Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.3.4. Global Biliary Stents Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Key Product/Brand Analysis

5.2. Technological Advancement

5.3. COVID-19 Impact Analysis

6. Global Biliary Stents Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Metal

6.3.2. Polymer

6.4. Market Attractiveness Analysis, by Product Type

7. Global Biliary Stents Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Malignant Biliary Obstruction

7.3.2. Benign Biliary Strictures

7.3.3. Biliary Leak

7.3.4. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Biliary Stents Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals/Clinics

8.3.2. Ambulatory Services

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Biliary Stents Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Biliary Stents Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Metal

10.2.2. Polymer

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Malignant Biliary Obstruction

10.3.2. Benign Biliary Strictures

10.3.3. Biliary Leak

10.3.4. Others

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals/Clinics

10.4.2. Ambulatory Services

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Biliary Stents Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Metal

11.2.2. Polymer

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Malignant Biliary Obstruction

11.3.2. Benign Biliary Strictures

11.3.3. Biliary Leak

11.3.4. Others

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals/Clinics

11.4.2. Ambulatory Services

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Biliary Stents Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Metal

12.2.2. Polymer

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Malignant Biliary Obstruction

12.3.2. Benign Biliary Strictures

12.3.3. Biliary Leak

12.3.4. Others

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals/Clinics

12.4.2. Ambulatory Services

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Biliary Stents Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Metal

13.2.2. Polymer

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Malignant Biliary Obstruction

13.3.2. Benign Biliary Strictures

13.3.3. Biliary Leak

13.3.4. Others

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals/Clinics

13.4.2. Ambulatory Services

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Biliary Stents Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Metal

14.2.2. Polymer

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Malignant Biliary Obstruction

14.3.2. Benign Biliary Strictures

14.3.3. Biliary Leak

14.3.4. Others

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals/Clinics

14.4.2. Ambulatory Services

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Global Biliary Stents Market, Company Share Analysis (2022)

15.2. Company Profiles

15.2.1. Boston Scientific Corporation

15.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.1.2. Product Portfolio

15.2.1.3. Financial Overview

15.2.1.4. SWOT Analysis

15.2.1.5. Strategic Overview

15.2.2. Cook Medical

15.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.2.2. Product Portfolio

15.2.2.3. Financial Overview

15.2.2.4. SWOT Analysis

15.2.2.5. Strategic Overview

15.2.3. Olympus Corporation

15.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.3.2. Product Portfolio

15.2.3.3. Financial Overview

15.2.3.4. SWOT Analysis

15.2.3.5. Strategic Overview

15.2.4. Medtronic

15.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.4.2. Product Portfolio

15.2.4.3. Financial Overview

15.2.4.4. SWOT Analysis

15.2.4.5. Strategic Overview

15.2.5. C.R. Bard (Becton, Dickinson & Company)

15.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.5.2. Product Portfolio

15.2.5.3. Financial Overview

15.2.5.4. SWOT Analysis

15.2.5.5. Strategic Overview

15.2.6. CONMED Corporation

15.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.6.2. Product Portfolio

15.2.6.3. Financial Overview

15.2.6.4. SWOT Analysis

15.2.6.5. Strategic Overview

15.2.7. Merit Medical Systems, Inc.

15.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.7.2. Product Portfolio

15.2.7.3. Financial Overview

15.2.7.4. SWOT Analysis

15.2.7.5. Strategic Overview

15.2.8. Cordis Corporation (Cardinal Health)

15.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.8.2. Product Portfolio

15.2.8.3. Financial Overview

15.2.8.4. SWOT Analysis

15.2.8.5. Strategic Overview

15.2.9. ENDO-FLEX GmbH

15.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.2.9.2. Product Portfolio

15.2.9.3. Financial Overview

15.2.9.4. SWOT Analysis

15.2.9.5. Strategic Overview

List of Tables

Table 01: Global Biliary Stents Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 02: Global Biliary Stents Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 03: Global Biliary Stents Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 04: Global Biliary Stents Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 05: North America Biliary Stents Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 06: North America Biliary Stents Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 07: North America Biliary Stents Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 08: North America Biliary Stents Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 09: Europe Biliary Stents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Europe Biliary Stents Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 11: Europe Biliary Stents Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 12: Europe Biliary Stents Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Asia Pacific Biliary Stents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Asia Pacific Biliary Stents Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 15: Asia Pacific Biliary Stents Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 16: Asia Pacific Biliary Stents Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 17: Latin America Biliary Stents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Biliary Stents Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 19: Latin America Biliary Stents Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 20: Latin America Biliary Stents Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 21: Middle East & Africa Biliary Stents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Biliary Stents Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 23: Middle East & Africa Biliary Stents Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 24: Middle East & Africa Biliary Stents Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Biliary Stents Market Value (US$ Mn) Forecast, 2017-2031

Figure 02: Global Biliary Stents Market Value Share, by Region, 2022

Figure 03: Global Biliary Stents Market Value Share, by Product Type, 2022

Figure 04: Global Biliary Stents Market Value Share, by Application, 2022

Figure 05: Global Biliary Stents Market Value Share, by End-user, 2022

Figure 06: Global Biliary Stents Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 07: Global Biliary Stents Market Value Share Analysis, by Product Type, 2022

Figure 08: Global Biliary Stents Market Value Share Analysis, by Product Type, 2031

Figure 09: Global Biliary Stents Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 10: Global Biliary Stents Market Value (US$ Mn), by Metal, 2017‒2031

Figure 11: Global Biliary Stents Market Value Share Analysis, by Metal, 2022 and 2031

Figure 12: Global Biliary Stents Market Value (US$ Mn), by Polymer, 2017‒2031

Figure 13: Global Biliary Stents Market Value Share Analysis, by Polymer, 2022 and 2031

Figure 14: Global Biliary Stents Market Value Share Analysis, by Application, 2022 and 2031

Figure 15: Global Biliary Stents Market Value Share Analysis, by Application, 2022

Figure 16: Global Biliary Stents Market Value Analysis, by Application, 2031

Figure 17: Global Biliary Stents Market Attractiveness Analysis, by Application, 2023–2031

Figure 18: Global Biliary Stents Market Value (US$ Mn), by Malignant Biliary Obstruction, 2017‒2031

Figure 19: Global Biliary Stents Market Value Share Analysis, by Malignant Biliary Obstruction, 2022 and 2031

Figure 20: Global Biliary Stents Market Value (US$ Mn), by Benign Biliary Strictures, 2017‒2031

Figure 21: Global Biliary Stents Market Value Share Analysis, by Benign Biliary Strictures, 2022 and 2031

Figure 22: Global Biliary Stents Market Value (US$ Mn), by Biliary Leak, 2017‒2031

Figure 23: Global Biliary Stents Market Value Share Analysis, by Biliary Leak, 2022 and 2031

Figure 24: Global Biliary Stents Market Value Share Analysis, by End-user, 2022 and 2031

Figure 25: Global Biliary Stents Market Value Share Analysis, by End-user, 2022

Figure 26: Global Biliary Stents Market Value Share Analysis, by End-user, 2031

Figure 27: Global Biliary Stents Market Attractiveness Analysis, by End-user, 2023–2031

Figure 28: Global Biliary Stents Market Value (US$ Mn), by Hospitals/Clinics, 2017‒2031

Figure 29: Global Biliary Stents Market Value Share Analysis, by Hospitals/Clinics, 2022 and 2031

Figure 30: Global Biliary Stents Market Value (US$ Mn), by Ambulatory Services, 2017‒2031

Figure 31: Global Biliary Stents Market Value Share Analysis, by Ambulatory Services, 2022 and 2031

Figure 32: Global Biliary Stents Market Value (US$ Mn), by Others, 2017‒2031

Figure 33: Global Biliary Stents Market Value Share Analysis, by Others, 2022 and 2031

Figure 34: Global Biliary Stents Market Value Share Analysis, by Region, 2022 and 2031

Figure 35: Global Biliary Stents Market Value Share Analysis, by Region, 2022

Figure 36: Global Biliary Stents Market Value Analysis, by Region, 2031

Figure 37: Global Biliary Stents Market Attractiveness Analysis, by Region, 2023–2031

Figure 38: North America Biliary Stents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 39: North America Biliary Stents Market Value Share Analysis, by Country, 2022 and 2031

Figure 40: North America Biliary Stents Market Attractiveness Analysis, by Country, 2023–2031

Figure 41: North America Biliary Stents Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 42: North America Biliary Stents Market Value (US$ Mn) Share Analysis, by Product Type, 2022

Figure 43: North America Biliary Stents Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 44: North America Biliary Stents Market Value (US$ Mn) Share Analysis, by Application, 2022

Figure 45: North America Biliary Stents Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 46: North America Biliary Stents Market Value (US$ Mn) Share Analysis, by End-user, 2022

Figure 47: Europe Biliary Stents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 48: Europe Biliary Stents Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 49: Europe Biliary Stents Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 50: Europe Biliary Stents Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 51: Europe Biliary Stents Market Value (US$ Mn) Share Analysis, by Product Type, 2022

Figure 52: Europe Biliary Stents Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 53: Europe Biliary Stents Market Value (US$ Mn) Share Analysis, by Application, 2022

Figure 54: Europe Biliary Stents Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 55: Europe Biliary Stents Market Value (US$ Mn) Share Analysis, by End-user, 2022

Figure 56: Asia Pacific Biliary Stents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 57: Asia Pacific Biliary Stents Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 58: Asia Pacific Biliary Stents Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 59: Asia Pacific Biliary Stents Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 60: Asia Pacific Biliary Stents Market Value (US$ Mn) Share Analysis, by Product Type, 2022

Figure 61: Asia Pacific Biliary Stents Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 62: Asia Pacific Biliary Stents Market Value (US$ Mn) Share Analysis, by Application, 2022

Figure 63: Asia Pacific Biliary Stents Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 64: Asia Pacific Biliary Stents Market Value (US$ Mn) Share Analysis, by End-user, 2022

Figure 65: Latin America Biliary Stents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 66: Latin America Biliary Stents Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 67: Latin America Biliary Stents Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 68: Latin America Biliary Stents Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 69: Latin America Biliary Stents Market Value (US$ Mn) Share Analysis, by Product Type, 2022

Figure 70: Latin America Biliary Stents Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 71: Latin America Biliary Stents Market Value (US$ Mn) Share Analysis, by Application, 2022

Figure 72: Latin America Biliary Stents Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 73: Latin America Biliary Stents Market Value (US$ Mn) Share Analysis, by End-user, 2022

Figure 74: Middle East & Africa Biliary Stents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 75: Middle East & Africa Biliary Stents Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 76: Middle East & Africa Biliary Stents Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 77: Middle East & Africa Biliary Stents Market Value (US$ Mn) Share Analysis, by Product Type, 2022 and 2031

Figure 78: Middle East & Africa Biliary Stents Market Value (US$ Mn) Share Analysis, by Product Type, 2022

Figure 79: Middle East & Africa Biliary Stents Market Value (US$ Mn) Share Analysis, by Application, 2022 and 2031

Figure 80: Middle East & Africa Biliary Stents Market Value (US$ Mn) Share Analysis, by Application, 2022

Figure 81: Middle East & Africa Biliary Stents Market Value (US$ Mn) Share Analysis, by End-user, 2022 and 2031

Figure 82: Middle East & Africa Biliary Stents Market Value (US$ Mn) Share Analysis, by End-user, 2022