Reports

Reports

Analysts’ Viewpoint on Market Scenario

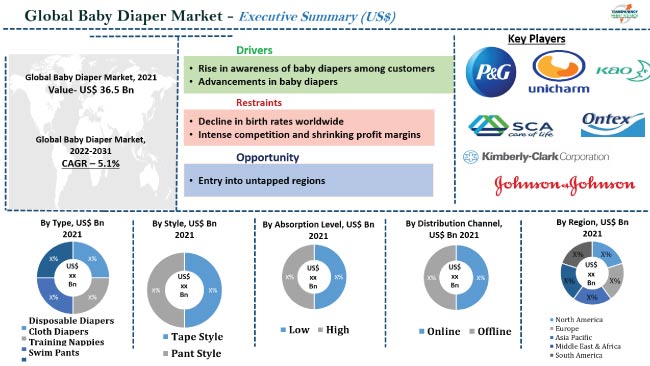

Increase in awareness about hygiene and advancements in diapers are driving the global baby diaper market. Rise in disposable income of the people in developing countries has led to rapid growth in adoption of baby products, including diapers. Nonprofit organizations, institutions, and governments are offering funds to low-income groups worldwide to boost the adoption of baby diapers, which is leading to future business opportunities in the global market. Key players in the market are investing in R&D to offer high-quality, durable, non-toxic, and allergen-free products made from plant-based ingredients instead of polypropylene materials. They are also spreading awareness about baby diapers through various online and offline mediums in order to enhance their revenue streams.

Baby diaper, also known as a nappy, is an underwear that allows a baby to urinate. It absorbs excreta to prevent the soiling of outer clothing or the external environment. Baby diapers for newborns can be placed between the legs and fastened around the waist, and are comfortable to wear due to the softness, lightness, and breathability of the materials used. They are available in two styles: diaper pants and tape-style diapers. Baby diaper pants are suitable for babies over six months of age, while tape-style diapers are preferred for babies below six months of age. Several types of baby diapers are available in the market including disposable diapers, cloth diapers, training diapers, swim pants, and biodegradable & sustainable diapers. The current trends in the baby diaper Industry suggest that customers are increasingly demanding chemical-free reusable baby diapers.

Diapers play a vital role in maintaining hygiene in newborns and toddlers. Newborns excrete frequently, which makes changing underwear a tedious task. Untimely change in normal underwear causes irritation and skin rashes, which can lead to blue diaper syndrome. Thus, parents prefer premium baby diapers that offer better safety and comfort. Demand for baby diaper pants is high due to their ease of use, effectiveness, and convenience. Disposable diapers with multiple layers are also gaining traction, as they are lightweight and available in different sizes and shapes. Various organizations and companies are raising awareness about baby diapers in emerging regions. Furthermore, expansion in the personal hygiene market in these regions is contributing to the growth of the baby diaper market. Loose baby diapers are popular in emerging economies, as they are disposable and cost-effective.

Key vendors in the market are investing significantly in advancements in baby diapers. A newborn’s skin is significantly thinner and more permeable than that of an adult, and can more readily absorb chemicals. Disposable diapers appear harmless enough on the surface, but can contain additives, chemicals, and toxins that can be harmful to babies. According to the Health and Environment Alliance, 14.5 million children are currently exposed to chemicals via the use of single-use diapers. Thus, key players are increasingly offering chemical-free baby diapers manufactured from plant-based materials such as bamboo, cotton, and hemp.

Several countries around the world still use cloth instead of diapers due to the lack of awareness and low income levels. On an average, parents spend around 14% of their income on diapers. Nearly one in three low-income families report inability to purchase diapers for their babies. In September 2022, the U.S. Department of Health and Human Services (HHS) announced a new pilot program to distribute diapers to low-income families.

Manufacturers are focusing on developing regions and are coming up with low-cost baby diapers for low-income group users to fulfill their hygiene requirements. They are also collaborating with nonprofit organizations and institutes to provide baby diapers on a large scale.

In terms of type, the global baby diaper market has been segmented into cloth diapers, disposable diapers, training nappies, and swim pants. The disposable diapers segment held major share of the global market in 2021. Disposable baby diapers are more convenient to use compared to cloth diapers. They also offer excellent absorbent properties and can be thrown away after every use. Cloth diapers increase the risk of exposure to chemicals and skin sensitivities. Disposable diapers, on the other hand, contain natural ingredients such as aloe vera, organic cotton, and vitamin E.

In terms of value, North America held significant share of the global baby diaper market in 2021. High standard of living coupled with rise in awareness about child health and hygiene is driving the market in the region. Constant technological advancements in the regional industry are also estimated to propel the market size in North America during the forecast period. Disposable diapers have gained widespread acceptance among U.S. customers, as they offer enhanced comfort over cloth diapers. Additionally, rise in availability of natural, organic, and eco-friendly products is fueling the baby diaper market in the U.S.

The market in Asia Pacific is expected to grow at the fastest rate during the forecast period due to the increase in disposable income and rise in the population in the region.

Detailed profiles of players in the baby diaper market are provided in the report to evaluate their financials, key product offerings, recent developments, and strategies. Most of the firms are investing significantly in comprehensive R&D activities, primarily to offer innovative products. Expansion of product portfolios and mergers & acquisitions are key strategies adopted by manufacturers in the market. Bambo Nature USA, Johnson & Johnson, Essity AB, Kao Corporation, Kimberly-Clark Corporation, Ontex BV, Procter & Gamble, Seventh Generation Inc., The Hain Celestial Group, Inc. The Honest Company, Inc., and Unicharm Corporation are key players operating in the global market.

Each of these players has been profiled in the global baby diaper market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 (Base Year) | US$ 36.5 Bn |

| Market Forecast Value in 2031 | US$ 59.4 Bn |

| Growth Rate (CAGR) | 5.1% |

| Forecast Period | 2022-2031 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profile |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The industry stood at US$ 36.5 Bn in 2021.

The market is expected to reach US$ 59.4 Bn by 2031.

Rise in awareness about baby diapers and advancements in baby diapers.

The disposable diapers segment held the highest share of the baby diaper market in 2021

North America held 32% share of the global market in 2021.

Bambo Nature USA, Johnson & Johnson, Essity AB, Kao Corporation, Kimberly-Clark Corporation, Ontex BV, Procter & Gamble, Seventh Generation Inc., The Hain Celestial Group, Inc. The Honest Company, Inc., and Unicharm Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overview of Overall Diaper Market

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. COVID-19 Impact Analysis

5.9. Raw Material Analysis

5.10. Technology Overview

5.11. Global Baby Diaper Market Analysis and Forecast, 2017-2031

5.11.1. Market Value Projections (US$ Mn)

5.11.2. Market Volume Projections (Thousand Units)

6. Global Baby Diaper Market Analysis and Forecast, By Type

6.1. Global Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017-2031

6.1.1. Cloth Diapers

6.1.1.1. Flat Cloth Diapers

6.1.1.2. Fitted Cloth Diapers

6.1.1.3. Pre-fold Cloth Diapers

6.1.1.4. Others

6.1.2. Disposable Diapers

6.1.2.1. Regular

6.1.2.2. Ultra

6.1.2.3. Biodegradable

6.1.3. Training Nappies

6.1.4. Swim Pants

6.2. Incremental Opportunity, By Type

7. Global Baby Diaper Market Analysis and Forecast, By Style

7.1. Global Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Style, 2017-2031

7.1.1. Tape Style

7.1.2. Pant Style

8. Global Baby Diaper Market Analysis and Forecast, By Absorption Level

8.1. Global Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Absorption Level, 2017-2031

8.1.1. Low

8.1.2. High

8.2. Incremental Opportunity, By Absorption Level

9. Global Baby Diaper Market Analysis and Forecast, By Distribution Channel

9.1. Global Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

9.1.1. Online

9.1.2. Offline

9.1.2.1. Hypermarkets/Supermarkets

9.1.2.2. Convenience Stores

9.1.2.3. Medical Stores

9.1.2.4. Others

9.2. Incremental Opportunity, By Distribution Channel

10. Global Baby Diaper Market Analysis and Forecast, Region

10.1. Global Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Region, 2017-2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Baby Diaper Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Brand Analysis

11.3. COVID-19 Impact Analysis

11.4. Consumer Buying Behavior Analysis

11.5. Key Trends Analysis

11.5.1. Demand Side Analysis

11.5.2. Supply Side Analysis

11.6. Price Trend Analysis

11.6.1. Weighted Average Selling Price (US$)

11.7. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017-2031

11.7.1. Cloth Diapers

11.7.1.1. Flat Cloth Diapers

11.7.1.2. Fitted Cloth Diapers

11.7.1.3. Pre-fold Cloth Diapers

11.7.1.4. Others

11.7.2. Disposable Diapers

11.7.2.1. Regular

11.7.2.2. Ultra

11.7.2.3. Biodegradable

11.7.3. Training Nappies

11.7.4. Swim Pants

11.8. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Style, 2017-2031

11.8.1. Tape Style

11.8.2. Pant Style

11.9. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Absorption Level, 2017-2031

11.9.1. Low

11.9.2. High

11.10. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

11.10.1. Online

11.10.2. Offline

11.10.2.1. Hypermarkets/Supermarkets

11.10.2.2. Convenience Stores

11.10.2.3. Medical Stores

11.10.2.4. Others

11.11. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Country, 2017-2031

11.11.1. The U.S.

11.11.2. Canada

11.11.3. Rest of North America

11.12. Incremental Opportunity Analysis

12. Europe Baby Diaper Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Brand Analysis

12.3. COVID-19 Impact Analysis

12.4. Consumer Buying Behavior Analysis

12.5. Key Trends Analysis

12.5.1. Demand Side Analysis

12.5.2. Supply Side Analysis

12.6. Price Trend Analysis

12.6.1. Weighted Average Selling Price (US$)

12.7. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017-2031

12.7.1. Cloth Diapers

12.7.1.1. Flat Cloth Diapers

12.7.1.2. Fitted Cloth Diapers

12.7.1.3. Pre-fold Cloth Diapers

12.7.1.4. Others

12.7.2. Disposable Diapers

12.7.2.1. Regular

12.7.2.2. Ultra

12.7.2.3. Biodegradable

12.7.3. Training Nappies

12.7.4. Swim Pants

12.8. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Style, 2017-2031

12.8.1. Tape Style

12.8.2. Pant Style

12.9. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Absorption Level, 2017-2031

12.9.1. Low

12.9.2. High

12.10. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

12.10.1. Online

12.10.2. Offline

12.10.2.1. Hypermarkets/Supermarkets

12.10.2.2. Convenience Stores

12.10.2.3. Medical Stores

12.10.2.4. Others

12.11. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Country, 2017-2031

12.11.1. The U.K.

12.11.2. Germany

12.11.3. France

12.11.4. Rest of Europe

12.12. Incremental Opportunity Analysis

13. Asia Pacific Baby Diaper Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Brand Analysis

13.3. COVID-19 Impact Analysis

13.4. Consumer Buying Behavior Analysis

13.5. Key Trends Analysis

13.5.1. Demand Side Analysis

13.5.2. Supply Side Analysis

13.6. Price Trend Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017-2031

13.7.1. Cloth Diapers

13.7.1.1. Flat Cloth Diapers

13.7.1.2. Fitted Cloth Diapers

13.7.1.3. Pre-fold Cloth Diapers

13.7.1.4. Others

13.7.2. Disposable Diapers

13.7.2.1. Regular

13.7.2.2. Ultra

13.7.2.3. Biodegradable

13.7.3. Training Nappies

13.7.4. Swim Pants

13.8. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Style, 2017-2031

13.8.1. Tape Style

13.8.2. Pant Style

13.9. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Absorption Level, 2017-2031

13.9.1. Low

13.9.2. High

13.10. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

13.10.1. Online

13.10.2. Offline

13.10.2.1. Hypermarkets/Supermarkets

13.10.2.2. Convenience Stores

13.10.2.3. Medical Stores

13.10.2.4. Others

13.11. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Country, 2017-2031

13.11.1. China

13.11.2. India

13.11.3. Japan

13.11.4. Rest of Asia Pacific

13.12. Incremental Opportunity Analysis

14. Middle East & Africa Baby Diaper Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Brand Analysis

14.3. COVID-19 Impact Analysis

14.4. Consumer Buying Behavior Analysis

14.5. Key Trends Analysis

14.5.1. Demand Side Analysis

14.5.2. Supply Side Analysis

14.6. Price Trend Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017-2031

14.7.1. Cloth Diapers

14.7.1.1. Flat Cloth Diapers

14.7.1.2. Fitted Cloth Diapers

14.7.1.3. Pre-fold Cloth Diapers

14.7.1.4. Others

14.7.2. Disposable Diapers

14.7.2.1. Regular

14.7.2.2. Ultra

14.7.2.3. Biodegradable

14.7.3. Training Nappies

14.7.4. Swim Pants

14.8. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Style, 2017-2031

14.8.1. Tape Style

14.8.2. Pant Style

14.9. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Absorption Level, 2017-2031

14.9.1. Low

14.9.2. High

14.10. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

14.10.1. Online

14.10.2. Offline

14.10.2.1. Hypermarkets/Supermarkets

14.10.2.2. Convenience Stores

14.10.2.3. Medical Stores

14.10.2.4. Others

14.11. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Country, 2017-2031

14.11.1. GCC

14.11.2. South Africa

14.11.3. Rest of Middle East & Africa

14.12. Incremental Opportunity Analysis

15. South America Baby Diaper Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Brand Analysis

15.3. COVID-19 Impact Analysis

15.4. Consumer Buying Behavior Analysis

15.5. Key Trends Analysis

15.5.1. Demand Side Analysis

15.5.2. Supply Side Analysis

15.6. Price Trend Analysis

15.6.1. Weighted Average Selling Price (US$)

15.7. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017-2031

15.7.1. Cloth Diapers

15.7.1.1. Flat Cloth Diapers

15.7.1.2. Fitted Cloth Diapers

15.7.1.3. Pre-fold Cloth Diapers

15.7.1.4. Others

15.7.2. Disposable Diapers

15.7.2.1. Regular

15.7.2.2. Ultra

15.7.2.3. Biodegradable

15.7.3. Training Nappies

15.7.4. Swim Pants

15.8. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Style, 2017-2031

15.8.1. Tape Style

15.8.2. Pant Style

15.9. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Absorption Level, 2017-2031

15.9.1. Low

15.9.2. High

15.10. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017-2031

15.10.1. Online

15.10.2. Offline

15.10.2.1. Hypermarkets/Supermarkets

15.10.2.2. Convenience Stores

15.10.2.3. Medical Stores

15.10.2.4. Others

15.11. Baby Diaper Market Size (US$ Mn and Thousand Units) Forecast, By Country, 2017-2031

15.11.1. Brazil

15.11.2. Rest of South America

15.12. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis (%)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

16.3.1. Bambo Nature USA

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Financial/Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Sales Channel Analysis

16.3.1.6. Size Portfolio

16.3.2. Essity AB

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Financial/Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Sales Channel Analysis

16.3.2.6. Size Portfolio

16.3.3. Kao Corporation

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Financial/Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Sales Channel Analysis

16.3.3.6. Size Portfolio

16.3.4. Kimberly-Clark Corporation

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Financial/Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Sales Channel Analysis

16.3.4.6. Size Portfolio

16.3.5. Ontex BV

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Financial/Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Sales Channel Analysis

16.3.5.6. Size Portfolio

16.3.6. Johnson & Johnson

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Financial/Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Sales Channel Analysis

16.3.6.6. Size Portfolio

16.3.7. Procter & Gamble

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Financial/Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Sales Channel Analysis

16.3.7.6. Size Portfolio

16.3.8. Seventh Generation Inc.

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Financial/Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Sales Channel Analysis

16.3.8.6. Size Portfolio

16.3.9. The Hain Celestial Group, Inc.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Financial/Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Sales Channel Analysis

16.3.9.6. Size Portfolio

16.3.10. The Honest Company, Inc.

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Financial/Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Sales Channel Analysis

16.3.10.6. Size Portfolio

16.3.11. Unicharm Corporation

16.3.11.1. Company Overview

16.3.11.2. Sales Area/Geographical Presence

16.3.11.3. Financial/Revenue

16.3.11.4. Strategy & Business Overview

16.3.11.5. Sales Channel Analysis

16.3.11.6. Size Portfolio

17. Key Takeaway

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Style

17.1.3. Absorption Level

17.1.4. Distribution Channel

17.1.5. Geography

17.2. Understanding the Buying Process of the Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Baby Diaper Market Value, by Type, US$ Mn, 2017-2031

Table 2: Global Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Table 3: Global Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Table 4: Global Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Table 5: Global Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Table 6: Global Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Table 7: Global Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 8: Global Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 9: Global Baby Diaper Market Value, by Region, US$ Mn, 2017-2031

Table 10: Global Baby Diaper Market Volume, by Region, Thousand Units,2017-2031

Table 11: North America Baby Diaper Market Value, by Type, US$ Mn, 2017-2031

Table 12: North America Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Table 13: North America Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Table 14: North America Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Table 15: North America Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Table 16: North America Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Table 17: North America Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 18: North America Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 19: North America Baby Diaper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 20: North America Baby Diaper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Table 21: Europe Baby Diaper Market Value, by Type, US$ Mn, 2017-2031

Table 22: Europe Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Table 23: Europe Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Table 24: Europe Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Table 25: Europe Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Table 26: Europe Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Table 27: Europe Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 28: Europe Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 29: Europe Baby Diaper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 30: Europe Baby Diaper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Table 31: Asia Pacific Baby Diaper Market Volume, by Type, US$ Mn, 2017-2031

Table 32: Asia Pacific Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Table 33: Asia Pacific Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Table 34: Asia Pacific Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Table 35: Asia Pacific Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Table 36: Asia Pacific Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Table 37: Asia Pacific Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 38: Asia Pacific Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 39: Asia Pacific Baby Diaper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 40: Asia Pacific Baby Diaper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Table 41: MEA Baby Diaper Market Value, by Type, US$ Mn, 2017-2031

Table 42: MEA Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Table 43: MEA Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Table 44: MEA Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Table 45: MEA Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Table 46: MEA Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Table 47: MEA Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 48: MEA Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 49: MEA Baby Diaper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 50: MEA Baby Diaper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Table 51: South America Baby Diaper Market Value, by Type, US$ Mn, 2017-2031

Table 52: South America Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Table 53: South America Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Table 54: South America Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Table 55: South America Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Table 56: South America Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Table 57: South America Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 58: South America Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 59: South America Baby Diaper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Table 60: South America Baby Diaper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

List of Figures

Figure 1: Global Baby Diaper Market Value, by Type, US$ Mn, 2017-2031

Figure 2: Global Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Figure 3: Global Baby Diaper Market Incremental Opportunity, by Type,2021-2031

Figure 4: Global Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Figure 5: Global Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Figure 6: Global Baby Diaper Market Incremental Opportunity, by Style,2021-2031

Figure 7: Global Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Figure 8: Global Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Figure 9: Global Baby Diaper Market Incremental Opportunity, by Absorption Level,2021-2031

Figure 10: Global Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 11: Global Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 12: Global Baby Diaper Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 13: Global Baby Diaper Market Value, by Region, US$ Mn, 2017-2031

Figure 14: Global Baby Diaper Market Volume, by Region, Thousand Units,2017-2031

Figure 15: Global Baby Diaper Market Incremental Opportunity, by Region,2021-2031

Figure 16: North America Baby Diaper Market Value, by Type, US$ Mn, 2017-2031

Figure 17: North America Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Figure 18: North America Baby Diaper Market Incremental Opportunity, by Type,2021-2031

Figure 19: North America Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Figure 20: North America Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Figure 21: North America Baby Diaper Market Incremental Opportunity, by Style,2021-2031

Figure 22: North America Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Figure 23: North America Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Figure 24: North America Baby Diaper Market Incremental Opportunity, by Absorption Level,2021-2031

Figure 25: North America Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 26: North America Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 27: North America Baby Diaper Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 28: North America Baby Diaper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 29: North America Baby Diaper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Figure 30: North America Baby Diaper Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 31: Europe Baby Diaper Market Value, by Type, US$ Mn, 2017-2031

Figure 32: Europe Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Figure 33: Europe Baby Diaper Market Incremental Opportunity, by Type,2021-2031

Figure 34: Europe Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Figure 35: Europe Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Figure 36: Europe Baby Diaper Market Incremental Opportunity, by Style,2021-2031

Figure 37: Europe Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Figure 38: Europe Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Figure 39: Europe Baby Diaper Market Incremental Opportunity, by Absorption Level,2021-2031

Figure 40: Europe Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 41: Europe Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 42: Europe Baby Diaper Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 43: Europe Baby Diaper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 44: Europe Baby Diaper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Figure 45: Europe Baby Diaper Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 46: Asia Pacific Baby Diaper Market Value, by Type, US$ Mn, 2017-2031

Figure 47: Asia Pacific Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Figure 48: Asia Pacific Baby Diaper Market Incremental Opportunity, by Type,2021-2031

Figure 49: Asia Pacific Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Figure 50: Asia Pacific Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Figure 51: Asia Pacific Baby Diaper Market Incremental Opportunity, by Style,2021-2031

Figure 52: Asia Pacific Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Figure 53: Asia Pacific Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Figure 54: Asia Pacific Baby Diaper Market Incremental Opportunity, by Absorption Level,2021-2031

Figure 55: Asia Pacific Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 56: Asia Pacific Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 57: Asia Pacific Baby Diaper Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 58: Asia Pacific Baby Diaper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 59: Asia Pacific Baby Diaper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Figure 60: Asia Pacific Baby Diaper Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 61: MEA Baby Diaper Market Value, by Type, US$ Mn, 2017-2031

Figure 62: MEA Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Figure 63: MEA Baby Diaper Market Incremental Opportunity, by Type,2021-2031

Figure 64: MEA Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Figure 65: MEA Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Figure 66: MEA Baby Diaper Market Incremental Opportunity, by Style,2021-2031

Figure 67: MEA Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Figure 68: MEA Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Figure 69: MEA Baby Diaper Market Incremental Opportunity, by Absorption Level,2021-2031

Figure 70: MEA Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 71: MEA Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 72: MEA Baby Diaper Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 73: MEA Baby Diaper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 74: MEA Baby Diaper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Figure 75: MEA Baby Diaper Market Incremental Opportunity, by Country/Sub-Region, 2021-2031

Figure 76: South America Baby Diaper Market Value, by Type, US$ Mn, 2017-2031

Figure 77: South America Baby Diaper Market Volume, by Type, Thousand Units,2017-2031

Figure 78: South America Baby Diaper Market Incremental Opportunity, by Type,2021-2031

Figure 79: South America Baby Diaper Market Value, by Style, US$ Mn, 2017-2031

Figure 80: South America Baby Diaper Market Volume, by Style, Thousand Units,2017-2031

Figure 81: South America Baby Diaper Market Incremental Opportunity, by Style,2021-2031

Figure 82: South America Baby Diaper Market Value, by Absorption Level, US$ Mn, 2017-2031

Figure 83: South America Baby Diaper Market Volume, by Absorption Level, Thousand Units,2017-2031

Figure 84: South America Baby Diaper Market Incremental Opportunity, by Absorption Level,2021-2031

Figure 85: South America Baby Diaper Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 86: South America Baby Diaper Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 87: South America Baby Diaper Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 88: South America Baby Diaper Market Value, by Country/Sub-Region, US$ Mn, 2017-2031

Figure 89: South America Baby Diaper Market Volume, by Country/Sub-Region, Thousand Units,2017-2031

Figure 90: South America Baby Diaper Market Incremental Opportunity, by Country/Sub-Region, 2021-2031