Reports

Reports

The Automotive Retrofit Electric Vehicle (EV) powertrain market is rapidly evolving owing to increased awareness of environmental issues, heightened regulatory pressures on emissions, and heightened pressure to reduce carbon emissions across existing vehicle fleets. When considering replacing their existing internal combustion engine (ICE) vehicles, many consumers and fleet operators instead view retrofitting the ICE vehicles with electric powertrains even as a cheaper environmentally friendlier alternative.

Due to new modular powertrain kits, advanced battery systems, advanced electric motors, and other existing technological advancements the automotive retrofit EV powertrain market is not only growing but is also briskly transitioning towards the mainstream vehicle market. More and more suppliers are focusing on providing modular powertrain kits and are forming strategic partnerships to expand their retrofit offerings, improve installation infrastructure, and stakeholders will tend to work together more often.

New companies such as Electric GT, Electra EV, and others are committing resources to research and development to build standardized retrofit solutions for all vehicle types. Also, an increase tidal wave of strong regulatory backing has been particularly prevalent and amplified adoption in those accelerated markets, as witnessed in Asia Pacific and also across Europe.

Furthermore, with additional increasing fuel prices increasing decreases in hiring to electric mobility alternatives combined with increasing consumer awareness on electric mobility, this market will continue to excel. Therefore, being backed by continued favorable conditions, it is a good time, and these broader trends to create meaningful vehicles transformation by advancing options modularization.

There are a number of practical and strategic reasons to consider the Automotive Retrofit EV powertrain-the greatest reason being the costs related to fossil fuels, which will drive private and commercial vehicle owners to go electric to reduce operating costs. Second, the stock of internal combustion engine vehicles in many jurisdictions are very old, and consumers seem to regard retrofitting as a cheaper option than simply purchasing new electric vehicles, which are prohibitively expensive for many buyers.

Third, more and more urban low-emission zones are being created, and compliance with standards will help owners, without the necessity of replacing their vehicle. Finally, advances in the components of electrical vehicles, and in particular battery and control systems, electrical energy management, and the evolution of highly compact motors has been increasing the efficiency and reliability of conversions, and the improvements in technology advances and supply chains provides a reliable opportunity. All these factors represent a powerful pull, which can enable expansion into developing markets with previously high levels of pollution and little access to new models of EVs.

| Attribute | Detail |

|---|---|

| Automotive Retrofit Electric Vehicle Powertrain Market Drivers |

|

One of the largest catalysts behind the automotive retrofit Electric Vehicle powertrain market is the growing availability and uptake of modular retrofit kits. These kits streamline the retrofit

process because the kits are pre-defined systems that feature pre-designed electric motors, controllers, batteries, and supporting hardware, all designed to retrofit on or be compatible with existing vehicles. This all helps reduce retrofit time, vehicle down time, and costs for the manufacturer/installer and vehicle owner. The standardization of retrofit kits has not only made retrofits available on larger scale to commercial fleets, but also more accessible to regular consumers.

For example, over in South Korea, electric retrofit providers have developed modular kits specifically for compact city cars. The modular kits allow for conversions in a matter of days and very little structural changes to the original vehicle.

Also, the systems are bogged down compared to larger kits made with multiple integrations, where you could find a set up that maintains performance, safety, and legal standards. With manufacturers producing more of these types of adaptable systems, it shall not be long before retrofits and retrofit kits find themselves further entrenched in the mainstream automotive practice. Modular kits help promote participation from service centers and help create a wider distribution network for certified retrofit installers.

These characteristics of modular retrofit kits make them an essential component to stimulate the gradual movement to electric mobility, especially for a populace with larger, pre-existing ICE infrastructure

Another influential driver of the automotive retrofit EV powertrain market is the rise of government policies and greenhouse gas emissions regulations to limit vehicle-related emissions. Multiple countries are tightening fuel efficiency rules, and they are also instituting targets to reduce emissions, and this is generating pressure for vehicle owners to switch to cleaner alternatives. However, totally replacing an entire fleet with new EVs may not be economically possible (for example, for small businesses or public transport). Retrofit options represent a sustainable choice, meeting retrofitting regulations while maintaining their operational vehicles in a cost-efficient manner.

For example, in India, public transport system support mechanisms introduced government programs with support for retrofitting public transport buses and taxis under FAME (Faster Adoption and Manufacturing of Electric Vehicles). State governments are now offering registration and tax incentives for retrofitted vehicles. Combined with the establishment of urban zones (where vehicles cannot enter those specific areas unless they were low-emitting), vehicle retrofitting is increasingly being acknowledged and encouraged by multiple states and local governments. Given how pollution is a major concern for people living in highly-densely populated municipal settings, this is a significant opportunity.

From an employment and opportunity perspective, demand driven by the government is stimulating the emergence of retrofit solution providers, and those providers will catalyze jobs and local manufacturing. As policy support continues to grow, demand for emission regulation will continue.

The most significant segment of the automotive retrofit Electric Vehicle powertrain market is passenger vehicles. This is because they make up the largest percentage of vehicles on the road, and makes sense from the perspective of the cost of retrofitting for an individual owner. The fact is, a large number of the personal cars on the road globally, whether in developed markets and developing markets, run on internal combustion engines, and many are older models that emit the highest levels of carbon. Retrofitting makes sense for the environmentally-minded consumer to upgrade to electric without having to buy an electric vehicle. This is particularly relevant in cities that are creating more and more low emissions zones (in places like Europe), which restrict access to emission-producing vehicles.

In Japan for example, private owners of old gasoline-powered vehicles are opting for EV retrofits to meet strict and getting even more strict environmental regulations, for not wanting to dispose of their old gasoline-powered cars. Many of the conversions have used compact and efficient motors, and modern lithium-ion batteries which give drivers a similar experience as before but at a much lower environmental expense. The growing availability of kits specific to passenger cars is also standardizing (in a way) and lowering costs.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia Pacific has been in the forefront of the automotive retrofit EV powertrain market, primarily because of the related government backing in combination with a large vehicle population and increasing urban pollution issues. Countries including China, India, Japan and South Korea are endorsing retrofit solutions as part of an overall electric mobility strategy. The presence of a strong manufacturing base for EV components in the region enables lower costs, which contributes to an accelerated roll out of retrofit kits.

In China, authorities are applying tough new emission laws and targeted scrapping policies which favor retrofitting over replacement. China’s scale as a battery manufacturer and EV parts supplier gives it an additional competitive advantage to ramp up retrofitting services. Becoming the growing trend, India is beginning to follow suit, especially for public mobility and shared mobility context.

More states and public transport agencies will now also support retrofitting with government subsidies and registration incentives and piloting programs for the retrofitting companies to convert old buses and taxis to an electric powertrain.

For example, in India’s capital New Delhi, public transport agencies are now converting diesel buses to electric powertrains to avoid air pollution and save money on maintenance and running costs. Japan and South Korea are now also promoting retrofits towards achieving national level climate neutrality targets and in response to ageing passenger vehicles.

While the US is also advancing in terms of funding and infrastructure, Asia Pacific is more aggressively focused on regulatory approaches.

Key players operating in the Automotive Retrofit Electric Vehicle Powertrain industry are investing through innovation, strategic partnerships, and technological advancements. They emphasize on improving imaging clarity, and expanding product portfolios, ensuring sustained growth and leadership in the evolving healthcare landscape.

Altigreen, Bharat Mobi, Continental AG, Delphi Technologies, ETrio, EV Europe, Folks Motor, Hitachi Astemo, Johnson Electric Holdings, Loop Moto, Magna International, Mando Corporation, Mitsubishi Electric, Robert Bosch GmbH, XL Fleet are the key players in Automotive Retrofit Electric Vehicle Powertrain market.

Each of these players has been profiled in the Automotive Retrofit Electric Vehicle Powertrain market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

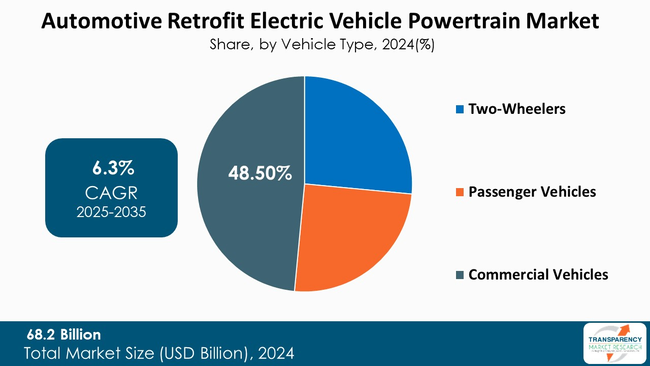

| Size in 2024 | US$ 68.2 Bn |

| Forecast Value in 2035 | US$ 134.0 Bn |

| CAGR | 6.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Automotive Retrofit Electric Vehicle Powertrain Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Vehicle Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global automotive retrofit electric vehicle powertrain market was valued at US$ 68.2 Bn in 2024

The global automotive retrofit electric vehicle powertrain industry is projected to reach US$ 134.0 Bn by the end of 2035

Rise of Modular Retrofit Kits, Government Policies and Emission Norms are some of the factors driving the expansion of Automotive Retrofit Electric Vehicle Powertrain market.

The CAGR is anticipated to be 6.3% from 2025 to 2035

Altigreen, Bharat Mobi, Continental AG, Delphi Technologies, ETrio, EV Europe, Folks Motor, Hitachi Astemo, Johnson Electric Holdings, Loop Moto, Magna International, Mando Corporation, and Mitsubishi Electric among others

Table 01: Global Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 02: Global Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 03: Global Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 04: Global Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 05: Global Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 06: North America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 07: North America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 08: North America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 09: North America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 10: North America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 11: U.S. Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 12: U.S. Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 13: U.S. Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 14: U.S. Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 15: Canada Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 16: Canada Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 17: Canada Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 18: Canada Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 19: Europe Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 20: Europe Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 21: Europe Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 22: Europe Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 23: Europe Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 24: Germany Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 25: Germany Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 26: Germany Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 27: Germany Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 28: UK Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 29: UK Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 30: UK Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 31: UK Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 32: France Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 33: France Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 34: France Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 35: France Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 36: Italy Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 37: Italy Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 38: Italy Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 39: Italy Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 40: Spain Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 41: Spain Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 42: Spain Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 43: Spain Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 44: Switzerland Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 45: Switzerland Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 46: Switzerland Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 47: Switzerland Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 48: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 49: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 50: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 51: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 52: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 53: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 54: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 55: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 56: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 57: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 58: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 59: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 60: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 61: China Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 62: China Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 63: China Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 64: China Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 65: Japan Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 66: Japan Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 67: Japan Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 68: Japan Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 69: India Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 70: India Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 71: India Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 72: India Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 73: South Korea Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 74: South Korea Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 75: South Korea Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 76: South Korea Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 77: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 78: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 79: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 80: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 81: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 82: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 83: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 84: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 85: Latin America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 86: Latin America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 87: Latin America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 88: Latin America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 89: Latin America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 90: Brazil Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 91: Brazil Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 92: Brazil Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 93: Brazil Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 94: Mexico Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 95: Mexico Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 96: Mexico Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 97: Mexico Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 98: Argentina Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 99: Argentina Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 100: Argentina Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 101: Argentina Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 102: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 103: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 104: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 105: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 106: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 107: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 108: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 109: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 110: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 111: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 112: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 113: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 114: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 115: South Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 116: South Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 117: South Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 118: South Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Table 119: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 120: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 121: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by EV Type, 2020 to 2035

Table 122: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Value (US$ Mn) Forecast, by Drive Type, 2020 to 2035

Figure 01: Global Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Region, 2024 and 2035

Figure 03: Global Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 04: Global Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 05: Global Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 06: Global Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 07: Global Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 08: Global Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 09: Global Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 10: Global Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 11: Global Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 12: North America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 13: North America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Country, 2024 and 2035

Figure 14: North America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 15: North America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 16: North America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 17: North America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 18: North America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 19: North America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 20: North America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 21: North America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 22: North America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 23: U.S. Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 24: U.S. Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 25: U.S. Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 26: U.S. Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 27: U.S. Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 28: U.S. Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 29: U.S. Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 30: U.S. Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 31: U.S. Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 32: Canada Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 33: Canada Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 34: Canada Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 35: Canada Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 36: Canada Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 37: Canada Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 38: Canada Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 39: Canada Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 40: Canada Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 41: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 42: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 43: Europe Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 44: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 45: Europe Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 46: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 47: Europe Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 48: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 49: Europe Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 50: Europe Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 51: Europe Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 52: Germany Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 53: Germany Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 54: Germany Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 55: Germany Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 56: Germany Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 57: Germany Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 58: Germany Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 59: Germany Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 60: Germany Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 61: UK Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 62: UK Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 63: UK Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 64: UK Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 65: UK Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 66: UK Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 67: UK Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 68: UK Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 69: UK Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 70: France Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 71: France Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 72: France Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 73: France Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 74: France Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 75: France Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 76: France Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 77: France Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 78: France Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 79: Italy Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 80: Italy Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 81: Italy Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 82: Italy Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 83: Italy Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 84: Italy Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 85: Italy Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 86: Italy Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 87: Italy Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 88: Spain Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 89: Spain Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 90: Spain Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 91: Spain Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 92: Spain Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 93: Spain Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 94: Spain Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 95: Spain Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 96: Spain Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 97: Switzerland Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 98: Switzerland Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 99: Switzerland Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 100: Switzerland Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 101: Switzerland Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 102: Switzerland Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 103: Switzerland Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 104: Switzerland Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 105: Switzerland Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 106: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 107: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 108: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 109: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 110: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 111: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 112: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 113: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 114: The Netherlands Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 115: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 116: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 117: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 118: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 119: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 120: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 121: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 122: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 123: Rest of Europe Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 124: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 125: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 126: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 127: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 128: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 129: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 130: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 131: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 132: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 133: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 134: Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 135: China Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 136: China Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 137: China Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 138: China Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 139: China Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 140: China Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 141: China Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 142: China Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 143: China Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 144: Japan Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 145: Japan Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 146: Japan Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 147: Japan Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 148: Japan Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 149: Japan Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 150: Japan Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 151: Japan Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 152: Japan Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 153: India Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 154: India Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 155: India Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 156: India Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 157: India Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 158: India Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 159: India Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 160: India Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 161: India Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 162: South Korea Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 163: South Korea Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 164: South Korea Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 165: South Korea Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 166: South Korea Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 167: South Korea Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 168: South Korea Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 169: South Korea Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 170: South Korea Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 171: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 172: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 173: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 174: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 175: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 176: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 177: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 178: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 179: Australia & New Zealand Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 180: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 181: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 182: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 183: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 184: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 185: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 186: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 187: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 188: Rest of Asia Pacific Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 189: Latin America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 190: Latin America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 191: Latin America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 192: Latin America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 193: Latin America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 194: Latin America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 195: Latin America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 196: Latin America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 197: Latin America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 198: Latin America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 199: Latin America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 200: Brazil Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 201: Brazil Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 202: Brazil Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 203: Brazil Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 204: Brazil Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 205: Brazil Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 206: Brazil Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 207: Brazil Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 208: Brazil Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 209: Mexico Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 210: Mexico Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 211: Mexico Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 212: Mexico Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 213: Mexico Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 214: Mexico Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 215: Mexico Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 216: Mexico Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 217: Mexico Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 218: Argentina Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 219: Argentina Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 220: Argentina Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 221: Argentina Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 222: Argentina Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 223: Argentina Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 224: Argentina Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 225: Argentina Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 226: Argentina Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 227: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 228: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 229: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 230: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 231: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 232: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 233: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 234: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 235: Rest of Latin America Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 236: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 237: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 238: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 239: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 240: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 241: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 242: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 243: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 244: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 245: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 246: Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 247: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 248: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 249: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 250: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 251: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 252: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 253: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 254: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 255: GCC Countries Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 256: South Africa Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 257: South Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 258: South Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 259: South Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 260: South Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 261: South Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 262: South Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 263: South Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 264: South Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035

Figure 265: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 266: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 267: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 268: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Components, 2024 and 2035

Figure 269: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 270: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by EV Type, 2024 and 2035

Figure 271: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by EV Type, 2025 to 2035

Figure 272: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Value Share Analysis, by Drive Type, 2024 and 2035

Figure 273: Rest of Middle East & Africa Automotive Retrofit Electric Vehicle Powertrain Market Attractiveness Analysis, by Drive Type, 2025 to 2035