Reports

Reports

Analyst Viewpoint

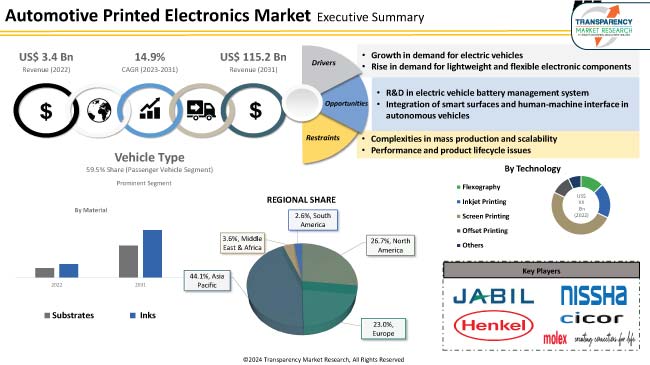

The global automotive printed electronics market size is experiencing rapid growth driven by the increase in demand for lightweight, flexible, and cost-effective electronic components in vehicles. Printed electronics, utilizing technologies such as screen printing and inkjet printing, enable the production of sensors, displays, and other electronic elements with enhanced design flexibility.

Surge in pursuit of energy-efficient solutions, advancements in materials and manufacturing processes, and rise in integration of advanced features in electric and autonomous vehicles are likely to offer lucrative automotive printed electronics market opportunities to vendors. Despite challenges in achieving consistent quality for mass production, collaborations between automotive manufacturers and technology specialists are fostering innovation.

Automotive printed electronics refer to the application of printing technologies to manufacture electronic components and systems used in vehicles. This involves the use of printing techniques, such as screen printing, and inkjet printing, to deposit conductive inks, dielectric materials, and other functional materials on various substrates. The goal is to create flexible, lightweight, and cost-effective electronic components for automotive applications, ranging from sensors and displays to lighting and energy storage devices.

Printed electronics is a printing process used to manufacture electronic devices on various substrates. The technology is gaining attention due to its ability to fabricate large-scale flexible electronic devices. It offers advantages such as high production speed, automation, and suitability for mass production. Printed electronics allow for the manufacturing of thin, flexible, lightweight, and affordable electronic products, which aligns with the development of modern electronic technologies.

The automotive printed electronics market landscape is poised for continued expansion as printed electronics play a pivotal role in shaping the future of automotive electronics, particularly in the context of electric and autonomous vehicle technologies. Automotive printed electronics presents opportunities for the transformation and upgrading of traditional print manufacturing companies and the modern microelectronics manufacturing sector.

Increase in adoption of electric Vehicles (EVs) and surge in development of autonomous driving technologies are boosting the demand for automotive printed electronics. As the automotive sector undergoes a profound shift toward sustainable and technologically advanced transportation solutions, printed electronics play a pivotal role in meeting the unique requirements of these transformative trends.

Rise in adoption of Battery Management Systems (BMS) is expected to spur the automotive printed electronics market growth in the near future. Printed electronics are instrumental in the development of BMS that monitor and optimize the performance of lithium-ion batteries. Flexible and stretchable electronic components enable the integration of sensors and control systems within the battery pack, ensuring safe and efficient energy storage. Additionally, printed electronics contribute to the creation of lightweight and compact electric powertrains, supporting the overall goal of maximizing vehicle range and efficiency.

BMS monitors and controls the performance of lithium-ion batteries, contributing to the efficiency and safety of EVs. Autonomous vehicles heavily rely on sensors and connectivity solutions. Printed sensors, such as LiDAR sensors and radar antennas, can be integrated seamlessly into the vehicle's design to support autonomous functionalities.

Traditional electronic components, such as rigid circuit boards, face limitations in adapting to the complex and curved shapes within vehicles. Automakers are focusing on designing lighter and more aerodynamic vehicles. This is boosting the demand for flexible and lightweight electronic solutions, thereby augmenting the automotive printed electronics market trajectory.

Lightweighting is a key strategy in the automotive sector to improve fuel efficiency and reduce emissions. Printed electronics, being inherently lighter than traditional components, contribute to overall vehicle weight reduction. They allow for greater design freedom, enabling the integration of electronic components into curved surfaces, flexible displays, and unconventional shapes. This flexibility is crucial for modern automotive interiors and exteriors.

Surge in demand for low-cost manufacturing processes is driving the automotive printed electronics market progress. The manufacturing process of printed electronics is often more cost-effective compared to traditional methods. This cost efficiency becomes a driving factor for automakers aiming to adopt innovative electronic solutions without significantly increasing production costs. Flexible and lightweight printed electronics contribute to enhanced user experiences within vehicles. From curved displays and touch-sensitive surfaces to smart textiles, these components improve the aesthetics and functionality of the vehicle's interior.

According to the latest automotive printed electronics market trends, the screen printing technology segment held largest share of 50.3% and contributed US$ 1.7 Bn in terms of revenue in 2022. The versatility and cost-effectiveness of screen printing makes it a preferred choice for various applications within the electronics sector. An advantage of screen printing in the realm of printed electronics is its capability to accommodate a diverse range of conductive inks, including those containing conductive nanoparticles or organic materials. Moreover, this flexibility in ink compatibility makes screen printing suitable for a broad spectrum of electronic devices, from simple RFID tags to complex flexible displays.

According to the latest automotive printed electronics market analysis, the passenger vehicle type segment dominated the sector in 2022 with a share of 59.4% and revenue of US$ 2.0 Bn. The integration of printed electronics in passenger vehicles enables the production of innovative components, such as flexible displays, touch-sensitive surfaces, and smart sensors, that enhance the driving experience. The passenger vehicle segment's dominance is driven by increase in demand for advanced electronics, including infotainment systems, navigation displays, and driver assistance technologies, in modern automobiles.

The growing trend toward electric and hybrid vehicles further amplifies the significance of printed electronics in the passenger vehicle segment. As automakers strive to create more energy-efficient and technologically sophisticated vehicles, printed electronics play a crucial role in the development of lightweight, flexible, and energy-efficient solutions.

According to the latest automotive printed electronics market insights, Asia Pacific accounted for major share of 44.1% and revenue of US$ 1.5 Bn in 2022, followed by North America. Asia Pacific is home to some of the world's largest and most technologically advanced economies, including China, Japan, and South Korea. These countries boast robust manufacturing capabilities, a skilled workforce, and significant investments in research and development, creating an environment conducive to innovation and the mass production of printed electronic components. As a result, the region has become a global hub for electronic manufacturing, driving the adoption and development of printed electronics across various applications. This, in turn, is boosting the automotive printed electronics industry share in Asia Pacific.

Presence of well-developed transportation infrastructure and major electric vehicle manufacturers focusing on the development of autonomous vehicles for a sustainable and safer future is driving the automotive printed electronics market dynamics of North America.

The global industry is fragmented, with a higher number of manufacturers controlling the market share. Major automotive printed electronics companies are adopting newer technologies to expand their product portfolio.

Brückner Maschinenbau GmbH & Co. KG, Cicor Group, Henkel AG & Co. KGaA, Jabil Inc., Komura-Tech Co., Ltd., Molex, LLC, Nissha Co., Ltd., Optomec, Inc., Tritek Micro Controls Pvt Ltd., Witte Technology GmbH, DuraTech Industries, Heidelberger Druckmaschinen AG, Ynvisible Interactive Inc., and InkTec Co., Ltd. are key players operating in this market.

Each of these players has been profiled in the automotive printed electronics market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 (Base Year) | US$ 3.4 Bn |

| Market Forecast Value in 2031 | US$ 115.2 Bn |

| Growth Rate (CAGR) | 14.9% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, Value chain analysis, industry trend analysis, etc. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 3.4 Bn in 2022

It is projected to advance at a CAGR of 14.9% from 2023 to 2031

It is estimated to reach US$ 115.2 Bn by the end of 2031

Growth in demand for electric vehicles and rise in demand for lightweight and flexible electronic components

The screen printing segment accounted for the largest share in 2022

Asia Pacific is a highly lucrative region

Brückner Maschinenbau GmbH & Co. KG, Cicor Group, Henkel AG & Co. KGaA, Jabil Inc., Komura-Tech Co., Ltd., Molex, LLC, Nissha Co., Ltd., Optomec, Inc., Tritek Micro Controls Pvt Ltd., Witte Technology GmbH, DuraTech Industries, Heidelberger Druckmaschinen AG, Ynvisible Interactive Inc., and InkTec Co., Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding Buying Process of Customers

1.2.4. Preferred Sales & Marketing Strategy

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. Macro-Economic Factors

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunity

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. Impact Factors: Automotive Printed Electronics

3.1. Emergence of Electric Vehicles

4. Global Automotive Printed Electronics Market, By Technology

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Technology

4.2.1. Flexography

4.2.2. Inkjet Printing

4.2.3. Screen Printing

4.2.4. Offset Printing

4.2.5. Others (Gravure Printing, Aerosol Jet Printing, etc.)

5. Global Automotive Printed Electronics Market, By Material

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Material

5.2.1. Substrates

5.2.1.1. Organic Materials

5.2.1.1.1. Polymers

5.2.1.1.2. Papers

5.2.1.1.3. Fabrics

5.2.1.2. Inorganic Materials

5.2.1.2.1. Silicon

5.2.1.2.2. Glass

5.2.1.2.3. Metals

5.2.2. Inks

5.2.2.1. Conductive Inks

5.2.2.2. Dielectric Inks

5.2.2.3. Semi-conductive Inks

6. Global Automotive Printed Electronics Market, By Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

6.2.1. Passenger Vehicle

6.2.2. Light Commercial Vehicle

6.2.3. Heavy Duty Truck

6.2.4. Bus and Coach

7. Global Automotive Printed Electronics Market, By Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Automotive Printed Electronics Market

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. North America Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Technology

8.2.1. Flexography

8.2.2. Inkjet Printing

8.2.3. Screen Printing

8.2.4. Offset Printing

8.2.5. Others (Gravure Printing, Aerosol Jet Printing, etc.)

8.3. North America Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Material

8.3.1. Substrates

8.3.1.1. Organic Materials

8.3.1.1.1. Polymers

8.3.1.1.2. Papers

8.3.1.1.3. Fabrics

8.3.1.2. Inorganic Materials

8.3.1.2.1. Silicon

8.3.1.2.2. Glass

8.3.1.2.3. Metals

8.3.2. Inks

8.3.2.1. Conductive Inks

8.3.2.2. Dielectric Inks

8.3.2.3. Semi-conductive Inks

8.4. North America Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

8.4.1. Passenger Vehicle

8.4.2. Light Commercial Vehicle

8.4.3. Heavy Duty Truck

8.4.4. Bus and Coach

8.5. Key Country Analysis – North America Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031

8.5.1. U.S.

8.5.2. Canada

8.5.3. Mexico

9. Europe Automotive Printed Electronics Market

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Europe Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Technology

9.2.1. Flexography

9.2.2. Inkjet Printing

9.2.3. Screen Printing

9.2.4. Offset Printing

9.2.5. Others (Gravure Printing, Aerosol Jet Printing, etc.)

9.3. Europe Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Material

9.3.1. Substrates

9.3.1.1. Organic Materials

9.3.1.1.1. Polymers

9.3.1.1.2. Papers

9.3.1.1.3. Fabrics

9.3.1.2. Inorganic Materials

9.3.1.2.1. Silicon

9.3.1.2.2. Glass

9.3.1.2.3. Metals

9.3.2. Inks

9.3.2.1. Conductive Inks

9.3.2.2. Dielectric Inks

9.3.2.3. Semi-conductive Inks

9.4. Europe Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

9.4.1. Passenger Vehicle

9.4.2. Light Commercial Vehicle

9.4.3. Heavy Duty Truck

9.4.4. Bus and Coach

9.5. Key Country Analysis – Europe Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031

9.5.1. Germany

9.5.2. U.K.

9.5.3. France

9.5.4. Italy

9.5.5. Spain

9.5.6. Nordic Countries

9.5.7. Russia & CIS

9.5.8. Rest of Europe

10. Asia Pacific Automotive Printed Electronics Market

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Asia Pacific Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Technology

10.2.1. Flexography

10.2.2. Inkjet Printing

10.2.3. Screen Printing

10.2.4. Offset Printing

10.2.5. Others (Gravure Printing, Aerosol Jet Printing, etc.)

10.3. Asia Pacific Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Material

10.3.1. Substrates

10.3.1.1. Organic Materials

10.3.1.1.1. Polymers

10.3.1.1.2. Papers

10.3.1.1.3. Fabrics

10.3.1.2. Inorganic Materials

10.3.1.2.1. Silicon

10.3.1.2.2. Glass

10.3.1.2.3. Metals

10.3.2. Inks

10.3.2.1. Conductive Inks

10.3.2.2. Dielectric Inks

10.3.2.3. Semi-conductive Inks

10.4. Asia-Pacific Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

10.4.1. Passenger Vehicle

10.4.2. Light Commercial Vehicle

10.4.3. Heavy Duty Truck

10.4.4. Bus and Coach

10.5. Key Country Analysis – Asia Pacific Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. ASEAN Countries

10.5.5. South Korea

10.5.6. ANZ

10.5.7. Rest of Asia Pacific

11. Middle East & Africa Automotive Printed Electronics Market

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Middle East & Africa Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Technology

11.2.1. Flexography

11.2.2. Inkjet Printing

11.2.3. Screen Printing

11.2.4. Offset Printing

11.2.5. Others (Gravure Printing, Aerosol Jet Printing, etc.)

11.3. Middle East & Africa Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Material

11.3.1. Substrates

11.3.1.1. Organic Materials

11.3.1.1.1. Polymers

11.3.1.1.2. Papers

11.3.1.1.3. Fabrics

11.3.1.2. Inorganic Materials

11.3.1.2.1. Silicon

11.3.1.2.2. Glass

11.3.1.2.3. Metals

11.3.2. Inks

11.3.2.1. Conductive Inks

11.3.2.2. Dielectric Inks

11.3.2.3. Semi-conductive Inks

11.4. Middle East & Africa Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.4.1. Passenger Vehicle

11.4.2. Light Commercial Vehicle

11.4.3. Heavy Duty Truck

11.4.4. Bus and Coach

11.5. Key Country Analysis – Middle East & Africa Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031

11.5.1. GCC

11.5.2. South Africa

11.5.3. Türkiye

11.5.4. Rest of Middle East & Africa

12. South America Automotive Printed Electronics Market

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. South America Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Technology

12.2.1. Flexography

12.2.2. Inkjet Printing

12.2.3. Screen Printing

12.2.4. Offset Printing

12.2.5. Others (Gravure Printing, Aerosol Jet Printing, etc.)

12.3. South America Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Material

12.3.1. Substrates

12.3.1.1. Organic Materials

12.3.1.1.1. Polymers

12.3.1.1.2. Papers

12.3.1.1.3. Fabrics

12.3.1.2. Inorganic Materials

12.3.1.2.1. Silicon

12.3.1.2.2. Glass

12.3.1.2.3. Metals

12.3.2. Inks

12.3.2.1. Conductive Inks

12.3.2.2. Dielectric Inks

12.3.2.3. Semi-conductive Inks

12.4. South America Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.4.1. Passenger Vehicle

12.4.2. Light Commercial Vehicle

12.4.3. Heavy Duty Truck

12.4.4. Bus and Coach

12.5. Key Country Analysis – South America Automotive Printed Electronics Market Size Analysis & Forecast, 2017-2031

12.5.1. Brazil

12.5.2. Argentina

12.5.3. Rest of South America

13. Competitive Landscape

13.1. Company Share Analysis/ Brand Share Analysis, 2022

13.2. Company Analysis for Each Player Company Overview, Company Footprints, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis

14. Company Profile/ Key Players

14.1. Brückner Maschinenbau GmbH & Co. KG

14.1.1. Company Overview

14.1.2. Company Footprints

14.1.3. Product Portfolio

14.1.4. Competitors & Customers

14.1.5. Subsidiaries & Parent Organization

14.1.6. Recent Developments

14.1.7. Financial Analysis

14.2. Cicor Group

14.2.1. Company Overview

14.2.2. Company Footprints

14.2.3. Product Portfolio

14.2.4. Competitors & Customers

14.2.5. Subsidiaries & Parent Organization

14.2.6. Recent Developments

14.2.7. Financial Analysis

14.3. Henkel AG & Co. KGaA

14.3.1. Company Overview

14.3.2. Company Footprints

14.3.3. Product Portfolio

14.3.4. Competitors & Customers

14.3.5. Subsidiaries & Parent Organization

14.3.6. Recent Developments

14.3.7. Financial Analysis

14.4. Jabil Inc.

14.4.1. Company Overview

14.4.2. Company Footprints

14.4.3. Product Portfolio

14.4.4. Competitors & Customers

14.4.5. Subsidiaries & Parent Organization

14.4.6. Recent Developments

14.4.7. Financial Analysis

14.5. Komura-Tech Co., Ltd.

14.5.1. Company Overview

14.5.2. Company Footprints

14.5.3. Product Portfolio

14.5.4. Competitors & Customers

14.5.5. Subsidiaries & Parent Organization

14.5.6. Recent Developments

14.5.7. Financial Analysis

14.6. Molex, LLC

14.6.1. Company Overview

14.6.2. Company Footprints

14.6.3. Product Portfolio

14.6.4. Competitors & Customers

14.6.5. Subsidiaries & Parent Organization

14.6.6. Recent Developments

14.6.7. Financial Analysis

14.7. Nissha Co., Ltd.

14.7.1. Company Overview

14.7.2. Company Footprints

14.7.3. Product Portfolio

14.7.4. Competitors & Customers

14.7.5. Subsidiaries & Parent Organization

14.7.6. Recent Developments

14.7.7. Financial Analysis

14.8. Optomec, Inc.

14.8.1. Company Overview

14.8.2. Company Footprints

14.8.3. Product Portfolio

14.8.4. Competitors & Customers

14.8.5. Subsidiaries & Parent Organization

14.8.6. Recent Developments

14.8.7. Financial Analysis

14.9. Tritek Micro Controls Pvt Ltd.

14.9.1. Company Overview

14.9.2. Company Footprints

14.9.3. Product Portfolio

14.9.4. Competitors & Customers

14.9.5. Subsidiaries & Parent Organization

14.9.6. Recent Developments

14.9.7. Financial Analysis

14.10. Witte Technology GmbH

14.10.1. Company Overview

14.10.2. Company Footprints

14.10.3. Product Portfolio

14.10.4. Competitors & Customers

14.10.5. Subsidiaries & Parent Organization

14.10.6. Recent Developments

14.10.7. Financial Analysis

14.11. DuraTech Industries

14.11.1. Company Overview

14.11.2. Company Footprints

14.11.3. Product Portfolio

14.11.4. Competitors & Customers

14.11.5. Subsidiaries & Parent Organization

14.11.6. Recent Developments

14.11.7. Financial Analysis

14.12. Heidelberger Druckmaschinen AG

14.12.1. Company Overview

14.12.2. Company Footprints

14.12.3. Product Portfolio

14.12.4. Competitors & Customers

14.12.5. Subsidiaries & Parent Organization

14.12.6. Recent Developments

14.12.7. Financial Analysis

14.13. Ynvisible Interactive Inc

14.13.1. Company Overview

14.13.2. Company Footprints

14.13.3. Product Portfolio

14.13.4. Competitors & Customers

14.13.5. Subsidiaries & Parent Organization

14.13.6. Recent Developments

14.13.7. Financial Analysis.

14.14. InkTec Co., Ltd.

14.14.1. Company Overview

14.14.2. Company Footprints

14.14.3. Product Portfolio

14.14.4. Competitors & Customers

14.14.5. Subsidiaries & Parent Organization

14.14.6. Recent Developments

14.14.7. Financial Analysis

14.15. Other Key Players

14.15.1. Company Overview

14.15.2. Company Footprints

14.15.3. Product Portfolio

14.15.4. Competitors & Customers

14.15.5. Subsidiaries & Parent Organization

14.15.6. Recent Developments

14.15.7. Financial Analysis

List of Tables

Table 1: Global Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 2: Global Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 3: Global Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 4: Global Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 5: North America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 6: North America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 7: North America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 8: North America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 9: Europe Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 10: Europe Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 11: Europe Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 12: Europe Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 13: Asia Pacific Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 14: Asia Pacific Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 15: Asia Pacific Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 16: Asia Pacific Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 17: Middle East & Africa Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 18: Middle East & Africa Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 19: Middle East & Africa Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 20: Middle East & Africa Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 21: South America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017‒2031

Table 22: South America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017‒2031

Table 23: South America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 24: South America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 2: Global Automotive Printed Electronics Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 3: Global Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 4: Global Automotive Printed Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 5: Global Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 6: Global Automotive Printed Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 7: Global Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 8: Global Automotive Printed Electronics Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023-2031

Figure 9: North America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 10: North America Automotive Printed Electronics Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 11: North America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 12: North America Automotive Printed Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 13: North America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 14: North America Automotive Printed Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 15: North America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 16: North America Automotive Printed Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 17: Europe Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 18: Europe Automotive Printed Electronics Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 19: Europe Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 20: Europe Automotive Printed Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 21: Europe Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 22: Europe Automotive Printed Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 23: Europe Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 24: Europe Automotive Printed Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 25: Asia Pacific Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 26: Asia Pacific Automotive Printed Electronics Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 27: Asia Pacific Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 28: Asia Pacific Automotive Printed Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 29: Asia Pacific Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 30: Asia Pacific Automotive Printed Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 31: Asia Pacific Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 32: Asia Pacific Automotive Printed Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 33: Middle East & Africa Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 34: Middle East & Africa Automotive Printed Electronics Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 35: Middle East & Africa Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 36: Middle East & Africa Automotive Printed Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 37: Middle East & Africa Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 38: Middle East & Africa Automotive Printed Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 39: Middle East & Africa Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 40: Middle East & Africa Automotive Printed Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 41: South America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 42: South America Automotive Printed Electronics Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 43: South America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Material, 2017-2031

Figure 44: South America Automotive Printed Electronics Market, Incremental Opportunity, by Material, Value (US$ Mn), 2023-2031

Figure 45: South America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 46: South America Automotive Printed Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 47: South America Automotive Printed Electronics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 48: South America Automotive Printed Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031