Reports

Reports

Analysts’ Viewpoint on Automotive Garage Equipment Market Scenario

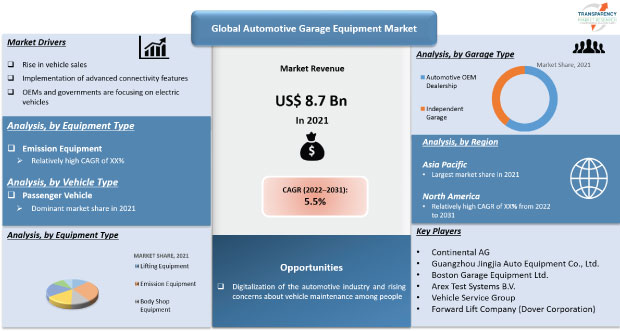

The demand for automotive garage equipment is driven by the implementation of stringent emission norms, rise in vehicle sales, digitalization of the automotive industry, and concerns about vehicle maintenance among people. Innovation, technology, and development of high-performance and fuel-efficient vehicles are key focus areas of companies operating in the automotive garage equipment market. Accordingly, the market is estimated to expand at a considerable growth rate (CAGR) of 5.5% during the forecast period. Moreover, advanced connectivity features have prompted OEMs and governments to focus more on electric vehicles and use sensor data for preventive maintenance around the globe.

The need for timely preventive maintenance of vehicles has gained significant importance around the world. Most people are trying to maintain their vehicle in a proper condition. People who commute daily are increasingly focusing on maintenance of their vehicles. This has been driving the automotive garage equipment market for the past few years.

Qualified and experienced technical staff providing prompt attention and good workmanship, along with satisfactory repair works through reasonable charges with the use of car tools and automotive tools help garages to maintain their reputation in a competitive global market.

A garage where cars are stored and repaired must be well-equipped to provide washing, lubrication, and tire & battery services. Specialized equipment such as lifting tackle, vehicle lifts, tire inflation, tire changing machines, and wheel balancing machines, along with different types of fixtures, tools, and jigs are the equipment available in an automotive garage. Moreover, other four-wheeler garage equipment, such as headlamp aligners, wheel alignment, emissions testing, 2 and 4 post lifts, and brake testers, are required extensively in garages across the globe.

According to a report published by the World Health Organization in 2015, the number of road traffic accidents resulting in fatal injuries per year is about 1.25 million. The rate of accidents is significant in low income countries such as countries those from Latin America and Africa. Considering the loss of life and economy, governing bodies are focused on implementation of stringent safety norms. Governments of countries in North America and Europe have mandated the integration of a few safety equipment such as airbags, ABS, and seat belts.

Higher number of road accidents effectively cause a loss to the economy and affects a nation’s GDP by approximately 3%. Several countries are focused on improving vehicle safety in order to reduce this loss.

After a crash, it is complicated to find out the exact problem in the electronic system of the vehicle. Diagnostic tools are efficient at analyzing the exact problem. Overhauling of vehicles recovered from accidents requires fabrication work coupled with replacement of irreparable parts. Therefore, a high number of road accidents is driving the automotive garage equipment market globally.

Digitalization of automotive systems is increasing at a significant pace, which requires digital diagnostic tools in order to diagnose and repair systems, such as ADAS, instrument console of vehicles, and functionality of airbags, sensors, and digital locks. Digitalization of automotive systems and rise in investment by leading OEMs in the automotive industry for the development of autonomous and digital systems are likely to propel the demand for diagnostic and calibration tools for digital systems in autonomous and semi-autonomous vehicles. Regular maintenance of vehicles is expected to ultimately require a higher number of automotive garages and garage equipment.

Garages are likely to require enhanced capacity for fabrication of vehicles, owing to rising concerns about vehicle maintenance and modification. This, in turn, is anticipated to boost the automotive garage equipment market during the forecast period.

The market for garage equipment is also being propelled by an increased demand for hybrid vehicles. Moreover, numerous rules for regular car inspections and the advent of newer technologies in the automobile aftermarket are further fuelling the automotive garage equipment market.

In terms of equipment type, the global automotive garage equipment market has been classified into lifting equipment, emission equipment, body shop equipment, wheel & tire equipment, vehicle diagnostics and testing, washing equipment, and other tools. The emission equipment segment held a major share of 34.16% in 2021. It is likely to maintain its position and expand at a growth rate of more than 5.4% during the forecast period. Increasing pollution levels is one of the major concerns for governments and OEMs around the world. Common emission equipment includes exhaust gas analyzers, diesel smoke meters, and emission testers. These measure various pollutants such as carbon monoxide, carbon dioxide, and nitrogen oxides. Such toxic compounds present in combustion gases have an adverse effect on the health of people living in urban areas. Long-term exposure to pollutant gases can even lead to permanent health deterioration.

In terms of garage type, the global automotive garage equipment market has been bifurcated into automotive OEM dealership and independent garage. The automotive OEM dealership segment held a major share of 54.01% of the global market in 2021. It is estimated to maintain its position and expand at a CAGR of 5.91% during the forecast period. The automotive OEM dealership segment is likely to expand at a rapid pace during the forecast period, as compared to the independent garages segment due to rise in the number of luxury vehicles that require higher grade and quality of maintenance systems, which independent garage owners are unlikely to afford. Bank funding for small businesses has become more difficult since 2015, which has led to a reduction in the number of independent garages.

In terms of volume, Asia Pacific held a notable share of 38.76% of the global automotive garage equipment market in 2021. Forthcoming emission norms in Asia Pacific is a key factor driving the automotive garage equipment market in the region. Countries in Europe, especially the EU-5 countries, are witness economic expansion during the forecast period, which in turn is estimated to fuel the demand for automotive garage equipment.

Users in North America and Europe have a high standard of living coupled with higher disposable incomes has led to a rise in trend of keeping their vehicles well-maintained, which is, in turn, estimated to propel the demand for automotive garage equipment in these regions. People across the globe have increased preference for smooth and comfortable driving experience, and hence, the market is estimated to expand at a rapid pace in all developed and developing countries in the near future.

Expanding economies in Asia Pacific, particularly India and China, are estimated to play a noteworthy role in the expansion of the automotive garage equipment market in the region in the near future. The automotive industry in India and China is expanding considerably, which is estimated to offer significant opportunities for the automotive garage equipment market in the near future.

The global automotive garage equipment market is fragmented with a higher number of manufacturers controlling the market. A majority of the firms are spending significantly on comprehensive research and development have fulfilled the requirements for modern vehicles. Expansion of product portfolios and mergers & acquisitions are major strategies adopted by key players.

Robert Bosch GmbH, Continental AG, Istobal S.A., Aro Equipments Pvt. Ltd., Guangzhou Jingjia Auto Equipment Co., Ltd., Nussbaum Automotive Solutions Lp, Boston Garage Equipment Ltd., Arex Test Systems B.V., Vehicle Service Group, Gray Manufacturing Company, Inc., VisiCon Automatisierungstechnik GmbH, MAHA Mechanical Engineering Haldenwang GmbH & Co. KG, and Forward Lift Company (Dover Corporation) are the prominent entities operating in the market.

Each of these players has been profiled in the automotive garage equipment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 8.7 Bn |

|

Market Forecast Value in 2031 |

US$ 14.8 Bn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market size of automotive garage equipment market stood at US$ 8.7 Bn in 2021

The automotive garage equipment market is expected to grow at a CAGR of 5.5% from 2022 to 2031

Surge in production & sales of vehicles, increase in safety concerns among vehicle owners, and digitalization of the automotive industry are key factors driving the automotive garage equipment market

The passenger vehicle segment accounted for a major share of 38.16% of the automotive garage equipment market in 2021

Asia Pacific is a more attractive region for vendors in the automotive garage equipment market

Key players operating in the automotive garage equipment market include Robert Bosch GmbH, Continental AG, Istobal S.A., Aro Equipments Pvt. Ltd., Guangzhou Jingjia Auto Equipment Co., Ltd., Nussbaum Automotive Solutions Lp, Boston Garage Equipment Ltd., Arex Test Systems B.V., Vehicle Service Group, Gray Manufacturing Company, Inc., VisiCon Automatisierungstechnik GmbH, MAHA Mechanical Engineering Haldenwang GmbH & Co. KG, and Forward Lift Company (Dover Corporation)

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017‒2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. SWOT Analysis

2.3.3. Value Chain Analysis

2.3.3.1. List of Key Manufacturers

2.3.3.2. List of Customers

2.3.3.3. Level of Integration

2.4. Regulatory Scenario

2.5. Key Trend Analysis

3. COVID-19 Impact Analysis – Automotive Garage Equipment Market

4. Global Automotive Garage Equipment Market, By Equipment Type

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Garage Equipment Market Size Analysis & Forecast, by Equipment Type, 2017‒2031

4.2.1. Lifting Equipment

4.2.2. Emission Equipment

4.2.3. Body Shop Equipment

4.2.4. Wheel & Tire Equipment

4.2.5. Vehicle Diagnostics & Testing

4.2.6. Washing Equipment

4.2.7. Other Tools

5. Global Automotive Garage Equipment Market, By Vehicle Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Garage Equipment Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

5.2.1. Two Wheelers

5.2.2. Three Wheelers

5.2.3. Passenger Vehicle

5.2.3.1. Hatchback

5.2.3.2. Sedan

5.2.3.3. Utility Vehicles

5.2.4. Light Commercial Vehicles

5.2.5. Trucks

5.2.6. Buses & Coaches

5.2.7. Off-road Vehicle

5.2.7.1. Agriculture Tractors & Equipment

5.2.7.2. Construction & Mining Equipment

6. Global Automotive Garage Equipment Market, by Garage Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Garage Equipment Market Size Analysis & Forecast, by Garage Type, 2017‒2031

6.2.1. Automotive OEM Dealership

6.2.2. Independent Garage

7. Global Automotive Garage Equipment Market, by Region

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Garage Equipment Market Size Analysis & Forecast, by Region, 2017‒2031

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Automotive Garage Equipment Market

8.1. Market Snapshot

8.2. Automotive Garage Equipment Market Size Analysis & Forecast, by Equipment Type, 2017‒2031

8.2.1. Lifting Equipment

8.2.2. Emission Equipment

8.2.3. Body Shop Equipment

8.2.4. Wheel & Tire Equipment

8.2.5. Vehicle Diagnostics & Testing

8.2.6. Washing Equipment

8.2.7. Other Tools

8.3. Automotive Garage Equipment Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

8.3.1. Two Wheelers

8.3.2. Three Wheelers

8.3.3. Passenger Vehicle

8.3.3.1. Hatchback

8.3.3.2. Sedan

8.3.3.3. Utility Vehicles

8.3.4. Light Commercial Vehicles

8.3.5. Trucks

8.3.6. Buses & Coaches

8.3.7. Off-road Vehicle

8.3.7.1. Agriculture Tractors & Equipment

8.3.7.2. Construction & Mining Equipment

8.4. Automotive Garage Equipment Market Size Analysis & Forecast, by Garage Type, 2017‒2031

8.4.1. Automotive OEM Dealership

8.4.2. Independent Garage

8.5. Key Country Analysis – North America Automotive Garage Equipment Market Size Analysis & Forecast, 2017‒2031

8.5.1. U.S.

8.5.2. Canada

8.5.3. Mexico

9. Europe Automotive Garage Equipment Market

9.1. Market Snapshot

9.2. Automotive Garage Equipment Market Size Analysis & Forecast, by Equipment Type, 2017‒2031

9.2.1. Lifting Equipment

9.2.2. Emission Equipment

9.2.3. Body Shop Equipment

9.2.4. Wheel & Tire Equipment

9.2.5. Vehicle Diagnostics & Testing

9.2.6. Washing Equipment

9.2.7. Other Tools

9.3. Automotive Garage Equipment Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

9.3.1. Two Wheelers

9.3.2. Three Wheelers

9.3.3. Passenger Vehicle

9.3.3.1. Hatchback

9.3.3.2. Sedan

9.3.3.3. Utility Vehicles

9.3.4. Light Commercial Vehicles

9.3.5. Trucks

9.3.6. Buses & Coaches

9.3.7. Off-road Vehicle

9.3.7.1. Agriculture Tractors & Equipment

9.3.7.2. Construction & Mining Equipment

9.4. Automotive Garage Equipment Market Size Analysis & Forecast, by Garage Type, 2017‒2031

9.4.1. Automotive OEM Dealership

9.4.2. Independent Garage

9.5. Key Country Analysis – Europe Automotive Garage Equipment Market Size Analysis & Forecast, 2017‒2031

9.5.1. Germany

9.5.2. U. K.

9.5.3. France

9.5.4. Italy

9.5.5. Spain

9.5.6. Nordic Countries

9.5.7. Russia & CIS

9.5.8. Rest of Europe

10. Asia Pacific Automotive Garage Equipment Market

10.1. Market Snapshot

10.2. Automotive Garage Equipment Market Size Analysis & Forecast, by Equipment Type, 2017‒2031

10.2.1. Lifting Equipment

10.2.2. Emission Equipment

10.2.3. Body Shop Equipment

10.2.4. Wheel & Tire Equipment

10.2.5. Vehicle Diagnostics & Testing

10.2.6. Washing Equipment

10.2.7. Other Tools

10.3. Automotive Garage Equipment Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

10.3.1. Two Wheelers

10.3.2. Three Wheelers

10.3.3. Passenger Vehicle

10.3.3.1. Hatchback

10.3.3.2. Sedan

10.3.3.3. Utility Vehicles

10.3.4. Light Commercial Vehicles

10.3.5. Trucks

10.3.6. Buses & Coaches

10.3.7. Off-road Vehicle

10.3.7.1. Agriculture Tractors & Equipment

10.3.7.2. Construction & Mining Equipment

10.4. Automotive Garage Equipment Market Size Analysis & Forecast, by Garage Type, 2017‒2031

10.4.1. Automotive OEM Dealership

10.4.2. Independent Garage

10.5. Key Country Analysis – Asia Pacific Automotive Garage Equipment Market Size Analysis & Forecast, 2017‒2031

10.5.1. China

10.5.2. India

10.5.3. Japan

10.5.4. ASEAN Countries

10.5.5. South Korea

10.5.6. ANZ

10.5.7. Rest of Asia Pacific

11. Middle East & Africa Automotive Garage Equipment Market

11.1. Market Snapshot

11.2. Automotive Garage Equipment Market Size Analysis & Forecast, by Equipment Type, 2017‒2031

11.2.1. Lifting Equipment

11.2.2. Emission Equipment

11.2.3. Body Shop Equipment

11.2.4. Wheel & Tire Equipment

11.2.5. Vehicle Diagnostics & Testing

11.2.6. Washing Equipment

11.2.7. Other Tools

11.3. Automotive Garage Equipment Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

11.3.1. Two Wheelers

11.3.2. Three Wheelers

11.3.3. Passenger Vehicle

11.3.3.1. Hatchback

11.3.3.2. Sedan

11.3.3.3. Utility Vehicles

11.3.4. Light Commercial Vehicles

11.3.5. Trucks

11.3.6. Buses & Coaches

11.3.7. Off-road Vehicle

11.3.7.1. Agriculture Tractors & Equipment

11.3.7.2. Construction & Mining Equipment

11.4. Automotive Garage Equipment Market Size Analysis & Forecast, by Garage Type, 2017‒2031

11.4.1. Automotive OEM Dealership

11.4.2. Independent Garage

11.5. Key Country Analysis – Middle East & Africa Automotive Garage Equipment Market Size Analysis & Forecast, 2017‒2031

11.5.1. GCC

11.5.2. South Africa

11.5.3. Turkey

11.5.4. Rest of Middle East & Africa

12. South America Automotive Garage Equipment Market

12.1. Market Snapshot

12.2. Automotive Garage Equipment Market Size Analysis & Forecast, by Equipment Type, 2017‒2031

12.2.1. Lifting Equipment

12.2.2. Emission Equipment

12.2.3. Body Shop Equipment

12.2.4. Wheel & Tire Equipment

12.2.5. Vehicle Diagnostics & Testing

12.2.6. Washing Equipment

12.2.7. Other Tools

12.3. Automotive Garage Equipment Market Size Analysis & Forecast, by Vehicle Type, 2017‒2031

12.3.1. Two Wheelers

12.3.2. Three Wheelers

12.3.3. Passenger Vehicle

12.3.3.1. Hatchback

12.3.3.2. Sedan

12.3.3.3. Utility Vehicles

12.3.4. Light Commercial Vehicles

12.3.5. Trucks

12.3.6. Buses & Coaches

12.3.7. Off-road Vehicle

12.3.7.1. Agriculture Tractors & Equipment

12.3.7.2. Construction & Mining Equipment

12.4. Automotive Garage Equipment Market Size Analysis & Forecast, by Garage Type, 2017‒2031

12.4.1. Automotive OEM Dealership

12.4.2. Independent Garage

12.5. Key Country Analysis – South America Automotive Garage Equipment Market Size Analysis & Forecast, 2017‒2031

12.5.1. Brazil

12.5.2. Argentina

12.5.3. Rest of South America

13. Competitive Landscape

13.1. Company Share Analysis/ Brand Share Analysis, 2020

13.2. Pricing comparison among key players

13.3. Company Analysis for each player

13.3.1. Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share

14. Company Profile/ Key Players

14.1. MAHA Maschinenbau Haldenwang Gmbh & Co. KG

14.1.1. Company Overview

14.1.2. Company Footprints

14.1.3. Production Locations

14.1.4. Product Portfolio

14.1.5. Competitors & Customers

14.1.6. Subsidiaries & Parent Organization

14.1.7. Recent Developments

14.1.8. Financial Analysis

14.1.9. Profitability

14.1.10. Revenue Share

14.2. Snap-on Incorporated

14.2.1. Company Overview

14.2.2. Company Footprints

14.2.3. Production Locations

14.2.4. Product Portfolio

14.2.5. Competitors & Customers

14.2.6. Subsidiaries & Parent Organization

14.2.7. Recent Developments

14.2.8. Financial Analysis

14.2.9. Profitability

14.2.10. Revenue Share

14.3. Robert Bosch GmbH

14.3.1. Company Overview

14.3.2. Company Footprints

14.3.3. Production Locations

14.3.4. Product Portfolio

14.3.5. Competitors & Customers

14.3.6. Subsidiaries & Parent Organization

14.3.7. Recent Developments

14.3.8. Financial Analysis

14.3.9. Profitability

14.3.10. Revenue Share

14.4. Continental AG

14.4.1. Company Overview

14.4.2. Company Footprints

14.4.3. Production Locations

14.4.4. Product Portfolio

14.4.5. Competitors & Customers

14.4.6. Subsidiaries & Parent Organization

14.4.7. Recent Developments

14.4.8. Financial Analysis

14.4.9. Profitability

14.4.10. Revenue Share

14.5. Forward Lift Company (Dover Corporation)

14.5.1. Company Overview

14.5.2. Company Footprints

14.5.3. Production Locations

14.5.4. Product Portfolio

14.5.5. Competitors & Customers

14.5.6. Subsidiaries & Parent Organization

14.5.7. Recent Developments

14.5.8. Financial Analysis

14.5.9. Profitability

14.5.10. Revenue Share

14.6. VisiCon Automatisierungstechnik GmbH

14.6.1. Company Overview

14.6.2. Company Footprints

14.6.3. Production Locations

14.6.4. Product Portfolio

14.6.5. Competitors & Customers

14.6.6. Subsidiaries & Parent Organization

14.6.7. Recent Developments

14.6.8. Financial Analysis

14.6.9. Profitability

14.6.10. Revenue Share

14.7. Standard Tools and Equipment Co.

14.7.1. Company Overview

14.7.2. Company Footprints

14.7.3. Production Locations

14.7.4. Product Portfolio

14.7.5. Competitors & Customers

14.7.6. Subsidiaries & Parent Organization

14.7.7. Recent Developments

14.7.8. Financial Analysis

14.7.9. Profitability

14.7.10. Revenue Share

14.8. Symach Srl

14.8.1. Company Overview

14.8.2. Company Footprints

14.8.3. Production Locations

14.8.4. Product Portfolio

14.8.5. Competitors & Customers

14.8.6. Subsidiaries & Parent Organization

14.8.7. Recent Developments

14.8.8. Financial Analysis

14.8.9. Profitability

14.8.10. Revenue Share

14.9. Nussbaum Automotive Solutions

14.9.1. Company Overview

14.9.2. Company Footprints

14.9.3. Production Locations

14.9.4. Product Portfolio

14.9.5. Competitors & Customers

14.9.6. Subsidiaries & Parent Organization

14.9.7. Recent Developments

14.9.8. Financial Analysis

14.9.9. Profitability

14.9.10. Revenue Share

14.10. SAMVIT GARAGE EQUIPMENTS

14.10.1. Company Overview

14.10.2. Company Footprints

14.10.3. Production Locations

14.10.4. Product Portfolio

14.10.5. Competitors & Customers

14.10.6. Subsidiaries & Parent Organization

14.10.7. Recent Developments

14.10.8. Financial Analysis

14.10.9. Profitability

14.10.10. Revenue Share

14.11. Sarveshwari Engineers

14.11.1. Company Overview

14.11.2. Company Footprints

14.11.3. Production Locations

14.11.4. Product Portfolio

14.11.5. Competitors & Customers

14.11.6. Subsidiaries & Parent Organization

14.11.7. Recent Developments

14.11.8. Financial Analysis

14.11.9. Profitability

14.11.10. Revenue Share

14.12. PULI Industries (Guangzhou Jingjia Auto Equipment Co., Ltd.)

14.12.1. Company Overview

14.12.2. Company Footprints

14.12.3. Production Locations

14.12.4. Product Portfolio

14.12.5. Competitors & Customers

14.12.6. Subsidiaries & Parent Organization

14.12.7. Recent Developments

14.12.8. Financial Analysis

14.12.9. Profitability

14.12.10. Revenue Share

14.13. Boston Garage Equipment Ltd.

14.13.1. Company Overview

14.13.2. Company Footprints

14.13.3. Production Locations

14.13.4. Product Portfolio

14.13.5. Competitors & Customers

14.13.6. Subsidiaries & Parent Organization

14.13.7. Recent Developments

14.13.8. Financial Analysis

14.13.9. Profitability

14.13.10. Revenue Share

14.14. Arex Test Systems B.V.

14.14.1. Company Overview

14.14.2. Company Footprints

14.14.3. Production Locations

14.14.4. Product Portfolio

14.14.5. Competitors & Customers

14.14.6. Subsidiaries & Parent Organization

14.14.7. Recent Developments

14.14.8. Financial Analysis

14.14.9. Profitability

14.14.10. Revenue Share

14.15. LKQ Coatings Ltd.

14.15.1. Company Overview

14.15.2. Company Footprints

14.15.3. Production Locations

14.15.4. Product Portfolio

14.15.5. Competitors & Customers

14.15.6. Subsidiaries & Parent Organization

14.15.7. Recent Developments

14.15.8. Financial Analysis

14.15.9. Profitability

14.15.10. Revenue Share

14.16. Aro Equipments Pvt. Ltd

14.16.1. Company Overview

14.16.2. Company Footprints

14.16.3. Production Locations

14.16.4. Product Portfolio

14.16.5. Competitors & Customers

14.16.6. Subsidiaries & Parent Organization

14.16.7. Recent Developments

14.16.8. Financial Analysis

14.16.9. Profitability

14.16.10. Revenue Share

14.17. Istobal S.A.

14.17.1. Company Overview

14.17.2. Company Footprints

14.17.3. Production Locations

14.17.4. Product Portfolio

14.17.5. Competitors & Customers

14.17.6. Subsidiaries & Parent Organization

14.17.7. Recent Developments

14.17.8. Financial Analysis

14.17.9. Profitability

14.17.10. Revenue Share

14.18. Con Air Equipment Private Limited

14.18.1. Company Overview

14.18.2. Company Footprints

14.18.3. Production Locations

14.18.4. Product Portfolio

14.18.5. Competitors & Customers

14.18.6. Subsidiaries & Parent Organization

14.18.7. Recent Developments

14.18.8. Financial Analysis

14.18.9. Profitability

14.18.10. Revenue Share

14.19. Oil Lube Systems Pvt Ltd.

14.19.1. Company Overview

14.19.2. Company Footprints

14.19.3. Production Locations

14.19.4. Product Portfolio

14.19.5. Competitors & Customers

14.19.6. Subsidiaries & Parent Organization

14.19.7. Recent Developments

14.19.8. Financial Analysis

14.19.9. Profitability

14.19.10. Revenue Share

14.20. Gray Manufacturing Company, Inc.

14.20.1. Company Overview

14.20.2. Company Footprints

14.20.3. Production Locations

14.20.4. Product Portfolio

14.20.5. Competitors & Customers

14.20.6. Subsidiaries & Parent Organization

14.20.7. Recent Developments

14.20.8. Financial Analysis

14.20.9. Profitability

14.20.10. Revenue Share

14.21. Other Key Players

14.21.1. Company Overview

14.21.2. Company Footprints

14.21.3. Production Locations

14.21.4. Product Portfolio

14.21.5. Competitors & Customers

14.21.6. Subsidiaries & Parent Organization

14.21.7. Recent Developments

14.21.8. Financial Analysis

14.21.9. Profitability

14.21.10. Revenue Share

List of Tables

Table 1: Global Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Table 2: Global Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Table 3: Global Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 4: Global Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 5: Global Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Table 6: Global Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Table 7: Global Automotive Garage Equipment Market Volume (Million Units) Forecast, by Region, 2017‒2031

Table 8: Global Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 9: North America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Table 10: North America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Table 11: North America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 12: North America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 13: North America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Table 14: North America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Table 15: North America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Country, 2017‒2031

Table 16: North America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 17: Europe Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Table 18: Europe Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Table 19: Europe Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 20: Europe Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 21: Europe Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Table 22: Europe Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Table 23: Europe Automotive Garage Equipment Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Table 24: Europe Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 25: Asia Pacific Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Table 26: Asia Pacific Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Table 27: Asia Pacific Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 28: Asia Pacific Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 29: Asia Pacific Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Table 30: Asia Pacific Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Table 31: Asia Pacific Automotive Garage Equipment Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Table 32: Asia Pacific Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 33: Middle East & Africa Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Table 34: Middle East & Africa Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Table 35: Middle East & Africa Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 36: Middle East & Africa Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 37: Middle East & Africa Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Table 38: Middle East & Africa Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Table 39: Middle East & Africa Automotive Garage Equipment Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Table 40: Middle East & Africa Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Table 41: South America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Table 42: South America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Table 43: South America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Table 44: South America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 45: South America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Table 46: South America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Table 47: South America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Table 48: South America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

List of Figures

Figure 1: Global Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Figure 2: Global Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Figure 3: Global Automotive Garage Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Bn), 2022‒2031

Figure 4: Global Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 5: Global Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 6: Global Automotive Garage Equipment Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 7: Global Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Figure 8: Global Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Figure 9: Global Automotive Garage Equipment Market, Incremental Opportunity, by Garage Type, Value (US$ Bn), 2022‒2031

Figure 10: Global Automotive Garage Equipment Market Volume (Million Units) Forecast, by Region, 2017‒2031

Figure 11: Global Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Figure 12: Global Automotive Garage Equipment Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022‒2031

Figure 13: North America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Figure 14: North America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Figure 15: North America Automotive Garage Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Bn), 2022‒2031

Figure 16: North America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 17: North America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 18: North America Automotive Garage Equipment Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 19: North America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Figure 20: North America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Figure 21: North America Automotive Garage Equipment Market, Incremental Opportunity, by Garage Type, Value (US$ Bn), 2022‒2031

Figure 22: North America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Country, 2017‒2031

Figure 23: North America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 24: North America Automotive Garage Equipment Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 25: Europe Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Figure 26: Europe Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Figure 27: Europe Automotive Garage Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Bn), 2022‒2031

Figure 28: Europe Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 29: Europe Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 30: Europe Automotive Garage Equipment Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 31: Europe Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Figure 32: Europe Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Figure 33: Europe Automotive Garage Equipment Market, Incremental Opportunity, by Garage Type, Value (US$ Bn), 2022‒2031

Figure 34: Europe Automotive Garage Equipment Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Figure 35: Europe Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 36: Europe Automotive Garage Equipment Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 37: Asia Pacific Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Figure 38: Asia Pacific Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Figure 39: Asia Pacific Automotive Garage Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Bn), 2022‒2031

Figure 40: Asia Pacific Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 41: Asia Pacific Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 42: Asia Pacific Automotive Garage Equipment Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 43: Asia Pacific Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Figure 44: Asia Pacific Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Figure 45: Asia Pacific Automotive Garage Equipment Market, Incremental Opportunity, by Garage Type, Value (US$ Bn), 2022‒2031

Figure 46: Asia Pacific Automotive Garage Equipment Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Figure 47: Asia Pacific Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 48: Asia Pacific Automotive Garage Equipment Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 49: Middle East & Africa Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Figure 50: Middle East & Africa Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Figure 51: Middle East & Africa Automotive Garage Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Bn), 2022‒2031

Figure 52: Middle East & Africa Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 53: Middle East & Africa Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 54: Middle East & Africa Automotive Garage Equipment Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 55: Middle East & Africa Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Figure 56: Middle East & Africa Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Figure 57: Middle East & Africa Automotive Garage Equipment Market, Incremental Opportunity, by Garage Type, Value (US$ Bn), 2022‒2031

Figure 58: Middle East & Africa Automotive Garage Equipment Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Figure 59: Middle East & Africa Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 60: Middle East & Africa Automotive Garage Equipment Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 61: South America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Equipment Type, 2017‒2031

Figure 62: South America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Equipment Type, 2017‒2031

Figure 63: South America Automotive Garage Equipment Market, Incremental Opportunity, by Equipment Type, Value (US$ Bn), 2022‒2031

Figure 64: South America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Vehicle Type, 2017‒2031

Figure 65: South America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 66: South America Automotive Garage Equipment Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 67: South America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Garage Type, 2017‒2031

Figure 68: South America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Garage Type, 2017‒2031

Figure 69: South America Automotive Garage Equipment Market, Incremental Opportunity, by Garage Type, Value (US$ Bn), 2022‒2031

Figure 70: South America Automotive Garage Equipment Market Volume (Million Units) Forecast, by Country & Sub-region, 2017‒2031

Figure 71: South America Automotive Garage Equipment Market Value (US$ Bn) Forecast, by Country & Sub-region, 2017‒2031

Figure 72: South America Automotive Garage Equipment Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Bn), 2022‒2031