Reports

Reports

Analysts’ Viewpoint on Market Scenario

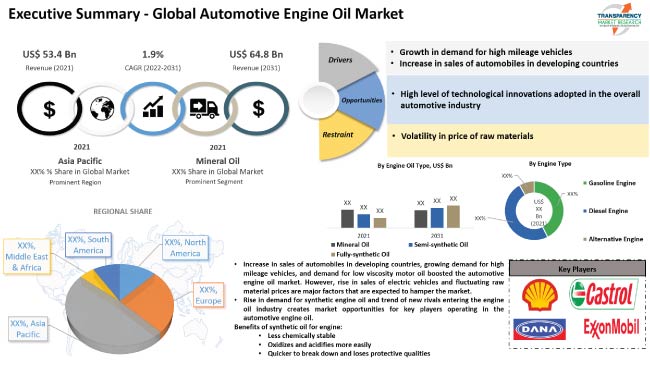

A key factor influencing the expansion of the vehicle engine oil market is how much less expensive conventional engine oil is as compared to cutting-edge lubes. Automotive engine oil is highly sought after all around the world. Additionally, synthetic automotive engine oil beats conventional oil in terms of long-term safety performance of vehicles and automobile parts, which further boosts market growth. Moreover, the automotive industry is anticipated expand in the next few years due to the gradual economic recovery and introduction of affordable options for rental and car loans.

However, rising prices for engine oil, a lack of raw materials, and environmental regulations are major factors limiting the supply of vehicle engine oil globally. Automotive engine production and manufacturing costs are significant. Therefore, consumer demand for fuel-efficient and high-performance versions would present manufacturers with considerable opportunities to increase their automotive engine oil market share. Furthermore, the downstream industry of motor oil is quite lucrative and offers significant opportunities for several manufacturers to expand their revenue streams.

Motorcycles, vehicles, and numerous other forms of automotive engines use automotive engine oil as a lubricant in their internal combustion engines. The primary job of the engine oil is to reduce wear and friction among the moving parts, while also clearing the engine of varnish and sludge. Automobile engine oil also enhances the sealing of the piston rings and neutralizes acids that come from the gasoline as a result of lubricant degradation.

Automotive engine oil also transfers heat away from the moving elements, which also acts as an insulator and cools the engine components. The type of engine determines the oil's quality. Engine oil requirements for diesel and gasoline engines are similar in some respects and have different key applications

When the engine is properly greased, it runs smoothly and the moving piston glides effortlessly, as it requires less effort. Usage of engine oil enables the vehicle to run more efficiently and at a cooler temperature. The ability of lower viscosity motor oils to increase fuel economy and the recommendation of these oils by OEMs to maximize performance are key factors driving market demand for these oils. Additionally, engine and add-on hardware innovations, such as turbochargers, further boost fuel-efficiency and reduce emissions. This significantly contributes to the rise in demand for motor oil.

For instance, in February 2020, For Arctic conditions, LUKOIL increased its selection of hydraulic oils for cold weather. The new product, LUKOIL GEYSER XLT 32, promises better stability of viscosity properties and resilience to mechanical loads at low temperatures due to an upgraded blend of LUKOIL's premium base oil and a unique thickening agent.

The hydraulic systems of mobile, special, and timber-harvesting vehicles (excavators), as well as other industrial equipment operating in extremely cold weather conditions across several regions in the Northern hemisphere are driving the demand for low-temperature hydraulic oils.

The automotive industry is swiftly transitioning into a new era characterized by improved lives, rising sustainability, changing consumer behaviors, the incorporation of connected and electric vehicles, and mobility fleet sharing. India, China, and Brazil offer the most promise for the automotive industry. Additionally, the competition among major players operating in the engine oil sector has increased due to the increased competitiveness among car manufacturers due to variables such as innovation and development time, reliability, fuel economy, safety, product quality and features, and pricing.

Additionally, the European Automobile Manufacturers Association (ACEA) reports that registrations in the European Union grew by 10% in June 2021 as compared to the same month in the previous year due to passenger cars' hybrid nature and improved fuel-efficiency. Consequently, engine oil manufacturers are currently expanding their operations in tandem with an increase in number of automobile sales in developing nations, which is projected to fuel the automotive engine oil market value.

Based on engine oil type, the automotive engine oil market segmentation comprises mineral oil, semi-synthetic oil, fully-synthetic oil. The mineral oil segment accounted for 56.10% share in 2021. Mineral oil is produced directly from refined crude petroleum oil as a product of the oil refining process. Mineral oils are less expansive and are readily available, hence they are widely utilized in automobiles. Additionally, the most fundamental and frequently utilized oil in the majority of ordinary cars is mineral-based automobile engine oil. It is better suited for two-wheelers in regions where the weather is not particularly hot or cold.

Demand for semi-synthetic oil is anticipated to increase in the near future because it is less expensive than synthetic lubricants. Mineral oil is a component in semi-synthetic oils; however, only in small amounts.

According to the automotive engine oil market analysis, in terms of region, Asia Pacific held 48.4% global market share in 2021 due to the presence of a sizable consumer base and rising production and consumption of the engine oil products in the region. Additionally, China and India are anticipated to have the most number of automobiles on the road. India is also the largest market for two-wheelers, which is estimated to further prompt the government to promote the adoption of energy-efficient automotive engine oils.

Widespread awareness about synthetic motor oil among consumers in Europe is projected to maintain the demand for synthetic motor oil in the region. The use of this environmentally friendly oil is anticipated to drive the market in Europe. Since the markets in South America, the Middle East, and Africa are still in their infancy, the automobile engine oil market share held by these regions is estimated to rise during the projected period.

The global automobile engine oil industry has become increasingly fragmented, with fewer manufacturers holding a larger portion of the market and significant players having the opportunity to accelerate expansion through the adoption of innovative technology. Key players frequently use mergers and acquisitions and product portfolio expansion as important tactics. Some of the key players identified in the automotive engine oil market across the globe are Royal Dutch Shell plc, Pentagon Lubricants Private Limited, Leo Lubricants Pvt. Ltd., DANA LUBRICANTS FACTORY LLC, Castrol Limited, HINDUJA GROUP, GP Petroleums Ltd., Saudi Arabian Oil Co., Total S.A, Gazprom, ROSNEFT, LUKOIL oil Company, Exxon Mobil Corporation, Chevron Corporation, Sinopec Lubricant Company, and JIANGSU LOPAL TECH. CO. LTD.

Key players in the automotive engine oil market report have been profiled in terms of company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 53.4 Bn |

|

Market Forecast Value in 2031 |

US$ 64.8 Bn |

|

Growth Rate (CAGR) |

1.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

Volume (Thousand Units) & US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market was valued at US$ 53.4 Bn in 2021.

It is expected to expand at a CAGR of 1.94% by 2031.

The global market would be worth US$ 64.8 Bn in 2031.

Growth in demand for high mileage vehicles, increase in sales of automobiles in developing countries and high level of technological innovations integrated in the overall automotive industry.

The mineral oil segment accounted for 56.1% share in 2021.

Asia Pacific is a highly lucrative region of the global market.

Royal Dutch Shell plc, Pentagon Lubricants Private Limited, Leo Lubricants Pvt. Ltd., DANA LUBRICANTS FACTORY LLC, Castrol Limited, HINDUJA GROUP, GP Petroleums Ltd., Saudi Arabian Oil Co., Total S.A, Gazprom, ROSNEFT, LUKOIL oil Company, Exxon Mobil Corporation, Chevron Corporation, Sinopec Lubricant Company, and JIANGSU LOPAL TECH. CO. LTD.

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Volume (Thousand Units), Value US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.6.3. Value Chain Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

3. Price Trend Analysis

4. COVID-19 Impact Analysis – Automotive Engine Oil Market

5. Global Automotive Engine Oil Market, By Engine Oil Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Oil Type

5.2.1. Mineral Oil

5.2.2. Semi-synthetic Oil

5.2.3. Fully-synthetic Oil

6. Global Automotive Engine Oil Market, By Engine Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Type

6.2.1. Gasoline Engine

6.2.2. Diesel Engine

6.2.3. Alternative Engine

7. Global Automotive Engine Oil Market, By Grade of Engine Oil

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Grade of Engine Oil

7.2.1. 5W-20

7.2.2. 5W-30

7.2.3. 5W-40

7.2.4. Others

8. Global Automotive Engine Oil Market, By Vehicle Type

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

8.2.1. Two Wheelers

8.2.2. Three Wheelers

8.2.3. Passenger Vehicles

8.2.3.1. Hatchback

8.2.3.2. Sedan

8.2.3.3. Utility Vehicle

8.2.4. Light Commercial Vehicles

8.2.5. Heavy Duty Trucks

8.2.6. Buses & Coaches

9. Global Automotive Engine Oil Market, By Sales Channel

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Sales Channel

9.2.1. OEM

9.2.2. Aftermarket

10. Global Automotive Engine Oil Market, By Region

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Automotive Engine Oil Market

11.1. Market Snapshot

11.2. North America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Oil Type

11.2.1. Mineral Oil

11.2.2. Semi-synthetic Oil

11.2.3. Fully-synthetic Oil

11.3. North America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Type

11.3.1. Gasoline Engine

11.3.2. Diesel Engine

11.3.3. Alternative Engine

11.4. North America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Grade of Engine Oil

11.4.1. 5W-20

11.4.2. 5W-30

11.4.3. 5W-40

11.4.4. Others

11.5. North America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.5.1. Two Wheelers

11.5.2. Three Wheelers

11.5.3. Passenger Vehicles

11.5.3.1. Hatchback

11.5.3.2. Sedan

11.5.3.3. Utility Vehicle

11.5.4. Light Commercial Vehicles

11.5.5. Heavy Duty Trucks

11.5.6. Buses & Coaches

11.6. North America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Sales Channel

11.6.1. OEM

11.6.2. Aftermarket

11.7. Key Country Analysis – North America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031

11.7.1. U.S.

11.7.2. Canada

11.7.3. Mexico

12. Europe Automotive Engine Oil Market

12.1. Market Snapshot

12.2. Europe Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Oil Type

12.2.1. Mineral Oil

12.2.2. Semi-synthetic Oil

12.2.3. Fully-synthetic Oil

12.3. Europe Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Type

12.3.1. Gasoline Engine

12.3.2. Diesel Engine

12.3.3. Alternative Engine

12.4. Europe Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Grade of Engine Oil

12.4.1. 5W-20

12.4.2. 5W-30

12.4.3. 5W-40

12.4.4. Others

12.5. Europe Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.5.1. Two Wheelers

12.5.2. Three Wheelers

12.5.3. Passenger Vehicles

12.5.3.1. Hatchback

12.5.3.2. Sedan

12.5.3.3. Utility Vehicle

12.5.4. Light Commercial Vehicles

12.5.5. Heavy Duty Trucks

12.5.6. Buses & Coaches

12.6. Europe Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Sales Channel

12.6.1. OEM

12.6.2. Aftermarket

12.7. Key Country Analysis – Europe Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031

12.7.1. Germany

12.7.2. U. K.

12.7.3. France

12.7.4. Italy

12.7.5. Spain

12.7.6. Nordic Countries

12.7.7. Russia & CIS

12.7.8. Rest of Europe

13. Asia Pacific Automotive Engine Oil Market

13.1. Market Snapshot

13.2. North America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Oil Type

13.2.1. Mineral Oil

13.2.2. Semi-synthetic Oil

13.2.3. Fully-synthetic Oil

13.3. Asia Pacific Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Type

13.3.1. Gasoline Engine

13.3.2. Diesel Engine

13.3.3. Alternative Engine

13.4. Asia Pacific Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Grade of Engine Oil

13.4.1. 5W-20

13.4.2. 5W-30

13.4.3. 5W-40

13.4.4. Others

13.5. Asia Pacific Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.5.1. Two Wheelers

13.5.2. Three Wheelers

13.5.3. Passenger Vehicles

13.5.3.1. Hatchback

13.5.3.2. Sedan

13.5.3.3. Utility Vehicle

13.5.4. Light Commercial Vehicles

13.5.5. Heavy Duty Trucks

13.5.6. Buses & Coaches

13.6. Asia Pacific Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Sales Channel

13.6.1. OEM

13.6.2. Aftermarket

13.7. Key Country Analysis – Asia Pacific Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031

13.7.1. China

13.7.2. India

13.7.3. Japan

13.7.4. ASEAN Countries

13.7.5. South Korea

13.7.6. ANZ

13.7.7. Rest of Asia Pacific

14. Middle East & Africa Automotive Engine Oil Market

14.1. Market Snapshot

14.2. Middle East & Africa Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Oil Type

14.2.1. Mineral Oil

14.2.2. Semi-synthetic Oil

14.2.3. Fully-synthetic Oil

14.3. Middle East & Africa Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Type

14.3.1. Gasoline Engine

14.3.2. Diesel Engine

14.3.3. Alternative Engine

14.4. Middle East & Africa Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Grade of Engine Oil

14.4.1. 5W-20

14.4.2. 5W-30

14.4.3. 5W-40

14.4.4. Others

14.5. Middle East & Africa Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

14.5.1. Two Wheelers

14.5.2. Three Wheelers

14.5.3. Passenger Vehicles

14.5.3.1. Hatchback

14.5.3.2. Sedan

14.5.3.3. Utility Vehicle

14.5.4. Light Commercial Vehicles

14.5.5. Heavy Duty Trucks

14.5.6. Buses & Coaches

14.6. Middle East & Africa Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Sales Channel

14.6.1. OEM

14.6.2. Aftermarket

14.7. Key Country Analysis – Middle East & Africa Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031

14.7.1. GCC

14.7.2. South Africa

14.7.3. Turkey

14.7.4. Rest of Middle East & Africa

15. South America Automotive Engine Oil Market

15.1. Market Snapshot

15.2. South America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Oil Type

15.2.1. Mineral Oil

15.2.2. Semi-synthetic Oil

15.2.3. Fully-synthetic Oil

15.3. South America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Engine Type

15.3.1. Gasoline Engine

15.3.2. Diesel Engine

15.3.3. Alternative Engine

15.4. South America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Grade of Engine Oil

15.4.1. 5W-20

15.4.2. 5W-30

15.4.3. 5W-40

15.4.4. Others

15.5. South America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

15.5.1. Two Wheelers

15.5.2. Three Wheelers

15.5.3. Passenger Vehicles

15.5.3.1. Hatchback

15.5.3.2. Sedan

15.5.3.3. Utility Vehicle

15.5.4. Light Commercial Vehicles

15.5.5. Heavy Duty Trucks

15.5.6. Buses & Coaches

15.6. South America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031, By Sales Channel

15.6.1. OEM

15.6.2. Aftermarket

15.7. Key Country Analysis – South America Automotive Engine Oil Market Size Analysis & Forecast, 2017-2031

15.7.1. Brazil

15.7.2. Argentina

15.7.3. Rest of South America

16. Competitive Landscape

16.1. Company Share Analysis/ Brand Share Analysis, 2021

16.2. Pricing comparison among key players

16.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

17. Company Profile/ Key Players

17.1. Royal Dutch Shell plc

17.1.1. Company Overview

17.1.2. Company Footprints

17.1.3. Production Locations

17.1.4. Product Portfolio

17.1.5. Competitors & Customers

17.1.6. Subsidiaries & Parent Organization

17.1.7. Recent Developments

17.1.8. Financial Analysis

17.1.9. Profitability

17.1.10. Revenue Share

17.2. Pentagon Lubricants Private Limited

17.2.1. Company Overview

17.2.2. Company Footprints

17.2.3. Production Locations

17.2.4. Product Portfolio

17.2.5. Competitors & Customers

17.2.6. Subsidiaries & Parent Organization

17.2.7. Recent Developments

17.2.8. Financial Analysis

17.2.9. Profitability

17.2.10. Revenue Share

17.3. Leo Lubricants Pvt. Ltd.

17.3.1. Company Overview

17.3.2. Company Footprints

17.3.3. Production Locations

17.3.4. Product Portfolio

17.3.5. Competitors & Customers

17.3.6. Subsidiaries & Parent Organization

17.3.7. Recent Developments

17.3.8. Financial Analysis

17.3.9. Profitability

17.3.10. Revenue Share

17.4. DANA LUBRICANTS FACTORY LLC

17.4.1. Company Overview

17.4.2. Company Footprints

17.4.3. Production Locations

17.4.4. Product Portfolio

17.4.5. Competitors & Customers

17.4.6. Subsidiaries & Parent Organization

17.4.7. Recent Developments

17.4.8. Financial Analysis

17.4.9. Profitability

17.4.10. Revenue Share

17.5. Castrol Limited

17.5.1. Company Overview

17.5.2. Company Footprints

17.5.3. Production Locations

17.5.4. Product Portfolio

17.5.5. Competitors & Customers

17.5.6. Subsidiaries & Parent Organization

17.5.7. Recent Developments

17.5.8. Financial Analysis

17.5.9. Profitability

17.5.10. Revenue Share

17.6. HINDUJA GROUP

17.6.1. Company Overview

17.6.2. Company Footprints

17.6.3. Production Locations

17.6.4. Product Portfolio

17.6.5. Competitors & Customers

17.6.6. Subsidiaries & Parent Organization

17.6.7. Recent Developments

17.6.8. Financial Analysis

17.6.9. Profitability

17.6.10. Revenue Share

17.7. GP Petroleums Ltd.

17.7.1. Company Overview

17.7.2. Company Footprints

17.7.3. Production Locations

17.7.4. Product Portfolio

17.7.5. Competitors & Customers

17.7.6. Subsidiaries & Parent Organization

17.7.7. Recent Developments

17.7.8. Financial Analysis

17.7.9. Profitability

17.7.10. Revenue Share

17.8. Saudi Arabian Oil Co.

17.8.1. Company Overview

17.8.2. Company Footprints

17.8.3. Production Locations

17.8.4. Product Portfolio

17.8.5. Competitors & Customers

17.8.6. Subsidiaries & Parent Organization

17.8.7. Recent Developments

17.8.8. Financial Analysis

17.8.9. Profitability

17.8.10. Revenue Share

17.9. Total S.A

17.9.1. Company Overview

17.9.2. Company Footprints

17.9.3. Production Locations

17.9.4. Product Portfolio

17.9.5. Competitors & Customers

17.9.6. Subsidiaries & Parent Organization

17.9.7. Recent Developments

17.9.8. Financial Analysis

17.9.9. Profitability

17.9.10. Revenue Share

17.10. Gazprom

17.10.1. Company Overview

17.10.2. Company Footprints

17.10.3. Production Locations

17.10.4. Product Portfolio

17.10.5. Competitors & Customers

17.10.6. Subsidiaries & Parent Organization

17.10.7. Recent Developments

17.10.8. Financial Analysis

17.10.9. Profitability

17.10.10. Revenue Share

17.11. ROSNEFT

17.11.1. Company Overview

17.11.2. Company Footprints

17.11.3. Production Locations

17.11.4. Product Portfolio

17.11.5. Competitors & Customers

17.11.6. Subsidiaries & Parent Organization

17.11.7. Recent Developments

17.11.8. Financial Analysis

17.11.9. Profitability

17.11.10. Revenue Share

17.12. LUKOIL oil Company

17.12.1. Company Overview

17.12.2. Company Footprints

17.12.3. Production Locations

17.12.4. Product Portfolio

17.12.5. Competitors & Customers

17.12.6. Subsidiaries & Parent Organization

17.12.7. Recent Developments

17.12.8. Financial Analysis

17.12.9. Profitability

17.12.10. Revenue Share

17.13. Exxon Mobil Corporation

17.13.1. Company Overview

17.13.2. Company Footprints

17.13.3. Production Locations

17.13.4. Product Portfolio

17.13.5. Competitors & Customers

17.13.6. Subsidiaries & Parent Organization

17.13.7. Recent Developments

17.13.8. Financial Analysis

17.13.9. Profitability

17.13.10. Revenue Share

17.14. Chevron Corporation

17.14.1. Company Overview

17.14.2. Company Footprints

17.14.3. Production Locations

17.14.4. Product Portfolio

17.14.5. Competitors & Customers

17.14.6. Subsidiaries & Parent Organization

17.14.7. Recent Developments

17.14.8. Financial Analysis

17.14.9. Profitability

17.14.10. Revenue Share

17.15. Sinopec Lubricant Company

17.15.1. Company Overview

17.15.2. Company Footprints

17.15.3. Production Locations

17.15.4. Product Portfolio

17.15.5. Competitors & Customers

17.15.6. Subsidiaries & Parent Organization

17.15.7. Recent Developments

17.15.8. Financial Analysis

17.15.9. Profitability

17.15.10. Revenue Share

17.16. JIANGSU LOPAL TECH. CO. LTD.

17.16.1. Company Overview

17.16.2. Company Footprints

17.16.3. Production Locations

17.16.4. Product Portfolio

17.16.5. Competitors & Customers

17.16.6. Subsidiaries & Parent Organization

17.16.7. Recent Developments

17.16.8. Financial Analysis

17.16.9. Profitability

17.16.10. Revenue Share

17.17. Other Key Players

17.17.1. Company Overview

17.17.2. Company Footprints

17.17.3. Production Locations

17.17.4. Product Portfolio

17.17.5. Competitors & Customers

17.17.6. Subsidiaries & Parent Organization

17.17.7. Recent Developments

17.17.8. Financial Analysis

17.17.9. Profitability

17.17.10. Revenue Share

List of Tables

Table 1: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Table 2: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017‒2031

Table 3: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Table 4: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017‒2031

Table 5: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Table 6: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017‒2031

Table 7: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 8: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 9: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 10: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 11: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Table 12: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 13: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Table 14: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017‒2031

Table 15: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Table 16: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017‒2031

Table 17: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Table 18: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017‒2031

Table 19: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 20: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 21: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 22: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 23: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 24: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Table 26: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017‒2031

Table 27: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Table 28: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017‒2031

Table 29: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Table 30: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017‒2031

Table 31: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 32: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 33: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 34: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 35: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 36: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 37: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Table 38: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017‒2031

Table 39: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Table 40: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017‒2031

Table 41: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Table 42: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017‒2031

Table 43: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 44: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 45: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 46: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 47: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 49: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Table 50: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017‒2031

Table 51: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Table 52: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017‒2031

Table 53: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Table 54: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017‒2031

Table 55: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 56: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 57: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 58: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 59: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 61: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Table 62: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017‒2031

Table 63: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Table 64: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017‒2031

Table 65: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Table 66: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017‒2031

Table 67: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Table 68: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 69: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Table 70: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017‒2031

Table 71: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Table 72: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Figure 2: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017-2031

Figure 3: Global Automotive Engine Oil Market, Incremental Opportunity, by Engine Oil Type, Value (US$ Bn), 2022-2031

Figure 4: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Figure 5: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017-2031

Figure 6: Global Automotive Engine Oil Market, Incremental Opportunity, by Engine Type, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Figure 8: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017-2031

Figure 9: Global Automotive Engine Oil Market, Incremental Opportunity, by Grade of Engine Oil, Value (US$ Bn), 2022-2031

Figure 10: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 11: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 12: Global Automotive Engine Oil Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 13: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 14: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 15: Global Automotive Engine Oil Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 16: Global Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Region, 2017-2031

Figure 17: Global Automotive Engine Oil Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Automotive Engine Oil Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Figure 20: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017-2031

Figure 21: North America Automotive Engine Oil Market, Incremental Opportunity, by Engine Oil Type, Value (US$ Bn), 2022-2031

Figure 22: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Figure 23: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017-2031

Figure 24: North America Automotive Engine Oil Market, Incremental Opportunity, by Engine Type, Value (US$ Bn), 2022-2031

Figure 25: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Figure 26: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017-2031

Figure 27: North America Automotive Engine Oil Market, Incremental Opportunity, by Grade of Engine Oil, Value (US$ Bn), 2022-2031

Figure 28: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 29: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 30: North America Automotive Engine Oil Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 31: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 32: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 33: North America Automotive Engine Oil Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 34: North America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 35: North America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Automotive Engine Oil Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 37: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Figure 38: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017-2031

Figure 39: Europe Automotive Engine Oil Market, Incremental Opportunity, by Engine Oil Type, Value (US$ Bn), 2022-2031

Figure 40: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Figure 41: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017-2031

Figure 42: Europe Automotive Engine Oil Market, Incremental Opportunity, by Engine Type, Value (US$ Bn), 2022-2031

Figure 43: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Figure 44: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017-2031

Figure 45: Europe Automotive Engine Oil Market, Incremental Opportunity, by Grade of Engine Oil, Value (US$ Bn), 2022-2031

Figure 46: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 47: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 48: Europe Automotive Engine Oil Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 49: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 50: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 51: Europe Automotive Engine Oil Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 52: Europe Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 53: Europe Automotive Engine Oil Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Automotive Engine Oil Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Figure 56: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017-2031

Figure 57: Asia Pacific Automotive Engine Oil Market, Incremental Opportunity, by Engine Oil Type, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Figure 59: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017-2031

Figure 60: Asia Pacific Automotive Engine Oil Market, Incremental Opportunity, by Engine Type, Value (US$ Bn), 2022-2031

Figure 61: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Figure 62: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017-2031

Figure 63: Asia Pacific Automotive Engine Oil Market, Incremental Opportunity, by Grade of Engine Oil, Value (US$ Bn), 2022-2031

Figure 64: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 65: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 66: Asia Pacific Automotive Engine Oil Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 67: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 68: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 69: Asia Pacific Automotive Engine Oil Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 70: Asia Pacific Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Automotive Engine Oil Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Automotive Engine Oil Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 73: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Figure 74: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017-2031

Figure 75: Middle East & Africa Automotive Engine Oil Market, Incremental Opportunity, by Engine Oil Type, Value (US$ Bn), 2022-2031

Figure 76: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Figure 77: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017-2031

Figure 78: Middle East & Africa Automotive Engine Oil Market, Incremental Opportunity, by Engine Type, Value (US$ Bn), 2022-2031

Figure 79: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Figure 80: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017-2031

Figure 81: Middle East & Africa Automotive Engine Oil Market, Incremental Opportunity, by Grade of Engine Oil, Value (US$ Bn), 2022-2031

Figure 82: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 83: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 84: Middle East & Africa Automotive Engine Oil Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 85: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 86: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 87: Middle East & Africa Automotive Engine Oil Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 88: Middle East & Africa Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Automotive Engine Oil Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Automotive Engine Oil Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031

Figure 91: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Oil Type, 2017-2031

Figure 92: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Oil Type, 2017-2031

Figure 93: South America Automotive Engine Oil Market, Incremental Opportunity, by Engine Oil Type, Value (US$ Bn), 2022-2031

Figure 94: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Engine Type, 2017-2031

Figure 95: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Engine Type, 2017-2031

Figure 96: South America Automotive Engine Oil Market, Incremental Opportunity, by Engine Type, Value (US$ Bn), 2022-2031

Figure 97: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Grade of Engine Oil, 2017-2031

Figure 98: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Grade of Engine Oil, 2017-2031

Figure 99: South America Automotive Engine Oil Market, Incremental Opportunity, by Grade of Engine Oil, Value (US$ Bn), 2022-2031

Figure 100: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Vehicle Type, 2017-2031

Figure 101: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 102: South America Automotive Engine Oil Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 103: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Sales Channel, 2017-2031

Figure 104: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 105: South America Automotive Engine Oil Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 106: South America Automotive Engine Oil Market Volume (Thousand Units) Forecast, by Country, 2017-2031

Figure 107: South America Automotive Engine Oil Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Automotive Engine Oil Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031