Reports

Reports

The automotive cybersecurity market is experiencing growth in response to new demands for modern vehicles. In contemporary vehicles, we now see a combination of sophisticated electrical systems, internet connectivity, on-board (embedded computers), as well as cloud based services.

Advanced Driver Assistance Systems (ADAS), infotainment systems, telematics, over-the-air (OTA) updates, and Vehicle-to-Everything (V2X) communications are just some of the many changes that have created a much larger attack surface, thereby making new vehicles more vulnerable to cyber threats. These new changes have increased the importance of automotive cybersecurity.

The automotive cybersecurity market is growing for a number of reasons. The primary reason is that automakers are paying more attention to cybersecurity due to the increasing number of features providing increased connectivity in vehicles (Infotainment, telematics data, GPS, V2X), which also effectively open potential entry to cyber criminals. Additionally, as more vehicles are incorporating autonomous technologies and software-defined vehicles (SDVs), an increased need to create advanced cybersecurity systems to protect critical function(s) of the vehicle in order to keep people safe is observed. Visible changes have been prompted by new regulatory requirements such as UNECE WP.29 and ISO/SAE 21434, which require any automaker to have cybersecurity measures in place to mitigate the risk across the whole life cycle of a vehicle, right from design to post-sales support.

The growing incidences of cyberattacks targeting vehicle networks and data privacy has further highlighted the vitality of robust protection, thereby pushing OEMs and suppliers to invest in technologies such as intrusion detection systems, secure OTA updates, and encrypted communications.

Moreover, the rising consumer awareness around digital security and the increasing adoption of electric vehicles (EVs) that rely heavily on software and connectivity, further drive the demand for effective automotive cybersecurity solutions.

This growing need has created a rich ground for innovation in automotive cybersecurity solutions. Companies across the automotive supply chain—including OEMs, Tier 1 suppliers, software developers, and cybersecurity firms—are developing as well as deploying technologies such as intrusion detection systems (IDS), hardware security modules (HSMs), secure gateways, encrypted communication protocols, and AI-powered threat monitoring tools. Such solutions are aimed not only at protecting vehicles from cyberattacks but also at building trust with consumers who increasingly rely on their cars as digital platforms.

Automotive cybersecurity implies the protection of vehicle systems—from infotainment and ECU controllers to connectivity modules—guarding against threats such as hacking, unauthorized access, malware, and ensuring the vehicle’s safety and data integrity. Vehicles are driven by software’s that include elements such as GPS, connectivity, over-the-air updates, and autonomous driving. Therefore, the potential for cyber-related threats increases, as the integrity of anything accessed via the vehicle and all things related to safety, privacy, and the ability to control the vehicle is at stake.

Automotive cybersecurity includes protecting both - vehicles and systems from unauthorized access, detection of intrusions and protecting the integrity and confidentiality of the systems for the entire lifespan of the vehicle. Automotive cybersecurity is an important element of vehicle designs. It establishes a series of objectives and has become an important topic, bolstered by regulations and standards that span international examples such as ISO/SAE 21434, to UNECE WP.29 as the automotive industry transitions into connected, electric and autonomous vehicles.

Automotive cybersecurity is primarily used in the automotive industry to protect vehicles from cyber threats by securing their systems, software, and communication networks. It is mostly used by automotive suppliers, software developers, and semiconductor companies that provide secure chips and control units. It is also used by telecommunications industry to safeguard vehicle-to-everything (V2X) communications with the rise of 5G connectivity.

IT firms and cybersecurity firms provide intrusion detection systems, firewalls, and cloud security solutions for vehicle data and remote updates. The other sectors such as mobility services, fleet management, insurance, and regulatory bodies also use automotive cybersecurity to assess risk, ensure compliance, and protect connected transportation systems.

| Attribute | Detail |

|---|---|

| Automotive Cybersecurity Market Drivers |

|

The ongoing trend toward software-defined and autonomous cars is highly propelling the need for automotive cybersecurity. Today's cars, as compared to traditional cars built primarily with mechanical systems now run on electronic control units (ECUs), networked sensors, and sophisticated software platforms. Software-defined vehicles (SDVs) facilitate manufacturers to remotely update features, improve performance, and patch bugs via over-the-air (OTA) updates.

Autonomous cars also depend on AI logic, real-time processing of information, and ongoing connectivity to operate securely. However, this greater dependency on connectivity and software also creates a huge array of cybersecurity threats. every software component or communication path is a potential attack vector. Ultimately, securing and integrity of such systems is paramount—not only to defend information, but also ensure functional safety and public confidence in autonomous and connected car technologies.

The increasing number of cyberattacks targeting automotive infrastructure and connected vehicles has become a major concern for the industry. High-profile demonstrations of vehicle hacking, such as remotely controlling a car's brakes or steering have highlighted the real-world risks linked with insecure vehicle systems.

Additionally, attackers are now targeting infotainment systems, vehicle telematics, and cloud-connected platforms for gaining access to personal data, location information, and even exercise control over vehicle functions. The rise in data breaches, ransomware attacks, and vulnerabilities in open-source automotive software has emphasized the need for robust cybersecurity measures.

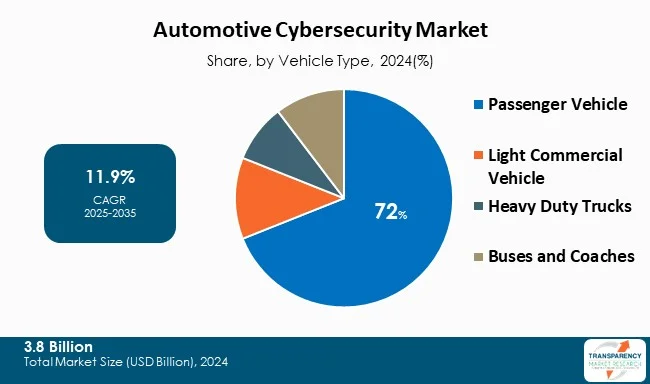

Passenger vehicles segment is dominating the automotive cybersecurity industry due to the increasing demand for advanced technologies such as telematics, Advanced Driver Assistance Systems (ADAS), digital cockpits, and internet-based infotainment systems in passenger cars. These advancements not only help to improve user experience and safety, but also expand the surface area for cyber-attacks. This pushes the manufacturers to invest more into cybersecurity of the vehicles. Additionally, customers are also demanding for connected features with data privacy and vehicle security.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America holds the major share of the automotive cybersecurity market. The advanced automotive manufacturers and technology companies are stationed in United States at large, which make the region dominating. Moreover, North America does benefit from a regulatory framework and increasing governmental focus on vehicle cybersecurity. Agencies such as NHTSA and CISA have introduced guidelines for improving vehicle cybersecurity, which is driving the demand for advanced security solutions.

The region also has a large number of top tech companies, car makers, and a high number of connected vehicles.

Key players are improving cybersecurity through bug bounty programs, partnerships, and compliance with global standards. Industry alliances support collaboration, while investments focus on secure software, encrypted communications, and threat detection.

Aptiv, Bosch Mobility Solutions, Capgemini, Continental AG (Argus Cyber Security), Cybellum Ltd., ETAS, Infineon Technologies AG, Karamba Security, Lattice Semiconductor, Microchip Technology, NXP Semiconductors, SBD Automotive Ltd, Panasonic Holdings Corporation, RunSafe Security, STMicroelectronics, Samsung Electronics Co., Ltd, Synopsys, Tata ELXSI, Upstream Security Ltd, and Vector Informatik GmbH are the key players in automotive cybersecurity market.

Each of these players has been profiled in the automotive cybersecurity market research report on the basis of parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

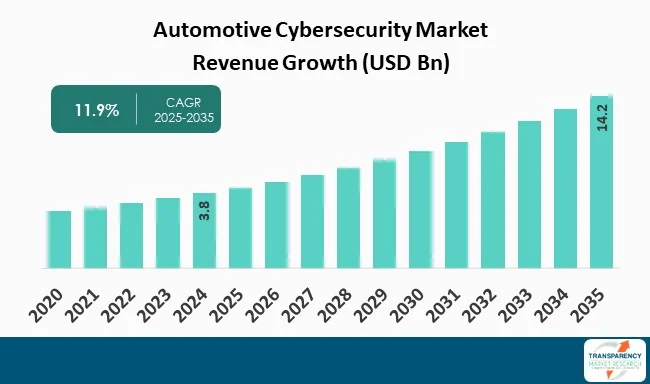

| Size in 2024 | US$ 3.8 Bn |

| Forecast Value in 2035 | US$ 14.2 Bn |

| CAGR | 11.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Automotive Cybersecurity Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The automotive cybersecurity market was valued at US$ 3.8 Bn in 2024

The automotive cybersecurity market is projected to reach US$ 14.2 Bn by 2035

Rise of software-defined and autonomous vehicles and growing incidence of cyberattacks

The CAGR is anticipated to be 11.9% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Aptiv, Bosch Mobility Solutions, Capgemini, Continental AG (Argus Cyber Security), Cybellum Ltd., ETAS, Infineon Technologies AG, Karamba Security, Lattice Semiconductor, Microchip Technology, NXP Semiconductors, SBD Automotive Ltd, Panasonic Holdings Corporation, RunSafe Security, STMicroelectronics, Samsung Electronics Co., Ltd, Synopsys, Tata ELXSI, Upstream Security Ltd, Vector Informatik GmbH, and Others

Table 01: Global Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 02: Global Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 03: Global Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 04: Global Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 05: Global Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 06: Global Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 07: Global Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 08: Global Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 09: Global Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 10: Global Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 11: North America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 12: North America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 13: North America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 14: North America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 15: North America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 16: North America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 17: North America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 18: North America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 19: North America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 20: North America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 21: U.S. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 22: U.S. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 23: U.S. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 24: U.S. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 25: U.S. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 26: U.S. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 27: U.S. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 28: U.S. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 29: U.S. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 30: Canada Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 31: Canada Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 32: Canada Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 33: Canada Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 34: Canada Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 35: Canada Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 36: Canada Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 37: Canada Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 38: Canada Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 39: Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 40: Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 41: Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 42: Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 43: Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 44: Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 45: Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 46: Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 47: Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 48: Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 49: Germany Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 50: Germany Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 51: Germany Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 52: Germany Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 53: Germany Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 54: Germany Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 55: Germany Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 56: Germany Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 57: Germany Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 58: U.K. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 59: U.K. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 60: U.K. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 61: U.K. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 62: U.K. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 63: U.K. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 64: U.K. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 65: U.K. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 66: U.K. Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 67: France Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 68: France Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 69: France Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 70: France Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 71: France Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 72: France Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 73: France Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 74: France Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 75: France Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 76: Italy Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 77: Italy Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 78: Italy Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 79: Italy Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 80: Italy Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 81: Italy Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 82: Italy Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 83: Italy Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 84: Italy Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 85: Spain Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 86: Spain Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 87: Spain Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 88: Spain Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 89: Spain Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 90: Spain Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 91: Spain Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 92: Spain Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 93: Spain Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 94: Switzerland Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 95: Switzerland Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 96: Switzerland Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 97: Switzerland Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 98: Switzerland Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 99: Switzerland Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 100: Switzerland Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 101: Switzerland Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 102: Switzerland Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 103: The Netherlands Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 104: The Netherlands Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 105: The Netherlands Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 106: The Netherlands Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 107: The Netherlands Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 108: The Netherlands Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 109: The Netherlands Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 110: The Netherlands Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 111: The Netherlands Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 112: Rest of Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 113: Rest of Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 114: Rest of Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 115: Rest of Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 116: Rest of Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 117: Rest of Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 118: Rest of Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 119: Rest of Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 120: Rest of Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 121: Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 122: Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 123: Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 124: Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 125: Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 126: Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 127: Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 128: Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 129: Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 130: Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 131: China Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 132: China Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 133: China Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 134: China Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 135: China Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 136: China Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 137: China Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 138: China Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 139: China Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 140: Japan Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 141: Japan Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 142: Japan Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 143: Japan Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 144: Japan Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 145: Japan Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 146: Japan Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 147: Japan Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 148: Japan Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 149: India Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 150: India Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 151: India Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 152: India Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 153: India Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 154: India Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 155: India Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 156: India Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 157: India Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 158: South Korea Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 159: South Korea Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 160: South Korea Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 161: South Korea Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 162: South Korea Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 163: South Korea Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 164: South Korea Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 165: South Korea Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 166: South Korea Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 167: Australia and New Zealand Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 168: Australia and New Zealand Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 169: Australia and New Zealand Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 170: Australia and New Zealand Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 171: Australia and New Zealand Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 172: Australia and New Zealand Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 173: Australia and New Zealand Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 174: Australia and New Zealand Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 175: Australia and New Zealand Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 176: Rest of Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 177: Rest of Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 178: Rest of Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 179: Rest of Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 180: Rest of Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 181: Rest of Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 182: Rest of Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 183: Rest of Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 184: Rest of Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 185: Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 186: Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 187: Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 188: Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 189: Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 190: Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 191: Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 192: Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 193: Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 194: Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 195: Brazil Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 196: Brazil Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 197: Brazil Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 198: Brazil Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 199: Brazil Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 200: Brazil Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 201: Brazil Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 202: Brazil Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 203: Brazil Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 204: Mexico Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 205: Mexico Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 206: Mexico Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 207: Mexico Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 208: Mexico Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 209: Mexico Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 210: Mexico Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 211: Mexico Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 212: Mexico Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 213: Argentina Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 214: Argentina Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 215: Argentina Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 216: Argentina Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 217: Argentina Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 218: Argentina Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 219: Argentina Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 220: Argentina Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 221: Argentina Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 222: Rest of Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 223: Rest of Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 224: Rest of Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 225: Rest of Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 226: Rest of Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 227: Rest of Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 228: Rest of Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 229: Rest of Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 230: Rest of Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 231: Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 232: Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 233: Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 234: Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 235: Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 236: Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 237: Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 238: Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 239: Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 240: Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 241: GCC Countries Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 242: GCC Countries Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 243: GCC Countries Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 244: GCC Countries Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 245: GCC Countries Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 246: GCC Countries Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 247: GCC Countries Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 248: GCC Countries Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 249: GCC Countries Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 250: South Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 251: South Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 252: South Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 253: South Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 254: South Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 255: South Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 256: South Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 257: South Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 258: South Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 259: Rest of Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 260: Rest of Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Deployment, 2020 to 2035

Table 261: Rest of Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Security Type, 2020 to 2035

Table 262: Rest of Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Vehicle Type, 2020 to 2035

Table 263: Rest of Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Passenger Vehicle, 2020 to 2035

Table 264: Rest of Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Propulsion, 2020 to 2035

Table 265: Rest of Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by IC Engine, 2020 to 2035

Table 266: Rest of Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Electric, 2020 to 2035

Table 267: Rest of Middle East and Africa Automotive Cybersecurity Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Figure 01: Global Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 03: Global Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 04: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Software, 2020 to 2035

Figure 05: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Hardware, 2020 to 2035

Figure 06: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Services, 2020 to 2035

Figure 07: Global Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 08: Global Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 09: Global Automotive Cybersecurity Market Revenue (US$ Mn), by In-Vehicle, 2020 to 2035

Figure 10: Global Automotive Cybersecurity Market Revenue (US$ Mn), by External Cloud Services, 2020 to 2035

Figure 11: Global Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 12: Global Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 13: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Application, 2020 to 2035

Figure 14: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Cloud Security, 2020 to 2035

Figure 15: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Endpoint, 2020 to 2035

Figure 16: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Wireless Network, 2020 to 2035

Figure 17: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 18: Global Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 19: Global Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 20: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Passenger Vehicle, 2020 to 2035

Figure 21: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Light Commercial Vehicle, 2020 to 2035

Figure 22: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Heavy Duty Trucks, 2020 to 2035

Figure 23: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Buses and Coaches, 2020 to 2035

Figure 24: Global Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 25: Global Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 26: Global Automotive Cybersecurity Market Revenue (US$ Mn), by IC Engine, 2020 to 2035

Figure 27: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Electric, 2020 to 2035

Figure 28: Global Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 29: Global Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 30: Global Automotive Cybersecurity Market Revenue (US$ Mn), by ADAS & Safety, 2020 to 2035

Figure 31: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Body Control & Comfort, 2020 to 2035

Figure 32: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Communication Systems, 2020 to 2035

Figure 33: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Electronic Control Units, 2020 to 2035

Figure 34: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Infotainment, 2020 to 2035

Figure 35: Global Automotive Cybersecurity Market Revenue (US$ Mn), by On-board Diagnostics, 2020 to 2035

Figure 36: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Powertrain Systems, 2020 to 2035

Figure 37: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Telematics, 2020 to 2035

Figure 38: Global Automotive Cybersecurity Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 39: Global Automotive Cybersecurity Market Value Share Analysis, by Region, 2024 and 2035

Figure 40: Global Automotive Cybersecurity Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 41: North America Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 42: North America Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 43: North America Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 44: North America Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 45: North America Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 46: North America Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 47: North America Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 48: North America Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 49: North America Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 50: North America Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 51: North America Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 52: North America Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 53: North America Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 54: North America Automotive Cybersecurity Market Value Share Analysis, by Country, 2024 and 2035

Figure 55: North America Automotive Cybersecurity Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 56: U.S. Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 57: U.S. Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 58: U.S. Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 59: U.S. Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 60: U.S. Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 61: U.S. Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 62: U.S. Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 63: U.S. Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 64: U.S. Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 65: U.S. Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 66: U.S. Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 67: U.S. Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 68: U.S. Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 69: Canada Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 70: Canada Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 71: Canada Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 72: Canada Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 73: Canada Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 74: Canada Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 75: Canada Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 76: Canada Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 77: Canada Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 78: Canada Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 79: Canada Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 80: Canada Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 81: Canada Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 82: Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 83: Europe Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 84: Europe Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 85: Europe Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 86: Europe Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 87: Europe Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 88: Europe Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 89: Europe Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 90: Europe Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 91: Europe Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 92: Europe Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 93: Europe Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 94: Europe Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 95: Europe Automotive Cybersecurity Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 96: Europe Automotive Cybersecurity Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 97: Germany Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 98: Germany Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 99: Germany Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 100: Germany Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 101: Germany Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 102: Germany Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 103: Germany Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 104: Germany Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 105: Germany Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 106: Germany Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 107: Germany Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 108: Germany Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 109: Germany Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 110: U.K. Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 111: U.K. Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 112: U.K. Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 113: U.K. Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 114: U.K. Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 115: U.K. Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 116: U.K. Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 117: U.K. Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 118: U.K. Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 119: U.K. Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 120: U.K. Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 121: U.K. Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 122: U.K. Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 123: France Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 124: France Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 125: France Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 126: France Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 127: France Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 128: France Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 129: France Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 130: France Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 131: France Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 132: France Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 133: France Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 134: France Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 135: France Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 136: Italy Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 137: Italy Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 138: Italy Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 139: Italy Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 140: Italy Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 141: Italy Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 142: Italy Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 143: Italy Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 144: Italy Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 145: Italy Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 146: Italy Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 147: Italy Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 148: Italy Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 149: Spain Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 150: Spain Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 151: Spain Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 152: Spain Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 153: Spain Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 154: Spain Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 155: Spain Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 156: Spain Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 157: Spain Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 158: Spain Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 159: Spain Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 160: Spain Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 161: Spain Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 162: Switzerland Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 163: Switzerland Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 164: Switzerland Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 165: Switzerland Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 166: Switzerland Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 167: Switzerland Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 168: Switzerland Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 169: Switzerland Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 170: Switzerland Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 171: Switzerland Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 172: Switzerland Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 173: Switzerland Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 174: Switzerland Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 175: The Netherlands Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 176: The Netherlands Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 177: The Netherlands Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 178: The Netherlands Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 179: The Netherlands Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 180: The Netherlands Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 181: The Netherlands Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 182: The Netherlands Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 183: The Netherlands Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 184: The Netherlands Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 185: The Netherlands Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 186: The Netherlands Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 187: The Netherlands Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 188: Rest of Europe Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 189: Rest of Europe Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 190: Rest of Europe Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 191: Rest of Europe Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 192: Rest of Europe Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 193: Rest of Europe Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 194: Rest of Europe Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 195: Rest of Europe Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 196: Rest of Europe Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 197: Rest of Europe Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 198: Rest of Europe Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 199: Rest of Europe Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 200: Rest of Europe Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 201: Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 202: Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 203: Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 204: Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 205: Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 206: Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 207: Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 208: Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 209: Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 210: Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 211: Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 212: Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 213: Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 214: Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 215: Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 216: China Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 217: China Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 218: China Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 219: China Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 220: China Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 221: China Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 222: China Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 223: China Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 224: China Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 225: China Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 226: China Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 227: China Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 228: China Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 229: Japan Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 230: Japan Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 231: Japan Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 232: Japan Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 233: Japan Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 234: Japan Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 235: Japan Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 236: Japan Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 237: Japan Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 238: Japan Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 239: Japan Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 240: Japan Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 241: Japan Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 242: India Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 243: India Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 244: India Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 245: India Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 246: India Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 247: India Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 248: India Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 249: India Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 250: India Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 251: India Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 252: India Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 253: India Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 254: India Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 255: South Korea Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 256: South Korea Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 257: South Korea Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 258: South Korea Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 259: South Korea Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 260: South Korea Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 261: South Korea Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 262: South Korea Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 263: South Korea Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 264: South Korea Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 265: South Korea Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 266: South Korea Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 267: South Korea Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 268: Australia and New Zealand Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 269: Australia and New Zealand Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 270: Australia and New Zealand Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 271: Australia and New Zealand Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 272: Australia and New Zealand Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 273: Australia and New Zealand Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 274: Australia and New Zealand Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 275: Australia and New Zealand Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 276: Australia and New Zealand Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 277: Australia and New Zealand Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 278: Australia and New Zealand Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 279: Australia and New Zealand Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 280: Australia and New Zealand Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 281: Rest of Asia Pacific Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 282: Rest of Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 283: Rest of Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 284: Rest of Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 285: Rest of Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 286: Rest of Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 287: Rest of Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 288: Rest of Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 289: Rest of Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 290: Rest of Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 291: Rest of Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 292: Rest of Asia Pacific Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 293: Rest of Asia Pacific Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 294: Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 295: Latin America Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 296: Latin America Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 297: Latin America Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 298: Latin America Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 299: Latin America Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 300: Latin America Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 301: Latin America Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 302: Latin America Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 303: Latin America Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 304: Latin America Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 305: Latin America Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 306: Latin America Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 307: Latin America Automotive Cybersecurity Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 308: Latin America Automotive Cybersecurity Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 309: Brazil Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 310: Brazil Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 311: Brazil Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 312: Brazil Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 313: Brazil Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 314: Brazil Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 315: Brazil Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 316: Brazil Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 317: Brazil Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 318: Brazil Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 319: Brazil Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 320: Brazil Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 321: Brazil Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 322: Mexico Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 323: Mexico Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 324: Mexico Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 325: Mexico Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 326: Mexico Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 327: Mexico Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 328: Mexico Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 329: Mexico Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 330: Mexico Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 331: Mexico Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 332: Mexico Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 333: Mexico Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 334: Mexico Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 335: Argentina Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 336: Argentina Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 337: Argentina Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 338: Argentina Automotive Cybersecurity Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 339: Argentina Automotive Cybersecurity Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 340: Argentina Automotive Cybersecurity Market Value Share Analysis, by Security Type, 2024 and 2035

Figure 341: Argentina Automotive Cybersecurity Market Attractiveness Analysis, by Security Type, 2025 to 2035

Figure 342: Argentina Automotive Cybersecurity Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 343: Argentina Automotive Cybersecurity Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 344: Argentina Automotive Cybersecurity Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 345: Argentina Automotive Cybersecurity Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 346: Argentina Automotive Cybersecurity Market Value Share Analysis, by Application, 2024 and 2035

Figure 347: Argentina Automotive Cybersecurity Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 348: Rest of Latin America Automotive Cybersecurity Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 349: Rest of Latin America Automotive Cybersecurity Market Value Share Analysis, by Component, 2024 and 2035

Figure 350: Rest of Latin America Automotive Cybersecurity Market Attractiveness Analysis, by Component, 2025 to 2035