Reports

Reports

Analysts’ Viewpoint on Market Scenario

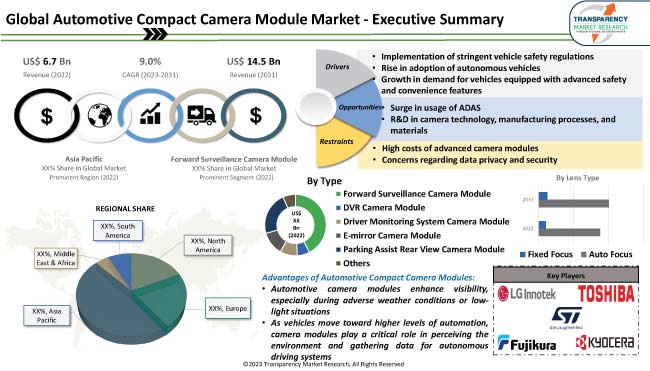

Implementation of stringent vehicle safety regulations and rise in adoption of autonomous vehicles are expected to propel the automotive compact camera module market size during the forecast period. Growth in demand for vehicles equipped with advanced safety and convenience features is also projected to augment market expansion in the near future.

Consumers are increasingly prioritizing safety and advanced features in their vehicles. Compact camera modules offer various features, such as 360-degree surround-view systems, parking assistance, and collision avoidance, enhancing the overall driving experience. R&D in camera sensor technology, image processing algorithms, and miniaturization is likely to offer lucrative opportunities to players in the global automotive compact camera module industry.

Automotive compact camera module refers to a small electronic device that incorporates a camera sensor, lens, and associated components, designed specifically for use in automotive applications. It is a crucial component of modern vehicles, particularly in Advanced Driver-assistance Systems (ADAS) and autonomous driving technologies. Forward surveillance camera modules, DVR camera modules, driver monitoring system camera modules, e-mirror camera modules, and parking assist rear view camera modules are major types of automotive compact camera modules.

The camera module provides visual input for ADAS features such as lane departure warning, forward collision warning, adaptive cruise control, and traffic sign recognition. These systems analyze the camera feed to detect and interpret road markings, objects, and signs, assisting the driver in making informed decisions and enhancing overall safety.

Rise in adoption of autonomous driving is projected to spur the automotive compact camera module market growth in the near future. Camera modules play a crucial role in providing the necessary visual data for vehicles to navigate and make informed decisions on the road. Technological improvements in modules are likely to attract automakers and consumers alike. The aftermarket for ADAS systems and camera modules is also expected to gain momentum during the forecast period.

Consumers are retrofitting their existing vehicles with camera-based safety systems, thereby boosting the demand for compact camera modules outside of new vehicle production. Growth in the electric vehicle market is also projected to influence the demand for compact camera modules in the next few years. Electric vehicle manufacturers are integrating camera-based ADAS features into their EV models to enhance vehicle safety. Camera-based driver assistance systems require proper calibration and occasional maintenance to ensure accurate performance.

Governments worldwide are implementing and strengthening regulations to enhance road safety and reduce accidents. These regulations often mandate the inclusion of specific safety features, including ADAS, which relies on compact camera modules.

Many governments are making it mandatory for vehicles to be equipped with certain safety features such as rear-view cameras, lane departure warning systems, automatic emergency braking, and other ADAS technologies. These safety systems typically require compact camera modules to function effectively. Thus, implementation of stringent vehicle safety regulations is fueling the automotive compact camera module market development.

Primary objective of these regulations is to improve road safety and reduce the number of accidents and fatalities. Compact camera modules play a crucial role in providing real-time visual information to ADAS, assisting drivers in avoiding collisions and potential hazards.

Implementation of stringent vehicle safety regulations is prompting automakers to adopt specific technologies, including compact camera modules, to comply with these standards and meet regulatory requirements. Demand for ADAS is expected to grow consistently as safety regulations continue to evolve and become more stringent. This, in turn, is anticipated to drive the automotive compact camera module market revenue in the next few years.

Autonomous vehicles heavily rely on various sensors, including compact camera modules, to perceive and interpret their surroundings. These cameras help the vehicle's onboard artificial intelligence system to detect and recognize objects, pedestrians, road signs, traffic lights, and other vehicles, enabling safe navigation and decision-making.

Redundancy is a critical aspect of autonomous vehicle design to ensure fail-safe operation. Integrating multiple compact camera modules around the vehicle provides redundancy in sensing capabilities, enhancing safety by reducing the risk of sensor failure. Compact camera modules are more cost-effective than other sensing technologies such as LiDAR. Hence, increase in adoption of autonomous vehicles is augmenting the automotive compact camera module market progress.

Compact camera modules can assist autonomous vehicles in adapting to different driving conditions including varying weather, lighting, and road conditions. This adaptability is crucial for ensuring the safety and reliability of autonomous driving systems.

According to the latest automotive compact camera module market trends, the forward surveillance camera module type segment is projected to hold largest share from 2023 to 2031. The segment held 42.4% share in 2022.

Forward surveillance cameras are an integral part of ADAS, providing crucial visual data for features such as lane departure warning, forward collision warning, automatic emergency braking, adaptive cruise control, and pedestrian detection. Increase in adoption of ADAS technologies in vehicles to enhance safety is driving the demand for forward surveillance camera modules.

Forward surveillance cameras enable vehicles to monitor the road ahead and detect potential hazards in real-time. By alerting drivers to potential collisions and assisting with emergency braking, these automotive micro-camera modules significantly contribute to road safety and accident prevention, making them a sought-after safety feature for modern vehicles.

According to the latest research report on automotive compact camera module market, the auto focus lens type segment is expected to dominate the industry during the forecast period. The segment accounted for 72.1% share in 2022.

Auto focus lenses allow the camera to adjust the focus automatically, resulting in sharper and clearer images. In automotive applications, this translates to better visibility and perception of the surroundings, improving the effectiveness of ADAS and other safety features. Automotive manufacturers are prioritizing delivering a positive user experience to drivers and passengers. Clear and focused images provided by auto-focus lenses contribute to user satisfaction and overall comfort during driving. Auto focus lenses can continuously adjust the focus based on the changing driving conditions, ensuring that the camera maintains clear and relevant images at all times.

According to the latest automotive compact camera module market forecast, Asia Pacific is anticipated to hold largest share from 2023 to 2031. Expansion in the automotive sector, especially in China, Japan, South Korea, and India, is fueling the market dynamics of the region.

Many countries in Asia Pacific are implementing stringent vehicle safety regulations, which is also propelling market statistics in the region. These regulations often mandate the inclusion of safety features, such as rear-view cameras and lane departure warning systems, driving the demand for compact camera modules. Rapid urbanization and increase in number of vehicles on the roads are also boosting the market trajectory in Asia Pacific.

The global industry is fragmented, with the presence of many automotive compact camera module companies. Vendors are expanding their supply chain networks and adopting various growth strategies, such as collaboration, partnership, and M&A, to increase their automotive compact camera module market share.

Ability Opto Electronics Technology Co., Ltd., AGC Automotive, ams OSRAM AG, Continental AG, Fujikura Ltd., KYOCERA Corporation, Leopard Imaging Inc., LG Innotek, Luxvisions Innovation Ltd., Mcnex Co., Ltd., Ofilm Group Co., Ltd., Primax Electronics Ltd., Samsung Electro-Mechanics, Sharp Devices Europe, STMicroelectronics, and Toshiba Corporation are key entities operating in this industry.

Each of these players has been profiled in the automotive compact camera module market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 6.7 Bn |

|

Market Forecast Value in 2031 |

US$ 14.5 Bn |

|

Growth Rate (CAGR) |

9.0% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 6.7 Bn in 2022

It is projected to grow at a CAGR of 9.0% from 2023 to 2031

It is anticipated to reach US$ 14.5 Bn by the end of 2031

Implementation of stringent vehicle safety regulations and rise in adoption of autonomous vehicles

The forward surveillance camera module type segment accounted for major share of 42.4% in 2022

Asia Pacific is projected to record the highest demand during the forecast period

Ability Opto Electronics Technology Co., Ltd., AGC Automotive, ams OSRAM AG, Continental AG, Fujikura Ltd., KYOCERA Corporation, Leopard Imaging Inc., LG Innotek, Luxvisions Innovation Ltd., Mcnex Co., Ltd., Ofilm Group Co., Ltd., Primax Electronics Ltd., Samsung Electro-Mechanics, Sharp Devices Europe, STMicroelectronics, and Toshiba Corporation

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value, Units, US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

2.9. Value Chain Analysis

2.10. Gross Margin Analysis

3. Global Automotive Compact Camera Module Market, By Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Type

3.2.1. Forward Surveillance Camera Module

3.2.2. DVR Camera Module

3.2.3. Driver Monitoring System Camera Module

3.2.4. E-mirror Camera Module

3.2.5. Parking Assist Rear View Camera Module

3.2.6. Others

4. Global Automotive Compact Camera Module Market, By Component

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Component

4.2.1. Image Sensors

4.2.2. Lens

4.2.3. Camera Module Assembly

4.2.4. VCM Suppliers

4.2.5. Others

5. Global Automotive Compact Camera Module Market, By Lens Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Lens Type

5.2.1. Auto Focus

5.2.2. Fixed Focus

6. Global Automotive Compact Camera Module Market, By Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

6.2.1. Passenger Cars

6.2.1.1. Hatchbacks

6.2.1.2. Sedans

6.2.1.3. SUVs

6.2.2. Light Commercial Vehicles

6.2.3. Heavy Duty Trucks

6.2.4. Buses and Coaches

6.2.5. Off-road Vehicles

6.2.5.1. Agriculture Tractors & Equipment

6.2.5.2. Construction & Mining Equipment

6.2.5.3. Industrial Vehicles (Forklifts, AGVs, etc.)

7. Global Automotive Compact Camera Module Market, By Application

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Application

7.2.1. Parking Management

7.2.2. Head-up Display

7.2.3. Blind Spot Detection

7.2.4. Lane Deviation Warning System

7.2.5. Driver Monitoring System

7.2.6. Others

8. Global Automotive Compact Camera Module Market, By Region

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Automotive Compact Camera Module Market

9.1. Market Snapshot

9.2. North America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Type

9.2.1. Forward Surveillance Camera Module

9.2.2. DVR Camera Module

9.2.3. Driver Monitoring System Camera Module

9.2.4. E-mirror Camera Module

9.2.5. Parking Assist Rear View Camera Module

9.2.6. Others

9.3. North America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Component

9.3.1. Image Sensors

9.3.2. Lens

9.3.3. Camera Module Assembly

9.3.4. VCM Suppliers

9.3.5. Others

9.4. North America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Lens Type

9.4.1. Auto Focus

9.4.2. Fixed Focus

9.5. North America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

9.5.1. Passenger Cars

9.5.1.1. Hatchbacks

9.5.1.2. Sedans

9.5.1.3. SUVs

9.5.2. Light Commercial Vehicles

9.5.3. Heavy Duty Trucks

9.5.4. Buses and Coaches

9.5.5. Off-road Vehicles

9.5.5.1. Agriculture Tractors & Equipment

9.5.5.2. Construction & Mining Equipment

9.5.5.3. Industrial Vehicles (Forklifts, AGVs, etc.)

9.6. North America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Application

9.6.1. Parking Management

9.6.2. Head-up Display

9.6.3. Blind Spot Detection

9.6.4. Lane Deviation Warning System

9.6.5. Driver Monitoring System

9.6.6. Others

9.7. Key Country Analysis - North America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031

9.7.1. U.S.

9.7.2. Canada

9.7.3. Mexico

10. Europe Automotive Compact Camera Module Market

10.1. Market Snapshot

10.2. Europe Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Type

10.2.1. Forward Surveillance Camera Module

10.2.2. DVR Camera Module

10.2.3. Driver Monitoring System Camera Module

10.2.4. E-mirror Camera Module

10.2.5. Parking Assist Rear View Camera Module

10.2.6. Others

10.3. Europe Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Component

10.3.1. Image Sensors

10.3.2. Lens

10.3.3. Camera Module Assembly

10.3.4. VCM Suppliers

10.3.5. Others

10.4. Europe Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Lens Type

10.4.1. Auto Focus

10.4.2. Fixed Focus

10.5. Europe Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

10.5.1. Passenger Cars

10.5.1.1. Hatchbacks

10.5.1.2. Sedans

10.5.1.3. SUVs

10.5.2. Light Commercial Vehicles

10.5.3. Heavy Duty Trucks

10.5.4. Buses and Coaches

10.5.5. Off-road Vehicles

10.5.5.1. Agriculture Tractors & Equipment

10.5.5.2. Construction & Mining Equipment

10.5.5.3. Industrial Vehicles (Forklifts, AGVs, etc.)

10.6. Europe Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Application

10.6.1. Parking Management

10.6.2. Head-up Display

10.6.3. Blind Spot Detection

10.6.4. Lane Deviation Warning System

10.6.5. Driver Monitoring System

10.6.6. Others

10.7. Key Country Analysis - Europe Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031

10.7.1. Germany

10.7.2. U.K.

10.7.3. France

10.7.4. Italy

10.7.5. Spain

10.7.6. Nordic Countries

10.7.7. Russia & CIS

10.7.8. Rest of Europe

11. Asia Pacific Automotive Compact Camera Module Market

11.1. Market Snapshot

11.2. Asia Pacific Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Type

11.2.1. Forward Surveillance Camera Module

11.2.2. DVR Camera Module

11.2.3. Driver Monitoring System Camera Module

11.2.4. E-mirror Camera Module

11.2.5. Parking Assist Rear View Camera Module

11.2.6. Others

11.3. Asia Pacific Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Component

11.3.1. Image Sensors

11.3.2. Lens

11.3.3. Camera Module Assembly

11.3.4. VCM Suppliers

11.3.5. Others

11.4. Asia Pacific Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Lens Type

11.4.1. Auto Focus

11.4.2. Fixed Focus

11.5. Asia Pacific Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

11.5.1. Passenger Cars

11.5.1.1. Hatchbacks

11.5.1.2. Sedans

11.5.1.3. SUVs

11.5.2. Light Commercial Vehicles

11.5.3. Heavy Duty Trucks

11.5.4. Buses and Coaches

11.5.5. Off-road Vehicles

11.5.5.1. Agriculture Tractors & Equipment

11.5.5.2. Construction & Mining Equipment

11.5.5.3. Industrial Vehicles (Forklifts, AGVs, etc.)

11.6. Asia Pacific Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Application

11.6.1. Parking Management

11.6.2. Head-up Display

11.6.3. Blind Spot Detection

11.6.4. Lane Deviation Warning System

11.6.5. Driver Monitoring System

11.6.6. Others

11.7. Key Country Analysis - Asia Pacific Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031

11.7.1. China

11.7.2. India

11.7.3. Japan

11.7.4. ASEAN Countries

11.7.5. South Korea

11.7.6. ANZ

11.7.7. Rest of Asia Pacific

12. Middle East & Africa Automotive Compact Camera Module Market

12.1. Market Snapshot

12.2. Middle East & Africa Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Type

12.2.1. Forward Surveillance Camera Module

12.2.2. DVR Camera Module

12.2.3. Driver Monitoring System Camera Module

12.2.4. E-mirror Camera Module

12.2.5. Parking Assist Rear View Camera Module

12.2.6. Others

12.3. Middle East & Africa Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Component

12.3.1. Image Sensors

12.3.2. Lens

12.3.3. Camera Module Assembly

12.3.4. VCM Suppliers

12.3.5. Others

12.4. Middle East & Africa Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Lens Type

12.4.1. Auto Focus

12.4.2. Fixed Focus

12.5. Middle East & Africa Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

12.5.1. Passenger Cars

12.5.1.1. Hatchbacks

12.5.1.2. Sedans

12.5.1.3. SUVs

12.5.2. Light Commercial Vehicles

12.5.3. Heavy Duty Trucks

12.5.4. Buses and Coaches

12.5.5. Off-road Vehicles

12.5.5.1. Agriculture Tractors & Equipment

12.5.5.2. Construction & Mining Equipment

12.5.5.3. Industrial Vehicles (Forklifts, AGVs, etc.)

12.6. Middle East & Africa Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Application

12.6.1. Parking Management

12.6.2. Head-up Display

12.6.3. Blind Spot Detection

12.6.4. Lane Deviation Warning System

12.6.5. Driver Monitoring System

12.6.6. Others

12.7. Key Country Analysis - Middle East & Africa Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031

12.7.1. GCC

12.7.2. South Africa

12.7.3. Turkey

12.7.4. Rest of Middle East & Africa

13. South America Automotive Compact Camera Module Market

13.1. Market Snapshot

13.2. South America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Type

13.2.1. Forward Surveillance Camera Module

13.2.2. DVR Camera Module

13.2.3. Driver Monitoring System Camera Module

13.2.4. E-mirror Camera Module

13.2.5. Parking Assist Rear View Camera Module

13.2.6. Others

13.3. South America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Component

13.3.1. Image Sensors

13.3.2. Lens

13.3.3. Camera Module Assembly

13.3.4. VCM Suppliers

13.3.5. Others

13.4. South America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Lens Type

13.4.1. Auto Focus

13.4.2. Fixed Focus

13.5. South America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Vehicle Type

13.5.1. Passenger Cars

13.5.1.1. Hatchbacks

13.5.1.2. Sedans

13.5.1.3. SUVs

13.5.2. Light Commercial Vehicles

13.5.3. Heavy Duty Trucks

13.5.4. Buses and Coaches

13.5.5. Off-road Vehicles

13.5.5.1. Agriculture Tractors & Equipment

13.5.5.2. Construction & Mining Equipment

13.5.5.3. Industrial Vehicles (Forklifts, AGVs, etc.)

13.6. South America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031, By Application

13.6.1. Parking Management

13.6.2. Head-up Display

13.6.3. Blind Spot Detection

13.6.4. Lane Deviation Warning System

13.6.5. Driver Monitoring System

13.6.6. Others

13.7. Key Country Analysis - South America Automotive Compact Camera Module Market Size Analysis & Forecast, 2017-2031

13.7.1. Brazil

13.7.2. Argentina

13.7.3. Rest of South America

14. Competitive Landscape

14.1. Company Share Analysis/ Brand Share Analysis, 2022

14.2. Pricing Comparison Among Key Players

14.3. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

15. Company Profile/ Key Players

15.1. Ability Opto Electronics Technology Co., Ltd.

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Production Locations

15.1.4. Product Portfolio

15.1.5. Competitors & Customers

15.1.6. Subsidiaries & Parent Organization

15.1.7. Recent Developments

15.1.8. Financial Analysis

15.1.9. Profitability

15.1.10. Revenue Share

15.2. AGC Automotive

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Production Locations

15.2.4. Product Portfolio

15.2.5. Competitors & Customers

15.2.6. Subsidiaries & Parent Organization

15.2.7. Recent Developments

15.2.8. Financial Analysis

15.2.9. Profitability

15.2.10. Revenue Share

15.3. Continental AG

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Production Locations

15.3.4. Product Portfolio

15.3.5. Competitors & Customers

15.3.6. Subsidiaries & Parent Organization

15.3.7. Recent Developments

15.3.8. Financial Analysis

15.3.9. Profitability

15.3.10. Revenue Share

15.4. Toshiba Corporation

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Production Locations

15.4.4. Product Portfolio

15.4.5. Competitors & Customers

15.4.6. Subsidiaries & Parent Organization

15.4.7. Recent Developments

15.4.8. Financial Analysis

15.4.9. Profitability

15.4.10. Revenue Share

15.5. KYOCERA Corporation

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Production Locations

15.5.4. Product Portfolio

15.5.5. Competitors & Customers

15.5.6. Subsidiaries & Parent Organization

15.5.7. Recent Developments

15.5.8. Financial Analysis

15.5.9. Profitability

15.5.10. Revenue Share

15.6. Samsung Electro-Mechanics

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Production Locations

15.6.4. Product Portfolio

15.6.5. Competitors & Customers

15.6.6. Subsidiaries & Parent Organization

15.6.7. Recent Developments

15.6.8. Financial Analysis

15.6.9. Profitability

15.6.10. Revenue Share

15.7. LG Innotek

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Production Locations

15.7.4. Product Portfolio

15.7.5. Competitors & Customers

15.7.6. Subsidiaries & Parent Organization

15.7.7. Recent Developments

15.7.8. Financial Analysis

15.7.9. Profitability

15.7.10. Revenue Share

15.8. Sharp Devices Europe

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Production Locations

15.8.4. Product Portfolio

15.8.5. Competitors & Customers

15.8.6. Subsidiaries & Parent Organization

15.8.7. Recent Developments

15.8.8. Financial Analysis

15.8.9. Profitability

15.8.10. Revenue Share

15.9. Primax Electronics Ltd.

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Production Locations

15.9.4. Product Portfolio

15.9.5. Competitors & Customers

15.9.6. Subsidiaries & Parent Organization

15.9.7. Recent Developments

15.9.8. Financial Analysis

15.9.9. Profitability

15.9.10. Revenue Share

15.10. STMicroelectronics

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Production Locations

15.10.4. Product Portfolio

15.10.5. Competitors & Customers

15.10.6. Subsidiaries & Parent Organization

15.10.7. Recent Developments

15.10.8. Financial Analysis

15.10.9. Profitability

15.10.10. Revenue Share

15.11. ams OSRAM AG

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Production Locations

15.11.4. Product Portfolio

15.11.5. Competitors & Customers

15.11.6. Subsidiaries & Parent Organization

15.11.7. Recent Developments

15.11.8. Financial Analysis

15.11.9. Profitability

15.11.10. Revenue Share

15.12. Ofilm Group Co. Ltd.

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Production Locations

15.12.4. Product Portfolio

15.12.5. Competitors & Customers

15.12.6. Subsidiaries & Parent Organization

15.12.7. Recent Developments

15.12.8. Financial Analysis

15.12.9. Profitability

15.12.10. Revenue Share

15.13. Fujikura Ltd.

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Production Locations

15.13.4. Product Portfolio

15.13.5. Competitors & Customers

15.13.6. Subsidiaries & Parent Organization

15.13.7. Recent Developments

15.13.8. Financial Analysis

15.13.9. Profitability

15.13.10. Revenue Share

15.14. Leopard Imaging Inc.

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Production Locations

15.14.4. Product Portfolio

15.14.5. Competitors & Customers

15.14.6. Subsidiaries & Parent Organization

15.14.7. Recent Developments

15.14.8. Financial Analysis

15.14.9. Profitability

15.14.10. Revenue Share

15.15. Luxvisions Innovation Ltd.

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Production Locations

15.15.4. Product Portfolio

15.15.5. Competitors & Customers

15.15.6. Subsidiaries & Parent Organization

15.15.7. Recent Developments

15.15.8. Financial Analysis

15.15.9. Profitability

15.15.10. Revenue Share

15.16. Mcnex Co., Ltd.

15.16.1. Company Overview

15.16.2. Company Footprints

15.16.3. Production Locations

15.16.4. Product Portfolio

15.16.5. Competitors & Customers

15.16.6. Subsidiaries & Parent Organization

15.16.7. Recent Developments

15.16.8. Financial Analysis

15.16.9. Profitability

15.16.10. Revenue Share

15.17. Other Key Players

15.17.1. Company Overview

15.17.2. Company Footprints

15.17.3. Production Locations

15.17.4. Product Portfolio

15.17.5. Competitors & Customers

15.17.6. Subsidiaries & Parent Organization

15.17.7. Recent Developments

15.17.8. Financial Analysis

15.17.9. Profitability

15.17.10. Revenue Share

List of Tables

Table 1: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Table 2: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 3: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Table 4: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 5: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Table 6: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Table 7: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 8: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 9: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Table 10: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 11: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Region, 2017‒2031

Table 12: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 13: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Table 14: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 15: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Table 16: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 17: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Table 18: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Table 19: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 20: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 21: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Table 22: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 23: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Country, 2017‒2031

Table 24: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Table 26: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 27: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Table 28: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 29: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Table 30: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Table 31: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 32: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 33: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Table 34: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 35: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Country, 2017‒2031

Table 36: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 37: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Table 38: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 39: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Table 40: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 41: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Table 42: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Table 43: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 44: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 45: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Table 46: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 47: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Country, 2017‒2031

Table 48: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 49: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Table 50: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 51: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Table 52: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 53: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Table 54: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Table 55: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 56: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 57: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Table 58: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 59: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Country, 2017‒2031

Table 60: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 61: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Table 62: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Table 63: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Table 64: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 65: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Table 66: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Table 67: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 68: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 69: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Table 70: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 71: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Country, 2017‒2031

Table 72: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Figure 2: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Figure 3: Global Automotive Compact Camera Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 4: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 5: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 6: Global Automotive Compact Camera Module Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 7: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Figure 8: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Figure 9: Global Automotive Compact Camera Module Market, Incremental Opportunity, by Lens Type, Value (US$ Bn), 2022‒2031

Figure 10: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 11: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 12: Global Automotive Compact Camera Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 13: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 14: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 15: Global Automotive Compact Camera Module Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 16: Global Automotive Compact Camera Module Market Volume (Units) Forecast, by Region, 2017‒2031

Figure 17: Global Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Figure 18: Global Automotive Compact Camera Module Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022‒2031

Figure 19: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Figure 20: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Figure 21: North America Automotive Compact Camera Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 22: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 23: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 24: North America Automotive Compact Camera Module Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 25: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Figure 26: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Figure 27: North America Automotive Compact Camera Module Market, Incremental Opportunity, by Lens Type, Value (US$ Bn), 2022‒2031

Figure 28: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 29: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 30: North America Automotive Compact Camera Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 31: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 32: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 33: North America Automotive Compact Camera Module Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 34: North America Automotive Compact Camera Module Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 35: North America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 36: North America Automotive Compact Camera Module Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 37: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Figure 38: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Figure 39: Europe Automotive Compact Camera Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 40: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 41: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 42: Europe Automotive Compact Camera Module Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 43: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Figure 44: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Figure 45: Europe Automotive Compact Camera Module Market, Incremental Opportunity, by Lens Type, Value (US$ Bn), 2022‒2031

Figure 46: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 47: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 48: Europe Automotive Compact Camera Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 49: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 50: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 51: Europe Automotive Compact Camera Module Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 52: Europe Automotive Compact Camera Module Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 53: Europe Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 54: Europe Automotive Compact Camera Module Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 55: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Figure 56: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Figure 57: Asia Pacific Automotive Compact Camera Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 58: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 59: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 60: Asia Pacific Automotive Compact Camera Module Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 61: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Figure 62: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Figure 63: Asia Pacific Automotive Compact Camera Module Market, Incremental Opportunity, by Lens Type, Value (US$ Bn), 2022‒2031

Figure 64: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 65: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 66: Asia Pacific Automotive Compact Camera Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 67: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 68: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 69: Asia Pacific Automotive Compact Camera Module Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 70: Asia Pacific Automotive Compact Camera Module Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 71: Asia Pacific Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 72: Asia Pacific Automotive Compact Camera Module Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 73: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Figure 74: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Figure 75: Middle East & Africa Automotive Compact Camera Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 76: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 77: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 78: Middle East & Africa Automotive Compact Camera Module Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 79: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Figure 80: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Figure 81: Middle East & Africa Automotive Compact Camera Module Market, Incremental Opportunity, by Lens Type, Value (US$ Bn), 2022‒2031

Figure 82: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 83: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 84: Middle East & Africa Automotive Compact Camera Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 85: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 86: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 87: Middle East & Africa Automotive Compact Camera Module Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 88: Middle East & Africa Automotive Compact Camera Module Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 89: Middle East & Africa Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 90: Middle East & Africa Automotive Compact Camera Module Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 91: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Type, 2017‒2031

Figure 92: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Type, 2017‒2031

Figure 93: South America Automotive Compact Camera Module Market, Incremental Opportunity, by Type, Value (US$ Bn), 2022‒2031

Figure 94: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Component, 2017‒2031

Figure 95: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 96: South America Automotive Compact Camera Module Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 97: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Lens Type, 2017‒2031

Figure 98: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Lens Type, 2017‒2031

Figure 99: South America Automotive Compact Camera Module Market, Incremental Opportunity, by Lens Type, Value (US$ Bn), 2022‒2031

Figure 100: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 101: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Figure 102: South America Automotive Compact Camera Module Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022‒2031

Figure 103: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 104: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Figure 105: South America Automotive Compact Camera Module Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022‒2031

Figure 106: South America Automotive Compact Camera Module Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 107: South America Automotive Compact Camera Module Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 108: South America Automotive Compact Camera Module Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031