Reports

Reports

The automotive chassis system market’s growth is driven by higher adoption of electric vehicles as a cleaner and greener alternative. Increased government funding for driving the usage of electric vehicles is expected to propel market expansion. Embracing sustainability via development of hybrid and electric vehicle chassis lets players to cater to the rising demand for eco-friendly mobility solutions.

Need to improve fuel efficiency, integrate smart features, and improve passenger safety & comfort does necessitate lucrative opportunities to market players. The manufacturers prioritize research & development activities for staying at the forefront of technological advancements.

Players in the industry are emphasizing diversifying their product mix for delivering innovative products and services to meet customer need. Using lightweight material to boost the performance and advance technologies such as adaptive suspension system, modular architectures and digital wins to improve driving dynamic and reduce development time in cost-effective way.

The rapid expansion of automotive industry and industrialization 4.0 leads the market players to invest in advanced automotive chassis system and adapt the technological advancements to upgrade the product mix. Hence, the automotive chassis systems market is facing a growing demand for lighter and stronger chassis systems.

An automotive chassis system is a component used in modern vehicles, particularly in advanced internal combustion engines and electric vehicles (EVs).

Automotive chassis serves as the base supporting the body, engine, suspension, transmission, and the other essential systems of a vehicle. The chassis provides the essential strength, durability, and stability required for carrying passengers and withstand the rigors of road travel.

Automotive chassis is typically designed for accommodating different types of vehicle bodies such as light commercial vehicles, passenger vehicles, heavy commercial vehicles, and off-road vehicles. The chassis itself does not include the vehicle body. It, instead, forms the underlying structure that holds the vehicle body in place. The automotive chassis systems market is facing a growing demand for lighter and stronger chassis systems.

Manufacturers of automotive chassis systems are investing significantly in research and development activities pertaining to innovation of the latest composite components. This would help in the manufacture of automotive chassis systems that are lighter and stronger. Latest innovative features such as automotive chassis sensors for the detection of any kind of malfunctioning of components used in the automotive chassis system market are driving the market.

| Attribute | Detail |

|---|---|

| Automotive Chassis System Market Drivers |

|

The rising demand for electric vehicles (EVs) is revolutionizing the automotive sector with raised environmental consciousness, stringent fuel emissions regulations, and technological advancements in batteries. With this growth comes equally crucial growth in smart and responsive chassis technologies that are a key to enhancing the performance and safety of EVs. Such technologies employ sensors, AI, and real-time data for continuously monitoring and regulating the suspension, steering, and braking systems of a vehicle.

This adaptability improves ride comfort, stability, and handling, thereby making EVs not only more efficient but also safer and more sensitive to the evolving road conditions. The marriage of intelligent chassis systems with electric powertrains is one of the major advancements in vehicle design, and it ascertains that the full potential of EVs is reached. Example- China, the world largest EVs maker, has launched new EV chassis with 120-kph frontal impact without catching fire or exploding.

Smart chassis systems—integrating sensors, AI, and real-time data—help EVs to dynamically adapt to road conditions, optimize handling, and ascertain greater driving stability. This synergy between electric powertrains and responsive chassis platforms does mark a critical step forward in the evolution of mobility.

The growing demand for lightweight and cost-efficient materials is playing a pivotal role in driving the expansion of the electric vehicle (EV) and smart mobility market. As manufacturers strive for improving vehicle efficiency, range, and performance, reducing the vehicles’ overall weight has become a key focus. Lightweight materials such as aluminum alloys, carbon fiber composites, high-strength steel, and advanced polymers are increasingly being used in vehicle chassis, body panels, and structural components.

The addition of fiberglass and high-strength polymers, along with aluminum alloys and high strength steel, make the vehicle body, panels, and even chassis a structural component that is much more energy-efficient and gears the vehicle toward smarter technology. Though a smart device may increase the vehicle’s total weight with the advanced polymers mentioned, no unnecessary weight will be added.

At the same time, cost-effectiveness remains highly important due to the need to ensure wider access and the lower price of the vehicle. New materials allow vehicle manufacturers to comply with the fuel economy and emissions control regulations and preferred emissions targets while keeping the cost of manufacturing the vehicle. The advanced and developing world alike will have access to electric and smart vehicles due to the combination of performance, efficiency, and cost.

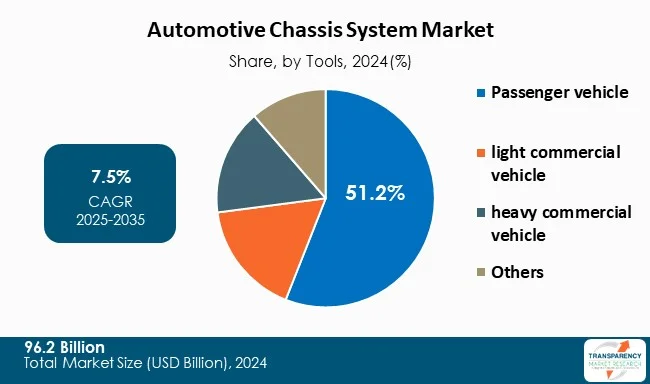

Due to rising demand for individual mobility, increasing vehicle production and latest developments in chassis technologies generally focused on comfort, safety, and performance, the passenger car category dominates the global automotive chassis system market. Passenger cars (sedan, hatchback, SUV, crossover) have the highest share of global vehicle sales. This high sales volume sets up a high level of demand for chassis systems, which is the structural foundation of vehicles.

As consumer expectations heighten for improved ride quality, handling, and safety, vehicle production companies are investing heavily in sophisticated elements of a chassis, such as lightweight materials, multi-link suspension systems, and integrated electronic controls (i.e., electronic stability control, adaptive suspension). Since these technologies are being implemented in passenger cars the most, it is applicable for both urban and highway driving, where comfort and handling become differentiators.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia-Pacific leads the global automotive chassis system market, this region has witnessed rising income level and higher demand for passenger vehicle. Rising incomes, expanding middle-class population had led urbanization in India and Southeast Asia, which fuels demand for new vehicles and EVs. The increased demand for vehicle drives the growth of automation chassis system market. As such, the rising domestic demand of vehicles in China & India has boosted the automotive chassis system industry in Asia Pacific region.

Also, the lower labor cost and vast skilled engineering workforce make Asia-Pacific an attractive hub for automotive chassis system market. Most of the prominent players have established manufacturing plants, R&D centers, and supplier bases in Asia-Pacific to adapt the faster innovation and supply chain efficiencies.

Key players operating in the automotive chassis system market industry are investing through innovation, strategic partnerships, and technological advancements. They emphasize improving imaging clarity and expanding product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

Continental AG, Robert Bosch GmbH, American Axle & Manufacturing Inc., Magna International Inc., Benteler International AG, ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., Dana Limited, Hyundai Mobis, Detroit Diesel Corporation, Gestamp Automocin S.A. are the key players in automotive chassis system market.

Each of these players has been profiled in the automotive chassis system market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

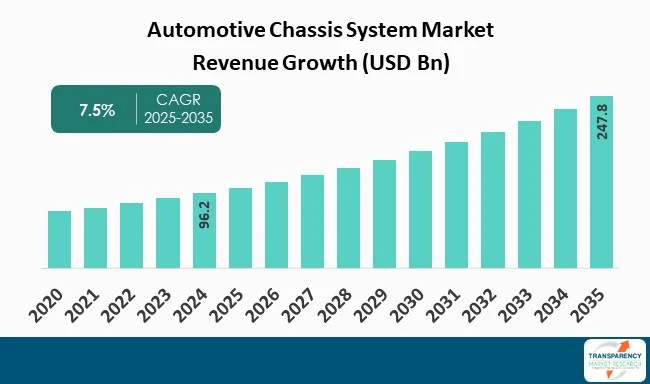

| Size in 2024 | US$ 96.2 Bn |

| Forecast Value in 2035 | US$ 247.8 Bn |

| CAGR | 7.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Automotive Chassis System Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Chassis Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global automotive chassis system market was valued at US$ 96.2 Bn in 2024

The global Automotive Chassis System industry is projected to reach US$ 247.8 Bn by 2035

Rapid expansion of EVs with Smart & Adaptive Chassis Technologies and Demand for cost-efficient and light-weight material are some of the factors driving the expansion of the automotive chassis system market.

The CAGR is anticipated to be 7.5% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

Continental AG, Robert Bosch GmbH, American Axle & Manufacturing Inc., Magna International Inc., Benteler International AG, ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., Dana Limited, Hyundai Mobis, Detroit Diesel Corporation, and Gestamp Automocin S.A. among others

Table 01: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 02: Global Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 03: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 04: Global Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 05: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 06: Global Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 07: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 08: Global Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 09: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 10: Global Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 11: Global Automotive Chassis System Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 12: Global Automotive Chassis System Market Volume (Units) Forecast, by Region, 2020 to 2035

Table 13: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 14: North America Automotive Chassis System Market Volume (Units) Forecast, by Country, 2020 to 2035

Table 15: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 16: North America Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 17: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 18: North America Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 19: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 20: North America Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 21: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 22: North America Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 23: North America Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 24: North America Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 25: U.S. Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 26: U.S. Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 27: U.S. Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 28: U.S. Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 29: U.S. Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 30: U.S. Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 31: U.S. Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 32: U.S. Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 33: U.S. Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 34: U.S. Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 35: Canada Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 36: Canada Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 37: Canada Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 38: Canada Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 39: Canada Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 40: Canada Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 41: Canada Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 42: Canada Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 43: Canada Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 44: Canada Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 45: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 46: Europe Automotive Chassis System Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 47: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 48: Europe Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 49: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 50: Europe Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 51: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 52: Europe Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 53: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 54: Europe Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 55: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 56: Europe Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 57: Germany Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 58: Germany Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 59: Germany Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 60: Germany Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 61: Germany Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 62: Germany Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 63: Germany Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 64: Germany Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 65: Germany Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 66: Germany Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 67: U.K Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 68: U.K Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 69: U.K Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 70: U.K Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 71: U.K Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 72: U.K Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 73: U.K Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 74: U.K Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 75: U.K Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 76: U.K Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 77: France Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 78: France Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 79: France Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 80: France Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 81: France Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 82: France Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 83: France Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 84: France Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 85: France Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 86: France Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 87: Italy Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 88: Italy Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 89: Italy Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 90: Italy Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 91: Italy Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 92: Italy Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 93: Italy Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 94: Italy Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 95: Italy Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 96: Italy Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 97: Spain Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 98: Spain Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 99: Spain Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 100: Spain Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 101: Spain Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 102: Spain Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 103: Spain Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 104: Spain Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 105: Spain Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 106: Spain Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 107: Switzerland Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 108: Switzerland Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 109: Switzerland Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 110: Switzerland Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 111: Switzerland Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 112: Switzerland Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 113: Switzerland Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 114: Switzerland Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 115: Switzerland Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 116: Switzerland Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 117: The Netherlands Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 118: The Netherlands Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 119: The Netherlands Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 120: The Netherlands Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 121: The Netherlands Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 122: The Netherlands Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 123: The Netherlands Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 124: The Netherlands Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 125: The Netherlands Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 126: The Netherlands Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 127: Rest of Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 128: Rest of Europe Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 129: Rest of Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 130: Rest of Europe Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 131: Rest of Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 132: Rest of Europe Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 133: Rest of Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 134: Rest of Europe Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 135: Rest of Europe Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 136: Rest of Europe Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 137: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 138: Asia Pacific Automotive Chassis System Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 139: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 140: Asia Pacific Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 141: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 142: Asia Pacific Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 143: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 144: Asia Pacific Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 145: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 146: Asia Pacific Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 147: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 148: Asia Pacific Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 149: China Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 150: China Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 151: China Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 152: China Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 153: China Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 154: China Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 155: China Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 156: China Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 157: China Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 158: China Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 159: India Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 160: India Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 161: India Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 162: India Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 163: India Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 164: India Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 165: India Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 166: India Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 167: India Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 168: India Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 169: Japan Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 170: Japan Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 171: Japan Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 172: Japan Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 173: Japan Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 174: Japan Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 175: Japan Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 176: Japan Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 177: Japan Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 178: Japan Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 179: South Korea Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 180: South Korea Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 181: South Korea Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 182: South Korea Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 183: South Korea Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 184: South Korea Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 185: South Korea Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 186: South Korea Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 187: South Korea Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 188: South Korea Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 189: Australia and New Zealand Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 190: Australia and New Zealand Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 191: Australia and New Zealand Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 192: Australia and New Zealand Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 193: Australia and New Zealand Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 194: Australia and New Zealand Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 195: Australia and New Zealand Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 196: Australia and New Zealand Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 197: Australia and New Zealand Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 198: Australia and New Zealand Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 199: Rest of Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 200: Rest of Asia Pacific Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 201: Rest of Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 202: Rest of Asia Pacific Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 203: Rest of Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 204: Rest of Asia Pacific Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 205: Rest of Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 206: Rest of Asia Pacific Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 207: Rest of Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 208: Rest of Asia Pacific Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 209: Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 210: Latin America Automotive Chassis System Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 211: Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 212: Latin America Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 213: Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 214: Latin America Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 215: Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 216: Latin America Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 217: Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 218: Latin America Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 219: Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 220: Latin America Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 221: Brazil Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 222: Brazil Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 223: Brazil Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 224: Brazil Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 225: Brazil Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 226: Brazil Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 227: Brazil Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 228: Brazil Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 229: Brazil Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 230: Brazil Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 231: Mexico Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 232: Mexico Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 233: Mexico Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 234: Mexico Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 235: Mexico Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 236: Mexico Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 237: Mexico Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 238: Mexico Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 239: Mexico Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 240: Mexico Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 241: Argentina Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 242: Argentina Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 243: Argentina Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 244: Argentina Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 245: Argentina Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 246: Argentina Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 247: Argentina Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 248: Argentina Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 249: Argentina Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 250: Argentina Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 251: Rest of Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 252: Rest of Latin America Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 253: Rest of Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 254: Rest of Latin America Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 255: Rest of Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 256: Rest of Latin America Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 257: Rest of Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 258: Rest of Latin America Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 259: Rest of Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 260: Rest of Latin America Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 261: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 262: Middle East and Africa Automotive Chassis System Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 263: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 264: Middle East and Africa Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 265: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 266: Middle East and Africa Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 267: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 268: Middle East and Africa Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 269: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 270: Middle East and Africa Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 271: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 272: Middle East and Africa Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 273: GCC Countries Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 274: GCC Countries Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 275: GCC Countries Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 276: GCC Countries Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 277: GCC Countries Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 278: GCC Countries Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 279: GCC Countries Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 280: GCC Countries Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 281: GCC Countries Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 282: GCC Countries Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 283: South Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 284: South Africa Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 285: South Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 286: South Africa Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 287: South Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 288: South Africa Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 289: South Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 290: South Africa Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 291: South Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 292: South Africa Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Table 293: Rest of Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Chassis Type, 2020 to 2035

Table 294: Rest of Middle East and Africa Automotive Chassis System Market Volume (Units) Forecast, by Chassis Type, 2020 to 2035

Table 295: Rest of Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Component Type, 2020 to 2035

Table 296: Rest of Middle East and Africa Automotive Chassis System Market Volume (Units) Forecast, by Component Type, 2020 to 2035

Table 297: Rest of Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 298: Rest of Middle East and Africa Automotive Chassis System Market Volume (Units) Forecast, by Vehicle Type, 2020 to 2035

Table 299: Rest of Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 300: Rest of Middle East and Africa Automotive Chassis System Market Volume (Units) Forecast, by Material Type, 2020 to 2035

Table 301: Rest of Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, by Sales Channel, 2020 to 2035

Table 302: Rest of Middle East and Africa Automotive Chassis System Market Volume (Units) Forecast, by Sales Channel, 2020 to 2035

Figure 01: Global Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 02: Global Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 03: Global Automotive Chassis System Market Revenue (US$ Bn), by Backbone Chassis, 2025 to 2035

Figure 04: Global Automotive Chassis System Market Revenue (US$ Bn), by Ladder Chassis, 2025 to 2035

Figure 05: Global Automotive Chassis System Market Revenue (US$ Bn), by Tubular Space Chassis, 2025 to 2035

Figure 06: Global Automotive Chassis System Market Revenue (US$ Bn), by Monocoque Chassis, 2025 to 2035

Figure 07: Global Automotive Chassis System Market Revenue (US$ Bn), by Modular Chassis, 2025 to 2035

Figure 08: Global Automotive Chassis System Market Revenue (US$ Bn), by Others, 2025 to 2035

Figure 09: Global Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 10: Global Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 11: Global Automotive Chassis System Market Revenue (US$ Bn), by Suspension ball joints, 2025 to 2035

Figure 12: Global Automotive Chassis System Market Revenue (US$ Bn), by Cross-axis joints, 2025 to 2035

Figure 13: Global Automotive Chassis System Market Revenue (US$ Bn), by Tie-rods, 2025 to 2035

Figure 14: Global Automotive Chassis System Market Revenue (US$ Bn), by Stabilizer links, 2025 to 2035

Figure 15: Global Automotive Chassis System Market Revenue (US$ Bn), by Control arms, 2025 to 2035

Figure 16: Global Automotive Chassis System Market Revenue (US$ Bn), by Hubs, 2025 to 2035

Figure 17: Global Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 18: Global Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 19: Global Automotive Chassis System Market Revenue (US$ Bn), by Passenger vehicle, 2025 to 2035

Figure 20: Global Automotive Chassis System Market Revenue (US$ Bn), by light commercial vehicle, 2025 to 2035

Figure 21: Global Automotive Chassis System Market Revenue (US$ Bn), by heavy commercial vehicle, 2025 to 2035

Figure 22: Global Automotive Chassis System Market Revenue (US$ Bn), by Others, 2025 to 2035

Figure 23: Global Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 24: Global Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 25: Global Automotive Chassis System Market Revenue (US$ Bn), by Aluminum alloy, 2025 to 2035

Figure 26: Global Automotive Chassis System Market Revenue (US$ Bn), by Mid Steel, 2025 to 2035

Figure 27: Global Automotive Chassis System Market Revenue (US$ Bn), by High speed steel, 2025 to 2035

Figure 28: Global Automotive Chassis System Market Revenue (US$ Bn), by Others, 2025 to 2035

Figure 29: Global Automotive Chassis System Market Value Share Analysis, by Region, 2024 and 2035

Figure 30: Global Automotive Chassis System Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 31: North America Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 32: North America Automotive Chassis System Market Value Share Analysis, by Country, 2024 and 2035

Figure 33: North America Automotive Chassis System Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 34: North America Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 35: North America Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 36: North America Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 37: North America Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 38: North America Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 39: North America Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 40: North America Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 41: North America Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 42: U.S. Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 43: U.S. Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 44: U.S. Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 45: U.S. Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 46: U.S. Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 47: U.S. Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 48: U.S. Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 49: U.S. Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 50: Canada Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 51: Canada Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 52: Canada Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 53: Canada Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 54: Canada Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 55: Canada Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 56: Canada Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 57: Canada Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 58: Canada Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 59: Europe Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 60: Europe Automotive Chassis System Market Value Share Analysis, by Country, 2024 and 2035

Figure 61: Europe Automotive Chassis System Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 62: Europe Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 63: Europe Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 64: Europe Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 65: Europe Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 66: Europe Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 67: Europe Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 68: Europe Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 69: Europe Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 70: Germany Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 71: Germany Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 72: Germany Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 73: Germany Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 74: Germany Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 75: Germany Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 76: Germany Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 77: Germany Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 78: Germany Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 79: U.K Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 80: U.K Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 81: U.K Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 82: U.K Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 83: U.K Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 84: U.K Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 85: U.K Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 86: U.K Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 87: U.K Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 88: France Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 89: France Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 90: France Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 91: France Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 92: France Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 93: France Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 94: France Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 95: France Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 96: France Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 97: Italy Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 98: Italy Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 99: Italy Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 100: Italy Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 101: Italy Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 102: Italy Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 103: Italy Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 104: Italy Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 105: Italy Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 106: Spain Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 107: Spain Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 108: Spain Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 109: Spain Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 110: Spain Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 111: Spain Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 112: Spain Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 113: Spain Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 114: Spain Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 115: Switzerland Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 116: Switzerland Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 117: Switzerland Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 118: Switzerland Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 119: Switzerland Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 120: Switzerland Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 121: Switzerland Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 122: Switzerland Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 123: Switzerland Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 124: The Netherlands Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 125: The Netherlands Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 126: The Netherlands Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 127: The Netherlands Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 128: The Netherlands Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 129: The Netherlands Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 130: The Netherlands Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 131: The Netherlands Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 132: The Netherlands Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 133: Rest of Europe Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 134: Rest of Europe Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 135: Rest of Europe Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 136: Rest of Europe Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 137: Rest of Europe Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 138: Rest of Europe Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 139: Rest of Europe Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 140: Rest of Europe Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 141: Rest of Europe Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 142: Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 143: Asia Pacific Automotive Chassis System Market Value Share Analysis, by Country, 2024 and 2035

Figure 144: Asia Pacific Automotive Chassis System Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 145: Asia Pacific Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 146: Asia Pacific Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 147: Asia Pacific Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 148: Asia Pacific Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 149: Asia Pacific Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 150: Asia Pacific Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 151: Asia Pacific Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 152: Asia Pacific Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 153: China Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 154: China Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 155: China Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 156: China Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 157: China Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 158: China Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 159: China Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 160: China Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 161: China Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 162: India Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 163: India Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 164: India Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 165: India Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 166: India Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 167: India Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 168: India Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 169: India Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 170: India Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 171: Japan Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 172: Japan Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 173: Japan Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 174: Japan Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 175: Japan Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 176: Japan Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 177: Japan Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 178: Japan Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 179: Japan Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 180: South Korea Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 181: South Korea Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 182: South Korea Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 183: South Korea Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 184: South Korea Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 185: South Korea Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 186: South Korea Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 187: South Korea Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 188: South Korea Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 189: Australia & New Zealand Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 190: Australia & New Zealand Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 191: Australia & New Zealand Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 192: Australia & New Zealand Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 193: Australia & New Zealand Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 194: Australia & New Zealand Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 195: Australia & New Zealand Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 196: Australia & New Zealand Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 197: Australia & New Zealand Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 198: Rest of Asia Pacific Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 199: Rest of Asia Pacific Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 200: Rest of Asia Pacific Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 201: Rest of Asia Pacific Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 202: Rest of Asia Pacific Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 203: Rest of Asia Pacific Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 204: Rest of Asia Pacific Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 205: Rest of Asia Pacific Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 206: Rest of Asia Pacific Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 207: Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 208: Latin America Automotive Chassis System Market Value Share Analysis, by Country, 2024 and 2035

Figure 209: Latin America Automotive Chassis System Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 210: Latin America Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 211: Latin America Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 212: Latin America Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 213: Latin America Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 214: Latin America Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 215: Latin America Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 216: Latin America Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 217: Latin America Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 218: Brazil Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 219: Brazil Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 220: Brazil Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 221: Brazil Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 222: Brazil Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 223: Brazil Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 224: Brazil Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 225: Brazil Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 226: Brazil Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 227: Mexico Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 228: Mexico Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 229: Mexico Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 230: Mexico Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 231: Mexico Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 232: Mexico Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 233: Mexico Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 234: Mexico Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 235: Mexico Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 236: Argentina Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 237: Argentina Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 238: Argentina Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 239: Argentina Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 240: Argentina Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 241: Argentina Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 242: Argentina Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 243: Argentina Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 244: Argentina Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 245: Rest of Latin America Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 246: Rest of Latin America Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 247: Rest of Latin America Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 248: Rest of Latin America Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 249: Rest of Latin America Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 250: Rest of Latin America Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 251: Rest of Latin America Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 252: Rest of Latin America Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 253: Rest of Latin America Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 254: Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 255: Middle East and Africa Automotive Chassis System Market Value Share Analysis, by Country, 2024 and 2035

Figure 256: Middle East and Africa Automotive Chassis System Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 257: Middle East and Africa Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 258: Middle East and Africa Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 259: Middle East and Africa Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 260: Middle East and Africa Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 261: Middle East and Africa Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 262: Middle East and Africa Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 263: Middle East and Africa Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 264: Middle East and Africa Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 265: GCC Countries Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 266: GCC Countries Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 267: GCC Countries Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 268: GCC Countries Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 269: GCC Countries Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 270: GCC Countries Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 271: GCC Countries Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 272: GCC Countries Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 273: GCC Countries Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 274: South Africa Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 275: South Africa Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 276: South Africa Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 277: South Africa Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 278: South Africa Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 279: South Africa Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 280: South Africa Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 281: South Africa Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 282: South Africa Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 283: Rest of Middle East and Africa Automotive Chassis System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 284: Rest of Middle East and Africa Automotive Chassis System Market Value Share Analysis, by Chassis Type, 2024 and 2035

Figure 285: Rest of Middle East and Africa Automotive Chassis System Market Attractiveness Analysis, by Chassis Type, 2025 to 2035

Figure 286: Rest of Middle East and Africa Automotive Chassis System Market Value Share Analysis, by Component Type, 2024 and 2035

Figure 287: Rest of Middle East and Africa Automotive Chassis System Market Attractiveness Analysis, by Component Type, 2025 to 2035

Figure 288: Rest of Middle East and Africa Automotive Chassis System Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 289: Rest of Middle East and Africa Automotive Chassis System Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 290: Rest of Middle East and Africa Automotive Chassis System Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 291: Rest of Middle East and Africa Automotive Chassis System Market Attractiveness Analysis, by Material Type, 2025 to 2035