Reports

Reports

Over the past few decades, the automotive sector has evolved at a rapid pace due to advancements in technology, innovations, and evolving industry requirements and standards. Internal combustion engines have experienced waves of modifications and innovations over a span of several decades. The camshaft is one of the integral components of an engine and is primarily deployed in engines to open or close the valve, which allows the entry of fuel and also releases gases efficiently. The shape of the camshaft largely controls the action of the valve. The camshaft plays an important role in enhancing the fundamental functioning of an engine. Camshafts are extensively used in both modern-day overhead-cam (OCH) engines as well as older engines.

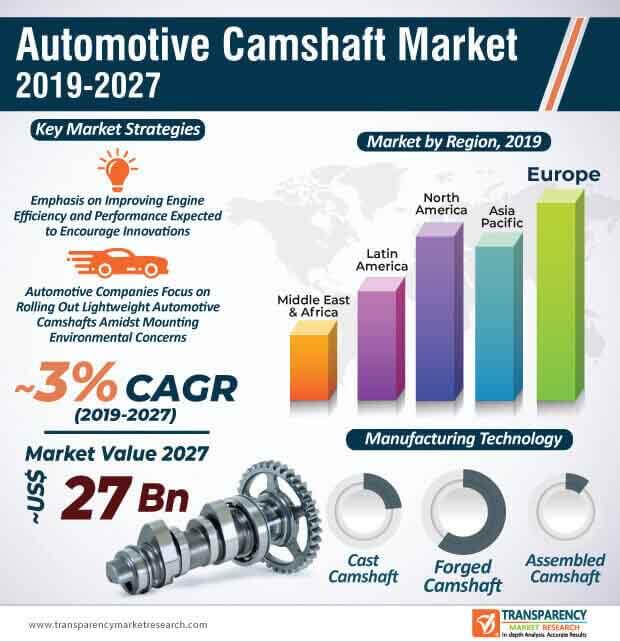

Technologies revolving around internal combustion engines have consistently evolved over the past few years and are largely inclined toward improving performance and efficiency. As the automotive sector continues to emphasize on launching lightweight vehicles, improve fuel efficiency, and reduce carbon emission, camshaft manufacturers are increasingly developing new products in tune with these requirements. The significant rise in the number of commercial vehicles particularly in the Asia Pacific region is expected to augment the demand for automotive camshafts during the forecast period. Moreover, government bodies across the world are imposing regulations to curb environmental degradation. At the back of these factors, the global automotive camshaft market is expected to attain a market value of ~US$ 27 Bn by the end of 2027.

Full-electric and hybrid vehicles have gained considerable popularity in the past 10 years. Automotive manufacturers, researchers, and consumers have expressed noteworthy interest in electric and hybrid vehicles, particularly in the past few years as a measure to curb pollution and save fuel. In hybrid cars, the main source of energy supply is the heat engine due to which combustion is streamlined and fuel-efficient. However, in their efforts to further improve the overall efficiency of heat engine, companies operating in the current automotive camshaft market landscape are increasingly focused on the design aspects of the automotive camshaft.

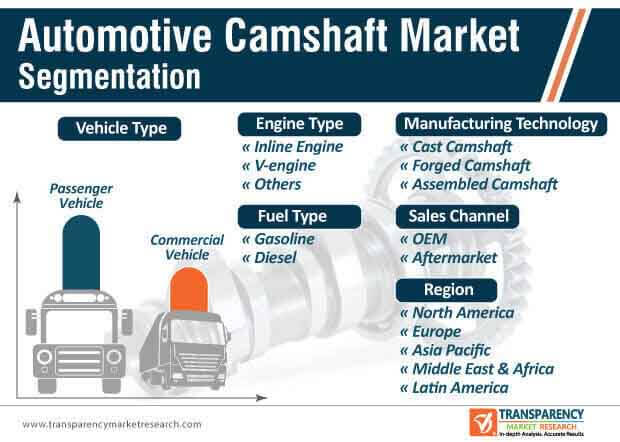

Within an internal combustion engine, the camshaft plays a key role in the cleaning and refilling of the engine. The valve timing of the engine determines the level of fuel consumed and thus, to manufacture an accurate automotive camshaft, the design aspect of it is highly critical. At present, due to advancements in technology, software tools are increasingly being used to design automotive camshafts. Within the automotive camshaft market, inline engines are set to remain the most popular engine type that will make use of camshafts followed by V-engines. As inline engines are relatively easier to manufacture, cost-effective, and adopted by a large amount of established automakers, the inline engine segment is expected to assert its dominance during the forecast period. However, in recent times, the soaring sales of premium vehicles, growing consumer demand for high performance and comfort are some of the major factors due to which the uptake of automotive camshaft in V-engine is on the rise.

Within the automotive sector, companies are expected to put their best foot forward and launch energy-efficient, sustainable, and technologically sound vehicles. Investments in new technologies, component design techniques, innovations, and other facets of the automotive sector are likely to present lucrative opportunities for participants involved in the current automotive camshaft market. Automotive companies are increasingly focusing on valve-timing technologies to gain an edge in the current market landscape. For instance, in July 2019, Hyundai revealed that the company has developed a continuous variable valve duration (CVVD) engine technology. The company further stated that the new technology is expected to enhance engine performance by 4% and efficiency by 5%. Innovations and development of similar technologies are expected to fuel the growth of the automotive camshaft market during the assessment period. Based on the manufacturing technology, the forged automotive camshaft is expected to have the highest market share followed by cast camshaft and assembled camshaft.

Analysts’ Viewpoint

The global automotive camshaft market is expected to grow at a CAGR of ~3% during the forecast period. Some of the leading factors that are likely to propel the growth of the market for automotive camshaft include growing interest in electric/hybrid vehicles, significant advancements in valve-technologies, and soaring adoption of software tools to refine the designs of automotive camshafts. Additionally, as automotive manufacturers continue to focus on reducing the weight of their vehicles, the demand for automotive camshaft is set to gain momentum in the upcoming years.

Camshaft Market: Regional Segmentation

Automotive Camshaft Market is projected to reach US$ 27 Bn by the end of the 2027

Automotive Camshaft Market is expected to grow at a CAGR of 3% during 2019 – 2027

Automotive Camshaft Market is studied from 2019 – 2027

Key vendors in the Automotive Camshaft Market are COMP Performance Group, Hirschvogel Holding GmbH, JBM Industries, JD Norman Industries, Inc., Kautex, MAHLE GmbH

Asia Pacific region Takes Lead in the Automotive Camshaft Market

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Automotive Camshaft Market

3.1. Global Automotive Camshaft Market Size, Million Units, US$ Mn, 2018?2027

4. Market Overview

4.1. Introduction

4.2. Global Market: Macro Economic Factors

4.2.1. Market Definition

4.2.2. Key Industry Developments

4.3. Key Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.5. Porter’s Five Force Analysis

4.6. Value Chain Analysis

4.6.1. List of Key Manufacturers

4.6.2. List of Customers

4.6.3. Level of Integration

4.7. Regulatory Scenario

4.8. SWOT Analysis

5. Global Snapshot:

5.1. Matured/ Key Countries

5.2. Emerging Countries

6. Automotive Camshaft Market: Technology Roadmap

7. Key Trend Analysis

7.1. Vehicle Type/ Technology Trend

7.2. Industry Trend

8. Automotive Camshaft Market: Manufacturer’s Perspective

9. Global Automotive Camshaft Market: Outline Market

9.1. North America

9.2. Europe

9.3. Asia Pacific

9.4. Middle East and Africa

9.5. Latin America

10. Key Players Customers for Camshaft

10.1. Key Supplier

10.2. Who Supplies Whom

11. Vehicle Type Portfolio/ Innovation for Camshaft

11.1. Key Supplier

11.2. Recent Development by key players

12. Global Automotive Camshaft Market Analysis and Forecast, by Vehicle Type

12.1. Introduction & Definition

12.2. Market Growth & Y-O-Y projection

12.3. Basis Point Share (BPS) Analysis

12.4. Global Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type, 2018?2027

12.4.1. Passenger Vehicle

12.4.2. Commercial Vehicle

12.5. Global Automotive Camshaft Market Attractiveness Analysis, by Vehicle Type

13. Global Automotive Camshaft Market Analysis and Forecast, by Engine Type

13.1. Introduction & Definition

13.2. Market Growth & Y-O-Y projection

13.3. Basis Point Share (BPS) Analysis

13.4. Global Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type, 2018?2027

13.4.1. Inline Engine

13.4.2. V- Engine

13.4.3. Others

13.5. Global Automotive Camshaft Market Attractiveness Analysis, by Engine Type

14. Global Automotive Camshaft Market Analysis and Forecast, by Manufacturing Technology

14.1. Introduction & Definition

14.2. Market Growth & Y-O-Y projection

14.3. Basis Point Share (BPS) Analysis

14.4. Global Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology, 2018?2027

14.4.1. Cast Camshaft

14.4.2. Forged Camshaft

14.4.3. Assembled Camshaft

14.5. Global Automotive Camshaft Market Attractiveness Analysis, by Manufacturing Technology

15. Global Automotive Camshaft Market Analysis and Forecast, by Fuel Type

15.1. Introduction & Definition

15.2. Market Growth & Y-O-Y projection

15.3. Basis Point Share (BPS) Analysis

15.4. Global Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type, 2018?2027

15.4.1. Gasoline

15.4.2. Diesel

15.5. Global Automotive Camshaft Market Attractiveness Analysis, by Fuel Type

16. Global Automotive Camshaft Market Analysis and Forecast, by Sales Channel

16.1. Introduction & Definition

16.2. Market Growth & Y-O-Y projection

16.3. Basis Point Share (BPS) Analysis

16.4. Global Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel, 2018?2027

16.4.1. OEM

16.4.2. Aftermarket

16.5. Global Automotive Camshaft Market Attractiveness Analysis, by Sales Channel

17. Global Automotive Camshaft Market Analysis and Forecast, by Region

17.1. Market Growth & Y-O-Y projection

17.2. Basis Point Share (BPS) Analysis

17.3. Global Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Region, 2018?2027

17.3.1. North America

17.3.2. Latin America

17.3.3. Europe

17.3.4. Asia Pacific

17.3.5. Middle East & Africa

17.4. Global Automotive Camshaft Market Attractiveness Analysis, by Region

18. North America Automotive Camshaft Market Size (Million Units and US$ Mn) Forecast, 2018?2027

18.1. Key Findings

18.2. Market Snapshot

18.3. North America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

18.3.1. Passenger Vehicle

18.3.2. Commercial Vehicle

18.4. North America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

18.4.1. Inline Engine

18.4.2. V- Engine

18.4.3. Others

18.5. North America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

18.5.1. Cast Camshaft

18.5.2. Forged Camshaft

18.5.3. Assembled Camshaft

18.6. North America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

18.6.1. Gasoline

18.6.2. Diesel

18.7. North America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

18.7.1. OEM

18.7.2. Aftermarket

18.8. North America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Country

18.8.1. U.S.

18.8.2. Canada

18.9. U.S. Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

18.9.1. Passenger Vehicle

18.9.2. Commercial Vehicle

18.10. U.S. Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

18.10.1. Inline Engine

18.10.2. V- Engine

18.10.3. Others

18.11. U.S. Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

18.11.1. Cast Camshaft

18.11.2. Forged Camshaft

18.11.3. Assembled Camshaft

18.12. U.S. Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

18.12.1. Gasoline

18.12.2. Diesel

18.13. U.S. Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

18.13.1. OEM

18.13.2. Aftermarket

18.14. Canada Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

18.14.1. Passenger Vehicle

18.14.2. Commercial Vehicle

18.15. Canada Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

18.15.1. Inline Engine

18.15.2. V- Engine

18.15.3. Others

18.16. Canada Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

18.16.1. Cast Camshaft

18.16.2. Forged Camshaft

18.16.3. Assembled Camshaft

18.17. Canada Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

18.17.1. Gasoline

18.17.2. Diesel

18.18. Canada Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

18.18.1. OEM

18.18.2. Aftermarket

19. Europe Automotive Camshaft Market Size (Million Units) and Forecast (US$ Mn), 2018?2027

19.1. Key Findings

19.2. Market Snapshot

19.3. Europe Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

19.3.1. Passenger Vehicle

19.3.2. Commercial Vehicle

19.4. Europe Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

19.4.1. Inline Engine

19.4.2. V- Engine

19.4.3. Others

19.5. Europe Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

19.5.1. Cast Camshaft

19.5.2. Forged Camshaft

19.5.3. Assembled Camshaft

19.6. Europe Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

19.6.1. Gasoline

19.6.2. Diesel

19.7. Europe Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

19.7.1. OEM

19.7.2. Aftermarket

19.8. Europe Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Country and Sub-region

19.8.1. Germany

19.8.2. U.K.

19.8.3. France

19.8.4. Italy

19.8.5. Spain

19.8.6. Rest of Europe

19.9. Germany Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

19.9.1. Passenger Vehicle

19.9.2. Commercial Vehicle

19.10. Germany Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

19.10.1. Inline Engine

19.10.2. V- Engine

19.10.3. Others

19.11. Germany Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

19.11.1. Cast Camshaft

19.11.2. Forged Camshaft

19.11.3. Assembled Camshaft

19.12. Germany Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

19.12.1. Gasoline

19.12.2. Diesel

19.13. Germany Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

19.13.1. OEM

19.13.2. Aftermarket

19.14. U.K. Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

19.14.1. Passenger Vehicle

19.14.2. Commercial Vehicle

19.15. U.K. Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

19.15.1. Cast Camshaft

19.15.2. Forged Camshaft

19.15.3. Assembled Camshaft

19.16. U.K. Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

19.16.1. Inline Engine

19.16.2. V- Engine

19.16.3. Others

19.17. U.K. Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

19.17.1. Gasoline

19.17.2. Diesel

19.18. U.K. Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

19.18.1. OEM

19.18.2. Aftermarket

19.19. France Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

19.19.1. Passenger Vehicle

19.19.2. Commercial Vehicle

19.20. France Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

19.20.1. Inline Engine

19.20.2. V- Engine

19.20.3. Others

19.21. France Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

19.21.1. Cast Camshaft

19.21.2. Forged Camshaft

19.21.3. Assembled Camshaft

19.22. France Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

19.22.1. Gasoline

19.22.2. Diesel

19.23. France Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

19.23.1. OEM

19.23.2. Aftermarket

19.24. Italy Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

19.24.1. Passenger Vehicle

19.24.2. Commercial Vehicle

19.25. Italy Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

19.25.1. Inline Engine

19.25.2. V- Engine

19.25.3. Others

19.26. Italy Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

19.26.1. Cast Camshaft

19.26.2. Forged Camshaft

19.26.3. Assembled Camshaft

19.27. Italy Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

19.27.1. Gasoline

19.27.2. Diesel

19.28. Italy Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

19.28.1. OEM

19.28.2. Aftermarket

19.29. Spain Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

19.29.1. Passenger Vehicle

19.29.2. Commercial Vehicle

19.30. Spain Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

19.30.1. Inline Engine

19.30.2. V- Engine

19.30.3. Others

19.31. Spain Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

19.31.1. Cast Camshaft

19.31.2. Forged Camshaft

19.31.3. Assembled Camshaft

19.32. Spain Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

19.32.1. Gasoline

19.32.2. Diesel

19.33. Spain Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

19.33.1. OEM

19.33.2. Aftermarket

19.34. Rest of Europe Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

19.34.1. Passenger Vehicle

19.34.2. Commercial Vehicle

19.35. Rest of Europe Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

19.35.1. Inline Engine

19.35.2. V- Engine

19.35.3. Others

19.36. Rest of Europe Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

19.36.1. Cast Camshaft

19.36.2. Forged Camshaft

19.36.3. Assembled Camshaft

19.37. Rest of Europe Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

19.37.1. Gasoline

19.37.2. Diesel

19.38. Rest of Europe Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

19.38.1. OEM

19.38.2. Aftermarket

20. Asia Pacific Automotive Camshaft Market Size (Million Units and US$ Mn) Forecast, 2018?2027

20.1. Key Findings

20.2. Market Snapshot

20.3. Asia Pacific Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

20.3.1. Passenger Vehicle

20.3.2. Commercial Vehicle

20.4. Asia Pacific Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

20.4.1. Inline Engine

20.4.2. V- Engine

20.4.3. Others

20.5. Asia Pacific Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

20.5.1. Cast Camshaft

20.5.2. Forged Camshaft

20.5.3. Assembled Camshaft

20.6. Asia Pacific Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

20.6.1. Gasoline

20.6.2. Diesel

20.7. Asia Pacific Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

20.7.1. OEM

20.7.2. Aftermarket

20.8. Asia Pacific Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Country

20.8.1. China

20.8.2. India

20.8.3. Japan

20.8.4. ASEAN

20.8.5. Rest of Asia Pacific

20.9. China Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

20.9.1. Passenger Vehicle

20.9.2. Commercial Vehicle

20.10. China Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

20.10.1. Inline Engine

20.10.2. V- Engine

20.10.3. Others

20.11. China Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

20.11.1. Cast Camshaft

20.11.2. Forged Camshaft

20.11.3. Assembled Camshaft

20.12. China Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

20.12.1. Gasoline

20.12.2. Diesel

20.13. China Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

20.13.1. OEM

20.13.2. Aftermarket

20.14. India Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

20.14.1. Passenger Vehicle

20.14.2. Commercial Vehicle

20.15. India Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

20.15.1. Inline Engine

20.15.2. V- Engine

20.15.3. Others

20.16. India Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

20.16.1. Cast Camshaft

20.16.2. Forged Camshaft

20.16.3. Assembled Camshaft

20.17. India Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

20.17.1. Gasoline

20.17.2. Diesel

20.18. India Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

20.18.1. OEM

20.18.2. Aftermarket

20.19. Japan Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

20.19.1. Passenger Vehicle

20.19.2. Commercial Vehicle

20.20. Japan Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

20.20.1. Inline Engine

20.20.2. V- Engine

20.20.3. Others

20.21. Japan Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

20.21.1. Cast Camshaft

20.21.2. Forged Camshaft

20.21.3. Assembled Camshaft

20.22. Japan Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

20.22.1. Gasoline

20.22.2. Diesel

20.23. Japan Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

20.23.1. OEM

20.23.2. Aftermarket

20.24. ASEAN Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

20.24.1. Passenger Vehicle

20.24.2. Commercial Vehicle

20.25. ASEAN Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

20.25.1. Inline Engine

20.25.2. V- Engine

20.25.3. Others

20.26. ASEAN Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

20.26.1. Cast Camshaft

20.26.2. Forged Camshaft

20.26.3. Assembled Camshaft

20.27. ASEAN Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

20.27.1. Gasoline

20.27.2. Diesel

20.28. ASEAN Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

20.28.1. OEM

20.28.2. Aftermarket

20.29. Rest of Asia Pacific Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

20.29.1. Passenger Vehicle

20.29.2. Commercial Vehicle

20.30. Rest of Asia Pacific Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

20.30.1. Inline Engine

20.30.2. V- Engine

20.30.3. Others

20.31. Rest of Asia Pacific Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

20.31.1. Cast Camshaft

20.31.2. Forged Camshaft

20.31.3. Assembled Camshaft

20.32. Rest of Asia Pacific Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

20.32.1. Gasoline

20.32.2. Diesel

20.33. Rest of Asia Pacific Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

20.33.1. OEM

20.33.2. Aftermarket

21. Middle East & Africa Automotive Camshaft Market Size (Million Units and US$ Mn) Forecast, 2018?2027

21.1. Key Findings

21.2. Market Snapshot

21.3. Middle East & Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

21.3.1. Passenger Vehicle

21.3.2. Commercial Vehicle

21.4. Middle East & Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

21.4.1. Inline Engine

21.4.2. V- Engine

21.4.3. Others

21.5. Middle East & Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

21.5.1. Cast Camshaft

21.5.2. Forged Camshaft

21.5.3. Assembled Camshaft

21.6. Middle East & Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

21.6.1. Gasoline

21.6.2. Diesel

21.7. Middle East & Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

21.7.1. OEM

21.7.2. Aftermarket

21.8. Middle East & Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Country and Sub-region

21.8.1. GCC

21.8.2. South Africa

21.8.3. Rest of Middle East & Africa

21.9. GCC Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

21.9.1. Passenger Vehicle

21.9.2. Commercial Vehicle

21.10. GCC Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

21.10.1. Inline Engine

21.10.2. V- Engine

21.10.3. Others

21.11. GCC Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

21.11.1. Cast Camshaft

21.11.2. Forged Camshaft

21.11.3. Assembled Camshaft

21.12. GCC Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

21.12.1. Gasoline

21.12.2. Diesel

21.13. GCC Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

21.13.1. OEM

21.13.2. Aftermarket

21.14. South Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

21.14.1. Passenger Vehicle

21.14.2. Commercial Vehicle

21.15. South Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

21.15.1. Inline Engine

21.15.2. V- Engine

21.15.3. Others

21.16. South Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

21.16.1. Cast Camshaft

21.16.2. Forged Camshaft

21.16.3. Assembled Camshaft

21.17. South Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

21.17.1. Gasoline

21.17.2. Diesel

21.18. South Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

21.18.1. OEM

21.18.2. Aftermarket

21.19. Rest of Middle East & Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

21.19.1. Passenger Vehicle

21.19.2. Commercial Vehicle

21.20. Rest of Middle East & Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

21.20.1. Inline Engine

21.20.2. V- Engine

21.20.3. Others

21.21. Rest of Middle East & Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

21.21.1. Cast Camshaft

21.21.2. Forged Camshaft

21.21.3. Assembled Camshaft

21.22. Rest of Middle East & Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

21.22.1. Gasoline

21.22.2. Diesel

21.23. Rest of Middle East & Africa Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

21.23.1. OEM

21.23.2. Aftermarket

22. Latin America Automotive Camshaft Market Size (Million Units and US$ Mn) Forecast, 2018?2027

22.1. Key Findings

22.2. Market Snapshot

22.3. Latin America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

22.3.1. Passenger Vehicle

22.3.2. Commercial Vehicle

22.4. Latin America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

22.4.1. Inline Engine

22.4.2. V- Engine

22.4.3. Others

22.5. Latin America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

22.5.1. Cast Camshaft

22.5.2. Forged Camshaft

22.5.3. Assembled Camshaft

22.6. Latin America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

22.6.1. Gasoline

22.6.2. Diesel

22.7. Latin America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

22.7.1. OEM

22.7.2. Aftermarket

22.8. Latin America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Country and Sub-region

22.8.1. Brazil

22.8.2. Mexico

22.8.3. Rest of Latin America

22.9. Brazil Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Types

22.9.1. Passenger Vehicle

22.9.2. Commercial Vehicle

22.10. Brazil Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

22.10.1. Inline Engine

22.10.2. V- Engine

22.10.3. Electric Vehicle

22.11. Brazil Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

22.11.1. Cast Camshaft

22.11.2. Forged Camshaft

22.11.3. Assembled Camshaft

22.12. Brazil Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

22.12.1. Gasoline

22.12.2. Diesel

22.13. Brazil Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

22.13.1. OEM

22.13.2. Aftermarket

22.14. Mexico Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

22.14.1. Passenger Vehicle

22.14.2. Commercial Vehicle

22.15. Mexico Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

22.15.1. Inline Engine

22.15.2. V- Engine

22.15.3. Others

22.16. Mexico Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

22.16.1. Cast Camshaft

22.16.2. Forged Camshaft

22.16.3. Assembled Camshaft

22.17. Mexico Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

22.17.1. Gasoline

22.17.2. Diesel

22.18. Mexico Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

22.18.1. OEM

22.18.2. Aftermarket

22.19. Rest of Latin America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Vehicle Type

22.19.1. Passenger Vehicle

22.19.2. Commercial Vehicle

22.20. Rest of Latin America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Engine Type

22.20.1. Inline Engine

22.20.2. V- Engine

22.20.3. Others

22.21. Rest of Latin America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Manufacturing Technology

22.21.1. Cast Camshaft

22.21.2. Forged Camshaft

22.21.3. Assembled Camshaft

22.22. Rest of Latin America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Fuel Type

22.22.1. Gasoline

22.22.2. Diesel

22.23. Rest of Latin America Automotive Camshaft Market Value (US$ Mn) and Volume (Million Units) Forecast, by Sales Channel

22.23.1. OEM

22.23.2. Aftermarket

23. Competition Landscape

23.1. Market Share Analysis, by Company (2018)

23.2. Market Player Competition Matrix (By Tier and Size of the Company)

23.3. Company Financials

23.4. Executive Bios/ Business expansion/ Key executive changes

23.5. Manufacturing Footprint

23.6. Vehicle Type Innovation

23.7. Key Market Players / Potential Players (Details – Overview, Overall Revenue, Recent Developments, Strategy)

23.7.1. COMP Performance Group

23.7.1.1. Overview

23.7.1.2. Overall Revenue

23.7.1.3. Recent Developments

23.7.1.4. Strategy

23.7.2. Hirschvogel Holding GmbH

23.7.2.1. Overview

23.7.2.2. Overall Revenue

23.7.2.3. Recent Developments

23.7.2.4. Strategy

23.7.3. JBM Industries

23.7.3.1. Overview

23.7.3.2. Overall Revenue

23.7.3.3. Recent Developments

23.7.3.4. Strategy

23.7.4. JD Norman Industries, Inc.

23.7.4.1. Overview

23.7.4.2. Overall Revenue

23.7.4.3. Recent Developments

23.7.4.4. Strategy

23.7.5. Kautex

23.7.5.1. Overview

23.7.5.2. Overall Revenue

23.7.5.3. Recent Developments

23.7.5.4. Strategy

23.7.6. MAHLE GmbH

23.7.6.1. Overview

23.7.6.2. Overall Revenue

23.7.6.3. Recent Developments

23.7.6.4. Strategy

23.7.7. Meritor, Inc.

23.7.7.1. Overview

23.7.7.2. Overall Revenue

23.7.7.3. Recent Developments

23.7.7.4. Strategy

23.7.8. PCL INDIA

23.7.8.1. Overview

23.7.8.2. Overall Revenue

23.7.8.3. Recent Developments

23.7.8.4. Strategy

23.7.9. Piper RS Ltd

23.7.9.1. Overview

23.7.9.2. Overall Revenue

23.7.9.3. Recent Developments

23.7.9.4. Strategy

23.7.10. Schrick Camshaft

23.7.10.1. Overview

23.7.10.2. Overall Revenue

23.7.10.3. Recent Developments

23.7.10.4. Strategy

23.7.11. ThyssenKrupp AG

23.7.11.1. Overview

23.7.11.2. Overall Revenue

23.7.11.3. Recent Developments

23.7.11.4. Strategy

23.7.12. Varroc Group

23.7.12.1. Overview

23.7.12.2. Overall Revenue

23.7.12.3. Recent Developments

23.7.12.4. Strategy

List of Tables

Table 1: Global Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 2: Global Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 3 : Global Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 4: Global Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 5 : Global Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 6: Global Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 7 : Global Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 8 : Global Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 9: Global Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 10: Global Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 11: Global Automotive Camshaft Market Volume (Thousand Units), by Region, 2018?2027

Table 12: Global Automotive Camshaft Market Value (US$ Mn), by Region, 2018?2027

Table 13: North America Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 14: North America Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 15: North America Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 16: North America Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 17: North America Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 18: North America Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 19: North America Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 20: North America Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 21: North America Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 22: North America Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 23: North America Automotive Camshaft Market Volume (Thousand Units), by Country, 2018?2027

Table 24: North America Automotive Camshaft Market Value (US$ Mn), by Country, 2018?2027

Table 25: U.S. Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 26: U.S. Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 27: U.S. Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 28: U.S. Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 29: U.S. Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 30: U.S. Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 31: U.S. Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 32: U.S. Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 33: U.S. Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 34: U.S. Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 35: Canada Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 36: Canada Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 37: Canada Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 38: Canada Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 39: Canada Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 40: Canada Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 41: Canada Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 42: Canada Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 43: Canada Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 44: Canada Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 45: Europe Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 46: Europe Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 47: Europe Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 48: Europe Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 49: Europe Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 50: Europe Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 51: Europe Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 52: Europe Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 53: Europe Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 54: Europe Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 55: Europe Automotive Camshaft Market Volume (Thousand Units), by Country and Sub-region, 2018?2027

Table 56: Europe Automotive Camshaft Market Value (US$ Mn), by Country and Sub-region, 2018?2027

Table 57: Germany Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 58: Germany Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 59: Germany Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 60: Germany Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 61: Germany Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 62: Germany Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 63: Germany Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 64: Germany Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 65: Germany Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 66: Germany Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 67: U.K. Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 68: U.K. Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 69: U.K. Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 70: U.K. Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 71: U.K. Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 72: U.K. Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 73: U.K. Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 74: U.K. Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 75: U.K. Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 76: U.K. Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 77: France Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 78: France Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 79: France Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 80: France Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 81: France Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 82: France Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 83: France Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 84: France Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 85: France Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 86: France Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 87: Italy Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 88: Italy Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 89: Italy Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 90: Italy Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 91: Italy Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 92: Italy Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 93: Italy Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 94: Italy Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 95: Italy Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 96: Italy Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 97: Spain Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 98: Spain Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 99: Spain Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 100: Spain Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 101: Spain Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 102: Spain Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 103: Spain Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 104: Spain Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 105: Spain Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 106: Spain Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 107: Rest of Europe Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 108: Rest of Europe Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 109: Rest of Europe Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 110: Rest of Europe Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 111: Rest of Europe Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 112: Rest of Europe Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 113: Rest of Europe Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 114: Rest of Europe Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 115: Rest of Europe Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 116: Rest of Europe Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 117: Asia Pacific Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 118: Asia Pacific Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 119: Asia Pacific Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 120: Asia Pacific Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 121: Asia Pacific Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 122: Asia Pacific Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 123: Asia Pacific Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 124: Asia Pacific Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 125: Asia Pacific Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 126: Asia Pacific Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 127: Asia Pacific Automotive Camshaft Market Volume (Thousand Units), by Country and Sub-region, 2018?2027

Table 128: Asia Pacific Automotive Camshaft Market Value (US$ Mn), by Country and Sub-region, 2018?2027

Table 129: China Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 130: China Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 131: China Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 132: China Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 133: China Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 134: China Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 135: China Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 136: China Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 137: China Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 138: China Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 139: India Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 140: India Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 141: India Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 142: India Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 143: India Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 144: India Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 145: India Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 146: India Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 147: India Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 148: India Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 149: Japan Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 150: Japan Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 151: Japan Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 152: Japan Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 153: Japan Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 154: Japan Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 155: Japan Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 156: Japan Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 157: Japan Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 158: Japan Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 159: ASEAN Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 160: ASEAN Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 161: ASEAN Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 162: ASEAN Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 163: ASEAN Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 164: ASEAN Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 165: ASEAN Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 166: ASEAN Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 167: ASEAN Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 168: ASEAN Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 169: Rest of Asia Pacific Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 170: Rest of Asia Pacific Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 171: Rest of Asia Pacific Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 172: Rest of Asia Pacific Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 173: Rest of Asia Pacific Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 174: Rest of Asia Pacific Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 175: Rest of Asia Pacific Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 176: Rest of Asia Pacific Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 177: Rest of Asia Pacific Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 178: Rest of Asia Pacific Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 179: Middle East & Africa Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 180: Middle East & Africa Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 181: Middle East & Africa Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 182: Middle East & Africa Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 183: Middle East & Africa Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 184: Middle East & Africa Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 185: Middle East & Africa Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 186: Middle East & Africa Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 187: Middle East & Africa Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 188: Middle East & Africa Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 189: Middle East & Africa Automotive Camshaft Market Volume (Thousand Units), by Country and Sub-region, 2018?2027

Table 190: Middle East & Africa Automotive Camshaft Market Value (US$ Mn), by Country and Sub-region, 2018?2027

Table 191: GCC Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 192: GCC Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 193: GCC Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 194: GCC Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 195: GCC Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 196: GCC Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 197: GCC Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 198: GCC Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 199: GCC Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 200: GCC Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 201: South Africa Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 202: South Africa Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 203: South Africa Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 204: South Africa Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 205: South Africa Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 206: South Africa Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 207: South Africa Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 208: South Africa Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 209: South Africa Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 210: South Africa Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 211: Rest of Middle East & Africa Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 212: Rest of Middle East & Africa Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 213: Rest of Middle East & Africa Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 214: Rest of Middle East & Africa Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 215: Rest of Middle East & Africa Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 216: Rest of Middle East & Africa Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 217: Rest of Middle East & Africa Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 218: Rest of Middle East & Africa Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 219: Rest of Middle East & Africa Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 220: Rest of Middle East & Africa Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 221: Latin America Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 222: Latin America Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 223: Latin America Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 224: Latin America Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 225: Latin America Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 226: Latin America Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 227: Latin America Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 228: Latin America Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 229: Latin America Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 230: Latin America Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 231: Latin America Automotive Camshaft Market Volume (Thousand Units), by Country and Sub-region, 2018?2027

Table 232: Latin America Automotive Camshaft Market Value (US$ Mn), by Country and Sub-region, 2018?2027

Table 233: Brazil Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 234: Brazil Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 235: Brazil Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 236: Brazil Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 237: Brazil Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 238: Brazil Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 239: Brazil Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 240: Brazil Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 241: Brazil Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 242: Brazil Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 243: Mexico Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 244: Mexico Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 245: Mexico Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 246: Mexico Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 247: Mexico Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 248: Mexico Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 249: Mexico Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 250: Mexico Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 251: Mexico Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 252: Mexico Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

Table 253: Rest of Latin America Automotive Camshaft Market Volume (Thousand Units), by Vehicle Type, 2018?2027

Table 254: Rest of Latin America Automotive Camshaft Market Value (US$ Mn), by Vehicle Type, 2018?2027

Table 255: Rest of Latin America Automotive Camshaft Market Volume (Thousand Units), by Fuel Type, 2018?2027

Table 256: Rest of Latin America Automotive Camshaft Market Value (US$ Mn), by Fuel Type, 2018?2027

Table 257: Rest of Latin America Automotive Camshaft Market Volume (Thousand Units), by Engine Type, 2018?2027

Table 258: Rest of Latin America Automotive Camshaft Market Value (US$ Mn), by Engine Type, 2018?2027

Table 259: Rest of Latin America Automotive Camshaft Market Volume (Thousand Units), by Manufacturing Technology, 2018?2027

Table 260: Rest of Latin America Automotive Camshaft Market Value (US$ Mn), by Manufacturing Technology, 2018?2027

Table 261: Rest of Latin America Automotive Camshaft Market Volume (Thousand Units), by Sales Channel, 2018?2027

Table 262: Rest of Latin America Automotive Camshaft Market Value (US$ Mn), by Sales Channel, 2018?2027

List of Figures

Figure 1: Global Automotive Camshaft Market Volume (Thousand Units) and Value (US$ Mn), 2018?2027

Figure 2: Global Automotive Camshaft Market Share, by Vehicle Type, 2018

Figure 3: Global Automotive Camshaft Market Share, by Vehicle Type, 2027

Figure 4: Global Automotive Camshaft Market Attractiveness, by Vehicle Type, 2018

Figure 5: Global Automotive Camshaft Market Share, by Fuel Type, 2018

Figure 6: Global Automotive Camshaft Market Share, by Fuel Type, 2027

Figure 7: Global Automotive Camshaft Market Attractiveness, by Fuel Type, 2018

Figure 8: Global Automotive Camshaft Market Share, by Engine Type, 2018

Figure 9: Global Automotive Camshaft Market Share, by Engine Type, 2027

Figure 10: Global Automotive Camshaft Market Attractiveness, by Engine Type, 2018

Figure 11: Global Automotive Camshaft Market Share, by Manufacturing Technology, 2018

Figure 12: Global Automotive Camshaft Market Share, by Manufacturing Technology, 2027

Figure 13: Global Automotive Camshaft Market Attractiveness, by Manufacturing Technology, 2018

Figure 14: Global Automotive Camshaft Market Share, by Sales Channel, 2018

Figure 15: Global Automotive Camshaft Market Share, by Sales Channel, 2027

Figure 16: Global Automotive Camshaft Market Attractiveness, by Sales Channel, 2018

Figure 17: Global Automotive Camshaft Market Share, by Region, 2018

Figure 18: Global Automotive Camshaft Market Share, by Region, 2027

Figure 19: Global Automotive Camshaft Market Attractiveness, by Region, 2018

Figure 20: North America Automotive Camshaft Market Volume (Thousand Units) and Value (US$ Mn), 2018?2027

Figure 21: North America Automotive Camshaft Market Share, by Vehicle Type, 2018

Figure 22: North America Automotive Camshaft Market Share, by Vehicle Type, 2027

Figure 23: North America Automotive Camshaft Market Share, by Fuel Type, 2018

Figure 24: North America Automotive Camshaft Market Share, by Fuel Type, 2027

Figure 25: North America Automotive Camshaft Market Share, by Engine Type, 2018

Figure 26: North America Automotive Camshaft Market Share, by Engine Type, 2027

Figure 27: North America Automotive Camshaft Market Share, by Manufacturing Technology, 2018

Figure 28: North America Automotive Camshaft Market Share, by Manufacturing Technology, 2027

Figure 29: North America Automotive Camshaft Market Share, by Sales Channel, 2018

Figure 30: North America Automotive Camshaft Market Share, by Sales Channel, 2027

Figure 31: North America Automotive Camshaft Market Share, by Country, 2018

Figure 32: North America Automotive Camshaft Market Share, by Country, 2027

Figure 33: Europe Automotive Camshaft Market Volume (Thousand Units) and Value (US$ Mn), 2018?2027

Figure 34: Europe Automotive Camshaft Market Share, by Vehicle Type, 2018

Figure 35: Europe Automotive Camshaft Market Share, by Vehicle Type, 2027

Figure 36: Europe Automotive Camshaft Market Share, by Fuel Type, 2018

Figure 37: Europe Automotive Camshaft Market Share, by Fuel Type, 2027

Figure 38: Europe Automotive Camshaft Market Share, by Engine Type, 2018

Figure 39: Europe Automotive Camshaft Market Share, by Engine Type, 2027

Figure 40: Europe Automotive Camshaft Market Share, by Manufacturing Technology, 2018

Figure 41: Europe Automotive Camshaft Market Share, by Manufacturing Technology, 2027

Figure 42: Europe Automotive Camshaft Market Share, by Sales Channel, 2018

Figure 43: Europe Automotive Camshaft Market Share, by Sales Channel, 2027

Figure 44: Europe Automotive Camshaft Market Share, by Country and Sub-region, 2018

Figure 45: Europe Automotive Camshaft Market Share, by Country and Sub-region, 2027

Figure 46: Asia Pacific Automotive Camshaft Market Volume (Thousand Units) and Value (US$ Mn), 2018?2027

Figure 47: Asia Pacific Automotive Camshaft Market Share, by Vehicle Type, 2018

Figure 48: Asia Pacific Automotive Camshaft Market Share, by Vehicle Type, 2027

Figure 49: Asia Pacific Automotive Camshaft Market Share, by Fuel Type, 2018

Figure 50: Asia Pacific Automotive Camshaft Market Share, by Fuel Type, 2027

Figure 51: Asia Pacific Automotive Camshaft Market Share, by Engine Type, 2018

Figure 52: Asia Pacific Automotive Camshaft Market Share, by Engine Type, 2027

Figure 53: Asia Pacific Automotive Camshaft Market Share, by Manufacturing Technology, 2018

Figure 54: Asia Pacific Automotive Camshaft Market Share, by Manufacturing Technology, 2027

Figure 55: Asia Pacific Automotive Camshaft Market Share, by Sales Channel, 2018

Figure 56: Asia Pacific Automotive Camshaft Market Share, by Sales Channel, 2027

Figure 57: Asia Pacific Automotive Camshaft Market Share, by Country and Sub-region, 2018

Figure 58: Asia Pacific Automotive Camshaft Market Share, by Country and Sub-region, 2027

Figure 59: Middle East & Africa Automotive Camshaft Market Volume (Thousand Units) and Value (US$ Mn), 2018?2027

Figure 60: Middle East & Africa Automotive Camshaft Market Share, by Vehicle Type, 2018

Figure 61: Middle East & Africa Automotive Camshaft Market Share, by Vehicle Type, 2027

Figure 62: Middle East & Africa Automotive Camshaft Market Share, by Fuel Type, 2018

Figure 63: Middle East & Africa Automotive Camshaft Market Share, by Fuel Type, 2027

Figure 64: Middle East & Africa Automotive Camshaft Market Share, by Engine Type, 2018

Figure 65: Middle East & Africa Automotive Camshaft Market Share, by Engine Type, 2027

Figure 66: Middle East & Africa Automotive Camshaft Market Share, by Manufacturing Technology, 2018

Figure 67: Middle East & Africa Automotive Camshaft Market Share, by Manufacturing Technology, 2027

Figure 68: Middle East & Africa Automotive Camshaft Market Share, by Sales Channel, 2018

Figure 69: Middle East & Africa Automotive Camshaft Market Share, by Sales Channel, 2027

Figure 70: Middle East & Africa Automotive Camshaft Market Share, by Country and Sub-region, 2018

Figure 71: Middle East & Africa Automotive Camshaft Market Share, by Country and Sub-region, 2027

Figure 72: Latin America Automotive Camshaft Market Volume (Thousand Units) and Value (US$ Mn), 2018?2027

Figure 73: Latin America Automotive Camshaft Market Share, by Vehicle Type, 2018

Figure 74: Latin America Automotive Camshaft Market Share, by Vehicle Type, 2027

Figure 75: Latin America Automotive Camshaft Market Share, by Fuel Type, 2018

Figure 76: Latin America Automotive Camshaft Market Share, by Fuel Type, 2027

Figure 77: Latin America Automotive Camshaft Market Share, by Engine Type, 2018

Figure 78: Latin America Automotive Camshaft Market Share, by Engine Type, 2027

Figure 79: Latin America Automotive Camshaft Market Share, by Manufacturing Technology, 2018

Figure 80: Latin America Automotive Camshaft Market Share, by Manufacturing Technology, 2027

Figure 81: Latin America Automotive Camshaft Market Share, by Sales Channel, 2018

Figure 82: Latin America Automotive Camshaft Market Share, by Sales Channel, 2027

Figure 83: Latin America Automotive Camshaft Market Share, by Country and Sub-region, 2018

Figure 84: Latin America Automotive Camshaft Market Share, by Country and Sub-region, 2027