Reports

Reports

Analysts’ Viewpoint

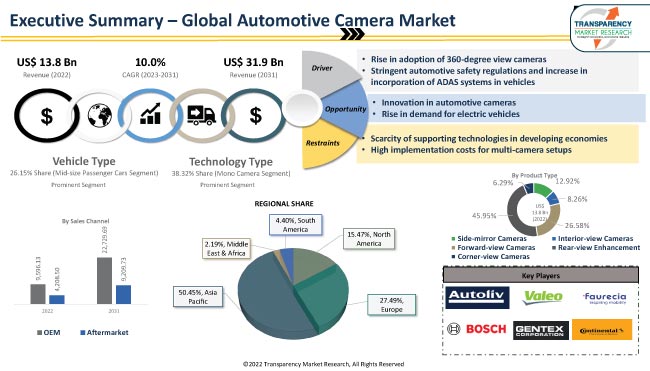

Rise in adoption of ADAS (Advance Driver Assistance System) features, such as blind spot detection, 360 degree surround view, night vision systems, and parking surround sound in passenger vehicles, globally, is augmenting the global automotive camera industry growth. Increased demand for automobile safety from vehicle buyers and rise in adoption of more stringent automobile safety norms have prompted key market players to rollout new cameras with technological advancements in camera functionality as well as the development of new use cases for camera applications. A prominent automotive camera market trend witnessed is the vehicle feature that detects driver behavior, which enhances overall vehicle safety through driver monitoring systems.

Furthermore, the latest automotive camera market analysis indicates that the rising usage of automotive cameras in Level 4 (High Automation) and Level 5 (Full Automation) of autonomous mobility is fueling the demand for vehicle cameras. Top players are focused on tapping into incremental opportunities in the automotive camera industry by offering new products, such as cameras with HD (High Definition) imaging capabilities, camera based depth perception platforms for fully and partially autonomous vehicles, back-end data analysis based on AI and ML based models, and camera integration services, to major automobile manufacturers.

Automotive camera is an imaging system that continuously captures and provides views of the surroundings to the vehicle’s driver in order to enhance the safety of driver and vehicle. This is achieved by enabling the driver to take better decisions in the interest of safety based on real-time imaging of the vehicle’s operating environment. Automotive cameras are mounted both onboard and outboard of a vehicle depending on the application. Automotive cameras are primarily used in ADAS systems of the vehicles.

Rising awareness about vehicle safety, adoption of stringent vehicle safety norms and laws, growing application of ADAS in vehicles, and booming sales of connected, electric, premium, and luxury vehicles are projected to augment the automotive camera market revenue. Furthermore, the automotive camera business is also estimated to grow due to the offering of new products, technologies, and back-end services by manufacturers to their clients.

The 360-degree camera setup has become the latest trend in the automotive industry. The technology once reserved only for luxury or premium cars is currently being employed in almost every car segment by the OEMs. The 360-degree camera setup comprising at least 4 cameras in the front and rear of the vehicles enables drivers to have a view of the vehicle’s surroundings and helps improve vehicle safety due to the better decision making. High-end vehicles use more number of cameras to have a better interpretation of the surroundings and accurate 360-degree perspective.

In rapidly growing markets for automobiles, such as Asia Pacific, several automakers have installed 360-degree cameras in top-end variants of their cars. For instance, Maruti Suzuki and Hyundai offer this feature in their top-end hatchbacks and other vehicles.

Automotive manufacturers are adding features such as blind spot monitoring systems using 360-degree cameras placed under the side-mirrors, which enables the driver to view footage from either sides to make safe turns. Thus, rise in adoption of 360-degree view cameras is projected to positively impact the global automotive camera market progress in the next few years.

New stringent automotive safety laws, such as Federal Safety Regulations for Automated Motor Vehicles and Stay Aware for Everyone (SAFE) Act of 2020 in North America and The Assessment Protocol - Safety Assist as well as The Assessment Protocol - ASSISTED DRIVING by Euro NCAP, are estimated to boost the demand for automotive camera during the forecast period.

Rise in sales of vehicles with ADAS systems in which automotive cameras play a pivotal role to help the driver with image-based inputs is also propelling the automotive camera market statistics. Furthermore, growing trend of 360 degree and HD imaging capabilities as well as offering of back-end data analysis and camera integration services is contributing toward the rising demand for vehicle camera systems.

Additionally, surge in adoption of Level 4 (High Automation) and Level 5 (Full Automation) vehicle autonomy levels in ADAS in dominant markets, such as North America and Europe, is expected to contribute to the growth in the automotive camera industry.

Analysis of the latest automotive camera industry research report reveals that, in terms of technology, the mono camera segment held majority share of the market in 2022. The segment is estimated to maintain the status quo and expand at a healthy growth rate during the forecast period. This is primarily due to the versatility of using mono cameras in several ADAS applications such as advanced emergency braking, emergency lane keeping, speed limit information and automatic limitation traffic sign assist, event data recorder, adaptive cruise control, traffic jam assist, traffic light recognition, continuous lane centering assist and head light assist. Thus ensuring the dominance of the mono camera segment in the automotive camera market. The other cameras segment is projected to expand at a rapid pace due to the growing demand for surround view cameras.

In terms of volume, Asia Pacific held a prominent share of the global market in 2022. This was majorly attributed to growing sales of vehicles featuring ADAS capabilities and increase in awareness about vehicle safety among young automobile buyers in the region. Moreover, growing sales of premium and luxury vehicles in Asia Pacific generate large demand for automotive cameras. China accounts for slightly less than 50% of the automotive camera market share in Asia Pacific.

North America and Europe are also key markets for automotive cameras. The rear-view enhancement segment dominates the market in North America due to its widespread adoption in light commercial vehicles such as pickup trucks. It is also the prominent segment in Europe because of the increased demand for rear view- enhancement cameras from mid-sized passenger cars in the region.

South America is a larger market for automotive camera systems as compared to the Middle East & Africa due to the significant presence of automobile manufacturers in growing economies such as Brazil; however, the automotive camera market size in Middle East & Africa is anticipated to increase at a higher growth rate as compared to South America due to growing sales of premium and luxury vehicles in the region.

The global automotive camera market is fairly consolidated with the major players controlling a majority of the market share. A majority of the firms are spending significantly on launching new products in addition to regular cameras. Expansion of service offerings and organic expansion are notable strategies adopted by key players. AMBARELLA, Aptiv plc, Autoliv Inc., Automated Engineering INC (AEI), Brigade Electronics, Clarion Co., Ltd., Continental AG, Denso Corporation, FAURECIA, FICOSA International, FLIR SYSTEMS, Gentex Corporation, Hella KGaA Hueck & Co., Hitachi Astemo LTD, HYUNDAI MOBIS, Kyocera Corporation, Magna International In, MCNEX CO, MOBILEYE, Omnivision Technologies Inc., Panasonic Corporation, Robert Bosch GmbH, Samsung Electro-Mechanics, Samvardhana Motherson Reflected , Sony Group Corporation, STONKAM CO. LTD, Valeo S.A, VEONEER and ZF are some of the prominent players operating in the global market.

Key players in the automotive camera market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 (Base Year) | US$ 13.8 Bn |

| Market Forecast Value in 2031 | US$ 31.9 Bn |

| Growth Rate (CAGR) | 10.0% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, industry trend analysis, etc. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global market was valued at US$ 13.8 Bn in 2022

It is expected to expand at a CAGR of 10.0% by 2031

It is estimated to reach a value of US$ 31.9 Bn in 2031

AMBARELLA, Aptiv plc, Autoliv Inc., Automated Engineering INC (AEI), Brigade Electronics, Clarion Co., Ltd., Continental AG, Denso Corporation, FAURECIA, FICOSA International, FLIR SYSTEMS, Gentex Corporation, Hella KGaA Hueck & Co., Hitachi Astemo LTD, HYUNDAI MOBIS, Kyocera Corporation, Magna International In, MCNEX CO, MOBILEYE, Omnivision Technologies Inc., Panasonic Corporation, Robert Bosch GmbH, Samsung Electro-Mechanics, Samvardhana Motherson Reflected , Sony Group Corporation

The U.S. is a prominent market due to the large number of automobile manufacturers and growing demand for vehicles equipped with ADAS features.

The rear-view enhancement camera segment accounted for highest share in 2022.

Introduction of cameras with HD (High Definition) capabilities, offering of back-end data analytics and camera integration services as well as computer vision enabled cameras

Asia Pacific was the most lucrative region in 2022

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Global Market Outlook

2.1.1. Market Size, Units, US$ Mn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Macro-Economic Factors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Regulatory Scenario

3.5. Key Trend Analysis

3.6. Value Chain Analysis

3.6.1. Component Manufacturers

3.6.2. Hardware and Software Integration

3.6.3. OEMs or Assemblers

4. COVID-19 Impact Analysis - Automotive Camera Market

5. Global Automotive Camera Market, by Product Type

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Product Type

5.2.1. Side-mirror Cameras

5.2.2. Interior-view Cameras

5.2.3. Forward-view Cameras

5.2.4. Rear-view Enhancement

5.2.5. Corner-view Cameras

6. Global Automotive Camera Market, by Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Vehicle Type

6.2.1. Compact Passenger Cars

6.2.2. Mid-sized Passenger Cars

6.2.3. Premium Passenger Cars

6.2.4. Luxury Passenger Cars

6.2.5. Light Commercial Vehicles

6.2.6. Heavy Commercial Vehicles

7. Global Automotive Camera Market, by Application

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

7.2.1. Blind Spot

7.2.2. Drive Recorders

7.2.3. 360° Surround View

7.2.4. Lane Departure Warning System (LDWS)

7.2.5. Night Vision

7.2.6. Parking Surround View

7.2.7. Drowsiness

7.2.8. Distance

7.2.9. Adaptive Frontlight System (AFS)

7.2.10. Others

8. Global Automotive Camera Market, by Technology

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Technology

8.2.1. Mono Cameras

8.2.2. Stereo Cameras

8.2.3. Infrared Cameras

8.2.4. Other Cameras (Thermal, Digital, etc.)

9. Global Automotive Camera Market, by Level of Autonomy

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Level of Autonomy

9.2.1. Level 1: Driver Assistance

9.2.2. Level 2: Partial Automation

9.2.3. Level 3: Conditional Automation

9.2.4. Level 4: High Automation

9.2.5. Level 5: Full Automation

10. Global Automotive Camera Market, by Sales Channel

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channels

10.2.1. OEM

10.2.2. Aftermarket

11. Global Automotive Camera Market, by Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Automotive Camera Market

12.1. Market Snapshot

12.2. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Product Type

12.2.1. Side-mirror Cameras

12.2.2. Interior-view Cameras

12.2.3. Forward-view Cameras

12.2.4. Rear-view Enhancement

12.2.5. Corner-view Cameras

12.3. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Vehicle Type

12.3.1. Compact Passenger Cars

12.3.2. Mid-sized Passenger Cars

12.3.3. Premium Passenger Cars

12.3.4. Luxury Passenger Cars

12.3.5. Light Commercial Vehicles

12.3.6. Heavy Commercial Vehicles

12.4. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

12.4.1. Blind Spot

12.4.2. Drive Recorders

12.4.3. 360° Surround View

12.4.4. Lane Departure Warning System (LDWS)

12.4.5. Night Vision

12.4.6. Parking Surround View

12.4.7. Drowsiness

12.4.8. Distance

12.4.9. Adaptive Frontlight System (AFS)

12.4.10. Others

12.5. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Technology

12.5.1. Mono Cameras

12.5.2. Stereo Cameras

12.5.3. Infrared Cameras

12.5.4. Other Cameras (Thermal, Digital, etc.)

12.6. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Level of Autonomy

12.6.1. Level 1: Driver Assistance

12.6.2. Level 2: Partial Automation

12.6.3. Level 3: Conditional Automation

12.6.4. Level 4: High Automation

12.6.5. Level 5: Full Automation

12.7. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

12.7.1. OEM

12.7.2. Aftermarket

12.8. Key Country Analysis – North America Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031

12.8.1. U. S.

12.8.2. Canada

12.8.3. Mexico

13. Europe Automotive Camera Market

13.1. Market Snapshot

13.2. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Product Type

13.2.1. Side-mirror Cameras

13.2.2. Interior-view Cameras

13.2.3. Forward-view Cameras

13.2.4. Rear-view Enhancement

13.2.5. Corner-view Cameras

13.3. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Vehicle Type

13.3.1. Compact Passenger Cars

13.3.2. Mid-sized Passenger Cars

13.3.3. Premium Passenger Cars

13.3.4. Luxury Passenger Cars

13.3.5. Light Commercial Vehicles

13.3.6. Heavy Commercial Vehicles

13.4. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

13.4.1. Blind Spot

13.4.2. Drive Recorders

13.4.3. 360° Surround View

13.4.4. Lane Departure Warning System (LDWS)

13.4.5. Night Vision

13.4.6. Parking Surround View

13.4.7. Drowsiness

13.4.8. Distance

13.4.9. Adaptive Frontlight System (AFS)

13.4.10. Others

13.5. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Technology

13.5.1. Mono Cameras

13.5.2. Stereo Cameras

13.5.3. Infrared Cameras

13.5.4. Other Cameras (Thermal, Digital, etc.)

13.6. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Level of Autonomy

13.6.1. Level 1: Driver Assistance

13.6.2. Level 2: Partial Automation

13.6.3. Level 3: Conditional Automation

13.6.4. Level 4: High Automation

13.6.5. Level 5: Full Automation

13.7. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

13.7.1. OEM

13.7.2. Aftermarket

13.8. Key Country Analysis – Europe Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031

13.8.1. Germany

13.8.2. U. K.

13.8.3. France

13.8.4. Italy

13.8.5. Spain

13.8.6. Nordic Countries

13.8.7. Russia & CIS

13.8.8. Rest of Europe

14. Asia Pacific Automotive Camera Market

14.1. Market Snapshot

14.2. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Product Type

14.2.1. Side-mirror Cameras

14.2.2. Interior-view Cameras

14.2.3. Forward-view Cameras

14.2.4. Rear-view Enhancement

14.2.5. Corner-view Cameras

14.3. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Vehicle Type

14.3.1. Compact Passenger Cars

14.3.2. Mid-sized Passenger Cars

14.3.3. Premium Passenger Cars

14.3.4. Luxury Passenger Cars

14.3.5. Light Commercial Vehicles

14.3.6. Heavy Commercial Vehicles

14.4. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

14.4.1. Blind Spot

14.4.2. Drive Recorders

14.4.3. 360° Surround View

14.4.4. Lane Departure Warning System (LDWS)

14.4.5. Night Vision

14.4.6. Parking Surround View

14.4.7. Drowsiness

14.4.8. Distance

14.4.9. Adaptive Frontlight System (AFS)

14.4.10. Others

14.5. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Technology

14.5.1. Mono Cameras

14.5.2. Stereo Cameras

14.5.3. Infrared Cameras

14.5.4. Other Cameras (Thermal, Digital, etc.)

14.6. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Level of Autonomy

14.6.1. Level 1: Driver Assistance

14.6.2. Level 2: Partial Automation

14.6.3. Level 3: Conditional Automation

14.6.4. Level 4: High Automation

14.6.5. Level 5: Full Automation

14.7. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

14.7.1. OEM

14.7.2. Aftermarket

14.8. Key Country Analysis – Asia Pacific Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031

14.8.1. China

14.8.2. India

14.8.3. Japan

14.8.4. ASEAN Countries

14.8.5. South Korea

14.8.6. ANZ

14.8.7. Rest of Asia Pacific

15. Middle East & Africa Automotive Camera Market

15.1. Market Snapshot

15.2. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Product Type

15.2.1. Side-mirror Cameras

15.2.2. Interior-view Cameras

15.2.3. Forward-view Cameras

15.2.4. Rear-view Enhancement

15.2.5. Corner-view Cameras

15.3. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Vehicle Type

15.3.1. Compact Passenger Cars

15.3.2. Mid-sized Passenger Cars

15.3.3. Premium Passenger Cars

15.3.4. Luxury Passenger Cars

15.3.5. Light Commercial Vehicles

15.3.6. Heavy Commercial Vehicles

15.4. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

15.4.1. Blind Spot

15.4.2. Drive Recorders

15.4.3. 360° Surround View

15.4.4. Lane Departure Warning System (LDWS)

15.4.5. Night Vision

15.4.6. Parking Surround View

15.4.7. Drowsiness

15.4.8. Distance

15.4.9. Adaptive Frontlight System (AFS)

15.4.10. Others

15.5. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Technology

15.5.1. Mono Cameras

15.5.2. Stereo Cameras

15.5.3. Infrared Cameras

15.5.4. Other Cameras (Thermal, Digital, etc.)

15.6. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Level of Autonomy

15.6.1. Level 1: Driver Assistance

15.6.2. Level 2: Partial Automation

15.6.3. Level 3: Conditional Automation

15.6.4. Level 4: High Automation

15.6.5. Level 5: Full Automation

15.7. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

15.7.1. OEM

15.7.2. Aftermarket

15.8. Key Country Analysis – Middle East & Africa Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031

15.8.1. GCC

15.8.2. South Africa

15.8.3. Turkey

15.8.4. Rest of Middle East & Africa

16. South America Automotive Camera Market

16.1. Market Snapshot

16.2. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Product Type

16.2.1. Side-mirror Cameras

16.2.2. Interior-view Cameras

16.2.3. Forward-view Cameras

16.2.4. Rear-view Enhancement

16.2.5. Corner-view Cameras

16.3. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Vehicle Type

16.3.1. Compact Passenger Cars

16.3.2. Mid-sized Passenger Cars

16.3.3. Premium Passenger Cars

16.3.4. Luxury Passenger Cars

16.3.5. Light Commercial Vehicles

16.3.6. Heavy Commercial Vehicles

16.4. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Application

16.4.1. Blind Spot

16.4.2. Drive Recorders

16.4.3. 360° Surround View

16.4.4. Lane Departure Warning System (LDWS)

16.4.5. Night Vision

16.4.6. Parking Surround View

16.4.7. Drowsiness

16.4.8. Distance

16.4.9. Adaptive Frontlight System (AFS)

16.4.10. Others

16.5. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Technology

16.5.1. Mono Cameras

16.5.2. Stereo Cameras

16.5.3. Infrared Cameras

16.5.4. Other Cameras (Thermal, Digital, etc.)

16.6. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Level of Autonomy

16.6.1. Level 1: Driver Assistance

16.6.2. Level 2: Partial Automation

16.6.3. Level 3: Conditional Automation

16.6.4. Level 4: High Automation

16.6.5. Level 5: Full Automation

16.7. Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031, by Sales Channel

16.7.1. OEM

16.7.2. Aftermarket

16.8. Key Country Analysis – South America Automotive Camera Market Volume (Units) & Value (US$ Mn) Analysis & Forecast, 2017-2031

16.8.1. Brazil

16.8.2. Argentina

16.8.3. Rest of South America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Share Analysis, 2022

17.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

17.3. Company Profile/ Key Players – Automotive Camera Market

17.3.1. AMBARELLA

17.3.1.1. Company Overview

17.3.1.2. Company Footprints

17.3.1.3. Production Locations

17.3.1.4. Product Portfolio

17.3.1.5. Competitors & Customers

17.3.1.6. Subsidiaries & Parent Organization

17.3.1.7. Recent Developments

17.3.1.8. Financial Analysis

17.3.1.9. Profitability

17.3.1.10. Revenue Share

17.3.1.11. Executive Bios

17.3.2. Aptiv plc

17.3.2.1. Company Overview

17.3.2.2. Company Footprints

17.3.2.3. Production Locations

17.3.2.4. Product Portfolio

17.3.2.5. Competitors & Customers

17.3.2.6. Subsidiaries & Parent Organization

17.3.2.7. Recent Developments

17.3.2.8. Financial Analysis

17.3.2.9. Profitability

17.3.2.10. Revenue Share

17.3.2.11. Executive Bios

17.3.3. Autoliv Inc.

17.3.3.1. Company Overview

17.3.3.2. Company Footprints

17.3.3.3. Production Locations

17.3.3.4. Product Portfolio

17.3.3.5. Competitors & Customers

17.3.3.6. Subsidiaries & Parent Organization

17.3.3.7. Recent Developments

17.3.3.8. Financial Analysis

17.3.3.9. Profitability

17.3.3.10. Revenue Share

17.3.3.11. Executive Bios

17.3.4. Automated Engineering INC (AEI)

17.3.4.1. Company Overview

17.3.4.2. Company Footprints

17.3.4.3. Production Locations

17.3.4.4. Product Portfolio

17.3.4.5. Competitors & Customers

17.3.4.6. Subsidiaries & Parent Organization

17.3.4.7. Recent Developments

17.3.4.8. Financial Analysis

17.3.4.9. Profitability

17.3.4.10. Revenue Share

17.3.4.11. Executive Bios

17.3.5. Brigade Electronics

17.3.5.1. Company Overview

17.3.5.2. Company Footprints

17.3.5.3. Production Locations

17.3.5.4. Product Portfolio

17.3.5.5. Competitors & Customers

17.3.5.6. Subsidiaries & Parent Organization

17.3.5.7. Recent Developments

17.3.5.8. Financial Analysis

17.3.5.9. Profitability

17.3.5.10. Revenue Share

17.3.5.11. Executive Bios

17.3.6. Clarion Co., Ltd.

17.3.6.1. Company Overview

17.3.6.2. Company Footprints

17.3.6.3. Production Locations

17.3.6.4. Product Portfolio

17.3.6.5. Competitors & Customers

17.3.6.6. Subsidiaries & Parent Organization

17.3.6.7. Recent Developments

17.3.6.8. Financial Analysis

17.3.6.9. Profitability

17.3.6.10. Revenue Share

17.3.6.11. Executive Bios

17.3.7. Continental AG

17.3.7.1. Company Overview

17.3.7.2. Company Footprints

17.3.7.3. Production Locations

17.3.7.4. Product Portfolio

17.3.7.5. Competitors & Customers

17.3.7.6. Subsidiaries & Parent Organization

17.3.7.7. Recent Developments

17.3.7.8. Financial Analysis

17.3.7.9. Profitability

17.3.7.10. Revenue Share

17.3.7.11. Executive Bios

17.3.8. Denso Corporation

17.3.8.1. Company Overview

17.3.8.2. Company Footprints

17.3.8.3. Production Locations

17.3.8.4. Product Portfolio

17.3.8.5. Competitors & Customers

17.3.8.6. Subsidiaries & Parent Organization

17.3.8.7. Recent Developments

17.3.8.8. Financial Analysis

17.3.8.9. Profitability

17.3.8.10. Revenue Share

17.3.8.11. Executive Bios

17.3.9. FAURECIA

17.3.9.1. Company Overview

17.3.9.2. Company Footprints

17.3.9.3. Production Locations

17.3.9.4. Product Portfolio

17.3.9.5. Competitors & Customers

17.3.9.6. Subsidiaries & Parent Organization

17.3.9.7. Recent Developments

17.3.9.8. Financial Analysis

17.3.9.9. Profitability

17.3.9.10. Revenue Share

17.3.9.11. Executive Bios

17.3.10. FICOSA International

17.3.10.1. Company Overview

17.3.10.2. Company Footprints

17.3.10.3. Production Locations

17.3.10.4. Product Portfolio

17.3.10.5. Competitors & Customers

17.3.10.6. Subsidiaries & Parent Organization

17.3.10.7. Recent Developments

17.3.10.8. Financial Analysis

17.3.10.9. Profitability

17.3.10.10. Revenue Share

17.3.10.11. Executive Bios

17.3.11. FLIR SYSTEMS

17.3.11.1. Company Overview

17.3.11.2. Company Footprints

17.3.11.3. Production Locations

17.3.11.4. Product Portfolio

17.3.11.5. Competitors & Customers

17.3.11.6. Subsidiaries & Parent Organization

17.3.11.7. Recent Developments

17.3.11.8. Financial Analysis

17.3.11.9. Profitability

17.3.11.10. Revenue Share

17.3.11.11. Executive Bios

17.3.12. Gentex Corporation

17.3.12.1. Company Overview

17.3.12.2. Company Footprints

17.3.12.3. Production Locations

17.3.12.4. Product Portfolio

17.3.12.5. Competitors & Customers

17.3.12.6. Subsidiaries & Parent Organization

17.3.12.7. Recent Developments

17.3.12.8. Financial Analysis

17.3.12.9. Profitability

17.3.12.10. Revenue Share

17.3.12.11. Executive Bios

17.3.13. Hella KGaA Hueck & Co.

17.3.13.1. Company Overview

17.3.13.2. Company Footprints

17.3.13.3. Production Locations

17.3.13.4. Product Portfolio

17.3.13.5. Competitors & Customers

17.3.13.6. Subsidiaries & Parent Organization

17.3.13.7. Recent Developments

17.3.13.8. Financial Analysis

17.3.13.9. Profitability

17.3.13.10. Revenue Share

17.3.13.11. Executive Bios

17.3.14. Hitachi Astemo LTD

17.3.14.1. Company Overview

17.3.14.2. Company Footprints

17.3.14.3. Production Locations

17.3.14.4. Product Portfolio

17.3.14.5. Competitors & Customers

17.3.14.6. Subsidiaries & Parent Organization

17.3.14.7. Recent Developments

17.3.14.8. Financial Analysis

17.3.14.9. Profitability

17.3.14.10. Revenue Share

17.3.14.11. Executive Bios

17.3.15. HYUNDAI MOBIS

17.3.15.1. Company Overview

17.3.15.2. Company Footprints

17.3.15.3. Production Locations

17.3.15.4. Product Portfolio

17.3.15.5. Competitors & Customers

17.3.15.6. Subsidiaries & Parent Organization

17.3.15.7. Recent Developments

17.3.15.8. Financial Analysis

17.3.15.9. Profitability

17.3.15.10. Revenue Share

17.3.15.11. Executive Bios

17.3.16. Kyocera Corporation

17.3.16.1. Company Overview

17.3.16.2. Company Footprints

17.3.16.3. Production Locations

17.3.16.4. Product Portfolio

17.3.16.5. Competitors & Customers

17.3.16.6. Subsidiaries & Parent Organization

17.3.16.7. Recent Developments

17.3.16.8. Financial Analysis

17.3.16.9. Profitability

17.3.16.10. Revenue Share

17.3.16.11. Executive Bios

17.3.17. Magna International In

17.3.17.1. Company Overview

17.3.17.2. Company Footprints

17.3.17.3. Production Locations

17.3.17.4. Product Portfolio

17.3.17.5. Competitors & Customers

17.3.17.6. Subsidiaries & Parent Organization

17.3.17.7. Recent Developments

17.3.17.8. Financial Analysis

17.3.17.9. Profitability

17.3.17.10. Revenue Share

17.3.17.11. Executive Bios

17.3.18. MCNEX CO

17.3.18.1. Company Overview

17.3.18.2. Company Footprints

17.3.18.3. Production Locations

17.3.18.4. Product Portfolio

17.3.18.5. Competitors & Customers

17.3.18.6. Subsidiaries & Parent Organization

17.3.18.7. Recent Developments

17.3.18.8. Financial Analysis

17.3.18.9. Profitability

17.3.18.10. Revenue Share

17.3.18.11. Executive Bios

17.3.19. MOBILEYE

17.3.19.1. Company Overview

17.3.19.2. Company Footprints

17.3.19.3. Production Locations

17.3.19.4. Product Portfolio

17.3.19.5. Competitors & Customers

17.3.19.6. Subsidiaries & Parent Organization

17.3.19.7. Recent Developments

17.3.19.8. Financial Analysis

17.3.19.9. Profitability

17.3.19.10. Revenue Share

17.3.19.11. Executive Bios

17.3.20. Omnivision Technologies Inc.

17.3.20.1. Company Overview

17.3.20.2. Company Footprints

17.3.20.3. Production Locations

17.3.20.4. Product Portfolio

17.3.20.5. Competitors & Customers

17.3.20.6. Subsidiaries & Parent Organization

17.3.20.7. Recent Developments

17.3.20.8. Financial Analysis

17.3.20.9. Profitability

17.3.20.10. Revenue Share

17.3.20.11. Executive Bios

17.3.21. Panasonic Corporation

17.3.21.1. Company Overview

17.3.21.2. Company Footprints

17.3.21.3. Production Locations

17.3.21.4. Product Portfolio

17.3.21.5. Competitors & Customers

17.3.21.6. Subsidiaries & Parent Organization

17.3.21.7. Recent Developments

17.3.21.8. Financial Analysis

17.3.21.9. Profitability

17.3.21.10. Revenue Share

17.3.21.11. Executive Bios

17.3.22. Robert Bosch GmbH

17.3.22.1. Company Overview

17.3.22.2. Company Footprints

17.3.22.3. Production Locations

17.3.22.4. Product Portfolio

17.3.22.5. Competitors & Customers

17.3.22.6. Subsidiaries & Parent Organization

17.3.22.7. Recent Developments

17.3.22.8. Financial Analysis

17.3.22.9. Profitability

17.3.22.10. Revenue Share

17.3.22.11. Executive Bios

17.3.23. Samsung Electro-Mechanics

17.3.23.1. Company Overview

17.3.23.2. Company Footprints

17.3.23.3. Production Locations

17.3.23.4. Product Portfolio

17.3.23.5. Competitors & Customers

17.3.23.6. Subsidiaries & Parent Organization

17.3.23.7. Recent Developments

17.3.23.8. Financial Analysis

17.3.23.9. Profitability

17.3.23.10. Revenue Share

17.3.23.11. Executive Bios

17.3.24. Samvardhana Motherson Reflected

17.3.24.1. Company Overview

17.3.24.2. Company Footprints

17.3.24.3. Production Locations

17.3.24.4. Product Portfolio

17.3.24.5. Competitors & Customers

17.3.24.6. Subsidiaries & Parent Organization

17.3.24.7. Recent Developments

17.3.24.8. Financial Analysis

17.3.24.9. Profitability

17.3.24.10. Revenue Share

17.3.24.11. Executive Bios

17.3.25. Sony Group Corporation

17.3.25.1. Company Overview

17.3.25.2. Company Footprints

17.3.25.3. Production Locations

17.3.25.4. Product Portfolio

17.3.25.5. Competitors & Customers

17.3.25.6. Subsidiaries & Parent Organization

17.3.25.7. Recent Developments

17.3.25.8. Financial Analysis

17.3.25.9. Profitability

17.3.25.10. Revenue Share

17.3.25.11. Executive Bios

17.3.26. STONKAM CO. LTD

17.3.26.1. Company Overview

17.3.26.2. Company Footprints

17.3.26.3. Production Locations

17.3.26.4. Product Portfolio

17.3.26.5. Competitors & Customers

17.3.26.6. Subsidiaries & Parent Organization

17.3.26.7. Recent Developments

17.3.26.8. Financial Analysis

17.3.26.9. Profitability

17.3.26.10. Revenue Share

17.3.26.11. Executive Bios

17.3.27. Valeo S.A

17.3.27.1. Company Overview

17.3.27.2. Company Footprints

17.3.27.3. Production Locations

17.3.27.4. Product Portfolio

17.3.27.5. Competitors & Customers

17.3.27.6. Subsidiaries & Parent Organization

17.3.27.7. Recent Developments

17.3.27.8. Financial Analysis

17.3.27.9. Profitability

17.3.27.10. Revenue Share

17.3.27.11. Executive Bios

17.3.28. VEONEER

17.3.28.1. Company Overview

17.3.28.2. Company Footprints

17.3.28.3. Production Locations

17.3.28.4. Product Portfolio

17.3.28.5. Competitors & Customers

17.3.28.6. Subsidiaries & Parent Organization

17.3.28.7. Recent Developments

17.3.28.8. Financial Analysis

17.3.28.9. Profitability

17.3.28.10. Revenue Share

17.3.28.11. Executive Bios

17.3.29. ZF

17.3.29.1. Company Overview

17.3.29.2. Company Footprints

17.3.29.3. Production Locations

17.3.29.4. Product Portfolio

17.3.29.5. Competitors & Customers

17.3.29.6. Subsidiaries & Parent Organization

17.3.29.7. Recent Developments

17.3.29.8. Financial Analysis

17.3.29.9. Profitability

17.3.29.10. Revenue Share

17.3.29.11. Executive Bios

17.3.30. Other Key Players

17.3.30.1. Company Overview

17.3.30.2. Company Footprints

17.3.30.3. Production Locations

17.3.30.4. Product Portfolio

17.3.30.5. Competitors & Customers

17.3.30.6. Subsidiaries & Parent Organization

17.3.30.7. Recent Developments

17.3.30.8. Financial Analysis

17.3.30.9. Profitability

17.3.30.10. Revenue Share

17.3.30.11. Executive Bios

List of Tables

Table 1: Global Automotive Camera Market Volume ( Units) Forecast, by Product Type, 2017-2031

Table 2: Global Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 3: Global Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 4: Global Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 5: Global Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Table 6: Global Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 7: Global Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Table 8: Global Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 9: Global Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 10: Global Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 11: Global Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 12: Global Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 13: Global Automotive Camera Market Volume (Units) Forecast, by Region, 2017-2031

Table 14: Global Automotive Camera Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 15: North America Automotive Camera Market Volume ( Units) Forecast, by Product Type, 2017-2031

Table 16: North America Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 17: North America Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 18: North America Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 19: North America Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Table 20: North America Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 21: North America Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Table 22: North America Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 23: North America Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 24: North America Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 25: North America Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 26: North America Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 27: North America Automotive Camera Market Volume (Units) Forecast, by Country, 2017-2031

Table 28: North America Automotive Camera Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 29: Europe Automotive Camera Market Volume ( Units) Forecast, by Product Type, 2017-2031

Table 30: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 31: Europe Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 32: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 33: Europe Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Table 34: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 35: Europe Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Table 36: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 37: Europe Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 38: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 39: Europe Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 40: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 41: Europe Automotive Camera Market Volume (Units) Forecast, by Country, 2017-2031

Table 42: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 43: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 44: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 45: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 46: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Table 47: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 48: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Table 49: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 50: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 51: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 52: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 53: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 54: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Country, 2017-2031

Table 55: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 56: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 57: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 58: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 59: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Table 60: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 61: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Table 62: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 63: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 64: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 65: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 66: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 67: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Country, 2017-2031

Table 68: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 69: South America Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Table 70: South America Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Table 71: South America Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 72: South America Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Table 73: South America Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Table 74: South America Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Table 75: South America Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 76: South America Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 77: South America Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 78: South America Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2031

Table 79: South America Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 80: South America Automotive Camera Market Volume (Units) Forecast, by Country, 2017-2031

Table 81: South America Automotive Camera Market Value (US$ Mn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Camera Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 2: Global Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Figure 3: Global Automotive Camera Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023-2031

Figure 4: Global Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 5: Global Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 6: Global Automotive Camera Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 7: Global Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 8: Global Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 9: Global Automotive Camera Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 10: Global Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Figure 11: Global Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 12: Global Automotive Camera Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 13: Global Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Figure 14: Global Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 15: Global Automotive Camera Market, Incremental Opportunity, by Level of Automation, Value (US$ Mn), 2023-2031

Figure 16: Global Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2034

Figure 17: Global Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2034

Figure 18: Global Automotive Camera Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 19: Global Automotive Camera Market Volume (Units) Forecast, by Region, 2017-2031

Figure 20: Global Automotive Camera Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 21: Global Automotive Camera Market, Incremental Opportunity, by region, Value (US$ Mn), 2023-2031

Figure 22: North America Automotive Camera Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 23: North America Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Figure 24: North America Automotive Camera Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023-2031

Figure 25: North America Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 26: North America Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 27: North America Automotive Camera Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 28: North America Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 29: North America Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 30: North America Automotive Camera Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 31: North America Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Figure 32: North America Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 33: North America Automotive Camera Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 34: North America Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Figure 35: North America Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 36: North America Automotive Camera Market, Incremental Opportunity, by Level of Automation, Value (US$ Mn), 2023-2031

Figure 37: North America Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2034

Figure 38: North America Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2034

Figure 39: North America Automotive Camera Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 40: North America Automotive Camera Market Volume (Units) Forecast, by Country, 2017-2031

Figure 41: North America Automotive Camera Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 42: North America Automotive Camera Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 43: Europe Automotive Camera Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 44: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Figure 45: Europe Automotive Camera Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023-2031

Figure 46: Europe Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 47: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 48: Europe Automotive Camera Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 49: Europe Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 50: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 51: Europe Automotive Camera Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 52: Europe Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Figure 53: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 54: Europe Automotive Camera Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 55: Europe Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Figure 56: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 57: Europe Automotive Camera Market, Incremental Opportunity, by Level of Automation, Value (US$ Mn), 2023-2031

Figure 58: Europe Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2034

Figure 59: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2034

Figure 60: Europe Automotive Camera Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 61: Europe Automotive Camera Market Volume (Units) Forecast, by Country, 2017-2031

Figure 62: Europe Automotive Camera Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 63: Europe Automotive Camera Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 64: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 65: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Figure 66: Asia Pacific Automotive Camera Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023-2031

Figure 67: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 66: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 67: Asia Pacific Automotive Camera Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 68: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 69: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 70: Asia Pacific Automotive Camera Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 71: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Figure 72: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 73: Asia Pacific Automotive Camera Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 74: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Figure 75: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 76: Asia Pacific Automotive Camera Market, Incremental Opportunity, by Level of Automation, Value (US$ Mn), 2023-2031

Figure 77: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2034

Figure 78: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2034

Figure 79: Asia Pacific Automotive Camera Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 80: Asia Pacific Automotive Camera Market Volume (Units) Forecast, by Country, 2017-2031

Figure 81: Asia Pacific Automotive Camera Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 82: Asia Pacific Automotive Camera Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 83: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 84: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Figure 85: Middle East & Africa Automotive Camera Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023-2031

Figure 86: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 87: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 88: Middle East & Africa Automotive Camera Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 89: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 90: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 91: Middle East & Africa Automotive Camera Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 92: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Figure 93: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 94: Middle East & Africa Automotive Camera Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 95: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Figure 96: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 97: Middle East & Africa Automotive Camera Market, Incremental Opportunity, by Level of Automation, Value (US$ Mn), 2023-2031

Figure 98: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2034

Figure 99: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2034

Figure 100: Middle East & Africa Automotive Camera Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 101: Middle East & Africa Automotive Camera Market Volume (Units) Forecast, by Country, 2017-2031

Figure 102: Middle East & Africa Automotive Camera Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 103: Middle East & Africa Automotive Camera Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031

Figure 104: South America Automotive Camera Market Volume (Units) Forecast, by Product Type, 2017-2031

Figure 105: South America Automotive Camera Market Value (US$ Mn) Forecast, by Product Type, 2017-2031

Figure 106: South America Automotive Camera Market, Incremental Opportunity, by Product Type, Value (US$ Mn), 2023-2031

Figure 107: South America Automotive Camera Market Volume (Units) Forecast, by Vehicle Type, 2017-2031

Figure 108: South America Automotive Camera Market Value (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Figure 109: South America Automotive Camera Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023-2031

Figure 110: South America Automotive Camera Market Volume (Units) Forecast, by Technology, 2017-2031

Figure 111: South America Automotive Camera Market Value (US$ Mn) Forecast, by Technology, 2017-2031

Figure 112: South America Automotive Camera Market, Incremental Opportunity, by Technology, Value (US$ Mn), 2023-2031

Figure 113: South America Automotive Camera Market Volume (Units) Forecast, by Application, 2017-2031

Figure 114: South America Automotive Camera Market Value (US$ Mn) Forecast, by Application, 2017-2031

Figure 115: South America Automotive Camera Market, Incremental Opportunity, by Application, Value (US$ Mn), 2023-2031

Figure 116: South America Automotive Camera Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Figure 117: South America Automotive Camera Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 118: South America Automotive Camera Market, Incremental Opportunity, by Level of Automation, Value (US$ Mn), 2023-2031

Figure 119: South America Automotive Camera Market Volume (Units) Forecast, by Sales Channel, 2017-2034

Figure 120: South America Automotive Camera Market Value (US$ Mn) Forecast, by Sales Channel, 2017-2034

Figure 121: South America Automotive Camera Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023-2031

Figure 122: South America Automotive Camera Market Volume (Units) Forecast, by Country, 2017-2031

Figure 123: South America Automotive Camera Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 124: South America Automotive Camera Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023-2031