Reports

Reports

The growth of the global 48V battery system market is driven by demand for fuel-efficient and low-emission vehicles. To meet global emissions regulations, automakers are looking for affordable options that do not require moving to a high-voltage electric platform. The cost, safety, and small footprint of 48V systems makes them a very good option for mild hybrids, two- and three-wheelers, and light commercial EVs, especially in emerging markets. The expanded use of start-stop systems and regenerative braking is also positively impacting the 48 Volt battery system market.

On the other hand, the most striking observation for the future is how the 48V architecture is fitting a wider range of vehicles, including small electric delivery vehicles, off-road equipment, and even marine systems. Manufacturers are looking for modular and scalable 48V solutions reacting to mobility and industries. The use of lithium-ion batteries and higher-level battery management systems (BMS) is expanding among 48V manufacturers to improve performance, efficiency, and safety.

Many automotive OEMs and battery technology companies are investing heavily in 48V systems. Many OEMs in the developed markets (i.e., Continental, Valeo, Bosch, and Mahle) are now introducing integrated 48V mild hybrid technologies, and there is a myriad of players in regional markets, particularly India and Southeast Asia who are adopting the architecture for electric scooters, electric rickshaws, and small EVs. Collaborations between component makers and start-up EV companies are also multiplying to expedite innovation and localization and therefore broaden the adoption of 48V technology.

A 48 Volt battery system is an electric storage solution that runs at a nominal voltage level of 48 Volts. Between the conventional 12V systems and high-voltage electric powertrains, it offers higher power and efficiency without the additional complexity and safety issues of high-voltage configurations. It is largely employed in automotive, industrial, and light electric vehicle applications.

48V battery technology has emerged as a viable option for partial electrification of vehicles. The technology was first introduced in mild hybrid electric vehicles (MHEVs) where it offered the best combination of performance, cost, and safety. By enabling engine start-stop, electric boost, and regenerative braking into vehicles, the 48V technology allows manufacturers to also reduce emissions and increase efficiency while moving away from high-voltage fully electric systems. With its small footprint and reduced safety risk, it makes sense for a much wider variety of low-to-mid power applications.

There are a number of types of 48V battery systems depending on their configuration and application. First, Mild Hybrid 48V Systems are used typically in MHEVs, wherein they provide assistance in torque delivery, regenerative braking, and idle start-stop features. Second, 48V Start-Stop Systems are more straightforward arrangements that are intended to turn off the internal combustion engine when in idle mode and restart it immediately to enhance fuel efficiency. Third, electric two-wheelers, three-wheelers, and small delivery vehicles utilize 48V Full Electric Systems and provide a clean, economical urban mobility option. Finally, Industrial and Off-Highway Systems employ 48V architecture for driving forklifts, AGVs, and light equipment where electrical safety and medium power requirements are critical.

The 48V battery system is widely used across powering mild hybrid functions in vehicles, electric two- and three-wheelers for urban transport, and light commercial vehicles like delivery vans. It also supports off-highway and industrial equipment such as forklifts and golf carts, as well as marine, recreational, and solar storage applications where compact, safe energy storage is needed.

| Attribute | Detail |

|---|---|

| 48 Volt Battery System Market Drivers |

|

Cost-effective hybridization, without the expense or complexity of conventional hybrids or electric powertrains, is one of the strongest drivers to 48-volt battery systems. This is an extraordinary opportunity for automakers to fulfill their fuel economy and emissions obligations without a complete shift in vehicle architecture.

For example, Ford's EcoBoost Hybrid system, recently launched in the Ford Focus and Fiesta models, integrates a 48V belt driven starter-generator and lithium-ion battery that provided up to 17% fuel economy and lower CO₂ emissions, all while keeping performance and driving dynamics consistent. Ford provided a low-cost option in harnessing 48V battery systems that will not have the high-voltage limitations of a conventional hybrid, thus accelerating the rate and pace of electrification for manufacturers without additional costs and risk. Low-cost solutions are important in price sensitive markets and allow manufacturers to upgrade their existing internal combustion engine (ICE) platforms without the major redesigns.

Consumer demand for mild hybrid electric vehicles (MHEVs) is on the rise. Consumers are looking for greener vehicles that are not too expensive and do not limit range when compared to ICE vehicles. MHEVs that have been produced with 48V systems provide a strong option. They offer a stronger combination of fuel savings, acceleration, and possible reduction of emissions with no change in driving habits or need to charge/recharge there is.

For example, the recently launched 2025 Toyota Fortuner Neo Drive in India is a 48V mild hybrid system that has improved mileage as well as improved start-stop function in the city. The acceptance of MHEVs in both - developed and developing markets contorts traditional consumer expectations while enabling a practical and incremental step toward conscious consumption.

There is less repulsion toward low emissions vehicles. Consumers are more accepting of reasonable utility, performance, and cost. MHEVs would have a role in sedans, SUVs, and potentially commercial or work vehicles. Automakers are converging to implement 48V systems across all automobile categories quickly.

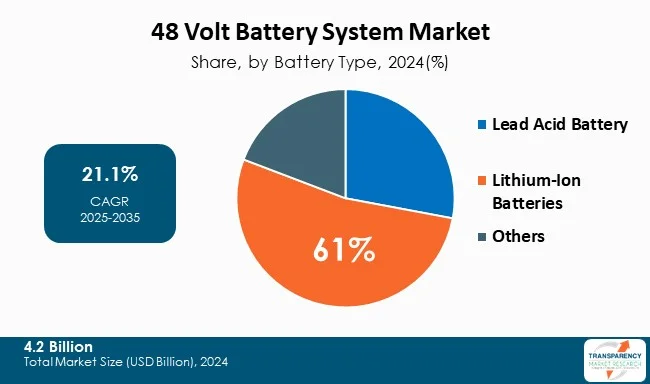

The lithium-ion batteries segment is the leading segment in terms of revenue in the global 48 Volt battery system market. They have the highest energy density, cycle life, and are the fastest charging ones, thereby making them the leading energy storage option. In comparison with the other options such as lead‑acid batteries, lithium-ion batteries take advantage of both - efficiency and performance, which makes them the energy embrace source for small applications as they require a compact and reliable source of power. This is especially important as it relates to thermal dynamics and conversion systems in mild hybrid electric vehicles (MHEVs). These technologies have traditionally used 48‑Volt systems.

However, 48‑Volt systems are being adopted more frequently to improve fuel economy and decrease emissions. As global currents toward electrification gains momentum, lithium‑ion batteries are supporting innovation in 48‑Volt systems and the continued growth of the segment.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia Pacific region is leading the global 48 Volt battery system market, primarily due to the fast pace of electrification of vehicles and high demand for energy-efficient automotive applications. The region incorporates a large manufacturing base that feeds the automotive sector, along with an established electronics industry that enables manufacturing and integration of 48‑Volt systems at a greater scale.

The region continues to lead in the deployment of mild hybrids electric vehicles (MHEVs) and other electrified transport; moreover, the Asia Pacific region is likely to continue leading in power system innovation. The continued growth of the automotive industry in terms of mobility and electrification will be supported by continued investments fostering research and development, and infrastructure in cleaner and more efficient power systems.

Key players are adopting several initiatives such as launching advanced 48V mild hybrid systems, entering into partnership with component suppliers for cost-efficient integration, and expanding MHEV offerings across vehicle segments. They are also investing in modular platforms for enabling faster and scalable deployment across global markets.

A123 Systems LLC, American Battery Solutions Inc., BorgWarner Inc., Continental AG, Delphi technologies, East Penn Manufacturing Company, EnerSys, EVE Energy Co., Ltd., GS Yuasa Corporation, Hitachi, Ltd., Johnson Controls International Plc, Lear Corporation, MAHLE Powertrain Ltd, PowerTech Systems, Robert Bosch GmbH, SEALED ENERGY SYSTEMS, Valeo SA, Vicor Corporation, and ZF Friedrichshafen AG are the key players in 48 Volt Battery System market.

Each of these players has been profiled in the 48 Volt battery system market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 4.2 Bn |

| Forecast Value in 2035 | US$ 51.5 Bn |

| CAGR | 21.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| 48 Volt Battery System Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Components

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The 48 Volt battery system market was valued at US$ 4.2 Bn in 2024

The 48 Volt battery system market is projected to reach US$ 51.5 Bn by 2035

Cost‑effective hybridization and growing consumer demand for mild hybrid vehicles (MHEVs)

The CAGR is anticipated to be 21.1% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

A123 Systems LLC, American Battery Solutions Inc., BorgWarner Inc., Continental AG, Delphi technologies, East Penn Manufacturing Company, EnerSys, EVE Energy Co., Ltd., GS Yuasa Corporation, Hitachi, Ltd., Johnson Controls International Plc, Lear Corporation, MAHLE Powertrain Ltd, PowerTech Systems, Robert Bosch GmbH, SEALED ENERGY SYSTEMS, Valeo SA, Vicor Corporation, and ZF Friedrichshafen AG, among others

Table 01: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 02: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 03: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 04: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 05: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 06: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 07: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 08: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 09: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 10: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 11: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 12: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 13: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 14: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 15: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 16: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 17: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 18: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 19: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 20: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 21: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 22: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 23: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 24: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 25: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 26: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 27: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 28: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 29: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 30: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 31: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 32: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 33: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 34: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 35: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 36: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 37: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 38: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 39: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 40: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 41: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 42: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 43: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 44: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 45: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 46: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 47: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 48: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 49: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 50: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 51: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 52: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 53: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 54: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 55: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 56: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 57: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 58: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 59: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 60: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 61: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 62: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 63: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 64: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 65: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 66: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 67: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 68: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 69: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 70: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 71: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 72: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 73: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 74: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 75: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 76: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 77: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 78: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 79: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 80: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 81: France 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 82: France 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 83: France 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 84: France 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 85: France 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 86: France 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 87: France 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 88: France 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 89: France 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 90: France 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 91: France 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 92: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 93: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 94: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 95: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 96: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 97: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 98: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 99: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 100: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 101: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 102: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 103: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 104: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 105: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 106: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 107: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 108: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 109: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 110: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 111: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 112: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 113: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 114: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 115: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 116: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 117: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 118: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 119: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 120: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 121: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 122: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 123: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 124: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 125: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 126: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 127: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 128: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 129: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 130: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 131: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 132: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 133: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 134: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 135: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 136: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 137: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 138: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 139: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 140: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 141: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 142: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 143: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 144: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 145: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 146: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 147: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 148: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 149: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 150: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 151: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 152: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 153: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 154: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 155: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 156: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 157: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 158: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 159: China 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 160: China 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 161: China 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 162: China 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 163: China 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 164: China 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 165: China 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 166: China 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 167: China 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 168: China 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 169: China 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 170: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 171: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 172: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 173: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 174: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 175: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 176: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 177: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 178: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 179: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 180: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 181: India 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 182: India 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 183: India 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 184: India 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 185: India 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 186: India 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 187: India 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 188: India 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 189: India 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 190: India 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 191: India 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 192: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 193: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 194: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 195: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 196: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 197: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 198: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 199: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 200: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 201: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 202: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 203: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 204: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 205: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 206: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 207: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 208: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 209: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 210: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 211: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 212: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 213: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 214: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 215: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 216: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 217: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 218: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 219: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 220: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 221: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 222: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 223: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 224: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 225: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 226: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 227: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 228: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 229: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 230: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 231: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 232: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 233: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 234: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 235: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 236: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 237: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 238: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 239: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 240: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 241: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 242: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 243: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 244: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 245: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 246: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 247: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 248: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 249: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 250: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 251: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 252: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 253: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 254: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 255: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 256: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 257: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 258: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 259: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 260: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 261: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 262: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 263: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 264: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 265: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 266: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 267: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 268: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 269: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 270: Rest of Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 271: Rest of Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 272: Rest of Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 273: Rest of Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 274: Rest of Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 275: Rest of Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 276: Rest of Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 277: Rest of Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 278: Rest of Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 279: Rest of Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 280: Rest of Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 281: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 282: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 283: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 284: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 285: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 286: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 287: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 288: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 289: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 290: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 291: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 292: Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 293: GCC Countries 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 294: GCC Countries 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 295: GCC Countries 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 296: GCC Countries 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 297: GCC Countries 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 298: GCC Countries 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 299: GCC Countries 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 300: GCC Countries 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 301: GCC Countries 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 302: GCC Countries 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 303: GCC Countries 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 304: South Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 305: South Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 306: South Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 307: South Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 308: South Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 309: South Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 310: South Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 311: South Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 312: South Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 313: South Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 314: South Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Table 315: Rest of Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Components, 2020 to 2035

Table 316: Rest of Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Architecture, 2020 to 2035

Table 317: Rest of Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Battery Type, 2020 to 2035

Table 318: Rest of Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lead Acid Battery, 2020 to 2035

Table 319: Rest of Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Lithium-Ion Batteries, 2020 to 2035

Table 320: Rest of Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 321: Rest of Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Automotive, 2020 to 2035

Table 322: Rest of Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Industrial, 2020 to 2035

Table 323: Rest of Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Marine, 2020 to 2035

Table 324: Rest of Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Energy and Utility, 2020 to 2035

Table 325: Rest of Middle East and Africa 48 Volt Battery System Market Value (US$ Mn) Forecast, by Sales Channel, 2020 to 2035

Figure 01: Global 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 03: Global 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 04: Global 48 Volt Battery System Market Revenue (US$ Mn), by AC/DC Inverter, 2020 to 2035

Figure 05: Global 48 Volt Battery System Market Revenue (US$ Mn), by 48-Volt Lithium-Ion Battery, 2020 to 2035

Figure 06: Global 48 Volt Battery System Market Revenue (US$ Mn), by Battery Controller, 2020 to 2035

Figure 07: Global 48 Volt Battery System Market Revenue (US$ Mn), by Power Distribution Box, 2020 to 2035

Figure 08: Global 48 Volt Battery System Market Revenue (US$ Mn), by Other Components, 2020 to 2035

Figure 09: Global 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 10: Global 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 11: Global 48 Volt Battery System Market Revenue (US$ Mn), by Crankshaft Mounted, 2020 to 2035

Figure 12: Global 48 Volt Battery System Market Revenue (US$ Mn), by Belt Driven, 2020 to 2035

Figure 13: Global 48 Volt Battery System Market Revenue (US$ Mn), by Transmission Output Shaft, 2020 to 2035

Figure 14: Global 48 Volt Battery System Market Revenue (US$ Mn), by Dual-Clutch Transmission-Mounted, 2020 to 2035

Figure 15: Global 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 16: Global 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 17: Global 48 Volt Battery System Market Revenue (US$ Mn), by Lead Acid Battery, 2020 to 2035

Figure 18: Global 48 Volt Battery System Market Revenue (US$ Mn), by Lithium-Ion Batteries, 2020 to 2035

Figure 19: Global 48 Volt Battery System Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 20: Global 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 21: Global 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 22: Global 48 Volt Battery System Market Revenue (US$ Mn), by Automotive, 2020 to 2035

Figure 23: Global 48 Volt Battery System Market Revenue (US$ Mn), by Industrial, 2020 to 2035

Figure 24: Global 48 Volt Battery System Market Revenue (US$ Mn), by Marine, 2020 to 2035

Figure 25: Global 48 Volt Battery System Market Revenue (US$ Mn), by Energy and Utility, 2020 to 2035

Figure 26: Global 48 Volt Battery System Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 27: Global 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 28: Global 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 29: Global 48 Volt Battery System Market Revenue (US$ Mn), by OEM, 2020 to 2035

Figure 30: Global 48 Volt Battery System Market Revenue (US$ Mn), by Aftermarket, 2020 to 2035

Figure 31: Global 48 Volt Battery System Market Value Share Analysis, by Region, 2024 and 2035

Figure 32: Global 48 Volt Battery System Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 33: North America 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 34: North America 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 35: North America 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 36: North America 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 37: North America 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 38: North America 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 39: North America 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 40: North America 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 41: North America 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 42: North America 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 43: North America 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 44: North America 48 Volt Battery System Market Value Share Analysis, by Country, 2024 and 2035

Figure 45: North America 48 Volt Battery System Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 46: U.S. 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 47: U.S. 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 48: U.S. 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 49: U.S. 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 50: U.S. 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 51: U.S. 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 52: U.S. 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 53: U.S. 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 54: U.S. 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 55: U.S. 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 56: U.S. 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 57: Canada 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 58: Canada 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 59: Canada 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 60: Canada 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 61: Canada 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 62: Canada 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 63: Canada 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 64: Canada 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 65: Canada 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 66: Canada 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 67: Canada 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 68: Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 69: Europe 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 70: Europe 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 71: Europe 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 72: Europe 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 73: Europe 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 74: Europe 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 75: Europe 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 76: Europe 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 77: Europe 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 78: Europe 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 79: Europe 48 Volt Battery System Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 80: Europe 48 Volt Battery System Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 81: Germany 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 82: Germany 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 83: Germany 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 84: Germany 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 85: Germany 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 86: Germany 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 87: Germany 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 88: Germany 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 89: Germany 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 90: Germany 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 91: Germany 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 92: U.K. 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 93: U.K. 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 94: U.K. 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 95: U.K. 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 96: U.K. 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 97: U.K. 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 98: U.K. 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 99: U.K. 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 100: U.K. 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 101: U.K. 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 102: U.K. 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 103: France 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 104: France 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 105: France 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 106: France 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 107: France 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 108: France 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 109: France 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 110: France 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 111: France 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 112: France 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 113: France 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 114: Italy 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 115: Italy 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 116: Italy 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 117: Italy 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 118: Italy 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 119: Italy 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 120: Italy 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 121: Italy 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 122: Italy 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 123: Italy 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 124: Italy 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 125: Spain 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 126: Spain 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 127: Spain 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 128: Spain 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 129: Spain 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 130: Spain 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 131: Spain 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 132: Spain 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 133: Spain 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 134: Spain 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 135: Spain 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 136: Switzerland 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 137: Switzerland 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 138: Switzerland 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 139: Switzerland 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 140: Switzerland 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 141: Switzerland 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 142: Switzerland 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 143: Switzerland 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 144: Switzerland 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 145: Switzerland 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 146: Switzerland 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 147: The Netherlands 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 148: The Netherlands 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 149: The Netherlands 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 150: The Netherlands 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 151: The Netherlands 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 152: The Netherlands 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 153: The Netherlands 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 154: The Netherlands 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 155: The Netherlands 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 156: The Netherlands 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 157: The Netherlands 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 158: Rest of Europe 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 159: Rest of Europe 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 160: Rest of Europe 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 161: Rest of Europe 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 162: Rest of Europe 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 163: Rest of Europe 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 164: Rest of Europe 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 165: Rest of Europe 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 166: Rest of Europe 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 167: Rest of Europe 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 168: Rest of Europe 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 169: Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 170: Asia Pacific 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 171: Asia Pacific 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 172: Asia Pacific 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 173: Asia Pacific 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 174: Asia Pacific 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 175: Asia Pacific 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 176: Asia Pacific 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 177: Asia Pacific 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 178: Asia Pacific 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 179: Asia Pacific 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 180: Asia Pacific 48 Volt Battery System Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 181: Asia Pacific 48 Volt Battery System Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 182: China 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 183: China 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 184: China 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 185: China 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 186: China 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 187: China 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 188: China 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 189: China 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 190: China 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 191: China 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 192: China 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 193: Japan 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 194: Japan 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 195: Japan 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 196: Japan 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 197: Japan 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 198: Japan 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 199: Japan 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 200: Japan 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 201: Japan 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 202: Japan 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 203: Japan 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 204: India 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 205: India 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 206: India 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 207: India 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 208: India 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 209: India 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 210: India 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 211: India 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 212: India 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 213: India 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 214: India 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 215: South Korea 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 216: South Korea 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 217: South Korea 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 218: South Korea 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 219: South Korea 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 220: South Korea 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 221: South Korea 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 222: South Korea 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 223: South Korea 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 224: South Korea 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 225: South Korea 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 226: Australia and New Zealand 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 227: Australia and New Zealand 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 228: Australia and New Zealand 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 229: Australia and New Zealand 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 230: Australia and New Zealand 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 231: Australia and New Zealand 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 232: Australia and New Zealand 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 233: Australia and New Zealand 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 234: Australia and New Zealand 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 235: Australia and New Zealand 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 236: Australia and New Zealand 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 237: Rest of Asia Pacific 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 238: Rest of Asia Pacific 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 239: Rest of Asia Pacific 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 240: Rest of Asia Pacific 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 241: Rest of Asia Pacific 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 242: Rest of Asia Pacific 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 243: Rest of Asia Pacific 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 244: Rest of Asia Pacific 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 245: Rest of Asia Pacific 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 246: Rest of Asia Pacific 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 247: Rest of Asia Pacific 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 248: Latin America 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 249: Latin America 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 250: Latin America 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 251: Latin America 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 252: Latin America 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 253: Latin America 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 254: Latin America 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 255: Latin America 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 256: Latin America 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 257: Latin America 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 258: Latin America 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 259: Latin America 48 Volt Battery System Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 260: Latin America 48 Volt Battery System Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 261: Brazil 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 262: Brazil 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 263: Brazil 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 264: Brazil 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 265: Brazil 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 266: Brazil 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 267: Brazil 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 268: Brazil 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 269: Brazil 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 270: Brazil 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 271: Brazil 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 272: Mexico 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 273: Mexico 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 274: Mexico 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 275: Mexico 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 276: Mexico 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 277: Mexico 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 278: Mexico 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 279: Mexico 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 280: Mexico 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 281: Mexico 48 Volt Battery System Market Value Share Analysis, by Sales Channel, 2024 and 2035

Figure 282: Mexico 48 Volt Battery System Market Attractiveness Analysis, by Sales Channel, 2025 to 2035

Figure 283: Argentina 48 Volt Battery System Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 284: Argentina 48 Volt Battery System Market Value Share Analysis, by Components, 2024 and 2035

Figure 285: Argentina 48 Volt Battery System Market Attractiveness Analysis, by Components, 2025 to 2035

Figure 286: Argentina 48 Volt Battery System Market Value Share Analysis, by Architecture, 2024 and 2035

Figure 287: Argentina 48 Volt Battery System Market Attractiveness Analysis, by Architecture, 2025 to 2035

Figure 288: Argentina 48 Volt Battery System Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 289: Argentina 48 Volt Battery System Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 290: Argentina 48 Volt Battery System Market Value Share Analysis, by Application, 2024 and 2035

Figure 291: Argentina 48 Volt Battery System Market Attractiveness Analysis, by Application, 2025 to 2035