Reports

Reports

Analysts’ Viewpoint on Market Scenario

Rise in penetration and adoption of automated material handling solutions in storage facilities for food and beverage, fast-moving consumer goods, 3PL, retail, and CEP sectors is a key factor driving automated material handling market growth across the globe.

The automated material handling industry in Asia Pacific is expected to grow at a rapid pace due to investment from large number of market players along with the presence of a large number of end-use customers demanding automated material handling solutions. Another factor aiding Asia Pacific market development is the proactive actions of governments to support manufacturing industries and industrial automation in the region.

European countries including Germany, France, Austria, and Italy offer saturated market growth for established automated material handling system manufacturers. However, countries in eastern central Europe, such as Poland, and Nordic countries, are expected to offer lucrative market opportunities.

Additionally, manufacturers should focus on establishing strategic partnerships and collaborations with integrators to increase the sale of automated material handling systems and equipment, as they are majorly engaged with small and medium local potential end-use manufacturers of food and beverage, cold chain, personal care, nondurable goods such as paper, tissue, chemicals, durable good (electronics, machinery, components), apparel, pharmaceutical, automotive, retail, 3PL, courier, express and parcel services.

Automated material handling equipment and systems are vital to many warehouse service providers as they are essential to handle and store bulk warehouse materials. Primarily, automated material handling equipment or systems are designed to perform several operations such as moving, sorting, protecting, store, and controlling material through various developments at warehouses and storage facilities.

Automated material handling system offers improved cycle times, easier location of material, efficient use of labor, reduced contamination, compliance with regulatory standards, greater efficiency, reduce waste, lower costs, better use of warehouse space, and increased employee safety. According to automated material handling market forecast, various industrial manufacturers and warehouse experts across the globe are already suggesting extensive adoption of industrial automated material handling systems in the near future.

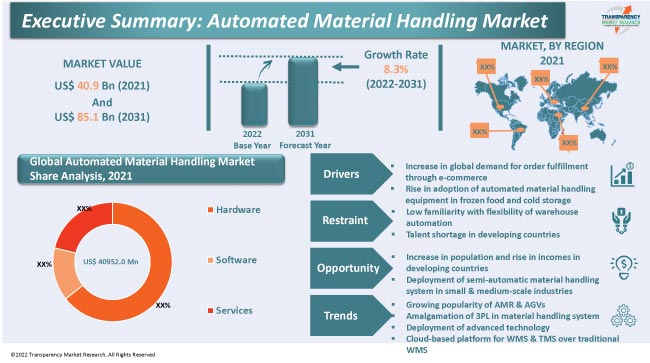

Rise in global demand for order fulfillment through e-commerce, increase in adoption of automated material handling equipment in frozen food and cold storage, and deployment of semi-automatic material handling system in small & medium-scale industries are some of the major factors driving automated material handling market development.

A 3PL arranges the whole process of order execution and owns it till the last-mile delivery. Wide element selections, omnichannel order fulfilment, one-day shipping options, and advanced order tracking have all become indispensable for any 3PL business to thrive. Consequently, automation has become an inevitable option for 3PL providers to cater these demands. Automated material handling solutions are satisfying this need of 3PL businesses and boosting the efficiency at every stage, from picking, sorting, kitting, and placing to assembly operation.

3PL service providers facilitate inventory management and handling peak season weights, particularly for fast moving consumer goods, food and beverage, apparel, hygiene, and personal care products. AI-powered solutions in 3PL inventory management offers various logistics platforms for automated inventory management and easier warehouse service.

Limited scalability or functionality of on-premise WMS, technical limitations, and risk of cybersecurity are a few challenges posed by outdated warehouse management systems. These are expected to be overcome by the cloud-based advanced warehouse management system and transportation management software by moving the operation, utilization, maintenance of a warehouse management system from an on premise solution to web-based platforms.

Cloud-based systems deliver the functionality to swap a complete suite of applications and organize warehouse and supply chain management, from obtaining through to concluding delivery. Rise in cloud-based WMS and TMS platforms to optimize capital investment with vast functionality is a prominent factor boosting the adoption of cloud-based WMS and TMS.

In terms of hardware, the automated storage and retrieval system (ASRS) segment held 26.5% share of global market demand in 2021. The segment is likely to expand at a growth rate of 10.5% during the forecast period. Demand for advanced ASRS solutions is rising due to an increasing need for optimal space utilization, expanding e-commerce industry on account of increasing digitalization, and surging demand for ASRS in automotive, food and beverage, pharmaceutical, and personal care.

ASRS systems offer several advantages such as increased productivity by approximately 67%, improved picking accuracy by up to 99.9%, and floor space recovery up to 85%. A reliable and efficient storage and retrieval system significantly reduces staff requirements and mitigates storage costs irrespective of the product. This system also provides a single access opening and significantly reduces travel time for goods pick-up and delivery.

According to the global automated material handling market analysis, North America held 33.5% of global market share in 2021. The U.S. is a significant market for vendors offering solutions for automated factories, warehouses, distribution centers, and storage facilities. The North America market is expected to grow at a significant pace during the forecast period owing to the early adoption of warehouse automation solutions in the region. The U.S. is on the verge of the fifth industrial revolution, where data is being used on a large scale for planning and execution of production activities that would require efficient automated material handling system while integrating the data with a wide variety of manufacturing systems throughout the supply chain.

Europe is also a major market for automated material handling, and held 29.4% share in 2021 due to the presence of several prominent manufacturing corporations in the European Union offering automated systems for wide range of industry verticals.

Asia Pacific is expected to offer lucrative business growth opportunities for automation providers owing to expansion of industrial control & factory automation solutions and expansion of the warehouse industry in the region. Growth of warehouse industry in Asia Pacific is expected to aid in the automated material handling market development, as it is a primary consumer of automated material handling systems. Opportunities for international trade of food and beverage products across major countries in Asia Pacific are increasing due to the presence of large consumer base and strong potential for food and beverage export in the region.

The global automated material handling industry is highly fragmented with established players having a strong hold on the market demand for material handling systems and equipment. Majority of companies are spending significantly on comprehensive research & development activities to develop fully automated, precise, and environment-friendly systems in order to boost their share in the global business.

Expansion of product portfolios and mergers and acquisitions are notable strategies adopted by the key players. Daifuku Co., Ltd., BEUMER GROUP, Dematic, ELETTRIC80 S.P.A., Fives Group, Honeywell International Inc. (Honeywell Intelligrated), Jungheinrich AG, Kardex, KNAPP AG, KUKA AG, Murata Machinery, Ltd., Blue Yonder Group, Inc., Datalogic S.p.A., Geekplus Technology Co., Ltd., GreyOrange, and Hikrobot Technology Co., Ltd. are the prominent entities operating in the automated material handling market.

Key players in the automated material handling market report have been profiled based on various parameters such as financial overview, business strategies, company overview, business segments, product portfolio, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 40.9 Bn |

|

Market Forecast Value in 2031 |

US$ 85.1 Bn |

|

Growth Rate (CAGR) |

8.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 40.9 Bn in 2021

It is expected to grow at a CAGR of 8.3% by 2031

The market is estimated to reach a value of US$ 85.1 Bn in 2031

Addverb Technologies Private Limited, BEUMER GROUP, Daifuku Co., Ltd., Dematic, ELETTRIC80 S.P.A., Fives Group, Honeywell International Inc. (Honeywell Intelligrated), Jungheinrich AG, Kardex, KNAPP AG, KUKA AG, MHS Global, Murata Machinery, Ltd., SCHAEFER SYSTEMS INTERNATIONAL PVT LTD., System Logistics S.p.A., TGW Logistics Group, Vanderlande Industries B.V., WITRON, Shanghai Quicktron Intelligent Technology Co., Ltd., Universal Robots, Blue Yonder Group, Inc., Datalogic S.p.A., Honeywell Inte

The U.S. accounted for 31.13% share in 2021

Based on offering, the hardware automated material handling segment is expected to hold 64.38% share of the market

Rise in popularity of AMR & AGVs, adoption of material handling system by 3PL, deployment of advanced technology, high preference for cloud-based platform for WMS & TMS over traditional WMS, and innovation in warehouse sortation system

Asia Pacific is more lucrative in the automated material handling market

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Automated Material Handling Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Supply Chain and Logistics Overview

4.2. Ecosystem Analysis

4.3. Equipment and System Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Porter Five Forces Analysis

4.6. Covid-19 Impact and Recovery Analysis

5. Global Automated Material Handling Market Analysis, by Offering

5.1. Automated Material Handling Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, by Offering, 2022-2031

5.1.1. Hardware

5.1.1.1. Automated Conveyors and Sortation Systems

5.1.1.2. Overhead Systems

5.1.1.3. Gantry Robots

5.1.1.4. Automated Storage and Retrieval System (ASRS)

5.1.1.4.1. 2-Way and 4-Way Shuttle

5.1.1.4.2. Unit-load and Mini-load

5.1.1.4.3. Carousel-based

5.1.1.4.4. Vertical Lift Module

5.1.1.5. Palletizing/De-Automated Material Handlings

5.1.1.6. Autonomous Guided Vehicles (AGV)

5.1.1.7. Autonomous Mobile Robots (AMR)

5.1.1.8. Order and Piece Picking Robots

5.1.1.9. Others

5.1.2. Software

5.1.2.1. WMS and WES

5.1.2.2. TMS

5.1.2.3. Automatic Identification and Data Capture (AIDC)

5.1.3. Services

5.2. Others Market Attractiveness Analysis, by Offering

6. Global Automated Material Handling Market Analysis, by Package Type

6.1. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Package Type, 2022-2031

6.1.1. Pallet

6.1.2. Containers

6.1.2.1. Bin

6.1.2.2. Tote

6.1.2.3. Bulk Container

6.1.3. Cartons

6.1.4. Others

6.2. Market Attractiveness Analysis, by Package Type

7. Global Automated Material Handling Market Analysis, by Industry Vertical

7.1. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2022-2031

7.1.1. Food & Beverage

7.1.1.1. Bakery

7.1.1.2. Food (dry)/Grocery

7.1.1.3. Beverage

7.1.1.4. Dairy

7.1.1.5. Convenience/Confectionary

7.1.1.6. Tobacco

7.1.1.7. Cold chain

7.1.2. Personal Care

7.1.3. Non-durable Goods

7.1.3.1. Paper

7.1.3.2. Tissue

7.1.3.3. Chemicals

7.1.4. Durable Good (Electronics, Machinery, Components)

7.1.5. Apparel

7.1.5.1. E-Commerce

7.1.5.2. Offline (Brick-mortar stores)

7.1.6. Pharmaceutical

7.1.7. Automotive

7.1.8. Retail

7.1.8.1. E-Commerce

7.1.8.2. Offline (Brick-mortar stores)

7.1.9. 3PL

7.1.10. Courier, Express and Parcel Services

7.1.11. Others

7.2. Market Attractiveness Analysis, by Industry Vertical

8. Global Automated Material Handling Market Analysis and Forecast, by Region

8.1. Automated Material Handling Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, by Region, 2022-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Automated Material Handling Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Automated Material Handling Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, by Offering, 2022-2031

9.3.1. Hardware

9.3.1.1. Automated Conveyors and Sortation Systems

9.3.1.2. Overhead Systems

9.3.1.3. Gantry Robots

9.3.1.4. Automated Storage and Retrieval System (ASRS)

9.3.1.4.1. 2-Way and 4-Way Shuttle

9.3.1.4.2. Unit-load and Mini-load

9.3.1.4.3. Carousel-based

9.3.1.4.4. Vertical Lift Module

9.3.1.5. Palletizing/De-Automated Material Handlings

9.3.1.6. Autonomous Guided Vehicles (AGV)

9.3.1.7. Autonomous Mobile Robots (AMR)

9.3.1.8. Order and Piece Picking Robots

9.3.1.9. Others

9.3.2. Software

9.3.2.1. WMS and WES

9.3.2.2. TMS

9.3.2.3. Automatic Identification and Data Capture (AIDC)

9.3.3. Services

9.4. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Package Type, 2022-2031

9.4.1. Pallet

9.4.2. Containers

9.4.2.1. Bin

9.4.2.2. Tote

9.4.2.3. Bulk Container

9.4.3. Cartons

9.4.4. Others

9.5. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2022-2031

9.5.1. Food & Beverage

9.5.1.1. Bakery

9.5.1.2. Food (dry)/Grocery

9.5.1.3. Beverage

9.5.1.4. Dairy

9.5.1.5. Convenience/Confectionary

9.5.1.6. Tobacco

9.5.1.7. Cold chain

9.5.2. Personal Care

9.5.3. Non-durable Goods

9.5.3.1. Paper

9.5.3.2. Tissue

9.5.3.3. Chemicals

9.5.4. Durable Good (Electronics, Machinery, Components)

9.5.5. Apparel

9.5.5.1. E-Commerce

9.5.5.2. Offline (Brick-mortar stores)

9.5.6. Pharmaceutical

9.5.7. Automotive

9.5.8. Retail

9.5.8.1. E-Commerce

9.5.8.2. Offline (Brick-mortar stores)

9.5.9. 3PL

9.5.10. Courier, Express and Parcel Services

9.5.11. Others

9.6. Automated Material Handling Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-Region, 2022-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Offering

9.7.2. By Package Type

9.7.3. By Industry Vertical

9.7.4. By Country/Sub-region

10. Europe Automated Material Handling Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Automated Material Handling Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, by Offering, 2022-2031

10.3.1. Hardware

10.3.1.1. Automated Conveyors and Sortation Systems

10.3.1.2. Overhead Systems

10.3.1.3. Gantry Robots

10.3.1.4. Automated Storage and Retrieval System (ASRS)

10.3.1.4.1. 2-Way and 4-Way Shuttle

10.3.1.4.2. Unit-load and Mini-load

10.3.1.4.3. Carousel-based

10.3.1.4.4. Vertical Lift Module

10.3.1.5. Palletizing/De-Automated Material Handlings

10.3.1.6. Autonomous Guided Vehicles (AGV)

10.3.1.7. Autonomous Mobile Robots (AMR)

10.3.1.8. Order and Piece Picking Robots

10.3.1.9. Others

10.3.2. Software

10.3.2.1. WMS and WES

10.3.2.2. TMS

10.3.2.3. Automatic Identification and Data Capture (AIDC)

10.3.3. Services

10.4. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Package Type, 2022-2031

10.4.1. Pallet

10.4.2. Containers

10.4.2.1. Bin

10.4.2.2. Tote

10.4.2.3. Bulk Container

10.4.3. Cartons

10.4.4. Others

10.5. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2022-2031

10.5.1. Food & Beverage

10.5.1.1. Bakery

10.5.1.2. Food (dry)/Grocery

10.5.1.3. Beverage

10.5.1.4. Dairy

10.5.1.5. Convenience/Confectionary

10.5.1.6. Tobacco

10.5.1.7. Cold chain

10.5.2. Personal Care

10.5.3. Non-durable Goods

10.5.3.1. Paper

10.5.3.2. Tissue

10.5.3.3. Chemicals

10.5.4. Durable Good (Electronics, Machinery, Components)

10.5.5. Apparel

10.5.5.1. E-Commerce

10.5.5.2. Offline (Brick-mortar stores)

10.5.6. Pharmaceutical

10.5.7. Automotive

10.5.8. Retail

10.5.8.1. E-Commerce

10.5.8.2. Offline (Brick-mortar stores)

10.5.9. 3PL

10.5.10. Courier, Express and Parcel Services

10.5.11. Others

10.6. Automated Material Handling Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, by Country & Sub-Region, 2022-2031

10.6.1. The U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Poland

10.6.5. Portugal

10.6.6. Italy

10.6.7. Spain

10.6.8. Austria

10.6.9. Switzerland

10.6.10. BeNeLux

10.6.11. Nordic

10.6.12. Hungary

10.6.13. Czech Republic

10.6.14. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Offering

10.7.2. By Package Type

10.7.3. By Industry Vertical

10.7.4. By Country/Sub-region

11. Asia Pacific Automated Material Handling Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Automated Material Handling Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, by Offering, 2022-2031

11.3.1. Hardware

11.3.1.1. Automated Conveyors and Sortation Systems

11.3.1.2. Overhead Systems

11.3.1.3. Gantry Robots

11.3.1.4. Automated Storage and Retrieval System (ASRS)

11.3.1.4.1. 2-Way and 4-Way Shuttle

11.3.1.4.2. Unit-load and Mini-load

11.3.1.4.3. Carousel-based

11.3.1.4.4. Vertical Lift Module

11.3.1.5. Palletizing/De-Automated Material Handlings

11.3.1.6. Autonomous Guided Vehicles (AGV)

11.3.1.7. Autonomous Mobile Robots (AMR)

11.3.1.8. Order and Piece Picking Robots

11.3.1.9. Others

11.3.2. Software

11.3.2.1. WMS and WES

11.3.2.2. TMS

11.3.2.3. Automatic Identification and Data Capture (AIDC)

11.3.3. Services

11.4. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Package Type, 2022-2031

11.4.1. Pallet

11.4.2. Containers

11.4.2.1. Bin

11.4.2.2. Tote

11.4.2.3. Bulk Container

11.4.3. Cartons

11.4.4. Others

11.5. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2022-2031

11.5.1. Food & Beverage

11.5.1.1. Bakery

11.5.1.2. Food (dry)/Grocery

11.5.1.3. Beverage

11.5.1.4. Dairy

11.5.1.5. Convenience/Confectionary

11.5.1.6. Tobacco

11.5.1.7. Cold chain

11.5.2. Personal Care

11.5.3. Non-durable Goods

11.5.3.1. Paper

11.5.3.2. Tissue

11.5.3.3. Chemicals

11.5.4. Durable Good (Electronics, Machinery, Components)

11.5.5. Apparel

11.5.5.1. E-Commerce

11.5.5.2. Offline (Brick-mortar stores)

11.5.6. Pharmaceutical

11.5.7. Automotive

11.5.8. Retail

11.5.8.1. E-Commerce

11.5.8.2. Offline (Brick-mortar stores)

11.5.9. 3PL

11.5.10. Courier, Express and Parcel Services

11.5.11. Others

11.6. Automated Material Handling Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, by Country & Sub-Region, 2022-2031

11.6.1. China

11.6.2. India

11.6.3. Japan

11.6.4. Singapore

11.6.5. Malaysia

11.6.6. Indonesia

11.6.7. Vietnam

11.6.8. Philippines

11.6.9. Thailand

11.6.10. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Offering

11.7.2. By Package Type

11.7.3. By Industry Vertical

11.7.4. By Country/Sub-region

12. Middle East & Africa Automated Material Handling Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Automated Material Handling Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, by Offering, 2022-2031

12.3.1. Hardware

12.3.1.1. Automated Conveyors and Sortation Systems

12.3.1.2. Overhead Systems

12.3.1.3. Gantry Robots

12.3.1.4. Automated Storage and Retrieval System (ASRS)

12.3.1.4.1. 2-Way and 4-Way Shuttle

12.3.1.4.2. Unit-load and Mini-load

12.3.1.4.3. Carousel-based

12.3.1.4.4. Vertical Lift Module

12.3.1.5. Palletizing/De-Automated Material Handlings

12.3.1.6. Autonomous Guided Vehicles (AGV)

12.3.1.7. Autonomous Mobile Robots (AMR)

12.3.1.8. Order and Piece Picking Robots

12.3.1.9. Others

12.3.2. Software

12.3.2.1. WMS and WES

12.3.2.2. TMS

12.3.2.3. Automatic Identification and Data Capture (AIDC)

12.3.3. Services

12.4. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Package Type, 2022-2031

12.4.1. Pallet

12.4.2. Containers

12.4.2.1. Bin

12.4.2.2. Tote

12.4.2.3. Bulk Container

12.4.3. Cartons

12.4.4. Others

12.5. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2022-2031

12.5.1. Food & Beverage

12.5.1.1. Bakery

12.5.1.2. Food (dry)/Grocery

12.5.1.3. Beverage

12.5.1.4. Dairy

12.5.1.5. Convenience/Confectionary

12.5.1.6. Tobacco

12.5.1.7. Cold chain

12.5.2. Personal Care

12.5.3. Non-durable Goods

12.5.3.1. Paper

12.5.3.2. Tissue

12.5.3.3. Chemicals

12.5.4. Durable Good (Electronics, Machinery, Components)

12.5.5. Apparel

12.5.5.1. E-Commerce

12.5.5.2. Offline (Brick-mortar stores)

12.5.6. Pharmaceutical

12.5.7. Automotive

12.5.8. Retail

12.5.8.1. E-Commerce

12.5.8.2. Offline (Brick-mortar stores)

12.5.9. 3PL

12.5.10. Courier, Express and Parcel Services

12.5.11. Others

12.6. Automated Material Handling Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, by Country & Sub-Region, 2022-2031

12.6.1. Israel

12.6.2. Egypt

12.6.3. Rest of the Middle East and Africa

12.7. Market Attractiveness Analysis

12.7.1. By Offering

12.7.2. By Package Type

12.7.3. By Industry Vertical

12.7.4. By Country/Sub-region

13. South America Automated Material Handling Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Automated Material Handling Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, by Offering, 2022-2031

13.3.1. Hardware

13.3.1.1. Automated Conveyors and Sortation Systems

13.3.1.2. Overhead Systems

13.3.1.3. Gantry Robots

13.3.1.4. Automated Storage and Retrieval System (ASRS)

13.3.1.4.1. 2-Way and 4-Way Shuttle

13.3.1.4.2. Unit-load and Mini-load

13.3.1.4.3. Carousel-based

13.3.1.4.4. Vertical Lift Module

13.3.1.5. Palletizing/De-Automated Material Handlings

13.3.1.6. Autonomous Guided Vehicles (AGV)

13.3.1.7. Autonomous Mobile Robots (AMR)

13.3.1.8. Order and Piece Picking Robots

13.3.1.9. Others

13.3.2. Software

13.3.2.1. WMS and WES

13.3.2.2. TMS

13.3.2.3. Automatic Identification and Data Capture (AIDC)

13.3.3. Services

13.4. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Package Type, 2022-2031

13.4.1. Pallet

13.4.2. Containers

13.4.2.1. Bin

13.4.2.2. Tote

13.4.2.3. Bulk Container

13.4.3. Cartons

13.4.4. Others

13.5. Automated Material Handling Market Size (US$ Mn) Analysis & Forecast, by Industry Vertical, 2022-2031

13.5.1. Food & Beverage

13.5.1.1. Bakery

13.5.1.2. Food (dry)/Grocery

13.5.1.3. Beverage

13.5.1.4. Dairy

13.5.1.5. Convenience/Confectionary

13.5.1.6. Tobacco

13.5.1.7. Cold chain

13.5.2. Personal Care

13.5.3. Non-durable Goods

13.5.3.1. Paper

13.5.3.2. Tissue

13.5.3.3. Chemicals

13.5.4. Durable Good (Electronics, Machinery, Components)

13.5.5. Apparel

13.5.5.1. E-Commerce

13.5.5.2. Offline (Brick-mortar stores)

13.5.6. Pharmaceutical

13.5.7. Automotive

13.5.8. Retail

13.5.8.1. E-Commerce

13.5.8.2. Offline (Brick-mortar stores)

13.5.9. 3PL

13.5.10. Courier, Express and Parcel Services

13.5.11. Others

13.6. Automated Material Handling Market Size (US$ Mn) and Volume (Units) Analysis & Forecast, by Country & Sub-Region, 2022-2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Offering

13.7.2. By Package Type

13.7.3. By Industry Vertical

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Automated Material Handling Market Competition Matrix - a Dashboard View

14.1.1. Global Automated Material Handling Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Automated Material Handling Equipment Providers

15.1.1. Addverb Technologies Private Limited

15.1.1.1. Overview

15.1.1.2. Product Portfolio

15.1.1.3. Sales Footprint

15.1.1.4. Key Subsidiaries or Distributors

15.1.1.5. Strategy and Recent Developments

15.1.1.6. Key Financials

15.1.2. BEUMER GROUP

15.1.2.1. Overview

15.1.2.2. Product Portfolio

15.1.2.3. Sales Footprint

15.1.2.4. Key Subsidiaries or Distributors

15.1.2.5. Strategy and Recent Developments

15.1.2.6. Key Financials

15.1.3. Daifuku Co., Ltd.

15.1.3.1. Overview

15.1.3.2. Product Portfolio

15.1.3.3. Sales Footprint

15.1.3.4. Key Subsidiaries or Distributors

15.1.3.5. Strategy and Recent Developments

15.1.3.6. Key Financials

15.1.4. Dematic

15.1.4.1. Overview

15.1.4.2. Product Portfolio

15.1.4.3. Sales Footprint

15.1.4.4. Key Subsidiaries or Distributors

15.1.4.5. Strategy and Recent Developments

15.1.4.6. Key Financials

15.1.5. ELETTRIC80 S.P.A.

15.1.5.1. Overview

15.1.5.2. Product Portfolio

15.1.5.3. Sales Footprint

15.1.5.4. Key Subsidiaries or Distributors

15.1.5.5. Strategy and Recent Developments

15.1.5.6. Key Financials

15.1.6. Fives Group

15.1.6.1. Overview

15.1.6.2. Product Portfolio

15.1.6.3. Sales Footprint

15.1.6.4. Key Subsidiaries or Distributors

15.1.6.5. Strategy and Recent Developments

15.1.6.6. Key Financials

15.1.7. Honeywell International Inc. (Honeywell Intelligrated)

15.1.7.1. Overview

15.1.7.2. Product Portfolio

15.1.7.3. Sales Footprint

15.1.7.4. Key Subsidiaries or Distributors

15.1.7.5. Strategy and Recent Developments

15.1.7.6. Key Financials

15.1.8. Jungheinrich AG

15.1.8.1. Overview

15.1.8.2. Product Portfolio

15.1.8.3. Sales Footprint

15.1.8.4. Key Subsidiaries or Distributors

15.1.8.5. Strategy and Recent Developments

15.1.8.6. Key Financials

15.1.9. Kardex

15.1.9.1. Overview

15.1.9.2. Product Portfolio

15.1.9.3. Sales Footprint

15.1.9.4. Key Subsidiaries or Distributors

15.1.9.5. Strategy and Recent Developments

15.1.9.6. Key Financials

15.1.10. KNAPP AG

15.1.10.1. Overview

15.1.10.2. Product Portfolio

15.1.10.3. Sales Footprint

15.1.10.4. Key Subsidiaries or Distributors

15.1.10.5. Strategy and Recent Developments

15.1.10.6. Key Financials

15.1.11. KUKA AG

15.1.11.1. Overview

15.1.11.2. Product Portfolio

15.1.11.3. Sales Footprint

15.1.11.4. Key Subsidiaries or Distributors

15.1.11.5. Strategy and Recent Developments

15.1.11.6. Key Financials

15.1.12. MHS Global

15.1.12.1. Overview

15.1.12.2. Product Portfolio

15.1.12.3. Sales Footprint

15.1.12.4. Key Subsidiaries or Distributors

15.1.12.5. Strategy and Recent Developments

15.1.12.6. Key Financials

15.1.13. Murata Machinery, Ltd.

15.1.13.1. Overview

15.1.13.2. Product Portfolio

15.1.13.3. Sales Footprint

15.1.13.4. Key Subsidiaries or Distributors

15.1.13.5. Strategy and Recent Developments

15.1.13.6. Key Financials

15.1.14. SCHAEFER SYSTEMS INTERNATIONAL PVT LTD

15.1.14.1. Overview

15.1.14.2. Product Portfolio

15.1.14.3. Sales Footprint

15.1.14.4. Key Subsidiaries or Distributors

15.1.14.5. Strategy and Recent Developments

15.1.14.6. Key Financials

15.1.15. System Logistics S.p.A.

15.1.15.1. Overview

15.1.15.2. Product Portfolio

15.1.15.3. Sales Footprint

15.1.15.4. Key Subsidiaries or Distributors

15.1.15.5. Strategy and Recent Developments

15.1.15.6. Key Financials

15.1.16. TGW Logistics Group

15.1.16.1. Overview

15.1.16.2. Product Portfolio

15.1.16.3. Sales Footprint

15.1.16.4. Key Subsidiaries or Distributors

15.1.16.5. Strategy and Recent Developments

15.1.16.6. Key Financials

15.1.17. Vanderlande Industries B.V.

15.1.17.1. Overview

15.1.17.2. Product Portfolio

15.1.17.3. Sales Footprint

15.1.17.4. Key Subsidiaries or Distributors

15.1.17.5. Strategy and Recent Developments

15.1.17.6. Key Financials

15.1.18. WITRON

15.1.18.1. Overview

15.1.18.2. Product Portfolio

15.1.18.3. Sales Footprint

15.1.18.4. Key Subsidiaries or Distributors

15.1.18.5. Strategy and Recent Developments

15.1.18.6. Key Financials

15.2. AGV/AMR and Drone Providers

15.2.1. Berkshire Grey

15.2.1.1. Overview

15.2.1.2. Product Portfolio

15.2.1.3. Sales Footprint

15.2.1.4. Key Subsidiaries or Distributors

15.2.1.5. Strategy and Recent Developments

15.2.1.6. Key Financials

15.2.2. ForwardX Robotics

15.2.2.1. Overview

15.2.2.2. Product Portfolio

15.2.2.3. Sales Footprint

15.2.2.4. Key Subsidiaries or Distributors

15.2.2.5. Strategy and Recent Developments

15.2.2.6. Key Financials

15.2.3. Geekplus Technology Co., Ltd.

15.2.3.1. Overview

15.2.3.2. Product Portfolio

15.2.3.3. Sales Footprint

15.2.3.4. Key Subsidiaries or Distributors

15.2.3.5. Strategy and Recent Developments

15.2.3.6. Key Financials

15.2.4. GreyOrange

15.2.4.1. Overview

15.2.4.2. Product Portfolio

15.2.4.3. Sales Footprint

15.2.4.4. Key Subsidiaries or Distributors

15.2.4.5. Strategy and Recent Developments

15.2.4.6. Key Financials

15.2.5. Hikrobot Technology Co., Ltd.

15.2.5.1. Overview

15.2.5.2. Product Portfolio

15.2.5.3. Sales Footprint

15.2.5.4. Key Subsidiaries or Distributors

15.2.5.5. Strategy and Recent Developments

15.2.5.6. Key Financials

15.2.6. inVia Robotics, Inc.

15.2.6.1. Overview

15.2.6.2. Product Portfolio

15.2.6.3. Sales Footprint

15.2.6.4. Key Subsidiaries or Distributors

15.2.6.5. Strategy and Recent Developments

15.2.6.6. Key Financials

15.2.7. Kindred, Inc.

15.2.7.1. Overview

15.2.7.2. Product Portfolio

15.2.7.3. Sales Footprint

15.2.7.4. Key Subsidiaries or Distributors

15.2.7.5. Strategy and Recent Developments

15.2.7.6. Key Financials

15.2.8. Mobile Industrial Robots

15.2.8.1. Overview

15.2.8.2. Product Portfolio

15.2.8.3. Sales Footprint

15.2.8.4. Key Subsidiaries or Distributors

15.2.8.5. Strategy and Recent Developments

15.2.8.6. Key Financials

15.2.9. plus one robotics

15.2.9.1. Overview

15.2.9.2. Product Portfolio

15.2.9.3. Sales Footprint

15.2.9.4. Key Subsidiaries or Distributors

15.2.9.5. Strategy and Recent Developments

15.2.9.6. Key Financials

15.2.10. RightHand Robotics, Inc.

15.2.10.1. Overview

15.2.10.2. Product Portfolio

15.2.10.3. Sales Footprint

15.2.10.4. Key Subsidiaries or Distributors

15.2.10.5. Strategy and Recent Developments

15.2.10.6. Key Financials

15.2.11. Shanghai Quicktron Intelligent Technology Co., Ltd

15.2.11.1. Overview

15.2.11.2. Product Portfolio

15.2.11.3. Sales Footprint

15.2.11.4. Key Subsidiaries or Distributors

15.2.11.5. Strategy and Recent Developments

15.2.11.6. Key Financials

15.2.12. Universal Robots

15.2.12.1. Overview

15.2.12.2. Product Portfolio

15.2.12.3. Sales Footprint

15.2.12.4. Key Subsidiaries or Distributors

15.2.12.5. Strategy and Recent Developments

15.2.12.6. Key Financials

15.3. WES/WMS, TMS, and AIDC Providers

15.3.1. Blue Yonder Group, Inc.

15.3.1.1. Overview

15.3.1.2. Product Portfolio

15.3.1.3. Sales Footprint

15.3.1.4. Key Subsidiaries or Distributors

15.3.1.5. Strategy and Recent Developments

15.3.1.6. Key Financials

15.3.2. Datalogic S.p.A.

15.3.2.1. Overview

15.3.2.2. Product Portfolio

15.3.2.3. Sales Footprint

15.3.2.4. Key Subsidiaries or Distributors

15.3.2.5. Strategy and Recent Developments

15.3.2.6. Key Financials

15.3.3. Honeywell International Inc.

15.3.3.1. Overview

15.3.3.2. Product Portfolio

15.3.3.3. Sales Footprint

15.3.3.4. Key Subsidiaries or Distributors

15.3.3.5. Strategy and Recent Developments

15.3.3.6. Key Financials

15.3.4. Infor

15.3.4.1. Overview

15.3.4.2. Product Portfolio

15.3.4.3. Sales Footprint

15.3.4.4. Key Subsidiaries or Distributors

15.3.4.5. Strategy and Recent Developments

15.3.4.6. Key Financials

15.3.5. Manhattan Associates, Inc.

15.3.5.1. Overview

15.3.5.2. Product Portfolio

15.3.5.3. Sales Footprint

15.3.5.4. Key Subsidiaries or Distributors

15.3.5.5. Strategy and Recent Developments

15.3.5.6. Key Financials

15.3.6. Oracle Corporation

15.3.6.1. Overview

15.3.6.2. Product Portfolio

15.3.6.3. Sales Footprint

15.3.6.4. Key Subsidiaries or Distributors

15.3.6.5. Strategy and Recent Developments

15.3.6.6. Key Financials

15.3.7. SAP

15.3.7.1. Overview

15.3.7.2. Product Portfolio

15.3.7.3. Sales Footprint

15.3.7.4. Key Subsidiaries or Distributors

15.3.7.5. Strategy and Recent Developments

15.3.7.6. Key Financials

15.3.8. Trimble Inc.

15.3.8.1. Overview

15.3.8.2. Product Portfolio

15.3.8.3. Sales Footprint

15.3.8.4. Key Subsidiaries or Distributors

15.3.8.5. Strategy and Recent Developments

15.3.8.6. Key Financials

15.3.9. Zebra Technologies Corp

15.3.9.1. Overview

15.3.9.2. Product Portfolio

15.3.9.3. Sales Footprint

15.3.9.4. Key Subsidiaries or Distributors

15.3.9.5. Strategy and Recent Developments

15.3.9.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Offering

16.1.2. By Package Type

16.1.3. By Industry Vertical

16.1.4. By Region

List of Tables

Table 01: Global Automated Material Handling Market Size & Forecast, by Offering, Value (US$ Mn), 2015-2031

Table 02: Global Automated Material Handling Market Size & Forecast, by Hardware, Value (US$ Mn), 2015-2031

Table 03: Global Automated Material Handling Market Size & Forecast, by Hardware, Volume (Units), 2015-2031

Table 04: Global Automated Material Handling Market Size & Forecast, by Software, Value (US$ Mn), 2015-2031

Table 05: Global Automated Material Handling Market Size & Forecast, by Package Type, Value (US$ Mn), 2015-2031

Table 06: Global Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 07: Global Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 08: Global Automated Material Handling Market Size & Forecast, by Region, Value (US$ Mn), 2015-2031

Table 09: Global Automated Material Handling Market Size & Forecast, by Region, Value (US$ Mn), 2015-2031

Table 10: North America Automated Material Handling Market Size & Forecast, by Offering, Value (US$ Mn), 2015-2031

Table 11: North America Automated Material Handling Market Size & Forecast, by Hardware, Value (US$ Mn), 2015-2031

Table 12: North America Automated Material Handling Market Size & Forecast, by Hardware, Volume (Units), 2015-2031

Table 13: North America Automated Material Handling Market Size & Forecast, by Software, Value (US$ Mn), 2015-2031

Table 14: North America Automated Material Handling Market Size & Forecast, by Package Type, Value (US$ Mn), 2015-2031

Table 15: North America Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 16: North America Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 17: North America Automated Material Handling Market Size & Forecast, by Country, Value (US$ Mn), 2015-2031

Table 18: North America Automated Material Handling Market Size & Forecast, by Country, Volume (Units), 2015-2031

Table 19: Europe Automated Material Handling Market Size & Forecast, by Offering, Value (US$ Mn), 2015-2031

Table 20: Europe Automated Material Handling Market Size & Forecast, by Hardware, Value (US$ Mn), 2015-2031

Table 21: Europe Automated Material Handling Market Size & Forecast, by Hardware, Volume (Units), 2015-2031

Table 22: Europe Automated Material Handling Market Size & Forecast, by Software, Value (US$ Mn), 2015-2031

Table 23: Europe Automated Material Handling Market Size & Forecast, by Package Type, Value (US$ Mn), 2015-2031

Table 24: Europe Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 25: Europe Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 26: Europe Automated Material Handling Market Size & Forecast, by Country, Value (US$ Mn), 2015-2031

Table 27: Europe Automated Material Handling Market Size & Forecast, by Country, Volume (Units), 2015-2031

Table 28: Asia Pacific Automated Material Handling Market Size & Forecast, by Offering, Value (US$ Mn), 2015-2031

Table 29: Asia Pacific Automated Material Handling Market Size & Forecast, by Hardware, Value (US$ Mn), 2015-2031

Table 30: Asia Pacific Automated Material Handling Market Size & Forecast, by Hardware, Volume (Units), 2015-2031

Table 31: Asia Pacific Automated Material Handling Market Size & Forecast, by Software, Value (US$ Mn), 2015-2031

Table 32: Asia Pacific Automated Material Handling Market Size & Forecast, by Package Type, Value (US$ Mn), 2015-2031

Table 33: Asia Pacific Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 34: Asia Pacific Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 35: Asia Pacific Automated Material Handling Market Size & Forecast, by Country, Value (US$ Mn), 2015-2031

Table 36: Asia Pacific Automated Material Handling Market Size & Forecast, by Country, Volume (Units), 2015-2031

Table 37: Middle East & Africa Automated Material Handling Market Size & Forecast, by Offering, Value (US$ Mn), 2015-2031

Table 38: Middle East & Africa Automated Material Handling Market Size & Forecast, by Hardware, Value (US$ Mn), 2015-2031

Table 39: Middle East and Arica Automated Material Handling Market Size & Forecast, by Hardware, Volume (Units), 2015-2031

Table 40: Middle East & Africa Automated Material Handling Market Size & Forecast, by Software, Value (US$ Mn), 2015-2031

Table 41: Middle East & Africa Automated Material Handling Market Size & Forecast, by Package Type, Value (US$ Mn), 2015-2031

Table 42: Middle East & Africa Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 43: Middle East & Africa Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 44: Middle East & Africa Automated Material Handling Market Size & Forecast, by Country, Value (US$ Mn), 2015-2031

Table 45: Middle East & Africa Automated Material Handling Market Size & Forecast, by Country, Volume (Units), 2015-2031

Table 46: South America Automated Material Handling Market Size & Forecast, by Offering, Value (US$ Mn), 2015-2031

Table 47: South America Automated Material Handling Market Size & Forecast, by Hardware, Value (US$ Mn), 2015-2031

Table 48: South America Automated Material Handling Market Size & Forecast, by Hardware, Volume (Units), 2015-2031

Table 49: South America Automated Material Handling Market Size & Forecast, by Software, Value (US$ Mn), 2015-2031

Table 50: South America Automated Material Handling Market Size & Forecast, by Package Type, Value (US$ Mn), 2015-2031

Table 51: South America Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 52: South America Automated Material Handling Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2015-2031

Table 53: South America Automated Material Handling Market Size & Forecast, by Country, Value (US$ Mn), 2015-2031

Table 54: South America Automated Material Handling Market Size & Forecast, by Country, Volume (Units), 2015-2031

List of Figures

Figure 01: North America Price Trend Analysis (Thousand US$) (2020, 2026, 2031)

Figure 02: Europe Price Trend Analysis (Thousand US$) (2020, 2026, 2031)

Figure 03: Asia Pacific Price Trend Analysis (Thousand US$) (2020, 2026, 2031)

Figure 04: Middle East and Africa Price Trend Analysis (Thousand US$) (2020, 2026, 2031)

Figure 05: South America Price Trend Analysis (Thousand US$) (2020, 2026, 2031)

Figure 06: Global Automated Material Handling Market, Value (US$ Mn), 2015-2031

Figure 07: Global Automated Material Handling Market, Volume (Units), 2015-2031

Figure 08: Global Automated Material Handling Market Size & Forecast, by Offering, Revenue (US$ Mn), 2015-2031

Figure 09: Global Automated Material Handling Market Attractiveness, By Offering, Value (US$ Mn), 2021-2031

Figure 10: Global Automated Material Handling Market Share Analysis, by Offering, 2021 and 2031

Figure 11: Global Automated Material Handling Market Size & Forecast, by Hardware, Revenue (US$ Mn), 2015-2031

Figure 12: Global Automated Material Handling Market Attractiveness, By Hardware, Value (US$ Mn), 2021-2031

Figure 13: Global Automated Material Handling Market Share Analysis, by Hardware, 2021 and 2031

Figure 14: Global Automated Material Handling Market Size & Forecast, by Software, Revenue (US$ Mn), 2015-2031

Figure 15: Global Automated Material Handling Market Attractiveness, By Software, Value (US$ Mn), 2021-2031

Figure 16: Global Automated Material Handling Market Share Analysis, by Software, 2021 and 2031

Figure 17: Global Automated Material Handling Market Size & Forecast, by Package Type, Revenue (US$ Mn), 2015-2031

Figure 18: Global Automated Material Handling Market Attractiveness, By Package Type, Value (US$ Mn), 2021-2031

Figure 19: Global Automated Material Handling Market Share Analysis, by Package Type, 2021 and 2031

Figure 20: Global Automated Material Handling Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2015-2031

Figure 21: Global Automated Material Handling Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2021-2031

Figure 22: Global Automated Material Handling Market Share Analysis, by Industry Vertical, 2021 and 2031

Figure 23: Global Automated Material Handling Market Size & Forecast, by Region, Revenue (US$ Mn), 2015-2031

Figure 24: Global Automated Material Handling Market Attractiveness, By Region, Value (US$ Mn), 2021-2031

Figure 25: Global Automated Material Handling Market Share Analysis, by Region, 2021 and 2031

Figure 26: North America Automated Material Handling Market, Value (US$ Mn), 2015-2031

Figure 27: North America Automated Material Handling Market, Volume (Units), 2015-2031

Figure 28: North America Automated Material Handling Market Size & Forecast, by Offering, Revenue (US$ Mn), 2015-2031

Figure 29: North America Automated Material Handling Market Attractiveness, By Offering, Value (US$ Mn), 2021-2031

Figure 30: North America Automated Material Handling Market Share Analysis, by Offering, 2021 and 2031

Figure 31: North America Automated Material Handling Market Size & Forecast, by Hardware, Revenue (US$ Mn), 2015-2031

Figure 32: North America Automated Material Handling Market Attractiveness, By Hardware, Value (US$ Mn), 2021-2031

Figure 33: North America Automated Material Handling Market Share Analysis, by Hardware, 2021 and 2031

Figure 34: North America Automated Material Handling Market Size & Forecast, by Software, Revenue (US$ Mn), 2015-2031

Figure 35: North America Automated Material Handling Market Attractiveness, By Software, Value (US$ Mn), 2021-2031

Figure 36: North America Automated Material Handling Market Share Analysis, by Software, 2021 and 2031

Figure 37: North America Automated Material Handling Market Size & Forecast, by Package Type, Revenue (US$ Mn), 2015-2031

Figure 38: North America Automated Material Handling Market Attractiveness, By Package Type, Value (US$ Mn), 2021-2031

Figure 39: North America Automated Material Handling Market Share Analysis, by Package Type, 2021 and 2031

Figure 40: North America Automated Material Handling Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2015-2031

Figure 41: North America Automated Material Handling Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2021-2031

Figure 42: North America Automated Material Handling Market Share Analysis, by Industry Vertical, 2021 and 2031

Figure 43: North America Automated Material Handling Market Size & Forecast, by Country, Revenue (US$ Mn), 2015-2031

Figure 44: North America Automated Material Handling Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 45: North America Automated Material Handling Market Share Analysis, by Country, 2021 and 2031

Figure 46: Europe Automated Material Handling Market, Value (US$ Mn), 2015-2031

Figure 47: Europe Automated Material Handling Market, Volume (Units), 2015-2031

Figure 48: Europe Automated Material Handling Market Size & Forecast, by Offering, Revenue (US$ Mn), 2015-2031

Figure 49: Europe Automated Material Handling Market Attractiveness, By Offering, Value (US$ Mn), 2021-2031

Figure 50: Europe Automated Material Handling Market Share Analysis, by Offering, 2021 and 2031

Figure 51: Europe Automated Material Handling Market Size & Forecast, by Hardware, Revenue (US$ Mn), 2015-2031

Figure 52: Europe Automated Material Handling Market Attractiveness, By Hardware, Value (US$ Mn), 2021-2031

Figure 53: Europe Automated Material Handling Market Share Analysis, by Hardware, 2021 and 2031

Figure 54: Europe Automated Material Handling Market Size & Forecast, by Software, Revenue (US$ Mn), 2015-2031

Figure 55: Europe Automated Material Handling Market Attractiveness, By Software, Value (US$ Mn), 2021-2031

Figure 56: Europe Automated Material Handling Market Share Analysis, by Software, 2021 and 2031

Figure 57: Europe Automated Material Handling Market Size & Forecast, by Package Type, Revenue (US$ Mn), 2015-2031

Figure 58: Europe Automated Material Handling Market Attractiveness, By Package Type, Value (US$ Mn), 2021-2031

Figure 59: Europe Automated Material Handling Market Share Analysis, by Package Type, 2021 and 2031

Figure 60: Europe Automated Material Handling Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2015-2031

Figure 61: Europe Automated Material Handling Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2021-2031

Figure 62: Europe Automated Material Handling Market Share Analysis, by Industry Vertical, 2021 and 2031

Figure 63: Europe Automated Material Handling Market Size & Forecast, by Region, Revenue (US$ Mn), 2015-2031

Figure 64: Europe Automated Material Handling Market Attractiveness, By Region, Value (US$ Mn), 2021-2031

Figure 65: Europe Automated Material Handling Market Share Analysis, by Region, 2021 and 2031

Figure 66: Asia Pacific Automated Material Handling Market, Value (US$ Mn), 2015-2031

Figure 67: South America Automated Material Handling Market, Volume (Units), 2015-2031

Figure 68: Asia Pacific Automated Material Handling Market Size & Forecast, by Offering, Revenue (US$ Mn), 2015-2031

Figure 69: Asia Pacific Automated Material Handling Market Attractiveness, By Offering, Value (US$ Mn), 2021-2031

Figure 70: Asia Pacific Automated Material Handling Market Share Analysis, by Offering, 2021 and 2031

Figure 71: Asia Pacific Automated Material Handling Market Size & Forecast, by Hardware, Revenue (US$ Mn), 2015-2031

Figure 72: Asia Pacific Automated Material Handling Market Attractiveness, By Hardware, Value (US$ Mn), 2021-2031

Figure 73: Asia Pacific Automated Material Handling Market Share Analysis, by Hardware, 2021 and 2031

Figure 74: Asia Pacific Automated Material Handling Market Size & Forecast, by Software, Revenue (US$ Mn), 2015-2031

Figure 75: Asia Pacific Automated Material Handling Market Attractiveness, By Software, Value (US$ Mn), 2021-2031

Figure 76: Asia Pacific Automated Material Handling Market Share Analysis, by Software, 2021 and 2031

Figure 77: Asia Pacific Automated Material Handling Market Size & Forecast, by Package Type, Revenue (US$ Mn), 2015-2031

Figure 78: Asia Pacific Automated Material Handling Market Attractiveness, By Package Type, Value (US$ Mn), 2021-2031

Figure 79: Asia Pacific Automated Material Handling Market Share Analysis, by Package Type, 2021 and 2031

Figure 80: Asia Pacific Automated Material Handling Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2015-2031

Figure 81: Asia Pacific Automated Material Handling Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2021-2031

Figure 82: Asia Pacific Automated Material Handling Market Share Analysis, by Industry Vertical, 2021 and 2031

Figure 83: Asia Pacific Automated Material Handling Market Size & Forecast, by Country, Revenue (US$ Mn), 2015-2031

Figure 84: Asia Pacific Automated Material Handling Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 85: Asia Pacific Automated Material Handling Market Share Analysis, by Country, 2021 and 2031

Figure 86: Middle East & Africa Automated Material Handling Market, Value (US$ Mn), 2015-2031

Figure 87: Middle East and Africa Automated Material Handling Market, Volume (Units), 2015-2031

Figure 88: Middle East & Africa Automated Material Handling Market Size & Forecast, by Offering, Revenue (US$ Mn), 2015-2031

Figure 89: Middle East & Africa Automated Material Handling Market Attractiveness, By Offering, Value (US$ Mn), 2021-2031

Figure 90: Middle East & Africa Automated Material Handling Market Share Analysis, by Offering, 2021 and 2031

Figure 91: Middle East & Africa Automated Material Handling Market Size & Forecast, by Hardware, Revenue (US$ Mn), 2015-2031

Figure 92: Middle East & Africa Automated Material Handling Market Attractiveness, By Hardware, Value (US$ Mn), 2021-2031

Figure 93: Middle East & Africa Automated Material Handling Market Share Analysis, by Hardware, 2021 and 2031

Figure 94: Middle East & Africa Automated Material Handling Market Size & Forecast, by Software, Revenue (US$ Mn), 2015-2031

Figure 95: Middle East & Africa Automated Material Handling Market Attractiveness, By Software, Value (US$ Mn), 2021-2031

Figure 96: Middle East & Africa Automated Material Handling Market Share Analysis, by Software, 2021 and 2031

Figure 97: Middle East & Africa Automated Material Handling Market Size & Forecast, by Package Type, Revenue (US$ Mn), 2015-2031

Figure 98: Middle East & Africa Automated Material Handling Market Attractiveness, By Package Type, Value (US$ Mn), 2021-2031

Figure 99: Middle East & Africa Automated Material Handling Market Share Analysis, by Package Type, 2021 and 2031

Figure 100: Middle East & Africa Automated Material Handling Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2015-2031

Figure 101: Middle East & Africa Automated Material Handling Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2021-2031

Figure 102: Middle East & Africa Automated Material Handling Market Share Analysis, by Industry Vertical, 2021 and 2031

Figure 103: Middle East & Africa Automated Material Handling Market Size & Forecast, by Country, Revenue (US$ Mn), 2015-2031

Figure 104: Middle East & Africa Automated Material Handling Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 105: Middle East & Africa Automated Material Handling Market Share Analysis, by Country, 2021 and 2031

Figure 106: South America Automated Material Handling Market, Value (US$ Mn), 2015-2031

Figure 107: South America Automated Material Handling Market, Volume (Units), 2015-2031

Figure 108: South America Automated Material Handling Market Size & Forecast, by Offering, Revenue (US$ Mn), 2015-2031

Figure 109: South America Automated Material Handling Market Attractiveness, By Offering, Value (US$ Mn), 2021-2031

Figure 110: South America Automated Material Handling Market Share Analysis, by Offering, 2021 and 2031

Figure 111: South America Automated Material Handling Market Size & Forecast, by Hardware, Revenue (US$ Mn), 2015-2031

Figure 112: South America Automated Material Handling Market Attractiveness, By Hardware, Value (US$ Mn), 2021-2031

Figure 113: South America Automated Material Handling Market Share Analysis, by Hardware, 2021 and 2031

Figure 114: South America Automated Material Handling Market Size & Forecast, by Software, Revenue (US$ Mn), 2015-2031

Figure 115: South America Automated Material Handling Market Attractiveness, By Software, Value (US$ Mn), 2021-2031

Figure 116: South America Automated Material Handling Market Share Analysis, by Software, 2021 and 2031

Figure 117: South America Automated Material Handling Market Size & Forecast, by Package Type, Revenue (US$ Mn), 2015-2031

Figure 118: South America Automated Material Handling Market Attractiveness, By Package Type, Value (US$ Mn), 2021-2031

Figure 119: South America Automated Material Handling Market Share Analysis, by Package Type, 2021 and 2031

Figure 120: South America Automated Material Handling Market Size & Forecast, by Industry Vertical, Revenue (US$ Mn), 2015-2031

Figure 121: South America Automated Material Handling Market Attractiveness, By Industry Vertical, Value (US$ Mn), 2021-2031

Figure 122: South America Automated Material Handling Market Share Analysis, by Industry Vertical, 2021 and 2031

Figure 123: South America Automated Material Handling Market Size & Forecast, by Country, Revenue (US$ Mn), 2015-2031

Figure 124: South America Automated Material Handling Market Attractiveness, By Country, Value (US$ Mn), 2021-2031

Figure 125: South America Automated Material Handling Market Share Analysis, by Country, 2021 and 2031