Reports

Reports

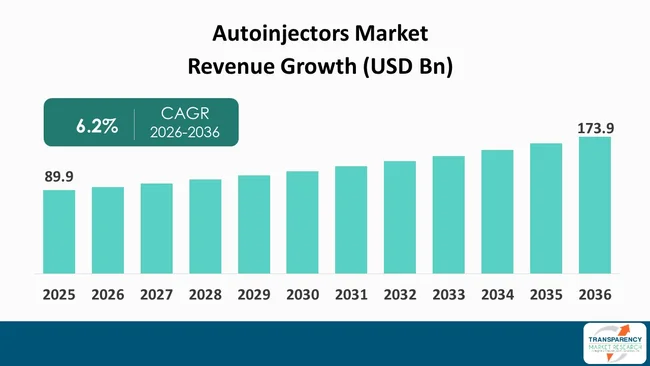

The global autoinjectors market was valued at US$ 89.9 Bn in 2025 and is projected to reach US$ 173.9 Bn by 2036, expanding at a CAGR of 6.2% from 2026 to 2036. The market is driven by the rising prevalence of chronic and autoimmune diseases, increasing adoption of biologics and injectable therapies, and growing demand for convenient, safe, and self-administered d rug delivery solutions.

The autoinjectors market is experiencing steady growth as healthcare infrastructure increasingly focuses on providing patients with self-administrative drug delivery options. Increasing usage of injectable biologic agents for various autoimmune disorders like diabetes, cardiovascular conditions, and allergies is propelling the demand for self-administration devices such as auto injectors.

Autoinjectors help tackle the challenges with traditional injections in terms of dosing error, needle phobia, and patient compliance, and are most beneficial for the elderly and patients in chronic care. The industry players are aggressively pursuing the development of drugs in combination with auto injector technology to maximize product life and differentiation in a highly competitive drug market. Technological innovations such as ergonomic design, invisible needles, dose-tracking functions, and biocompatibility with high-viscosity substances are also further accelerating the adoption. At the same time, the approach toward homecare and outpatient treatment also emphasizes the importance of a home injection solution.

Due to the priority given to patient safety and the increasing recognition of the value of self-diabetes care, the industry maintains a rising trend. Although reduced costs and personalized device requirements might still pose a problem, the cooperation between the drug industry and device industry in terms of innovation and collaboration will basically prolong an extended growth in the development and emerging markets.

The auto injectors have emerged as an indispensable category in the injectable drug delivery devices market, enabling the convenient administration of injectable products to treat various medical conditions. Auto injectors have been designed to facilitate self-administration of defined doses of injectable medications by individuals without requiring much training.

The growth of the market is largely tied to the increased usage of specialty drugs and biologics, many of which are parenterally administered. Additionally, growing preference for treatment at home, higher patient awareness, and the need to improve adherence to prescribed therapies are intensifying the demand even more.

Continuous innovation in device design, safety features, and formulation compatibility is determining the progression of the auto injectors market globally. Patient safety and ease of use have been the major concerns of regulators.

Such focus has therefore been a great catalyst in the adoption of these products in both - the developed and emerging healthcare markets. Along with the changes in healthcare delivery models, auto injectors are projected to become more significant in facilitating self-administration and treatments at home or in remote locations.

| Attribute | Detail |

|---|---|

| Autoinjectors Market Drivers |

|

Chronic diseases remain a major drivers in the auto injectors market, as there are various conditions including diabetes, multiple sclerosis, rheumatoid arthritis, and inflammation, which require frequent injections. In addition, patients who suffer from these conditions require frequent treatments, which makes these factors important in the market.

Auto injectors make the injection process simpler, as there is less manual handling, less needle anxiety, and better delivery consistency. This is especially important in older patients as well as patients with less dexterity in their hands. As the world sees an escalation in chronic and aged-related disorders, the demand for suitable devices for self-injection is going up.

As per the World Health Organization, Non-communicable diseases (NCDs) killed at least 43 million people in 2021, equivalent to 75% of non-pandemic-related deaths globally. In 2021, 18 million people died from an NCD before reaching 70 years; 82% of these premature deaths occurred in low- and middle-income countries.

Cardiovascular diseases account for most NCD deaths, or at least 19 million deaths in 2021, followed by cancers (10 million), chronic respiratory diseases (4 million), and diabetes (over 2 million including kidney disease deaths caused by diabetes).

Technological innovation is proving to be a major driving force behind the development of the autoinjector market due to the addition of smartness into these devices. The latest autoinjectors will include connectivity and data management capabilities that will enable patients to record their dosage statistics.

Such features also enhance patient compliance, remote patient monitoring, and therapy success. Improved usability in terms of ergonomic designs, automatic needle insertion, and audible or visual feedback cues boost patient confidence and usability.

Digital integration also allows for the inclusion of reminder messages, adherence, as well as insights. All these factors contribute to patient engagement with long-term treatment. Automated injectors that are technologically highly advanced, exhibit the ongoing trend in popularity alongside the rising embrace of digital health in the healthcare environment. Those innovations not only enable personalized treatment management but also correspond to the general trend of connected, patient-centric healthcare ecosystems. Thus, smart auto injectors are becoming more and more a part of next-generation drug-delivery solutions.

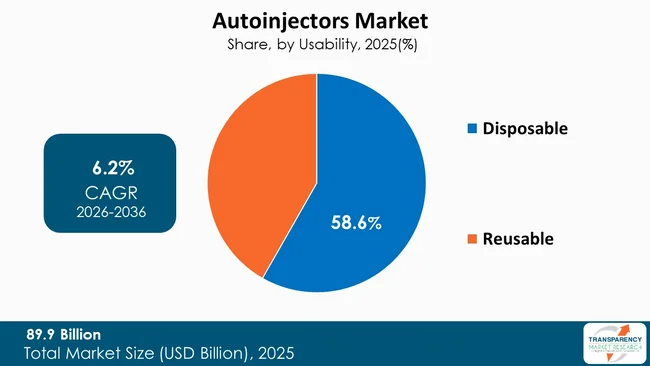

The main segment of the autoinjectors market is disposable auto injectors, which dominate the market with 58.6% share, due to their convenience, safety, and very good matching with single-use biologic and emergency therapies. These devices come prefilled, ready to use, and do not require cartridge replacement or device maintenance, thus they are very appropriate for self-administration in both chronic and acute indications.

Disposable auto injectors are especially well-liked when it comes to the treatment of allergies, autoimmune conditions, as well as hormonal therapies. This is especially with regards to ease of usage, as well as the precision of dosage, which is always a priority. Additionally, such devices are more hygienic.

Simplified regulatory pathways and the possibility of painless integration into drug-device combination products make pharmaceutical companies favor disposable formats. With an increasing demand for home-based care and patient-centric delivery, disposable auto injectors keep their strong position in the market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Currently, North America dominates the regional market for autoinjectors with 46.5% share, mainly due to its advanced healthcare system, a higher level of acceptance of self-administration therapies, and presence of well-established pharmaceuticals and healthcare devices industry all over the U.S. Also, North America is home to a wide range of chronic and autoimmune diseases such as rheumatoid arthritis, diabetes, and multiple sclerosis, which require Injectable treatments for an extended period of time.

The increasing demand for home care treatment along with self-administration of medication further boosts the demand for user-friendly automatic injectors. North America dominates the global autoinjectors market towing to the continuous innovation, regulatory focus on patient safety, and strong investments in pharmaceutical R&D.

Higher patient awareness and the availability of optimal treatment modalities further augment demand at the regional level. Innovative and collaborative efforts in the regional healthcare industry further help support the sustainable growth of the regional market.

Key players operating in the autoinjectors industry are investing through innovation, strategic partnerships, and technological advancements. They emphasize on improving imaging clarity and expanding product portfolios, ensuring sustained growth and leadership in the evolving healthcare landscape.

Eli Lilly and Company, SHL Medical, Owen Mumford, Ypsomed, BD, E3D, Amgen Inc., Teva Pharmaceuticals USA, Inc., Biogen, Mylan N.V., Pfizer Inc., Union Medico ApS., Sanofi, Nemera, Gerresheimer AG the key players in autoinjectors market.

Each of these players has been profiled in the Autoinjectors market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 89.9 Bn |

| Forecast Value in 2036 | US$ 173.9 Bn |

| CAGR | 6.2 % |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2024 |

| Quantitative Units | US$ Bn |

| Autoinjectors Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Usability

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global autoinjectors market was valued at US$ 89.9 Bn in 2025

The global autoinjectors industry is projected to reach more than US$ 173.9 Bn by the end of 2036

Rising prevalence of chronic diseases and technological advancements in Autoinjectors are some of the factors driving the expansion of autoinjectors market.

The CAGR is anticipated to be 6.2% from 2026 to 2036

North America is expected to account for the largest share from 2026 to 2036

Eli Lilly and Company, SHL Medical, Owen Mumford, Ypsomed, BD, E3D, Amgen Inc., Teva Pharmaceuticals USA, Inc., Biogen, Mylan N.V., Pfizer Inc., Union Medico ApS., Sanofi, Nemera, Gerresheimer AG, and the other prominent players.

Table 01: Global Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 02: Global Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 03: Global Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 04: Global Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 05: Global Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 06: Global Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 07: Global Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 08: Global Autoinjectors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 09: North America Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 10: North America Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 11: North America Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 12: North America Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 13: North America Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 14: North America Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 15: North America Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 16: North America Autoinjectors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 17: U.S. Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 18: U.S. Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 19: U.S. Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 20: U.S. Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 21: U.S. Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 22: U.S. Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 23: U.S. Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 24: Canada Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 25: Canada Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 26: Canada Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 27: Canada Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 28: Canada Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 29: Canada Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 30: Canada Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 31: Europe Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 32: Europe Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 33: Europe Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 34: Europe Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 35: Europe Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 36: Europe Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 37: Europe Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 38: Europe Autoinjectors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 39: Germany Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 40: Germany Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 41: Germany Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 42: Germany Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 43: Germany Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 44: Germany Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 45: Germany Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 46: U.K. Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 47: U.K. Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 48: U.K. Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 49: U.K. Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 50: U.K. Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 51: U.K. Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 52: U.K. Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 53: France Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 54: France Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 55: France Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 56: France Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 57: France Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 58: France Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 59: France Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 60: Italy Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 61: Italy Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 62: Italy Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 63: Italy Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 64: Italy Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 65: Italy Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 66: Italy Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 67: Spain Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 68: Spain Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 69: Spain Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 70: Spain Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 71: Spain Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 72: Spain Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 73: Spain Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 74: Switzerland Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 75: Switzerland Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 76: Switzerland Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 77: Switzerland Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 78: Switzerland Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 79: Switzerland Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 80: Switzerland Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 81: The Netherlands Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 82: The Netherlands Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 83: The Netherlands Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 84: The Netherlands Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 85: The Netherlands Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 86: The Netherlands Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 87: The Netherlands Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 88: Rest of Europe Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 89: Rest of Europe Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 90: Rest of Europe Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 91: Rest of Europe Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 92: Rest of Europe Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 93: Rest of Europe Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 94: Rest of Europe Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 95: Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 96: Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 97: Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 98: Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 99: Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 100: Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 101: Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 102: Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 103: China Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 104: China Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 105: China Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 106: China Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 107: China Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 108: China Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 109: China Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 110: Japan Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 111: Japan Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 112: Japan Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 113: Japan Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 114: Japan Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 115: Japan Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 116: Japan Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 117: India Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 118: India Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 119: India Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 120: India Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 121: India Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 122: India Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 123: India Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 124: South Korea Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 125: South Korea Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 126: South Korea Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 127: South Korea Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 128: South Korea Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 129: South Korea Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 130: South Korea Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 131: Australia and New Zealand Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 132: Australia and New Zealand Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 133: Australia and New Zealand Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 134: Australia and New Zealand Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 135: Australia and New Zealand Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 136: Australia and New Zealand Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 137: Australia and New Zealand Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 138: Rest of Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 139: Rest of Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 140: Rest of Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 141: Rest of Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 142: Rest of Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 143: Rest of Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 144: Rest of Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 145: Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 146: Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 147: Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 148: Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 149: Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 150: Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 151: Latin America Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 152: Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 153: Brazil Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 154: Brazil Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 155: Brazil Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 156: Brazil Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 157: Brazil Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 158: Brazil Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 159: Brazil Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 160: Mexico Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 161: Mexico Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 162: Mexico Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 163: Mexico Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 164: Mexico Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 165: Mexico Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 166: Mexico Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 167: Argentina Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 168: Argentina Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 169: Argentina Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 170: Argentina Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 171: Argentina Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 172: Argentina Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 173: Argentina Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 174: Rest of Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 175: Rest of Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 176: Rest of Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 177: Rest of Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 178: Rest of Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 179: Rest of Latin America Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 180: Rest of Latin America Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 181: Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 182: Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 183: Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 184: Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 185: Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 186: Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 187: Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 188: Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 189: GCC Countries Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 190: GCC Countries Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 191: GCC Countries Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 192: GCC Countries Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 193: GCC Countries Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 194: GCC Countries Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 195: GCC Countries Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 196: South Africa Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 197: South Africa Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 198: South Africa Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 199: South Africa Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 200: South Africa Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 201: South Africa Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 202: South Africa Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 203: Rest of Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Usability, 2021 to 2036

Table 204: Rest of Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Route of Administration, 2021 to 2036

Table 205: Rest of Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Type of Molecule Delivered, 2021 to 2036

Table 206: Rest of Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Type of Actuation Mechanism, 2021 to 2036

Table 207: Rest of Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Volume of Container, 2021 to 2036

Table 208: Rest of Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 209: Rest of Middle East and Africa Autoinjectors Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Figure 01: Global Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 02: Global Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 03: Global Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 04: Global Autoinjectors Market Revenue (US$ Bn), by Disposable, 2021 to 2036

Figure 05: Global Autoinjectors Market Revenue (US$ Bn), by Reusable, 2021 to 2036

Figure 06: Global Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 07: Global Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 08: Global Autoinjectors Market Revenue (US$ Bn), by Intramuscular, 2021 to 2036

Figure 09: Global Autoinjectors Market Revenue (US$ Bn), by Intravenous, 2021 to 2036

Figure 10: Global Autoinjectors Market Revenue (US$ Bn), by Subcutaneous, 2021 to 2036

Figure 11: Global Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 12: Global Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 13: Global Autoinjectors Market Revenue (US$ Bn), by Antibodies, 2021 to 2036

Figure 14: Global Autoinjectors Market Revenue (US$ Bn), by Peptides, 2021 to 2036

Figure 15: Global Autoinjectors Market Revenue (US$ Bn), by Proteins, 2021 to 2036

Figure 16: Global Autoinjectors Market Revenue (US$ Bn), by Molecules, 2021 to 2036

Figure 17: Global Autoinjectors Market Revenue (US$ Bn), by Other, 2021 to 2036

Figure 18: Global Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 19: Global Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 20: Global Autoinjectors Market Revenue (US$ Bn), by Manual, 2021 to 2036

Figure 21: Global Autoinjectors Market Revenue (US$ Bn), by Automatic, 2021 to 2036

Figure 22: Global Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 23: Global Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 24: Global Autoinjectors Market Revenue (US$ Bn), by Less than 1 ML, 2021 to 2036

Figure 25: Global Autoinjectors Market Revenue (US$ Bn), by 1-2 mL, 2021 to 2036

Figure 26: Global Autoinjectors Market Revenue (US$ Bn), by More than 2 mL, 2021 to 2036

Figure 27: Global Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 28: Global Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 29: Global Autoinjectors Market Revenue (US$ Bn), by Anaphylaxis, 2021 to 2036

Figure 30: Global Autoinjectors Market Revenue (US$ Bn), by Diabetes, 2021 to 2036

Figure 31: Global Autoinjectors Market Revenue (US$ Bn), by Migraine, 2021 to 2036

Figure 32: Global Autoinjectors Market Revenue (US$ Bn), by Sclerosis, 2021 to 2036

Figure 33: Global Autoinjectors Market Revenue (US$ Bn), by Arthritis, 2021 to 2036

Figure 34: Global Autoinjectors Market Revenue (US$ Bn), by Loss, 2021 to 2036

Figure 35: Global Autoinjectors Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 36: Global Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 37: Global Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 38: Global Autoinjectors Market Revenue (US$ Bn), by Ambulatory Surgical Centres, 2021 to 2036

Figure 39: Global Autoinjectors Market Revenue (US$ Bn), by Home Settings, 2021 to 2036

Figure 40: Global Autoinjectors Market Revenue (US$ Bn), by Hospitals, 2021 to 2036

Figure 41: Global Autoinjectors Market Revenue (US$ Bn), by Clinics, 2021 to 2036

Figure 42: Global Autoinjectors Market Value Share Analysis, By Region, 2025 and 2036

Figure 43: Global Autoinjectors Market Attractiveness Analysis, By Region, 2026 to 2036

Figure 44: North America Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 45: North America Autoinjectors Market Value Share Analysis, by Country, 2025 and 2036

Figure 46: North America Autoinjectors Market Attractiveness Analysis, by Country, 2026 to 2036

Figure 47: North America Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 48: North America Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 49: North America Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 50: North America Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 51: North America Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 52: North America Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 53: North America Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 54: North America Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 55: North America Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 56: North America Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 57: North America Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 58: North America Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 59: North America Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 60: North America Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 61: U.S. Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 62: U.S. Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 63: U.S. Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 64: U.S. Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 65: U.S. Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 66: U.S. Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 67: U.S. Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 68: U.S. Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 69: U.S. Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 70: U.S. Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 71: U.S. Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 72: U.S. Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 73: U.S. Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 74: U.S. Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 75: U.S. Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 76: Canada Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 77: Canada Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 78: Canada Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 79: Canada Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 80: Canada Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 81: Canada Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 82: Canada Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 83: Canada Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 84: Canada Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 85: Canada Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 86: Canada Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 87: Canada Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 88: Canada Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 89: Canada Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 90: Canada Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 91: Europe Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 92: Europe Autoinjectors Market Value Share Analysis, by Country/Region, 2025 and 2036

Figure 93: Europe Autoinjectors Market Attractiveness Analysis, by Country/Region, 2026 to 2036

Figure 94: Europe Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 95: Europe Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 96: Europe Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 97: Europe Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 98: Europe Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 99: Europe Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 100: Europe Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 101: Europe Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 102: Europe Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 103: Europe Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 104: Europe Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 105: Europe Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 106: Europe Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 107: Europe Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 108: Germany Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 109: Germany Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 110: Germany Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 111: Germany Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 112: Germany Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 113: Germany Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 114: Germany Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 115: Germany Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 116: Germany Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 117: Germany Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 118: Germany Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 119: Germany Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 120: Germany Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 121: Germany Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 122: Germany Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 123: U.K. Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 124: U.K. Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 125: U.K. Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 126: U.K. Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 127: U.K. Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 128: U.K. Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 129: U.K. Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 130: U.K. Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 131: U.K. Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 132: U.K. Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 133: U.K. Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 134: U.K. Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 135: U.K. Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 136: U.K. Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 137: U.K. Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 138: France Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 139: France Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 140: France Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 141: France Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 142: France Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 143: France Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 144: France Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 145: France Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 146: France Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 147: France Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 148: France Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 149: France Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 150: France Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 151: France Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 152: France Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 153: Italy Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 154: Italy Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 155: Italy Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 156: Italy Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 157: Italy Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 158: Italy Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 159: Italy Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 160: Italy Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 161: Italy Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 162: Italy Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 163: Italy Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 164: Italy Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 165: Italy Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 166: Italy Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 167: Italy Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 168: Spain Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 169: Spain Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 170: Spain Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 171: Spain Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 172: Spain Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 173: Spain Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 174: Spain Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 175: Spain Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 176: Spain Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 177: Spain Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 178: Spain Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 179: Spain Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 180: Spain Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 181: Spain Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 182: Spain Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 183: The Netherlands Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 184: The Netherlands Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 185: The Netherlands Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 186: The Netherlands Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 187: The Netherlands Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 188: The Netherlands Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 189: The Netherlands Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 190: The Netherlands Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 191: The Netherlands Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 192: The Netherlands Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 193: The Netherlands Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 194: The Netherlands Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 195: The Netherlands Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 196: The Netherlands Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 197: The Netherlands Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 198: Rest of Europe Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 199: Rest of Europe Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 200: Rest of Europe Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 201: Rest of Europe Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 202: Rest of Europe Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 203: Rest of Europe Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 204: Rest of Europe Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 205: Rest of Europe Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 206: Rest of Europe Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 207: Rest of Europe Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 208: Rest of Europe Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 209: Rest of Europe Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 210: Rest of Europe Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 211: Rest of Europe Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 212: Rest of Europe Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 213: Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 214: Asia Pacific Autoinjectors Market Value Share Analysis, by Country/Region, 2025 and 2036

Figure 215: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Country/Region, 2026 to 2036

Figure 216: Asia Pacific Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 217: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 218: Asia Pacific Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 219: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 220: Asia Pacific Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 221: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 222: Asia Pacific Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 223: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 224: Asia Pacific Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 225: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 226: Asia Pacific Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 227: Asia Pacific Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 228: Asia Pacific Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 229: Asia Pacific Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 230: China Pacific Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 231: China Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 232: China Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 233: China Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 234: China Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 235: China Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 236: China Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 237: China Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 238: China Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 239: China Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 240: China Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 241: China Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 242: China Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 243: China Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 244: China Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 245: India Pacific Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 246: India Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 247: India Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 248: India Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 249: India Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 250: India Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 251: India Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 252: India Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 253: India Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 254: India Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 255: India Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 256: India Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 257: India Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 258: India Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 259: India Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 260: Japan Pacific Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 261: Japan Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 262: Japan Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 263: Japan Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 264: Japan Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 265: Japan Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 266: Japan Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 267: Japan Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 268: Japan Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 269: Japan Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 270: Japan Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 271: Japan Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 272: Japan Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 273: Japan Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 274: Japan Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 275: South Korea Pacific Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 276: South Korea Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 277: South Korea Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 278: South Korea Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 279: South Korea Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 280: South Korea Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 281: South Korea Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 282: South Korea Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 283: South Korea Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 284: South Korea Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 285: South Korea Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 286: South Korea Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 287: South Korea Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 288: South Korea Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 289: South Korea Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 290: Australia Pacific Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 291: Australia Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 292: Australia Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 293: Australia Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 294: Australia Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 295: Australia Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 296: Australia Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 297: Australia Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 298: Australia Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 299: Australia Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 300: Australia Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 301: Australia Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 302: Australia Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 303: Australia Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 304: Australia Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 305: ASEAN Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 306: ASEAN Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 307: ASEAN Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 308: ASEAN Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 309: ASEAN Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 310: ASEAN Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 311: ASEAN Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 312: ASEAN Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 313: ASEAN Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 314: ASEAN Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 315: ASEAN Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 316: ASEAN Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 317: ASEAN Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 318: ASEAN Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 319: ASEAN Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 320: Rest of Asia Pacific Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 321: Rest of Asia Pacific Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 322: Rest of Asia Pacific Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 323: Rest of Asia Pacific Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 324: Rest of Asia Pacific Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 325: Rest of Asia Pacific Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 326: Rest of Asia Pacific Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 327: Rest of Asia Pacific Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 328: Rest of Asia Pacific Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 329: Rest of Asia Pacific Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 330: Rest of Asia Pacific Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 331: Rest of Asia Pacific Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 332: Rest of Asia Pacific Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 333: Rest of Asia Pacific Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 334: Rest of Asia Pacific Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 335: Latin America Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 336: Latin America Autoinjectors Market Value Share Analysis, by Country/Region, 2025 and 2036

Figure 337: Latin America Autoinjectors Market Attractiveness Analysis, by Country/Region, 2026 to 2036

Figure 338: Latin America Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 339: Latin America Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 340: Latin America Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 341: Latin America Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 342: Latin America Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 343: Latin America Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 344: Latin America Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 345: Latin America Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 346: Latin America Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 347: Latin America Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 348: Latin America Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 349: Latin America Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 350: Latin America Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 351: Latin America Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 352: Brazil Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 353: Brazil Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 354: Brazil Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 355: Brazil Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 356: Brazil Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 357: Brazil Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 358: Brazil Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 359: Brazil Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 360: Brazil Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 361: Brazil Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 362: Brazil Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 363: Brazil Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 364: Brazil Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 365: Brazil Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 366: Brazil Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 367: Mexico Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 368: Mexico Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 369: Mexico Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 370: Mexico Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 371: Mexico Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 372: Mexico Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 373: Mexico Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 374: Mexico Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 375: Mexico Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 376: Mexico Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 377: Mexico Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 378: Mexico Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 379: Mexico Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 380: Mexico Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 381: Mexico Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 382: Argentina Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 383: Argentina Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 384: Argentina Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 385: Argentina Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 386: Argentina Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 387: Argentina Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 388: Argentina Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 389: Argentina Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 390: Argentina Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 391: Argentina Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 392: Argentina Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 393: Argentina Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 394: Argentina Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 395: Argentina Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 396: Argentina Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 397: Rest of Latin America Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 398: Rest of Latin America Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 399: Rest of Latin America Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 400: Rest of Latin America Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 401: Rest of Latin America Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 402: Rest of Latin America Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 403: Rest of Latin America Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 404: Rest of Latin America Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 405: Rest of Latin America Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 406: Rest of Latin America Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 407: Rest of Latin America Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 408: Rest of Latin America Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 409: Rest of Latin America Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 410: Rest of Latin America Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 411: Rest of Latin America Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 412: Middle East & Africa Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 413: Middle East & Africa Autoinjectors Market Value Share Analysis, by Country/Region, 2025 and 2036

Figure 414: Middle East & Africa Autoinjectors Market Attractiveness Analysis, by Country/Region, 2026 to 2036

Figure 415: Middle East & Africa Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 416: Middle East & Africa Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 417: Middle East & Africa Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 418: Middle East & Africa Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 419: Middle East & Africa Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 420: Middle East & Africa Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 421: Middle East & Africa Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 422: Middle East & Africa Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 423: Middle East & Africa Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036

Figure 424: Middle East & Africa Autoinjectors Market Attractiveness Analysis, by Volume of Container, 2026 to 2036

Figure 425: Middle East & Africa Autoinjectors Market Value Share Analysis, by Application, 2025 and 2036

Figure 426: Middle East & Africa Autoinjectors Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 427: Middle East & Africa Autoinjectors Market Value Share Analysis, by End-user, 2025 and 2036

Figure 428: Middle East & Africa Autoinjectors Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 429: GCC Countries Autoinjectors Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 430: GCC Countries Autoinjectors Market Value Share Analysis, by Usability, 2025 and 2036

Figure 431: GCC Countries Autoinjectors Market Attractiveness Analysis, by Usability, 2026 to 2036

Figure 432: GCC Countries Autoinjectors Market Value Share Analysis, by Route of Administration, 2025 and 2036

Figure 433: GCC Countries Autoinjectors Market Attractiveness Analysis, by Route of Administration, 2026 to 2036

Figure 434: GCC Countries Autoinjectors Market Value Share Analysis, by Type of Molecule Delivered, 2025 and 2036

Figure 435: GCC Countries Autoinjectors Market Attractiveness Analysis, by Type of Molecule Delivered, 2026 to 2036

Figure 436: GCC Countries Autoinjectors Market Value Share Analysis, by Type of Actuation Mechanism, 2025 and 2036

Figure 437: GCC Countries Autoinjectors Market Attractiveness Analysis, by Type of Actuation Mechanism, 2026 to 2036

Figure 438: GCC Countries Autoinjectors Market Value Share Analysis, by Volume of Container, 2025 and 2036