Reports

Reports

Analysts’ Viewpoint on Market Scenario

Auger drilling is a common technique used in the construction sector to drill holes in soil and rock. Demand for this method is high in the sector due to its versatility and efficiency in creating holes for various purposes such as installing foundations, utilities, and environmental investigations. Auger drilling can be performed quickly and with minimal impact on the surrounding area, making it a preferred choice for various construction projects.

Development of advanced auger drills and the availability of various sizes and configurations are expected to fuel the global auger drilling market value during the forecast period. Manufacturers are expanding their product portfolio to cater to different types of construction projects and to reach a wider customer base.

Auger drilling is used to create boreholes in soil, rock, or other subsurface materials. It involves the use of a rotating helical blade, known as an auger, which is attached to a drill stem. Auger drilling is commonly employed in the construction sector to install foundations and utilities.

Auger drilling is a versatile and efficient method and the drilling equipment is available in various sizes and configurations. Different types of augers are available for different soil and rock conditions.

Auger drilling is extensively utilized across all end-use industries such as mining, oil & gas, construction, automotive, manufacturing, and agriculture. Rise in the global population has led to significant investment in the construction sector. Having bounced back from the COVID-19 fallout, the global construction sector is set to grow by 2.3% a year to reach US$ 16.6 Trn by the end of 2030. Governments across the globe are investing significantly in infrastructure and housing, which is anticipated to spur the auger drilling market growth in the next few years.

Oil and natural gas are major sources of energy and play an influential role in the global economy. Processes involved in the production and distribution of oil & gas are capital-intensive, highly complex, and rely on state-of-the-art technology. Fuel oil and gasoline (petrol) are major products of the sector.

The oil & gas sector is projected to grow at a significant pace in the near future. 39% of the global crude oil is produced by the Organization of the Petroleum Exporting Countries (OPEC). Saudi Arabia, its founding member, is the largest producer with over 12.2 million barrels of oil produced per day. Rise in production and adoption of oil is estimated to propel the demand for heavy engineering equipment, thereby augmenting the auger drilling market size.

The machine type segment is anticipated to hold largest share from 2023 to 2031. Growth of the segment can be ascribed to increase in the demand for drilling in construction and mining sectors.

The handheld segment is expected to grow at a significant pace in the next few years owing to surge in residential and commercial construction activities. Handheld augers typically consist of a handle, a drill stem, and an auger head. The drill stem and auger head can be manually rotated using the handle, or they can be powered by a small gas engine or electric motor.

Handheld augers can be equipped with various types of augers to suit different soil conditions. These augers are portable, inexpensive, and can be used in tight spaces or areas that are difficult to access with larger drilling equipment. However, they have limited drilling depth and capacity. Thus, these augers are typically not suitable for large-scale construction projects.

According to the latest auger drilling market trends, the construction end-use segment is projected to dominate the industry during the forecast period. Continuous Flight Augers (CFA) and bucket augers are commonly employed to construct deep foundations in order to make the building more earthquake-resistant. CFA is a type of auger drilling method where the auger blade is designed to continuously rotate and advance into the ground without being withdrawn, creating a continuous borehole. This method is typically used for deep foundation installations, such as piles and drilled shafts, which require high levels of stability and strength.

According to the latest auger drilling market forecast, Asia Pacific is estimated to account for largest share from 2023 to 2031. The region dominated the industry in 2022. Rise in government investment in infrastructure development and growth in the residential sector are likely to propel market expansion in the region. According to the India Brand Equity Foundation, the Government of India allocated US$ 17.24 Bn to the National Highways Authority of India (NHAI) in its budget for 2022-23.

The global industry is consolidated, with a few large-scale vendors controlling majority of the market share. Most firms are focused on expansion of their revenue streams with significant investments in the R&D of new products. They are also adopting various organic and inorganic growth strategies to broaden their revenue streams.

Agromaster Agricultural Machinery, Sysbohr GmbH, Terex Corporation, Barbco Inc., Champion Equipment Company, Little Beaver, Inc., Premier Attachments, Sollami Company, Marl Technologies Inc., and Liebherr-International AG are prominent entities operating in this industry. These players have been profiled in the auger drilling market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 2.0 Bn |

|

Market Forecast Value in 2031 |

US$ 3.5 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the region as well as country level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

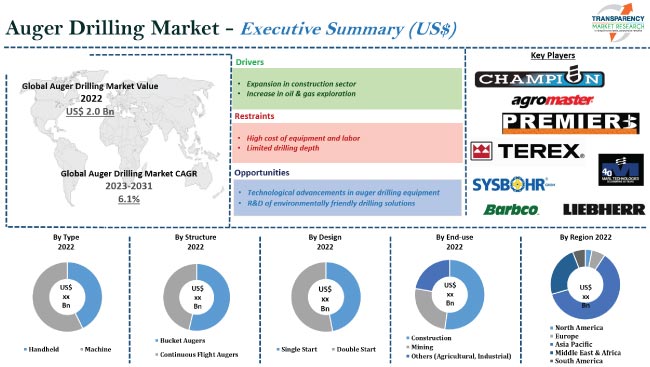

The global market was valued at US$ 2.0 Bn in 2022.

It is estimated to grow at a CAGR of 6.1% from 2023 to 2031.

It is projected to reach US$ 3.5 Bn by the end of 2031.

Expansion in construction sector and increase in oil & gas exploration.

Machine type segment is expected to record highest share during the forecast period.

Asia Pacific is expected to grow at the highest CAGR from 2022 to 2031.

Agromaster Agricultural Machinery, Sysbohr GmbH, Terex Corporation, Barbco Inc., Champion Equipment Company, Little Beaver, Inc., Premier Attachments, Sollami Company, Marl Technologies Inc., and Liebherr-International AG.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Construction Market Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Technological Overview

5.9. Standards and Regulations

5.10. Global Auger Drilling Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Revenue Projection (US$ Mn)

5.10.2. Market Revenue Projection (Thousand Units)

6. Global Auger Drilling Market Analysis and Forecast, by Type

6.1. Global Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

6.1.1. Handheld

6.1.2. Machine

6.2. Incremental Opportunity, By Type

7. Global Auger Drilling Market Analysis and Forecast, by Structure

7.1. Global Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Structure, 2017 - 2031

7.1.1. Bucket Augers

7.1.2. Continuous Flight Augers

8. Global Auger Drilling Market Analysis and Forecast, by Design

8.1. Global Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Design, 2017 - 2031

8.1.1. Single Start

8.1.2. Double Start

8.2. Incremental Opportunity, By Design

9. Global Auger Drilling Market Analysis and Forecast, by End-use

9.1. Global Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by End-use, 2017 - 2031

9.1.1. Construction

9.1.2. Mining

9.1.3. Others (Agricultural, Industrial)

9.2. Incremental Opportunity, By End-use

10. Global Auger Drilling Market Analysis and Forecast, by Region

10.1. Global Auger Drilling Market (US$ Mn and Thousand Units), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Auger Drilling Market Analysis and Forecast

11.1. Regional Snapshot

11.2. COVID-19 Impact Analysis

11.3. Price Trend Analysis

11.3.1. Weighted Average Selling Price (US$)

11.4. Key Trends Analysis

11.4.1. Demand Side

11.4.2. Supply Side

11.5. Key Supplier Analysis

11.6. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

11.6.1. Handheld

11.6.2. Machine

11.7. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Structure, 2017 - 2031

11.7.1. Bucket Augers

11.7.2. Continuous Flight Augers

11.8. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Design, 2017 - 2031

11.8.1. Single Start

11.8.2. Double Start

11.9. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by End-use, 2017 - 2031

11.9.1. Construction

11.9.2. Mining

11.9.3. Others (Agricultural, Industrial)

11.10. Auger Drilling Market (US$ Mn and Thousand Units), by Country, 2017 - 2031

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Auger Drilling Market Analysis and Forecast

12.1. Regional Snapshot

12.2. COVID-19 Impact Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Trends Analysis

12.4.1. Demand Side

12.4.2. Supply Side

12.5. Key Supplier Analysis

12.6. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

12.6.1. Handheld

12.6.2. Machine

12.7. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Structure, 2017 - 2031

12.7.1. Bucket Augers

12.7.2. Continuous Flight Augers

12.8. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Design, 2017 - 2031

12.8.1. Single Start

12.8.2. Double Start

12.9. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by End-use, 2017 - 2031

12.9.1. Construction

12.9.2. Mining

12.9.3. Others (Agricultural, Industrial)

12.10. Auger Drilling Market (US$ Mn and Thousand Units), by Country, 2017 - 2031

12.10.1. Germany

12.10.2. U.K.

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Auger Drilling Market Analysis and Forecast

13.1. Regional Snapshot

13.2. COVID-19 Impact Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Selling Price (US$)

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supply Side

13.5. Key Supplier Analysis

13.6. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

13.6.1. Handheld

13.6.2. Machine

13.7. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Structure, 2017 - 2031

13.7.1. Bucket Augers

13.7.2. Continuous Flight Augers

13.8. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Design, 2017 - 2031

13.8.1. Single Start

13.8.2. Double Start

13.9. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by End-use, 2017 - 2031

13.9.1. Construction

13.9.2. Mining

13.9.3. Others (Agricultural, Industrial)

13.10. Auger Drilling Market (US$ Mn and Thousand Units), by Country, 2017 - 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa Auger Drilling Market Analysis and Forecast

14.1. Regional Snapshot

14.2. COVID-19 Impact Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Key Trends Analysis

14.4.1. Demand Side

14.4.2. Supply Side

14.5. Key Supplier Analysis

14.6. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

14.6.1. Handheld

14.6.2. Machine

14.7. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Structure, 2017 - 2031

14.7.1. Bucket Augers

14.7.2. Continuous Flight Augers

14.8. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Design, 2017 - 2031

14.8.1. Single Start

14.8.2. Double Start

14.9. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by End-use, 2017 - 2031

14.9.1. Construction

14.9.2. Mining

14.9.3. Others (Agricultural, Industrial)

14.10. Auger Drilling Market (US$ Mn and Thousand Units), by Country, 2017 - 2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America Auger Drilling Market Analysis and Forecast

15.1. Regional Snapshot

15.2. COVID-19 Impact Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price (US$)

15.4. Key Trends Analysis

15.4.1. Demand Side

15.4.2. Supply Side

15.5. Key Supplier Analysis

15.6. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Type, 2017 - 2031

15.6.1. Handheld

15.6.2. Machine

15.7. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Structure, 2017 - 2031

15.7.1. Bucket Augers

15.7.2. Continuous Flight Augers

15.8. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by Design, 2017 - 2031

15.8.1. Single Start

15.8.2. Double Start

15.9. Auger Drilling Market (US$ Mn and Thousand Units) Forecast, by End-use, 2017 - 2031

15.9.1. Construction

15.9.2. Mining

15.9.3. Others (Agricultural, Industrial)

15.10. Auger Drilling Market (US$ Mn and Thousand Units), by Country, 2017 - 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Revenue Share Analysis (%), By Company, (2021)

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Agromaster Agricultural Machinery

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Sysbohr GmbH

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Terex Corporation

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Barbco Inc.

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Champion Equipment Company

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Little Beaver, Inc.

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Premier Attachments

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Sollami Company

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Marl Technologies Inc.

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Liebherr-International AG

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaway

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Structure

17.1.3. Design

17.1.4. End-use

17.1.5. Region`

17.2. Understanding Procurement Process of Customers

17.3. Prevailing Market Risks

List of Tables

Table 1: Global Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Table 2: Global Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Table 3: Global Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Table 4: Global Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Table 5: Global Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Table 6: Global Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Table 7: Global Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Table 8: Global Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Table 9: Global Auger Drilling Market Value, by Region, US$ Mn, 2017-2031

Table 10: Global Auger Drilling Market Volume, by Region, Thousand Units,2017-2031

Table 11: North America Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Table 12: North America Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Table 13: North America Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Table 14: North America Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Table 15: North America Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Table 16: North America Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Table 17: North America Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Table 18: North America Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Table 19: North America Auger Drilling Market Value, by Country, US$ Mn, 2017-2031

Table 20: North America Auger Drilling Market Volume, by Country, Thousand Units,2017-2031

Table 21: Europe Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Table 22: Europe Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Table 23: Europe Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Table 24: Europe Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Table 25: Europe Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Table 26: Europe Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Table 27: Europe Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Table 28: Europe Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Table 29: Europe Auger Drilling Market Value, by Country, US$ Mn, 2017-2031

Table 30: Europe Auger Drilling Market Volume, by Country, Thousand Units,2017-2031

Table 31: Asia Pacific Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Table 32: Asia Pacific Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Table 33: Asia Pacific Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Table 34: Asia Pacific Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Table 35: Asia Pacific Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Table 36: Asia Pacific Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Table 37: Asia Pacific Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Table 38: Asia Pacific Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Table 39: Asia Pacific Auger Drilling Market Value, by Country, US$ Mn, 2017-2031

Table 40: Asia Pacific Auger Drilling Market Volume, by Country, Thousand Units,2017-2031

Table 41: Middle East & Africa Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Table 42: Middle East & Africa Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Table 43: Middle East & Africa Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Table 44: Middle East & Africa Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Table 45: Middle East & Africa Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Table 46: Middle East & Africa Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Table 47: Middle East & Africa Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Table 48: Middle East & Africa Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Table 49: Middle East & Africa Auger Drilling Market Value, by Country, US$ Mn, 2017-2031

Table 50: Middle East & Africa Auger Drilling Market Volume, by Country, Thousand Units,2017-2031

Table 51: South America Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Table 52: South America Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Table 53: South America Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Table 54: South America Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Table 55: South America Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Table 56: South America Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Table 57: South America Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Table 58: South America Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Table 59: South America Auger Drilling Market Value, by Country, US$ Mn, 2017-2031

Table 60: South America Auger Drilling Market Volume, by Country, Thousand Units,2017-2031

List of Figures

Figure 1: Global Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Figure 2: Global Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Figure 3: Global Auger Drilling Market Incremental Opportunity, by Type, 2021-2031

Figure 4: Global Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Figure 5: Global Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Figure 6: Global Auger Drilling Market Incremental Opportunity, by Design, 2021-2031

Figure 7: Global Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Figure 8: Global Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Figure 9: Global Auger Drilling Market Incremental Opportunity, by Structure, 2021-2031

Figure 10: Global Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Figure 11: Global Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Figure 12: Global Auger Drilling Market Incremental Opportunity, by End-use, 2021-2031

Figure 13: Global Auger Drilling Market Value, by Region, US$ Mn, 2017-2031

Figure 14: Global Auger Drilling Market Volume, by Region, Thousand Units,2017-2031

Figure 15: Global Auger Drilling Market Incremental Opportunity, by Region,2021-2031

Figure 16: North America Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Figure 17: North America Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Figure 18: North America Auger Drilling Market Incremental Opportunity, by Type, 2021-2031

Figure 19: North America Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Figure 20: North America Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Figure 21: North America Auger Drilling Market Incremental Opportunity, by Design, 2021-2031

Figure 22: North America Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Figure 23: North America Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Figure 24: North America Auger Drilling Market Incremental Opportunity, by Structure, 2021-2031

Figure 25: North America Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Figure 26: North America Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Figure 27: North America Auger Drilling Market Incremental Opportunity, by End-use, 2021-2031

Figure 28: North America Auger Drilling Market Value, by Country, US$ Mn, 2017-2031

Figure 29: North America Auger Drilling Market Volume, by Country, Thousand Units,2017-2031

Figure 30: North America Auger Drilling Market Incremental Opportunity, by Country,2021-2031

Figure 31: Europe Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Figure 32: Europe Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Figure 33: Europe Auger Drilling Market Incremental Opportunity, by Type, 2021-2031

Figure 34: Europe Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Figure 35: Europe Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Figure 36: Europe Auger Drilling Market Incremental Opportunity, by Design, 2021-2031

Figure 37: Europe Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Figure 38: Europe Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Figure 39: Europe Auger Drilling Market Incremental Opportunity, by Structure, 2021-2031

Figure 40: Europe Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Figure 41: Europe Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Figure 42: Europe Auger Drilling Market Incremental Opportunity, by End-use, 2021-2031

Figure 43: Europe Auger Drilling Market Value, by Country, US$ Mn, 2017-2031

Figure 44: Europe Auger Drilling Market Volume, by Country, Thousand Units,2017-2031

Figure 45: Europe Auger Drilling Market Incremental Opportunity, by Country,2021-2031

Figure 46: Asia Pacific Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Figure 47: Asia Pacific Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Figure 48: Asia Pacific Auger Drilling Market Incremental Opportunity, by Type, 2021-2031

Figure 49: Asia Pacific Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Figure 50: Asia Pacific Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Figure 51: Asia Pacific Auger Drilling Market Incremental Opportunity, by Design, 2021-2031

Figure 52: Asia Pacific Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Figure 53: Asia Pacific Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Figure 54: Asia Pacific Auger Drilling Market Incremental Opportunity, by Structure, 2021-2031

Figure 55: Asia Pacific Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Figure 56: Asia Pacific Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Figure 57: Asia Pacific Auger Drilling Market Incremental Opportunity, by End-use, 2021-2031

Figure 58: Asia Pacific Auger Drilling Market Value, by Country, US$ Mn, 2017-2031

Figure 59: Asia Pacific Auger Drilling Market Volume, by Country, Thousand Units,2017-2031

Figure 60: Asia Pacific Auger Drilling Market Incremental Opportunity, by Country,2021-2031

Figure 61: Middle East & Africa Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Figure 62: Middle East & Africa Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Figure 63: Middle East & Africa Auger Drilling Market Incremental Opportunity, by Type, 2021-2031

Figure 64: Middle East & Africa Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Figure 65: Middle East & Africa Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Figure 66: Middle East & Africa Auger Drilling Market Incremental Opportunity, by Design, 2021-2031

Figure 67: Middle East & Africa Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Figure 68: Middle East & Africa Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Figure 69: Middle East & Africa Auger Drilling Market Incremental Opportunity, by Structure, 2021-2031

Figure 70: Middle East & Africa Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Figure 71: Middle East & Africa Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Figure 72: Middle East & Africa Auger Drilling Market Incremental Opportunity, by End-use, 2021-2031

Figure 73: Middle East & Africa Auger Drilling Market Value, by Country, US$ Mn, 2017-2031

Figure 74: Middle East & Africa Auger Drilling Market Volume, by Country, Thousand Units,2017-2031

Figure 75: Middle East & Africa Auger Drilling Market Incremental Opportunity, by Country,2021-2031

Figure 76: South America Auger Drilling Market Value, by Type, US$ Mn, 2017-2031

Figure 77: South America Auger Drilling Market Volume, by Type, Thousand Units,2017-2031

Figure 78: South America Auger Drilling Market Incremental Opportunity, by Type, 2021-2031

Figure 79: South America Auger Drilling Market Value, by Design, US$ Mn, 2017-2031

Figure 80: South America Auger Drilling Market Volume, by Design, Thousand Units,2017-2031

Figure 81: South America Auger Drilling Market Incremental Opportunity, by Design, 2021-2031

Figure 82: South America Auger Drilling Market Value, by Structure, US$ Mn, 2017-2031

Figure 83: South America Auger Drilling Market Volume, by Structure, Thousand Units,2017-2031

Figure 84: South America Auger Drilling Market Incremental Opportunity, by Structure, 2021-2031

Figure 85: South America Auger Drilling Market Value, by End-use, US$ Mn, 2017-2031

Figure 86: South America Auger Drilling Market Volume, by End-use, Thousand Units,2017-2031

Figure 87: South America Auger Drilling Market Incremental Opportunity, by End-use, 2021-2031

Figure 88: South America Auger Drilling Market Value, by Country, US$ Mn, 2017-2031

Figure 89: South America Auger Drilling Market Volume, by Country, Thousand Units,2017-2031

Figure 90: South America Auger Drilling Market Incremental Opportunity, by Country,2021-2031