Reports

Reports

Manufacturers are coming up with new needle designs to improve patient comfort and the success of the procedure. Atraumatic needles like pencil-point, Sprotte, and Whitacre become increasingly popular since they can reduce tissue trauma and reduce post-procedure headaches. Such designs are well-positioned for spinal anesthesia and pain management procedures.

.webp)

The growing trend toward minimally invasive procedures, coupled with the advancements in spinal anesthesia techniques, is boosting the demand for atraumatic needles. The minimally invasive procedures are less painful, have shorter recovery times, and fewer possibilities of complications, which are contributing to market growth.

Atraumatic needles that incorporate safety devices, including needle tip protection and protect mechanisms, are being designed to avoid needlestick injuries and enhance clinician confidence with unsafe procedures.

The global market for atraumatic needles is witnessing aggressive growth due to the rising need for minimally invasive medical treatments and advancement in needles. Atraumatic needles, as a step to minimize tissue trauma and side-effects such as post-dural puncture headache, are utilized as a first line of treatment in spinal anesthesia, pain relief, and diagnostic lumbar puncture. These needles, including pencil-point, Whitacre, and Sprotte are less painful and patient-friendly and highly preferred by healthcare providers.

Increased incidences of chronic diseases and worldwide rates of operations have helped make increased utilization of atraumatic needles feasible. Additionally, greater interest in the prevention of infection and patient safety has also driven hospitals and clinics in the direction of adopting needles that are less traumatic and lead to fewer complications. Advancements in the technology of needles such as enhanced tip structure and security also continue to shape the performance and acceptability of atraumatic needles among specialties.

Geographically, North America currently enjoys a strong position in the atraumatic needles market due to established medical infrastructure, efficient regulatory policies, and high health expenditure in the continent.

The Asia-Pacific is expected to be the fastest-growing market, aided by enhanced access to healthcare, improved patient awareness, and enhanced government initiative for better medical facilities in India and China. It is a field that offers immense market opportunity to stakeholders interested in reaching a growing patient population and improving healthcare systems. According to the WHO, in 2024, it was reported that around 15 million people are living with spinal cord injury (SCI).

| Attribute | Detail |

|---|---|

| Atraumatic Needles Market Drivers |

|

Increasing number of procedures performed worldwide is basically leading the market for atraumatic needles. With growth in the healthcare industry and more accessibility of patients to surgery, especially minimally invasive surgery, need for products providing increased safety with fewer complications has picked up pace.

Atraumatic needles industry are a specific type of needle with the purpose of reducing tissue trauma and minimizing the potential for complication from post-operative headache and pain, and, as such, are found in every kind of surgical and anesthetic procedure.

For instance, orthopedic surgery involving hip and knee arthroplasty, cesarean section, and urology surgery employs spinal anesthesia mostly by virtue of atraumatic needles to avoid post-dural puncture headache and enhance patient recovery. Use of pencil-point type needles for such surgeries has become the norm in most hospitals due to the dramatic improvement in patient outcome over the use of standard cutting needles.

Also contributing to demand is expansion of daycare procedures and ambulatory surgery, many of which involve spinal or epidural anesthesia, as these involve only short-term hospitalization. Applications of minimally invasive techniques in procedures such as laparoscopic cholecystectomy, herniorrhaphy, and gynecologic procedures are adding to the revenue.

Minimally invasive surgery including smaller and more accurate interventions via minimum incision has a range of advantages like less pain, quicker recovery, shorter stay at the hospital, and fewer complications.

Such benefits have caught on in the medical community among a range of specialties, generating pressure for specialist medical devices that enable such approaches- that is, atraumatic needles.

Atraumatic needles are used to reduce tissue trauma in the performance of spinal or epidural anesthesia, usually the choice for minimally invasive procedure. Due to its very design, complications such as post-dural puncture headache and nerve damage are minimized, leading to better patient outcome and satisfaction.

In orthopedic minimally invasive surgery such as arthroscopic joint repair and hip replacement, the atraumatic needles are favored above spinal anesthesia since they limit post-operative complications and allow for faster recovery. The same applies to the overall principles of minimally invasive surgery-better patient outcome and lower healthcare costs.

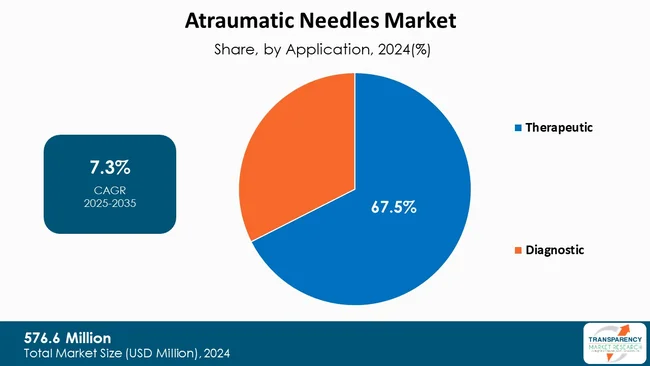

Based on application, the therapeutics segment is expected to hold the maximum market share of 67.5% in 2025 due to their specificity toward a target. The therapeutics market leads the market for atraumatic needles simply as the needles are used mostly in spinal anesthesia, pain management, and drug delivery procedures, all of which come under therapeutic applications.

Atraumatic needles aim to reduce tissue trauma and minimize issues like post-dural puncture headache, which is crucial when administering therapeutics directly into delicate tracts like the spinal canal or epidural space.

In therapeutic interventions, patient comfort and precision are the top priority. As an example, spinal anesthesia has a common use in surgery such as urologic surgery, obstetric (cesarean section), and orthopedic, where atraumatic needles represent a more comfortable and safer option as compared to conventional cutting needles.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America leads the market for atraumatic needles globally with a projected 37.3% share in 2025 due to the intensive presence of pharmaceutical giants and industry players in nations such as the U.S. The big pharma has spent considerably on R&D activities involving nanomedicines and nanocarriers.

Friendly government policies and extensive funding for research in nanotech by government organizations have driven drug development with the assistance of nanotechnology in North America. Most of the nanoparticle-based drugs approved were launched for the first time within this region.

Asia Pacific has been the most rapidly growing regional atraumatic needles market fueled by expansion in healthcare expenditure together with the enormous patient population in the economies such as China and India.

Presence of huge numbers of global clinical trial locations and favorable approval procedures allows Asia Pacific to be a favorite destination for contract research work concerning nanomedicines. The countries also import large quantities of finished medicines with nanocarriers from the other countries. This raises the need for nanotech-facilitated individualized formulations.

Leading companies are partnering with hospitals, specialty clinics, and research institutes to expand inorganically. Merck & Co., Inc., Pfizer Inc., Johnson & Johnson, Novartis AG, Roche Holding AG, AbbVie Inc., Sanofi S.A., Amgen Inc., Celgene Corporation, Gilead Sciences, Inc are the prominent atraumatic needles market players.

Each of these players has been profiled in the atraumatic needles market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 576.6 Mn |

| Forecast Value in 2035 | US$ 1,254.3 Mn |

| CAGR | 7.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global atraumatic needles market was valued at US$ 576.6 Mn in 2024.

Atraumatic needles business is projected to cross US$ 1,254.3 Mn by the end of 2035.

Rising surgical procedures and growing preference for minimally invasive techniques.

The CAGR is anticipated to be 7.3% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Stitchwell., Micro Sharp Needles Pvt. Ltd., Assut Medical Sarl, PAJUNK, UNISIS CORP., SERAG-WIESSNER GmbH & Co. KG, Egemen International, Epimed International, Inc., AdvaCare Pharma, Centenialindia, Beko Needle Mfg. Co, and others are the prominent atraumatic needles market players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Atraumatic Needles Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Atraumatic Needles Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Regulatory Landscape across Key Regions / Countries

5.2. Reimbursement Scenario by Region/Globally

5.3. Porter’s Five Forces Analysis

5.4. PESTEL Analysis

5.5. Key Product/Brand Analysis

6. Global Atraumatic Needles Market Analysis and Forecast, by Application

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Application, 2020 to 2035

6.3.1. Therapeutic

6.3.2. Diagnostic

6.4. Market Attractiveness Analysis, by Application

7. Global Atraumatic Needles Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2020 to 2035

7.3.1. Hospitals and Clinics

7.3.2. Diagnostic Centers

7.3.3. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Atraumatic Needles Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Atraumatic Needles Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Application, 2020 to 2035

9.2.1. Therapeutic

9.2.2. Diagnostic

9.3. Market Value Forecast, by End-user, 2020 to 2035

9.3.1. Hospitals and Clinics

9.3.2. Diagnostic Centers

9.3.3. Others

9.4. Market Value Forecast, by Country, 2020 to 2035

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Application

9.5.2. By End-user

9.5.3. By Country

10. Europe Atraumatic Needles Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Application, 2020 to 2035

10.2.1. Therapeutic

10.2.2. Diagnostic

10.3. Market Value Forecast, by End-user, 2020 to 2035

10.3.1. Hospitals and Clinics

10.3.2. Diagnostic Centers

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Switzerland

10.4.7. The Netherlands

10.4.8. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Application

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Atraumatic Needles Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Application, 2020 to 2035

11.2.1. Therapeutic

11.2.2. Diagnostic

11.3. Market Value Forecast, by End-user, 2020 to 2035

11.3.1. Hospitals and Clinics

11.3.2. Diagnostic Centers

11.3.3. Others

11.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

11.4.1. China

11.4.2. India

11.4.3. Japan

11.4.4. South Korea

11.4.5. Australia & New Zealand

11.4.6. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Application

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Atraumatic Needles Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Application, 2020 to 2035

12.2.1. Therapeutic

12.2.2. Diagnostic

12.3. Market Value Forecast, by End-user, 2020 to 2035

12.3.1. Hospitals and Clinics

12.3.2. Diagnostic Centers

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Argentina

12.4.4. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Application

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Atraumatic Needles Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Application, 2020 to 2035

13.2.1. Therapeutic

13.2.2. Diagnostic

13.3. Market Value Forecast, by End-user, 2020 to 2035

13.3.1. Hospitals and Clinics

13.3.2. Diagnostic Centers

13.3.3. Others

13.4. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Application

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2024)

14.3. Company Profiles

14.3.1. Stitchwell.

14.3.1.1. Company Overview

14.3.1.2. Financial Overview

14.3.1.3. Financial Overview

14.3.1.4. Business Strategies

14.3.1.5. Recent Developments

14.3.2. Micro Sharp Needles Pvt. Ltd.

14.3.2.1. Company Overview

14.3.2.2. Financial Overview

14.3.2.3. Financial Overview

14.3.2.4. Business Strategies

14.3.2.5. Recent Developments

14.3.3. Assut Medical Sarl

14.3.3.1. Company Overview

14.3.3.2. Financial Overview

14.3.3.3. Financial Overview

14.3.3.4. Business Strategies

14.3.3.5. Recent Developments

14.3.4. PAJUNK

14.3.4.1. Company Overview

14.3.4.2. Financial Overview

14.3.4.3. Financial Overview

14.3.4.4. Business Strategies

14.3.4.5. Recent Developments

14.3.5. UNISIS CORP.

14.3.5.1. Company Overview

14.3.5.2. Financial Overview

14.3.5.3. Financial Overview

14.3.5.4. Business Strategies

14.3.5.5. Recent Developments

14.3.6. SERAG-WIESSNER GmbH & Co. KG

14.3.6.1. Company Overview

14.3.6.2. Financial Overview

14.3.6.3. Financial Overview

14.3.6.4. Business Strategies

14.3.6.5. Recent Developments

14.3.7. Egemen International

14.3.7.1. Company Overview

14.3.7.2. Financial Overview

14.3.7.3. Financial Overview

14.3.7.4. Business Strategies

14.3.7.5. Recent Developments

14.3.8. Epimed International, Inc.

14.3.8.1. Company Overview

14.3.8.2. Financial Overview

14.3.8.3. Financial Overview

14.3.8.4. Business Strategies

14.3.8.5. Recent Developments

14.3.9. AdvaCare Pharma

14.3.9.1. Company Overview

14.3.9.2. Financial Overview

14.3.9.3. Financial Overview

14.3.9.4. Business Strategies

14.3.9.5. Recent Developments

14.3.10. Centenialindia

14.3.10.1. Company Overview

14.3.10.2. Financial Overview

14.3.10.3. Financial Overview

14.3.10.4. Business Strategies

14.3.10.5. Recent Developments

14.3.11. Beko Needle Mfg. Co.

14.3.11.1. Company Overview

14.3.11.2. Financial Overview

14.3.11.3. Financial Overview

14.3.11.4. Business Strategies

14.3.11.5. Recent Developments

List of Tables

Table 01: Global Atraumatic Needles Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 02: Global Atraumatic Needles Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 03: Global Atraumatic Needles Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 04: North America Atraumatic Needles Market Value (US$ Mn) Forecast, by Country, 2020-2035

Table 05: North America Atraumatic Needles Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 06: North America Atraumatic Needles Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 07: Europe Atraumatic Needles Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 08: Europe Atraumatic Needles Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 09: Europe Atraumatic Needles Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 10: Asia Pacific Atraumatic Needles Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 11: Asia Pacific Atraumatic Needles Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 12: Asia Pacific Atraumatic Needles Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 13: Latin America Atraumatic Needles Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 14: Latin America Atraumatic Needles Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 15: Latin America Atraumatic Needles Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 16: Middle East & Africa Atraumatic Needles Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 17: Middle East & Africa Atraumatic Needles Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 18: Middle East & Africa Atraumatic Needles Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Atraumatic Needles Market Value Share Analysis, By Application, 2024 and 2035

Figure 02: Global Atraumatic Needles Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 03: Global Atraumatic Needles Market Revenue (US$ Mn), by Therapeutic, 2020 to 2035

Figure 04: Global Atraumatic Needles Market Revenue (US$ Mn), by Diagnostic, 2020 to 2035

Figure 05: Global Atraumatic Needles Market Value Share Analysis, By End-user, 2024 and 2035

Figure 06: Global Atraumatic Needles Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 07: Global Atraumatic Needles Market Revenue (US$ Mn), by Hospital, 2020 to 2035

Figure 08: Global Atraumatic Needles Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2020 to 2035

Figure 09: Global Atraumatic Needles Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 10: Global Atraumatic Needles Market Value Share Analysis, By Region, 2024 and 2035

Figure 11: Global Atraumatic Needles Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 12: North America Atraumatic Needles Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 13: North America Atraumatic Needles Market Value Share Analysis, by Country, 2024 and 2035

Figure 14: North America Atraumatic Needles Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 15: North America Atraumatic Needles Market Value Share Analysis, By Application, 2024 and 2035

Figure 16: North America Atraumatic Needles Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 17: North America Atraumatic Needles Market Value Share Analysis, By End-user, 2024 and 2035

Figure 18: North America Atraumatic Needles Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 19: Europe Atraumatic Needles Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 20: Europe Atraumatic Needles Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 21: Europe Atraumatic Needles Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 22: Europe Atraumatic Needles Market Value Share Analysis, By Application, 2024 and 2035

Figure 23: Europe Atraumatic Needles Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 24: Europe Atraumatic Needles Market Value Share Analysis, By End-user, 2024 and 2035

Figure 25: Europe Atraumatic Needles Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 26: Asia Pacific Atraumatic Needles Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 27: Asia Pacific Atraumatic Needles Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 28: Asia Pacific Atraumatic Needles Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 29: Asia Pacific Atraumatic Needles Market Value Share Analysis, By Application, 2024 and 2035

Figure 30: Asia Pacific Atraumatic Needles Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 31: Asia Pacific Atraumatic Needles Market Value Share Analysis, By End-user, 2024 and 2035

Figure 32: Asia Pacific Atraumatic Needles Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 33: Latin America Atraumatic Needles Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 34: Latin America Atraumatic Needles Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 35: Latin America Atraumatic Needles Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 36: Latin America Atraumatic Needles Market Value Share Analysis, By Application, 2024 and 2035

Figure 37: Latin America Atraumatic Needles Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 38: Latin America Atraumatic Needles Market Value Share Analysis, By End-user, 2024 and 2035

Figure 39: Latin America Atraumatic Needles Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 40: Middle East & Africa Atraumatic Needles Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 41: Middle East & Africa Atraumatic Needles Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 42: Middle East & Africa Atraumatic Needles Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 43: Middle East & Africa Atraumatic Needles Market Value Share Analysis, By Application, 2024 and 2035

Figure 44: Middle East & Africa Atraumatic Needles Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 45: Middle East & Africa Atraumatic Needles Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: Middle East & Africa Atraumatic Needles Market Attractiveness Analysis, By End-user, 2025 to 2035