Reports

Reports

Analysts’ Viewpoint

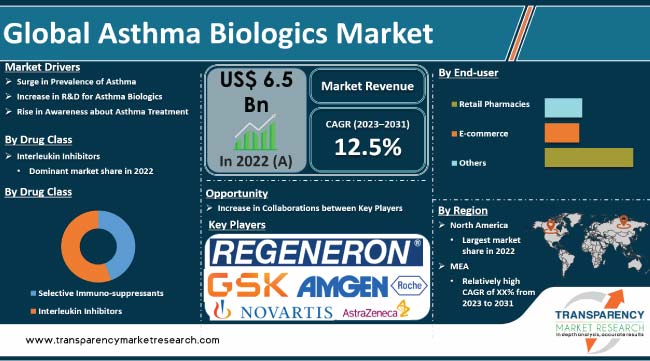

Asthma is a chronic lung disease that affects people of all ages, worldwide, which places a heavy cost on both individuals and healthcare systems. The consequences include a significant decline in one's quality of life and even early death. Children, adolescents, and adults all display similar symptoms of asthma; however, adolescents suffer the greatest burden in terms of the prevalence and severity of the disease. Furthermore, regulatory bodies are hastening the approval of biologics, and healthcare professionals are presently more likely to include biologics in their asthma treatment plans.

In summary, increased awareness about asthma therapy has ushered in a new age for asthma biologics, characterized by increased demand, creative solutions, and more access to these game-changing medications. However, a number of the side-effects associated with asthma drugs, including dry mouth, elevated heart rate, nausea, headaches, and tremors, are expected to somewhat restrain the asthma biologics market growth in the near future.

Biologics are used to treat severe cases of asthma that are difficult to control with conventional inhaled medicines. Biologics can assist to enhance lung function, lessen the requirement for oral corticosteroids, and lessen the severity of asthma symptoms.

Numerous biologics have been licensed for the treatment of asthma. These biologics focus on several disease-related processes, including inflammation, allergic reaction, and airway remodeling. Asthma biologics minimize asthma attacks, alleviate symptoms, and reduce dependency on oral steroids by targeting pathways that cause lung inflammation. They are routinely administered as an injection or infusion in hospitals, or patients can self-inject at home, depending on the biologic being taken.

Asthma treatment primarily comprises FDA-approved asthma biologics, which include Omalizumab (anti-IgE), mepolizumab (anti-IL-5), reslizumab (anti-IL-5), benralizumab (anti-IL-5 receptor), dupilumab (anti-IL-4/IL-13 receptor), and tezepelumab.

Increase in awareness among patients, healthcare providers, and communities regarding asthma management and the array of treatment choices available are boosting the acknowledgment of the paramount importance of achieving improved control over asthma, especially in cases that are severe and unmanageable.

This heightened awareness is prompting individuals to actively seek more effective solutions that extend beyond the traditional use of inhalers and oral medications. One of the key asthma biologics market trends witnessed across the globe is the growing popularity of asthma biologics as an alternative treatment for asthma. This is because asthma biologics are characterized by their precision in addressing the root causes of inflammation and specific molecular pathways implicated in asthma.

Furthermore, individuals are becoming increasingly health-conscious, engaging in practices such as breathing exercises and yoga, and promptly consulting healthcare professionals. This heightened awareness and proactive approach to asthma management are contributing significantly to controlling asthma and, consequently, fueling the asthma treatment and biologics market.

Moreover, healthcare providers are currently more inclined to incorporate biologics into their asthma treatment regimens, and regulatory agencies are expediting approvals for these therapies. People with asthma and organizations dedicated to asthma control and education work together on World Asthma Day (May 3, 2022) and throughout May to spread awareness about asthma, raise awareness about asthma, and enhance the lives of all people with asthma.

Obtaining a worldwide outlook on asthma management is crucial, as it allows us to pinpoint existing deficiencies and formulate strategies for implementing interventions that can bolster asthma control across diverse healthcare environments.

In terms of drug class, the interleukin inhibitors segment held significant asthma biologics market share in 2022. The interleukin inhibitors segment is predicted to expand during the forecast period due to Dupixent. Dupixent is a human monoclonal antibody that blocks the signaling of interleukin-4 (IL-4) and interleukin-13 (IL-13) pathways.

Several nations across the world have approved Dupixent for the treatment of specific patients with atopic dermatitis, asthma, chronic rhinosinusitis with nasal polyposis (CRSwNP), or eosinophilic esophagitis in distinct age demographics. Dupixent is currently licensed for all of these indications in the U.S., while in the European Union, Japan, and more than 60 other countries, it has received approval for one or more of these indications. Globally, more than 400,000 people have received treatment.

Based on distribution channel, the retail pharmacies of asthma biologics market segmentation accounted for the largest share of the global asthma biologics market value in 2022. Retail pharmacies often have pharmacists who can educate patients, thus ensuring that individuals understand how to use biologics effectively and safely.

Retail pharmacies also offer convenience and accessibility to patients with asthma. These pharmacies are commonly located in residential areas. Increase in number of retail pharmacies worldwide, availability of asthma biologics in these settings, and growth in preference among patients for easy access to medication and advice from trained pharmacists are likely to boost segment growth during the forecast period

According to the latest regional asthma biologics market analysis, North America dominated the global market due to the high prevalence of respiratory disorders, well-established healthcare infrastructure, and high healthcare spending. The region is home to several leading pharmaceutical companies that have a strong presence in the global asthma biologics industry and continue to develop innovative therapies.

On the other hand, the asthma biologics market size in Asia Pacific is expected to expand at a rapid pace due to the growing geriatric population, rapidly expansion of healthcare infrastructure, and increase in government initiatives to improve access to healthcare services across the region.

The global asthma biologics business is highly consolidated, with the presence of small number of leading players. Expansion of product portfolio and mergers & acquisitions are the key strategies implemented by leading players in the global market. Amgen, Inc., AstraZeneca, F. Hoffmann-La Roche Ltd., GSK plc, Novartis AG, Regeneron Pharmaceuticals, Inc., Sanofi, Teva Pharmaceutical Industries Ltd., and other prominent players operate in the global asthma biologics market.

Key players in the asthma biologics market have been profiled based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 6.5 Bn |

| Market Forecast Value in 2031 | More than US$ 19.2 Bn |

| Growth Rate (CAGR) | 12.5% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Disease Prevalence Rate with Key Countries, T2 Inflammation Disease State Overview, Pipeline Analysis, Major Biologics Brand Value Forecast. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global market was valued at US$ 6.5 Bn in 2022

It is projected to reach a value of more than US$ 19.2 Bn by 2031

The global business is anticipated to grow at a CAGR of 12.5% from 2023 to 2031

Rise in awareness about asthma treatment and control of asthma

North America is expected to account for major share of the global market during the forecast period

Amgen, Inc., AstraZeneca, F. Hoffmann-La Roche Ltd., GSK plc, Novartis AG, Regeneron Pharmaceuticals, Inc., Sanofi, Teva Pharmaceutical Industries Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Asthma Biologics Market

4. Market Overview

4.1. Introduction

4.1.1. Drug Class Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Asthma Biologics Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Pipeline Analysis

5.2. T2 Inflammation Disease State Overview

5.3. Disease Prevalence Rate with Key Countries

5.4. COVID-19 Pandemics Impact on Industry

6. Global Asthma Biologics Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Class, 2017 - 2031

6.3.1. Selective Immunosuppressants

6.3.2. Interleukin Inhibitors

6.3.3. Others

6.4. Market Attractiveness, by Drug Class

7. Global Asthma Biologics Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Distribution Channel, 2017 - 2031

7.3.1. Retail Pharmacies

7.3.1.1. E-commerce

7.3.1.2. Others

7.4. Market Attractiveness, by Distribution Channel

8. Global Asthma Biologics Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Country/Region

9. North America Asthma Biologics Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Drug Class, 2017 - 2031

9.2.1. Selective Immunosuppressants

9.2.2. Interleukin Inhibitors

9.2.3. Others

9.3. Market Value Forecast, by Distribution Channel, 2017 - 2031

9.3.1. Retail Pharmacies

9.3.2. E-commerce

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017 - 2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Drug Class

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Asthma Biologics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Class, 2017 - 2031

10.2.1. Selective Immunosuppressants

10.2.2. Interleukin Inhibitors

10.2.3. Others

10.3. Market Value Forecast, by Distribution Channel, 2017 - 2031

10.3.1. Retail Pharmacies

10.3.1.1. E-commerce

10.3.1.2. Others

10.4. Market Value Forecast, by Country, 2017 - 2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Drug Class

10.5.2. By Distribution Channel

10.5.3. By Country

11. Asia Pacific Asthma Biologics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017 - 2031

11.2.1. Selective Immunosuppressants

11.2.2. Interleukin Inhibitors

11.2.3. Others

11.3. Market Value Forecast, by Distribution Channel, 2017 - 2031

11.3.1. Retail Pharmacies

11.3.1.1. E-commerce

11.3.1.2. Others

11.4. Market Value Forecast, by Country, 2017 - 2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Drug Class

11.5.2. By Distribution Channel

11.5.3. By Country

12. Latin America Asthma Biologics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017 - 2031

12.2.1. Selective Immunosuppressants

12.2.2. Interleukin Inhibitors

12.2.3. Others

12.3. Market Value Forecast, by Distribution Channel, 2017 - 2031

12.3.1. Retail Pharmacies

12.3.1.1. E-commerce

12.3.1.2. Others

12.4. Market Value Forecast, by Country, 2017 - 2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Drug Class

12.5.2. By Distribution Channel

12.5.3. By Country

13. Middle East & Africa Asthma Biologics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017 - 2031

13.2.1. Selective Immunosuppressants

13.2.2. Interleukin Inhibitors

13.2.3. Others

13.3. Market Value Forecast, by Distribution Channel, 2017 - 2031

13.3.1. Retail Pharmacies

13.3.1.1. E-commerce

13.3.1.2. Others

13.4. Market Value Forecast, by Country, 2017 - 2031

13.4.1. GCC

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Drug Class

13.5.2. By Distribution Channel

13.5.3. By Country

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2021)

14.3. Company Profiles

14.3.1. Amgen, Inc.

14.3.1.1. Company Overview

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. Strategic Overview

14.3.1.5. SWOT Analysis

14.3.2. AstraZeneca

14.3.2.1. Company Overview

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. Strategic Overview

14.3.2.5. SWOT Analysis

14.3.3. F. Hoffmann-La Roche Ltd.

14.3.3.1. Company Overview

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. Strategic Overview

14.3.3.5. SWOT Analysis

14.3.4. GSK plc

14.3.4.1. Company Overview

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. Strategic Overview

14.3.4.5. SWOT Analysis

14.3.5. Novartis AG

14.3.5.1. Company Overview

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. Strategic Overview

14.3.5.5. SWOT Analysis

14.3.6. Regeneron Pharmaceuticals, Inc.

14.3.6.1. Company Overview

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. Strategic Overview

14.3.6.5. SWOT Analysis

14.3.7. Sanofi

14.3.7.1. Company Overview

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. Strategic Overview

14.3.7.5. SWOT Analysis

14.3.8. Teva Pharmaceutical Industries Ltd.

14.3.8.1. Company Overview

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. Strategic Overview

14.3.8.5. SWOT Analysis

List of Tables

Table 01: Global Asthma Biologics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 02: Global Asthma Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 03: Global Asthma Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: North America Asthma Biologics Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America Asthma Biologics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 06: North America Asthma Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 07: Europe Asthma Biologics Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 08: Europe Asthma Biologics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 09: Europe Asthma Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 10: Asia Pacific Asthma Biologics Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 11: Asia Pacific Asthma Biologics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 12: Asia Pacific Asthma Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Latin America Asthma Biologics Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 14: Latin America Asthma Biologics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 15: Latin America Asthma Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 16: Middle East & Africa Asthma Biologics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Asthma Biologics Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 18: Middle East & Africa Asthma Biologics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Asthma Biologics Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Asthma Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 03: Global Asthma Biologics Market Attractiveness, by Drug Class, 2023-2031

Figure 04: Global Asthma Biologics Market Revenue (US$ Mn), by Selective Immuno-suppressants, 2017–2031

Figure 05: Global Asthma Biologics Market Revenue (US$ Mn), by Interleukin Inhibitors, 2017–2031

Figure 06: Global Asthma Biologics Market Revenue (US$ Mn), by Others, 2017–2031

Figure 07: Global Asthma Biologics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 08: Global Asthma Biologics Market Attractiveness, by Distribution Channel, 2023-2031

Figure 09: Global Asthma Biologics Market Revenue (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 10: Global Asthma Biologics Market Revenue (US$ Mn), by E-commerce, 2017–2031

Figure 11: Global Asthma Biologics Market Revenue (US$ Mn), by Others, 2017–2031

Figure 12: Global Asthma Biologics Market Value Share Analysis, by Region, 2022 and 2031

Figure 13: Global Asthma Biologics Market Attractiveness, by Region, 2023-2031

Figure 14: North America Asthma Biologics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 15: North America Asthma Biologics Market Value Share (%), by Country, 2022 and 2031

Figure 16: North America Asthma Biologics Market Attractiveness Analysis, by Country, 2023–2031

Figure 17: North America Asthma Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 18: North America Asthma Biologics Market Attractiveness, by Drug Class, 2023-2031

Figure 19: North America Asthma Biologics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 20: North America Asthma Biologics Market Attractiveness, by Distribution Channel, 2023-2031

Figure 21: Europe Asthma Biologics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 22: Europe Asthma Biologics Market Value Share (%), by Country/Sub-region, 2022 and 2031

Figure 23: Europe Asthma Biologics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 24: Europe Asthma Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 25: Europe Asthma Biologics Market Attractiveness, by Drug Class, 2023-2031

Figure 26: Europe Asthma Biologics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 27: Europe Asthma Biologics Market Attractiveness, by Distribution Channel, 2023-2031

Figure 28: Asia Pacific Asthma Biologics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 29: Asia Pacific Asthma Biologics Market Value Share (%), by Country, 2022 and 2031

Figure 30: Asia Pacific Asthma Biologics Market Attractiveness Analysis, by Country, 2023–2031

Figure 31: Asia Pacific Asthma Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 32: Asia Pacific Asthma Biologics Market Attractiveness, by Drug Class, 2023-2031

Figure 33: Asia Pacific Asthma Biologics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 34: Asia Pacific Asthma Biologics Market Attractiveness, by Distribution Channel, 2023-2031

Figure 35: Latin America Asthma Biologics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 36: Latin America Asthma Biologics Market Value Share (%), by Country, 2022 and 2031

Figure 37: Latin America Asthma Biologics Market Attractiveness Analysis, by Country, 2023–2031

Figure 38: Latin America Asthma Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 39: Latin America Asthma Biologics Market Attractiveness, by Drug Class, 2023-2031

Figure 40: Latin America Asthma Biologics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 41: Latin America Asthma Biologics Market Attractiveness, by Distribution Channel, 2023-2031

Figure 42: Middle East & Africa Asthma Biologics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 43: Middle East & Africa Asthma Biologics Market Value Share (%), by Country/Sub-region, 2022 and 2031

Figure 44: Middle East & Africa Asthma Biologics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 45: Middle East & Africa Asthma Biologics Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 46: Middle East & Africa Asthma Biologics Market Attractiveness, by Drug Class, 2023-2031

Figure 47: Middle East & Africa Asthma Biologics Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 48: Middle East & Africa Asthma Biologics Market Attractiveness, by Distribution Channel, 2023-2031