Reports

Reports

Analyst Viewpoint

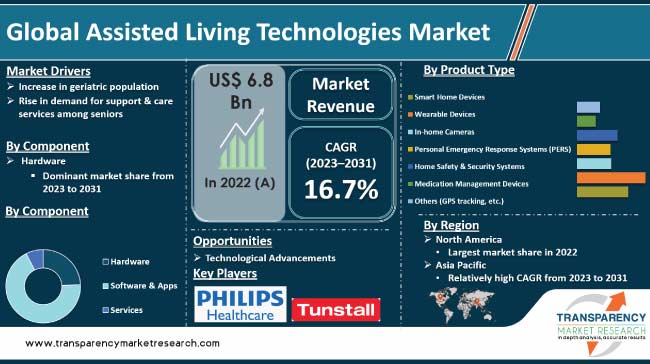

Increase in geriatric population is a primary factor driving the global market. Automation significantly alleviates the burden on caregivers, offering them a more efficient and effective means of managing care responsibilities. Rise in demand for support & care services among seniors and individuals with disabilities is another factor propelling market expansion. Furthermore, advances such as automation of tasks, real-time data & alert provision, and facilitation of remote care delivery are expected to bolster the global assisted living technologies market growth during the forecast period.

Technological advancements offer lucrative opportunities to market players. Manufacturers and senior living technology firms are focusing on the development of innovative and advanced solutions, including remote monitoring devices, wearables, smart home systems, and telehealth solutions in order to capture larger share of the assisted living technologies market.

Assisted living technologies encompass a diverse array of innovative solutions tailored to elevate the care, safety, and overall well-being of individuals residing in assisted living facilities, nursing homes, or those receiving care at home. These technologies play a pivotal role in enabling individuals to preserve their independence, ensuring prompt assistance, and facilitating remote monitoring and care.

Assisted living technologies offer valuable support to caregivers and healthcare providers, enhancing communication, coordination, and overall efficiency in care delivery. Thus, increase in demand for advanced technologies that empower seniors to lead independent lives is fueling the global assisted living technologies market development.

As life expectancy rises, so does demand for assistance and care among older adults. Assisted living technologies address this need by providing essential care, monitoring, and assistance to ensure the well-being and quality of life of the aging population.

Surge in adoption of assisted living technologies is further underscored by the projected demographic shift outlined by the World Health Organization (WHO). Around 1 in 6 individuals globally will be aged 60 years or over by 2030. The population aged 60 years and older is anticipated to rise from 1 billion in 2020 to 1.4 billion during this period. And by 2050, the trend becomes even more pronounced, with the world's population of people aged 60 years and older expected to double, reaching 2.1 billion.

Within this demographic, the number of individuals aged 80 years or older is projected to undergo a remarkable tripling from 2020 to 2050, reaching a substantial figure of 426 million.

Remote monitoring systems, leveraging sensors, wearables, and IoT devices collect data on vital signs, activity levels, and sleep patterns. This data is transmitted to healthcare professionals for remote monitoring of older adults' health status. Early detection of potential health issues or emergencies through remote monitoring allows for timely interventions, ultimately reducing hospitalizations.

Managing complex medication regimens is a common challenge for aging adults. Assisted living technologies, such as medication management systems, offer reminders, dispensing assistance, and automated tracking of medication schedules. These technologies contribute to effective medication management, thereby reducing the risk of errors. Thus, increase in geriatric population is likely to fuel the global assisted living technologies market statistics in the next few years.

Wearable devices, such as smartwatches and fitness trackers, have become increasingly popular in the assisted living space. These devices can track vital signs, activity levels, and sleep patterns, and even detect falls.

For instance, smartwatches equipped with heart rate monitors and fall detection sensors can alert caregivers or healthcare providers in case of abnormal readings or a fall, enabling prompt intervention.

IoT technology has revolutionized the way assisted living technologies operate. IoT devices and sensors can be integrated into the living environment to provide real-time data on various parameters.

Artificial intelligence plays a crucial role in analyzing and interpreting the vast amount of data collected by assisted living technologies. AI algorithms can detect patterns, predict health outcomes, and provide personalized insights. Such technological advancements not only enhance the quality of care, but also improve the overall experience for older adults.

Telehealth has emerged as a game-changer in the assisted living sector, enabling remote care delivery and reducing the need for in-person visits. Telehealth platforms facilitate virtual consultations, remote monitoring of vital signs, and remote diagnosis of conditions.

Assisted living technologies leverage these innovations to provide personalized, proactive, and convenient care, promoting independence and well-being while reducing the burden on healthcare systems. Thus, technological strides taken by key players operating in the sector are augmenting the assisted living technologies market.

In terms of component, the hardware segment accounted for the largest global assisted living technologies market share. Hardware devices play a significant role in enabling and supporting the functionality of assisted living technologies.

Hardware components include wearable devices, sensors, monitors, smart home systems, and medical equipment. These hardware devices serve as the foundation for implementing and integrating assisted living technologies into the care environment.

For instance, In March 2023, MetAlert, Inc. launched its 4G GPS SmartSole in the U.K. with its distribution partner, Possum Ltd. The SmartSole is a location-sensitive health monitoring device and wearable technology product designed for remote patient monitoring. The technology aims to promote lifestyle, wellness, and independence, particularly for patients with mild cognitive impairment. Possum Ltd., a leading supplier of assistive technology and telecare, would help distribute the SmartSole in the U.K.

Based on product type, the wearable devices segment dominated the global assisted living technologies industry in 2022. Wearable devices are revolutionizing the landscape of assisted living technologies.

Offering a discreet and personalized approach to senior care, wearable devices have become integral in facilitating remote health monitoring and emergency response. These devices, ranging from smartwatches to health trackers, contribute significantly to enhancing the independence and safety of seniors.

By collecting vital health data and providing real-time alerts, wearable devices empower both individuals and caregivers. The segment's dominance is a testament to the increasing preference for wearable solutions that seamlessly integrate into daily life while addressing the unique challenges associated with aging, reflecting a paradigm shift in the delivery of personalized and proactive healthcare for seniors.

Based on end-user, the assisted living facilities segment dominated the global assistive living technologies market value in 2022. This is ascribed to the holistic approach of these facilities toward addressing various aspects of senior well-being. These facilities offer personalized care for the elderly.

Assisted living facilities play a pivotal role by creating a safe living environment, facilitating remote monitoring, enhancing emergency response capabilities, and streamlining medication management. This underscores the effectiveness of a multifaceted approach in meeting the evolving needs of seniors in assisted living.

According to assisted living technologies market research report, North America is anticipated to account for major share of the global industry during the forecast period. Increase in geriatric population and technological advancements are the major factors fueling the market in the region. North America has a well-developed healthcare infrastructure and high level of awareness and acceptance of assisted living technologies.

The market in the region is characterized by the presence of several players offering a range of innovative solutions, including remote monitoring systems, medication management devices, wearable technologies, and smart home systems. Additionally, rise in government initiatives and favorable reimbursement policies are likely to augment the market in North America.

Surge in geriatric population, rise in healthcare expenditure, and increase in awareness about the benefits are driving the assisted living technologies market in Asia Pacific. Demand for these technologies is rising in countries such as China, Japan, and India.

As per the global assisted living technologies market analysis, the industry is fragmented, with the presence of several players. These players are engaged in investment in R&D, new product launches, and collaboration to increase market revenue.

Philips Healthcare, Tunstall Healthcare Group, Medtronic plc, Siemens Healthineers, Johnson & Johnson, Honeywell International, Inc., ResMed, Inc., General Electric Company, ADT, Inc., Legrand SA, 2PCS Solutions GmbH, Assisted Living Technologies, Inc., Alcove, Televic, and Bay Alarm Medical are the prominent players in the global assisted living technologies market.

Key players in the assisted living technologies market report have been profiled based on parameters such as company overview, latest developments, business strategies, application portfolio, business segments, and financial overview.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 6.8 Bn |

| Forecast (Value) in 2031 | More than US$ 26.9 Bn |

| Growth Rate (CAGR) | 16.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 6.8 Bn in 2022.

It is projected to reach more than US$ 26.9 Bn by 2031.

It is anticipated to advance at a CAGR of 16.7% from 2023 to 2031.

Increase in geriatric population and rise in demand for support & care services among seniors.

The hardware component segment accounted for more than 32% share in 2022.

North America is expected to be a lucrative region from 2023 to 2031.

Philips Healthcare, Tunstall Healthcare Group, Medtronic plc, Siemens Healthineers, Johnson & Johnson, Honeywell International, Inc., ResMed, Inc., General Electric Company, ADT, Inc., Legrand SA, 2PCS Solutions GmbH, Assisted Living Technologies, Inc., Alcove, Televic, and Bay Alarm Medical.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Assisted Living Technologies Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Assisted Living Technologies Market Analysis and Forecast, 2023–2031

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Technological Advancements

5.2. Reimbursement Scenario by Region/globally

5.3. Key product/brand Analysis

5.4. COVID-19 Pandemic Impact on Industry

6. Global Assisted Living Technologies Market Analysis and Forecast, By Component

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Component, 2023–2031

6.3.1. Hardware

6.3.1.1. Sensors

6.3.1.2. Camera

6.3.1.3. Display Systems

6.3.1.4. Accessories

6.3.2. Software & Apps

6.3.3. Services

6.3.3.1. B2B

6.3.3.2. B2C

6.4. Market Attractiveness Analysis, By Component

7. Global Assisted Living Technologies Market Analysis and Forecast, By Product Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Product Type, 2023–2031

7.3.1. Smart Home Devices

7.3.2. Wearable Devices

7.3.3. In-home Cameras

7.3.4. Personal Emergency Response Systems (PERS)

7.3.5. Home Safety & Security Systems

7.3.6. Medication Management Devices

7.3.7. Others (GPS tracking, etc.)

7.4. Market Attractiveness Analysis, By Product Type

8. Global Assisted Living Technologies Market Analysis and Forecast, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2023–2031

8.3.1. Assisted Living Facilities

8.3.2. Nursing Homes

8.3.3. Rehabilitation Centers

8.3.4. Home Care Settings

8.3.5. Hospices

8.3.6. Others

8.4. Market Attractiveness Analysis, By End-user

9. Global Assisted Living Technologies Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Rest of the World

9.3. Market Attractiveness Analysis, By Region

10. North America Assisted Living Technologies Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Component, 2023–2031

10.2.1. Hardware

10.2.1.1. Sensors

10.2.1.2. Camera

10.2.1.3. Display Systems

10.2.1.4. Accessories

10.2.2. Software & Apps

10.2.3. Services

10.2.3.1. B2B

10.2.3.2. B2C

10.3. Market Value Forecast, by Product Type, 2023–2031

10.3.1. Smart Home Devices

10.3.2. Wearable Devices

10.3.3. In-home Cameras

10.3.4. Personal Emergency Response Systems (PERS)

10.3.5. Home Safety & Security Systems

10.3.6. Medication Management Devices

10.3.7. Others (GPS tracking, etc.)

10.4. Market Value Forecast, by End-user, 2023–2031

10.4.1. Assisted Living Facilities

10.4.2. Nursing Homes

10.4.3. Rehabilitation Centers

10.4.4. Home Care Settings

10.4.5. Hospices

10.4.6. Others

10.5. Market Value Forecast, by Country, 2023–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Component

10.6.2. By Product Type

10.6.3. By End-user

10.6.4. By Country

11. Europe Assisted Living Technologies Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Component, 2023–2031

11.2.1. Hardware

11.2.1.1. Sensors

11.2.1.2. Camera

11.2.1.3. Display Systems

11.2.1.4. Accessories

11.2.2. Software & Apps

11.2.3. Services

11.2.3.1. B2B

11.2.3.2. B2C

11.3. Market Value Forecast, by Product Type, 2023–2031

11.3.1. Smart Home Devices

11.3.2. Wearable Devices

11.3.3. In-home Cameras

11.3.4. Personal Emergency Response Systems (PERS)

11.3.5. Home Safety & Security Systems

11.3.6. Medication Management Devices

11.3.7. Others (GPS tracking, etc.)

11.4. Market Value Forecast, by End-user, 2023–2031

11.4.1. Assisted Living Facilities

11.4.2. Nursing Homes

11.4.3. Rehabilitation Centers

11.4.4. Home Care Settings

11.4.5. Hospices

11.4.6. Others

11.5. Market Value Forecast, by Country/Sub-region, 2023–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Component

11.6.2. By Product Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Assisted Living Technologies Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Component, 2023–2031

12.2.1. Hardware

12.2.1.1. Sensors

12.2.1.2. Camera

12.2.1.3. Display Systems

12.2.1.4. Accessories

12.2.2. Software & Apps

12.2.3. Services

12.2.3.1. B2B

12.2.3.2. B2C

12.3. Market Value Forecast, by Product Type, 2023–2031

12.3.1. Smart Home Devices

12.3.2. Wearable Devices

12.3.3. In-home Cameras

12.3.4. Personal Emergency Response Systems (PERS)

12.3.5. Home Safety & Security Systems

12.3.6. Medication Management Devices

12.3.7. Others (GPS tracking, etc.)

12.4. Market Value Forecast, by End-user, 2023–2031

12.4.1. Assisted Living Facilities

12.4.2. Nursing Homes

12.4.3. Rehabilitation Centers

12.4.4. Home Care Settings

12.4.5. Hospices

12.4.6. Others

12.5. Market Value Forecast, by Country/Sub-region, 2023–2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Component

12.6.2. By Product Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Rest of the World Assisted Living Technologies Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Component, 2023–2031

13.2.1. Hardware

13.2.1.1. Sensors

13.2.1.2. Camera

13.2.1.3. Display Systems

13.2.1.4. Accessories

13.2.2. Software & Apps

13.2.3. Services

13.2.3.1. B2B

13.2.3.2. B2C

13.3. Market Value Forecast, by Product Type, 2023–2031

13.3.1. Smart Home Devices

13.3.2. Wearable Devices

13.3.3. In-home Cameras

13.3.4. Personal Emergency Response Systems (PERS)

13.3.5. Home Safety & Security Systems

13.3.6. Medication Management Devices

13.3.7. Others (GPS tracking, etc.)

13.4. Market Value Forecast, by End-user, 2023–2031

13.4.1. Assisted Living Facilities

13.4.2. Nursing Homes

13.4.3. Rehabilitation Centers

13.4.4. Home Care Settings

13.4.5. Hospices

13.4.6. Others

13.5. Market Value Forecast, by Country/Sub-region, 2023–2031

13.6. Market Attractiveness Analysis

13.6.1. By Component

13.6.2. By Product Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Philips Healthcare

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Tunstall Healthcare Group

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Medtronic plc

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Siemens Healthineers

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Johnson & Johnson

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Honeywell International, Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. ResMed, Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. General Electric Company

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. ADT, Inc.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Legrand SA

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. 2PCS Solutions GmbH

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Assisted Living Technologies, Inc.

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

14.3.13. Alcove

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Product Portfolio

14.3.13.3. Financial Overview

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

14.3.14. Televic

14.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.14.2. Product Portfolio

14.3.14.3. Financial Overview

14.3.14.4. SWOT Analysis

14.3.15. Bay Alarm Medical

14.3.15.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.15.2. Product Portfolio

14.3.15.3. Financial Overview

14.3.15.4. SWOT Analysis

14.3.15.5. Strategic Overview

List of Tables

Table 01: Global Assisted Living Technologies Market Value (US$ Mn) Forecast, by Component, 2023–2031

Table 02: Global Assisted Living Technologies Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 03: Global Assisted Living Technologies Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 04: Global Assisted Living Technologies Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 05: North America Assisted Living Technologies Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 06: North America Assisted Living Technologies Market Value (US$ Mn) Forecast, by Component, 2023–2031

Table 07: North America Assisted Living Technologies Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 08: North America Assisted Living Technologies Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 09: Europe Assisted Living Technologies Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 10: Europe Assisted Living Technologies Market Value (US$ Mn) Forecast, by Component, 2023–2031

Table 11: Europe Assisted Living Technologies Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 12: Europe Assisted Living Technologies Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 13: Asia Pacific Assisted Living Technologies Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 14: Asia Pacific Assisted Living Technologies Market Value (US$ Mn) Forecast, by Component, 2023–2031

Table 15: Asia Pacific Assisted Living Technologies Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 16: Asia Pacific Assisted Living Technologies Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 17: Rest of the World Assisted Living Technologies Market Value (US$ Mn) Forecast, by Component, 2023–2031

Table 18: Rest of the World Assisted Living Technologies Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 19: Rest of the World Assisted Living Technologies Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 20: Middle East & Africa Assisted Living Technologies Market Value (US$ Mn) Forecast, by Country/Sub

List of Figures

Figure 01: Global Assisted Living Technologies Market Value (US$ Mn) Forecast, 2023–2031

Figure 02: Global Assisted Living Technologies Market Value Share, by Component, 2022

Figure 03: Global Assisted Living Technologies Market Value Share, by Product Type, 2022

Figure 04: Global Assisted Living Technologies Market Value Share, by End-user, 2022

Figure 05: Global Assisted Living Technologies Market Value Share, by Region, 2022

Figure 06: Global Assisted Living Technologies Market Value Share Analysis, by Component, 2022 and 2031

Figure 07: Global Assisted Living Technologies Market Attractiveness Analysis, by Component, 2023–2031

Figure 08: Global Assisted Living Technologies Market Value (US$ Mn), by Hardware, 2017–2031

Figure 09: Global Assisted Living Technologies Market Value (US$ Mn), by Software & Apps 2017–2031

Figure 10: Global Assisted Living Technologies Market Value (US$ Mn), by Services, 2017–2031

Figure 11: Global Assisted Living Technologies Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 12: Global Assisted Living Technologies Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 13: Global Assisted Living Technologies Market Value (US$ Mn), by Smart Home Devices, 2017–2031

Figure 14: Global Assisted Living Technologies Market Value (US$ Mn), Wearable Devices, 2017–2031

Figure 15: Global Assisted Living Technologies Market Value (US$ Mn), by In-home Cameras, 2017–2031

Figure 16: Global Assisted Living Technologies Market Value (US$ Mn), by Personal Emergency Response Systems (PERS), 2017–2031

Figure 17: Global Assisted Living Technologies Market Value (US$ Mn), by Home Safety & Security Systems, 2017–2031

Figure 18: Global Assisted Living Technologies Market Value (US$ Mn), by Medication Management Devices, 2017–2031

Figure 19: Global Assisted Living Technologies Market Value (US$ Mn), by Others (GPS tracking, etc.), 2017–2031

Figure 20: Global Assisted Living Technologies Market Value Share Analysis, by End-user, 2022–2031

Figure 21: Global Assisted Living Technologies Market Attractiveness Analysis, by End-user, 2023–2031

Figure 22: Global Assisted Living Technologies Market Value (US$ Mn), by Assisted Living Facilities, 2017–2031

Figure 23: Global Assisted Living Technologies Market Value (US$ Mn), by Nursing Homes, 2017–2031

Figure 24: Global Assisted Living Technologies Market Value (US$ Mn), by Rehabilitation Centers, 2017–2031

Figure 25: Global Assisted Living Technologies Market Value (US$ Mn), by Home Care Settings, 2017–2031

Figure 26: Global Assisted Living Technologies Market Value (US$ Mn), by Hospices, 2017–2031

Figure 27: Global Assisted Living Technologies Market Value (US$ Mn), by Others (Hospitals, Memory Care Facilities)2017–2031

Figure 28: Global Assisted Living Technologies Market Value Share Analysis, by Region, 2022 and 2031

Figure 29: Global Assisted Living Technologies Market Attractiveness Analysis, by Region, 2023–2031

Figure 30: North America Assisted Living Technologies Market Value (US$ Mn) Forecast, 2023–2031

Figure 31: North America Assisted Living Technologies Market Value Share Analysis, by Country, 2022 and 2031

Figure 32: North America Assisted Living Technologies Market Attractiveness Analysis, by Country, 2023–2031

Figure 33: North America Assisted Living Technologies Market Value Share Analysis, by Component, 2022 and 2031

Figure 34: North America Assisted Living Technologies Market Attractiveness Analysis, by Component, 2023–2031

Figure 35: North America Assisted Living Technologies Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 36: North America Assisted Living Technologies Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 37: North America Assisted Living Technologies Market Value Share Analysis (US$ Mn), by End-user, 2022–2031

Figure 38: North America Assisted Living Technologies Market Attractiveness Analysis, by End-user, 2023–2031

Figure 39: Europe Assisted Living Technologies Market Value (US$ Mn) Forecast, 2023–2031

Figure 40: Europe Assisted Living Technologies Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 41: Europe Assisted Living Technologies Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 42: Europe Assisted Living Technologies Market Value Share Analysis, by Component, 2022 and 2031

Figure 43: Europe Assisted Living Technologies Market Attractiveness Analysis, by Component, 2023–2031

Figure 44: Europe Assisted Living Technologies Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 45: Europe Assisted Living Technologies Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 46: Europe Assisted Living Technologies Market Value Share Analysis, by End-user, 2022–2031

Figure 47: Europe Assisted Living Technologies Market Attractiveness Analysis, by End-user, 2023–2031

Figure 48: Asia Pacific Assisted Living Technologies Market Value (US$ Mn) Forecast, 2023–2031

Figure 49: Asia Pacific Assisted Living Technologies Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 50: Asia Pacific Assisted Living Technologies Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 51: Asia Pacific Assisted Living Technologies Market Value Share Analysis, by Component, 2022 and 2031

Figure 52: Asia Pacific Assisted Living Technologies Market Attractiveness Analysis, by Component, 2023–2031

Figure 53: Asia Pacific Assisted Living Technologies Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 54: Asia Pacific Assisted Living Technologies Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 55: Asia Pacific Assisted Living Technologies Market Value Share Analysis, by End-user, 2022–2031

Figure 56: Asia Pacific Assisted Living Technologies Market Attractiveness Analysis, by End-user, 2023–2031

Figure 57: Rest of the World Assisted Living Technologies Market Value (US$ Mn) Forecast, 2023–2031

Figure 58: Rest of the World Assisted Living Technologies Market Value Share Analysis, by Component, 2022 and 2031

Figure 59: Rest of the World Assisted Living Technologies Market Attractiveness Analysis, by Component, 2023–2031

Figure 60: Rest of the World Assisted Living Technologies Market Value Share Analysis, by Product Type, 2022–2031

Figure 61: Rest of the World Assisted Living Technologies Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 62: Rest of the World Assisted Living Technologies Market Value Share Analysis, by End-user, 2022–2031

Figure 63: Rest of the World Assisted Living Technologies Market Attractiveness Analysis, by End-user, 2023–2031