Reports

Reports

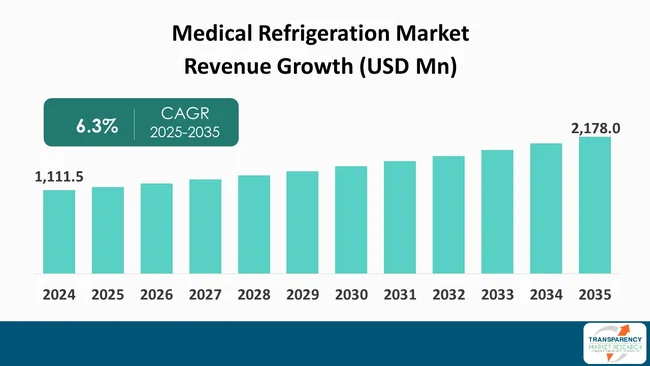

The Asia Pacific Medical Refrigeration market size was valued at US$ 1,111.5 Mn in 2024 and is projected to reach US$ 2,178.0 Mn by 2035, expanding at a CAGR of 6.3% from 2025 to 2035. The market growth is driven by expansion of immunization & public health programs, and strengthening of cold chain infrastructure across healthcare systems.

The medical refrigeration market in the Asia Pacific region is placed right in the middle of the growing healthcare infrastructure and the fast-changing cold chain requirements. In the whole region, the healthcare systems are pouring their money into temperature-controlled storage mainly to keep the vaccines, biologics, and diagnostics, which highlights the strategic role of dependable refrigeration technologies in the patient quality outcomes.

At the same time, the Asia Pacific’s economies are improving the resiliency of their supply chains in the rural and remote areas by the use of the sophisticated refrigeration and monitoring equipment for immunization programs thus, they are also strengthening the servicability of the supply chains.

The international organizations have been quite vocal about the ultra-cold and cold chain equipment being essential; one such example is UNICEF's and WHO's support of an initiative that provided 26 ultra-cold freezers which not only facilitated but also increased the vaccine storage capacity in the underserved areas. This is a clear manifestation of the dependency on these technologies for operations. It is a fact therefore; that there will be an increased demand caused by the public health plan in the region that will support the availability of vaccines, preparedness for emergencies, and establishment of secure storage systems.

Medical refrigeration is a term that encompasses the use of specific refrigeration systems whose main purpose is storage and preservation of medical items which are highly sensitive to changes in temperature. These products include vaccines, blood components, plasma, biological samples, organs, and a variety of drugs.

The medical systems have very strict temperature ranges that they need to maintain as opposed to the standard refrigeration systems; hence, the use of advanced controls, alarms, and backup power is often required. They can be divided into different categories according to the method of cooling (e.g., standard cooling or ultra-low temperature) and their ability to move (fixed units or portable solutions suitable for transportation and use in the field).

This kind of equipment is necessary in all the healthcare settings that need to use them, such as hospitals, diagnostic laboratories, blood banks, clinics, and research institutions, and the performance of such equipment directly affects the quality and safety of the products thus causing spoilage prevention and effective clinical care to happen. Moreover, medical refrigeration has a role in the support of global health initiatives, such as the routine immunization campaigns and emergency response operations that are taking place.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The rapid growth of immunization and public health campaigns is among the prime factors propelling the market for medical refrigerators in the Asia-Pacific region. Vaccines that need strict cold chain management are now part of the national immunization schedules in most countries, which, in turn, is leading to an increase in the demand for the dependable infrastructure for refrigerating the medicines to be installed at all the levels of healthcare delivery. Governments and international partners' efforts to eliminate the vaccination gap in inaccessible or underserved populations make it even more important.

Operations need proper temperature control: WHO/UNICEF guidance states that vaccines generally need to be stored and transported within a very narrow temperature range of about −70 °C to +8 °C so as to keep their potency and prevent spoilage. This situation has pushed the manufacturers to invest in both standard and super-cold refrigeration units capable of handling these conditions safely, particularly for novel vaccine types such as those used for COVID-19 and other infectious diseases that are on the rise.

Nonetheless, large-scale vaccination campaigns drive the demand for reliable power supplies and monitoring systems to minimize the loss of vaccines and guarantee the uninterrupted refrigeration. The growth of the refrigeration market in Asia Pacific is thus firmly linked to the region's commitment to sustaining immunization as countries gradually ramp up health programs to achieve the Sustainable Development Goals.

The systematic improvement of cold chain infrastructure in Asia Pacific healthcare systems is one of the most important factors driving the market growth. The governments and global health partners have come to the conclusion that efficient cold chain logistics that consist of storage, handling, and transport are very important for modern clinical care, emergency response, and routine vaccine delivery.

International organizations have extended their support to these efforts. For instance - UNICEF and partners are still procuring and deploying cold chain equipment in order to strengthen the regional capacity. One of the projects, for instance, 26 ultra-cold freezers, were provided through a UNICEF/WHO-linked scheme, which, in particular areas, has greatly improved the storage potential for vaccines that are sensitive to high temperatures.

The emphasis on the infrastructure not only makes the healthcare system stronger against disease but also allows healthcare delivery, research, and biobanking operations to continue. There is the ability of ultra-cold storage deployment to cut down the time it takes to respond to emergencies, mitigate the risk of vaccine spoilage, and, so, make the healthcare reliability at last-mile stronger. Therefore, as the governments in the region make more investments in cold chain, medical refrigeration is becoming a critical healthcare backbone that is supporting both public health security and the expansion of life-science research.

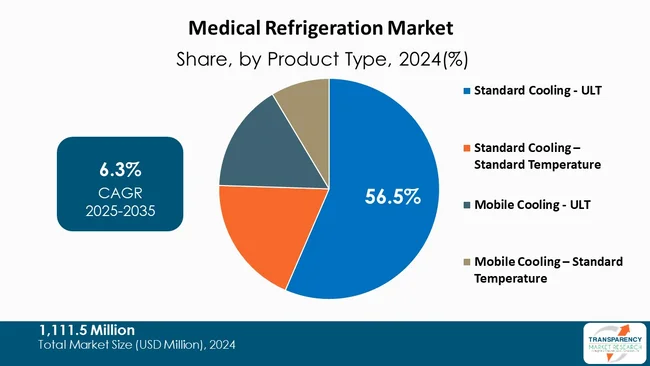

In the medical refrigeration market, the Standard Cooling - ULT sector, which holds the largest market share of 56.5%, is the main player as it secures the extremely low temperature that is necessary for the preservation of sensitive biological materials. These ULT systems are the core of hospitals, research institutions, and vaccine storage facilities where the specimen is kept much less than the normal freezing point to ensure longevity and health compliance. Their large share represents penetration in healthcare sectors where any temperature change carries the risk of losing the active ingredient in the product.

The ULT refrigeration systems can deliver much lower temperatures than the conventional units. Thus, the storage of cutting-edge biologics and vaccines that are extremely temperature-sensitive is made possible. Usually these systems come with high-tech monitoring, and alarm systems are used to alert the user of temperature changes, thus, being in line with international standards regarding product safety and storage.

ULT technology investments are a part of the Asia Pacific healthcare ecosystems reflecting both - clinical requirements and regulatory priorities about cold chain quality, especially in the emerging therapeutic areas needing deep-freeze conditions for storage, research, and emergency preparedness.

| Attribute | Detail |

|---|---|

| Leading Country |

|

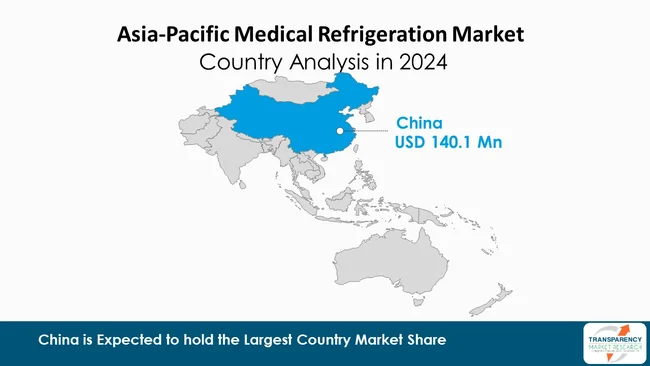

In the Asia Pacific region, China has become the leading contender in the medical refrigeration market, commanding a share of 37.8%. This leadership is bolstered by China's vast healthcare system, manufacturing capacity, and government-coordinated cold chain projects. Moreover, China's considerable input as the region's prime supplier of vaccines and biologics signifies the need for excellent refrigeration systems, from ordinary clinical settings to ultra-modern research laboratories, thereby consolidating its position in terms of both quantity and technology acceptance.

China's health authorities and medical institutions are still working to raise the standard of cold chains and this is primarily done through routine service delivery and emergency preparedness strategies. The country's investments in cold chain logistics that include ultra-cold storage units, temperature-monitoring systems, and integrated supply chains have improved the accessibility of quality healthcare products across the provinces by broadening the reach of critical healthcare services.

The international health partners are often seen collaborating with China in the areas of cold storage capacity improvement which not only shows the nation’s central role in regional health security but also puts it in the forefront of Asia Pacific medical refrigeration innovation and deployment.

Angelantoni Life Science, B Medical Systems S.à r.l., Blue Star Limited, Dohmeyer Mielec, Dulas Ltd., Follett Products, LLC, Haier Biomedical, Helmer Scientific Inc., Liebherr Group, PHC Holdings Corporation, So-Low Environmental Equipment Co., Inc., SunDanzer Refrigeration Inc., Thermo Fisher Scientific, Vestfrost Solutions, and Zhongke Meiling Cryogenics Co. Ltd are some of the leading manufacturers operating in the Asia Pacific Medical Refrigeration market.

Each of these companies has been profiled in the Asia Pacific medical refrigeration industry report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 1,111.5 Mn |

| Market Forecast Value in 2035 | US$ 2,178.0 Mn |

| Growth Rate (CAGR 2025 to 2035) | 6.3% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The Asia Pacific medical refrigeration market was valued at US$ 1,111.5 Mn in 2024

The Asia Pacific medical refrigeration industry is projected to reach at US$ 2,178.0 Mn by the end of 2035

Expansion of immunization & public health programs and strengthening of cold chain infrastructure across healthcare systems, are some of the driving factors for this market

The CAGR is anticipated to be 6.3% from 2025 to 2035

Angelantoni Life Science, B Medical Systems S.à r.l., Blue Star Limited, Dohmeyer Mielec, Dulas Ltd., Follett Products, LLC, Haier Biomedical, Helmer Scientific Inc., Liebherr Group, PHC Holdings Corporation, So-Low Environmental Equipment Co., Inc., SunDanzer Refrigeration Inc., Thermo Fisher Scientific, Vestfrost Solutions, and Zhongke Meiling Cryogenics Co. Ltd, and others

Table 1: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 2: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 3: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Table 4: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Table 5: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Table 6: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 7: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Table 8: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Table 9: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Table 10: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Table 11: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Table 12: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 13: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 14: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 15: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 16: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 17: China Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 18: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 19: China Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Table 20: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Table 21: China Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Table 22: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 23: China Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Table 24: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Table 25: China Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Table 26: China Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Table 27: China Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Table 28: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 29: China Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 30: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 31: India Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 32: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 33: India Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Table 34: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Table 35: India Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Table 36: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 37: India Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Table 38: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Table 39: India Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Table 40: India Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Table 41: India Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Table 42: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 43: India Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 44: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 45: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 46: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 47: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Table 48: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Table 49: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Table 50: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 51: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Table 52: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Table 53: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Table 54: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Table 55: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Table 56: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 57: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 58: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 59: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 60: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 61: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Table 62: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Table 63: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Table 64: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 65: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Table 66: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Table 67: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Table 68: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Table 69: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Table 70: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 71: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 72: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 73: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 74: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 75: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Table 76: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Table 77: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Table 78: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 79: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Table 80: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Table 81: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Table 82: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Table 83: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Table 84: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 85: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 86: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 87: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Table 88: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 89: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Table 90: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Table 91: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Table 92: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 93: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Table 94: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Table 95: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Table 96: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Table 97: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Table 98: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 99: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 100: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 1: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 2: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 3: Asia Pacific Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 4: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Figure 5: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Figure 6: Asia Pacific Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Capacity 2025 to 2035

Figure 7: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Figure 8: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 9: Asia Pacific Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 10: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Figure 11: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Figure 12: Asia Pacific Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Cabinet Type 2025 to 2035

Figure 13: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Figure 14: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Figure 15: Asia Pacific Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By No. of Doors 2025 to 2035

Figure 16: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 17: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 18: Asia Pacific Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 19: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 20: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 21: Asia Pacific Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 22: Asia Pacific Medical Refrigeration Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 23: Asia Pacific Medical Refrigeration Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 24: Asia Pacific Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Country 2025 to 2035

Figure 25: China Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 26: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 27: China Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 28: China Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Figure 29: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Figure 30: China Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Capacity 2025 to 2035

Figure 31: China Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Figure 32: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 33: China Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 34: China Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Figure 35: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Figure 36: China Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Cabinet Type 2025 to 2035

Figure 37: China Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Figure 38: China Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Figure 39: China Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By No. of Doors 2025 to 2035

Figure 40: China Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 41: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 42: China Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 43: China Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 44: China Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 45: China Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 46: India Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 47: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 48: India Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 49: India Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Figure 50: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Figure 51: India Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Capacity 2025 to 2035

Figure 52: India Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Figure 53: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 54: India Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 55: India Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Figure 56: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Figure 57: India Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Cabinet Type 2025 to 2035

Figure 58: India Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Figure 59: India Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Figure 60: India Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By No. of Doors 2025 to 2035

Figure 61: India Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 62: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 63: India Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 64: India Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 65: India Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 66: India Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 67: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 68: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 69: Japan Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 70: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Figure 71: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Figure 72: Japan Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Capacity 2025 to 2035

Figure 73: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Figure 74: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 75: Japan Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 76: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Figure 77: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Figure 78: Japan Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Cabinet Type 2025 to 2035

Figure 79: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Figure 80: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Figure 81: Japan Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By No. of Doors 2025 to 2035

Figure 82: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 83: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 84: Japan Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 85: Japan Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 86: Japan Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 87: Japan Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 88: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 89: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 90: Australia Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 91: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Figure 92: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Figure 93: Australia Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Capacity 2025 to 2035

Figure 94: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Figure 95: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 96: Australia Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 97: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Figure 98: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Figure 99: Australia Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Cabinet Type 2025 to 2035

Figure 100: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Figure 101: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Figure 102: Australia Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By No. of Doors 2025 to 2035

Figure 103: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 104: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 105: Australia Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 106: Australia Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 107: Australia Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 108: Australia Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 109: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 110: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 111: South Korea Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 112: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Figure 113: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Figure 114: South Korea Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Capacity 2025 to 2035

Figure 115: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Figure 116: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 117: South Korea Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 118: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Figure 119: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Figure 120: South Korea Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Cabinet Type 2025 to 2035

Figure 121: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Figure 122: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Figure 123: South Korea Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By No. of Doors 2025 to 2035

Figure 124: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 125: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 126: South Korea Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 127: South Korea Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 128: South Korea Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 129: South Korea Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035

Figure 130: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Product Type 2020 to 2035

Figure 131: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 132: ASEAN Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Product Type 2025 to 2035

Figure 133: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Capacity 2020 to 2035

Figure 134: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Capacity 2020 to 2035

Figure 135: ASEAN Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Capacity 2025 to 2035

Figure 136: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Category 2020 to 2035

Figure 137: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 138: ASEAN Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Category 2025 to 2035

Figure 139: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Cabinet Type 2020 to 2035

Figure 140: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Cabinet Type 2020 to 2035

Figure 141: ASEAN Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Cabinet Type 2025 to 2035

Figure 142: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By No. of Doors 2020 to 2035

Figure 143: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By No. of Doors 2020 to 2035

Figure 144: ASEAN Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By No. of Doors 2025 to 2035

Figure 145: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Application 2020 to 2035

Figure 146: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 147: ASEAN Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Application 2025 to 2035

Figure 148: ASEAN Medical Refrigeration Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 149: ASEAN Medical Refrigeration Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 150: ASEAN Medical Refrigeration Market, Incremental Opportunities (US$ Mn), Forecast, By Distribution Channel 2025 to 2035