Reports

Reports

Analysts’ Viewpoint

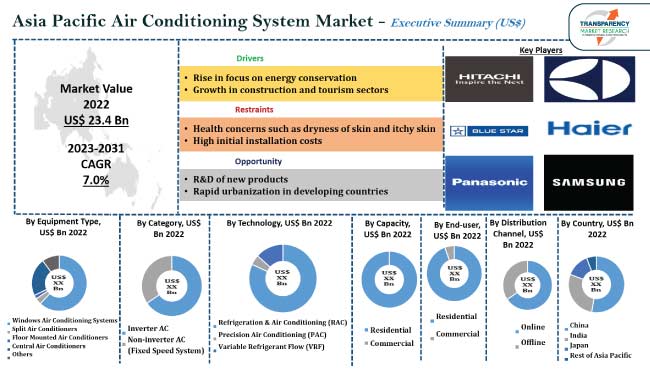

Rise in focus on energy conservation and growth in construction and tourism sectors are projected to augment the Asia Pacific air conditioning system market size during the forecast period. Surges in temperatures continue to boost the demand for cooling solutions, particularly in urban areas.

Increase in focus on energy efficiency and sustainability along with the implementation of stringent energy regulations are fueling adoption of eco-friendly and energy-efficient systems. Recent key developments in the Asia Pacific air conditioning system market focus on the integration of inverter technology and smart features. Surge in need for improved indoor air quality and air purification is likely to offer lucrative opportunities to players in the Asia Pacific air conditioning system industry.

The air conditioning system sector in Asia Pacific encompasses a variety of products including split systems, window units, central air conditioning, and portable air conditioners. These systems incorporate different technologies, such as Refrigeration & Air Conditioning (RAC), Precision Air Conditioning (PAC), and Variable Refrigerant Flow (VRF).

The Asia Pacific air conditioning system market dynamics are shaped by the development and launch of new products with features that enhance cooling efficiency and user experience. Air conditioning systems play a vital role in maintaining indoor comfort across various settings. Customers are increasingly looking for solutions that provide efficient cooling, eco-friendly refrigerants, and the ability to integrate with smart technology for remote control and energy management.

Consumers and businesses are increasingly mindful of energy consumption and costs. Energy-efficient systems, equipped with advanced technologies, such as inverter compressors, adjust their operations to reduce energy usage, leading to lower electricity bills. Government incentives and regulations further promote these systems, fostering the Asia Pacific air conditioning system market progress. Emphasis on energy efficiency benefits consumers and aligns with their sustainability goals, thereby reducing environmental impact.

Human performance and productivity can benefit from air conditioning. People can concentrate, stay alert, and perform better in a variety of contexts, including offices, classrooms, or commercial spaces, by keeping a comfortable interior environment. These factors are contributing to the Asia Pacific air conditioning system market share.

Construction and tourism sectors play a substantial role in driving the Asia Pacific air conditioning system market value. The construction sector contributes by generating demand for HVAC systems in newly constructed residential, commercial, and industrial buildings, often incorporating advanced technologies to meet modern standards. Simultaneously, the tourism sector heavily relies on air conditioning to ensure the comfort and satisfaction of tourists in hotels, resorts, restaurants, and various tourist-related establishments. This results in a consistent need for heating and cooling solutions in APAC, particularly in regions with hot climates, making the tourism sector a significant influencer of the Asia Pacific air conditioning system market growth.

According to the latest Asia Pacific air conditioning system market trends, the split air conditioners equipment type segment is expected to hold largest share from 2023 to 2031. The versatility of split air conditioners allows them to be installed in a wide range of settings, making them suitable for both small rooms and larger spaces.

Split systems are known for their energy efficiency, especially when equipped with inverter technology, which adjusts the compressor speed to reduce energy consumption. Furthermore, they operate quietly, making them an ideal choice for bedrooms and living rooms where noise can be a concern.

According to the latest Asia Pacific air conditioning system market forecast, China is anticipated to account for major share from 2023 to 2031. Rapid urbanization and rise in construction of residential and commercial buildings are fueling the market statistics of the country. China is witnessing the widespread adoption of air conditioning systems for indoor comfort, particularly in regions with hot and humid climates. The country's industrial and commercial sectors have expanded substantially, resulting in a high demand for cooling in various establishments.

China is promoting energy efficiency and environmentally friendly solutions through various initiatives and regulations, which are expected to offer lucrative Asia Pacific air conditioning system market opportunities to manufacturers. The sector in India is projected to grow at a considerable pace owing to rise in population, rapid urbanization, and extreme climatic conditions, including hot and humid summers.

Most air conditioning system manufacturers in Asia Pacific are investing in the R&D of new products to expand their product portfolio. They are also adopting partnership, collaboration, and M&A strategies to broaden their customer base.

The industry is highly competitive, with the presence of various companies including Hitachi Ltd., Electrolux AB, Blue Star Limited., Mitsubishi Corporation, Carrier Corporation, Panasonic Corporation, Haier Electronics Group Co., Ltd., LG Electronics, Samsung Electronics, and Gree Electric Appliances, Inc.

Each of these players has been profiled in the Asia Pacific air conditioning system market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 23.4 Bn |

| Market Forecast Value in 2031 | US$ 42.6 Bn |

| Growth Rate (CAGR) | 7.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2022 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Includes cross segment analysis at country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Country Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 23.4 Bn in 2022

It is projected to reach US$ 42.6 Bn by the end of 2031

Rise in focus on energy conservation and growth in construction and tourism sectors

The split air conditioners equipment type segment held largest share in 2022

China is projected to hold largest share from 2023 to 2031

Hitachi Ltd., Electrolux AB, Blue Star Limited., Mitsubishi Corporation, Carrier Corporation, Panasonic Corporation, Haier Electronics Group Co., Ltd., LG Electronics, Samsung Electronics, and Gree Electric Appliances, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Asia Pacific Air Conditioning System Market Analysis and Forecast, 2017 - 2031

5.7.1. Market Value Projection (US$ Bn)

5.7.2. Market Volume Projection (Thousand Units)

6. Asia Pacific Air Conditioning System Market Analysis and Forecast, by Equipment Type

6.1. Asia Pacific Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Equipment Type, 2017- 2031

6.1.1. Window Air Conditioning Systems

6.1.2. Split Air Conditioners

6.1.3. Floor Mounted Air Conditioners (Portable)

6.1.4. Central Air Conditioners

6.1.5. Others (Packaged Terminal Air Conditioners, Vertical Packaged Air Conditioners, etc.)

6.2. Incremental Opportunity, by Equipment Type

7. Asia Pacific Air Conditioning System Market Analysis and Forecast, by Category

7.1. Asia Pacific Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Category, 2017- 2031

7.1.1. Inverter AC

7.1.2. Non-inverter AC (Fixed Speed System)

7.2. Incremental Opportunity, by Category

8. Asia Pacific Air Conditioning System Market Analysis and Forecast, by Technology

8.1. Asia Pacific Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Technology, 2017- 2031

8.1.1. Refrigeration & Air Conditioning (RAC)

8.1.2. Precision Air Conditioning (PAC)

8.1.3. Variable Refrigerant Flow (VRF)

8.2. Incremental Opportunity, by Technology

9. Asia Pacific Air Conditioning System Market Analysis and Forecast, by Capacity

9.1. Asia Pacific Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Capacity, 2017- 2031

9.1.1. Residential

9.1.1.1. Up to 0.8 Tons

9.1.1.2. 0.9 – 1.5 Tons

9.1.1.3. 1.6 – 2.5 Tons

9.1.1.4. Above 2.5 Tons

9.1.2. Commercial

9.1.2.1. Up to 8 Tons

9.1.2.2. 8.1 – 16.0 Tons

9.1.2.3. 16.1 – 24 Tons

9.1.2.4. Above 24 Tons

9.2. Incremental Opportunity, by Capacity

10. Asia Pacific Air Conditioning System Market Analysis and Forecast, by End-user

10.1. Asia Pacific Air Conditioning System Market Size (US$ Bn) (Thousand Units), by End-user, 2017- 2031

10.1.1. Residential

10.1.2. Commercial

10.1.2.1. Hotels

10.1.2.2. Hospitals

10.1.2.3. Data Centers

10.1.2.4. Offices

10.1.2.5. Others

10.2. Incremental Opportunity, by End-user

11. Asia Pacific Air Conditioning System Market Analysis and Forecast, by Distribution Channel

11.1. Asia Pacific Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

11.1.1. Online

11.1.2. Offline

11.1.2.1. Direct

11.1.2.2. Indirect

11.2. Incremental Opportunity, by Distribution Channel

12. Asia Pacific Air Conditioning System Market Analysis and Forecast, by Country

12.1. Asia Pacific Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Country, 2017- 2031

12.1.1. China

12.1.2. India

12.1.3. Japan

12.1.4. Rest of Asia Pacific

12.2. Incremental Opportunity, by Country

13. China Air Conditioning System Market Analysis and Forecast

13.1. Country Snapshot

13.2. Demographic Overview

13.3. Key Trends Analysis

13.3.1. Supply Side

13.3.2. Demand Side

13.4. Market Share Analysis (%)

13.5. Consumer Buying Behavior Analysis

13.6. Pricing Analysis

13.6.1. Weighted Average Selling Price (US$)

13.7. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Equipment Type, 2017- 2031

13.7.1. Window Air Conditioning Systems

13.7.2. Split Air Conditioners

13.7.3. Floor Mounted Air Conditioners (Portable)

13.7.4. Central Air Conditioners

13.7.5. Others (Packaged Terminal Air Conditioners, Vertical Packaged Air Conditioners, etc.)

13.8. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Category, 2017- 2031

13.8.1. Inverter AC

13.8.2. Non-inverter AC (Fixed Speed System)

13.9. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Technology, 2017- 2031

13.9.1. Refrigeration & Air Conditioning (RAC)

13.9.2. Precision Air Conditioning (PAC)

13.9.3. Variable Refrigerant Flow (VRF)

13.10. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Capacity, 2017- 2031

13.10.1. Residential

13.10.1.1. Up to 0.8 Tons

13.10.1.2. 0.9 – 1.5 Tons

13.10.1.3. 1.6 – 2.5 Tons

13.10.1.4. Above 2.5 Tons

13.10.2. Commercial

13.10.2.1. Up to 8 Tons

13.10.2.2. 8.1 – 16.0 Tons

13.10.2.3. 16.1 – 24 Tons

13.10.2.4. Above 24 Tons

13.11. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by End-user, 2017- 2031

13.11.1. Residential

13.11.2. Commercial

13.11.2.1. Hotels

13.11.2.2. Hospitals

13.11.2.3. Data Centers

13.11.2.4. Offices

13.11.2.5. Others

13.12. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

13.12.1. Online

13.12.2. Offline

13.12.2.1. Direct

13.12.2.2. Indirect

13.13. Incremental Opportunity Analysis

14. India Air Conditioning System Market Analysis and Forecast

14.1. Country Snapshot

14.2. Demographic Overview

14.3. Key Trends Analysis

14.3.1. Supply Side

14.3.2. Demand Side

14.4. Market Share Analysis (%)

14.5. Consumer Buying Behavior Analysis

14.6. Pricing Analysis

14.6.1. Weighted Average Selling Price (US$)

14.7. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Equipment Type, 2017- 2031

14.7.1. Window Air Conditioning Systems

14.7.2. Split Air Conditioners

14.7.3. Floor Mounted Air Conditioners (Portable)

14.7.4. Central Air Conditioners

14.7.5. Others (Packaged Terminal Air, Conditioners, Vertical Package, and Air Conditioners etc.)

14.8. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Category, 2017- 2031

14.8.1. Inverter AC

14.8.2. Non-inverter AC (Fixed Speed System)

14.9. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Technology, 2017- 2031

14.9.1. Refrigeration & Air Conditioning (RAC)

14.9.2. Precision Air Conditioning (PAC)

14.9.3. Variable Refrigerant Flow (VRF)

14.10. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Capacity, 2017- 2031

14.10.1. Residential

14.10.1.1. Up to 0.8 Tons

14.10.1.2. 0.9 – 1.5 Tons

14.10.1.3. 1.6 – 2.5 Tons

14.10.1.4. Above 2.5 Tons

14.10.2. Commercial

14.10.2.1. Up to 8 Tons

14.10.2.2. 8.1 – 16.0 Tons

14.10.2.3. 16.1 – 24 Tons

14.10.2.4. Above 24 Tons

14.11. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by End-user, 2017- 2031

14.11.1. Residential

14.11.2. Commercial

14.11.2.1. Hotels

14.11.2.2. Hospitals

14.11.2.3. Data Centers

14.11.2.4. Offices

14.11.2.5. Others

14.12. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

14.12.1. Online

14.12.2. Offline

14.12.2.1. Direct

14.12.2.2. Indirect

14.13. Incremental Opportunity Analysis

15. Japan Air Conditioning System Market Analysis and Forecast

15.1. Country Snapshot

15.2. Demographic Overview

15.3. Key Trends Analysis

15.3.1. Supply Side

15.3.2. Demand Side

15.4. Market Share Analysis (%)

15.5. Consumer Buying Behavior Analysis

15.6. Pricing Analysis

15.6.1. Weighted Average Selling Price (US$)

15.7. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Equipment Type, 2017- 2031

15.7.1. Window Air Conditioning Systems

15.7.2. Split Air Conditioners

15.7.3. Floor Mounted Air Conditioners (Portable)

15.7.4. Central Air Conditioners

15.7.5. Others (Packaged Terminal Air, Conditioners, Vertical Package, and Air Conditioners etc.)

15.8. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Category, 2017- 2031

15.8.1. Inverter AC

15.8.2. Non-inverter AC (Fixed Speed System)

15.9. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Technology, 2017- 2031

15.9.1. Refrigeration & Air Conditioning (RAC)

15.9.2. Precision Air Conditioning (PAC)

15.9.3. Variable Refrigerant Flow (VRF)

15.10. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Capacity, 2017- 2031

15.10.1. Residential

15.10.1.1. Up to 0.8 Tons

15.10.1.2. 0.9 – 1.5 Tons

15.10.1.3. 1.6 – 2.5 Tons

15.10.1.4. Above 2.5 Tons

15.10.2. Commercial

15.10.2.1. Up to 8 Tons

15.10.2.2. 8.1 – 16.0 Tons

15.10.2.3. 16.1 – 24 Tons

15.10.2.4. Above 24 Tons

15.11. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by End-user, 2017- 2031

15.11.1. Residential

15.11.2. Commercial

15.11.2.1. Hotels

15.11.2.2. Hospitals

15.11.2.3. Data Centers

15.11.2.4. Offices

15.11.2.5. Others

15.12. Air Conditioning System Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

15.12.1. Online

15.12.2. Offline

15.12.2.1. Direct

15.12.2.2. Indirect

15.13. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Competition Dashboard

16.2. Market Share Analysis % (2022)

16.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

16.3.1. Hitachi Ltd.

16.3.1.1. Company Overview,

16.3.1.2. Product Portfolio,

16.3.1.3. Financial Information,

16.3.1.4. (Subject to Data Availability),

16.3.1.5. Business Strategies / Recent Developments

16.3.2. Electrolux AB

16.3.2.1. Company Overview,

16.3.2.2. Product Portfolio,

16.3.2.3. Financial Information,

16.3.2.4. (Subject to Data Availability),

16.3.2.5. Business Strategies / Recent Developments

16.3.3. Blue Star Limited

16.3.3.1. Company Overview,

16.3.3.2. Product Portfolio,

16.3.3.3. Financial Information,

16.3.3.4. (Subject to Data Availability),

16.3.3.5. Business Strategies / Recent Developments

16.3.4. Mitsubishi Corporation

16.3.4.1. Company Overview,

16.3.4.2. Product Portfolio,

16.3.4.3. Financial Information,

16.3.4.4. (Subject to Data Availability),

16.3.4.5. Business Strategies / Recent Developments

16.3.5. Carrier Corporation

16.3.5.1. Company Overview,

16.3.5.2. Product Portfolio,

16.3.5.3. Financial Information,

16.3.5.4. (Subject to Data Availability),

16.3.5.5. Business Strategies / Recent Developments

16.3.6. Panasonic Corporation

16.3.6.1. Company Overview,

16.3.6.2. Product Portfolio,

16.3.6.3. Financial Information,

16.3.6.4. (Subject to Data Availability),

16.3.6.5. Business Strategies / Recent Developments

16.3.7. Haier Electronics Group Co., Ltd.

16.3.7.1. Company Overview,

16.3.7.2. Product Portfolio,

16.3.7.3. Financial Information,

16.3.7.4. (Subject to Data Availability),

16.3.7.5. Business Strategies / Recent Developments

16.3.8. LG Electronics

16.3.8.1. Company Overview,

16.3.8.2. Product Portfolio,

16.3.8.3. Financial Information,

16.3.8.4. (Subject to Data Availability),

16.3.8.5. Business Strategies / Recent Developments

16.3.9. Samsung Electronics

16.3.9.1. Company Overview,

16.3.9.2. Product Portfolio,

16.3.9.3. Financial Information,

16.3.9.4. (Subject to Data Availability),

16.3.9.5. Business Strategies / Recent Developments

16.3.10. Gree Electric Appliances, Inc.

16.3.10.1. Company Overview,

16.3.10.2. Product Portfolio,

16.3.10.3. Financial Information,

16.3.10.4. (Subject to Data Availability),

16.3.10.5. Business Strategies / Recent Developments

16.3.11. Other Key Players

16.3.11.1. Company Overview,

16.3.11.2. Product Portfolio,

16.3.11.3. Financial Information,

16.3.11.4. (Subject to Data Availability),

16.3.11.5. Business Strategies / Recent Developments

17. Go To Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Understanding Buying Process of Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Equipment Type, 2017-2031

Table 2: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Equipment Type, 2017-2031

Table 3: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Category, 2017-2031

Table 4: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Category, 2017-2031

Table 5: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Technology, 2017-2031

Table 6: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Technology, 2017-2031

Table 7: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Capacity, 2017-2031

Table 8: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Capacity, 2017-2031

Table 9: Asia Pacific Air Conditioning System Market Value (US$ Bn), by End-user, 2017-2031

Table 10: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by End-user, 2017-2031

Table 11: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 12: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 13: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Country, 2017-2031

Table 14: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Country, 2017-2031

Table 15: China Air Conditioning System Market Value (US$ Bn), by Equipment Type, 2017-2031

Table 16: China Air Conditioning System Market Volume (Thousand Units), by Equipment Type, 2017-2031

Table 17: China Air Conditioning System Market Value (US$ Bn), by Category, 2017-2031

Table 18: China Air Conditioning System Market Volume (Thousand Units), by Category, 2017-2031

Table 19: China Air Conditioning System Market Value (US$ Bn), by Technology, 2017-2031

Table 20: China Air Conditioning System Market Volume (Thousand Units), by Technology, 2017-2031

Table 21: China Air Conditioning System Market Value (US$ Bn), by Capacity, 2017-2031

Table 22: China Air Conditioning System Market Volume (Thousand Units), by Capacity, 2017-2031

Table 23: China Air Conditioning System Market Value (US$ Bn), by End-user, 2017-2031

Table 24: China Air Conditioning System Market Volume (Thousand Units), by End-user, 2017-2031

Table 25: China Air Conditioning System Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 26: China Air Conditioning System Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 27: India Air Conditioning System Market Value (US$ Bn), by Equipment Type, 2017-2031

Table 28: India Air Conditioning System Market Volume (Thousand Units), by Equipment Type, 2017-2031

Table 29: India Air Conditioning System Market Value (US$ Bn), by Category, 2017-2031

Table 30: India Air Conditioning System Market Volume (Thousand Units), by Category, 2017-2031

Table 31: India Air Conditioning System Market Value (US$ Bn), by Technology, 2017-2031

Table 32: India Air Conditioning System Market Volume (Thousand Units), by Technology, 2017-2031

Table 33: India Air Conditioning System Market Value (US$ Bn), by Capacity, 2017-2031

Table 34: India Air Conditioning System Market Volume (Thousand Units), by Capacity, 2017-2031

Table 35: India Air Conditioning System Market Value (US$ Bn), by End-user, 2017-2031

Table 36: India Air Conditioning System Market Volume (Thousand Units), by End-user, 2017-2031

Table 37: India Air Conditioning System Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 38: India Air Conditioning System Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 39: Japan Air Conditioning System Market Value (US$ Bn), by Equipment Type, 2017-2031

Table 40: Japan Air Conditioning System Market Volume (Thousand Units), by Equipment Type, 2017-2031

Table 41: Japan Air Conditioning System Market Value (US$ Bn), by Category, 2017-2031

Table 42: Japan Air Conditioning System Market Volume (Thousand Units), by Category, 2017-2031

Table 43: Japan Air Conditioning System Market Value (US$ Bn), by Technology, 2017-2031

Table 44: Japan Air Conditioning System Market Volume (Thousand Units), by Technology, 2017-2031

Table 45: Japan Air Conditioning System Market Value (US$ Bn), by Capacity, 2017-2031

Table 46: Japan Air Conditioning System Market Volume (Thousand Units), by Capacity, 2017-2031

Table 47: Japan Air Conditioning System Market Value (US$ Bn), by End-user, 2017-2031

Table 48: Japan Air Conditioning System Market Volume (Thousand Units), by End-user, 2017-2031

Table 49: Japan Air Conditioning System Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 50: Japan Air Conditioning System Market Volume (Thousand Units), by Distribution Channel, 2017-2031

List of Figures

Figure 1: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Equipment Type, 2017-2031

Figure 2: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Equipment Type, 2017-2031

Figure 3: Asia Pacific Air Conditioning System Market Incremental Opportunity (US$ Bn), by Equipment Type, 2017-2031

Figure 4: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Category, 2017-2031

Figure 5: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Category, 2017-2031

Figure 6: Asia Pacific Air Conditioning System Market Incremental Opportunity (US$ Bn), by Category, 2017-2031

Figure 7: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Technology, 2017-2031

Figure 8: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Technology, 2017-2031

Figure 9: Asia Pacific Air Conditioning System Market Incremental Opportunity (US$ Bn), by Technology, 2017-2031

Figure 10: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Capacity, 2017-2031

Figure 11: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Capacity, 2017-2031

Figure 12: Asia Pacific Air Conditioning System Market Incremental Opportunity (US$ Bn), by Capacity, 2017-2031

Figure 13: Asia Pacific Air Conditioning System Market Value (US$ Bn), by End-user, 2017-2031

Figure 14: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by End-user, 2017-2031

Figure 15: Asia Pacific Air Conditioning System Market Incremental Opportunity (US$ Bn), by End-user, 2017-2031

Figure 16: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 17: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 18: Asia Pacific Air Conditioning System Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 19: Asia Pacific Air Conditioning System Market Value (US$ Bn), by Country, 2017-2031

Figure 20: Asia Pacific Air Conditioning System Market Volume (Thousand Units), by Country, 2017-2031

Figure 21: Asia Pacific Air Conditioning System Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figure 22: China Air Conditioning System Market Value (US$ Bn), by Equipment Type, 2017-2031

Figure 23: China Air Conditioning System Market Volume (Thousand Units), by Equipment Type, 2017-2031

Figure 24: China Air Conditioning System Market Incremental Opportunity (US$ Bn), by Equipment Type, 2017-2031

Figure 25: China Air Conditioning System Market Value (US$ Bn), by Category, 2017-2031

Figure 26: China Air Conditioning System Market Volume (Thousand Units), by Category, 2017-2031

Figure 27: China Air Conditioning System Market Incremental Opportunity (US$ Bn), by Category, 2017-2031

Figure 28: China Air Conditioning System Market Value (US$ Bn), by Technology, 2017-2031

Figure 29: China Air Conditioning System Market Volume (Thousand Units), by Technology, 2017-2031

Figure 30: China Air Conditioning System Market Incremental Opportunity (US$ Bn), by Technology, 2017-2031

Figure 31: China Air Conditioning System Market Value (US$ Bn), by Capacity, 2017-2031

Figure 32: China Air Conditioning System Market Volume (Thousand Units), by Capacity, 2017-2031

Figure 33: China Air Conditioning System Market Incremental Opportunity (US$ Bn), by Capacity, 2017-2031

Figure 34: China Air Conditioning System Market Value (US$ Bn), by End-user, 2017-2031

Figure 35: China Air Conditioning System Market Volume (Thousand Units), by End-user, 2017-2031

Figure 36: China Air Conditioning System Market Incremental Opportunity (US$ Bn), by End-user, 2017-2031

Figure 37: China Air Conditioning System Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 38: China Air Conditioning System Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 39: China Air Conditioning System Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 40: India Air Conditioning System Market Value (US$ Bn), by Equipment Type, 2017-2031

Figure 41: India Air Conditioning System Market Volume (Thousand Units), by Equipment Type, 2017-2031

Figure 42: India Air Conditioning System Market Incremental Opportunity (US$ Bn), by Equipment Type, 2017-2031

Figure 43: India Air Conditioning System Market Value (US$ Bn), by Category, 2017-2031

Figure 44: India Air Conditioning System Market Volume (Thousand Units), by Category, 2017-2031

Figure 45: India Air Conditioning System Market Incremental Opportunity (US$ Bn), by Category, 2017-2031

Figure 46: India Air Conditioning System Market Value (US$ Bn), by Technology, 2017-2031

Figure 47: India Air Conditioning System Market Volume (Thousand Units), by Technology, 2017-2031

Figure 48: India Air Conditioning System Market Incremental Opportunity (US$ Bn), by Technology, 2017-2031

Figure 49: India Air Conditioning System Market Value (US$ Bn), by Capacity, 2017-2031

Figure 50: India Air Conditioning System Market Volume (Thousand Units), by Capacity, 2017-2031

Figure 51: India Air Conditioning System Market Incremental Opportunity (US$ Bn), by Capacity, 2017-2031

Figure 52: India Air Conditioning System Market Value (US$ Bn), by End-user, 2017-2031

Figure 53: India Air Conditioning System Market Volume (Thousand Units), by End-user, 2017-2031

Figure 54: India Air Conditioning System Market Incremental Opportunity (US$ Bn), by End-user, 2017-2031

Figure 55: India Air Conditioning System Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 56: India Air Conditioning System Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 57: India Air Conditioning System Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figure 58: Japan Air Conditioning System Market Value (US$ Bn), by Equipment Type, 2017-2031

Figure 59: Japan Air Conditioning System Market Volume (Thousand Units), by Equipment Type, 2017-2031

Figure 60: Japan Air Conditioning System Market Incremental Opportunity (US$ Bn), by Equipment Type, 2017-2031

Figure 61: Japan Air Conditioning System Market Value (US$ Bn), by Category, 2017-2031

Figure 62: Japan Air Conditioning System Market Volume (Thousand Units), by Category, 2017-2031

Figure 63: Japan Air Conditioning System Market Incremental Opportunity (US$ Bn), by Category, 2017-2031

Figure 64: Japan Air Conditioning System Market Value (US$ Bn), by Technology, 2017-2031

Figure 65: Japan Air Conditioning System Market Volume (Thousand Units), by Technology, 2017-2031

Figure 66: Japan Air Conditioning System Market Incremental Opportunity (US$ Bn), by Technology, 2017-2031

Figure 67: Japan Air Conditioning System Market Value (US$ Bn), by Capacity, 2017-2031

Figure 68: Japan Air Conditioning System Market Volume (Thousand Units), by Capacity, 2017-2031

Figure 69: Japan Air Conditioning System Market Incremental Opportunity (US$ Bn), by Capacity, 2017-2031

Figure 70: Japan Air Conditioning System Market Value (US$ Bn), by End-user, 2017-2031

Figure 71: Japan Air Conditioning System Market Volume (Thousand Units), by End-user, 2017-2031

Figure 72: Japan Air Conditioning System Market Incremental Opportunity (US$ Bn), by End-user, 2017-2031

Figure 73: Japan Air Conditioning System Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 74: Japan Air Conditioning System Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 75: Japan Air Conditioning System Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031