Reports

Reports

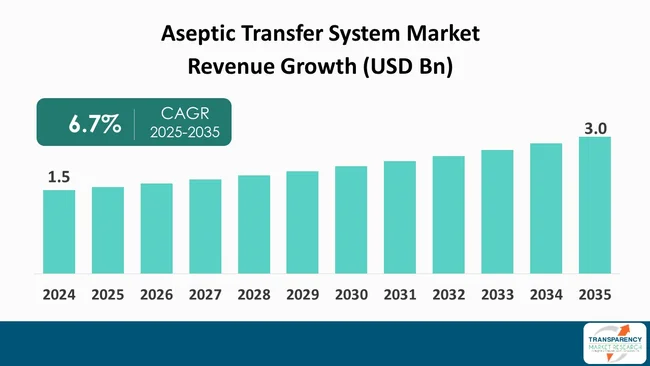

The global aseptic transfer system market size was valued at US$ 1.5 Bn in 2024 and is projected to reach US$ 3.0 Bn by 2035, expanding at a CAGR of 6.7% from 2025 to 2035. Its growth is driven mainly by the rising production of sterile biologics and vaccines, along with stricter contamination-control regulations that push companies toward advanced, single-use aseptic transfer solutions.

The aseptic transfer systems (ATS) market is witnessing consistency due to the increased demand for sterile and contaminant-free manufacturing in the pharmaceutical and biotechnology industries.

Increased demand for aseptic processing and contamination control is driving the industry to incorporate automatic ATS solutions within manufacturing facilities. Technological advancements such as real-time monitoring, robotics, single-use systems, and modular cleanrooms extend support to increased flexibility, making ATS systems indispensable for both - large manufacturers of pharmaceuticals and emerging biotech companies. While the market continues to present several opportunities for growth, barriers to entry stay due to the prevailing high capital costs and operational costs of the systems, challenging validation processes, and essential skills for supporting ATS systems.

Demand is expected to be substantial across territory geographical locations due to increased manufacturing capacities. Demand is also especially strong for scalable and flexible manufacturing systems.

Suppliers offering complete and integrated solutions enabling automation, consumables, and digital monitoring have competitive advantages. Sustainable solutions and solutions encouraging operation flexibility are growing in consideration and importance.

An aseptic transfer system (ATS) is a specialized system utilized in pharmaceutical or biotechnology manufacturing for the safe transfer of materials - powders, liquids, or equipment across different processing areas without risk of contamination. ATS systems allow for sustenance of a sterile environment during the transfer of materials between different environments while preventing microbial, particulate, or cross-contamination while still adhering to regulatory standards for aseptic processing.

ATS solutions can come in the form of closed containers, sterilizable connectors, isolators, gloveboxes, and transfer ports. ATS is essential in manufacturing to enable movement of contaminated free materials while sustaining the safety, quality, and integrity of sensitive products such as injectable drugs, biologics, and advanced therapies. ATS has grown to be a standard of practice in manufacturing to sustain sterile supply operations while increasing efficiency of transfers and supporting regulatory compliance with good manufacturing practices (GMP).

| Attribute | Detail |

|---|---|

| Aseptic Transfer SystemMarket Drivers |

|

The growth of sterile drug and biologics manufacturing is one of the primary drivers to the aseptic transfer system (ATS) market. As the biotechnology and pharmaceutical industry advance, the focus on vaccines, injectable drugs, monoclonal antibodies, and the other biologics that require strict aseptic conditions grows. Aseptic products are sensitive and could be compromised by particulates, microorganisms, and environmental contaminants. Transporting materials in this context requires ATS solutions to protect product quality and sterility throughout the manufacturing process.

The rise in frequency of advanced therapies, e.g., cell and gene therapy, is compounding the need for effective aseptic transfer systems. Advanced therapies typically consist of small batch manufacturing and will require the handling of very sensitive materials, which means precise handling and closed system transfers.

Manufacturers are employing an increasingly high amount of automated, single-use, and modular ATS technologies to minimize human intervention, minimize contamination risk, and maintain compliance with tight regulatory standards. ATS also contributes to moving secure and contamination free material handling, along with a potentially higher quality product, operational efficiencies, and enhanced patient safety.

Stringent regulatory requirements are a key driver to the aseptic transfer system (ATS) market. The biotechnology and pharmaceuticals’ manufacturers work within strict guidelines for maintaining product sterility, quality, and safety. Regulatory authorities like the U.S. FDA, EMA, and others enforce strict regulations, thereby governing aseptic processing including the handling of materials, contamination controls, and environmental monitoring.

Compliance, therefore, is vital. ATS solutions provide manufacturers with the ability to safely transfer materials between controlled environments while preventing microbial, particulate or cross-contamination allowing them to maintain compliance with these strict regulations.

The market for ATS systems has only been further driven by the rise in demand for these products, particularly injectables, biologics or advanced therapy medicinal products that are highly susceptible to contamination. Closed, automated, and single-use ATS technologies significantly reduce the exposure to human hands ('forced'), minimizing the risks of contamination from both - human intervention as well as the risk of ‘cross-contamination’ including both - microbial and non-microbial contamination.

These ATS technologies have been shown to quickly and effectively ensure that the final products meet regulatory expectations for sterility. Additionally, ATS technologies enhance operational efficiency by enabling consistent, validated processes that can be facilitated in a more controlled environment, making them easier to monitor and audit. Therefore, as global regulatory frameworks continue to tighten, the need for ATS technologies are now required, thereby making regulatory compliance a key driver for growth in the aseptic transfer system industry.

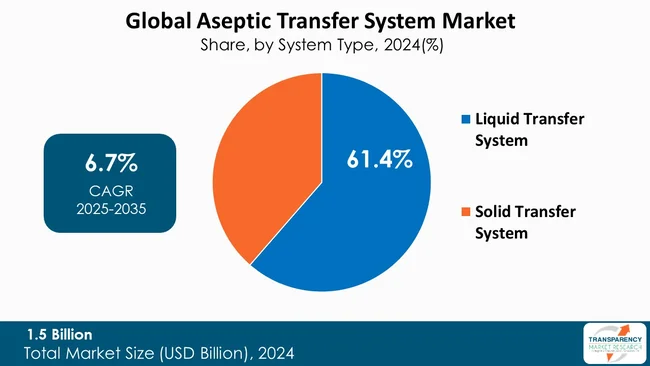

The liquid transfer system segment is a major contributor to the growth of the ATS market. In the pharmaceuticals and biotechnology manufacturing, the transfer of sterile liquids such as injectable drugs, vaccines, and biologics takes place in controlled environments to reduce contamination risk. Liquid transfer systems are intended to transport these sensitive materials from one area of production to another while preserving sterility, and minimizing any chance of microbial, particulate, or cross contamination. The continued growth in production of injectable therapeutics and biologics has put a premium on efficient, reliable liquid transfer systems that help ensure both product quality and patient safety.

Innovations in liquid transfer ATS include single-use tubing, closed system connectors, automated pumps, and real-time monitoring systems have collectively increased operational efficiency, minimized operator intervention, and help maintain the same sterility paradigm throughout the transfer process. Liquid transfer ATS systems also emphasize compliance with rigorous regulatory standards for aseptic processing and support good manufacturing practices (GMP) while maintaining control over contamination delays or product recalls.

Liquid transfer ATS systems are customizable and versatile, from small-scale and large-scale manufacturing to contract manufacturing organizations (CMO) to large multi-product manufacturing facilities.

| Attribute | Detail |

|---|---|

| Leading Region |

|

In the global aseptic transfer system (ATS) market, the North American region is the largest player, holding a total regional share of about 35.8%, due to its established sterile manufacturing infrastructure, innovative biotechnology capabilities, and unique regulatory environment. The United States, in particular, is a significant contributor given it is home to many of the largest pharmaceutical and biotech firms in the world, hosting contract development and manufacturing organizations (CDMOs) on a grand scale.

Regulatory agencies such as the U.S. FDA impose strict compliance needs for aseptic processing, which, in turn, leads manufacturers to invest in closed-system transfers, automation, and single-use technology.

The North American region also has a matured research and development ecosystem, with large capital expenditures for facility upgrades and upgrades that are necessary to keep up with evolving standards for facilities and manufacturing processes to keep their regulatory status and pre-eminence in the marketplace. In addition to these growing demands for ATS solutions, the other regions such as Asia-Pacific or Latin America are increasing capacity for manufacturing and regulatory attention. However, North America will remain the leading regional landscape of the ATS marketplace as the benchmark region - the region that drives technology trends, suppliers’ strategies and regulatory adoption in the ATS marketplace.

ABC Transfer, Aseptic Group, Cape-Europe, Castus GmbH & Co. KG, Central Research Laboratories., JCE BIOTECHNOLOGY, Sartorius AG, STERIS plc, EMA SINERGIE S.p.A., Pharmalab India Private Limited, Inos., AST, LLC, Steriline S.r.l., Ortner Reinraumtechnik, and other prominent players are the key players governing the global Aseptic Transfer System Market.

Each of these players has been profiled in the aseptic transfer system market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.5 Bn |

| Forecast Value in 2035 | More than US$ 3.0 Bn |

| CAGR | 6.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By System Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.5 Bn in 2024

It is projected to cross US$ 3.0 Bn by the end of 2035

Rising production of sterile drugs and biologics and stringent regulatory requirements

It is anticipated to grow at a CAGR of 6.7% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

ABC Transfer, Aseptic Group, Cape-Europe, Castus GmbH & Co. KG, Central Research Laboratories., JCE BIOTECHNOLOGY, Sartorius AG, STERIS plc., EMA SINERGIE S.p.A., Pharmalab India Private Limited, Inos, AST, LLC, Steriline S.r.l., Ortner Reinraumtechnik, and other prominent players

Table 01: Global Aseptic Transfer System Market Value (US$ Bn) Forecast, by System Type, 2020 to 2035

Table 02: Global Aseptic Transfer System Market Value (US$ Bn) Forecast, by Usability, 2020 to 2035

Table 03: Global Aseptic Transfer System Market Value (US$ Bn) Forecast, by Transfer Type, 2020 to 2035

Table 04: Global Aseptic Transfer System Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 05: Global Aseptic Transfer System Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 06: North America Aseptic Transfer System Market Value (US$ Bn) Forecast, by System Type, 2020 to 2035

Table 07: North America Aseptic Transfer System Market Value (US$ Bn) Forecast, by Usability, 2020 to 2035

Table 08: North America Aseptic Transfer System Market Value (US$ Bn) Forecast, by Transfer Type, 2020 to 2035

Table 09: North America Aseptic Transfer System Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 10: North America Aseptic Transfer System Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 11: Europe Aseptic Transfer System Market Value (US$ Bn) Forecast, by System Type, 2020 to 2035

Table 12: Europe Aseptic Transfer System Market Value (US$ Bn) Forecast, by Usability, 2020 to 2035

Table 13: Europe Aseptic Transfer System Market Value (US$ Bn) Forecast, by Transfer Type, 2020 to 2035

Table 14: Europe Aseptic Transfer System Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Europe Aseptic Transfer System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 16: Asia Pacific Aseptic Transfer System Market Value (US$ Bn) Forecast, by System Type, 2020 to 2035

Table 17: Asia Pacific Aseptic Transfer System Market Value (US$ Bn) Forecast, by Usability, 2020 to 2035

Table 18: Asia Pacific Aseptic Transfer System Market Value (US$ Bn) Forecast, by Transfer Type, 2020 to 2035

Table 19: Asia Pacific Aseptic Transfer System Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 20: Asia Pacific Aseptic Transfer System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 21: Latin America Aseptic Transfer System Market Value (US$ Bn) Forecast, by System Type, 2020 to 2035

Table 22: Latin America Aseptic Transfer System Market Value (US$ Bn) Forecast, by Usability, 2020 to 2035

Table 23: Latin America Aseptic Transfer System Market Value (US$ Bn) Forecast, by Transfer Type, 2020 to 2035

Table 24: Latin America Aseptic Transfer System Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 25: Latin America Aseptic Transfer System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 26: Middle East and Africa Aseptic Transfer System Market Value (US$ Bn) Forecast, by System Type, 2020 to 2035

Table 27: Middle East and Africa Aseptic Transfer System Market Value (US$ Bn) Forecast, by Usability, 2020 to 2035

Table 28: Middle East and Africa Aseptic Transfer System Market Value (US$ Bn) Forecast, by Transfer Type, 2020 to 2035

Table 29: Middle East and Africa Aseptic Transfer System Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 30: Middle East and Africa Aseptic Transfer System Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Figure 01: Global Aseptic Transfer System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Aseptic Transfer System Market Value Share Analysis, by System Type, 2024 and 2035

Figure 03: Global Aseptic Transfer System Market Attractiveness Analysis, by System Type, 2025 to 2035

Figure 04: Global Aseptic Transfer System Market Revenue (US$ Bn), by Liquid Transfer System, 2020 to 2035

Figure 05: Global Aseptic Transfer System Market Revenue (US$ Bn), by Solid Transfer System, 2020 to 2035

Figure 06: Global Aseptic Transfer System Market Value Share Analysis, by Usability, 2024 and 2035

Figure 07: Global Aseptic Transfer System Market Attractiveness Analysis, by Usability, 2025 to 2035

Figure 08: Global Aseptic Transfer System Market Revenue (US$ Bn), by Single Use, 2020 to 2035

Figure 09: Global Aseptic Transfer System Market Revenue (US$ Bn), by Multiple Use, 2020 to 2035

Figure 10: Global Aseptic Transfer System Market Value Share Analysis, by Transfer Type, 2024 and 2035

Figure 11: Global Aseptic Transfer System Market Attractiveness Analysis, by Transfer Type, 2025 to 2035

Figure 12: Global Aseptic Transfer System Market Revenue (US$ Bn), by Port, 2020 to 2035

Figure 13: Global Aseptic Transfer System Market Revenue (US$ Bn), by Portbags, 2020 to 2035

Figure 14: Global Aseptic Transfer System Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 15: Global Aseptic Transfer System Market Value Share Analysis, by End-user, 2024 and 2035

Figure 16: Global Aseptic Transfer System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 17: Global Aseptic Transfer System Market Revenue (US$ Bn), by Pharmaceutical & Biotech Manufacturers, 2020 to 2035

Figure 18: Global Aseptic Transfer System Market Revenue (US$ Bn), by Contract Development & Manufacturing Organizations (CDMOs), 2020 to 2035

Figure 19: Global Aseptic Transfer System Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Aseptic Transfer System Market Value Share Analysis, by Region, 2024 and 2035

Figure 21: Global Aseptic Transfer System Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 22: North America Aseptic Transfer System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 23: North America Aseptic Transfer System Market Value Share Analysis, by System Type, 2024 and 2035

Figure 24: North America Aseptic Transfer System Market Attractiveness Analysis, by System Type, 2025 to 2035

Figure 25: North America Aseptic Transfer System Market Value Share Analysis, by Usability, 2024 and 2035

Figure 26: North America Aseptic Transfer System Market Attractiveness Analysis, by Usability, 2025 to 2035

Figure 27: North America Aseptic Transfer System Market Value Share Analysis, by Transfer Type, 2024 and 2035

Figure 28: North America Aseptic Transfer System Market Attractiveness Analysis, by Transfer Type, 2025 to 2035

Figure 29: North America Aseptic Transfer System Market Value Share Analysis, by End-user, 2024 and 2035

Figure 30: North America Aseptic Transfer System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 31: North America Aseptic Transfer System Market Value Share Analysis, by Country, 2024 and 2035

Figure 32: North America Aseptic Transfer System Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 33: Europe Aseptic Transfer System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Europe Aseptic Transfer System Market Value Share Analysis, by System Type, 2024 and 2035

Figure 35: Europe Aseptic Transfer System Market Attractiveness Analysis, by System Type, 2025 to 2035

Figure 36: Europe Aseptic Transfer System Market Value Share Analysis, by Usability, 2024 and 2035

Figure 37: Europe Aseptic Transfer System Market Attractiveness Analysis, by Usability, 2025 to 2035

Figure 38: Europe Aseptic Transfer System Market Value Share Analysis, by Transfer Type, 2024 and 2035

Figure 39: Europe Aseptic Transfer System Market Attractiveness Analysis, by Transfer Type, 2025 to 2035

Figure 40: Europe Aseptic Transfer System Market Value Share Analysis, by End-user, 2024 and 2035

Figure 41: Europe Aseptic Transfer System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 42: Europe Aseptic Transfer System Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 43: Europe Aseptic Transfer System Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 44: Asia Pacific Aseptic Transfer System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Asia Pacific Aseptic Transfer System Market Value Share Analysis, by System Type, 2024 and 2035

Figure 46: Asia Pacific Aseptic Transfer System Market Attractiveness Analysis, by System Type, 2025 to 2035

Figure 47: Asia Pacific Aseptic Transfer System Market Value Share Analysis, by Usability, 2024 and 2035

Figure 48: Asia Pacific Aseptic Transfer System Market Attractiveness Analysis, by Usability, 2025 to 2035

Figure 49: Asia Pacific Aseptic Transfer System Market Value Share Analysis, by Transfer Type, 2024 and 2035

Figure 50: Asia Pacific Aseptic Transfer System Market Attractiveness Analysis, by Transfer Type, 2025 to 2035

Figure 51: Asia Pacific Aseptic Transfer System Market Value Share Analysis, by End-user, 2024 and 2035

Figure 52: Asia Pacific Aseptic Transfer System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 53: Asia Pacific Aseptic Transfer System Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 54: Asia Pacific Aseptic Transfer System Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 55: Latin America Aseptic Transfer System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Latin America Aseptic Transfer System Market Value Share Analysis, by System Type, 2024 and 2035

Figure 57: Latin America Aseptic Transfer System Market Attractiveness Analysis, by System Type, 2025 to 2035

Figure 58: Latin America Aseptic Transfer System Market Value Share Analysis, by Usability, 2024 and 2035

Figure 59: Latin America Aseptic Transfer System Market Attractiveness Analysis, by Usability, 2025 to 2035

Figure 60: Latin America Aseptic Transfer System Market Value Share Analysis, by Transfer Type, 2024 and 2035

Figure 61: Latin America Aseptic Transfer System Market Attractiveness Analysis, by Transfer Type, 2025 to 2035

Figure 62: Latin America Aseptic Transfer System Market Value Share Analysis, by End-user, 2024 and 2035

Figure 63: Latin America Aseptic Transfer System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 64: Latin America Aseptic Transfer System Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 65: Latin America Aseptic Transfer System Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 66: Middle East and Africa Aseptic Transfer System Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: Middle East and Africa Aseptic Transfer System Market Value Share Analysis, by System Type, 2024 and 2035

Figure 68: Middle East and Africa Aseptic Transfer System Market Attractiveness Analysis, by System Type, 2025 to 2035

Figure 69: Middle East and Africa Aseptic Transfer System Market Value Share Analysis, by Usability, 2024 and 2035

Figure 70: Middle East and Africa Aseptic Transfer System Market Attractiveness Analysis, by Usability, 2025 to 2035

Figure 71: Middle East and Africa Aseptic Transfer System Market Value Share Analysis, by Transfer Type, 2024 and 2035

Figure 72: Middle East and Africa Aseptic Transfer System Market Attractiveness Analysis, by Transfer Type, 2025 to 2035

Figure 73: Middle East and Africa Aseptic Transfer System Market Value Share Analysis, by End-user, 2024 and 2035

Figure 74: Middle East and Africa Aseptic Transfer System Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 75: Middle East and Africa Aseptic Transfer System Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 76: Middle East and Africa Aseptic Transfer System Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035